Navigating Challenges: The Intersection of Housing, Finance, and Holiday Joy in Canada

From November 23 to 28, 2023, Abacus Data conducted a national survey of 1,374 Canadians (18+). with current mortgages (fixed or variable) or who pay rent. The intent was to gauge the extent to which the housing crisis is influencing holiday plans and overall enjoyment among these Canadians.

As the financial landscape undergoes transformation, housing costs emerge as a pivotal factor not only in shaping current circumstances but also in influencing the outlook of many Canadians for the year ahead. This research provides valuable insights into how housing impacts budgets, long-term financial goals, and the holiday season.

Current Financial Strain

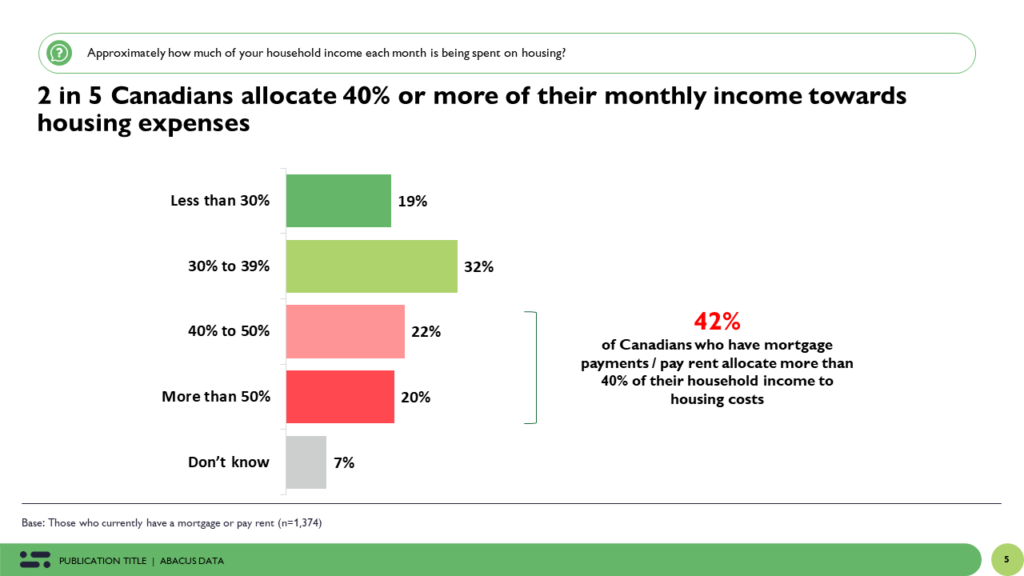

A significant revelation is that 42% of Canadians with a mortgage or rental payments are allocating 40% or more of their household income to housing expenses. This surpasses the recommended threshold set by the Canada Mortgage and Housing Corporation (CMHC), which advises that the gross debt service ratio—representing the percentage of income allocated to housing costs—should not exceed 39%.

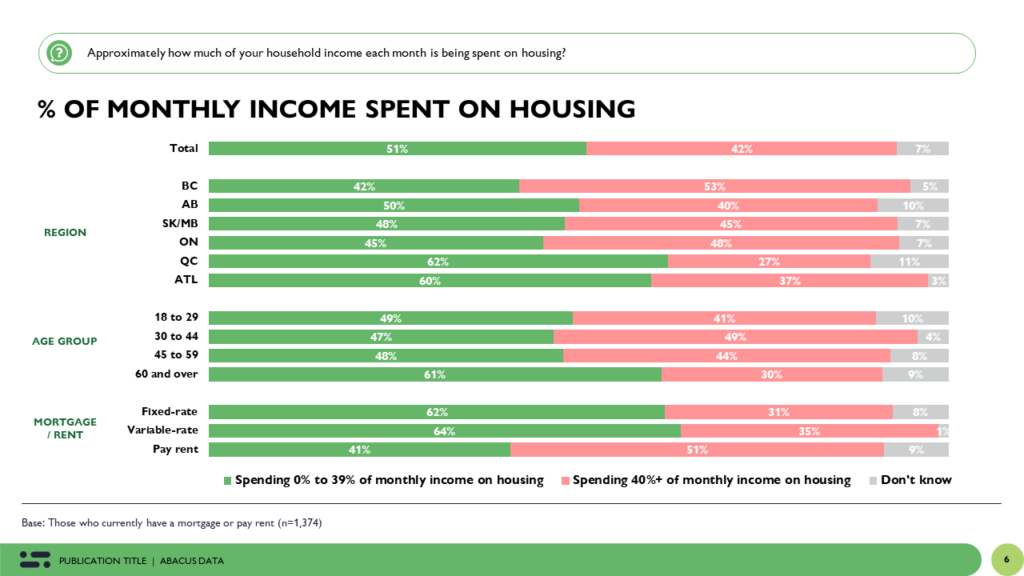

Particularly noteworthy is the situation in British Columbia and Ontario, where approximately half of residents are grappling with this financial strain. The age factor adds another layer to this financial challenge, with Canadians aged 30-44 shouldering a substantial burden, as 49% allocate 40% or more of their monthly income to housing, compared to the 61% in the 60+ age group.

Holiday Budgets and Plans

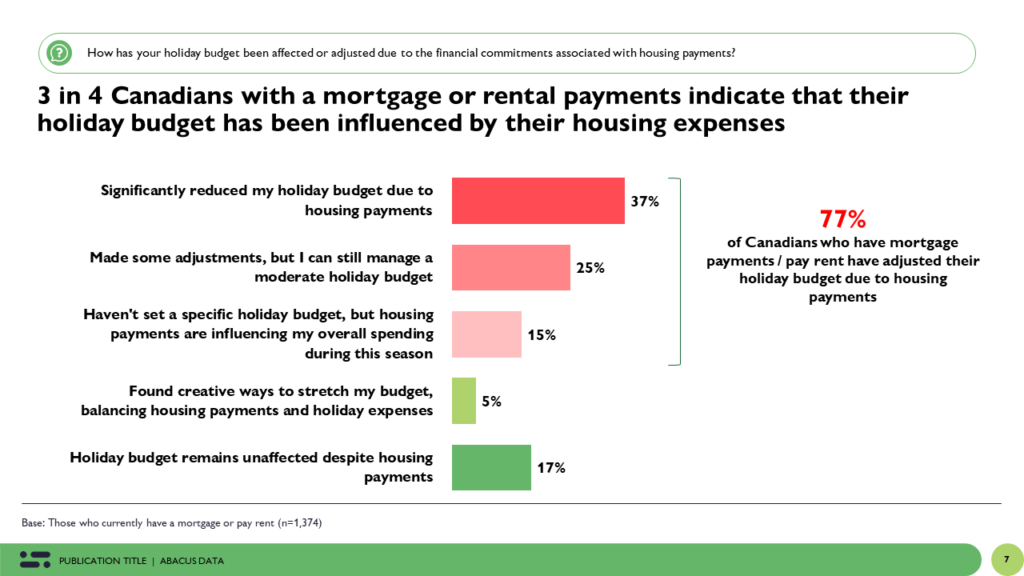

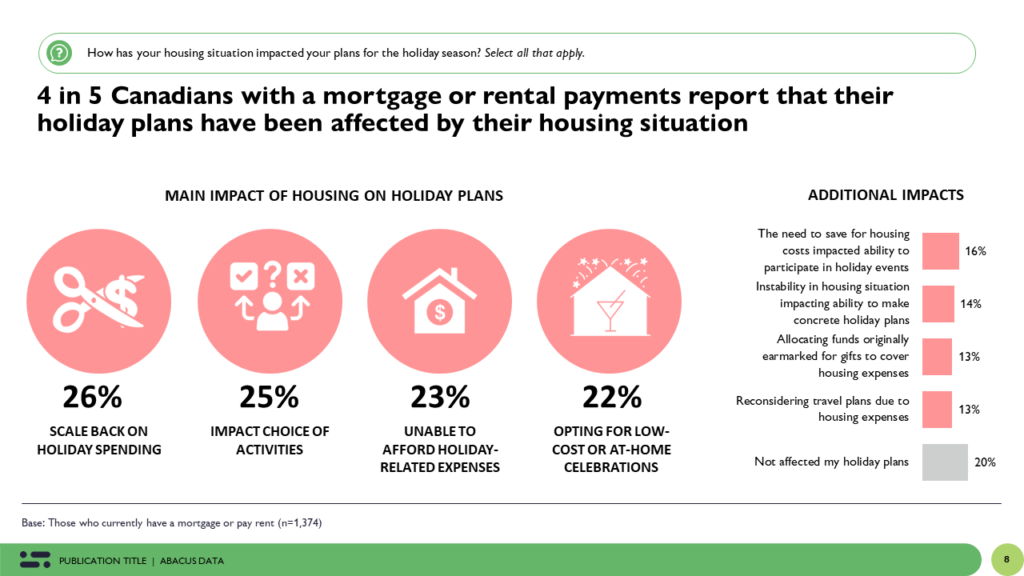

The holiday season, traditionally a time of joy and celebration, is now tinged with financial concerns. A substantial 77% of Canadians state that their holiday budget has been impacted by housing payments. For 37% of them, this has resulted in a significant reduction in their holiday budget. Moreover, 80% note that their holiday plans have been affected, leading many to scale back on spending, alter activities, opt for low-cost celebrations, or eliminate holiday spending altogether.

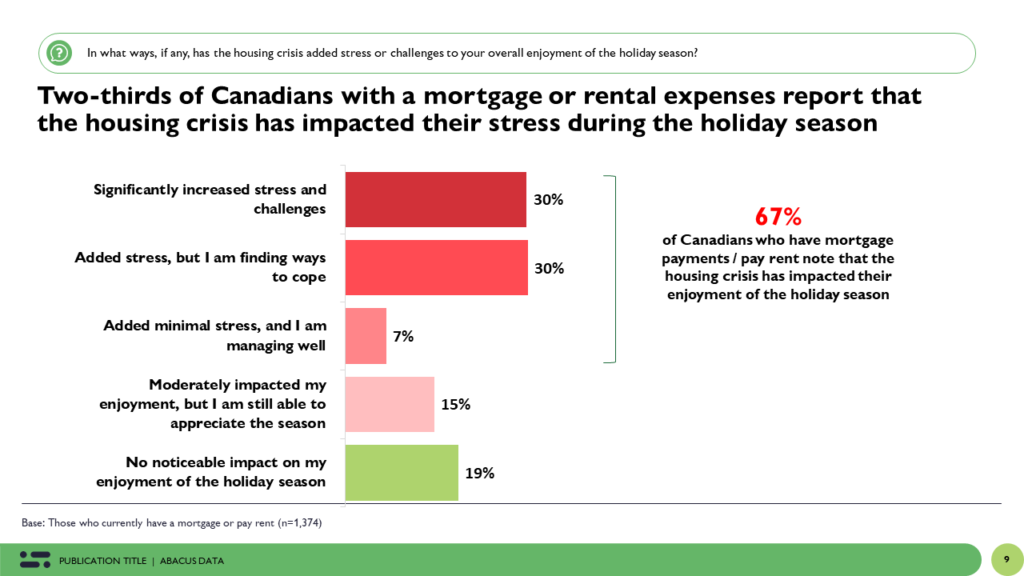

The housing crisis is clearly impacting the holiday season, with 67% of Canadians with mortgage or rent payments reporting that it has affected their level of stress and overall enjoyment of the holiday season. The burden of housing costs not only weighs on the budget but also adds an emotional layer, highlighting the intricate interplay between economic challenges and the quality of life during what should be a joyous time of the year.

Looking Ahead to 2024

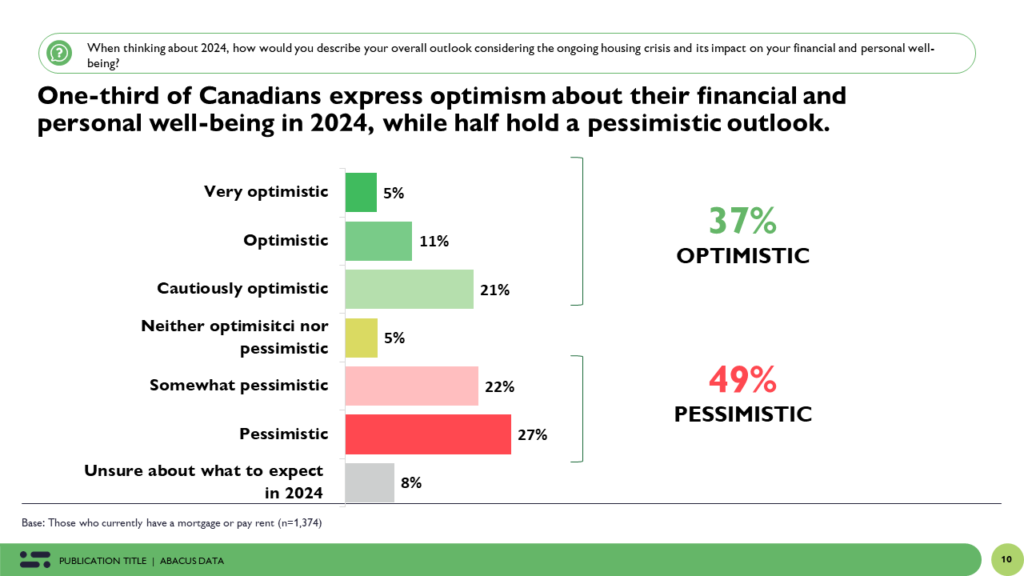

As Canadians look to the future, a mixed outlook emerges. A significant portion, nearly half (49%), voices apprehension regarding the forthcoming challenges associated with the housing crisis anticipated in 2024. These concerns underscore the gravity of the situation and the potential hurdles individuals foresee in their financial and personal lives. Conversely, 37% of Canadians maintain an optimistic stance, demonstrating a belief in their ability to surmount the challenges posed by the housing crisis.

The contrasting sentiments encapsulate the diverse perspectives and coping mechanisms Canadians are adopting as they prepare for the dynamic landscape of 2024, emphasizing the need for proactive measures to address housing concerns and ensure a more secure outlook for Canadians.

The Upshot

As we continue to explore the impact of the housing crisis on Canadians, it’s clear that financial stress extends beyond numbers, affecting joyful moments, especially during the holidays. Many Canadians find their holiday budgets entangled with housing costs, leading to a significant cutback in festivities. The housing crisis has a notable impact on numerous Canadians, compelling them to modify their holiday plans and causing increased stress due to housing costs. This underscores how economic challenges cast a shadow on these special moments.

Looking ahead to 2024, a nuanced view emerges. Many express valid concerns about the challenges posed by the ongoing housing crisis, emphasizing the need for proactive measures. Yet, amidst these concerns, a resilient portion remains optimistic, illustrating a determination to overcome adversity and build a brighter financial future.

These findings emphasize the urgency for immediate action. Proactive measures are essential to address housing concerns and pave the way for a secure and optimistic future for all Canadians. It’s not just about finances; it’s a call to protect the well-being, joy, and hope that every Canadian deserves, regardless of economic challenges. Overcoming the housing crisis requires a collective effort, urgency, and a commitment to building a future where housing is affordable, available, and accessible for all Canadians. As families navigate the holiday season, the evident impact of the housing crisis underscores the need for comprehensive solutions to address immediate financial strain and enhance the overall well-being of individuals and communities.

Methodology

The survey was conducted with 1,374 Canadian adults who have a mortgage/pay rent from November 23 to 28, 2023. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.65%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

About Abacus Data

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.