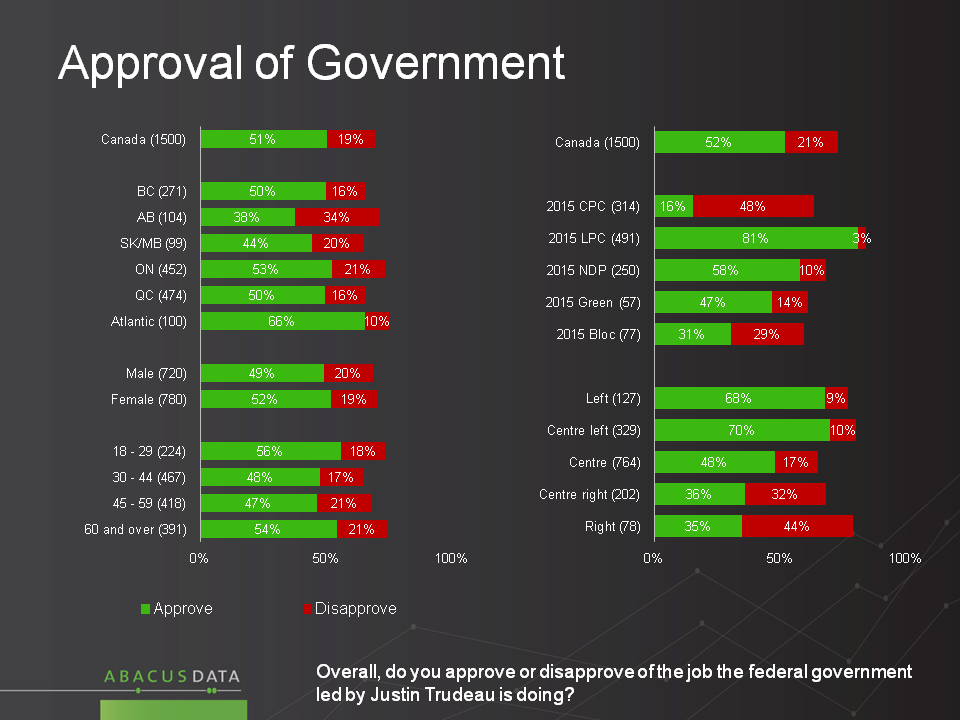

How do we feel about the Trudeau government?

