Housing the Goal: How Canadians Are Resizing Expectations and Redefining What Homeownership Means

Abacus Data, in partnership with the Canadian Real Estate Association (CREA), conducted a national survey examining how Canadians are navigating today’s housing crisis. This second release in the series explores the state of homeownership as both a personal goal and a social marker, the growing sense of compromise Canadians feel in pursuit of it, and the kinds of housing solutions they believe are needed to restore balance.

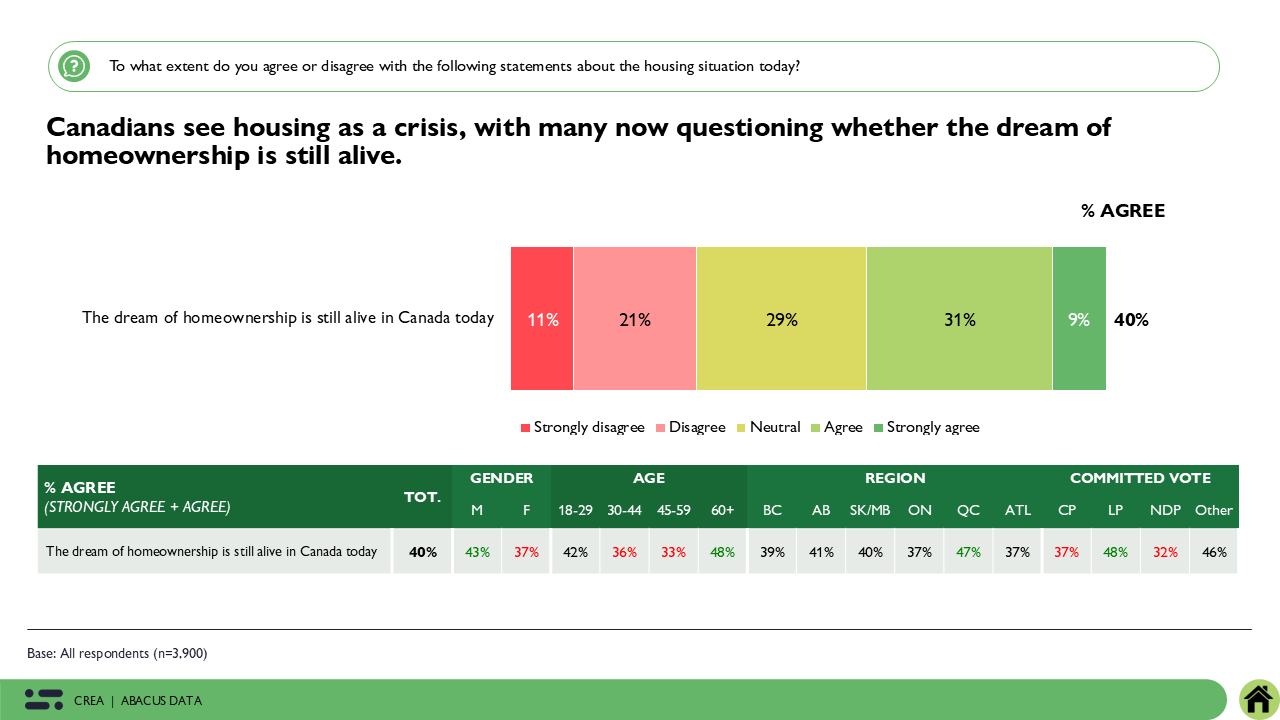

Findings show that while Canadians continue to value homeownership, many have adjusted their expectations – rethinking what, where, and how they can buy in today’s market. At the same time, there is broad agreement that the current mix of housing options doesn’t match people’s needs. Canadians point to the “missing middle” – the shortage of attainable, mid-density homes like townhouses, duplexes, and family-sized rentals – as a key barrier to ownership and affordability.

This release examines how Canadians are adapting their behavior and expectations in the face of these challenges and highlights the opportunity for policymakers and industry leaders to meet them where they are – by building the kinds of homes that make ownership attainable again and for the lives Canadians want to live.

