Canada’s Financial Future: Insights into Financial Literacy, Banking Satisfaction, and Open Banking Adoption

February 20, 2024

Between January 18 and 23, 2024, Abacus Data conducted a nationwide survey with 2,199 Canadians aged 18 and above to examine their attitudes towards financial services, banking, and technology. The survey examines Canadians’ digital literacy, financial technology knowledge, banking preferences, and the potential of open banking adoption. This research was paid for by Abacus Data and was conducted to help inform a presentation I gave at a recent open banking/FinTech meeting.

Despite overall satisfaction with traditional banking, concerns are raised about fees, interest rates, and limited branch availability, highlighting the potential for open banking to address these challenges and offer personalized financial solutions.

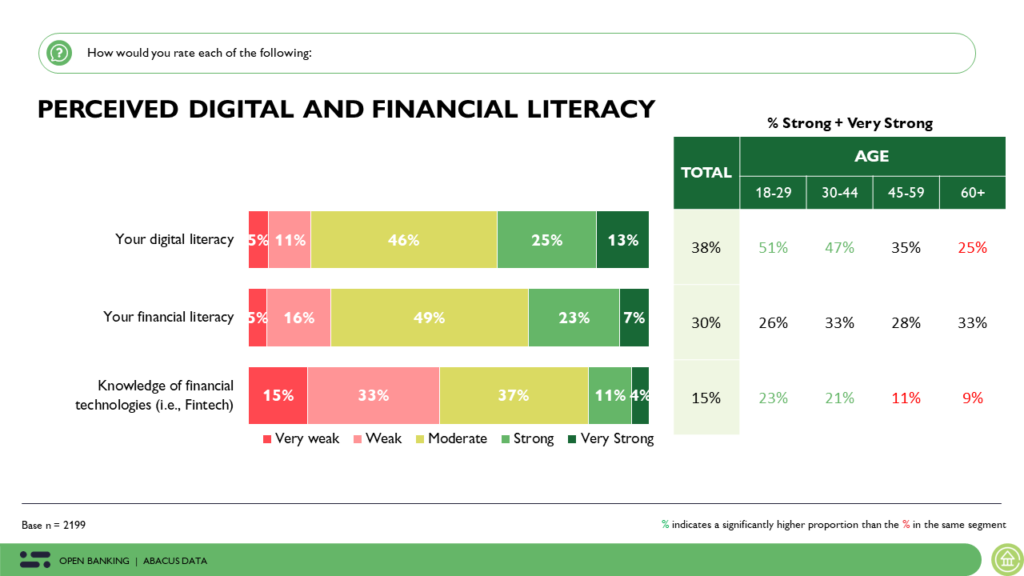

Digital Literacy and FinTech Knowledge

The results show that just 38% of individuals feel confident in their digital literacy, while only 30% claim proficiency in financial literacy, and a mere 15% demonstrate familiarity with financial technologies. Moreover, the findings reveal a clear generational divide, as younger Canadians (aged 18-29 and 30-44) demonstrate significantly higher levels of digital literacy (51% and 47% respectively) and comprehension of financial technology (23% and 21% respectively) in contrast to older Canadians (aged 60 and above), where only 25% exhibit digital literacy and a mere 9% possess knowledge of financial technologies.

