Financial Literacy in Canada: Trust and Sources of Information

December 1, 2015

Research Objectives

In June, Canada launched its first-ever National Strategy for Financial Literacy and the country is now examining how best to increase the financial knowledge and skills of Canadians.

On behalf of the Canadian Bankers Association, Abacus conducted an extensive nationwide study of Canadians’ financial aspirations and their know-how when it comes to managing money in ways that will help them achieve their goals. This research is designed to explore the values, financial goals and priorities of Canadians of different ages and to get a better understanding of what financial issues they would like to know more about and where they go to look for information. This study is being widely released so that all financial literacy organizations can use the knowledge to properly evaluate their programs and ensure that they are reaching all generations in this digital age.

This is the fourth of a series of releases to highlight key elements of this fascinating study.

Important Sources of Information

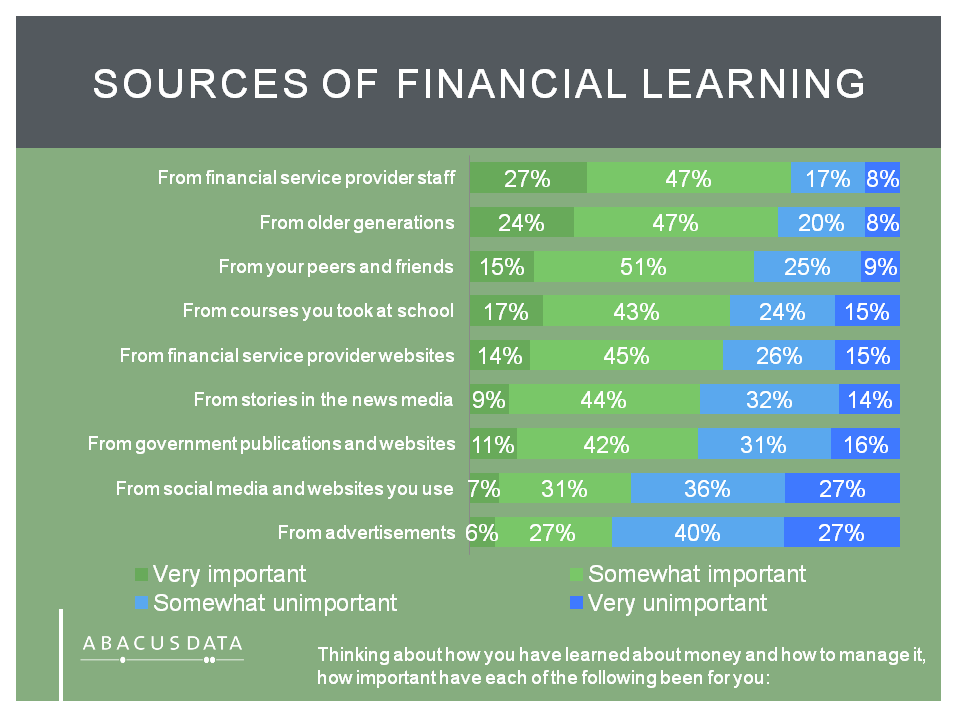

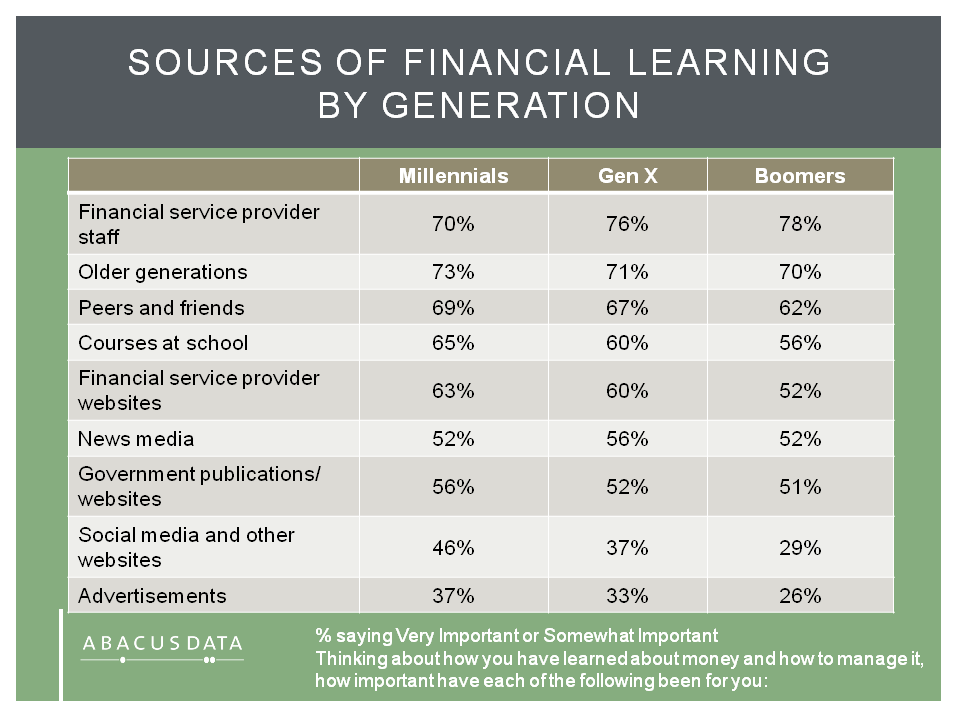

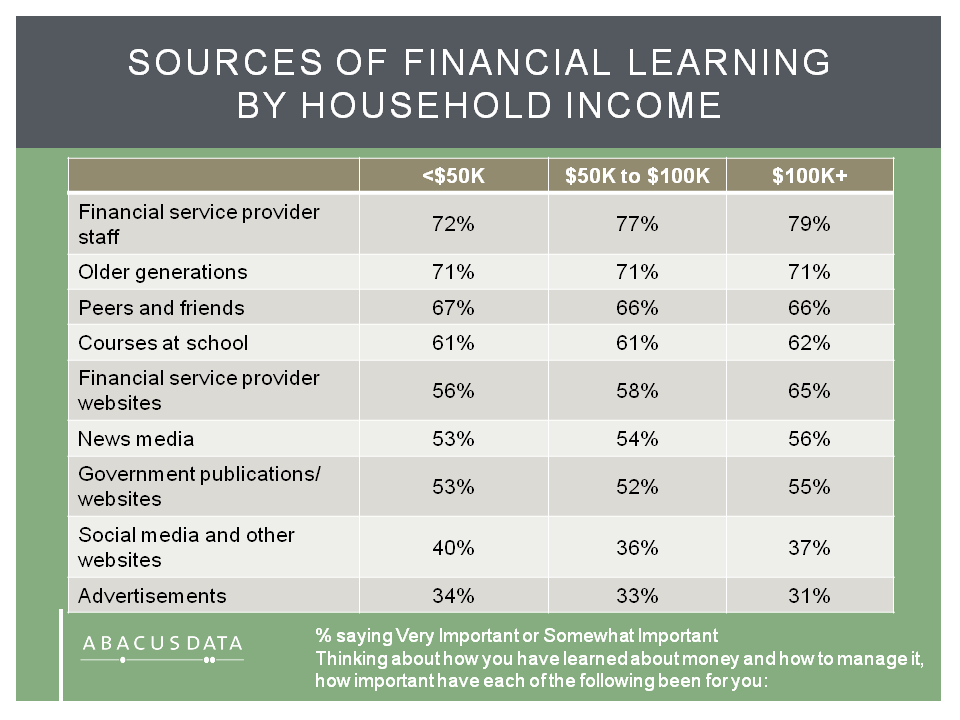

Canadians learn about money from a wide variety of sources. Information is passed on from financial service staff but also from friends and family. Just over 7 in 10 say that older generations were helpful sources for them, and two thirds have counted on peers and friends.

School courses have been useful sources for the majority of those interviewed. As technology has changed so many marketplaces, it is also playing a strong role in the dissemination of learning about money. Financial service company websites are important sources of information for about 6 in 10 people, and almost as many say they use government publications and websites.

When it comes to generational differences, Millennials are more likely to say that social media and other websites, advertisements, financial service provider websites, and government websites are important sources compared to older generations while Gen Xers and Boomers are more likely to say that financial service provider staff are important. Millennials are more likely to rely on digital sources while Boomers, for example, are more likely to rely on more traditional sources of information.

When it comes to socio-economic status, we find almost no difference across income groups except when it comes to financial service provider staff – lower income respondents were somewhat less likely to say they are important sources for information.

Trusted Sources of Information

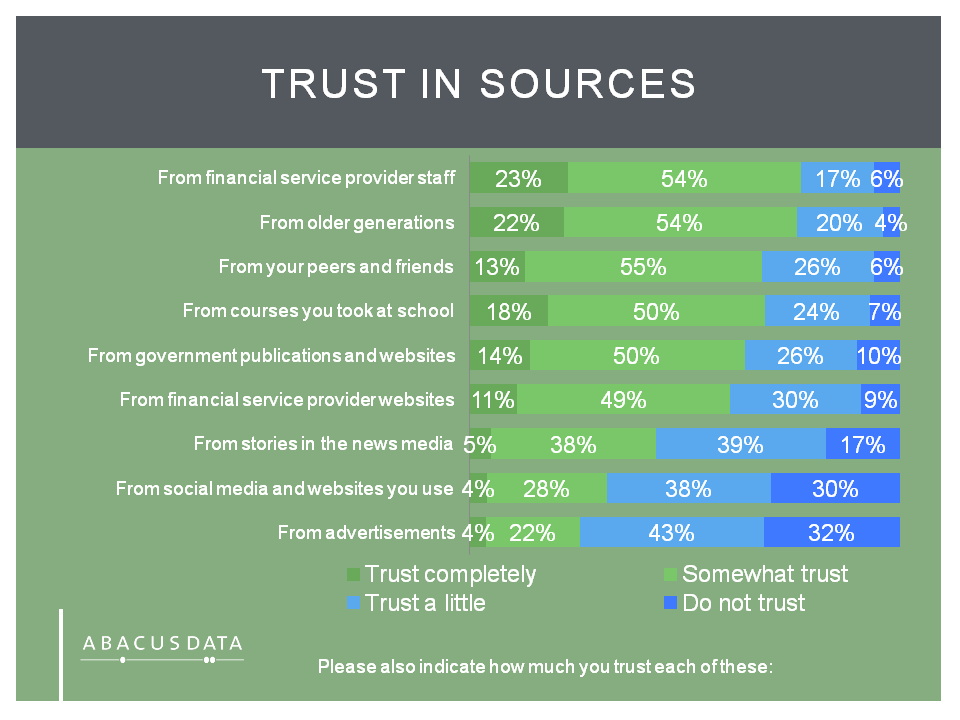

Most people say they trust the information about money that they get from staff and financial service companies as they do advice from people who are older. Peers, government, and school sources are almost as well trusted, with two thirds or more saying they trust these sources.

Trust levels are lower when it comes to advertisements and social media and general websites. This suggests that people consider the source more important than the platform when it comes to trust.

News media stories do not enjoy particularly high levels of trust when it comes to this subject matter.

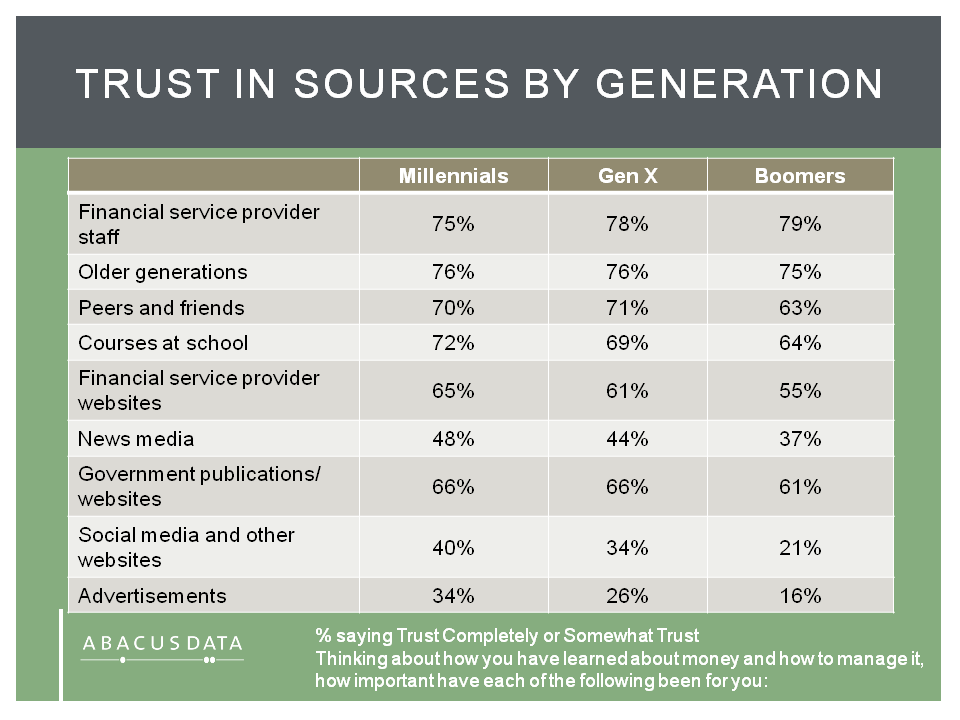

We examined differences by generation on these questions and found relatively few important differences. Across all generations, people are about equally likely to trust peers and friends, as well as staff in financial services companies. There are slightly higher levels of trust in social media and general websites among younger people, but the differences are modest.

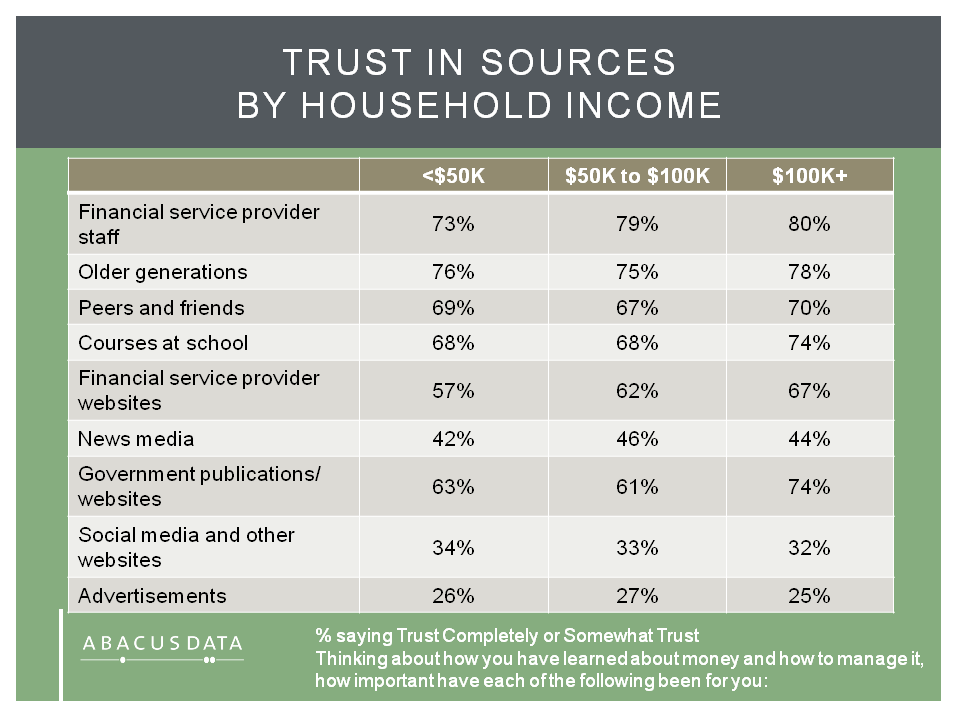

We also find lower trust levels among those whose household income is $50,000 or less for financial service provider staff and websites. Otherwise, there is little variation across socio-economic status.

The Upshot

Learning about money is something that is not a function of any single source of information, rather it happens over time through a combination of formal/structural ways and informal peer and inter-generational influences.

For the most part, it appears that Canadians feel they have access to a good number of information sources they can trust, using traditional, word of mouth and digital delivery systems. While generations differ on many things, how they acquire information and the sources they trust are not all that different, when it comes to learning how to manage money well.

Methodology

The survey, commissioned by the Canadian Bankers Association, was conducted online with 1,978 Canadians aged 18 to 70 from April 10 to 21, 2015. A random sample of panelists was invited to complete the survey from a large representative panel of over 500,000 Canadians, recruited and managed by Research Now, one of the world’s leading provider of online research samples.

The Marketing Research and Intelligence Association policy limits statements about margins of sampling error for most online surveys. The margin of error for a comparable probability-based random sample of the same size is +/- 2.2%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

Abacus Data Inc.

We offer global research capacity with a strong focus on customer service, attention to detail and value added insight. Our team combines the experience of our Chairman Bruce Anderson, one of Canada’s leading research executives for two decades, with the energy, creativity and research expertise of CEO David Coletto, PhD.