Homeownership as a Goal and a Symbol

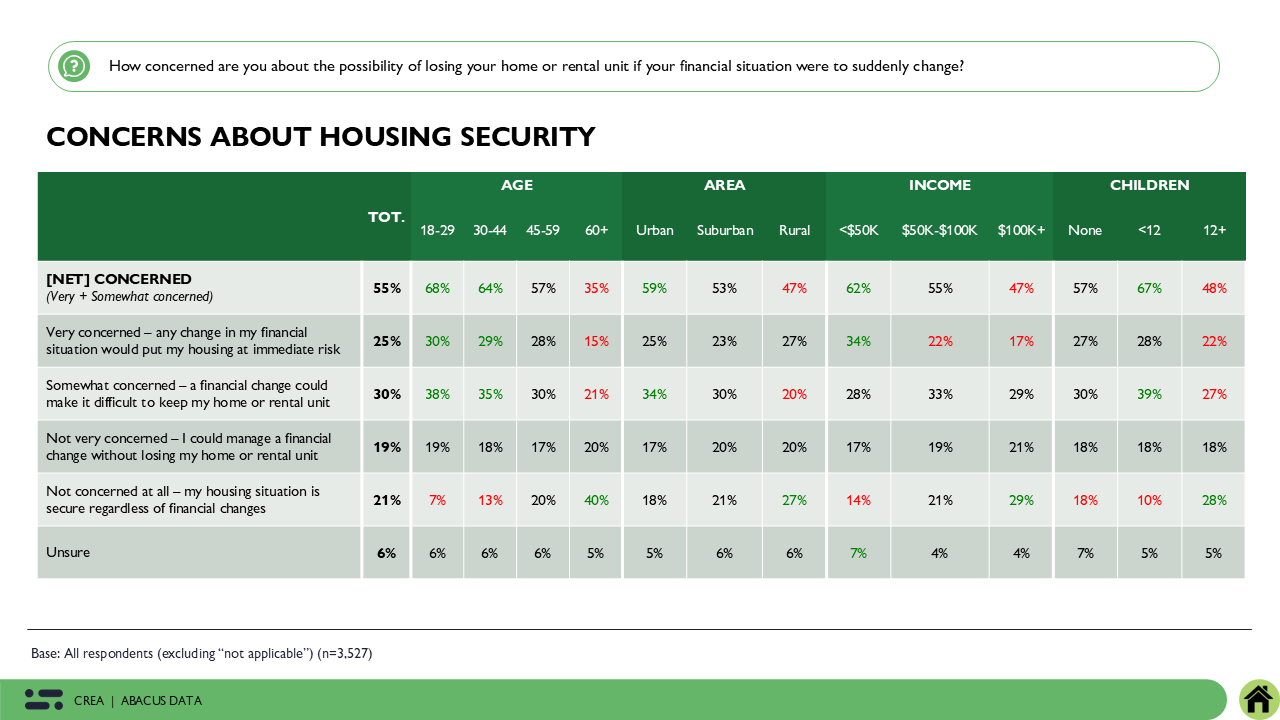

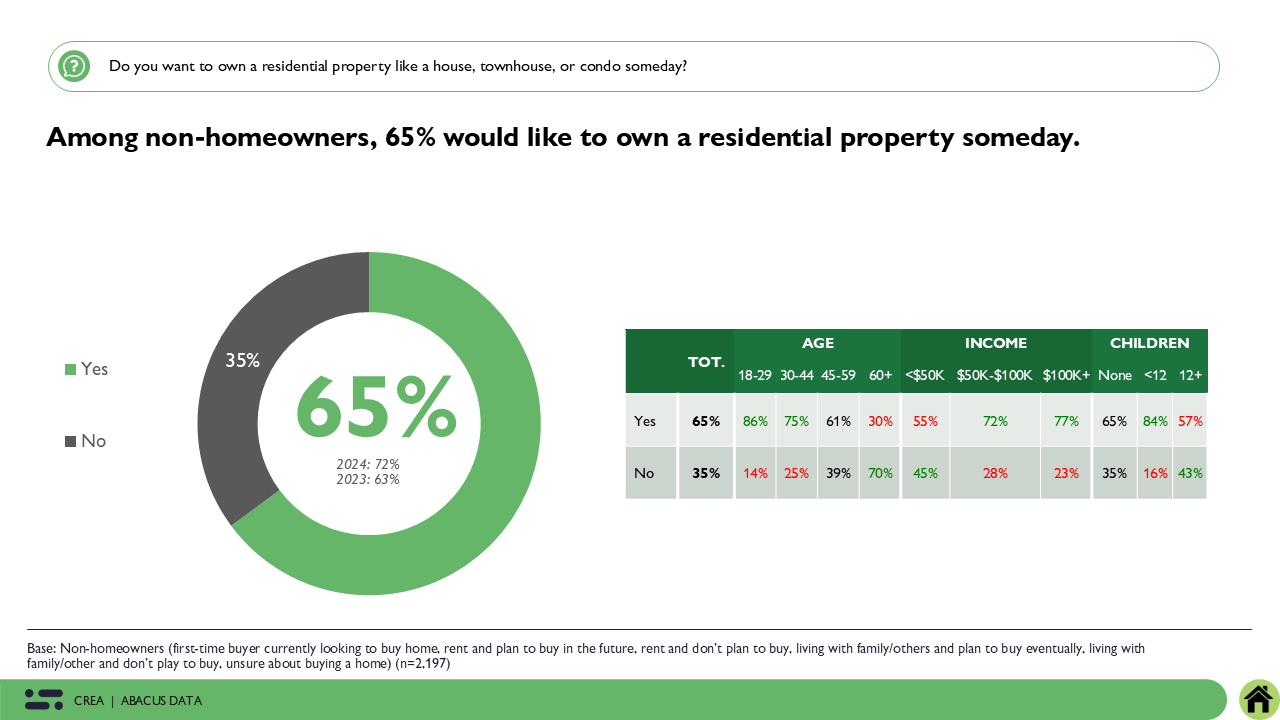

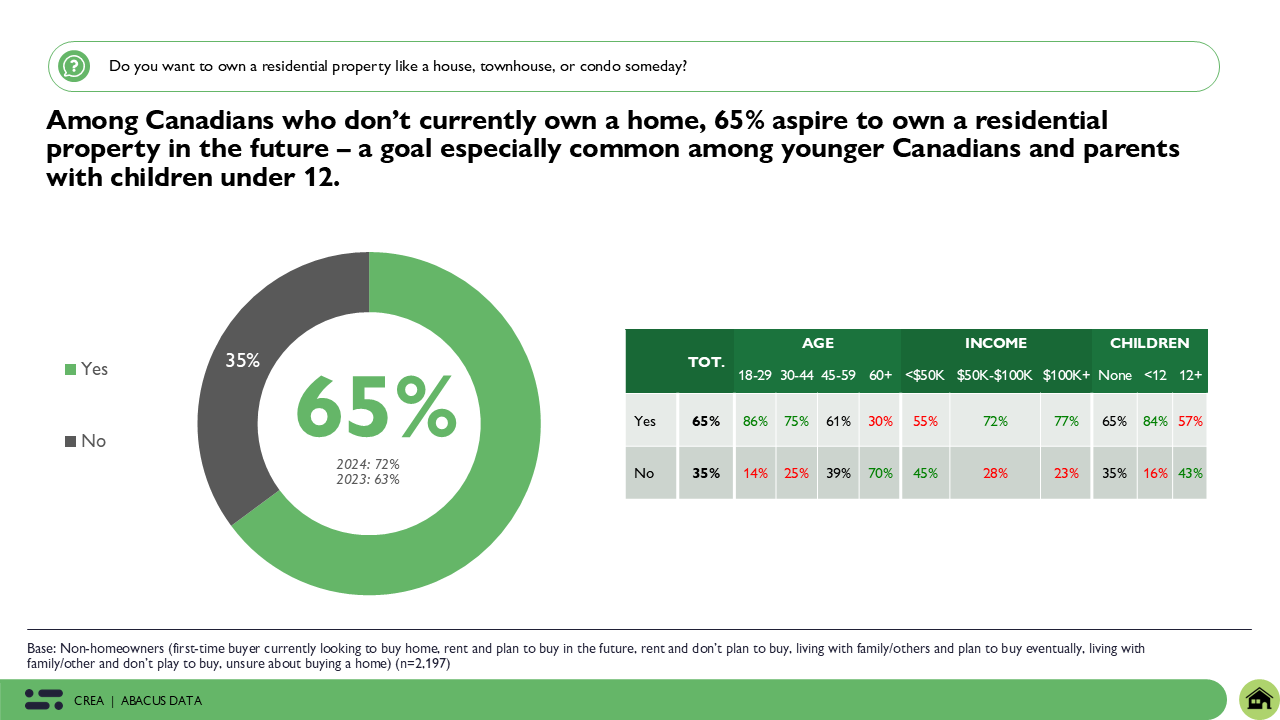

Despite today’s affordability challenges, homeownership remains a defining goal for many Canadians. Among non-homeowners, two-thirds (65%) say they would like to own a residential property someday. This desire is especially strong among younger Canadians – 86% of those aged 18–29 and 75% of those aged 30–44 – as well as families with young children (84% of those with children under 12).

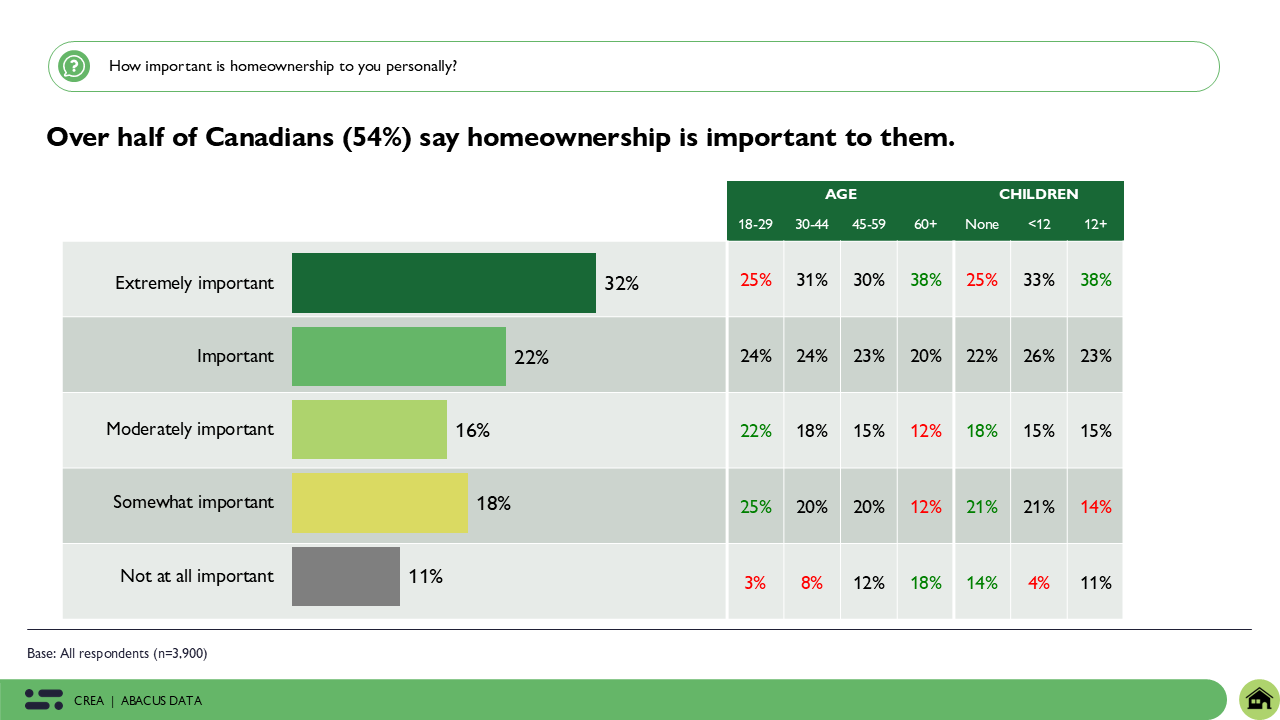

More than half of Canadians (54%) say owning a home is important to them, rising to 59% among families with young kids. Only 11% say it is not important at all, underscoring that homeownership continues to serve as a key life milestone and source of stability.

