How are Canadian small business leaders feeling about their businesses and the broader Canadian economy?

October 20, 2023

Earlier this week, we completed a national survey of Canadian small business entrepreneurs as part of the Business Development Bank of Canada’s Small Business Week.

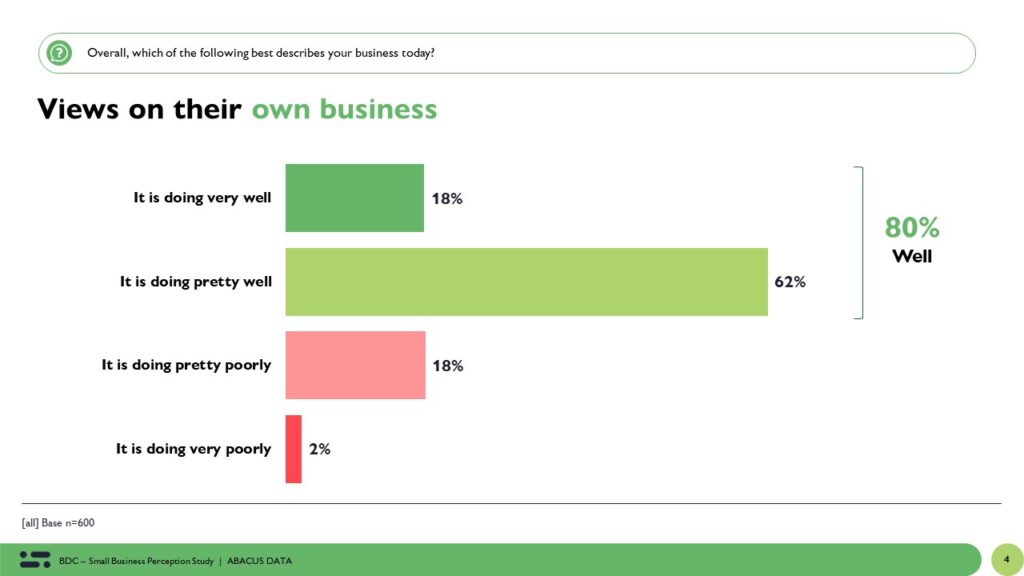

The survey interviewed a representative sample of small business owners and leaders from October 11 to 16, 2023. The objectives of this study was to see how small business owners are feeling about their business and the broader economic environment, to explore generational differences in perceptions, and to understand the persistent perceptual gap in the thinking of small businesses that sees business leaders feeling good about how their business is doing even when they feel bearish about the Canadian economy.

Here is a summary of what we found.

Bullish about their business; Bearish about the Canadian economy

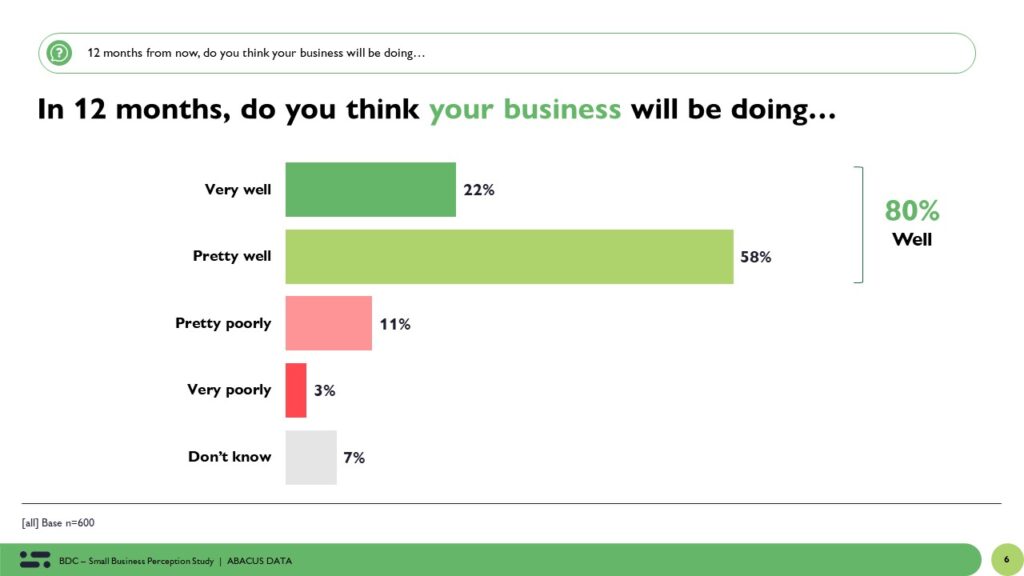

Eight in ten small business entrepreneurs in Canada describe their business as doing very well or pretty well today. At the same time, 64% of these same business owners feel the Canadian economy is doing poorly. Despite pessimism about the country’s economy, the proportion of business leaders (80%) who think their business is doing well today think it will be doing well 12 months from now.

