Abacus Election Bulletin: The top 4 data shifts, so far.

September 14, 2021

Each day during the 2021 Federal Election campaign, researchers at Abacus Data will share insights and analysis from our polling in concise, insights-focused reports. To never miss our polls and analysis, subscribe to our newsletter.

Over the last four weeks we’ve been tracking a lot of data points about the federal election. Everything from where the parties, stand, to how we are getting our content about the election. As we go into the final week of this election I wanted to review some of the biggest jumps we’ve seen in the numbers, and what they might as we head into this final week.

The following are some of the biggest changes I’ve noted since the start of the election period, and are presented in no particular order.

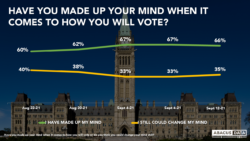

#4: Have you made up your mind about who you are voting for?

One number that we saw climb at the start of the election is the percentage of eligible voters who’ve made up their mind.

However, this number may be more of an honourable mention, if you just consider the last couple weeks.

After about week three, the number of decided Canadians sat at two thirds and has been fairly stable since, with the debates doing little to sway the number. With one week to go, a third of the electorate still has yet to decide. Still, the jump in decided voters in late August was a big one, and lines up with what we are seeing in the other data as well (larger swings early on in the campaign with a stabilization heading into the final week).

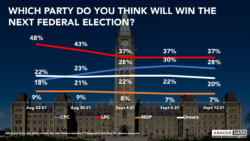

#3: Which party is going to win?

Up next is the question of who voters think will win the next election. TLDR: most think the Liberals, but the margins have tightened significantly.

At the beginning of the election, one in two voters felt the Liberals would take the win, but this steadily declined over the next two weeks. Like the previous, these numbers seem to have stabilized as well, and a majority of voters still think the Liberals will win, but since we started tracking the Liberals have seen a 10-pt decrease while the Conservatives have seen an almost equal increase.

There may be many reasons for this stabilization but one possible gain from the Liberals may be them pulling the electorate back towards them on cost of living issues. Early on, we saw a near tie between the Conservatives and Liberals when we asked which party was best positioned to address this issue. The gap widened slightly, as Erin O’Toole took a 3-4 pt lead. But our latest poll shows this is back to a tie.

#2: Impressions of Erin O’Toole

Next up are impressions of Conservative leader Erin O’Toole. As we started the election, 40% of voters didn’t know enough about the Conservative leader to form impressions. But once the campaign kicked off, Canadians became more familiar and that increased awareness seems to have translated directly to the positives. Positive impressions have risen 11-pts, a significant climb, negatives have stayed consistent.

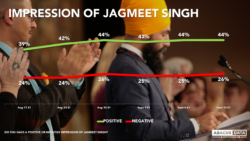

#1: Impressions of Jagmeet Singh

And finally, finishing off some of the biggest changes we’ve seen so far are impressions of Jagmeet Singh. Awareness of Singh at the start of the campaign was about in line with awareness of O’Toole. And also like O’Toole, Singh experienced a significant shift in awareness, that trended almost entirely positive. Since the start of the election Singh has seen an increase in positive impressions, 5 pts in a month.

THE UPSHOT

According to Oksana Kishchuk:

During this election we saw some big shifts at the start, but heading into the final week numbers have leveled off, making this a tight race. With a third of eligible voters undecided, there is still room for the increased positive impressions of O’Toole and Singh to have an impact. The same can be said for the narrowing race of which party voters think will win the election- the majority still think the Liberals will win but the Conservative momentum seen early on could impact vote decisions in the end.

We will continue tracking these insights and more, daily, during the final week of the 2021 federal election.

METHODOLOGY

Our survey were conducted over 5 waves:

August 12-16th: 1,500 Canadian adults from August 12 to 16, 2021. The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20.

August 17 to 22nd: 2,000 Canadian adults from August 17 to 22, 2021. The margin of error for a comparable probability-based random sample of the same size is +/- 2.2%, 19 times out of 20.

August 24 to 29th: 2,000 Canadian adults eligible to vote from August 24 to 29, 2021.The margin of error for a comparable probability-based random sample of the same size is +/- 2.2%, 19 times out of 20.

September 1 to 4th: 2,692 Canadian adults eligible to vote from September 1 to 4, 2021.The margin of error for a comparable probability-based random sample of the same size is +/-1.9%, 19 times out of 20.

September 3 to 6th: 2,875 Canadian adults eligible to vote from September 3 to 6, 2021. The margin of error for a comparable probability-based random sample of the same size is +/-1.9%, 19 times out of 20.

September 10 to 12th: 2,000 Canadian adults eligible to vote from September 10 to 12, 2021. The margin of error for a comparable probability-based random sample of the same size is +/-2.1%, 19 times out of 20.

All surveys were conducted using a random sample of panellists was invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are double opt-in survey panels, blended to manage out potential skews in the data from a single source.

In Canada the data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

The survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

Find out more about what we are doing to help clients respond to the COVID-19 pandemic.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

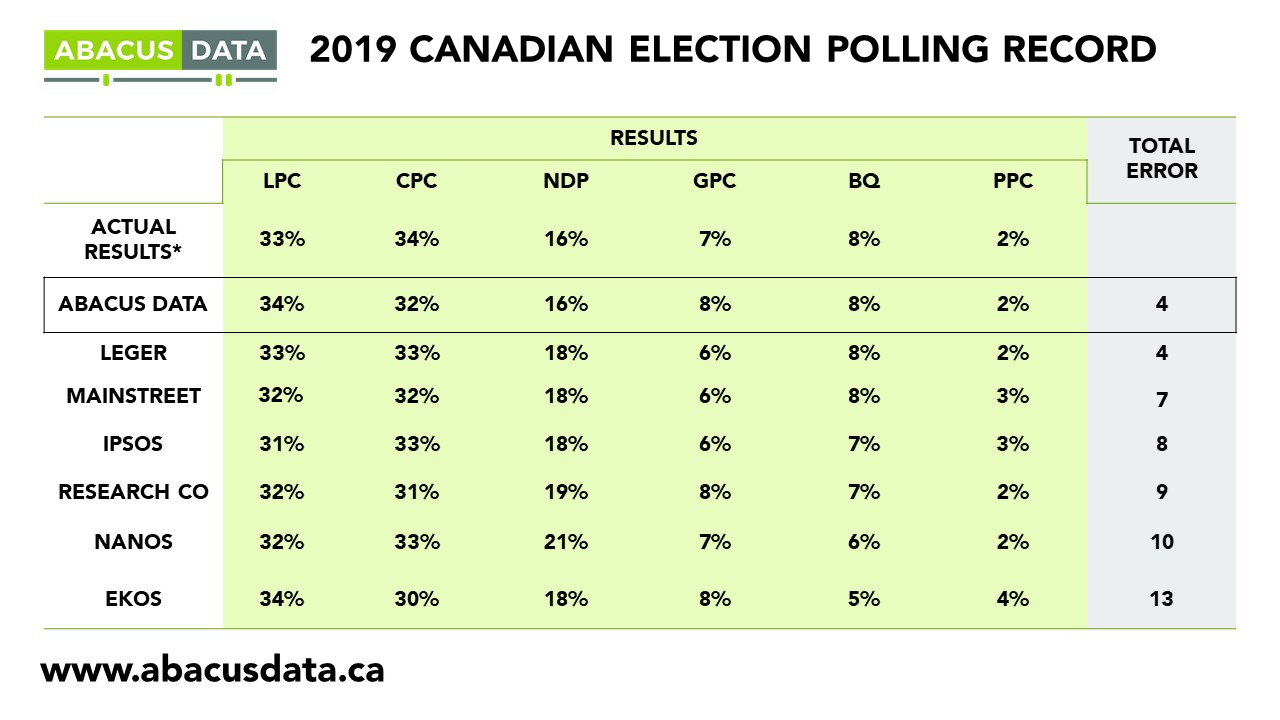

We were one of the most accurate pollsters conducting research during the 2019 Canadian Election.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.