While the goal remains, its meaning is evolving. Among younger Canadians, only 49% now describe ownership as essential, while 47% see it as somewhat or moderately important. This shift reflects a redefinition of success – one that prioritizes stability and belonging, even if those qualities come in smaller or less traditional forms.

Resetting Expectations and Resizing Dreams

Adjusting to a New Reality

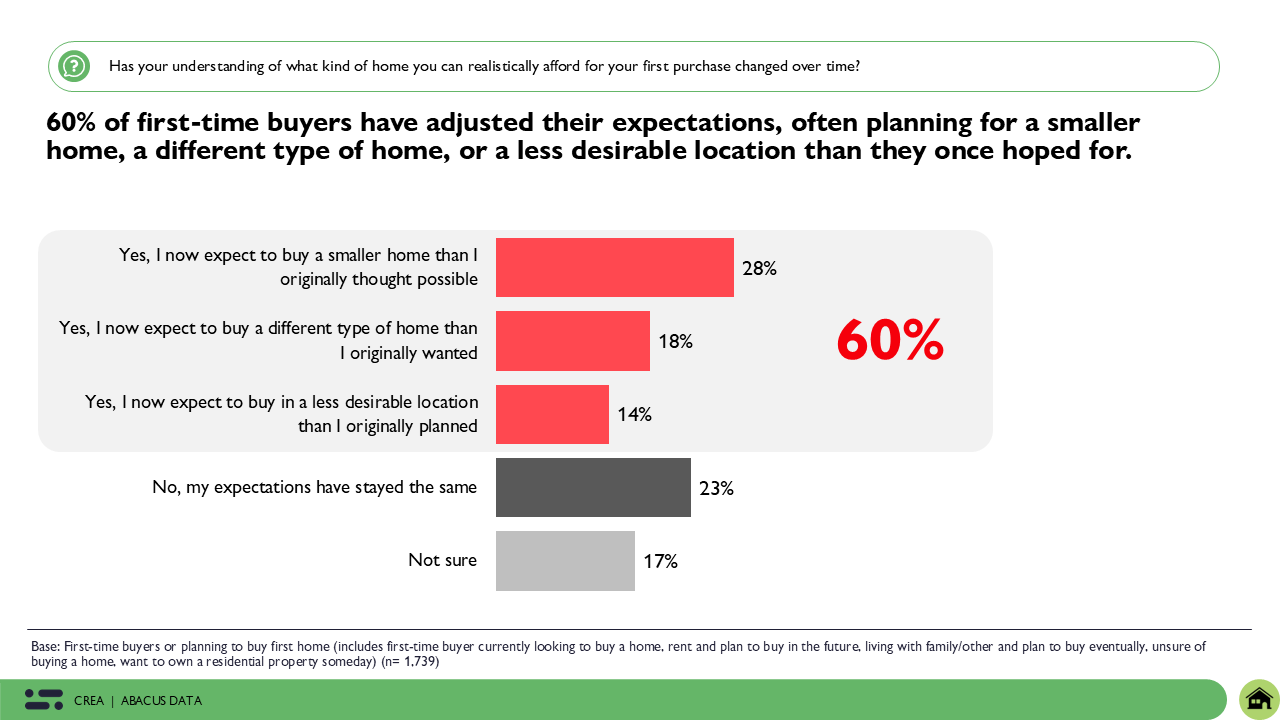

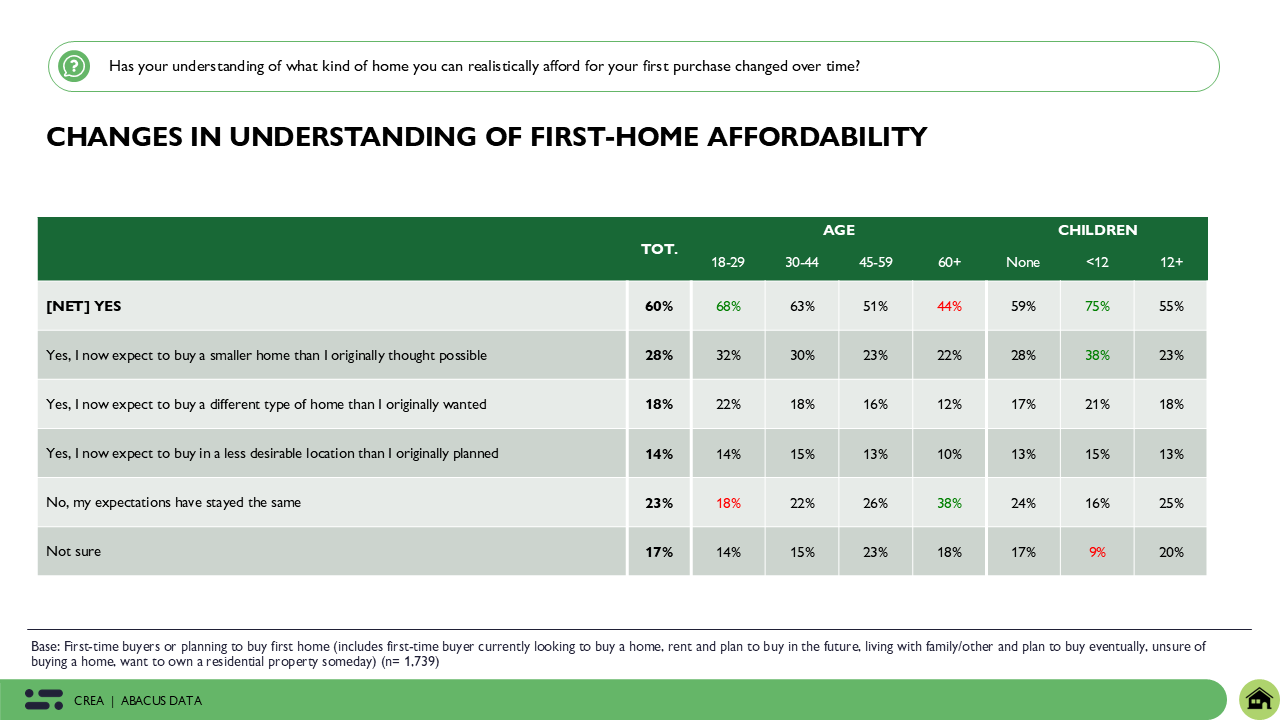

Canadians are already reshaping what homeownership looks like. Among first-time buyers, 60% have adjusted their expectations – planning for a smaller home (28%), a different type of property (18%), or a less desirable community (14%).

Younger Canadians are leading this adjustment: 68% of those aged 18–29 say they’ve changed their expectations, with one-third (32%) now planning to buy smaller homes and one in five (22%) considering different types of properties altogether. Among parents with children under 12, three-quarters (75%) have made similar trade-offs, often downsizing plans or rethinking where to buy.

