Housing Affordability Hits Home: A closer look at Canadian families’ financial stress

As we embark on the third segment of our in-depth investigation into Canada’s housing crisis, a collaborative effort with the Canadian Real Estate Association (CREA), we turn to an exploration of the financial challenges faced by families with children aged 18 and under. This extensive study, encompassing responses from 3,500 Canadian adults aged 18 and above, was conducted from September 22 to 28, 2023. The data paints a clear picture, portraying the economic hurdles that Canadian families with young children grapple with, as they content with economic uncertainty while navigating the current housing crisis, requiring them to make difficult decisions along the way.

Concerns with Affordability

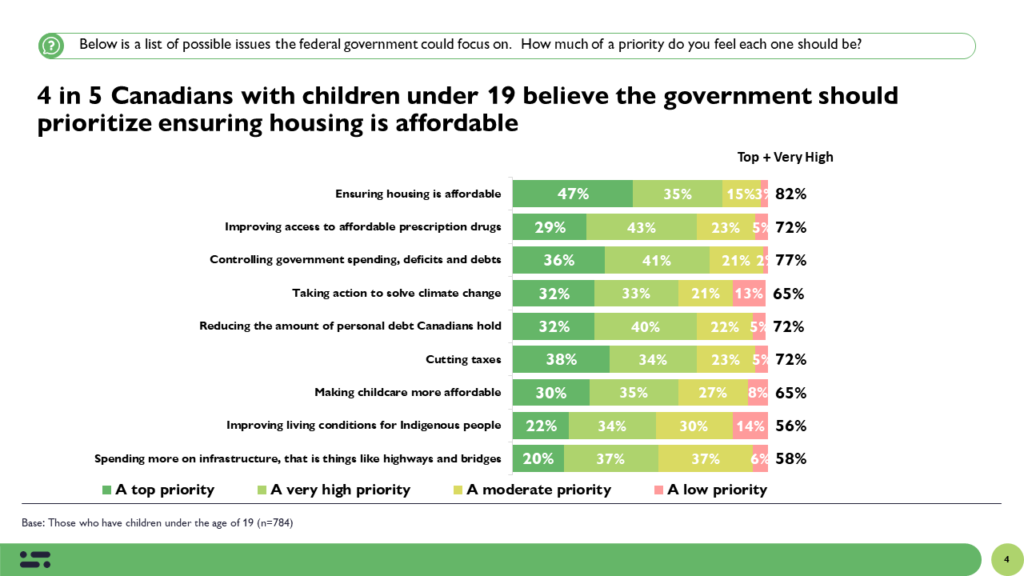

An overwhelming 82% of Canadian households with children under the age of 19 express a strong belief that the government should give top priority to making housing more affordable. Additionally, a substantial 72% advocate for governmental measures to reduce the amount of personal debt carried by Canadians, with this sentiment being notably higher among families with children than those without. These statistics underscore the acute financial pressures experienced by families in their daily lives, amplified by the current cost of living and the housing crisis. It’s evident that Canadian families, especially those with young children, are seeking substantial relief and support from the government to alleviate their financial hardships.

Among those with children aged 18 and under, a substantial 57% report an increase in their concerns regarding housing affordability over the past few months. In contrast, this figure is slightly lower for households with children over 18 (48%) and individuals without children (53%). This data illuminates the growing unease felt by families with young children, highlighting the pressing nature of housing affordability as a top priority for these households.