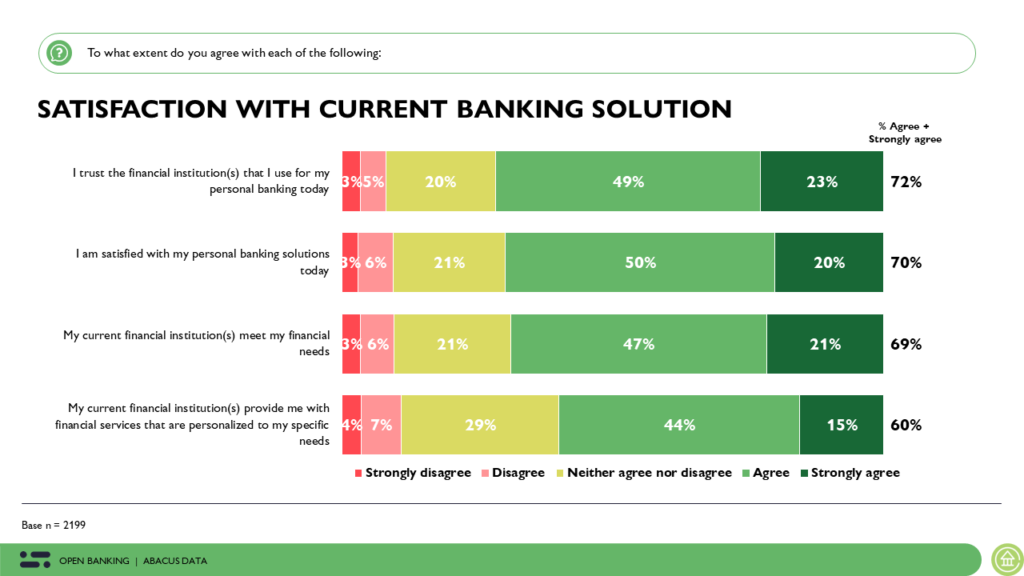

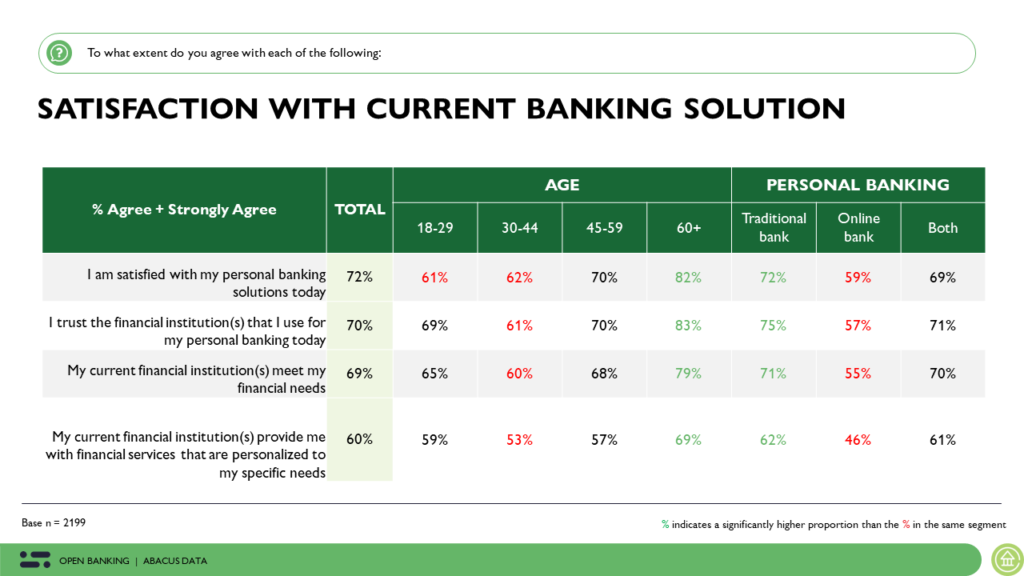

Assessing Satisfaction with Personal Banking Solutions

Overall, Canadians are generally quite satisfied with their primary financial institutions. Specifically, 72% are satisfied with their personal banking, 70% trust their institution, and 69% feel that their financial needs are being met. Additionally, 60% feel their current financial institution delivers personalized services tailored to their individual requirements. However, demographic analysis reveals differences, with younger Canadians less in agreement compared to older demographics across the statements presented. Thus, while overall satisfaction with banking solutions appears high among Canadians, demographic disparities and preferences for banking methods underscore the importance of tailored services and targeted communication strategies to meet diverse customer needs effectively.

This may also signal a shift in preferences over time as younger generations enter the market and older ones leave it.

