Redefining Loyalty: Understanding Canadians’ Relationship with Financial Institutions

Between March 14 to 21, 2024, Abacus Data conducted a nationwide survey with 3,550 Canadians aged 18 and above to examine their attitudes towards financial services. With all eyes on the federal budget scheduled for April 16th, which is expected to include a legislative framework for ‘open banking’, we explore the current consumer landscape of banking services in Canada.

In Part 1 of our series on Canada’s financial future, we explored Canadians’ digital literacy, understanding of financial technology, and the potential for open banking adoption. In Part 2, we shift our focus to gain deeper insights into Canadians’ readiness to change financial institutions, the factors anchoring them to their current providers, and the perceived obstacles holding them back from alternative solutions. The findings reveal a degree of ‘soft satisfaction’ with existing financial providers, indicating that financial institutions are not immune to disruption in the financial sector, particularly among young Canadians.

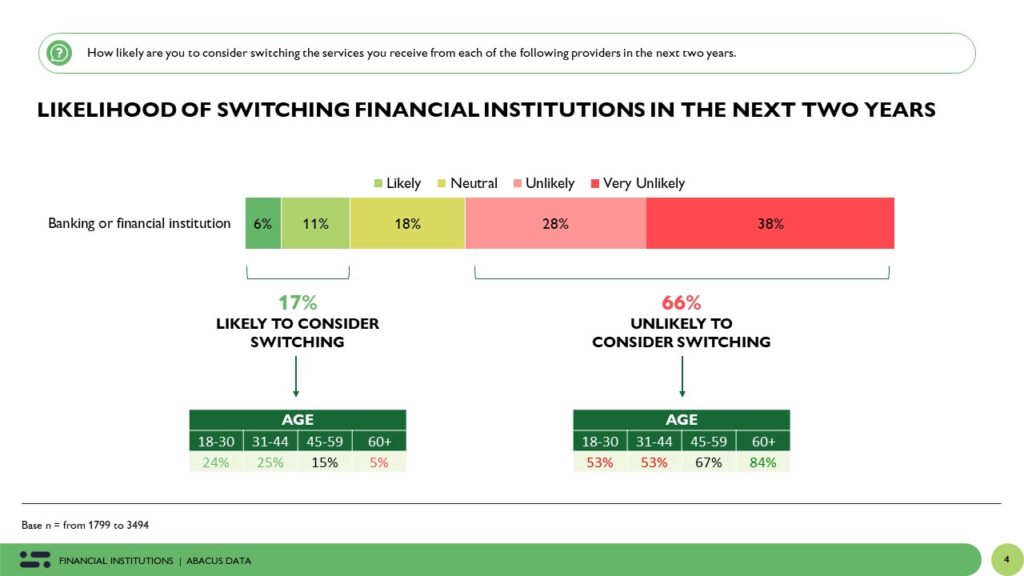

CANADIANS’ WILLINGNESS TO SWITCH FINANCIAL PROVIDERS

Two-thirds of Canadians (66%) express no intention of considering switching financial providers in the next two years. Notably, individuals aged 60 and above are significantly less inclined to consider such a switch, with 84% expressing their reluctance. Conversely, while many young Canadians indicate reluctance to switch, a notable 25% of those aged 18 to 44 express a likelihood of considering a change. This underscores an opportunity for current financial providers to delve deeper into understanding the needs of this demographic to sustain their loyalty, while simultaneously paving the way for alternative providers to showcase their offerings and enhance willingness to switch.