Financial Hardship

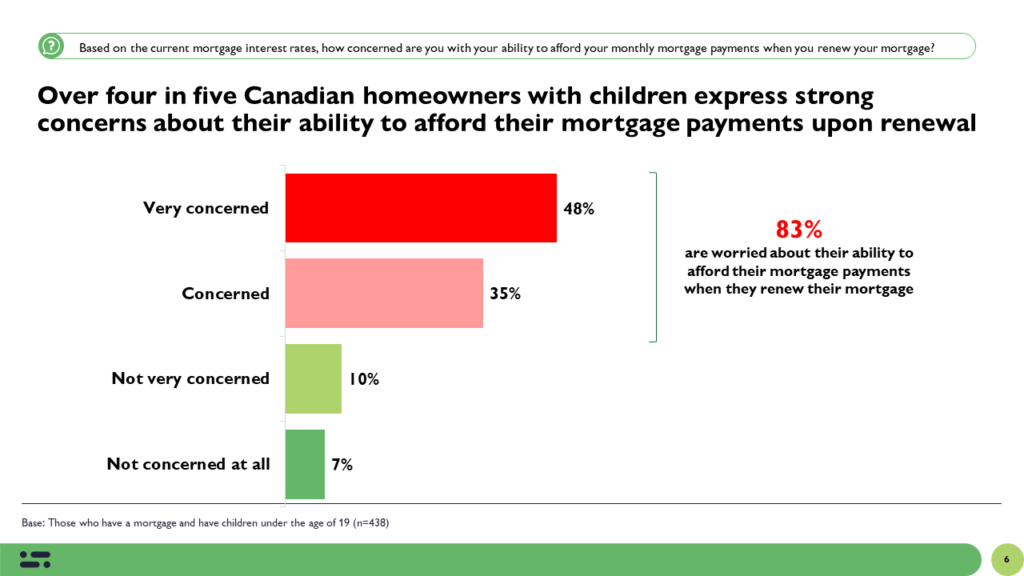

Homeownership Anxiety: For those who have children under 19 and own their homes, 87% made their purchase at a time when interest rates were lower than the current rates. While this might have seemed like a sound financial decision at the time, the data unveils a pressing issue: 80% of these homeowners are now concerned about their ability to afford their monthly mortgage payments when their mortgage comes up for renewal. The dream of homeownership, once seen as a secure investment in one’s family and future, now carries the heavy burden of uncertainty.

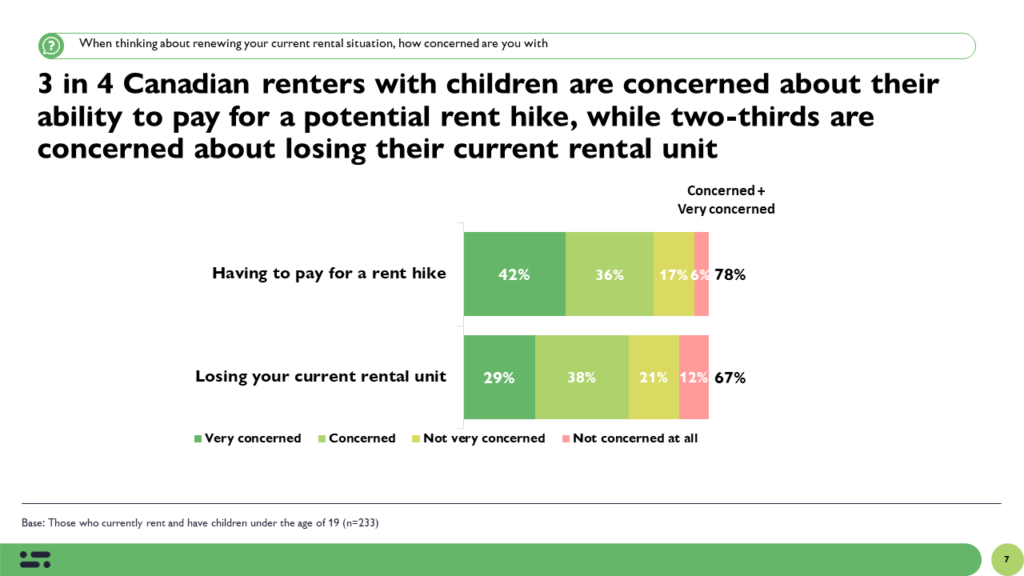

Renters’ Dilemma: For renters, the situation is no less challenging. A striking 78% of renters with children 18 and under expressed deep concern about their ability to manage an increase in rent, should such an eventuality arise. With the cost of living on the rise, rent hikes pose a substantial threat to the financial stability of Canadian families. Further, 67% of renters with children under 19 also worry about the possibility of losing their current rental unit when their current rent agreement comes up for renewal. In a competitive rental market, where affordable housing is increasingly scarce, this fear is not unfounded.

