Five Years Out: What Canadians Expect to Happen and Why It Matters

When we think about the future, our expectations shape more than our conversations — they influence how we plan, spend, save, vote, and adapt. In public opinion research, understanding what people believe is likely to happen matters because expectations can be as powerful as reality in driving behaviour. We plan our careers, make investments, choose where to live, and even decide which political leaders to support based not just on the world as it is, but the world as we think it will be.

But history, and human psychology, suggest we often get the timing wrong. As futurist Roy Amara famously put it, “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.” While Amara was speaking about technology, the same principle applies more broadly: we can be quick to predict dramatic change in the next few years, yet slow to grasp how deeply those changes might reshape our lives over decades.

Our latest Abacus Data survey asked Canadians how likely they thought a range of events could happen in the next five years. The results reveal a mental map of the near future that blends technological disruption, geopolitical instability, environmental risk, and economic uncertainty. And when we compare across generations and political affiliations, striking differences emerge in how groups anticipate change, and, in light of Amara’s Law, where they may be getting the short-term and long-term wrong.

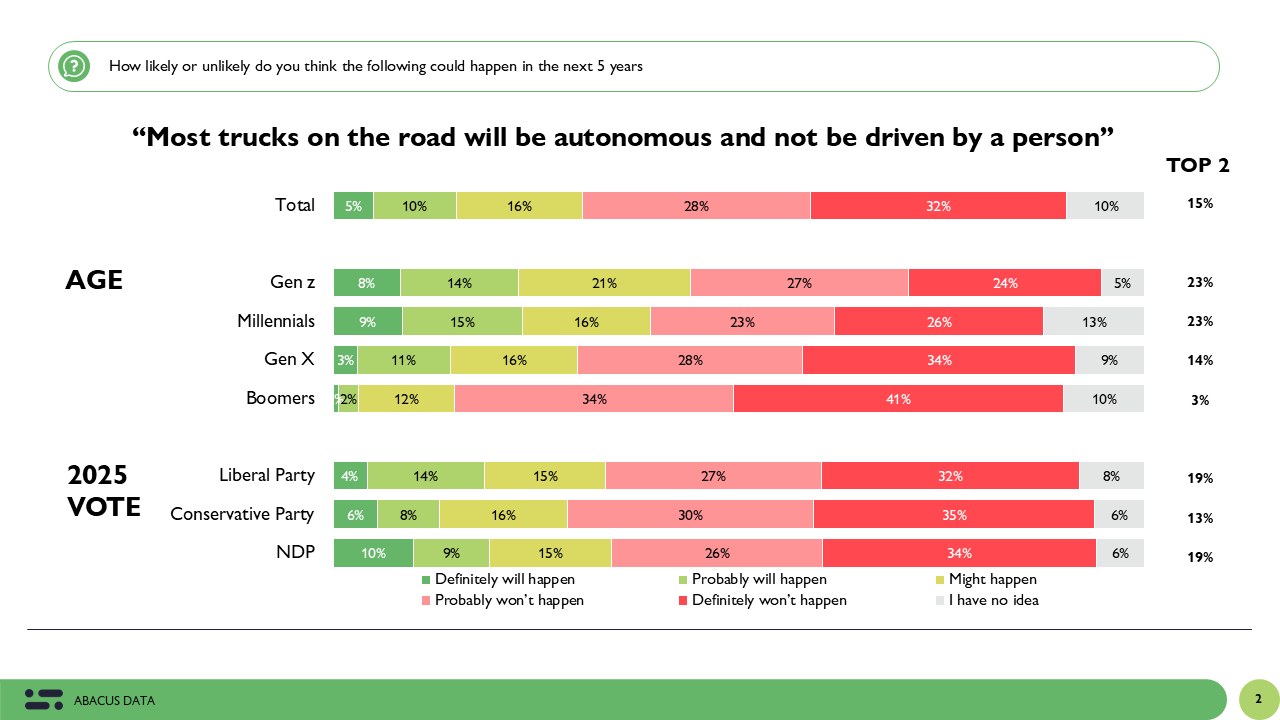

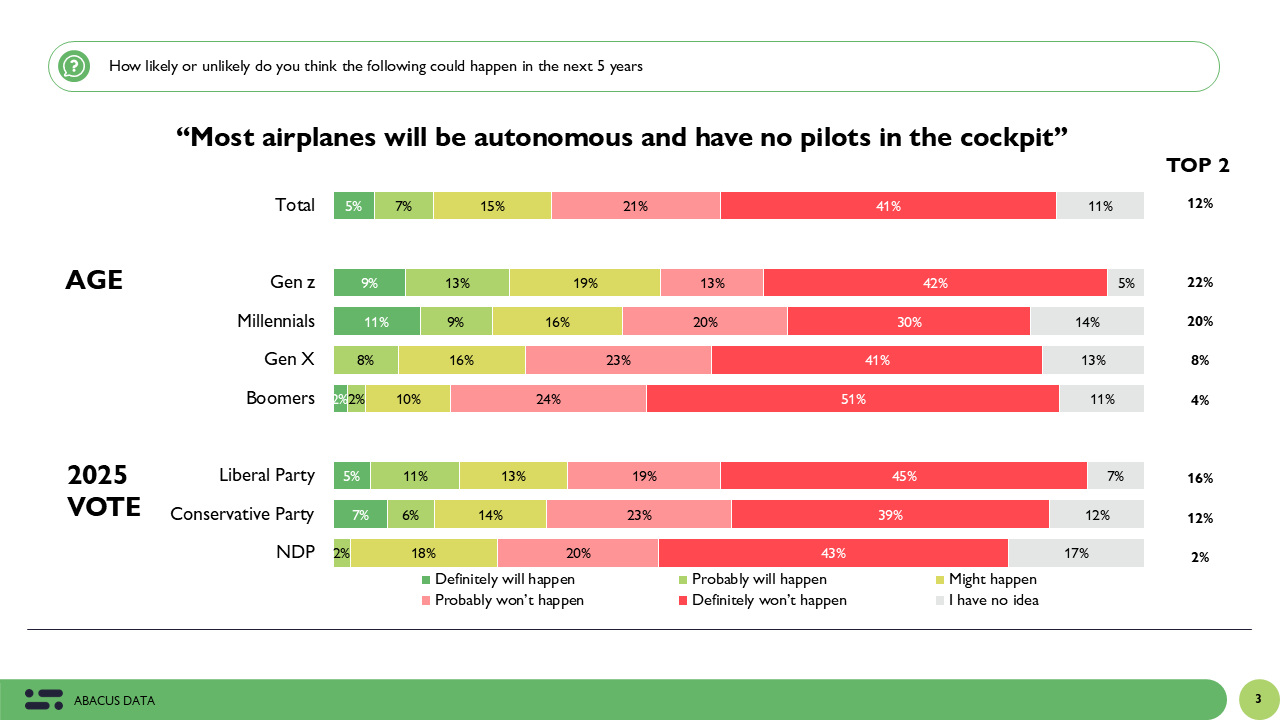

Cautious on Driverless Roads and Pilotless Skies

Nationally, there’s deep scepticism toward autonomous transportation. Only 15% think most trucks will be driverless within five years, and just 12% expect most passenger planes to operate without pilots.

Gen Z is more open to the idea. 23% see driverless trucks as likely and 22% say the same for pilotless planes. Boomers are almost entirely unconvinced: just 3% and 4%, respectively.

Among partisans, Liberal voters are slightly more optimistic (19% trucks, 16% planes) than Conservatives (13% trucks, 12% planes), though neither group sees widespread adoption as probable. While political leanings shift these numbers only marginally, age remains the biggest dividing line as younger Canadians are more prepared to see rapid technological adoption, older Canadians are not.

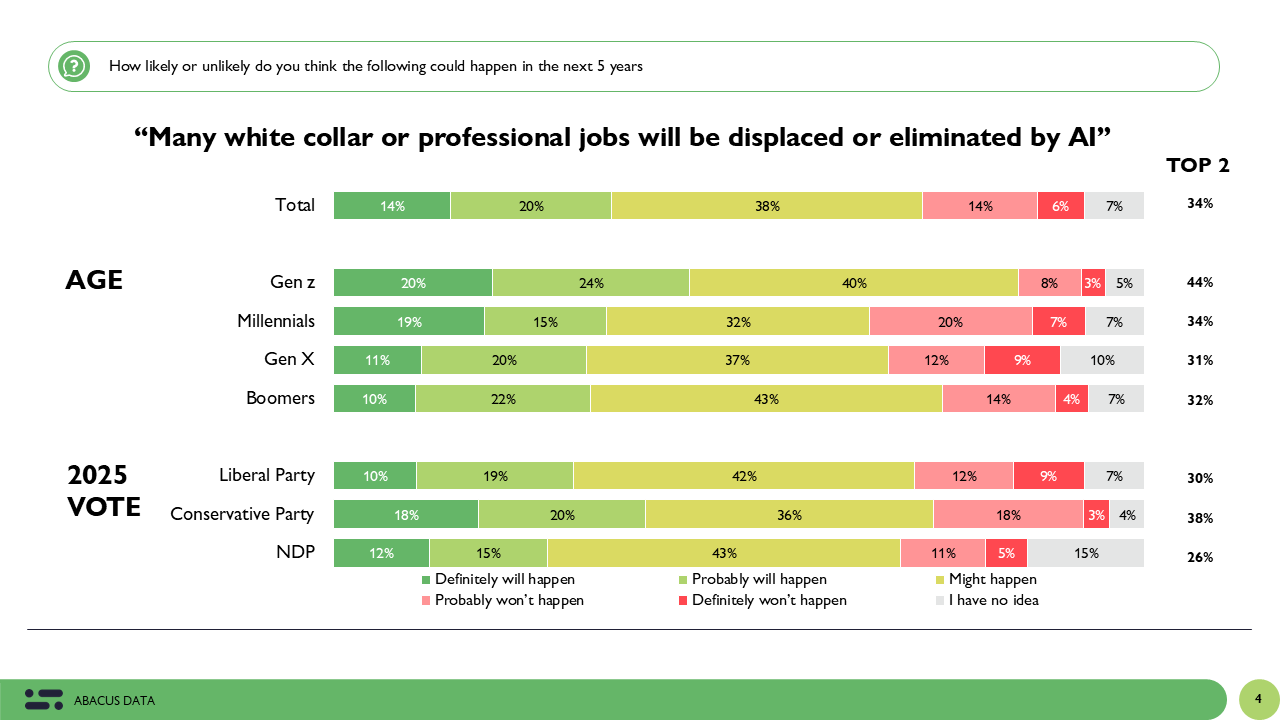

AI and the White-Collar Workforce

AI’s potential to reshape the professional job market is one of the most widely anticipated changes in the survey. A third of Canadians think significant white-collar job displacement will happen within five years, and nearly four in ten say it might.