Perceived Effectiveness of the Canadian Banking System

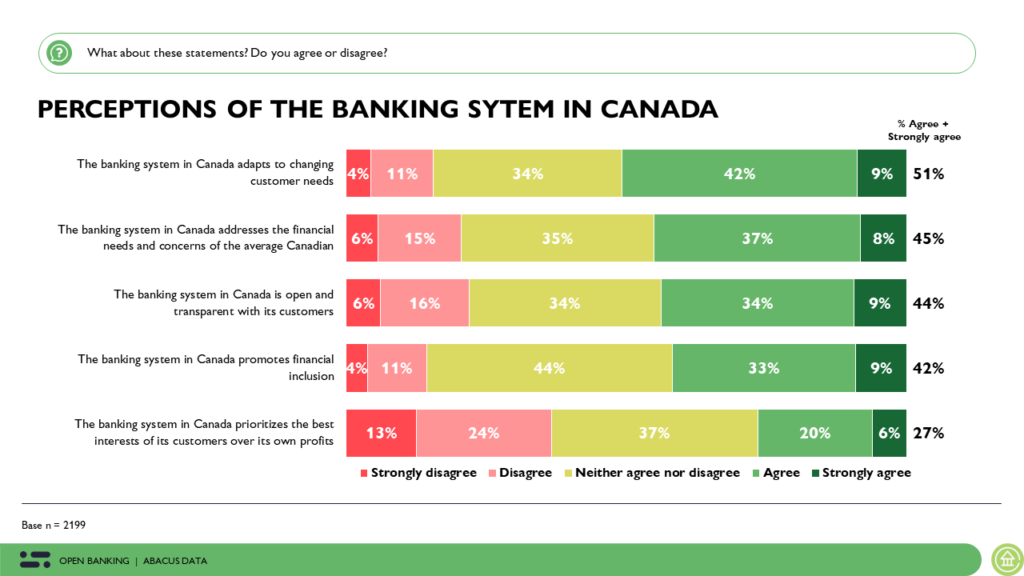

Despite Canadians’ overall satisfaction and trust in their financial institutions, findings suggest that certain needs are not being sufficiently met.

Only 51% believe that the Canadian banking system adapts to changing customer needs, 45% feel it addresses the financial concerns of the average Canadian, and a mere 44% perceive it as open and transparent. Moreover, just 27% agree that the system prioritizes customers’ best interests over profits – a concern we find with most private sector, for-profit businesses.

These results highlight a disparity between personal satisfaction with individual financial institutions and the perception of the banking system’s effectiveness in meeting Canadians’ needs.