Personal Finances

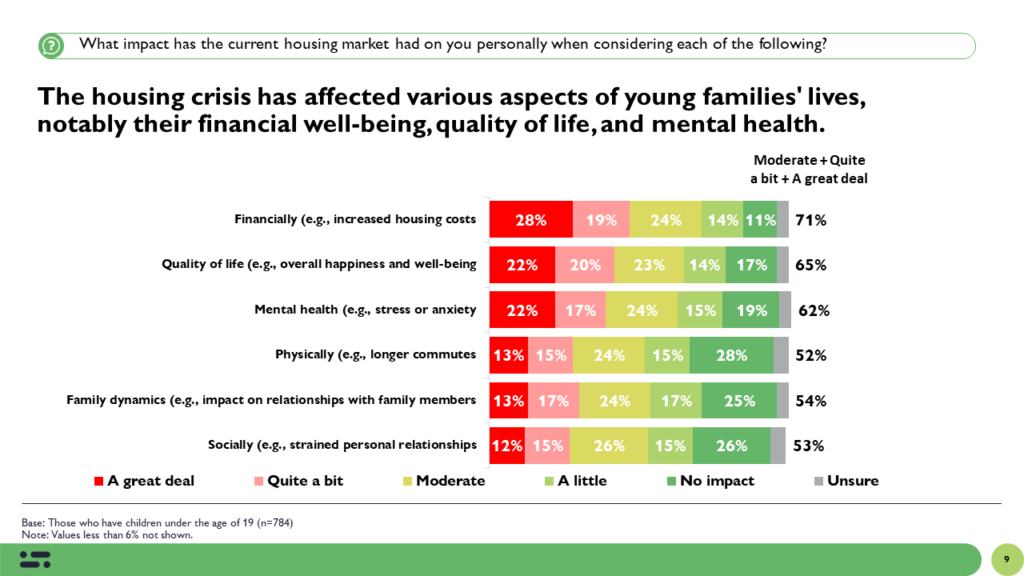

Strain on Families: Undoubtedly, the current housing market has inflicted significant harm on Canadians, especially families with children under 19. A striking 41% of such families report a personal negative impact from the housing market. These families are enduring widespread hardship, with 71% facing financial difficulties, 65% experiencing a decline in their quality of life, and 54% grappling with strained family dynamics. This toll surpasses the effect seen on families with older children and those without children.