Gen Z is most convinced, 44% say it’s probable, compared with 32% of Boomers. Political leanings shape this perception too: Conservative voters (38% likely) are more convinced than Liberal voters (30% likely) that AI will displace many white-collar jobs. The gap here may reflect different attitudes toward technological change and economic disruption with Conservatives perhaps more inclined to see competitive pressures and automation as unavoidable.

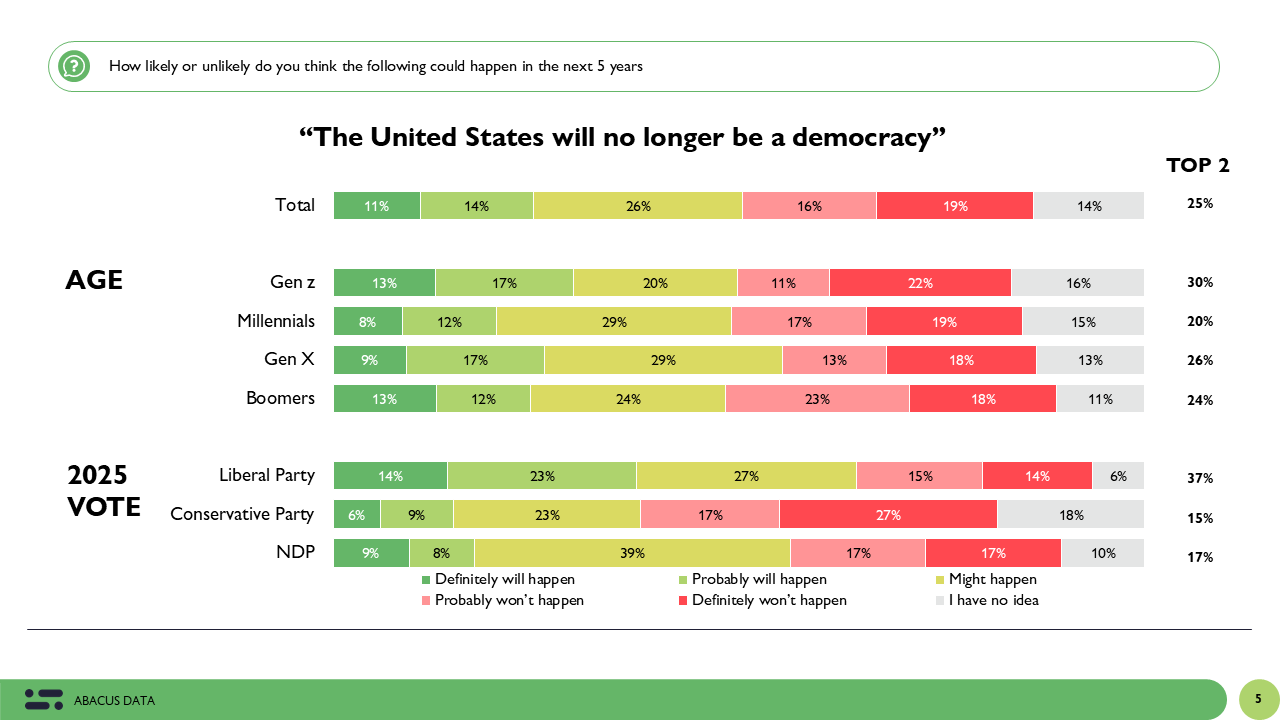

Geopolitical Flashpoints on the Horizon

One in four Canadians believe the United States will no longer be a democracy within five years. Gen Z (30%) is slightly more likely than average to believe this, Boomers slightly less (24%). Liberal voters are substantially higher at 37%, while Conservatives are much lower at 15%. This is one of the most politically polarized questions in the survey — reflecting different perceptions of U.S. politics and the state of American democracy.