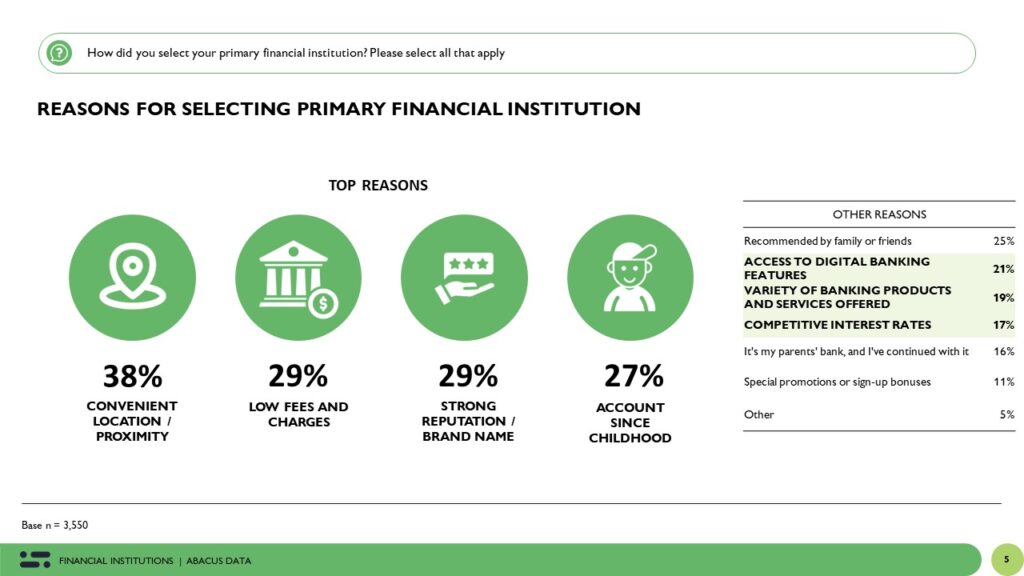

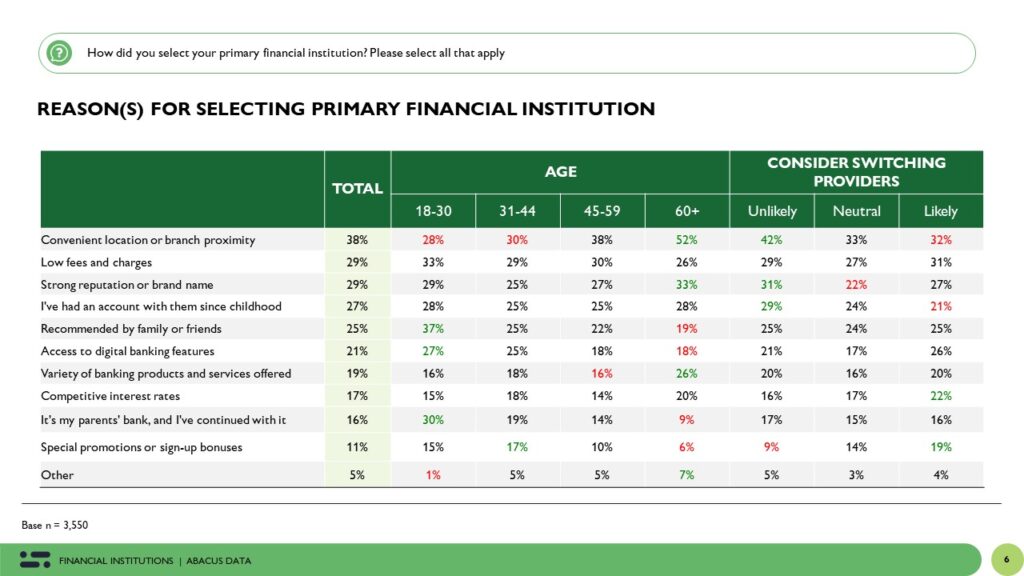

FACTORS INFLUENCING CANADIANS’ CHOICE OF FINANCIAL INSTITUTIONS

Two in five Canadians (38%) chose their primary financial institution primarily because of the convenient location or proximity of its branch. Additionally, 29% cited the institution’s strong reputation as a key factor, while 27% mentioned having been with the same bank since childhood. Only a small fraction of respondents, aside from the 29% who prioritized low charges and fees, identified products, rates, or service offerings as the main motivator behind their choice of financial institution.

Demographic analysis revealed notable differences, with individuals aged 60 and above being significantly more inclined to select their bank due to its convenient location (52%) and strong reputation (33%). Conversely, younger Canadians were more likely to opt for their parents’ bank and continue with it (30% among those aged 18-34), as well as to choose a bank recommended by family and friends (37% among those aged 18-34).

These results suggest that Canadians often choose banks based on practical factors like proximity and emotional ties such as reputation and familial connections, likely due to limited financial literacy and awareness of alternatives. This presents an opportunity for financial institutions to leverage both emotional connections and practical considerations to better meet Canadians’ needs and preferences, while also emphasizing the importance of improving financial literacy and awareness to drive preferences towards institutions offering greater value and benefits.