Compromise as the New Normal

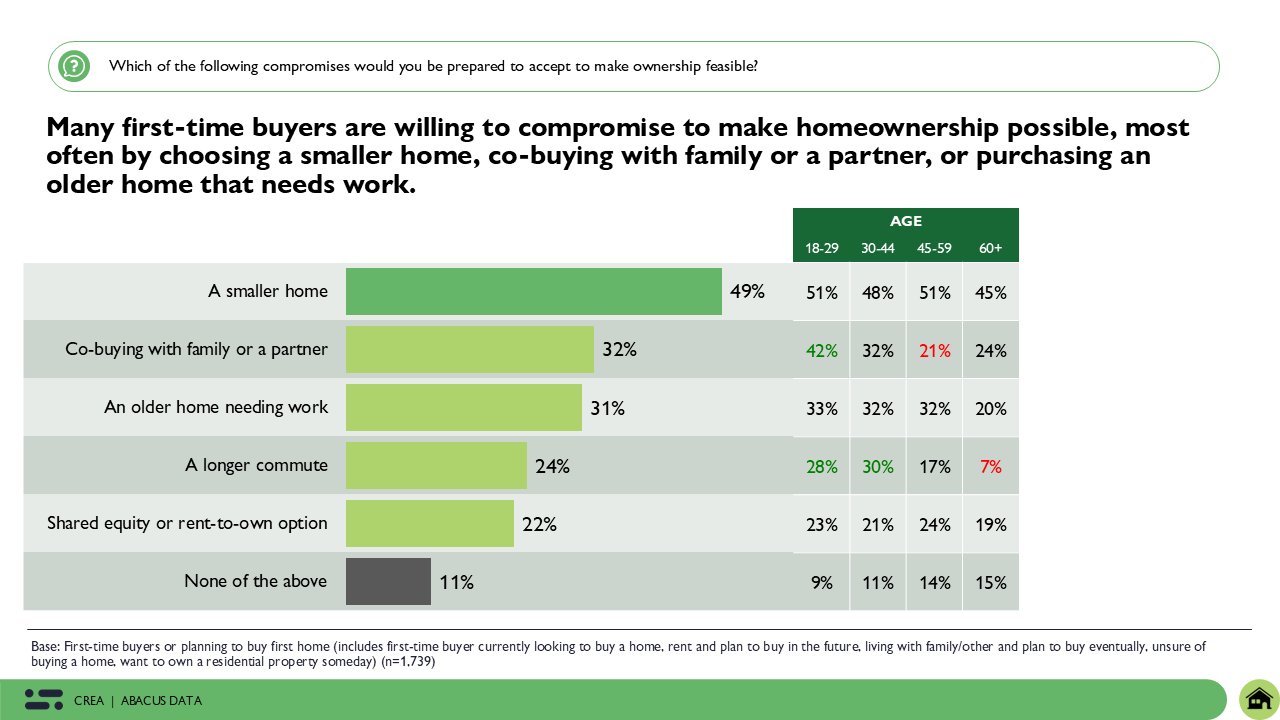

Nearly half of Canadians (49%) are prepared to buy smaller homes than they once envisioned, and one in three (32%) would consider co-buying with family or friends. Another 31% are open to purchasing an older home that needs work, while one in four (24%) would take on a longer commute – particularly those aged 18–44.

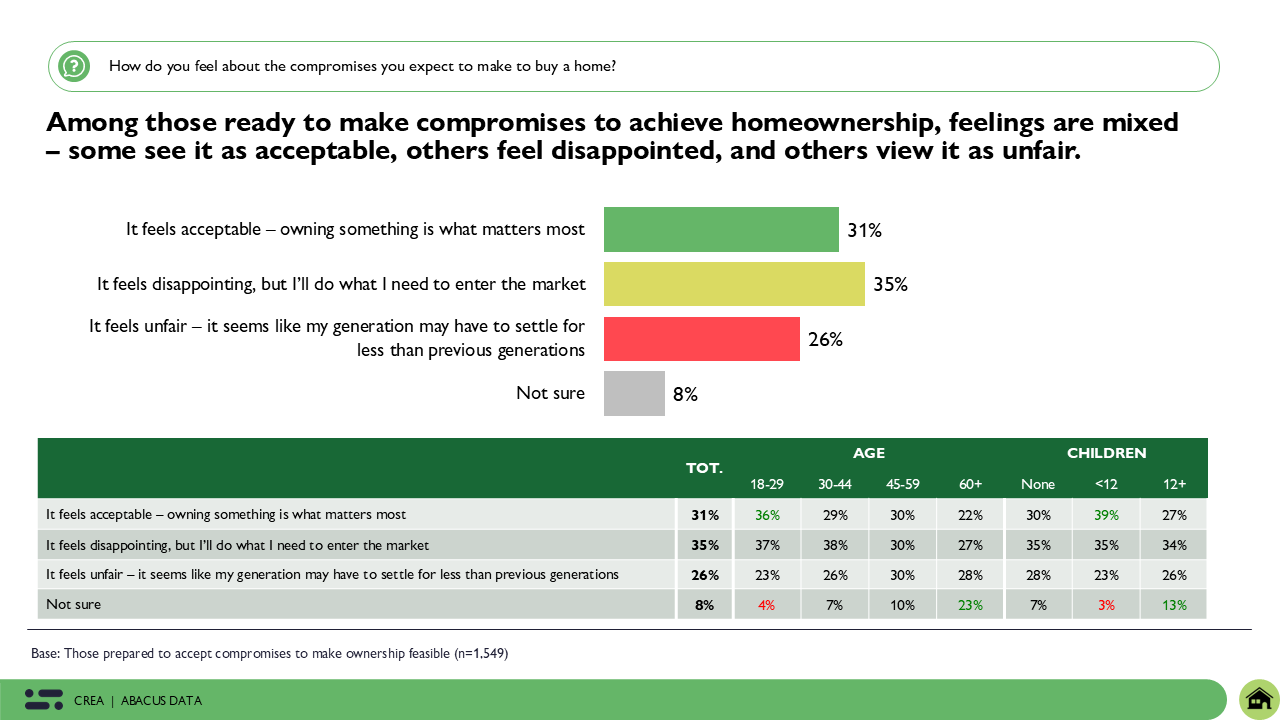

While many view these compromises as disappointing (35%) or unfair (26%), nearly one in three (31%) say they’re acceptable because ownership itself is what matters most. Among young Canadians (36%) and families with children (39%), compromise is increasingly seen as part of the process, not a setback.