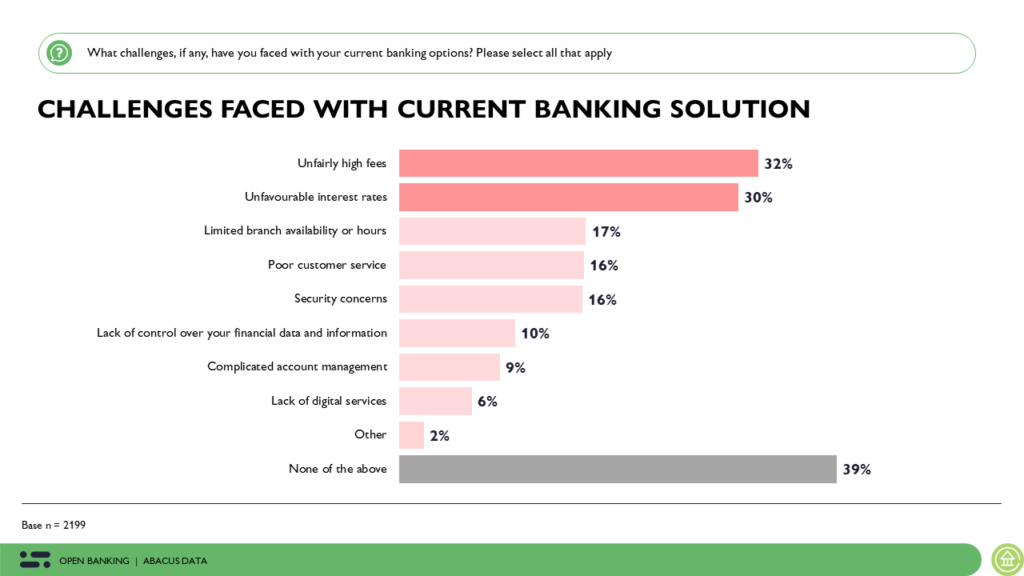

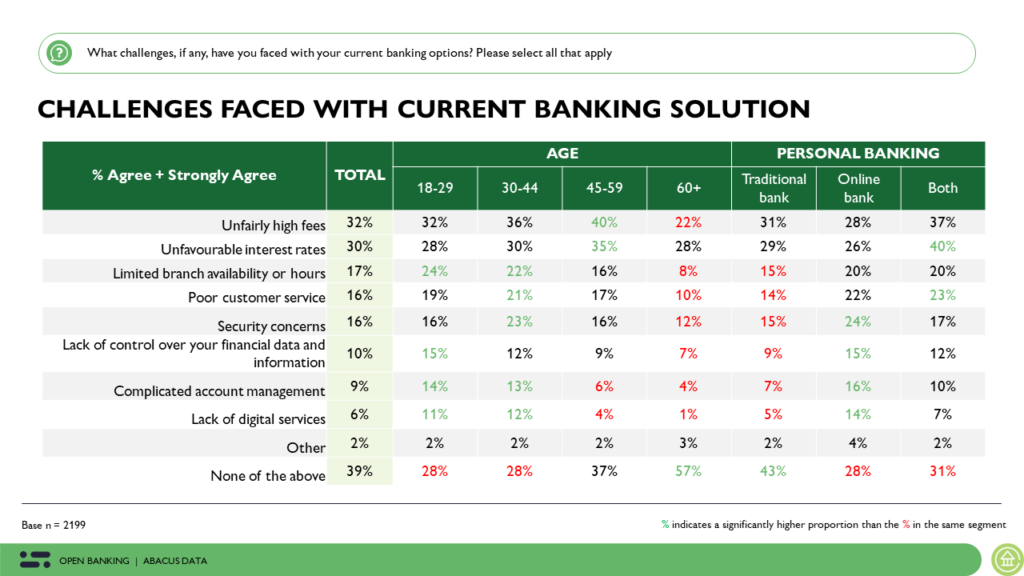

Navigating Challenges in Canadian Banking Solutions

When evaluating the current challenges Canadians encounter with their banking solutions, high fees (32%) and unfavorable interest rates (30%) emerge as the most significant concerns. Additionally, 17% of Canadians express frustrations over limited branch availability or hours, while 16% cite poor customer service and security concerns.

It’s also worth mentioning that a small proportion of Canadians cite a lack of control over their financial data and information and a lack of digital services as a top concern. This is important when trying to understand the demand for open banking and fintech.

Finally, there is a sizeable portion of the public who have no issues with the banking system. Close to 4 in 10 Canadians say there are no significant challenges with their current banking options.

The findings also indicate a shift in the challenges encountered by Canadians today, reflecting generational differences. While issues like high fees and interest rates affect many Canadians across age groups, younger Canadians face unique challenges such as limited operating hours, security apprehensions, lack of control over their financial data, and complex account management when compared to those aged 60 and above. Although these concerns may only affect a minority of Canadians, they offer preliminary evidence of the market’s response to generational shifts.

