Will an Interest Rate Cut Ignite Housing Transactions? We asked Canadians.

From June 6 to 13, 2024, Abacus Data conducted a national survey involving 1,550 Canadian adults (18+) to gauge their views on the current housing landscape in Canada. The survey was conducted in the wake of the Bank of Canada’s recent 0.25% interest rate reduction. This report focuses in on Canadian perceptions of how the rate cut could impact the housing market, affordability, decisions to buy or sell homes, and current sentiments among mortgage holders.

The recent rate cut by the Bank of Canada has left Canadians cautiously skeptical about its impact on housing market affordability and activity. While a significant majority do not anticipate improvements in affordability or increased housing sales, younger Canadians show more optimism compared to older demographics. The decision-making process for buying or selling homes reflects a wait-and-see approach, with a notable portion intending to delay decisions until further rate cuts are realized.

This release comes following recent reports indicating that home sales across the country did not see an uptick after the BoC’s quarter point cut on June 5th.

Perceptions of the Rate Cut on the Housing Market

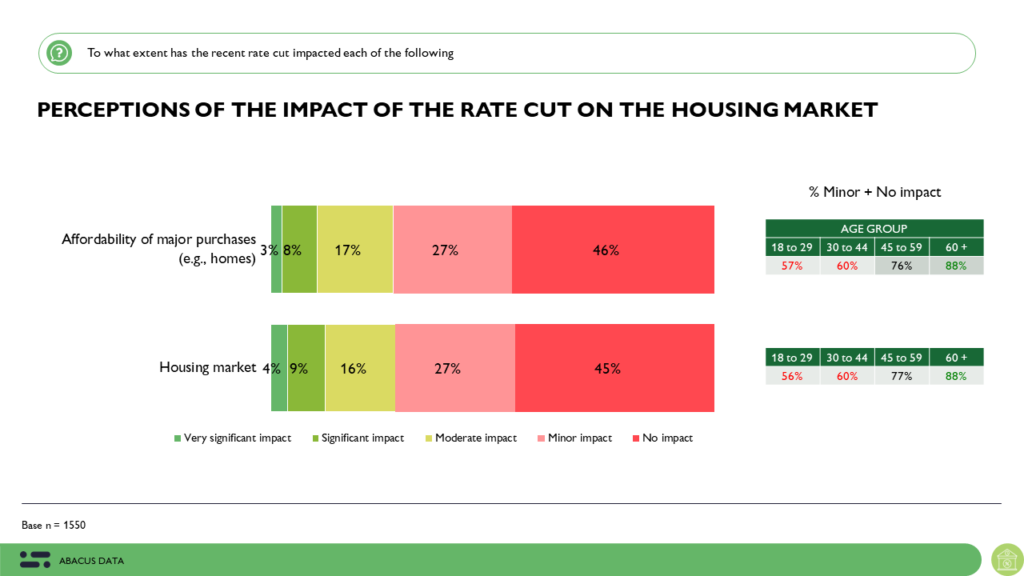

The initial rate cut by the Bank of Canada seems to have had a minimal effect on perceptions of the housing market in general. Specifically, 73% of Canadians anticipate that the rate cut will not significantly impact the affordability of major purchases such as homes, while 72% believe it will have little to no effect on the housing market overall.

This sentiment is notably stronger among adults aged 60 and above compared to younger Canadians. That is, 88% of Canadians aged 60 and older believe the rate cut will have minimal impact on purchase affordability, and similarly, 88% of those 60 and older believe it will have little to no impact on the housing market.