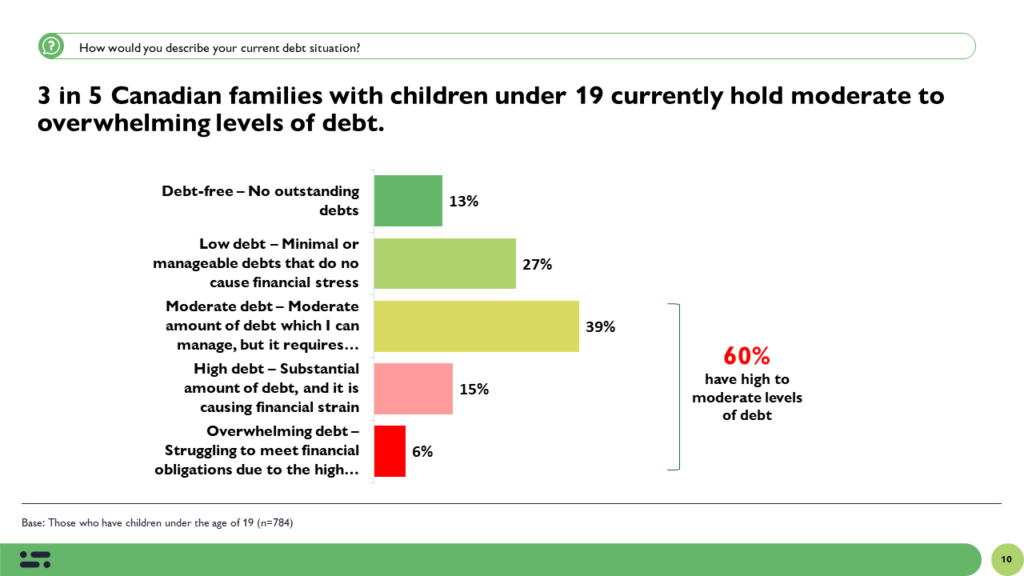

Financial Challenges Faced: A substantial 43% of families with children aged 18 and under categorize their current household finances as poor (vs. 32% among families with older children and 40% among those without children). Furthermore, a worrisome 60% of families with children under 18 are currently wrestling with moderate to overwhelming levels of debt, considerably higher than the 38% for families with older children and the 41% for those without children. This heavy debt burden creates a precarious financial predicament for these families.

The Dream of Homeownership

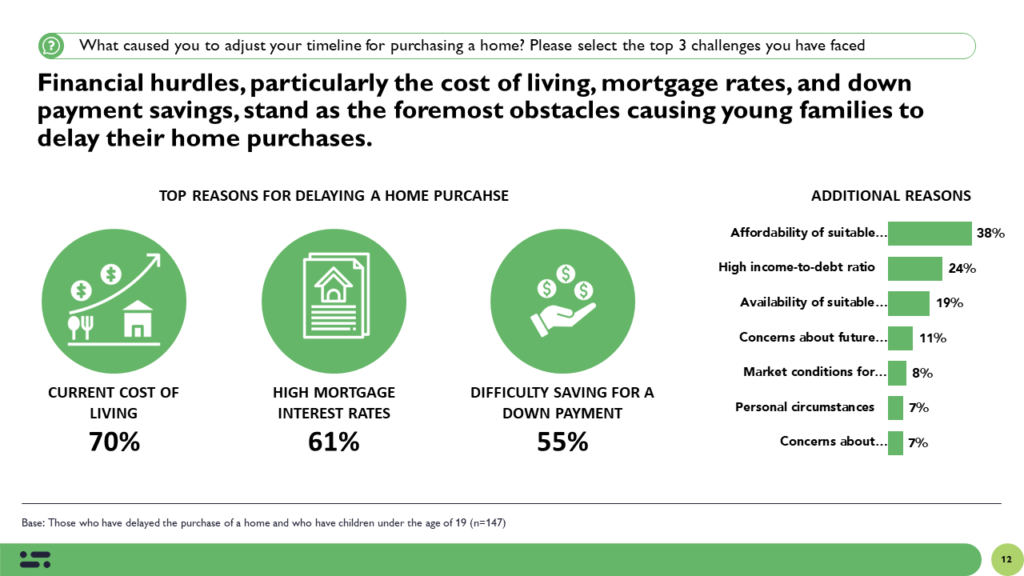

Within the demographic of individuals who presently do not own a home and have children under 19, a significant 74% express their desire to eventually become homeowners. However, nearly half of this group (48%) find themselves compelled to delay their home acquisition due to the current housing market conditions, pushing their dream of homeownership further into the distant future. When asked about the reasons behind this postponement, financial factors take center stage, with 70% citing the current cost of living, 61% pinpointing high mortgage interest rates, and 55% indicating difficulties in saving for a down payment.