By a 2:1 margin, people approve

By Bruce Anderson & David Coletto

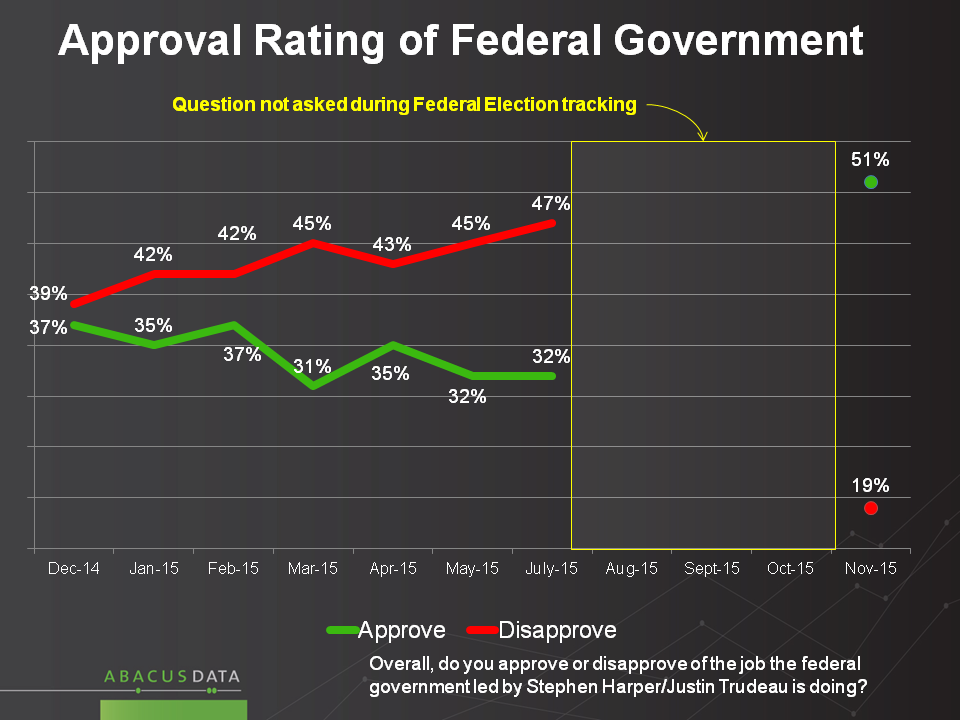

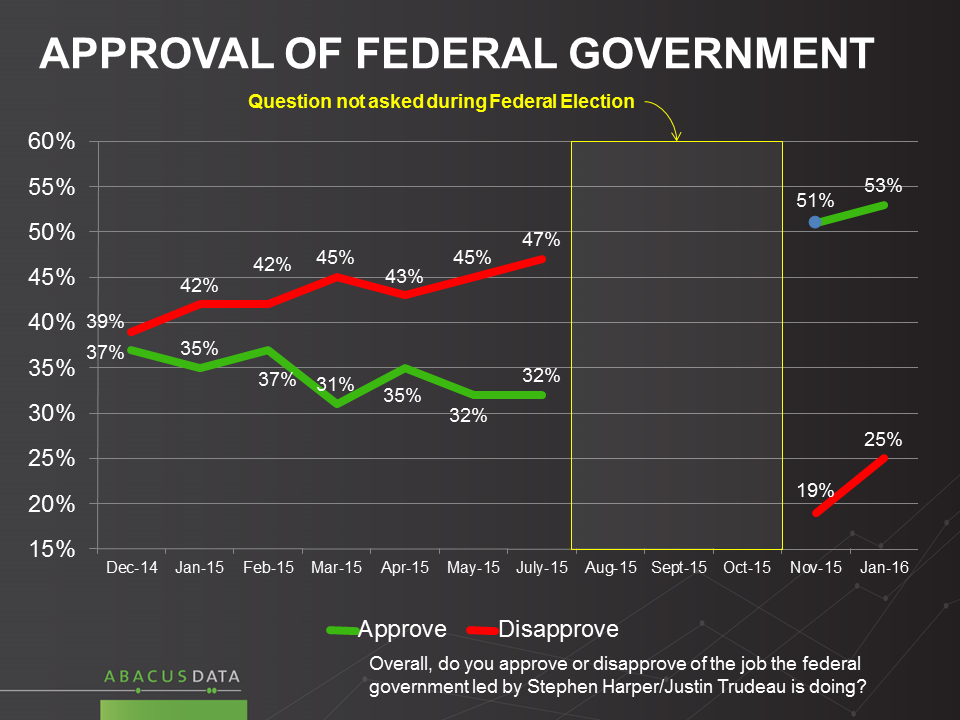

Today, 53% say they approve of the performance of the federal government, similar to the 51% we measured in December. To put this in context, at no point during 2015 did the Harper government find an approval rating higher than 37%.