Making Sacrifices to Make It Work

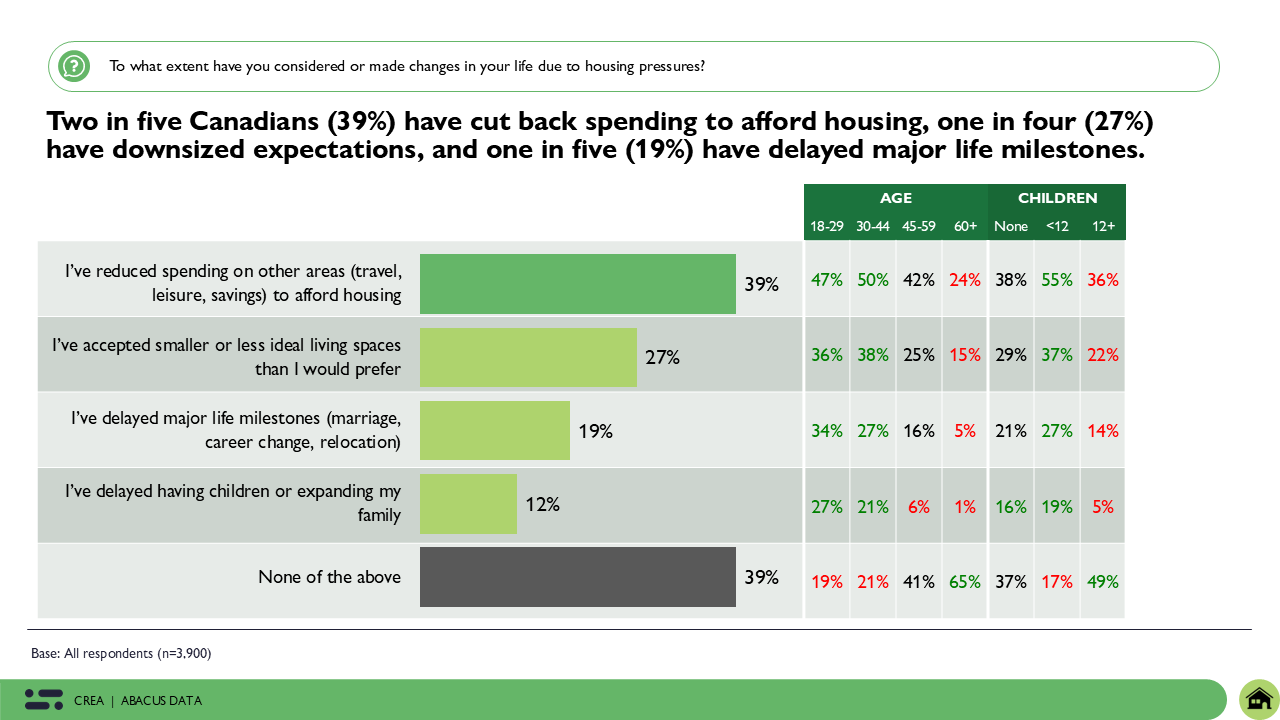

Many aspiring homeowners are already making tangible sacrifices to reach their goal. Four in ten (39%) have cut back on other spending, more than a quarter (27%) have settled for smaller or less ideal homes, and one in five (19%) have delayed major life milestones. These trade-offs have become normalized – part of a new reality in which flexibility and persistence define the path to ownership.

Supply and Mix: Building the Right Homes, Not Just More Homes

A Crisis of Fit, Not Just Quantity

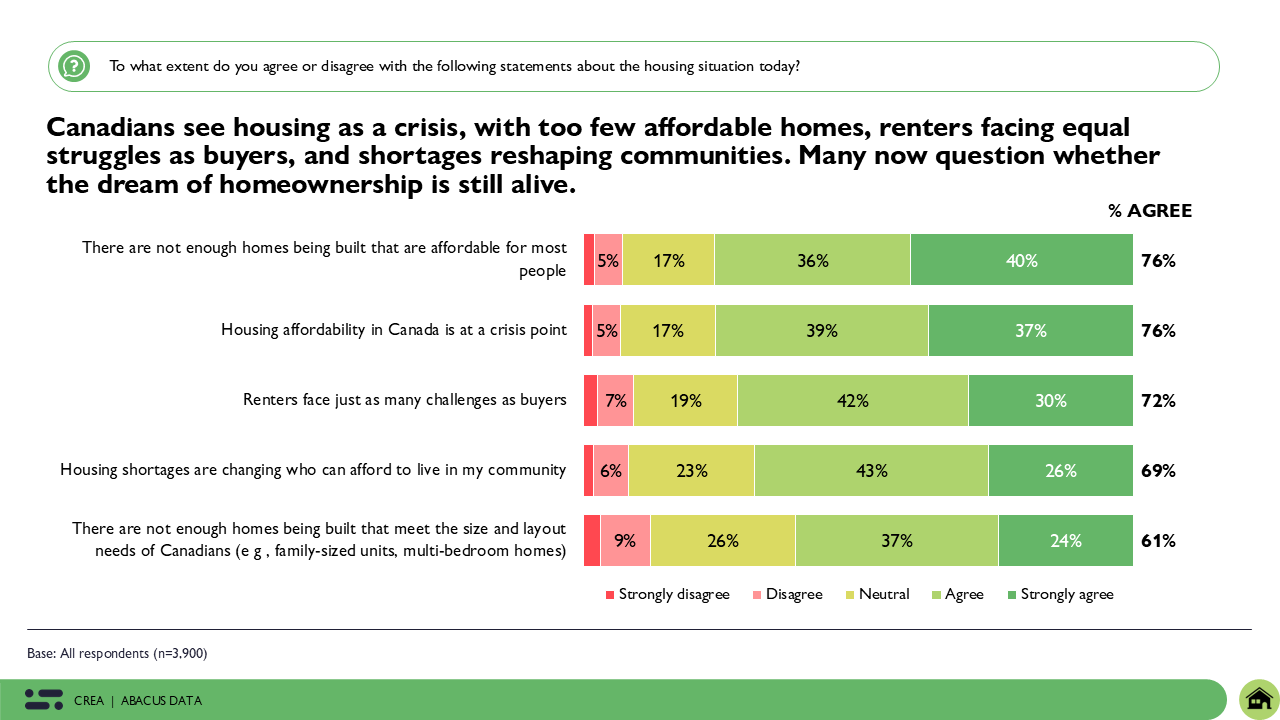

Canadians widely agree that affordability and availability have reached a crisis point. Three-quarters (76%) believe not enough affordable homes are being built, and two-thirds (69%) say shortages are changing who can afford to live in their community. More than six in ten (61%) also believe that the homes being built today don’t meet the needs of Canadian households – particularly when it comes to size, layout, and family suitability.

