Has the Greenbelt scandal hurt the Ford PCs in Ontario?

In partnership with the Toronto Star, we conducted a survey of 1,040 Ontario adults from August 18 to 23, 2023 to explore public opinion about the Ford government and to assess whether the Greenbelt scandal has impacted public perceptions and opinions about the government and the Premier. Note, this survey was completed prior to the resignation of the Minister of Municipal Affairs and Housing’s chief of staff and the news that the RCMP is looking into the matter.

Here’s what we found:

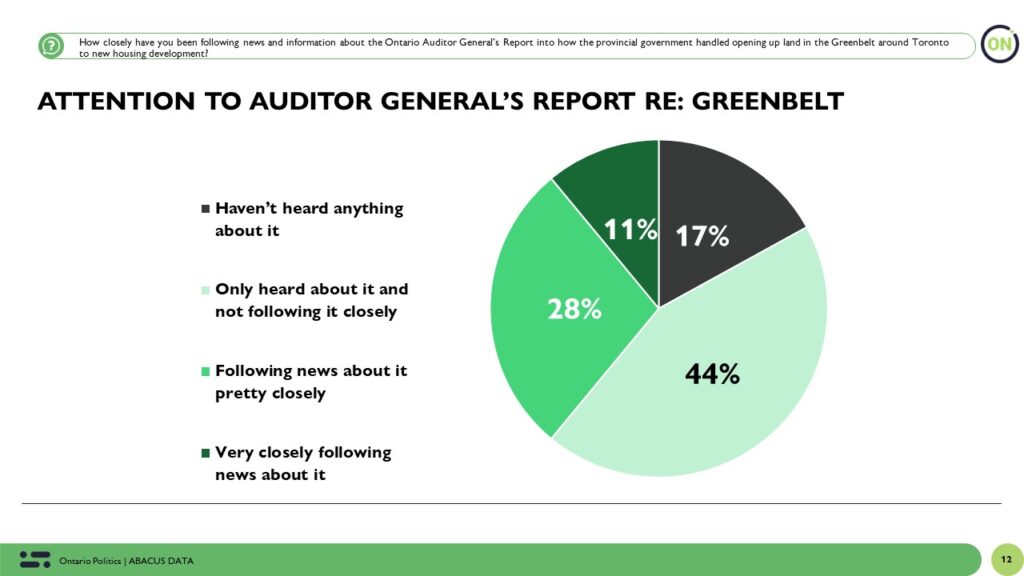

Awareness of the Auditor General’s report is widespread although less than half are following the story closely.

Overall, 83% of Ontarians are aware of the Auditor General’s report into how the provincial government handled opening up land in the Greenbelt and 39% are following it pretty or very closely.