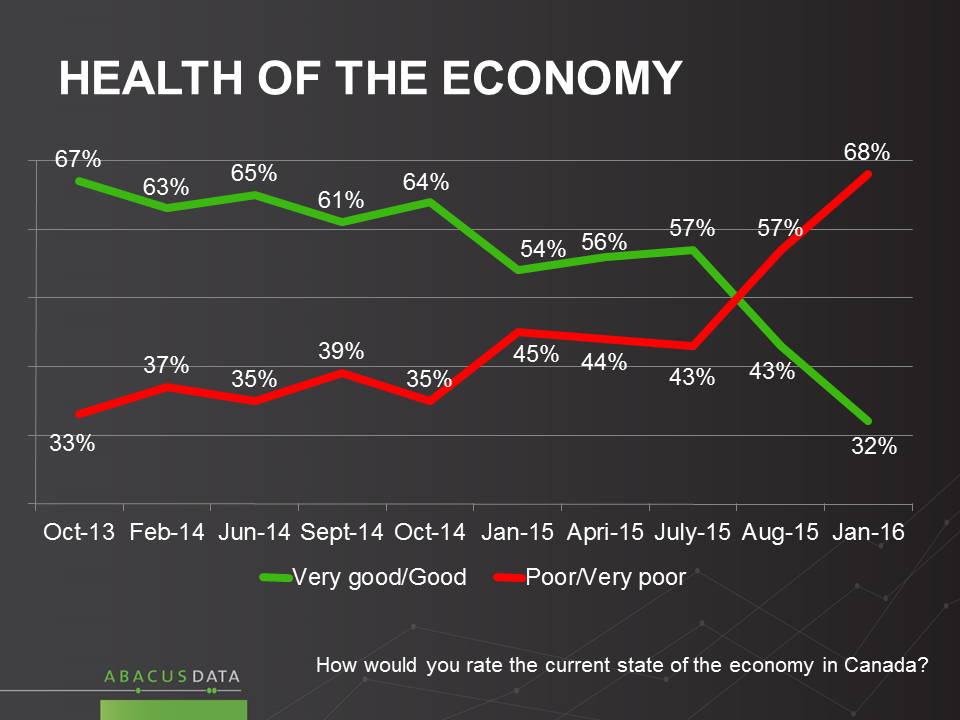

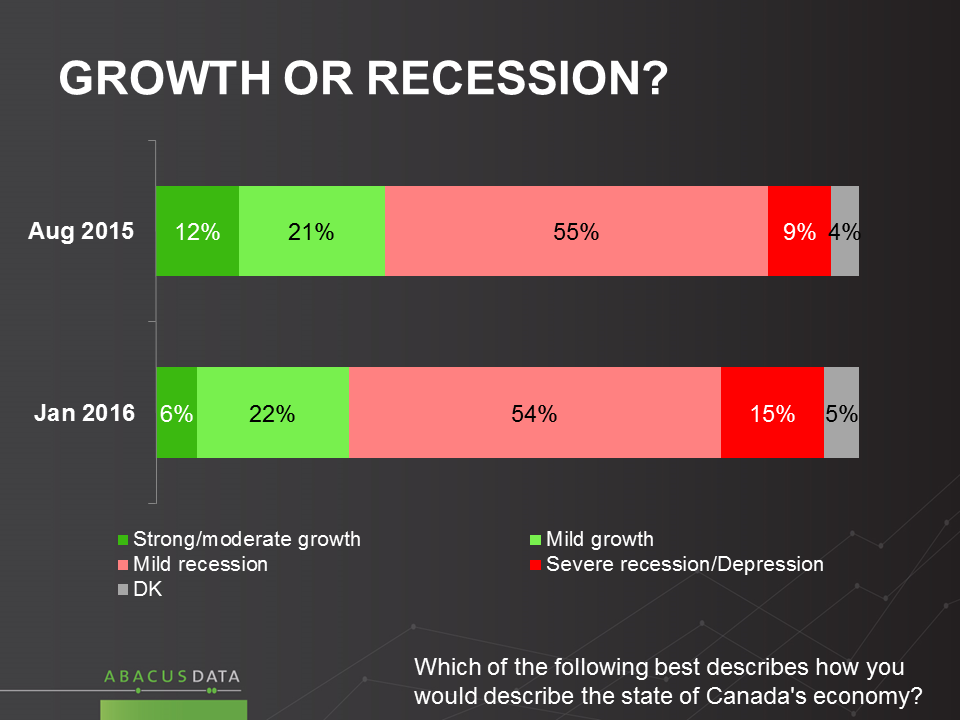

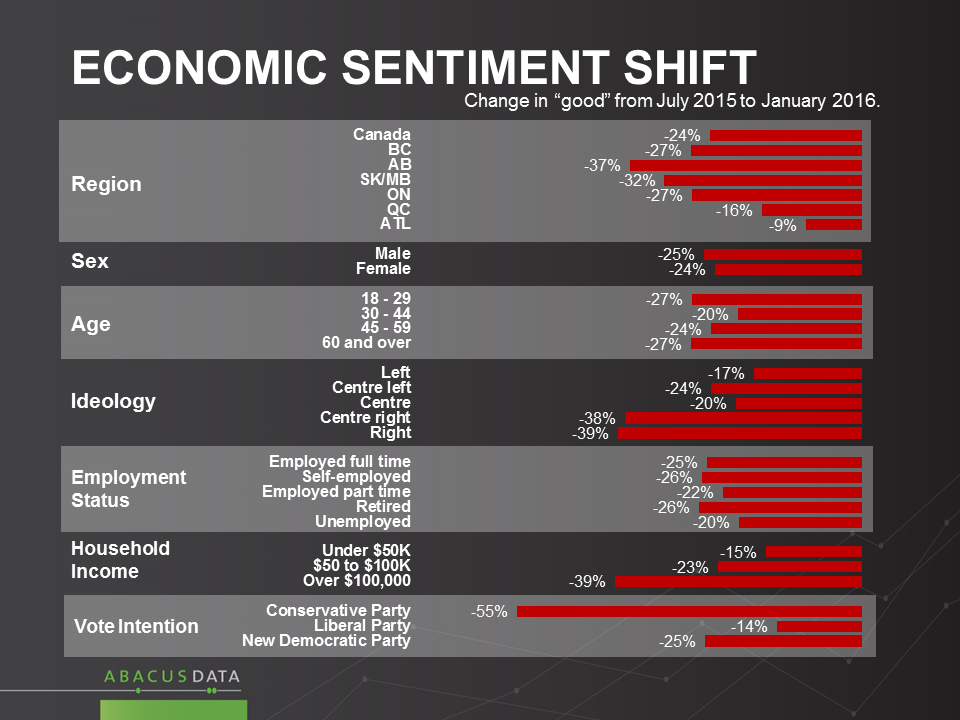

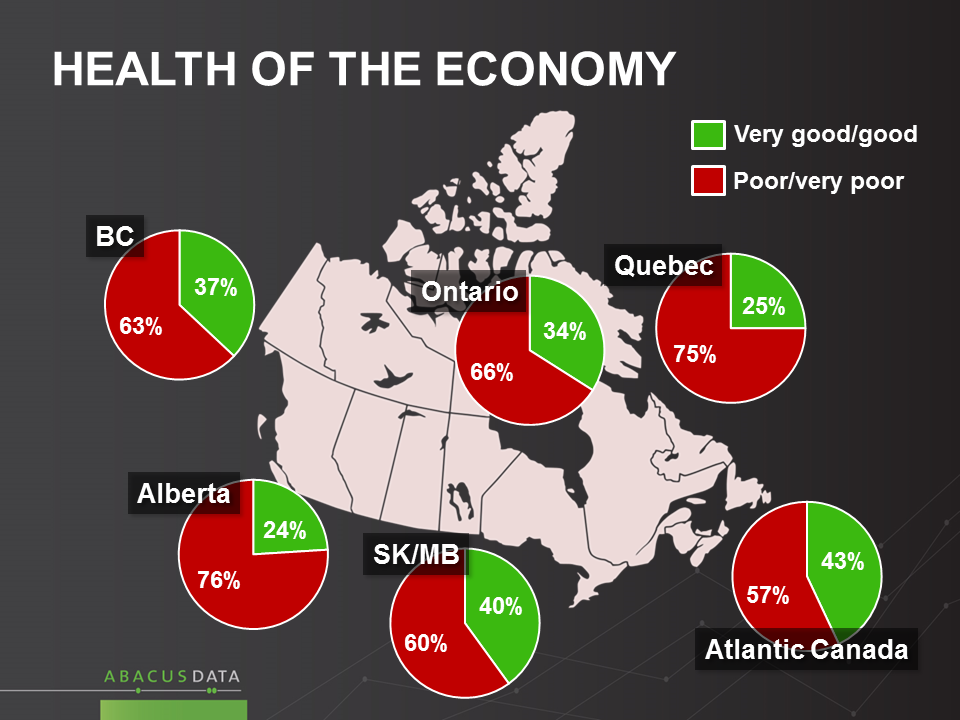

Also noteworthy is that a year ago, 2 out of 3 people thought the economy was doing well; today, 2 out of 3 describe it as poor.

Today, just 25% disapprove of the performance of the government, even