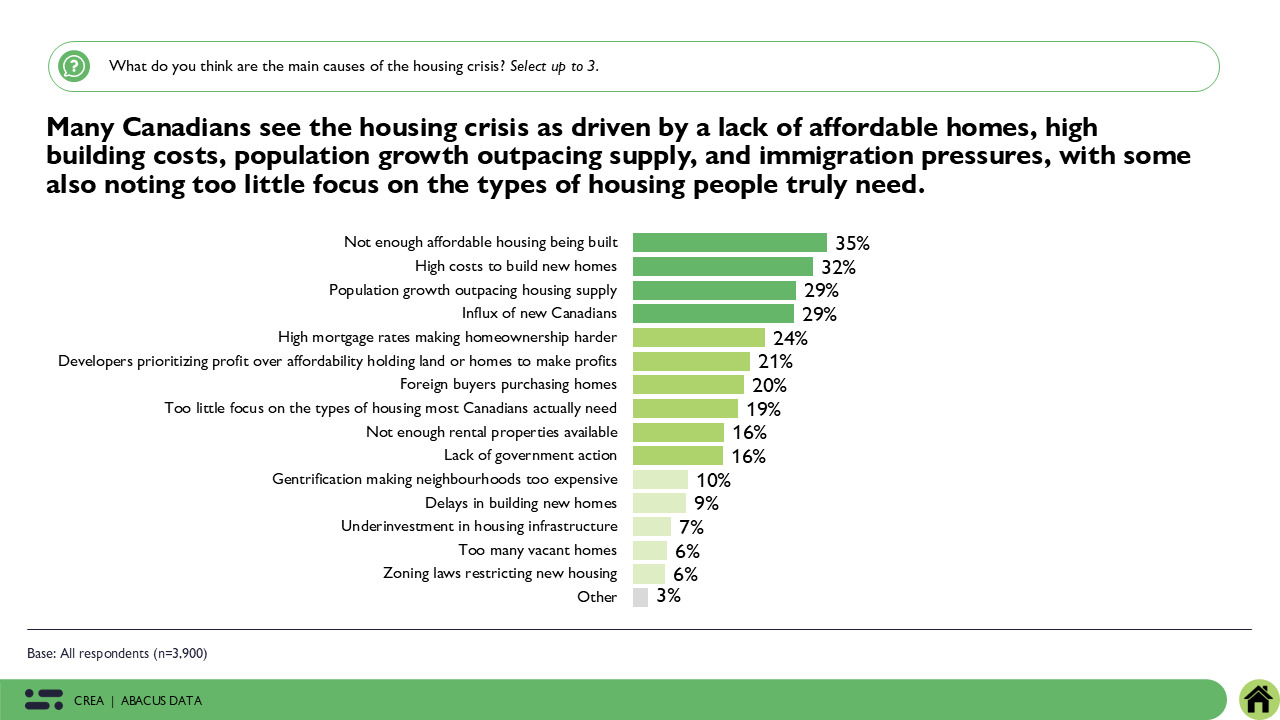

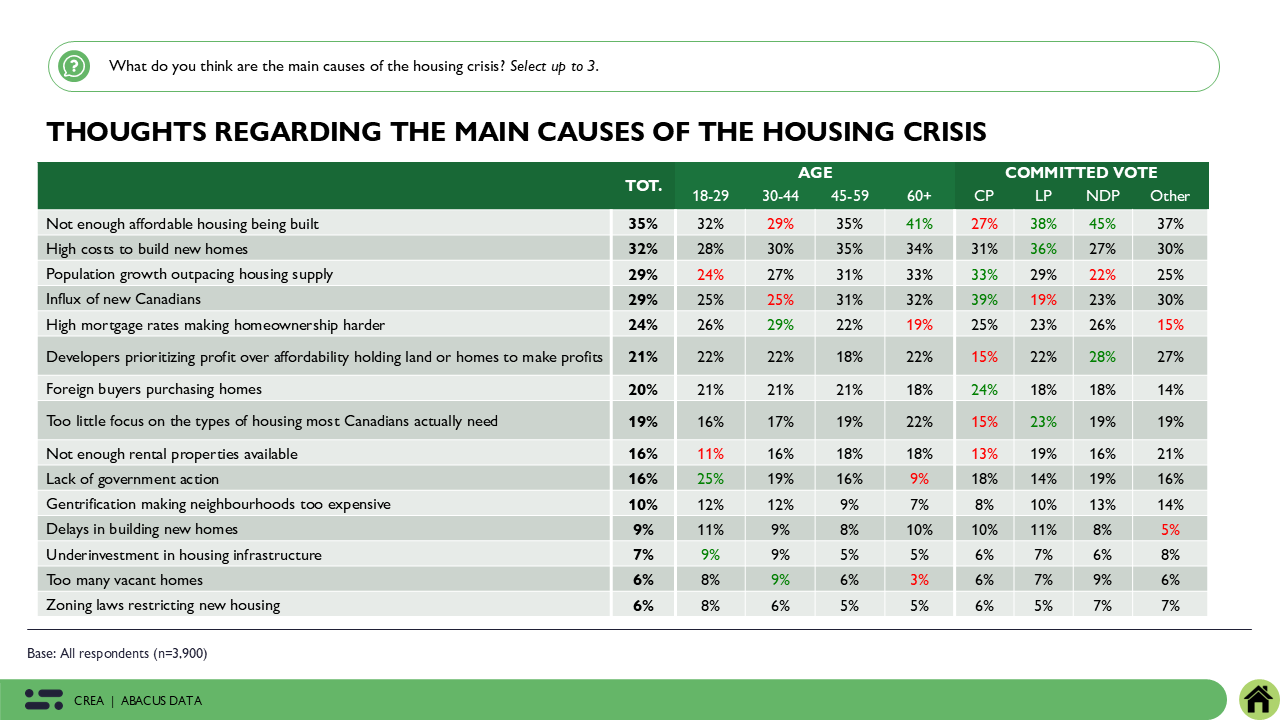

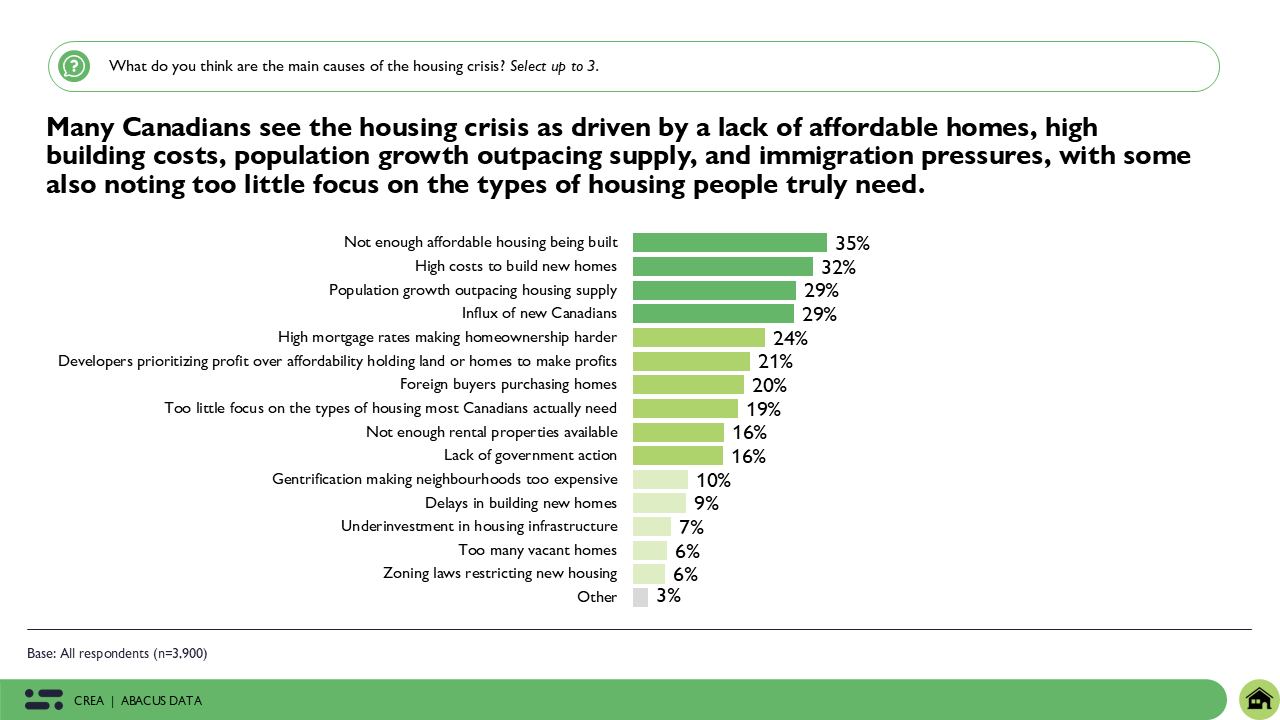

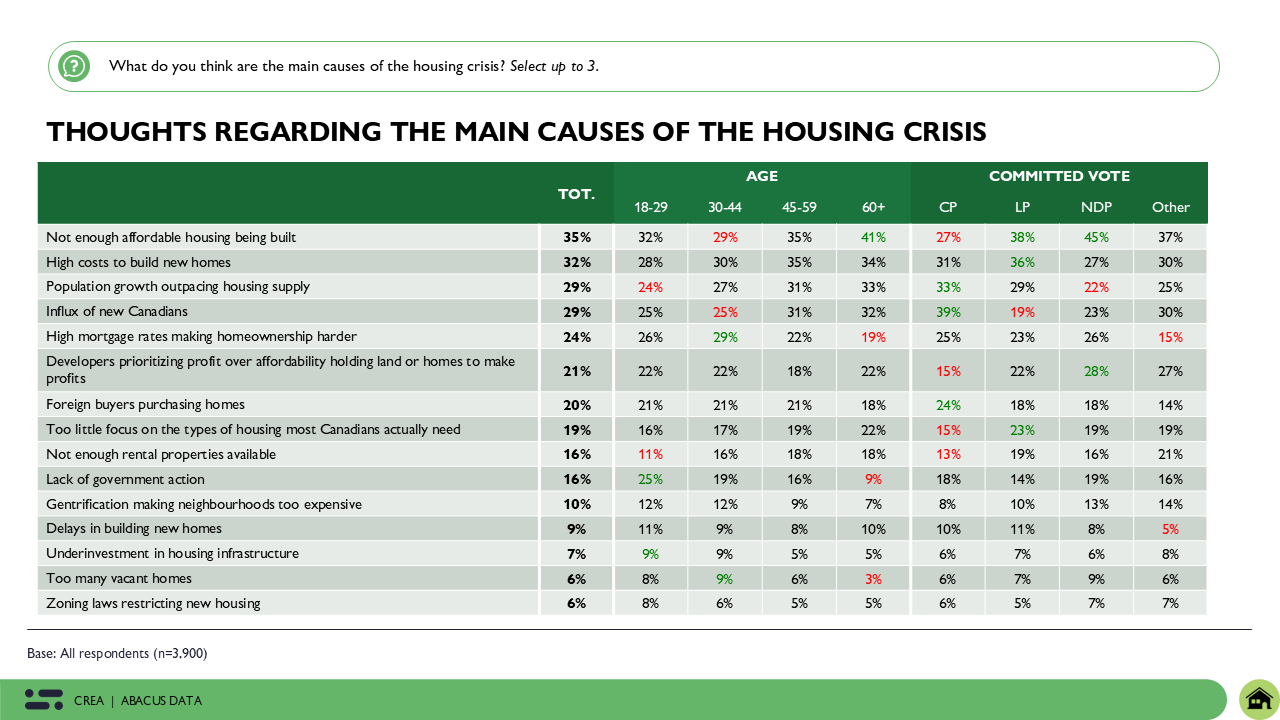

Canadians point to several key drivers: high construction costs (32%), population growth outpacing supply (29%), and a lack of affordable builds (35%). Importantly, one in five (19%) believe too little attention is being paid to the types of homes Canadians actually need – suggesting the issue is not just quantity, but suitability.

A Shared Understanding, With Divided Views on Causes

Within this broad agreement, political perspectives influence how Canadians interpret the problem. Liberal supporters are more likely to say that not enough affordable homes are being built (38%) and that high construction costs (36%) are key contributors. Conservative supporters, on the other hand, are more likely to emphasize population growth outpacing housing supply (33%) and the influx of new Canadians (39%) as primary causes.