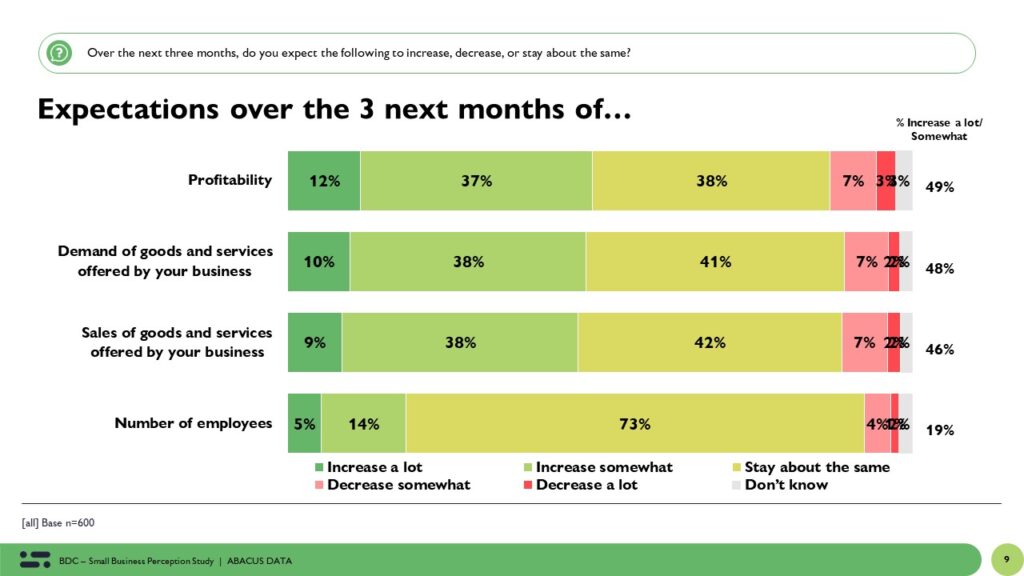

Moreover, when we ask about profitability, demand, and sales, most think those aspects of their business will improve or stay about the same. In other words, despite most entrepreneurs believing that the economy is poor and will remain poor over the next 12 months, most think their business won’t be impacted that much.