though 60% voted for another party. This underscores the challenge facing opposition parties, as Canadians are inclined to give this government some time to establish its agenda.

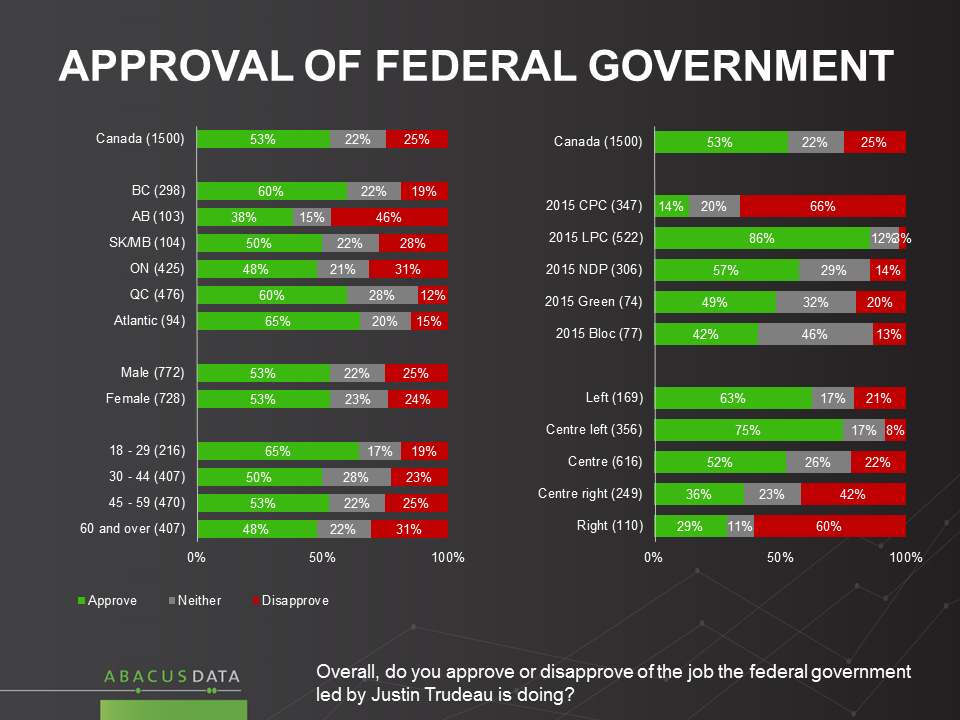

14% of those who voted Conservative voters approve of the Liberal government’s performance so far, as do a striking 57% of those who voted for the NDP.