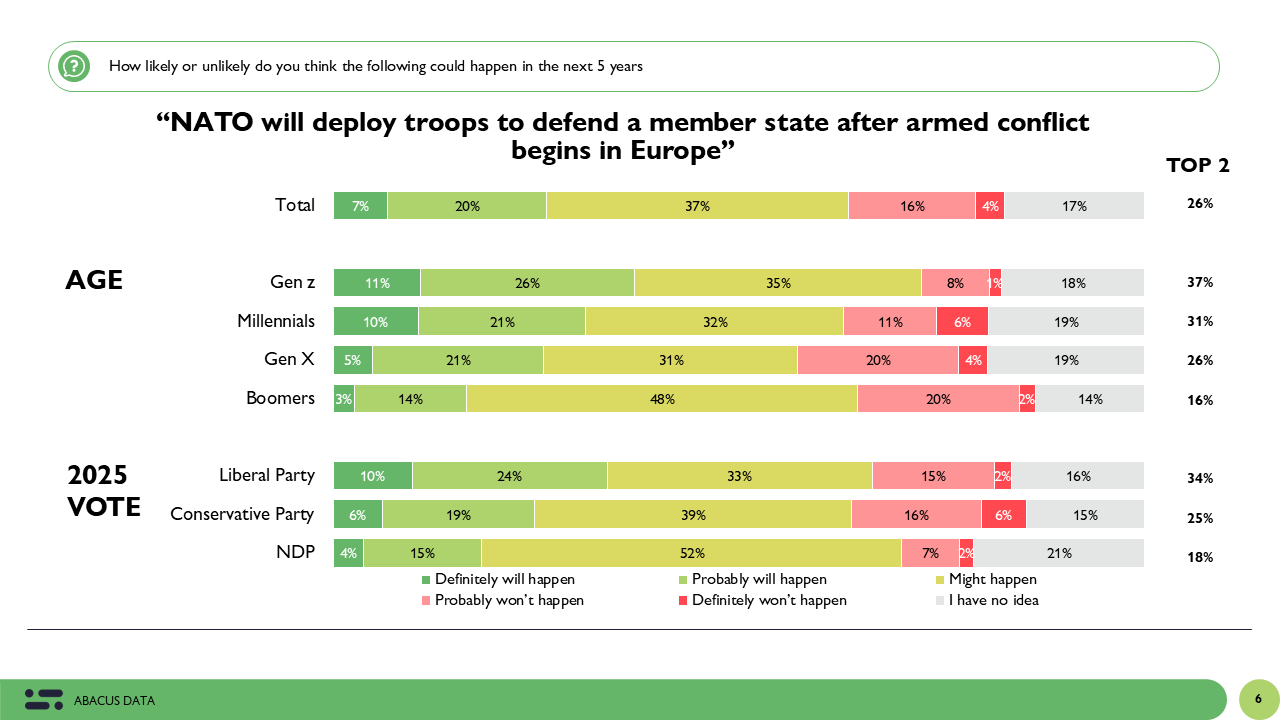

On NATO’s potential to deploy troops to defend a member state in Europe, Gen Z (37%) again leads, Boomers (16%) are more sceptical, and partisans split: Liberals at 34%, Conservatives at 25%. The partisan gap here may reflect differing views on Canada’s role in global alliances.

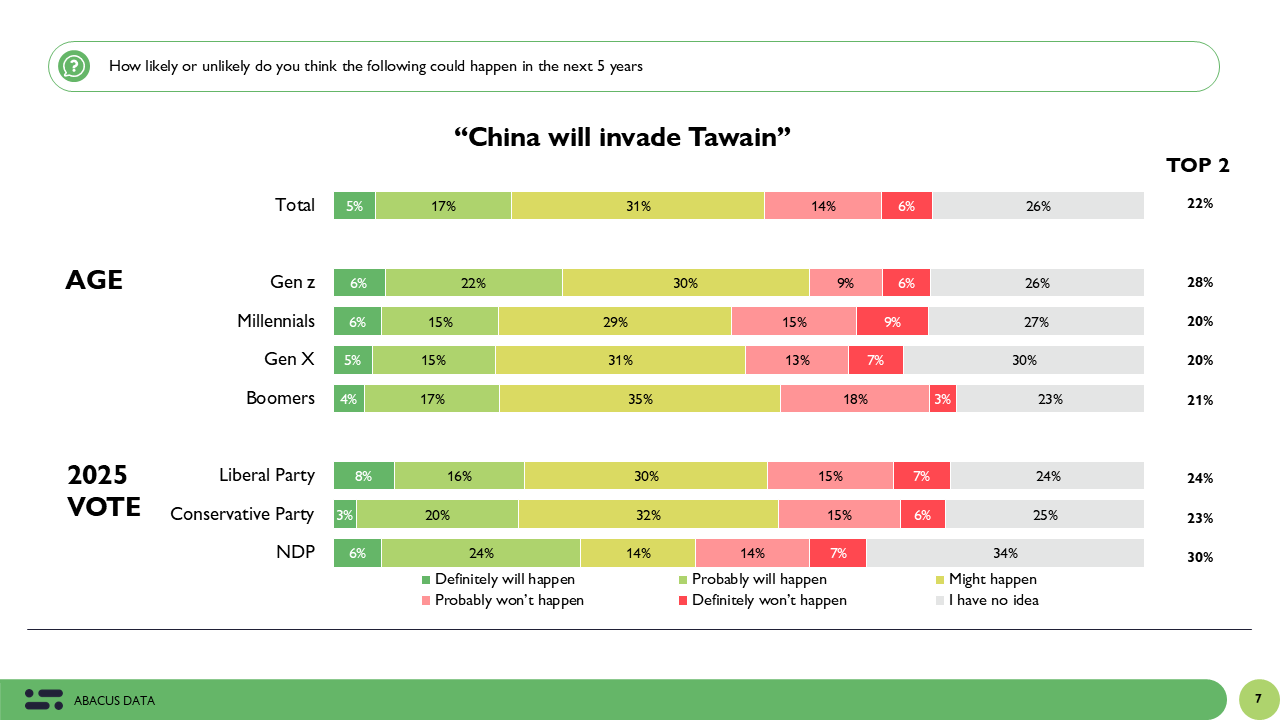

On a potential China–Taiwan conflict, the national average is 22% likely. Liberals (24%) and Conservatives (23%) are nearly identical here, though Conservatives have a slightly higher share saying “don’t know” (25% vs. 24% for Liberals).