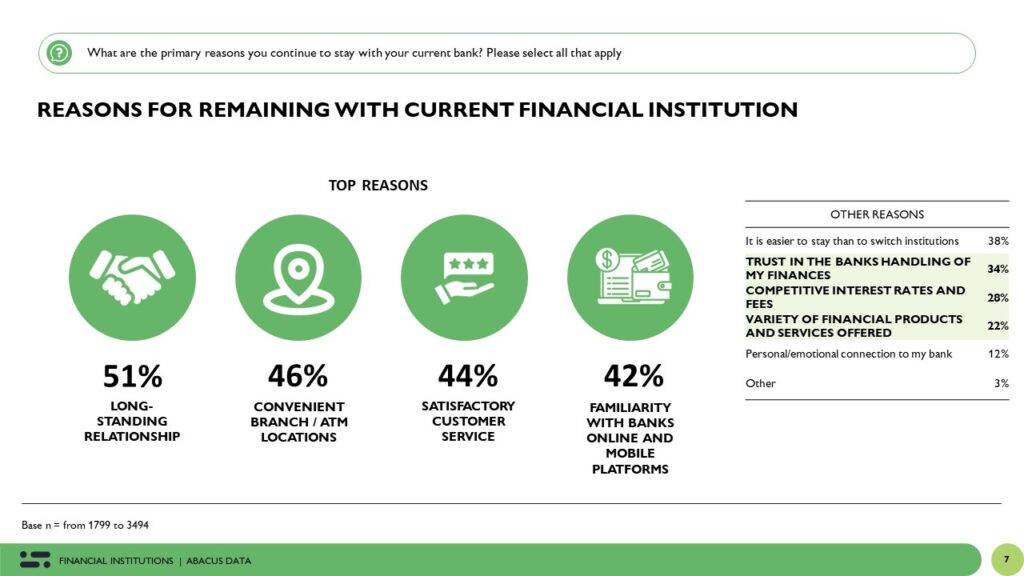

THE DRIVERS OF LOYALTY

Exploring the reasons behind Canadians’ loyalty to their primary financial institutions, 51% emphasize their longstanding relationship, closely followed by 46% who prioritize convenient branch locations or proximity. Additionally, 44% attribute their loyalty to satisfactory service, while 42% highlight familiarity with online products and tools.

Surprisingly, few Canadians note the impact that their bank has on their finances as a reason to stay. Specifically, only one in three Canadians (34%) cite trust in their bank’s ability to handle their finances as a significant factor for staying, with even fewer mentioning competitive rates and fees (28%) or the variety of products and services offered (22%).

These findings underscore the significance of personal connections and convenience/familiarity in Canadians’ decisions to remain loyal to their primary financial providers.

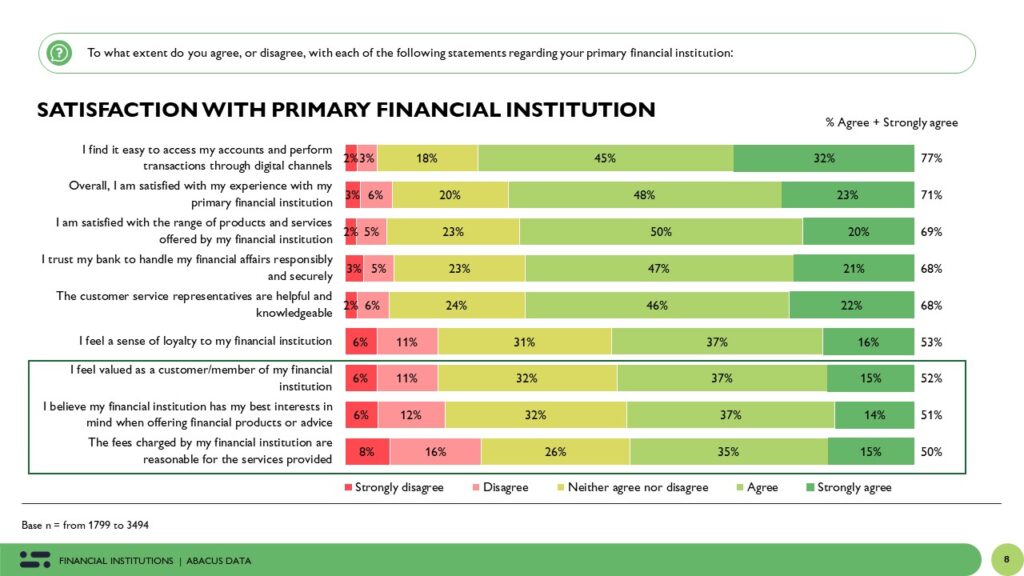

ASSESSING CANADIANS’ VIEWS ON THEIR FINANCIAL INSTITUTION

Overall, 7 in 10 Canadians note that they are satisfied with the experience at their primary financial institution. Further, 77% indicate that they are satisfied with their ability to access their accounts and perform transactions through digital channels, while 69% are satisfied wit the products and services being offered to them.

However, satisfaction does go down when examining specific aspects of the banking experience. Specifically, only 52% believe they are valued as a customer at their financial institution, while 51% believe their financial institution has their best interests in mind when offering products or advice. Further, believe the fees charged by their institution are reasonable for the services provided.

These results highlight a concerning trend: only half of Canadians feel valued by their primary financial institution and believe their bank has their best interests at heart, despite their loyalty. This reveals a gap between customer expectations and the actual delivery of personalized care by financial institutions. It emphasizes the importance for banks to prioritize strategies that enhance customer satisfaction, trust, and a sense of value. The results suggest that Canadians are not necessarily aware of this gap, but neglecting to bridge this gap may result in diminished customer loyalty and trust as more options enter an increasingly competitive market.

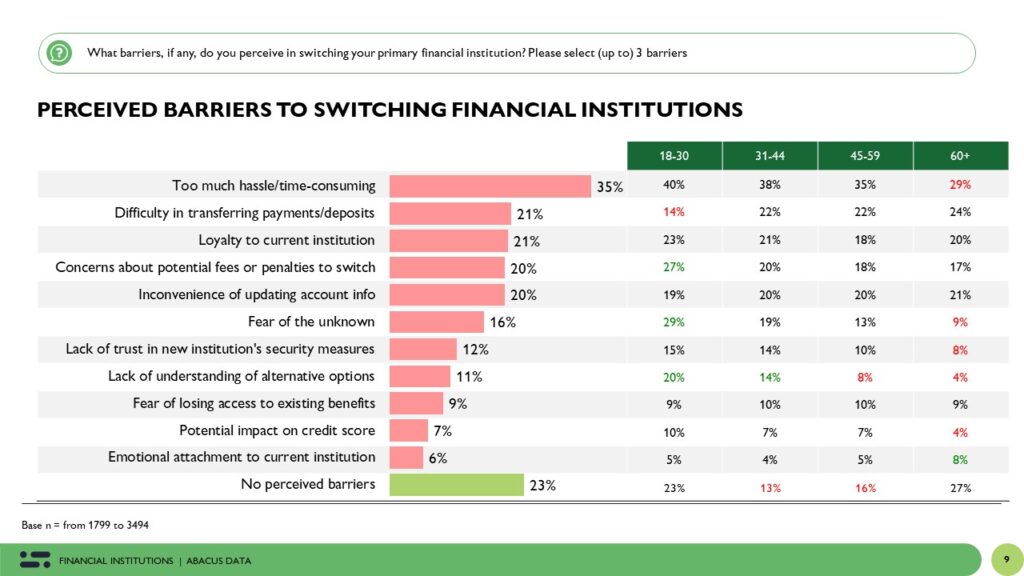

NAVIGATING PERCEIVED BARRIERS TO SWITCHING PROVIDERS

When examining the obstacles associated with switching financial institutions, many Canadians cite the sheer hassle involved in making the transition. Specifically, 35% mention the inconvenience and time-consuming nature of switching, while 21% highlight difficulties in transferring direct deposit and payment information. Additionally, 20% note the inconvenience of updating account information. Loyalty to their current institution serves as a barrier for 21% of respondents, alongside concerns about fees and penalties for switching, mentioned by 20%.

Interestingly, young Canadians aged 18-30 are most likely to express a fear of the unknown (29%), hinting at potential barriers stemming from limited financial literacy.

These findings underscore the importance for financial institutions to address the practical challenges and emotional barriers associated with switching. Efforts to streamline the transition process and enhance financial literacy could facilitate greater mobility among customers and foster a more dynamic and competitive banking landscape.

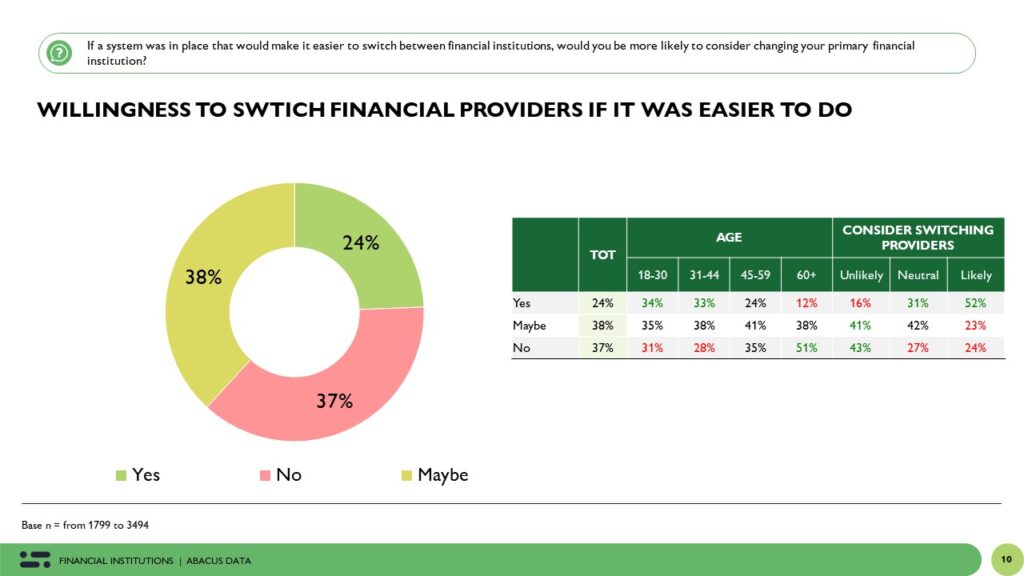

CHANGING DYNAMICS IN FINANCIAL INSTITUTION LOYALTY

When prompted about their willingness to switch financial institutions if the process were more streamlined, 24% of respondents expressed definite interest in doing so, while an additional 38% indicated they might consider it. This sentiment is particularly pronounced among younger Canadians, with 34% of those aged 18-30 and 33% of individuals aged 31-44 stating they would switch institutions if the process were simplified.

This growing openness to change within the banking sector poses significant risks for traditional financial institutions, especially in light of the evolving landscape characterized by the emergence of open banking and the rapid growth of FinTech companies. As younger demographics demonstrate a greater willingness to explore alternative options, banks face intensified competition and the threat of losing market share.

THE UPSHOT

The current findings highlight the potential for significant shifts in Canada’s banking landscape, driven by evolving consumer preferences and the emergence of open banking. Canadians exhibit a “soft satisfaction” with their primary financial institutions, primarily rooted in familiarity and emotional ties rather than purely financial considerations. This preference for familiarity over financial benefits suggests an opportunity for financial institutions to leverage emotional connections and improve financial literacy to guide preferences towards options offering greater value and benefits.

However, our sense of attachment to our financial institutions is not absolute. There is a growing openness among Canadians, especially younger demographics, to consider switching financial institutions if the process were simplified. This poses a risk for traditional banks, particularly in the context of increasing competition and the potential impact of open banking on the sector.

To navigate these changes, both traditional banks and FinTech companies must adapt. Traditional banks need to innovate to meet evolving consumer expectations and maintain their market relevance, while also preserving the emotional connection that Canadians currently value. Meanwhile, FinTech firms should concentrate on ongoing innovation and customer-centric solutions to draw customers away from traditional banks. This includes efforts to simplify the transition process and improve financial literacy, enabling greater mobility among customers and fostering a more vibrant and competitive banking environment.

As we await the federal budget announcement on April 16, the banking sector in Canada stands at the brink of exciting opportunities for growth and innovation. With the impending legislative framework for open banking on the horizon, traditional banks and FinTechs alike are poised to usher in a new era of financial services, driven by adaptability, customer-centric solutions, and technological advancement. These developments have the potential to reshape the banking landscape, offering consumers enhanced choices, convenience, and financial empowerment.

Methodology

The survey was conducted with 3,550 Canadian adults from March 14 to 21, 2024. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 1.6%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in the 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.