Approval of Prime Minister Trudeau personally is at 57% while disapproval is 24% underlining that a very large proportion of the positive feeling about the government has to do with reactions to Mr. Trudeau himself.

Detailed Assessments of the Prime Minister

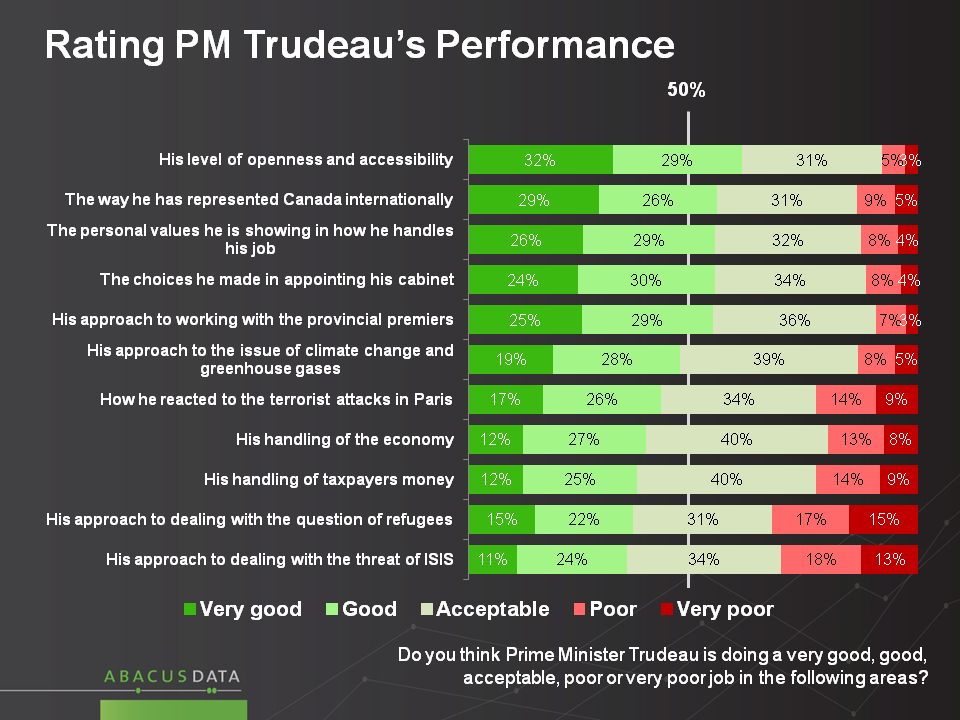

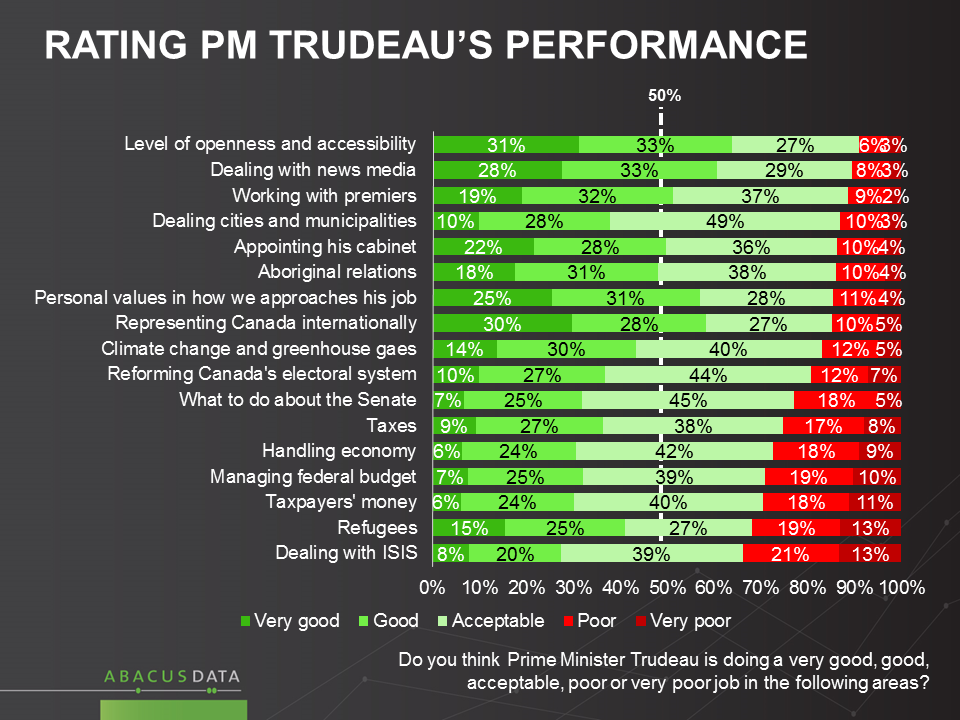

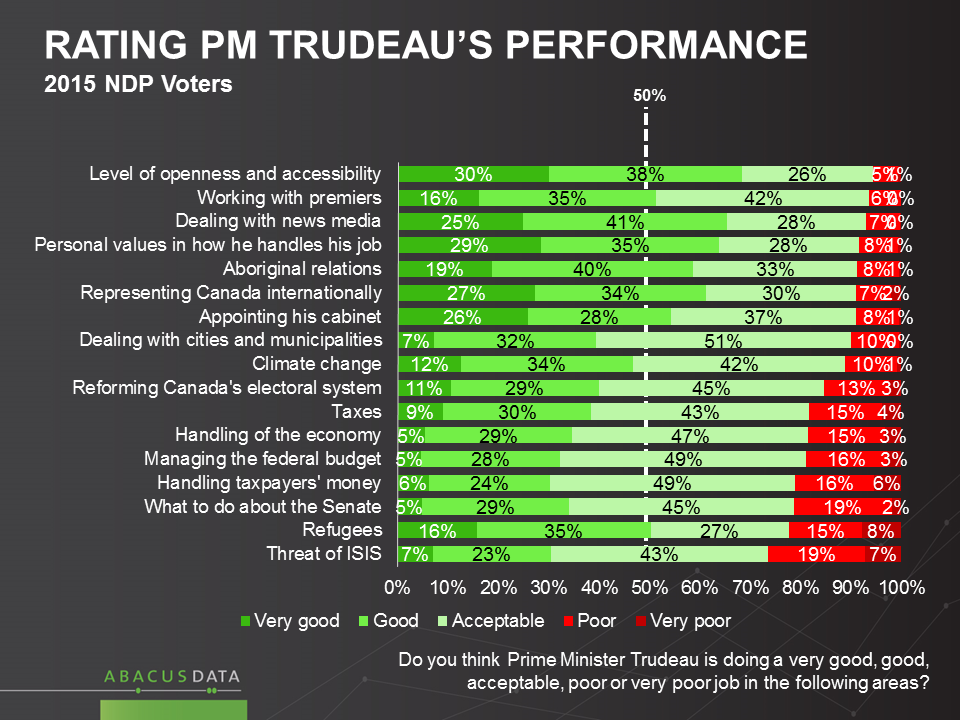

We explored reactions to Mr. Trudeau’s performance in office on 17 different items.

• On all 17 items a sizeable majority (never smaller than 67%) said he was doing an acceptable or better job.