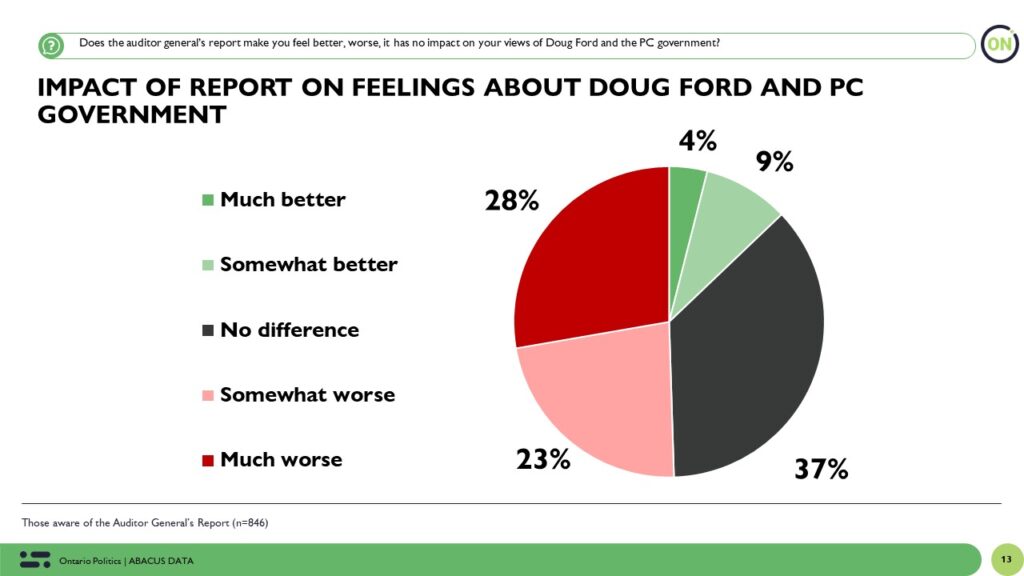

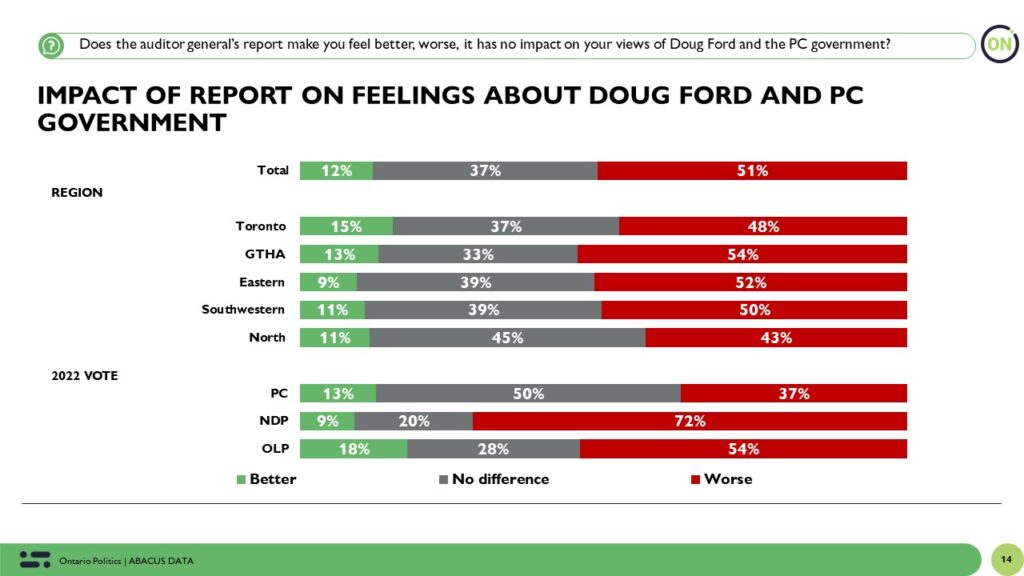

When asked how the report makes them feel about Doug Ford and the PC government, 51% say it makes them feel worse, 13% say it makes them feel better while 37% say it had no impact on their views.

Those living in the GTHA are the most likely to say it’s made their views of Ford and his government worse. Of note, 1 in 3 of those who voted PC in 2022 say their opinions of the PC government and Doug Ford are worse as a result of the report and the news surrounding it.

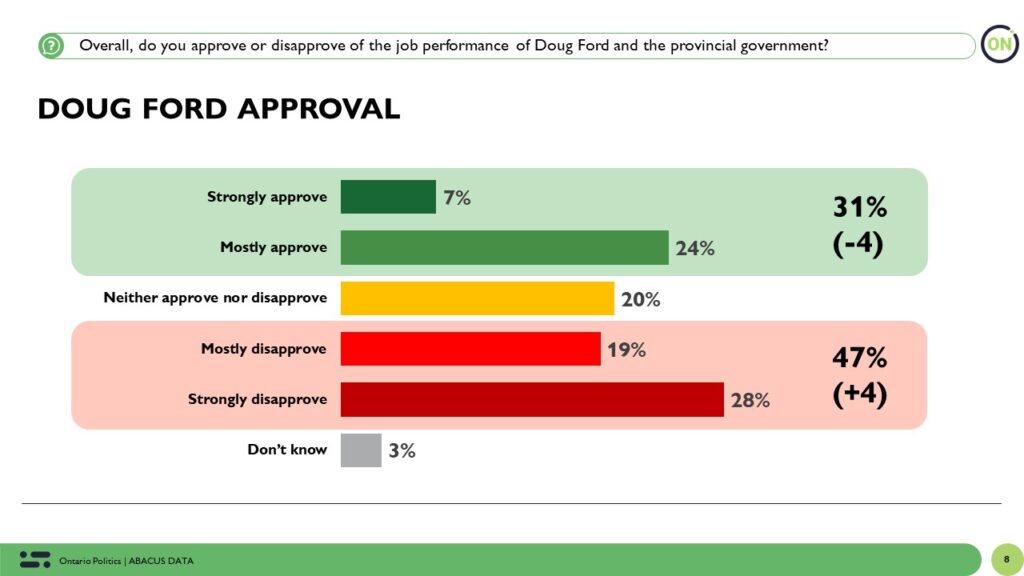

The PC government’s approval rating has taken a hit.

Today, 31% approve of the job performance of Doug Ford and the provincial government while 47% disapprove. Since the end of July, those disapproving of the Ford government’s performance is up 4 points while approval is down 4 points.

Of note, those who strongly disapprove of the government is four times the number of those who strongly approve.

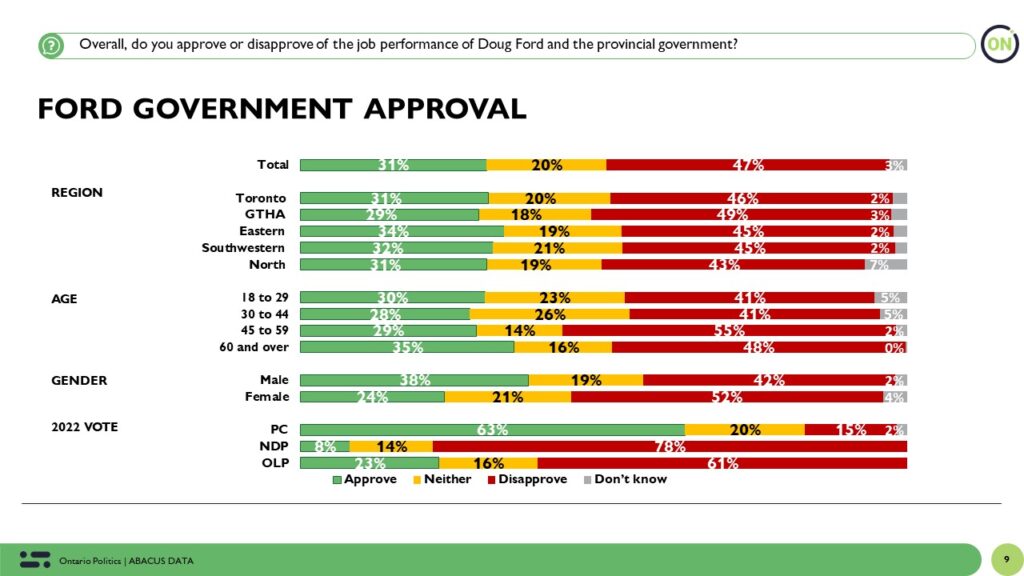

Views are fairly consistent across region and age group. Among 2022 PC voters, 15% disapprove of the job the government is doing while 23% of Ontario Liberal voters say they approve.

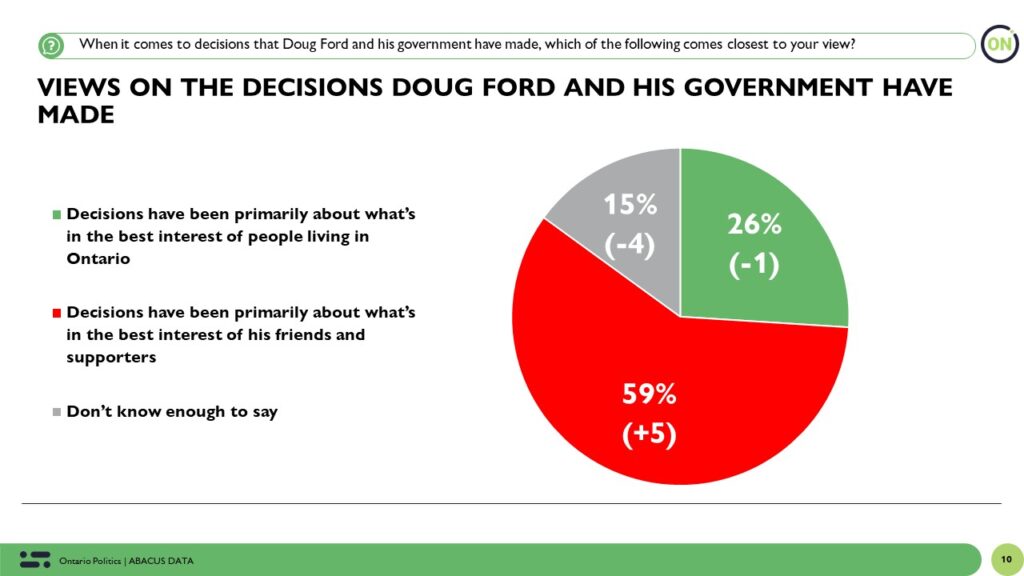

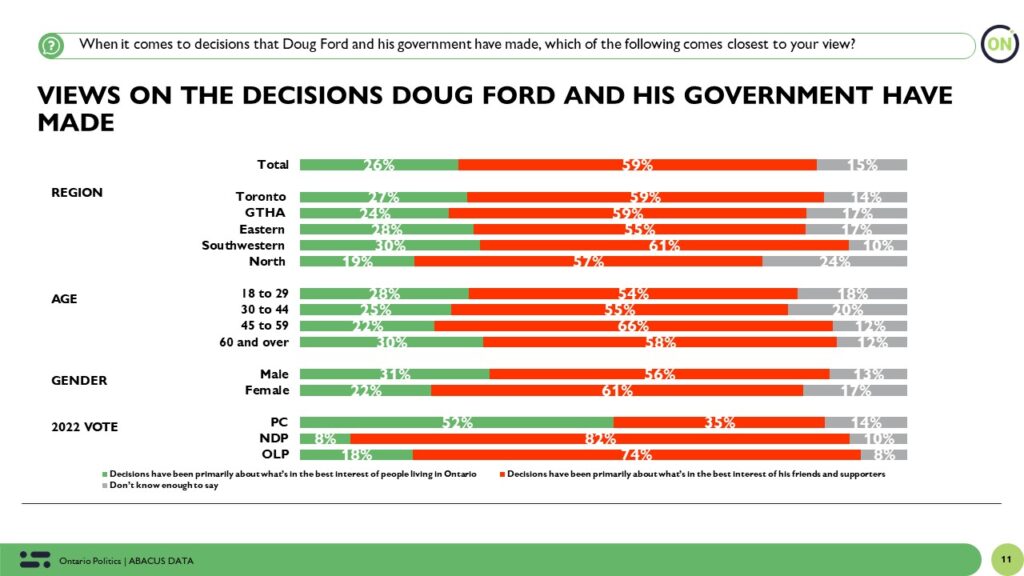

More think Doug Ford and the PC government make decisions to benefit friends and supporters today than did last month.

Last month we asked people whether they felt the decisions Doug Ford and the provincial government make are in the interests of people in the province or more in the interests of their friends and supporters.

Today, close to 6 in 10 Ontarians believe decisions are made more in the interests of Ford’s friends and supporters, up 5 points in a month. 26% feel he’s making decisions in the best interest of people living in the province (down 1) while 15% don’t know enough to say (down 4).

The widespread awareness of the issue likely accounts for the shift from “don’t know” to “helps his friends” in this case.

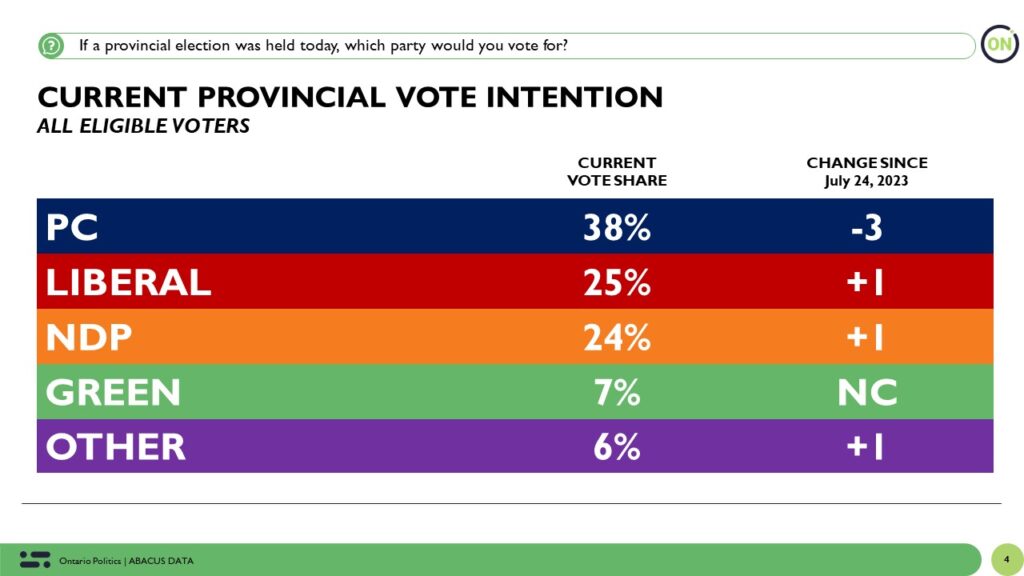

Despite all of this, the PCs still hold a healthy lead over the Ontario Liberals and NDP.