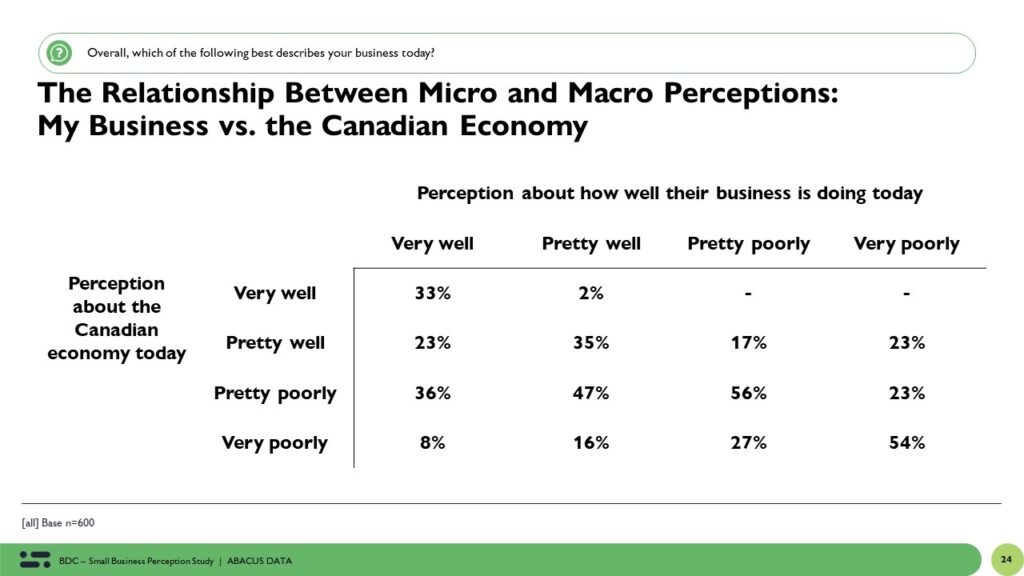

So, the expected perceptual gap exists. 44% of business leadership who report their own business doing well also feel that the Canadian economy is doing poorly. Among those who think their business is doing pretty well, 64% believe the Canadian economy is doing poorly.

In contrast, fewer are likely to think their business is doing poorly but also think the Canadian economy is doing well.

Overall, almost half of Canadian small business entrepreneurs (44%) think their business is doing well despite believing that the Canadian economy is doing poorly.

What might explain this perceptual gap?

One place to look is the confidence that small business leaders have in their skills and the competitive position of their businesses.

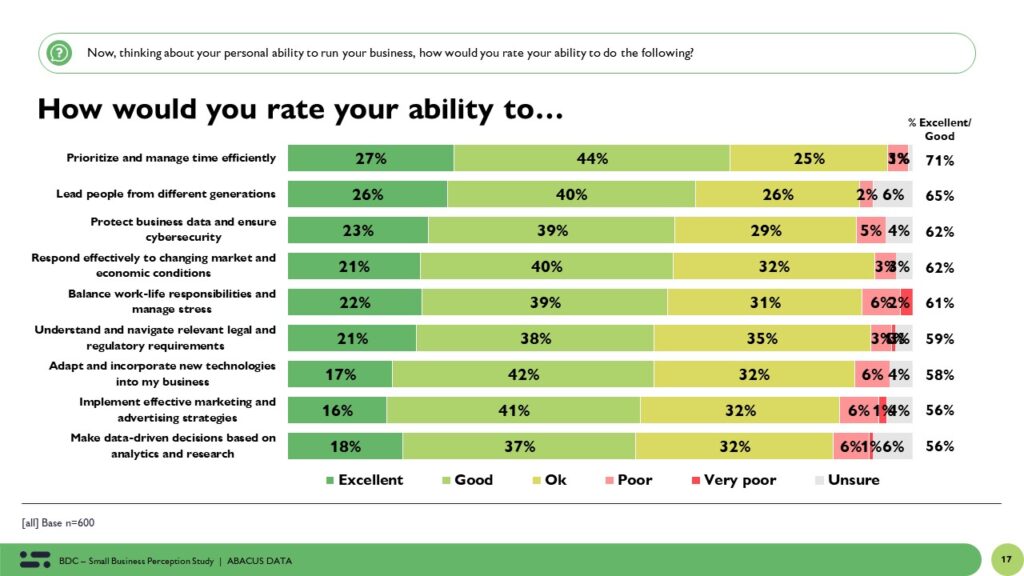

Most Canadian small business leaders give themselves positive ratings when it comes to running their business. Between 50% to 70% believe they are doing an excellent or good job prioritizing and managing their time efficiently, leading people from different generations, protecting their business data, responding effectively to changing market and economic conditions, and balancing work in life. In short, entrepreneurs are pretty bullish on their own business abilities.