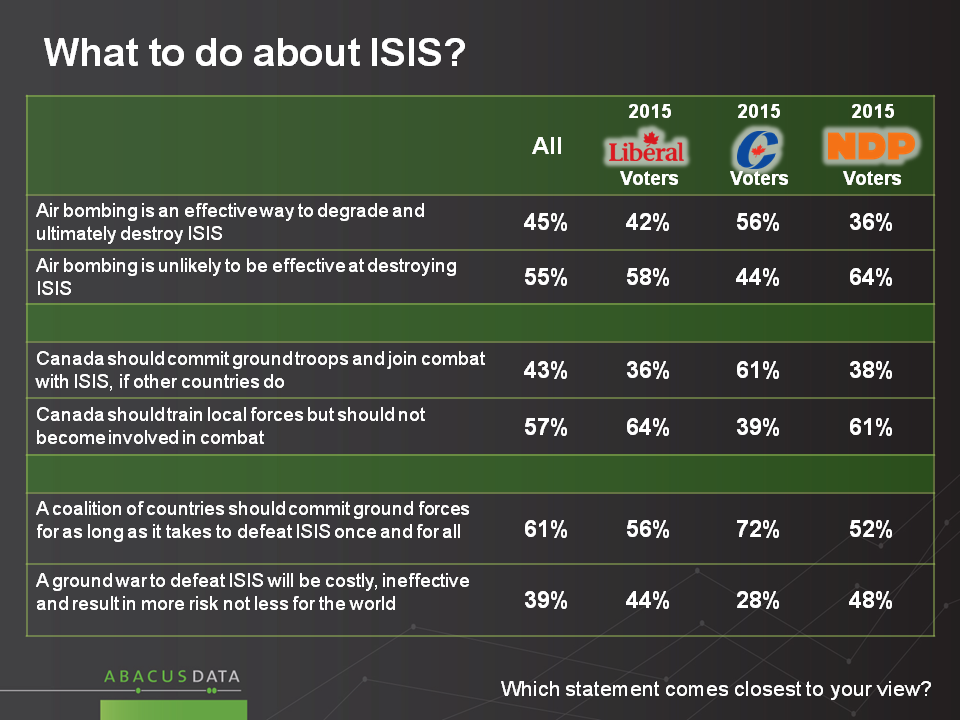

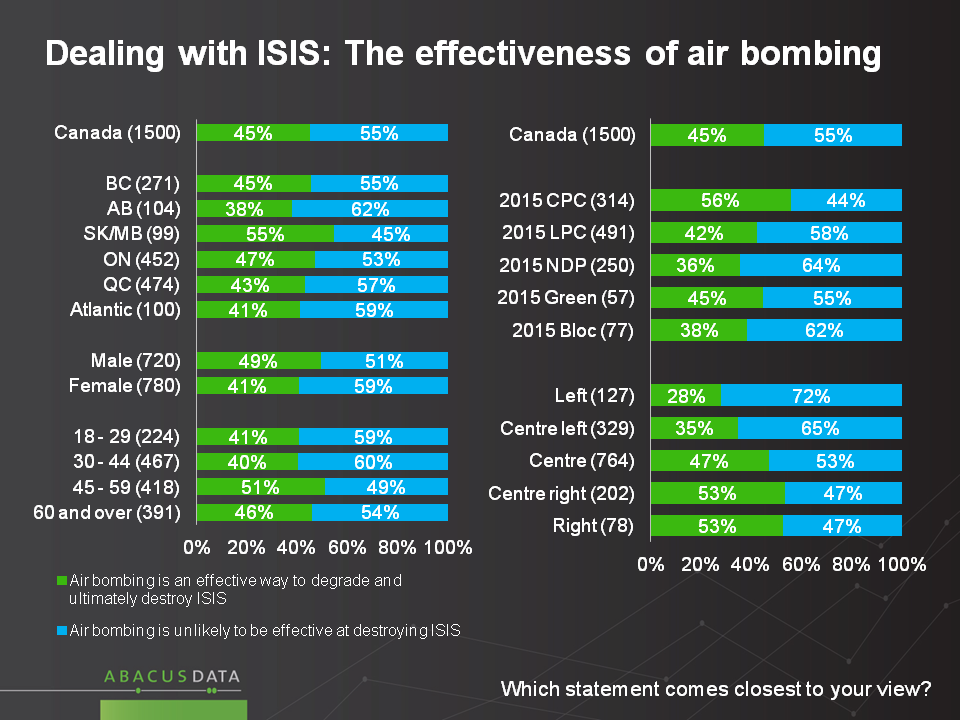

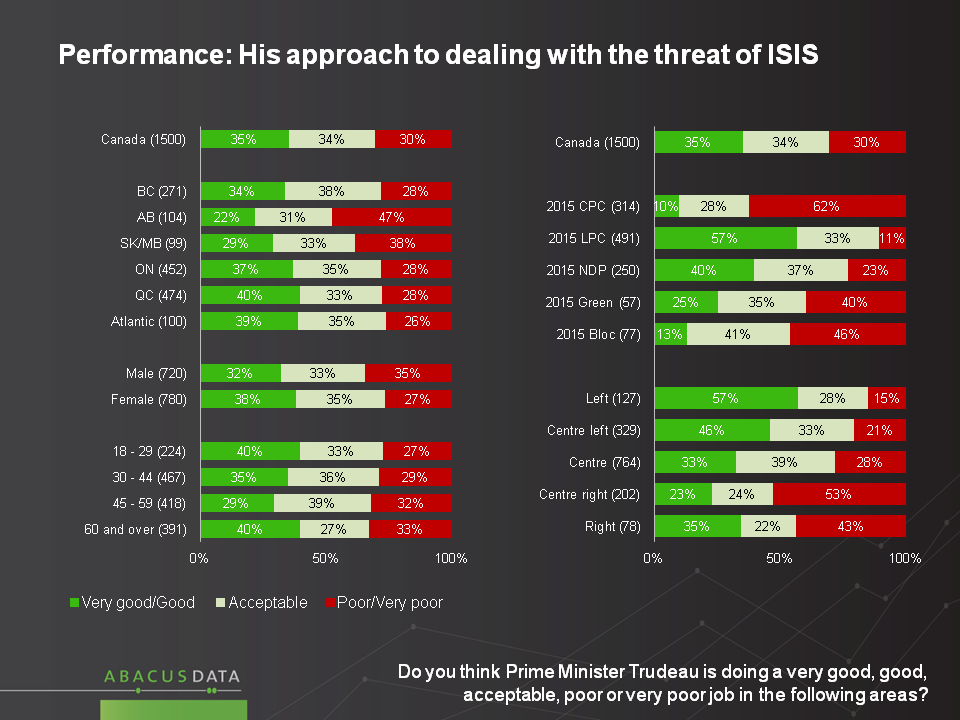

• On his worst rated item, “dealing with ISIS”, only 34% give the PM a poor rating.

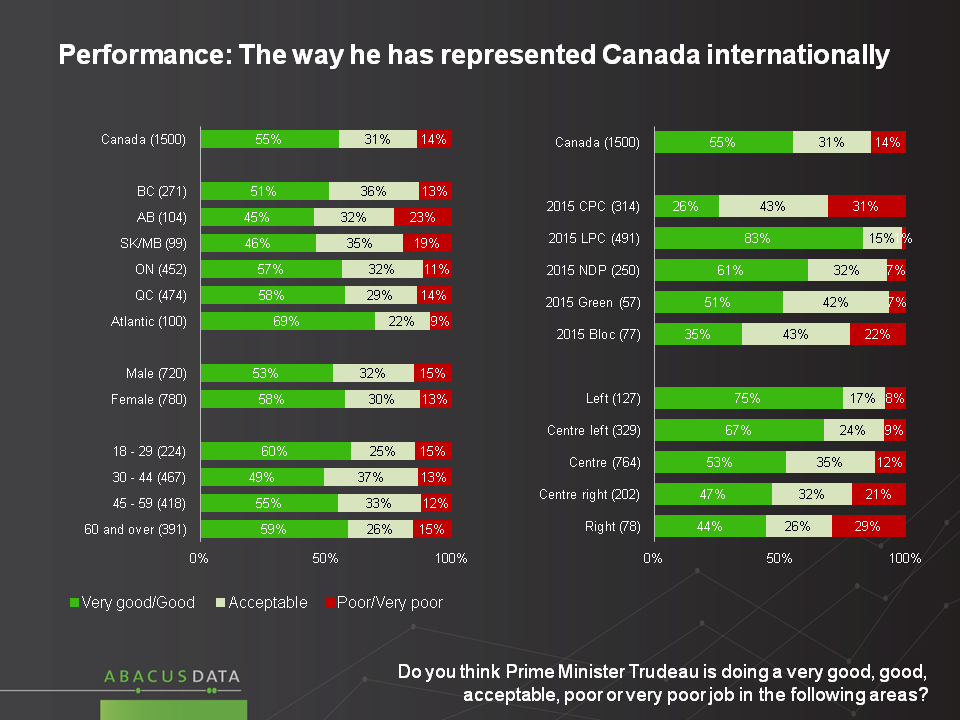

• Four items stand out for showing the strongest positive assessments: “level of openness and accessibility’, approach to “dealing with the news media” “personal values in how he approaches his job” and “representing Canada internationally”