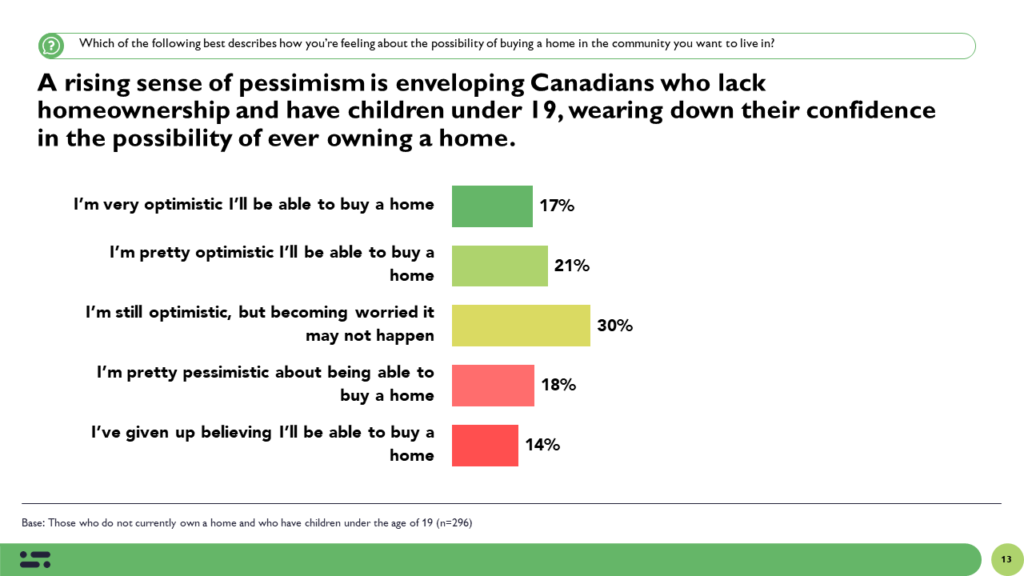

Optimism is also starting to dwindle within this group, as 30% are optimistic but growing concerned about their ability to ever buy a home, 18% have become pessimistic about their prospects, and 14% have altogether abandoned the dream of homeownership. These findings underscore the extent to which young families are compelled to postpone their homeownership aspirations due to ongoing financial challenges and their struggles to save for the future.

Cost of Living Pressing Down on Canadian Families

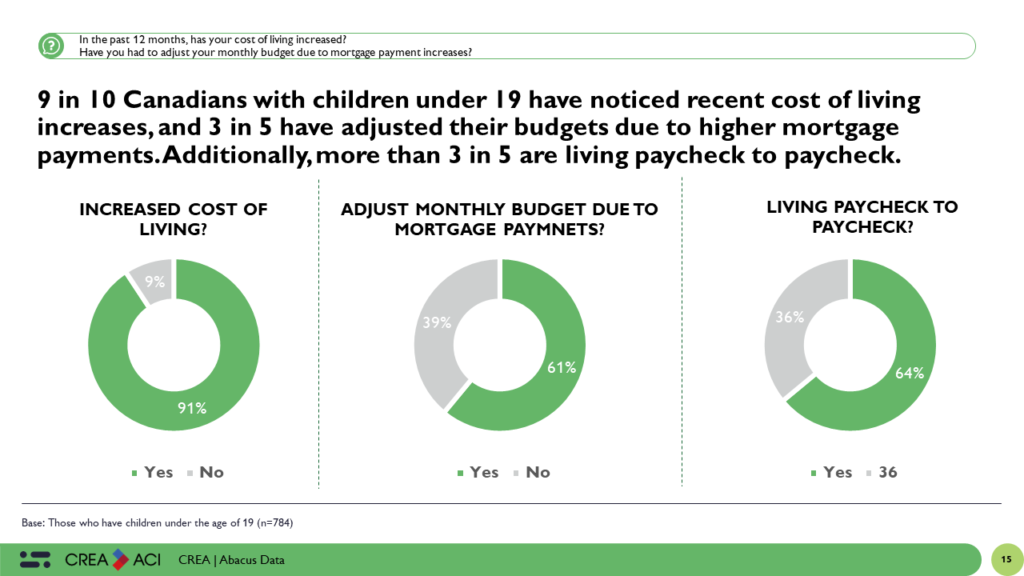

Cost of Living: The data reveals that a 9 in 10 Canadians with children 18 and under acknowledge that their cost of living has significantly increased over the past year. Further, 61% of families with children under 19 note that they have had to adjust their day-to-day expenses, primarily due to mortgage or rent hikes. This figure contrasts starkly with just 30% of households with children over 18 and 38% of those without children who have had to adapt to these rising costs.

Living on the Edge: Furthermore, a significant 64% of families with children under the age of 18 report living paycheck to paycheck, leaving little room for financial security and unexpected expenses. This percentage is notably higher compared to the 43% of families with children over 18 and the 50% of those without children who face similar financial challenges. These families are acutely vulnerable to financial instability, underlining the urgent need for relief measures.