Open Banking Awareness Among Canadians

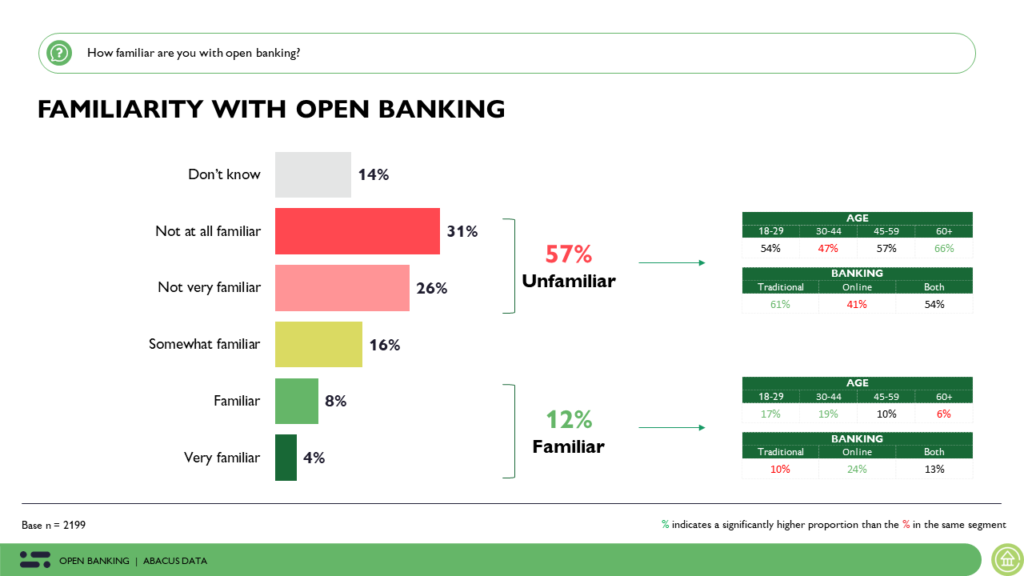

When it comes to open banking, 57% of Canadians acknowledge being unfamiliar, while a mere 12% claim to be familiar with the concept.

Familiarity is more prevalent among younger Canadians (18-29: 17% aware; 30-44: 19% aware) and among current users of online banking (24% aware). In contrast, older Canadians (60+) and those who currently use traditional banking express lower levels of familiarity, with 66% and 61% respectively stating they are unfamiliar with open banking.

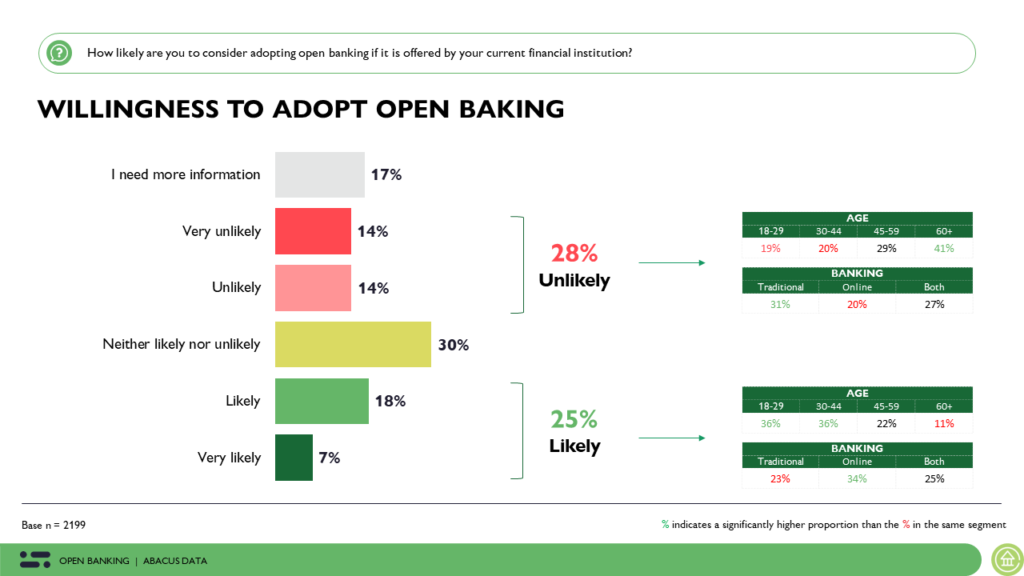

Despite initial unfamiliarity, findings suggest a early interest in adopting open banking among Canadians once they become acquainted with it. Specifically, 1 in 4 Canadians express likelihood in adopting open banking, while 17% indicate a need for more information, followed by 30% who remain neutral. This interest is particularly pronounced among younger demographics, highlighting a notable generational divide in adoption readiness.

However, there is still quite a bit of uncertainty over whether open banking will be beneficial to consumers.