Despite these differing views, Canadians broadly agree on the path forward: solving the housing crisis isn’t just about building more homes – it’s about building the right homes in the right places, with a better balance of affordability, accessibility, and design to meet the needs of today’s households.

The Missing Middle: Canada’s Overlooked Opportunity

Bridging the Gap Between Condos and Detached Homes

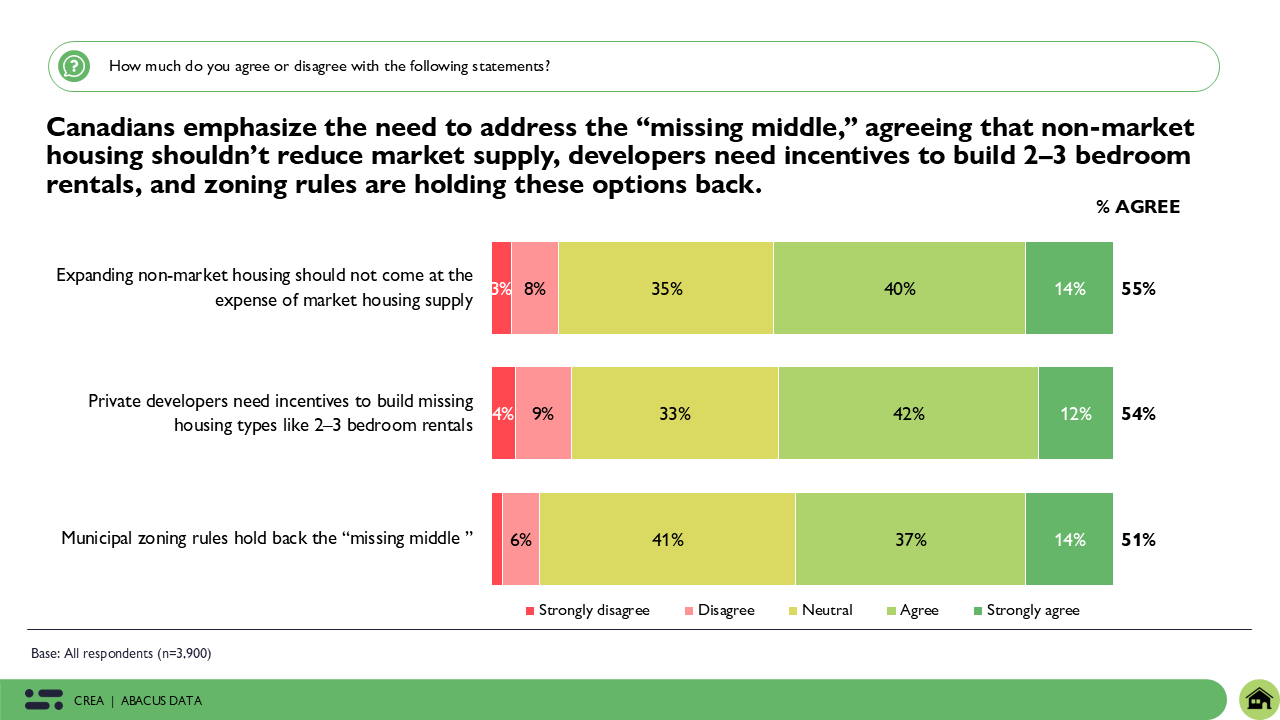

Many Canadians believe the housing crisis is not only about a shortage of homes but also about the lack of housing that fits their lives. More than half (51%) say municipal zoning rules are holding back the development of the “missing middle” – townhomes, duplexes, and mid-sized rentals that bridge the gap between condos and large detached homes.

Canadians also see a need for greater balance and incentive in how homes are built. Over half (54%) believe private developers should receive stronger incentives to build two- and three-bedroom rentals that families can afford. At the same time, 55% say expanding non-market housing should not come at the expense of market housing supply, showing that Canadians see both as essential to a healthy housing ecosystem.