Economic Risks: Recession Feels Possible, Housing Crash Less So

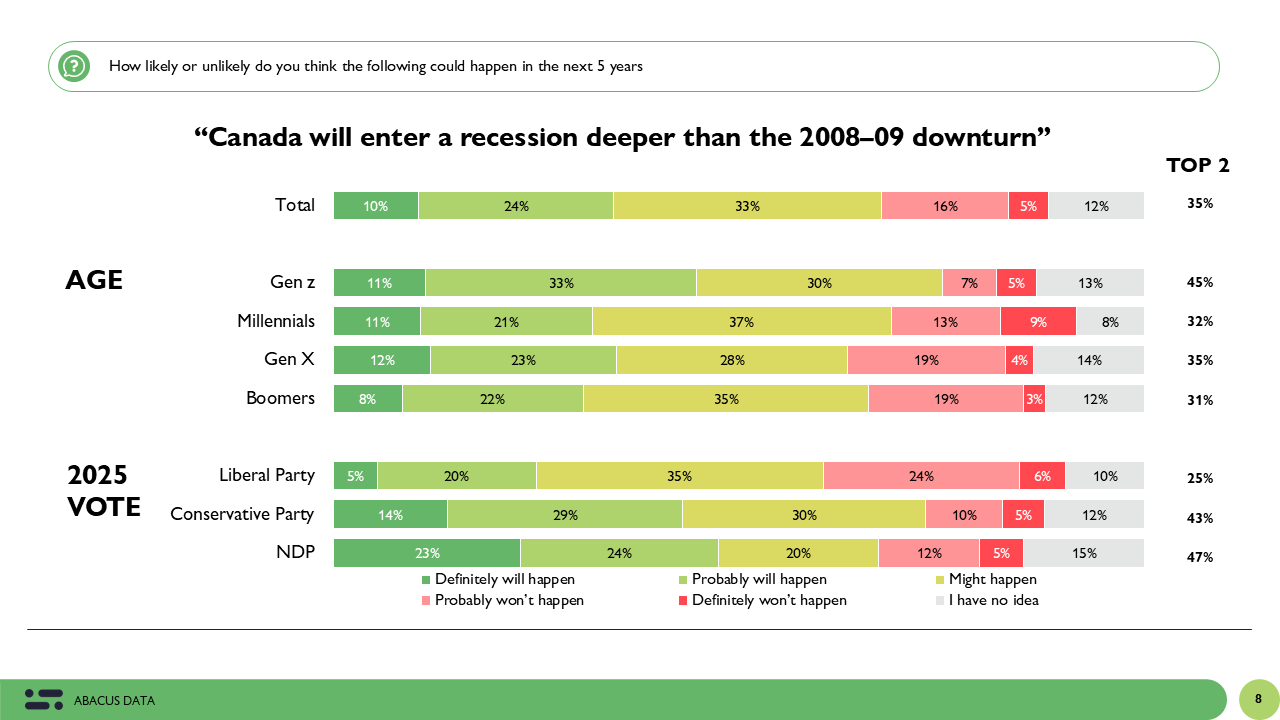

Nationally, 35% believe Canada will face a recession deeper than 2008–09. Gen Z is most pessimistic (45%), Boomers less so (31%). Partisan leanings matter here: Conservative voters are much more likely to expect a deep recession (43%) than Liberals (25%). This likely reflects different levels of confidence in the current government’s economic management.

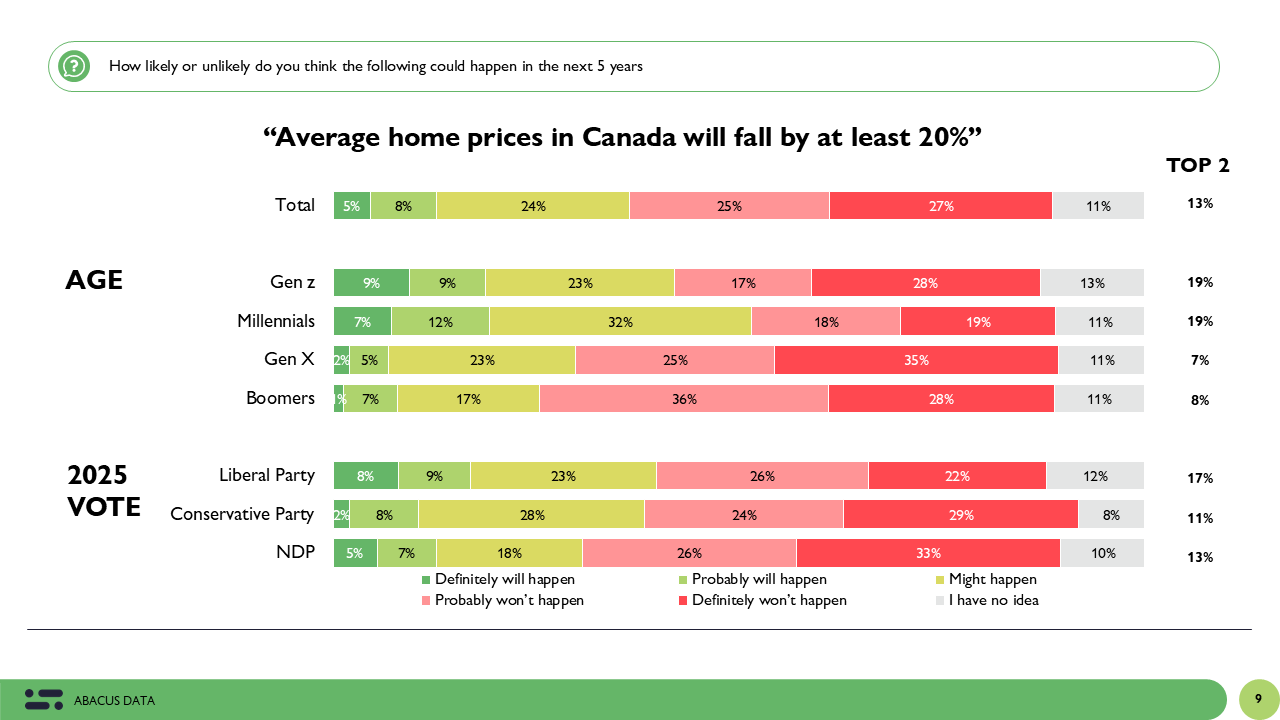

On housing, only 13% nationally think prices will fall by 20% or more in the next five years. Gen Z is somewhat more open to the idea (19%) than Boomers (8%). Among partisans, Liberals are at 17%, Conservatives lower at 11%. This small partisan difference is overshadowed by a much larger age divide with older Canadians remain far more confident in housing market stability.

Climate Change and the Cost of Risk

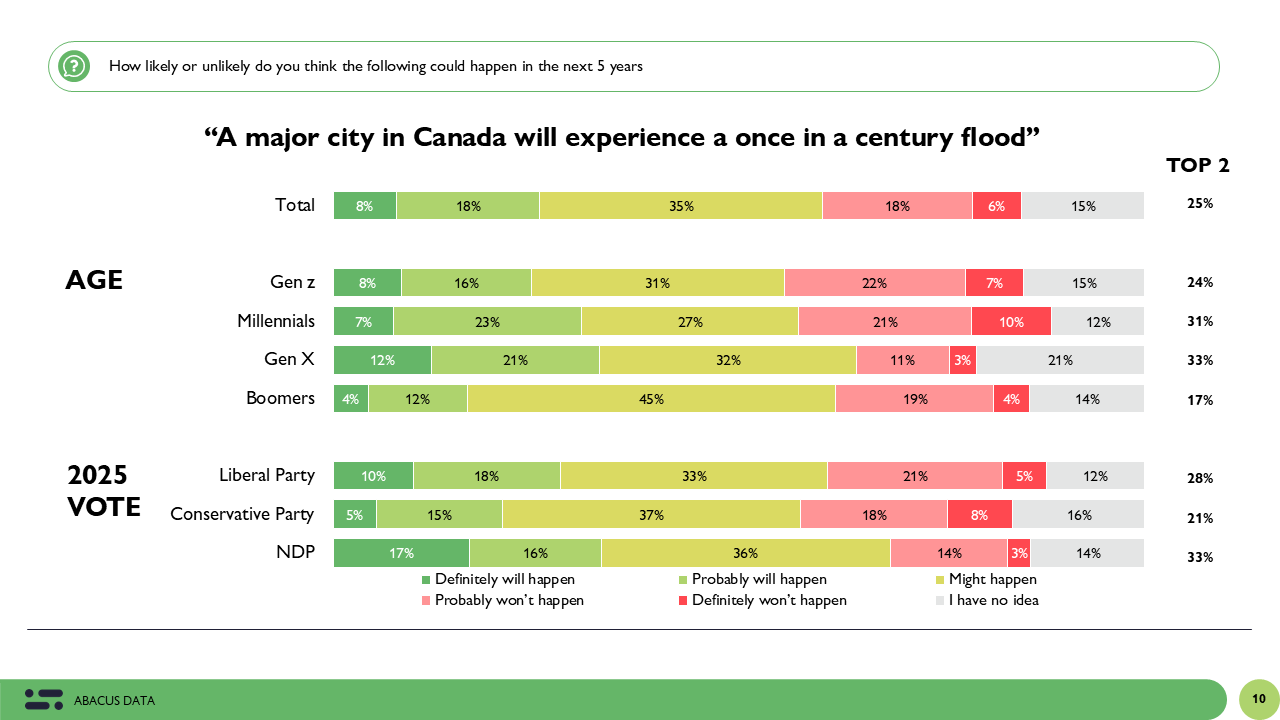

One in four Canadians believe a major Canadian city will experience a once-in-a-century flood within five years. Gen Z is slightly below average (24%), Boomers below that (17%). Partisan differences are sharper: Liberals (28%) are more likely than Conservatives (21%) to see this happening.