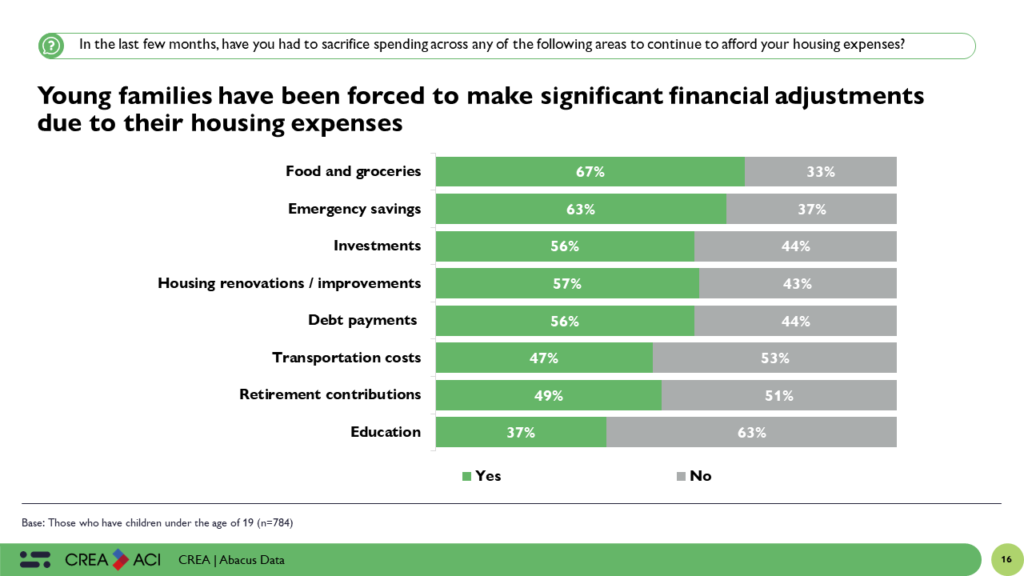

Financial Sacrifices: The ripple effect of these changes is felt across all aspects of life. Families with children under 18 have been compelled to make sacrifices, especially in areas like food and groceries, where 67% have had to curtail their spending. Furthermore, 63% have had to sacrifice emergency savings, and 56% have found themselves needing to make sacrifices in debt payments. It doesn’t end there; education investments, critical for securing the future, are also being affected, with 37% of these families having to trim their commitments. The impact on Canadian families is significant, with the rising cost of living leaving them with little room for financial security and investments in their future.

The Upshot

The results outlined in this article carry significant personal and political implications for Canadian families. On a personal level, the findings underscore the profound challenges and anxieties that families, especially those with children under 19, are grappling with due to the ongoing housing crisis and financial instability. The dreams of homeownership and financial security have been replaced with concerns about affording mortgage payments, rent increases, and mounting debts. These challenges extend to daily living expenses and the ability to invest in their children’s education and future. The toll on family well-being and quality of life is unmistakable, further accentuating the urgency for concrete solutions.

From a political perspective, these results have clear implications for government priorities and policy decisions. With such overwhelming support among Canadian households for government action on housing affordability and debt reduction, there is a growing mandate for policymakers to address these issues comprehensively. The data underscores the necessity of crafting and implementing effective measures to make housing more accessible and to ease the financial burdens on families. The government’s responsiveness to these concerns will be pivotal in addressing the acute financial pressures felt by citizens, particularly young families. Neglecting these issues could have far-reaching implications on social and economic stability.

Overall, these findings are a compelling call to action for both individuals and policymakers. For Canadian families, they highlight the urgency of addressing housing affordability and debt reduction as top priorities for improving their financial and familial well-being. On the political front, the results reinforce the need for responsive, effective, and well-crafted policies to address these challenges and support the future stability of Canadian families and the broader economy.

Methodology

The survey was conducted with 3,500 Canadian adults from September 22 to 28, 2023. The current results focus on 784 families with children 18 and under. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 3.50%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by the Canadian Real Estate Association (CREA).

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here:

About Abacus Data

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions

Find out more about how we can help your organization by downloading our corporate profile and service offering.