Abacus Data Poll: Canadians React to the Bank of Canada Interest Rate Cut

Between June 6 and 13 2024, Abacus Data conducted a nationwide survey involving 1,550 Canadians (18+) to assess their perceptions of the housing situation in Canada. This survey explores Canadians’ awareness and reactions to the Bank of Canada’s recent interest rate announcement, highlighting demographic disparities in awareness, satisfaction with the rate cut, personal impacts, economic expectations, and political implications.

Some key findings from the current research are:

- 71% of Canadians were aware of the Bank of Canada’s rate announcement, with higher awareness among older adults and homeowners.

- Satisfaction with the rate cut was reported by 40% of Canadians, notably highest among homeowners.

- 67% of Canadians believed the rate cut had little to no personal impact, especially among older demographics.

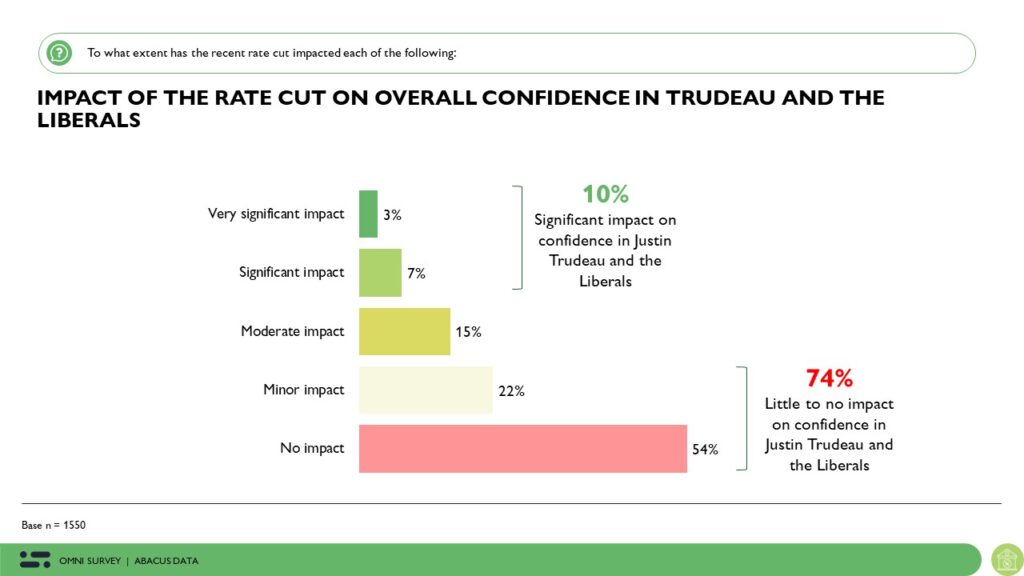

- 74% of Canadians reported that the rate cut had little to no impact on their confidence in Justin Trudeau and the Liberals.

Awareness of Bank of Canada’s Rate Announcement

Most Canadians, 71%, reported being aware of the Bank of Canada’s rate announcement on June 5th, 2024, while 29% were unaware. Awareness was highest among individuals aged 60 and older (84% aware) and among homeowners (82% aware). Conversely, younger Canadians were less likely to be informed about the rate cut, with 46% of those aged 18-29 indicating a lack of awareness. This disparity in awareness highlights the varying levels of engagement across different demographics in Canada.

Diverse Reactions to Bank of Canada’s Interest Rate Cut

Two in five Canadians report being satisfied with the Bank of Canada’s decision to cut the interest rate by 0.25%, with only 16% expressing dissatisfaction. Satisfaction is highest among homeowners (47%), as the rate cut has the potential to impact mortgage rates and renewals for many Canadians.

Meanwhile, two-thirds of Canadians believe the rate cut has little to no personal impact on them (67%). This sentiment is strongest among those aged 60 and older (81%), while younger Canadians show a marginal degree of optimism, with 12% of those aged 18-29 noting that it had a significant to extreme impact on them.

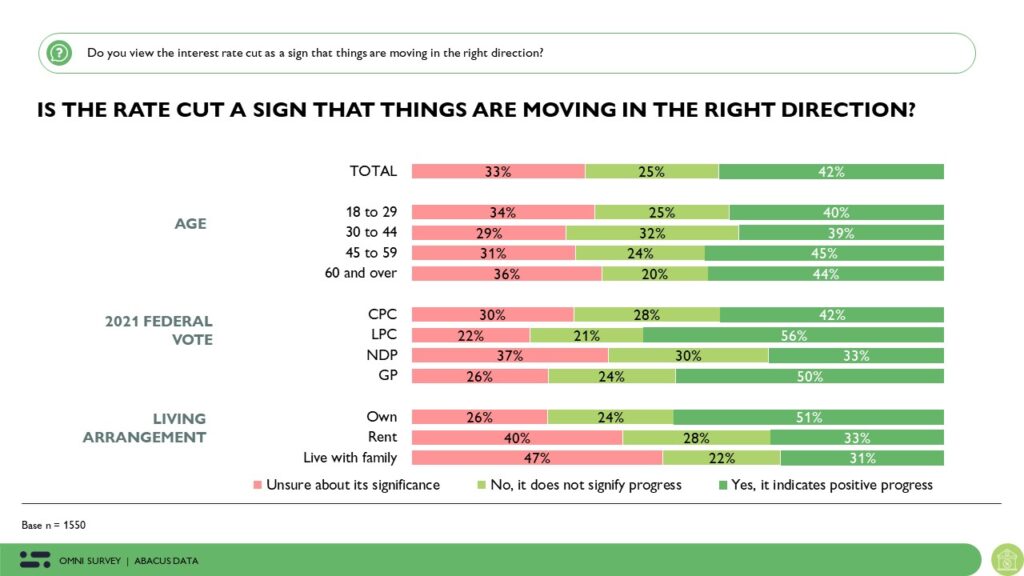

Additionally, 42% of Canadians see the rate cut as a sign of positive progress, a belief most prevalent among homeowners (51%) and those who voted for the Liberals in the 2021 election (56%).