Impact on Housing Market Activity

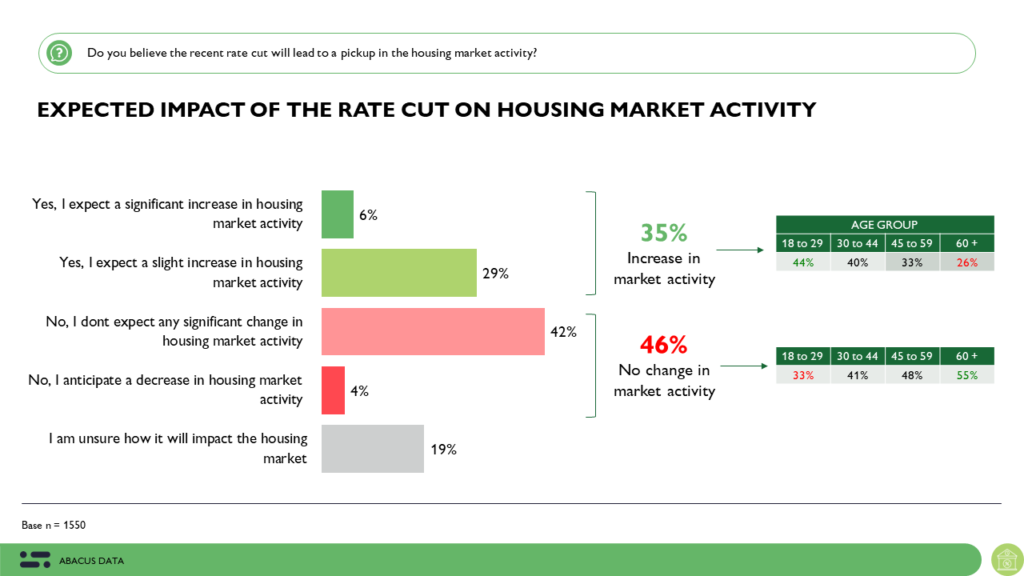

Overall, only 35% of Canadians expect the rate cut to influence housing market activity, while 46% foresee no change in housing sales. Younger Canadians show more optimism, with 44% of those aged 18-29 anticipating increased market activity, contrasting with 26% among adults aged 60 and older.

In addition to its impact on sales, a significant majority of Canadians (80%) do not believe the rate cut will enhance home affordability. This sentiment is particularly strong among older Canadians, with 93% of those aged 60 and above expressing skepticism, compared to 68% of individuals aged 18-29 and 67% of those aged 30-44.

Moreover, a significant portion of Canadians (61%) anticipate no changes in the number of homes sold, while 33% are optimistic that the rate cut will stimulate an increase in housing sales.

These findings underscore a cautious outlook among Canadians regarding the rate cut’s potential effects on both housing market dynamics and affordability.

The Decision to Buy or Sell a Home

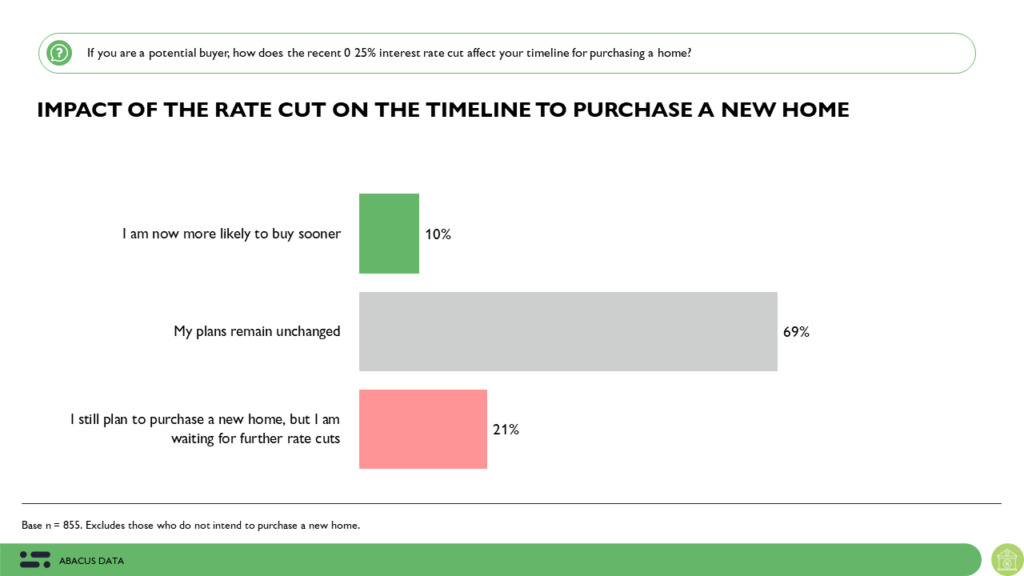

Reflecting recent reports indicating the minimal impact of the initial rate cut on the housing market, our findings reveal that only 10% of Canadians plan to expedite their home purchase due to the rate cut, while 21% intend to postpone buying until more rate cuts occur. Additionally, 69% report that the rate cut has had no influence on their purchase timeline.

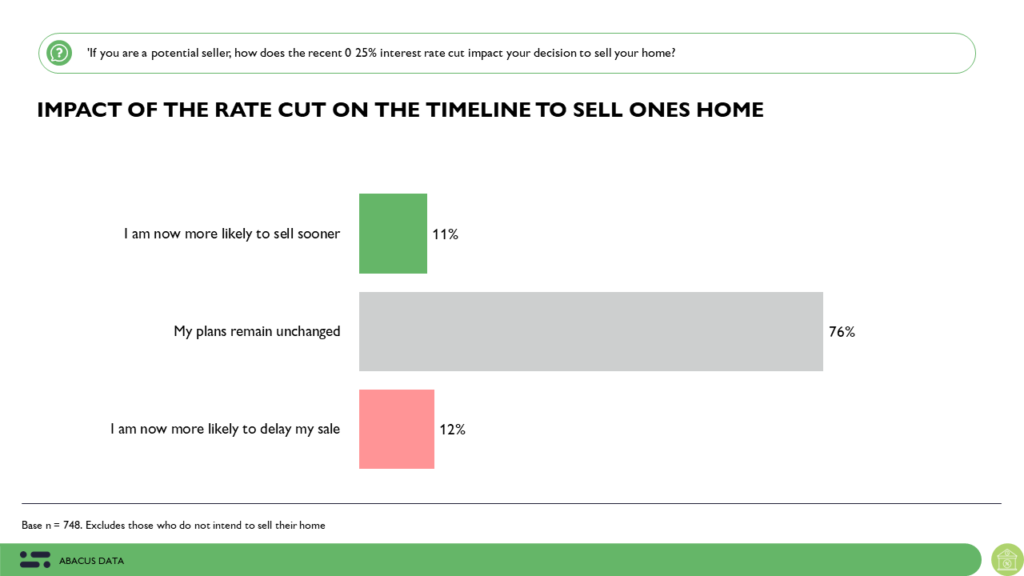

In terms of selling decisions, just 11% of Canadians are accelerating their home sales in response to the rate cut, while 12% plan to defer selling until further rate reductions take place. A substantial majority (76%) indicate that the rate cut has not affected their decision on when to sell.

These findings underscore a cautious consumer sentiment regarding the rate cut’s influence on buying and selling decisions in the Canadian housing market. Many potential buyers view the initial rate cut as a signal of possible future reductions, prompting them to postpone purchases until more favourable rates materialize.

Relief for Mortgage Holders

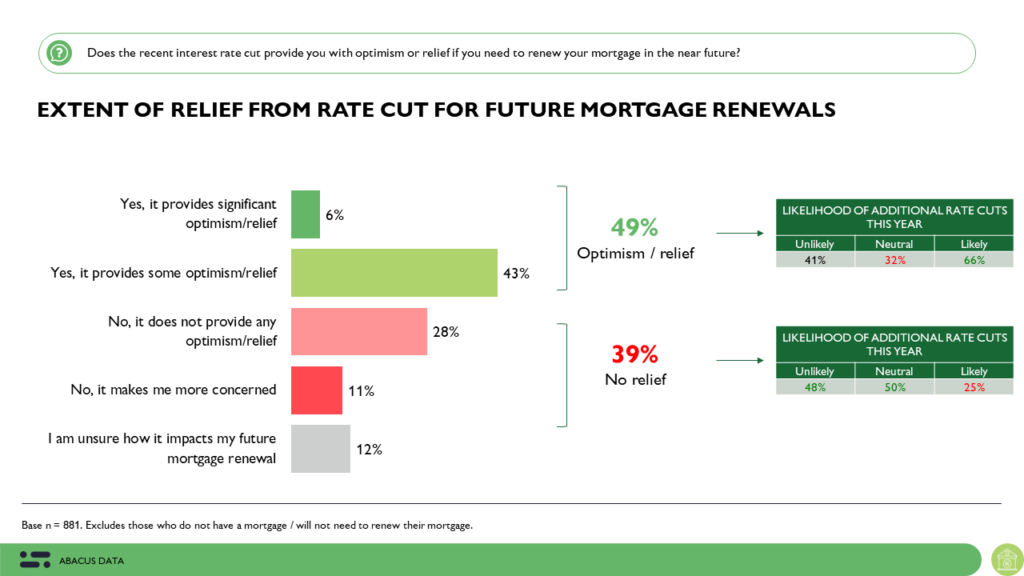

When discussing current mortgage holders, much of the focus revolves around how current interest rates will affect their upcoming mortgage renewals, potentially forcing many Canadians to renew at higher rates than they currently enjoy. In our study, 49% of mortgage holders expressed optimism or relief about their upcoming mortgage renewal due to the recent rate cut. This sentiment was most pronounced among those anticipating further rate cuts in 2024, with 66% feeling optimistic or relieved.

Conversely, 39% of Canadians indicated that the current rate cut did not bring them a sense of optimism or relief. This sentiment was particularly strong among those who do not anticipate additional cuts in 2024, suggesting that the current reduction was insufficient to sway their outlook without the prospect of future decreases.

The Upshot

When Canadians look at the recent rate cut by the Bank of Canada, many are playing it safe. They’re not convinced it’ll make buying a home cheaper or shake things up much in the housing market. About half think it won’t really change how homes are sold either.

Our research confirms Canadians are cautious about diving into the housing market right now. They’re holding off on buying homes sooner and not rushing to sell either, even with the rate cut. Mortgage holders are split—some see potential savings on renewals, while others are unsure how future rate changes might play out. This cautious approach shows how Canadians are taking their time to see how things unfold in the housing market.

Canadians’ cautious outlook on the potential impacts of the rate cut indicates a guarded approach to housing market dynamics in Canada. With doubts about improvements in affordability and market activity, the current research suggests that Canadians in the market are likely to proceed carefully, closely watching for future developments before committing to major decisions related to buying, selling, or mortgage renewals.

Methodology

The survey was conducted with 1,550 Canadian adults from June 6 and 13 2024. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.53%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in the 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.