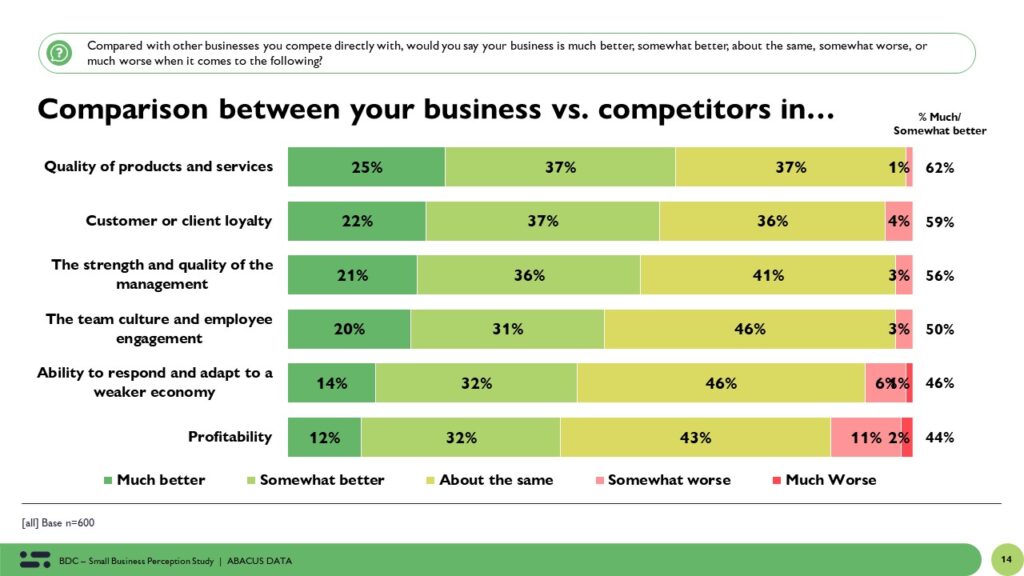

At the same time, when we ask entrepreneurs whether their business is better, worse, or about the same as other businesses they compete directly with, most believe the quality of their products and services are better than most and they have better customer and client loyalty. In contrast, when it comes to agility, team culture, and profitability, half or more think their business is about the same or worse than other businesses they compete with.

And so, part of the answer lies in entrepreneurs feeling they can overcome macro-economic challenges that might be impacting the broader business environment.

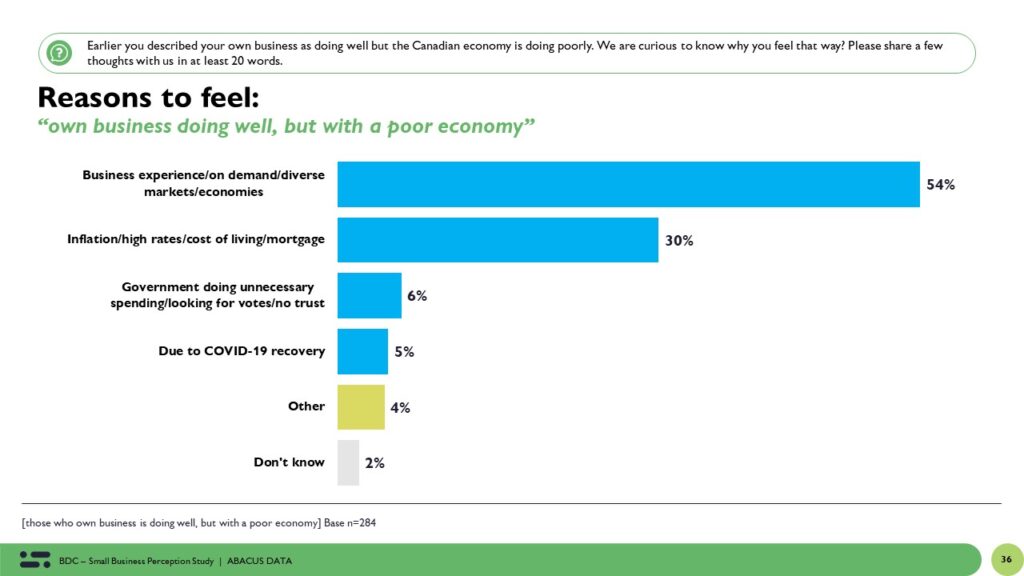

Later in the survey, we specifically asked entrepreneurs who felt their business was doing well but the Canadian economy wasn’t, why they felt that way.

Based on the responses, several reasons can be discerned as to why small business entrepreneurs in Canada believe their businesses are doing well despite their concerns about the broader economy.

Firstly, many businesses have carved out unique niches or cater to specific markets that are less sensitive to economic fluctuations. Examples include the art business, which caters to clients not significantly influenced by economic conditions, and the mental health industry, which might even see increased demand during tough times.

Secondly, experience plays a pivotal role. Entrepreneurs with years or even decades of experience have weathered previous economic storms and possess the skills and knowledge to navigate challenges effectively. They have cultivated loyal customer bases, operate in sectors resistant to automation or technological takeover, and in some cases, benefit from diversified sources of revenue, such as international exports or clients across borders.