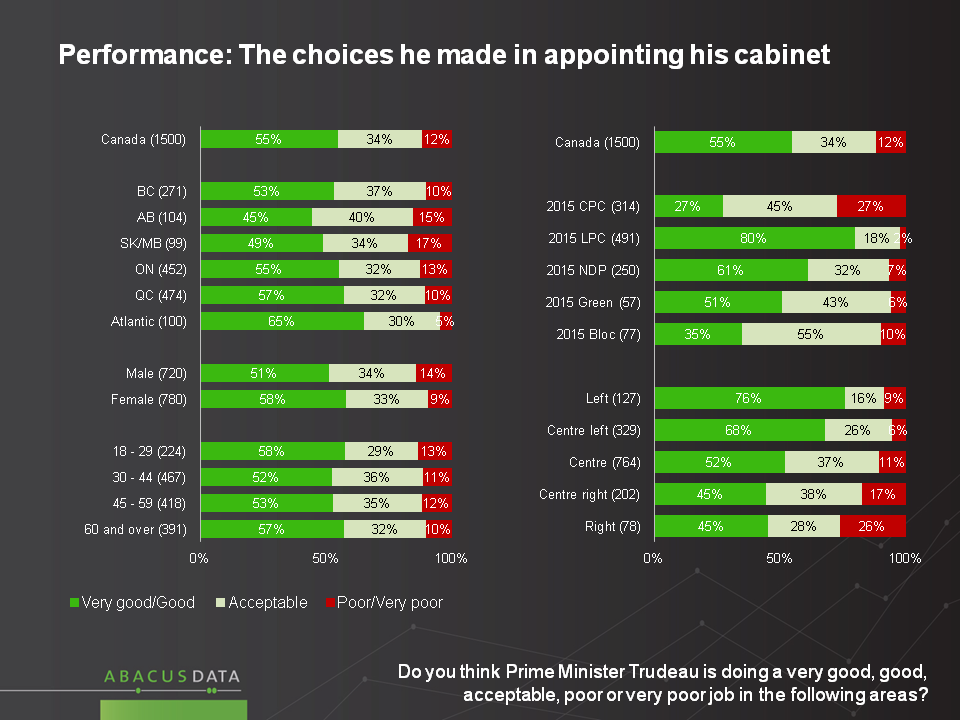

• Close behind these were “working with the Premiers” “aboriginal relations” and his selections to Cabinet posts.

• On handling the economy, managing the federal budget, and dealing with taxpayers money, Mr. Trudeau gets acceptable or better ratings from 70%-72%.

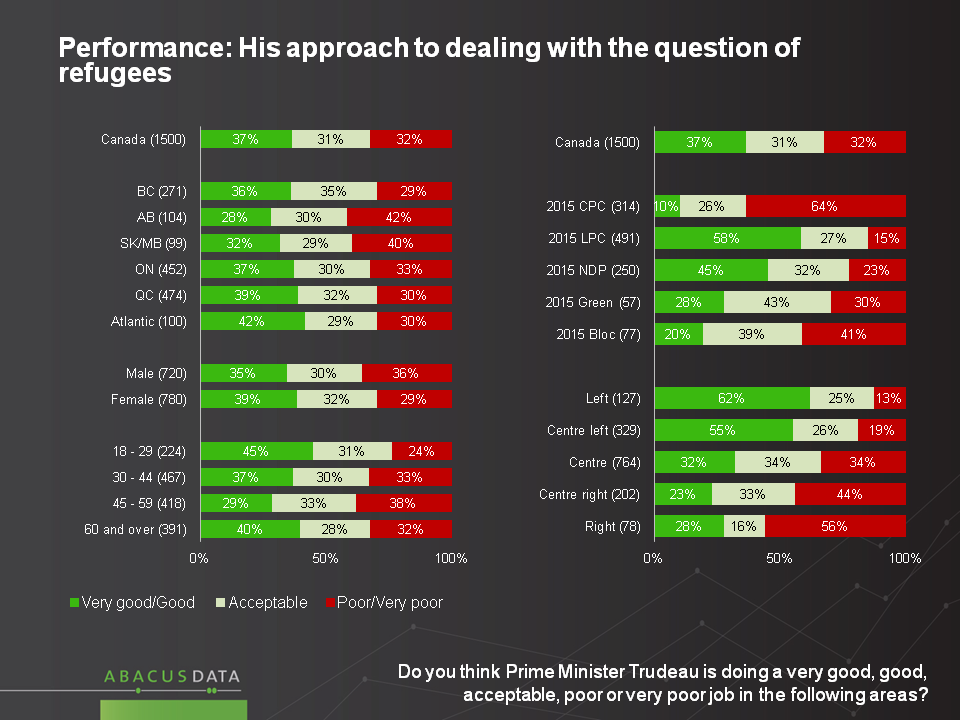

• On his approach to refugees, 40% give Mr. Trudeau a good rating, 27% acceptable, and 32% a poor rating. Deeper analysis shows that this issue more than any other creates a clear dividing line between Conservative Party supporters and other voters.

• When it comes to reforming the electoral system, 37% say the PM is doing a good job, another 44% acceptable, while only 19% are unhappy at this point in time.

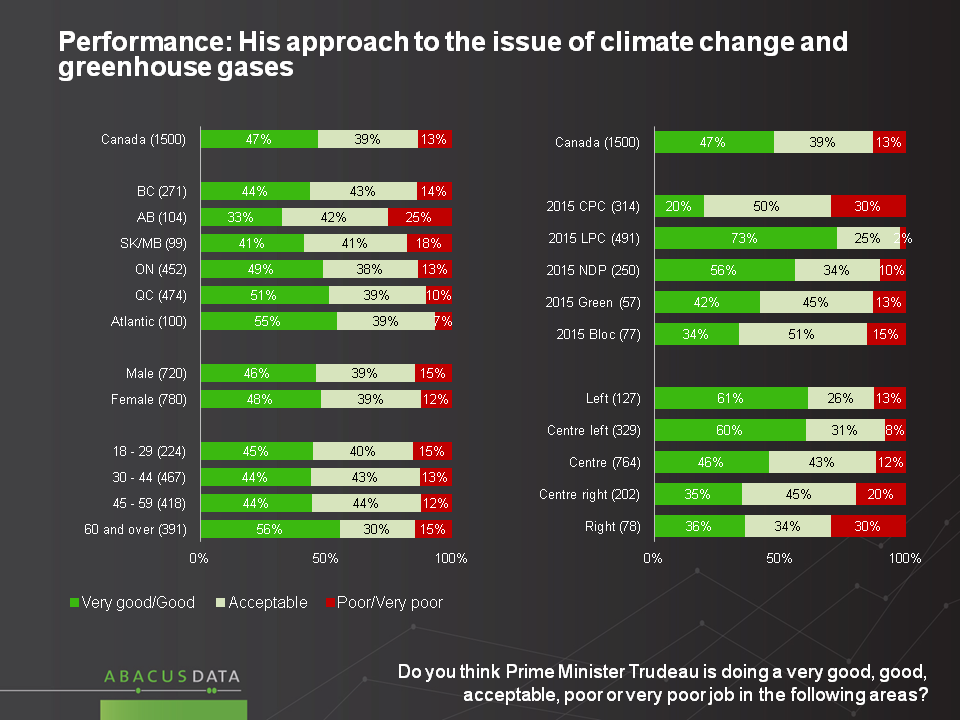

• In the wake of the COP21 agreement, 44% give the PM a good rating, 40% acceptable, and just 17% say “poor” when it comes to how he has dealt with climate change and greenhouse gases.