Navigating Concerns and Opportunities in Open Banking Adoption Among Canadians

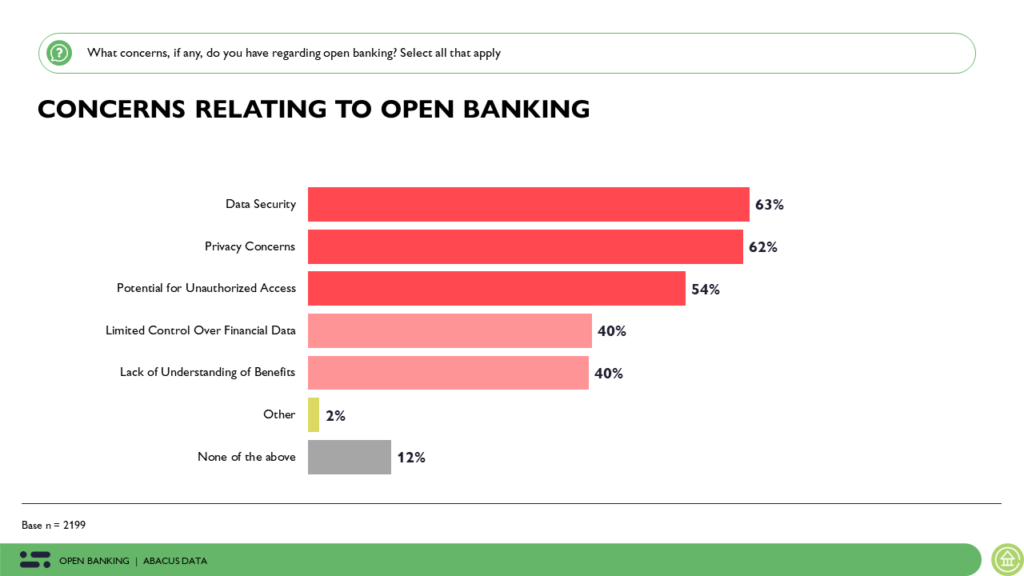

In the realm of open banking, Canadians’ primary concerns revolve around data security (63%), privacy (62%), and the potential for unauthorized access (54%) as many individuals perceive their data to be more accessible and vulnerable through open banking solutions. Given these apprehensions, it’s necessary for open banking solutions to prioritize innovation while ensuring consumer protection and data security measures.

Beyond security and privacy worries, many Canadians express concerns stemming from a lack of knowledge. Specifically, 40% of respondents highlight their limited understanding of the benefits of open banking as a source of unease.

The Importance of Customization and Personalization in Open Banking Evaluation

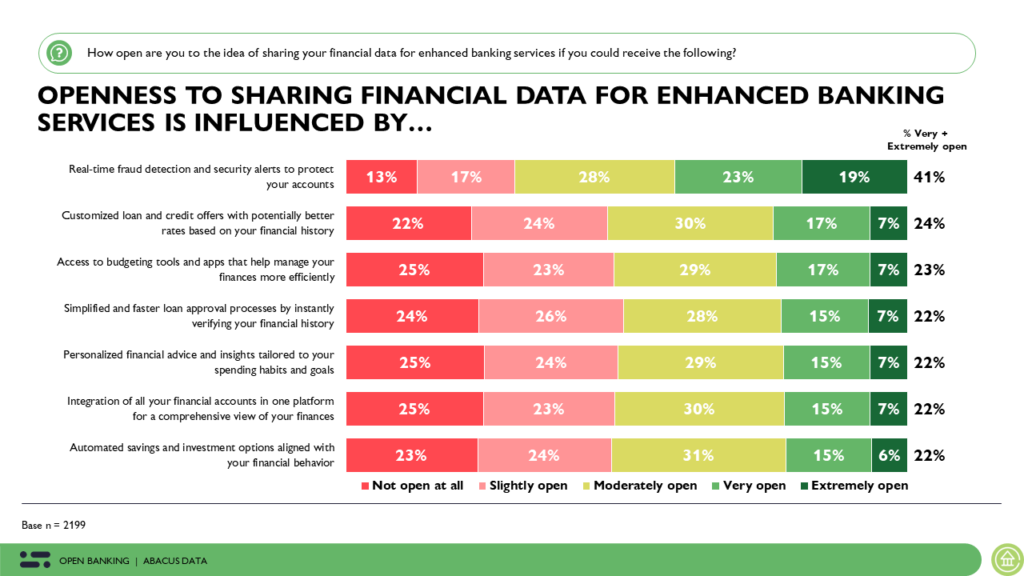

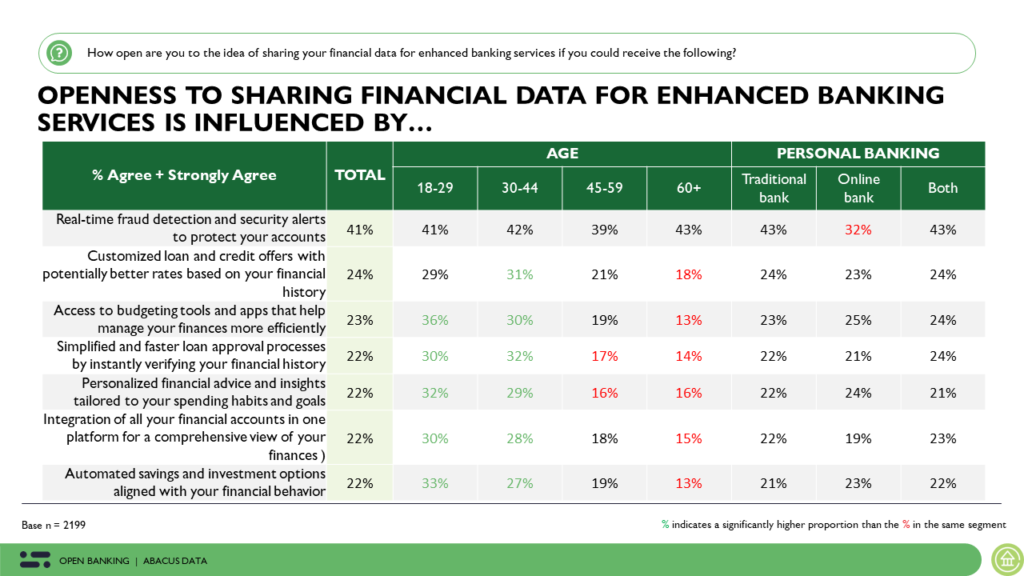

While open banking remains unfamiliar to many Canadians, its potential benefits are understood by some. Notably, 41% are willing to share data for real-time fraud detection. Additionally, there is some interest in personalized benefits, with 24% interested in tailored loan offers and 1 in 5 Canadians intrigued by simplified loan approvals, personalized financial guidance, and automated savings options. It is important to note, however, that interest for the benefits of open banking is limited and most of the benefits don’t appeal to the majority of Canadians. This may be due to a lack of interest and/or due to a lack of knowledge about open banking in general.

Once more, these findings underscore a notable generational gap, with younger Canadians showing a significantly higher propensity to value the influence of personalization, customization, integration, and speed of services offered through open banking, in contrast to Canadians aged 60 and above.

The Upshot

Although satisfaction with personal financial institutions remains high, Canadians acknowledge persistent challenges, such as adapting to meet their needs, transparency, and prioritizing Canadians’ best interests. Addressing these concerns necessitates collaboration among financial institutions, regulators, and policymakers to foster a fair and transparent banking environment that effectively serves Canadians’ changing needs.

In this context, the emergence of open banking presents an opportunity to address some of these challenges and deliver more personalized and innovative financial services. However, there is a clear need for increased awareness and education about open banking among Canadians, particularly among older generations and traditional bank users.

Right now, there doesn’t appear to be much demand for it. The challenge with open banking is that many Canadians don’t understand it and, as a result, they are resistant to embracing it. We have witnessed similar technological advancements where people were resistant to change like the transition to email.

At present, open banking lacks substantial demand. A primary obstacle it encounters is the widespread lack of understanding among many Canadians, which fosters resistance to its adoption. This resistance reflects patterns seen in past technological advancements, including the shift to email, the advent of cellular phones evolving into smartphones, and the emergence of online shopping. In each instance, initial resistance gave way to widespread acceptance as people recognized the benefits of these innovations.

Advocating for the implementation of open banking should be a priority in the financial service sector, as it holds promise for addressing numerous challenges Canadians encounter. With a focus on consumer protection, data security, and customized services, open banking has the capacity to improve financial inclusion and enable individuals to make better-informed financial choices.

Fostering digital literacy, advancing open banking awareness, and advocating for consumer-centric policies are crucial steps towards creating a more inclusive and resilient financial ecosystem in Canada. By addressing these key areas, the industry can better equip Canadians to navigate the complexities of modern banking and improve their financial well-being.

Methodology

The survey was conducted with 2,199 Canadian adults from January 18 to 23, 2024. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.09%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

About Abacus Data

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019. Find out more about how we can help your organization by downloading our corporate profile and service offering.