Lastly, many highlighted their efficient business models, low debt, or prudent financial management, which gives them a buffer during economic downturns. Even in a challenging economy, these entrepreneurs emphasize the importance of quality, customer service, and adaptability, which they believe are the keys to their businesses’ resilience.

What else did we learn?

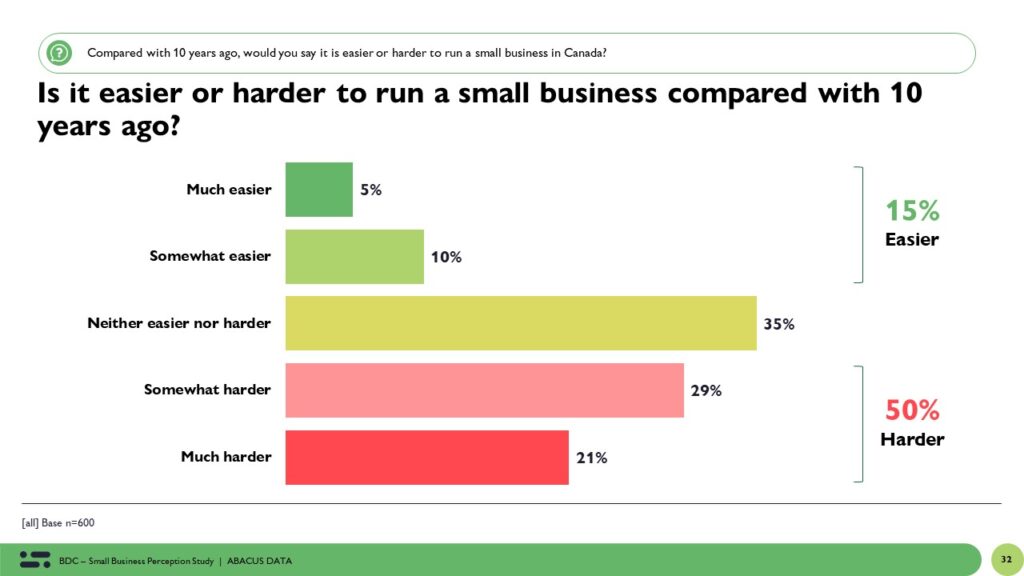

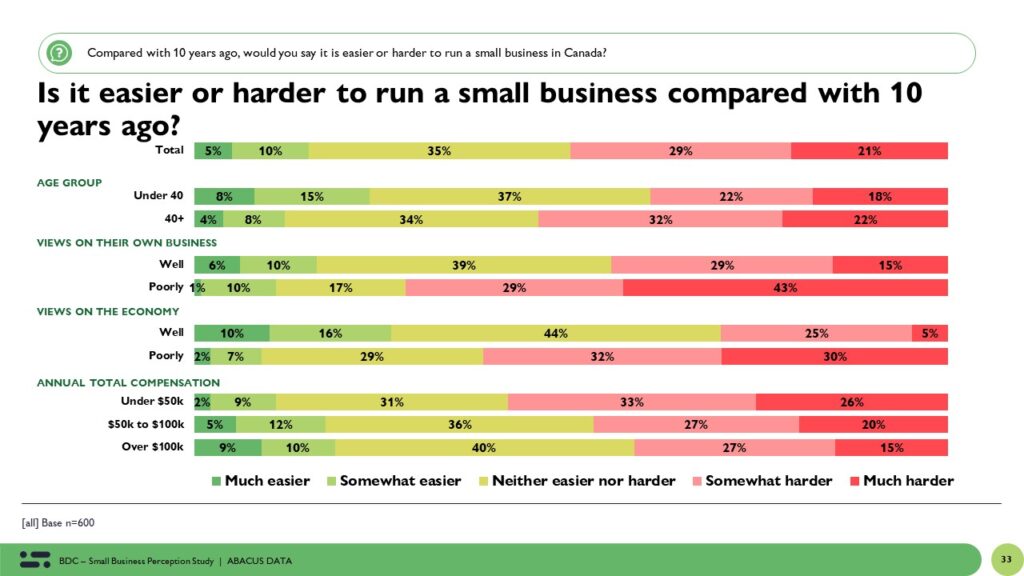

- Half of small business entrepreneurs feel it is harder to run a small business today than it was 10 years ago. Interestingly, older entrepreneurs (40+) were more likely to feel this way than younger ones. Only 15% say it’s easier to run a small business today compared with 10 years ago.