• On “what to do about the Senate” 32% say Trudeau is doing well, 45% acceptably, while 23% offer a poor rating.

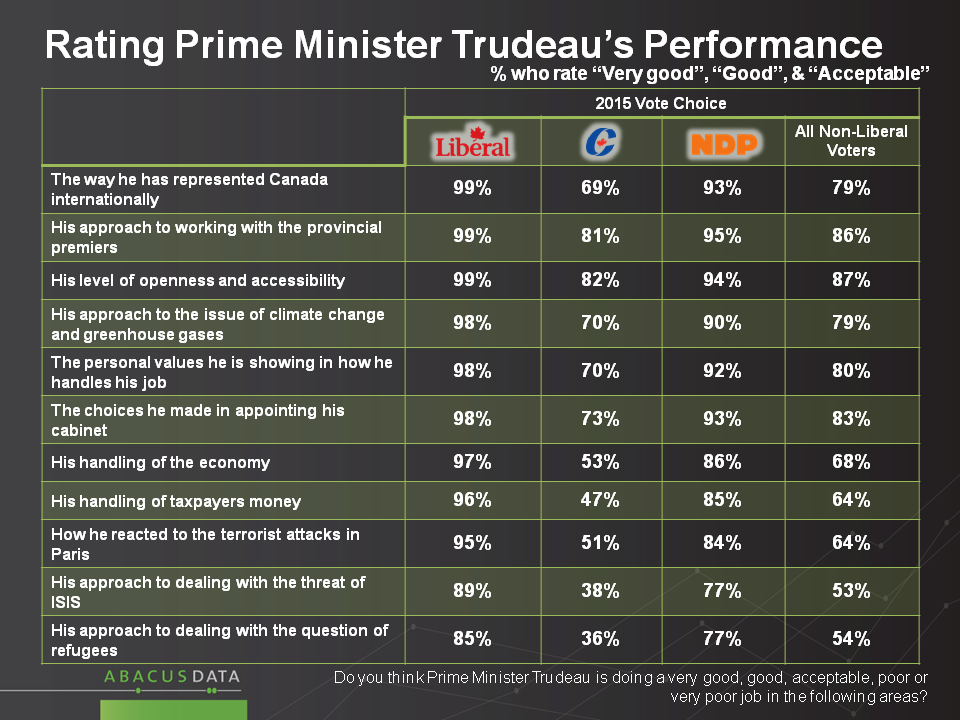

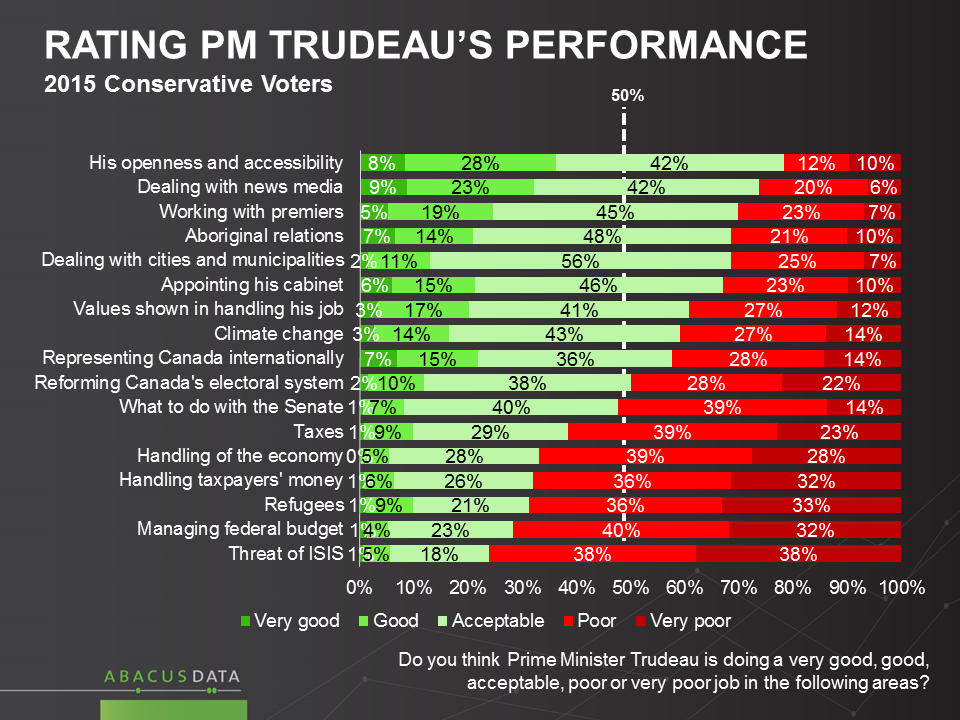

Mr. Trudeau receives positive reviews from most of those who voted NDP: large majorities describe his performance as acceptable or better on all 17 items. A majority of Conservative voters rate Mr. Trudeau’s performance as acceptable or better on 10 of the 17 items.

The Upshot

According to Bruce Anderson: “The positive feelings about the federal government so far, despite a weakening economy, challenge the conventional wisdom that politics is always about the economy.

While the government is getting pretty good marks for handling challenging substantive issues, the most positive assessments continue to have a lot to do with appreciation for the tone and attitude of the Prime Minister towards others.

Recalling the degree to which both his major opponents built campaigns on the assumption Mr. Trudeau would not wear well with Canadians, it is very clear that they have their work cut out for them now. So far, Mr. Trudeau is converting what was hope that he would do well into a feeling that he is proving himself fit, and then some, to hold the office of Prime Minister.”

Methodology

Our survey was conducted online with 1,500 Canadians aged 18 and over from January 8 to 12, 2016. A random sample of panelists was invited to complete the survey from a large representative panel of over 400,000 Canadians.

The Marketing Research and Intelligence Association policy limits statements about margins of sampling error for most online surveys. The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

Abacus Data Inc.

We offer global research capacity with a strong focus on customer service, attention to detail and value added insight. Our team combines the experience of our Chairman Bruce Anderson, one of Canada’s leading research executives for two decades, with the energy, creativity and research expertise of CEO David Coletto, PhD.