Expectations on the Economic Impact and Future Rate Cuts

Overall, 42% of Canadians do not believe the rate cut will have any noticeable impact on the economy, while 43% think it will make a difference. Young Canadians are more optimistic, with 56% expecting a noticeable economic impact, compared to 58% of those aged 60 and older who believe it will have no effect.

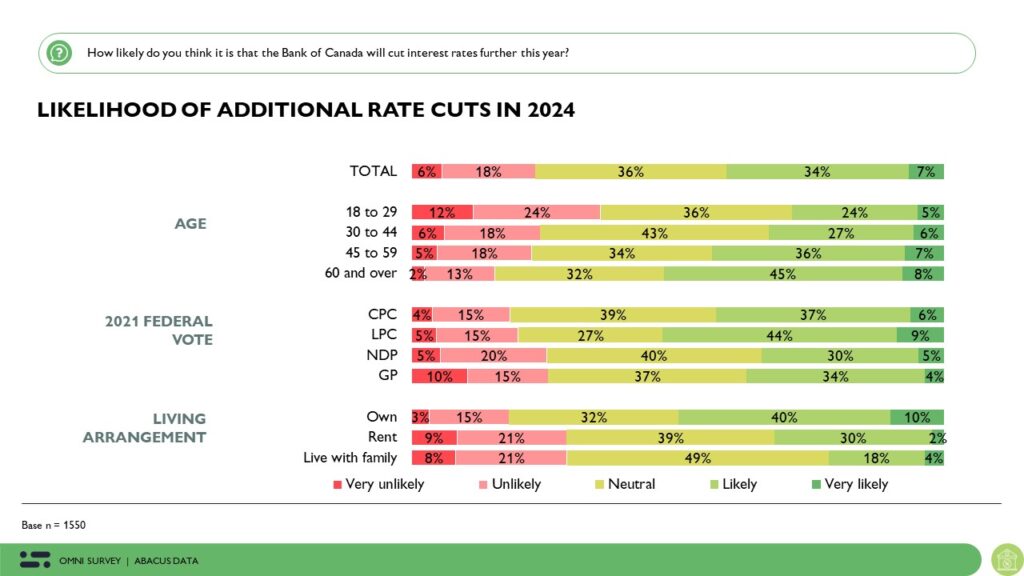

Additionally, 40% of Canadians anticipate further rate cuts this year, whereas 24% think additional cuts are unlikely. Those who voted for the Liberal party in the 2021 election are more likely to expect further rate cuts (53%), while 39% of Conservative voters from 2021 remain unsure about future cuts. These varying perspectives highlight the differing economic outlooks and expectations among Canadians based on age and political affiliation.

Rate Cut’s Impact on Confidence in Prime Minister Trudeau and the Liberals

Responses to the rate cut’s effect on confidence in Justin Trudeau and the Liberals varied significantly among Canadians. Overall, 74% felt it had little to no impact on their confidence. Younger Canadians, particularly 18-29-year-olds (16%) and 30-44-year-olds (15%), were more likely to perceive an impact, while older Canadians, notably those aged 60 and above, largely believed it had no effect (87%).

Among Liberal voters from the last federal election, 15% noted a significant impact on their confidence in Trudeau’s government, contrasting with 65% of Conservative voters who reported no change. Moreover, among those supporting the re-election of the Liberals, 17% felt a significant impact, whereas 62% of those seeking change with an alternative and 52% of those unsure about an alternative noted no effect on their confidence in Trudeau.

The Upshot

Overall, the recent rate cut by the Bank of Canada garnered significant attention among Canadians but had a relatively modest impact on public sentiment. While awareness of the rate announcement was high, satisfaction with the cut was tempered, with only 40% expressing explicit satisfaction. Note, the rate cut is not great news for everyone. Those with savings and little debt have benefited from higher rates in terms of interest earned on that savings. Moreover, a substantial majority of Canadians, 67%, believed the rate cut had little to no personal impact, indicating cautious optimism about its economic implications.

While many Canadians initially viewed the rate cut as a positive step towards future economic improvements, the reality of its perceived minimal immediate impact on personal finances and economic confidence is apparent.

The immediate political impact of the rate cut has been minimal to date. Yesterday, we reported no shift in political opinions and the Conservatives holding a 20-point lead over the Liberals. In fact, when asked how people would vote in this poll, the Liberal Party’s vote share was the lowest we’ve recorded since it was elected in October 2015.

Perhaps most informative from that poll is the finding that among those who rate the cost of living as one of their top three issues (73% of Canadians), only 14% believe the Liberal Party is best able to hand the issue, 4-points fewer than feel that way about the NDP and 24-points fewer than pick the Conservatives.

Voters usually vote for the party they think can best handle the issue they care more about. As long as Canadians are focused on the cost of living and continue to feel friction on the issue, the Liberals face tough odds to be re-elected.

As Canadians continue to navigate economic uncertainties and evaluate political leadership, the rate cut’s muted effects suggest it may not serve as a definitive solution or political boon for the Liberals.

Many Canadians are happy with the rate cut and believe more are coming. This may ultimately improve the public’s mood and give credit to the Trudeau government. But right now, that is not happening suggesting the path forward will likely require further loosening of monetary policy and a shift in perceptions about the federal government’s effort to handle the issues that matter most to people.

Methodology

The survey was conducted with 1,550 Canadian adults from June 6 to 13, 2024. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.53%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in the 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.