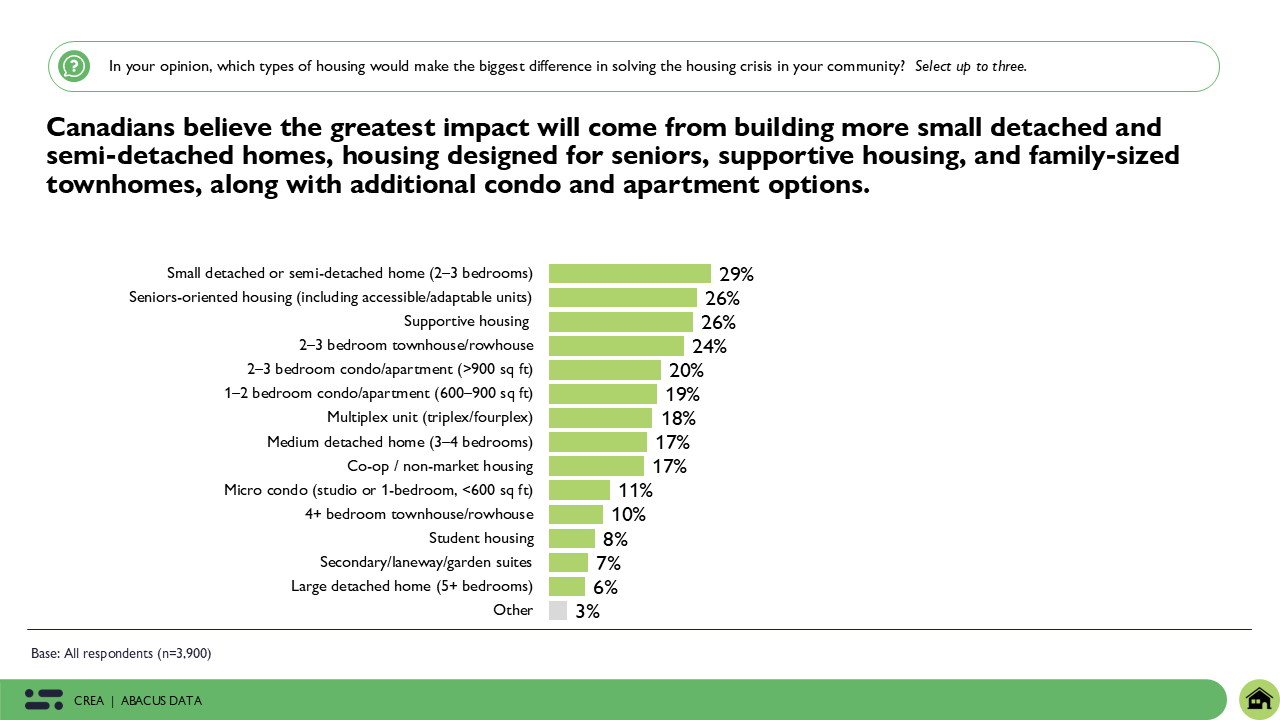

When asked what types of homes would make the biggest difference, Canadians most often point to small detached and semi-detached homes (29%), townhomes (24%), and family-sized rentals, alongside supportive and seniors-oriented housing. These are the very options that have become increasingly scarce – yet they are where affordability and livability intersect. Without this missing middle, families are squeezed out of both the rental and ownership markets.

Priorities for Change

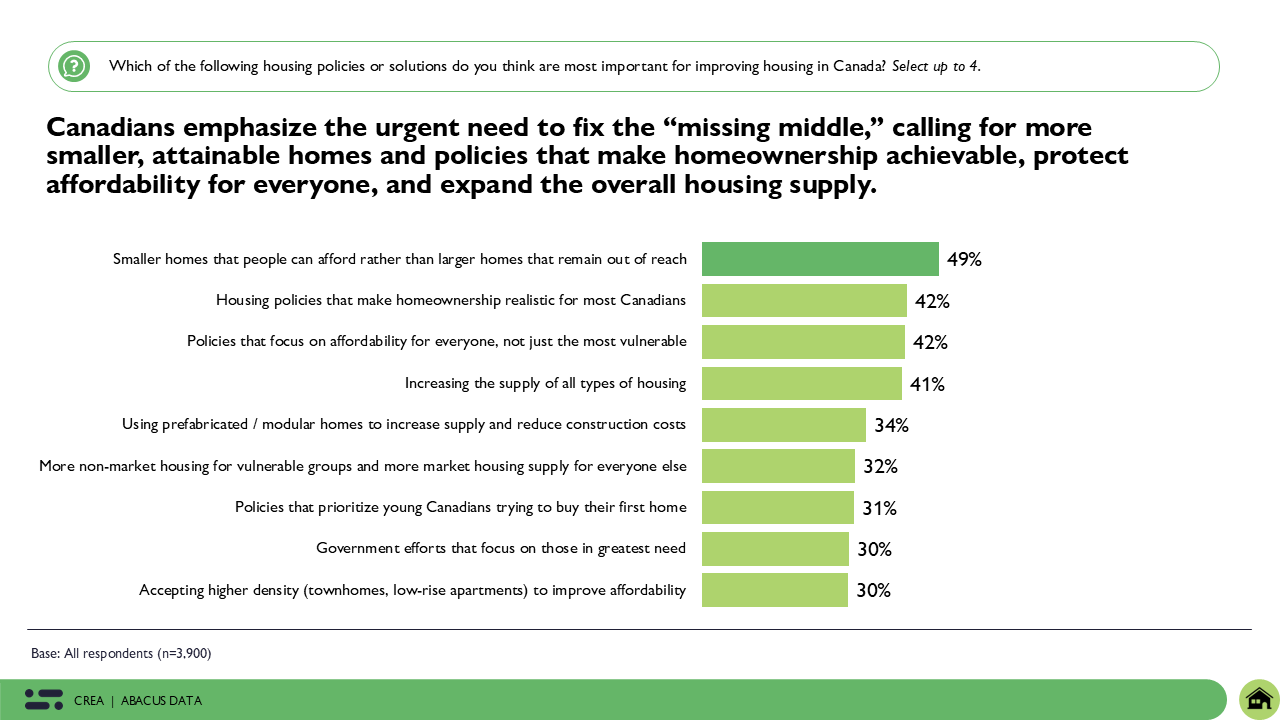

Canadians are clear about what needs to happen next. Nearly half (49%) say building more smaller, attainable homes that people can afford should be a top national priority. They also emphasize the importance of policies that make homeownership realistic (42%), ensure affordability for all (42%), and increase overall housing supply (41%). One in three (34%) see promise in prefabricated and modular homes as a way to boost supply and reduce construction costs.

Together, these findings point to a clear message: Canadians are ready for a housing strategy that focuses not just on building more homes, but on building the right mix – homes that reflect how people actually live today.

The Upshot

Canadians are redefining what it means to own a home. The goal of homeownership remains deeply important, but its expression has evolved. It’s no longer about how big the home is or where it’s located – it’s simply about having a place to call their own. Canadians want stability and belonging, and they’re showing a remarkable willingness to adapt to get there: planning smaller, sharing ownership, buying older, and moving farther. They haven’t given up; they’re determined to make ownership possible in whatever form it takes.

That determination exposes a deeper problem – the housing market hasn’t adapted as quickly as Canadians have. People have already changed their expectations; the supply has not. At the center of this disconnect lies the “missing middle” – the absence of attainable, mid-density homes like townhouses, duplexes, and family-sized rentals that make ownership realistic for ordinary Canadians. Without it, families are squeezed between small condos that don’t suit their lives and detached homes they can’t afford. The missing middle is where affordability and livability meet – and Canadians know it’s key to restoring balance.

Many feel they’re being forced to compromise – settling for less space or less choice just to own – but it doesn’t have to be that way. By focusing on the right mix of housing and embracing innovations like modular and offsite construction, Canada can scale supply without turning the housing crisis into a zero-sum game of supportive vs. rental vs. ownership. With the right policies, compromise can give way to opportunity.

Politically, the message is clear. Canadians want leadership that recognizes how their housing needs have changed and acts with urgency to meet them. Those who focus on unlocking the missing middle, reforming zoning, and incentivizing attainable, family-suitable housing won’t just respond to a crisis – they’ll help rebuild the foundation of homeownership for a new generation.

In the end, the path forward is not about recreating the past but building for the realities of today – homes that are attainable, adaptable, and reflective of how Canadians actually live. The willingness to change is already there among the public; what’s needed now is the same determination from those shaping the country’s housing future.

Methodology

The survey was conducted with 3,900 Canadian adults from September 5 to 16, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 1.57%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by the Canadian Real Estate Association.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in the 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.