- Why is it easier? Entrepreneurs point to several reasons. Central to these is the exponential growth and accessibility of technology, particularly the internet, which offers multiple avenues for sales, promotion, and reaching a global customer base. The widespread use of social media platforms facilitates business growth and promotion, and numerous online tools and platforms simplify the management and operational aspects of businesses. Furthermore, the Canadian government provides enhanced resources, aids, tools, and continual support for small to medium-sized businesses. Access to digital marketing tools, online resources, and the shift towards e-commerce, especially post-COVID, have made running a business more convenient and less reliant on physical infrastructures.

- Why is it harder? Small business entrepreneurs believe it is more challenging to run a business today due to several converging factors. The economic landscape has evolved, with heightened concerns about cash flow, increased costs in areas like shipping, importing, and basic necessities, as well as challenges related to inflation and rising interest rates. The digital age has ushered in a wave of worldwide competition, further saturating many industries. Additionally, government regulations have become more stringent, adding to the administrative burden for businesses. The COVID-19 pandemic has left an indelible mark, changing consumer behavior and exacerbating supply chain disruptions. Furthermore, businesses face increased competition not only from other local entities but also from global giants, with the added pressure of adapting to rapid technological changes and navigating an environment of economic uncertainty. Labour challenges, both in terms of cost and availability, have also been highlighted, along with shifting sentiments regarding prices and spending among consumers.