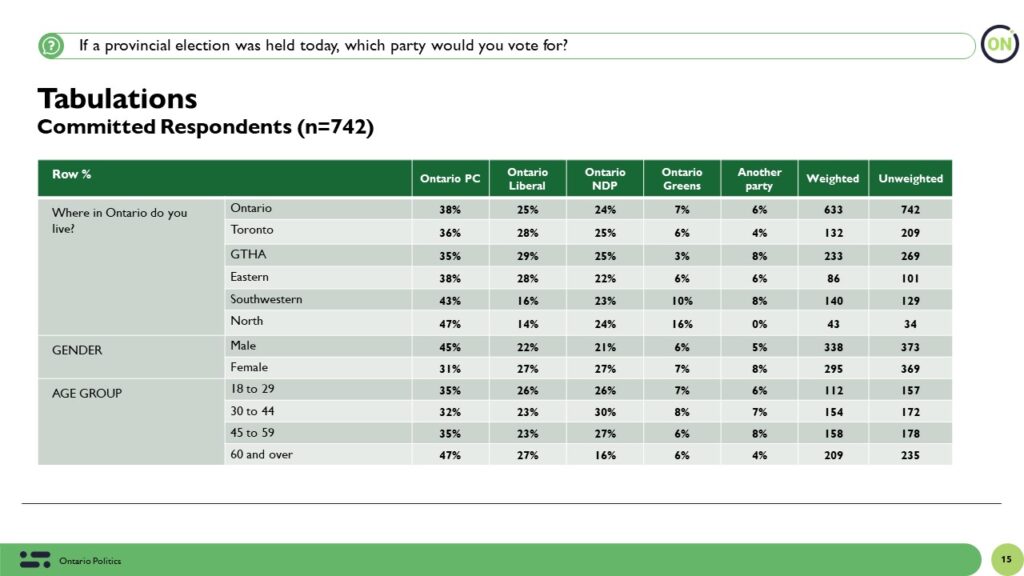

If an election was held at the time of the survey, the PCs would still win a majority and lead the Ontario Liberals by double digits. 38% of committed Ontarians would vote PC (down 3 from last month), 25% would vote for the Liberals and 24% would vote NDP. Note, the Liberals are currently in the middle of a leadership race so the dynamics of the ballot would likely change depending on who wins the leadership.

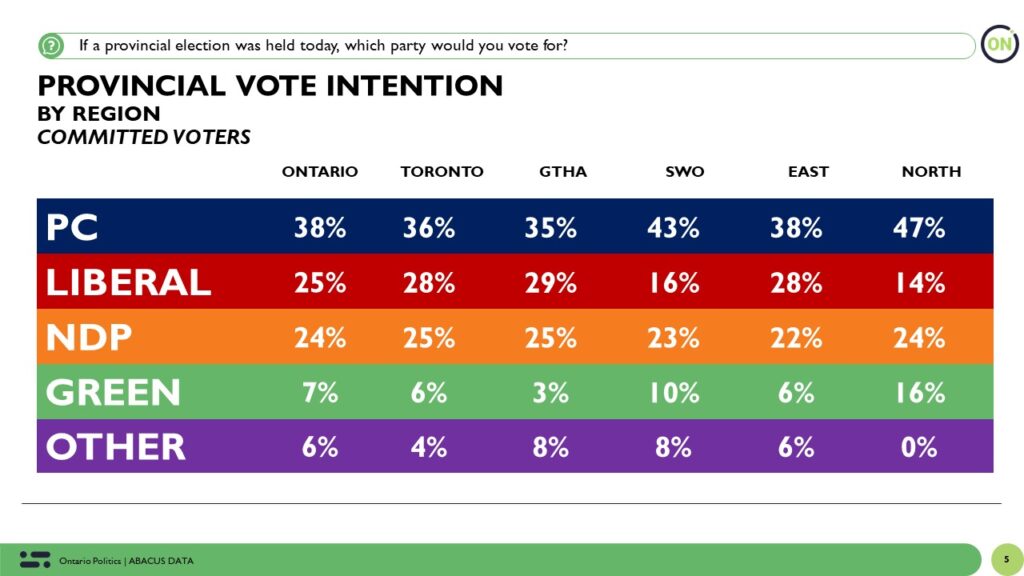

Regionally, the PCs are ahead in every region of the province from a 20-point lead in Southwestern Ontario to a smaller 6-point lead in the GTHA.

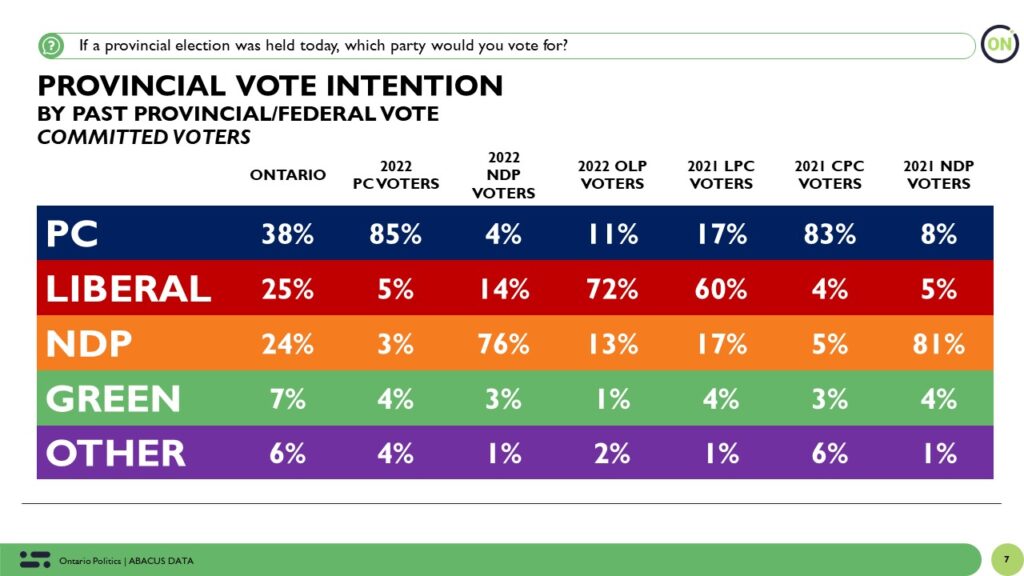

One reason the PC vote has head up so far is because the vast majority of its previous supporters are staying with the party. 85% of past PC supporters say they would vote PC today as would 11% of past Liberal supporters. Interestingly, 17% of past federal Liberal supporters say they would vote PC today.

The Upshot

According to David Coletto, Chair and CEO of Abacus Data:

“The awareness and the subsequent impact of the Auditor General’s report on the government’s handling of the Greenbelt indicates a pronounced skepticism towards Doug Ford and the PC government. An overwhelming majority of Ontarians are aware of the report’s content, and this has played a pivotal role in influencing the perceptions of a significant portion of the population. Specifically, over half have indicated that the report has negatively impacted their view of the Ford administration, a sentiment especially pronounced in the GTHA. It’s crucial to highlight that even among those who voted PC in the last election, a considerable 1 in 3 have seen their views soured as a consequence of the report.

The report and news about it has dented the PC government’s approval ratings and further exemplifies the public’s discontent with the current administration. A considerable segment of the population, nearly half, disapproves of their performance, a figure that has been on the rise since July. The fact that the count of those who strongly disapprove is four times those who strongly approve underscores the gravity of dissatisfaction.

However, despite the evident challenges in the realm of public perception, the PCs still maintain a considerable electoral advantage. Their lead, even in the face of controversy and skepticism, is robust and extends across various regions in Ontario. A critical factor in this sustained lead is the loyalty of the PC voter base, with a vast majority of previous supporters expressing their intention to stick with the party. The potential of the Liberals to change the dynamics of the upcoming election depends significantly on their leadership race, suggesting that while the PCs are currently ahead, the political landscape remains fluid and can be influenced by new leadership and policy proposals from opposing parties.

So far this scandal has not been devistating to perceptions of Ford or the PC government but if this issue comes under criminal investigation and continues to play out over the next weeks and months, the damage could become far more extensive to the PC Party and Ford brands. We will keep monitoring public opinion with our partners at the Toronto Star.”

Methodology

The survey was conducted with 1,040 adults living in Ontario adults from August 18 to 23, 2023. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 3.1%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Ontario’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.