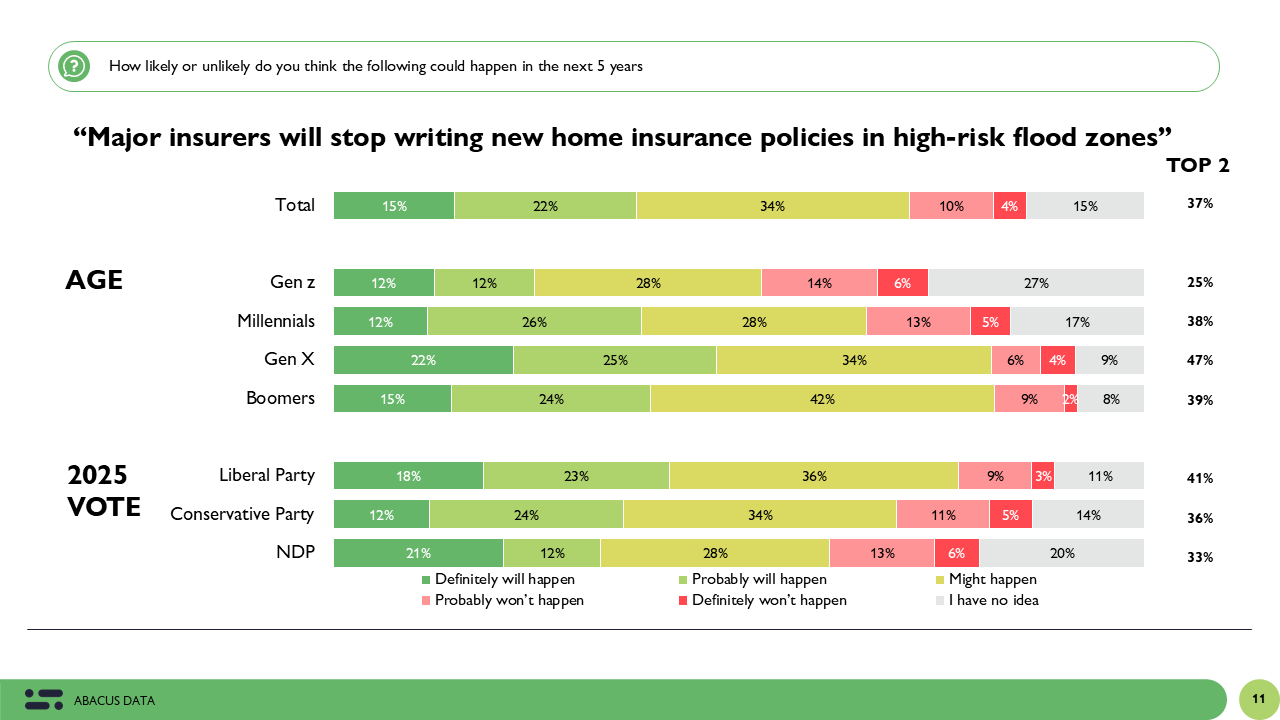

On insurance market impacts, 37% nationally expect major insurers to stop writing new home insurance policies in high-risk flood zones. Boomers are slightly above average at 39%, Gen Z is lower at 25%. Partisan divides are again notable: Liberals lead at 41%, Conservatives close behind at 36%. While both groups see this as a plausible development, Liberals appear more convinced that climate-related market changes will arrive quickly.

Quebec Independence Expectations

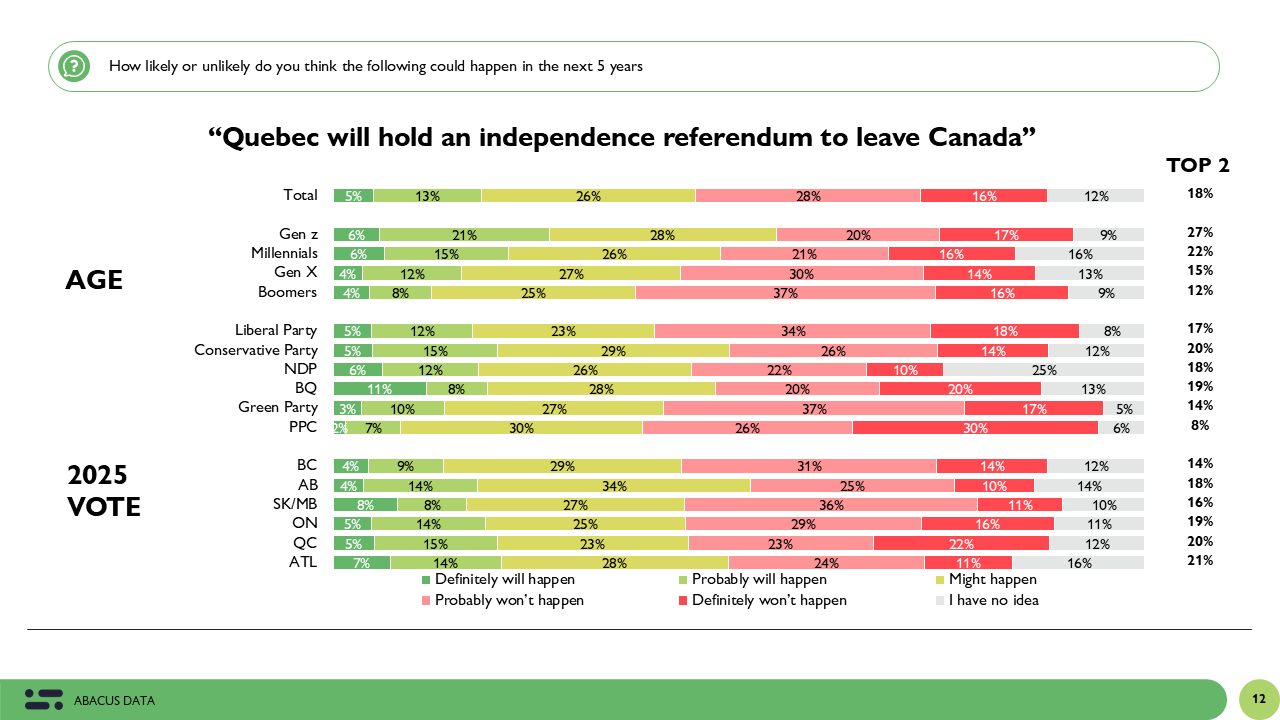

When asked whether Quebec will hold an independence referendum within the next five years, Canadians are more inclined to doubt it than to believe it will happen. Nationally, 18% think such a vote will “definitely” or “probably” take place, 26% say it “might happen,” and 43% believe it probably or definitely will not happen. Another 12% say they have no idea.

Generationally, younger Canadians are far more open to the possibility. Among 18- to 29-year-olds, 27% think a referendum is likely and another 28% think it might happen, leaving just over a third (37%) who think it won’t. Support for the likelihood drops steadily with age with only 12% of those 60 and over believe a vote will be held, while a majority (53%) dismiss the idea outright.

Regionally, expectations vary, though not as dramatically as one might think. Quebecers themselves are somewhat more likely than average to expect a referendum (20% likely, 23% might happen), but a similar share in Atlantic Canada (21%) also see it as probable. British Columbia (14%) and Saskatchewan/Manitoba (16%) are least likely to see a vote as imminent. Across all provinces, “might happen” responses are common, signalling that while Canadians don’t necessarily expect a referendum, they aren’t ruling it out entirely.

Politically, views are more polarized. Conservative voters (20% likely) are somewhat more inclined than Liberals (17%) to believe a referendum will occur, while Bloc Québécois supporters are, unsurprisingly, higher at 19% “likely” and 28% “might happen.” The strongest dismissal comes from Green Party voters (54% unlikely) and People’s Party supporters (56% unlikely). Among NDP voters, just 18% think a referendum will happen, though a quarter say they have no idea, the highest uncertainty among major federal parties.

This pattern, where a majority of Canadians either reject or are unsure about the possibility, suggests that while Quebec sovereignty remains a political undercurrent, it is not a widely anticipated near-term event. However, the higher likelihood placed on it by younger Canadians is notable. If this perception persists, it could shape how future political leaders frame national unity and constitutional debates.

Summary of the Landscape

When you step back, a clear pattern emerges. Age is the strongest driver of differences in future expectations. Younger Canadians are more open to the rapid adoption of new technology, more convinced AI will reshape work, and more pessimistic about economic stability. Older Canadians tend to be more sceptical about technological disruption, more confident in housing market stability, and less certain about major geopolitical change.

Political affiliation shapes the lens through which people view geopolitical and economic risks. Liberal voters are more likely to see threats to democracy in the U.S., anticipate climate-related disruptions, and expect NATO involvement in conflict. Conservative voters are more inclined to foresee a deep recession, more convinced about AI-driven job losses, and less likely to believe U.S. democracy will fail.

On issues like autonomous transportation and housing market collapse, there is cross-partisan consensus both Liberals and Conservatives are sceptical about rapid change. But on democracy, climate, and economic outlook, political identity pulls expectations in different directions.

Why Expectations Matter — and the Implications

Expectations aren’t idle speculation, they shape decisions in the present.

If Canadians believe AI will disrupt the workplace, they may invest in re-skilling, avoid certain career paths, or push for stronger regulation. If they expect climate risks to reshape insurance markets, they might alter home-buying decisions or demand infrastructure upgrades. If they anticipate geopolitical instability, they may support higher defence spending or leaders who promise stability.

From a consumer behaviour standpoint, younger Canadians’ higher expectations for technological and economic change suggest greater openness to new tools and wariness about long-term commitments. Older Canadians’ scepticism toward rapid change, especially in transport and housing, points to more stable consumption patterns. Liberal voters’ heightened expectations on climate and geopolitical risk could translate into stronger support for related policy action, while Conservatives’ greater recession fears may align with calls for fiscal restraint and economic policy change.

In employment planning, Gen Z’s stronger belief in AI-driven job loss suggests greater receptivity to training programs, while Conservatives’ slightly higher AI displacement expectations may influence business investment strategies differently than among Liberal-leaning firms.

For financial planning, Boomers’ faith in housing stability reinforces real estate as a store of wealth, while Gen Z’s more open view to a possible correction may influence their investment mix. Liberals’ higher climate-risk expectations could affect decisions on property location, insurance, and asset diversification, while Conservatives’ recession expectations may lead to more conservative investment portfolios.

In politics, these differences matter. The Liberal base appears more attuned to global democratic risk, climate-driven economic changes, and NATO’s potential role in conflict. Conservatives are more focused on economic vulnerability and AI disruption. These different mental maps of the next five years will influence which issues rise to the top in public debate and shape the policy agendas parties choose to champion.

But there’s another dimension: what happens if expectations are wrong?

If AI and automation evolve more rapidly than most Canadians anticipate, industries, workers, and governments could face sudden skill mismatches, mass displacement, and public anxiety. The pace of policy and training responses might lag, leading to sharper economic and social shocks.

If major geopolitical changes such as the collapse of U.S. democratic institutions, a new European conflict, or an unexpected escalation in Asia occur faster or more dramatically than expected, public opinion could shift overnight. Such events could reorder political priorities, reshape alliances, and cause rapid changes in consumer and investor confidence.

Shocks like these, where the future unfolds faster or more dramatically than people imagine, often have outsized impacts because they disrupt not only the real-world situation but also the psychological and strategic assumptions people have been using to make decisions. This is why measuring and tracking expectations matters: it’s not just about predicting the future, but about preparing for the emotional and behavioural turbulence that comes when reality departs sharply from what people believed was likely.

The future will not unfold exactly as any group expects, but the way Canadians imagine it today will shape how they prepare, respond, and adapt. For leaders in business, government, and advocacy, understanding these expectations and planning for what happens if they’re wrong, is essential to anticipating both market shifts and political currents.mer wears on, it’s the economy, not foreign affairs, that could add more complexity to the political climate heading into fall.”

METHODOLOGY

The survey was conducted with 1,686 Canadians from July 31 to August 7, 2025. A random sample of panelists were invited to complete the survey via partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.4%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, and region. Totals may not add up to 100 due to rounding.

The survey was paid for by Abacus Data.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.