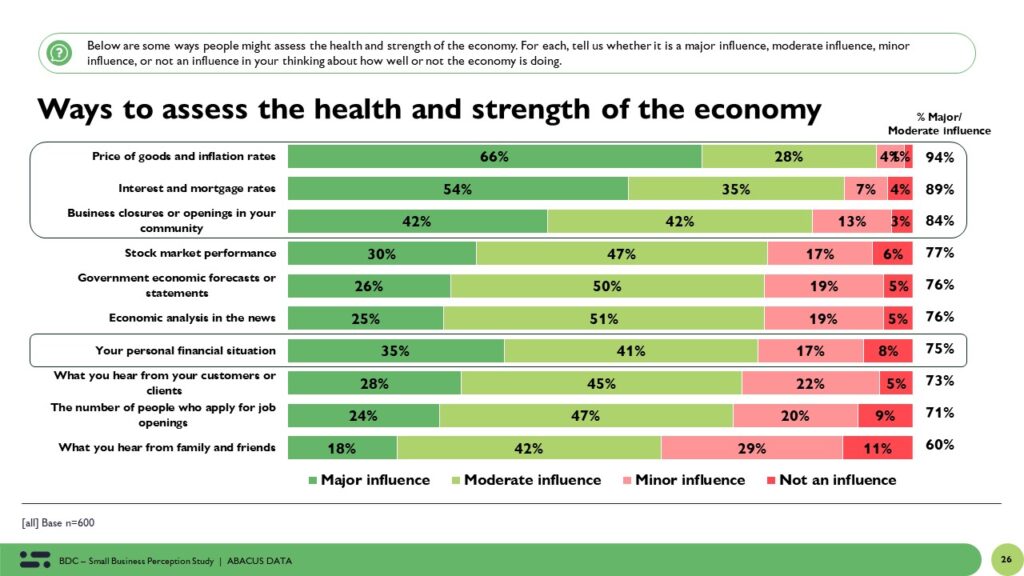

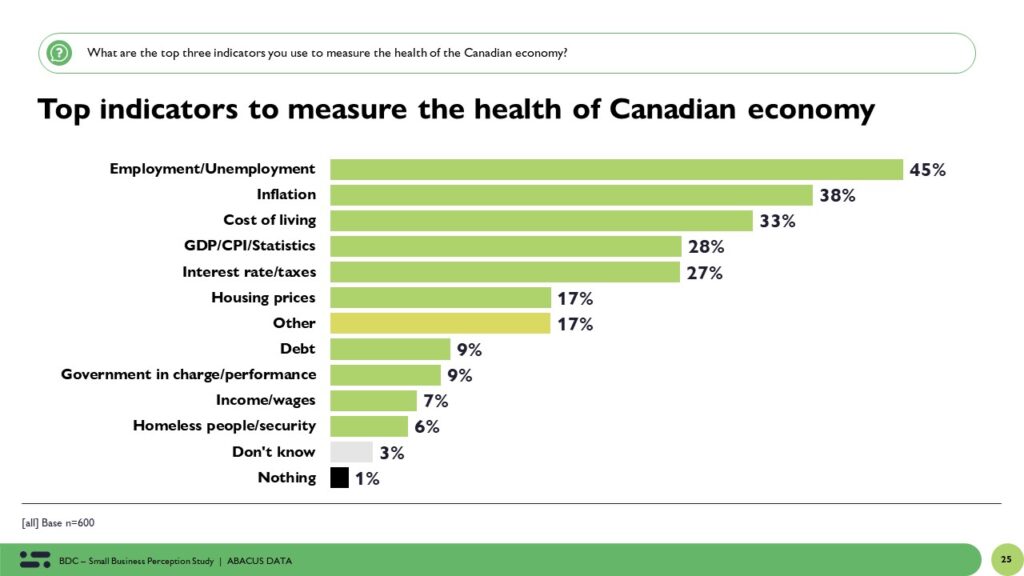

- Entrepreneurs say they look at employment figures, inflation, interest rates, and business closures/openings in their community as the main indicators of the macroeconomic picture. Many also equate their own personal finances with the broader economic picture. But the most important indicator to entrepreneurs of the health of the economy right now is inflation. Higher inflation signals a weaker economy, in their minds.

- An entrepreneur’s housing and mortgage situation has some impact on their business outlook, but not substantially so. For example, those with a larger mortgage – over $500,000 – are 20-points more likely to say their business is doing poorly than those with a smaller mortgage on their principal residence (37% vs. 17%). Likewise, those who own their principal residence are slightly more likely to feel their business is doing well than those who rent or live with family (82% vs. 75%).

The Upshot

The Perceptual Gap is Real: Many Canadian entrepreneurs believe their businesses are thriving despite their pessimism about the broader Canadian economy. This could be attributed to their belief in the superiority of their products/services, the diversity of their market, or their ability to adapt to changing conditions.

Self-Confidence: The majority of business leaders are confident about their managerial skills, which might influence their positive outlook on their own business despite a gloomy economic scenario. They believe they can navigate the challenges better than others.

Generational Differences Exist: Older entrepreneurs tend to find it harder to run a business today compared to a decade ago. This might be due to rapid technological changes and the challenges of adapting to a digital landscape.

Technology is a Double-Edged Sword: While technology has enabled businesses to reach global audiences and streamline operations, it has also increased competition. Businesses are not just competing locally but with global entities, making the marketplace more saturated.

COVID-19’s Impact is Still Felt: The pandemic has altered consumer behaviors, brought about supply chain disruptions, and has set a tone of economic uncertainty.

Inflation is a Key Economic Indicator: For most entrepreneurs, rising inflation is a sign of a weakening economy. This could impact their business decisions, such as pricing strategies and cost management.

Housing and Mortgages Play a Role: Entrepreneurs’ personal financial situations, especially concerning housing and mortgages, influence their business outlook to some extent.

Why Do These Results Matter?

Informative for Policymakers: These insights can be useful for policymakers to understand the mindset of small business owners, which can guide policy and economic decision-making. If entrepreneurs are basing their economic outlook on certain indicators like inflation, then managing these indicators becomes even more crucial.

Economic Forecasting: The dichotomy between business performance and economic outlook can provide economists with interesting data points when predicting future economic directions.

Support Systems: Knowing that entrepreneurs view technology as both an enabler and a challenge, support systems, training programs, or incentives can be designed to help them harness its benefits fully.

Sectoral Planning: By understanding what entrepreneurs view as challenges (like rising shipping costs, stringent government regulations, etc.), specific interventions can be planned for sectors most affected by these challenges.

How are Canadian Small Business Leaders Feeling?

Canadian small business leaders are generally optimistic about their individual business’s prospects, largely due to their confidence in their skills, product quality, and adaptability. However, there is a notable apprehension about the broader Canadian economy. This dichotomy presents a unique scenario where businesses are preparing for growth amidst perceived economic challenges.

Methodology

The survey was conducted with 600 Canadian small business entrepreneurs from October 11 to 16, 2023. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 4.1%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s small business leader population by sector, region, and business size.

This survey was paid for by the Business Development Bank of Canada

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: