3 in 4 Canadians think a national forest fire fighting force is a good idea.

In light of recent warnings by Federal Emergency Preparedness Minister Harjit Sajjan that this year’s wildfire season could surpass the severity of the last, a new poll conducted by Abacus Data sheds light on Canadians’ perspectives on a measure to combat the growing wildfire threat. Minister Sajjan’s cautionary statement last week, describing the upcoming wildfire season’s forecast as “alarming but not surprising,” underscores the urgency of addressing this escalating challenge.

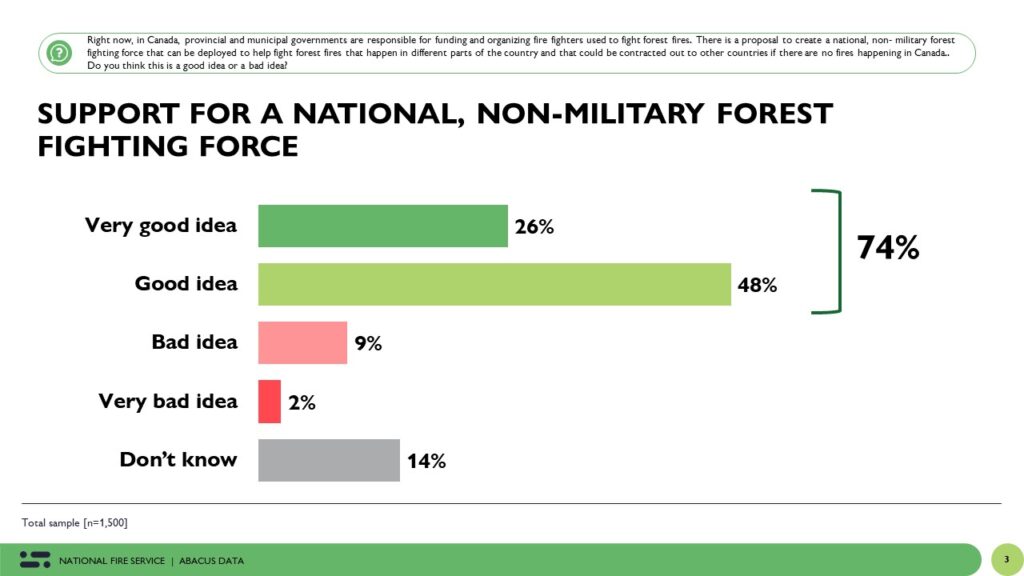

The survey reveals overwhelming support among Canadians for a proposal by BC MP Richard Cannings to establish a national, non-military forest fighting force. This specialized unit would be deployed across Canada to assist in combating forest fires and could be offered as a resource to other countries during periods without domestic fires. According to the poll, 3 in 4 Canadians endorse this initiative, with only 11% opposing it and 14% undecided.

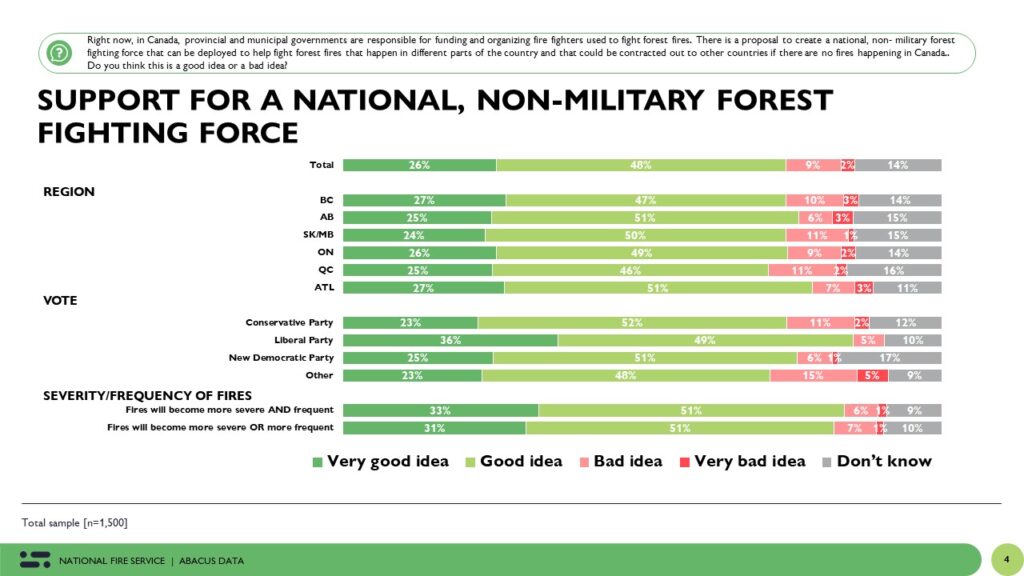

This support is remarkably consistent across the country, with 74% in BC, 76% in Alberta, 75% in Ontario, 71% in Quebec, and 78% in Atlantic Canada backing the idea. Political affiliation does not significantly alter this view, with Liberal supporters showing the highest enthusiasm at 85% approval, followed closely by Conservatives at 75% and NDP supporters at 76%. Moreover, the data indicates that this consensus extends beyond political lines and is uniform regardless of one’s belief in the changing patterns of wildfire severity and frequency.

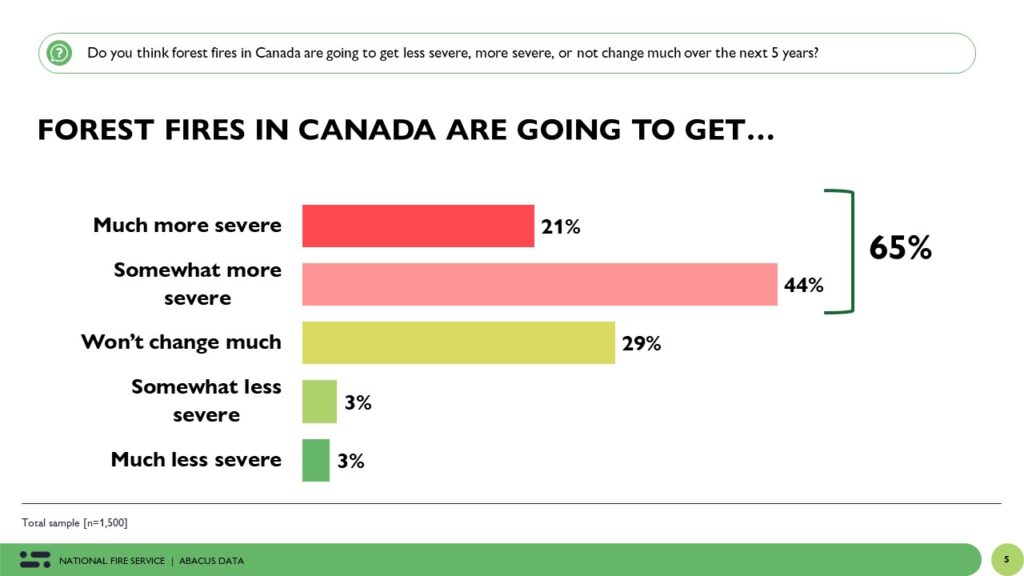

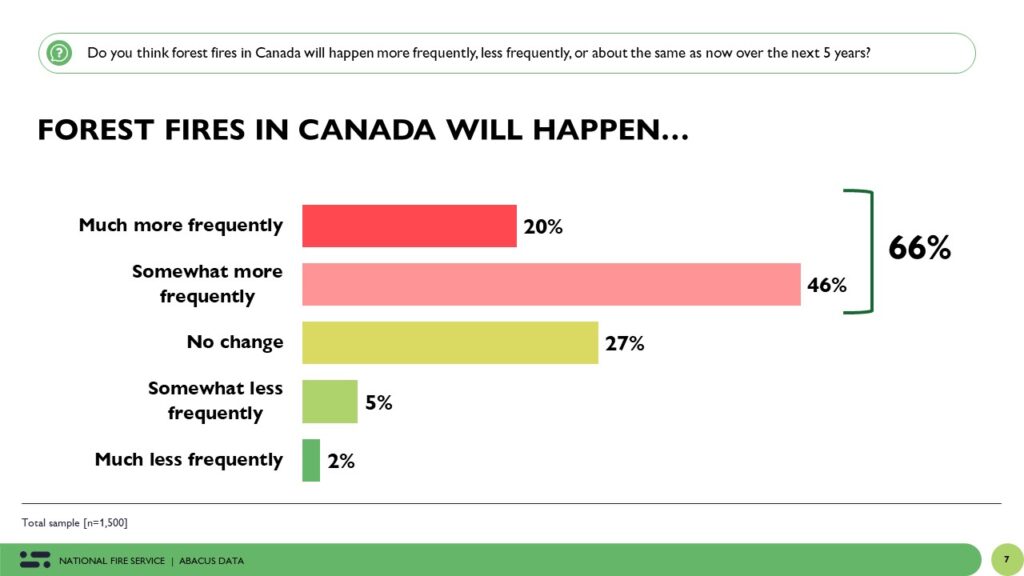

The broad-based support for Cannings’ proposal can be largely attributed to the growing concern among Canadians regarding the future of wildfires in the country. A significant 65% of respondents anticipate an increase in the severity of forest fires over the next five years, with 66% expecting them to become more frequent.

This polling data suggests that Canadians across all demographics and political spectrums recognize the need for more robust national strategies to address the wildfire crisis. The widespread approval of a dedicated forest fighting force reflects a collective understanding that the challenges posed by wildfires, exacerbated by climate change, demand innovative and unified responses.

The Upshot

Last summer’s wildfires, which affected regions across Canada, have evidently left a lasting impression on the public consciousness, emphasizing that wildfires are not isolated incidents but a national problem requiring a national solution. The consensus around the establishment of a national forest fighting force underscores the urgency with which Canadians from all walks of life seek proactive measures to protect their communities, landscapes, and ecosystems from the ravages of wildfires.

The poll results represent a clear mandate from Canadians for their leaders to take decisive action in the face of an increasingly volatile and unpredictable wildfire season. As the threat of wildfires grows more acute, the call for a national, non-military forest fighting force is a testament to the country’s collective will to seek out and support solutions that safeguard the environment and public safety on a national scale. This unified stance sends a powerful message about the importance of foresight, preparedness, and cooperation in addressing one of the most pressing environmental challenges of our time.

Looking to conduct polling or market research in 2024? Have budget left to spend before the end of March? Send Yvonne an email to connect with the Abacus Data team today!

Methodology

The survey was conducted with 1,500 Canadian adults from January 4 to 9, 2024. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.5%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in the 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.