The Local Traveller Will Be Around for One More Season, at Least.

A few months ago as the weather warmed, mandates lifted and some countries eased their rules and restrictions, we wondered if optimism about travel would rise.

With the pandemic and the trickle-down impacts continuing to impact our lives, choices and behaviours, travel is no different. Our pocketbooks are starting to oppose the predicted flood of post-pandemic spending, and there is no shortage of new stories about travel difficulties across the globe.

To understand how our travel habits and intentions continue to shift, we went into field late last month to test the pulse of Canadians. Here is what we found:

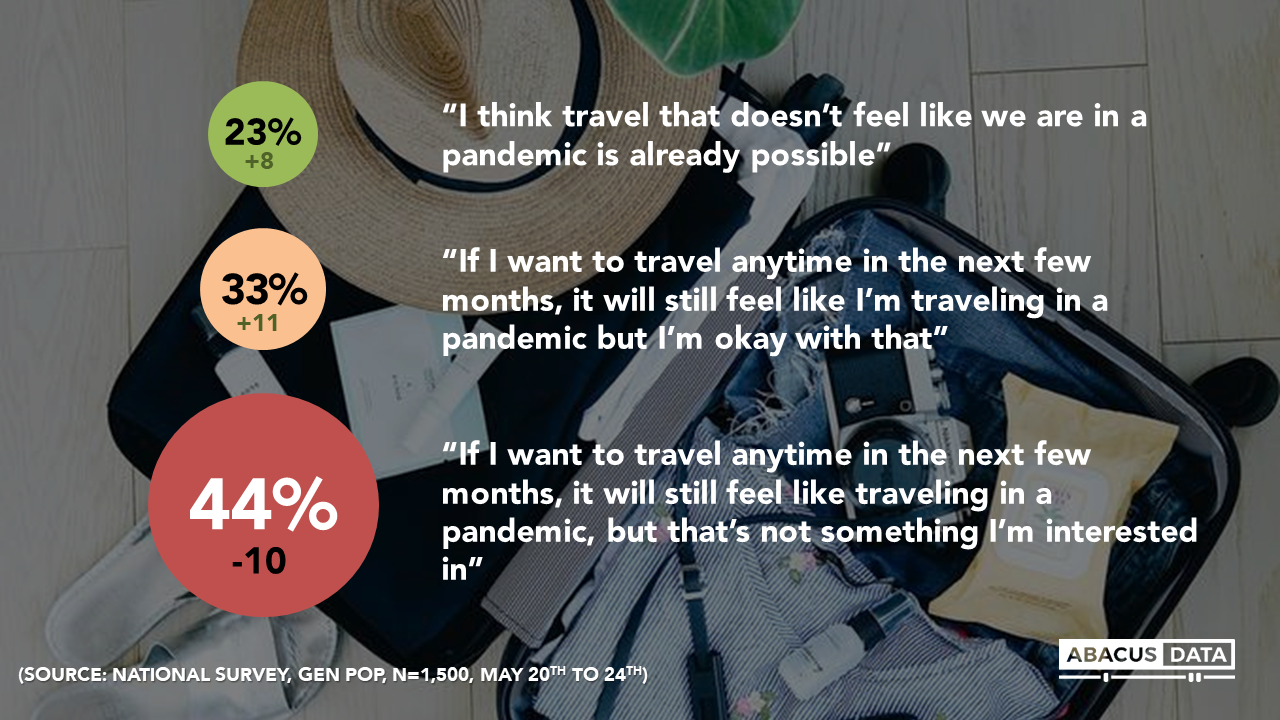

Travel still isn’t ‘back to normal’ in the eyes of Canadians, and this feeling continues to drive our travel desires. More Canadians now believe it’s possible to travel without feeling like we are living in a pandemic (1 in 4), but three quarters still believe that if they want to travel in the next few months, it will feel like ‘pandemic travel’.

The majority also say this feeling will prevent them from making plans. 44% of Canadians say if they want to travel in the next few months, it will feel like travelling in a pandemic and that just isn’t something they are interested in.

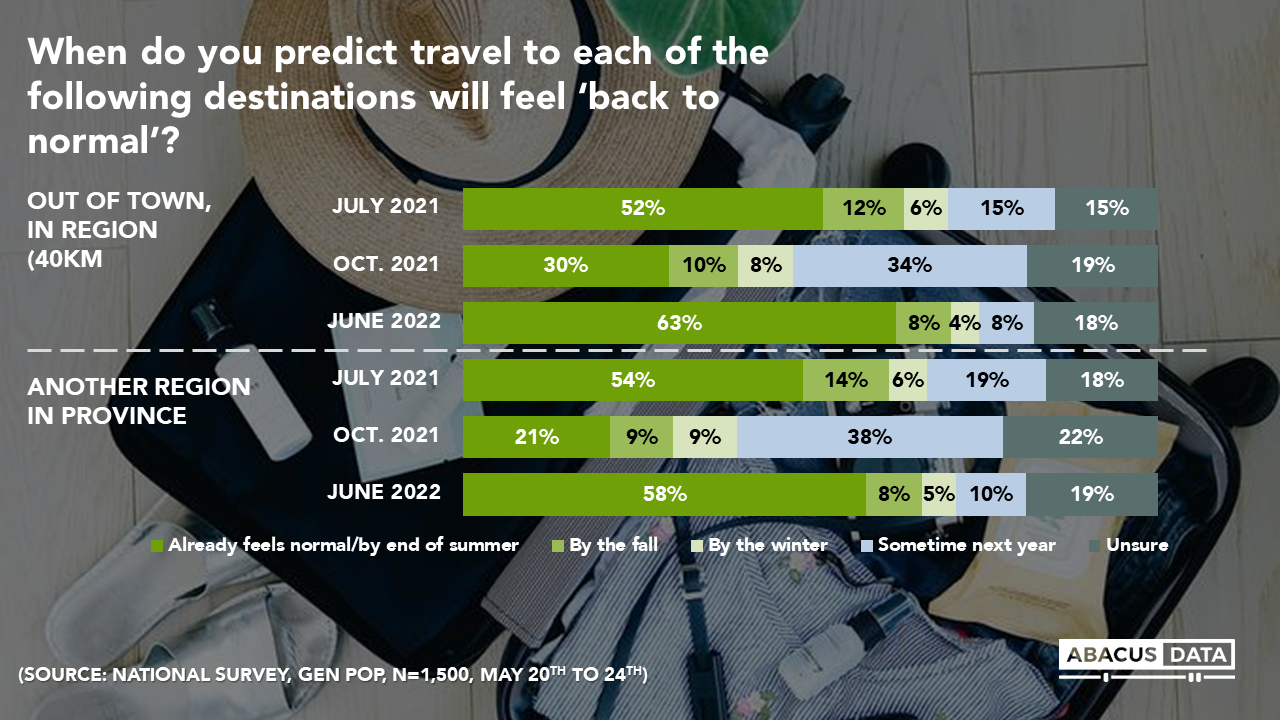

The sentiment of ‘a lack of normalcy’ is having a far bigger impact on international travel, compared to local travel. The closer the destination, the more likely it is to feel normal again. 63% of Ontarians say travel within their region is back to normal already, and 58% say the same about travelling to another region of the province. Both seeing a significant jump since October 2022, when they hovered between 20-30%.

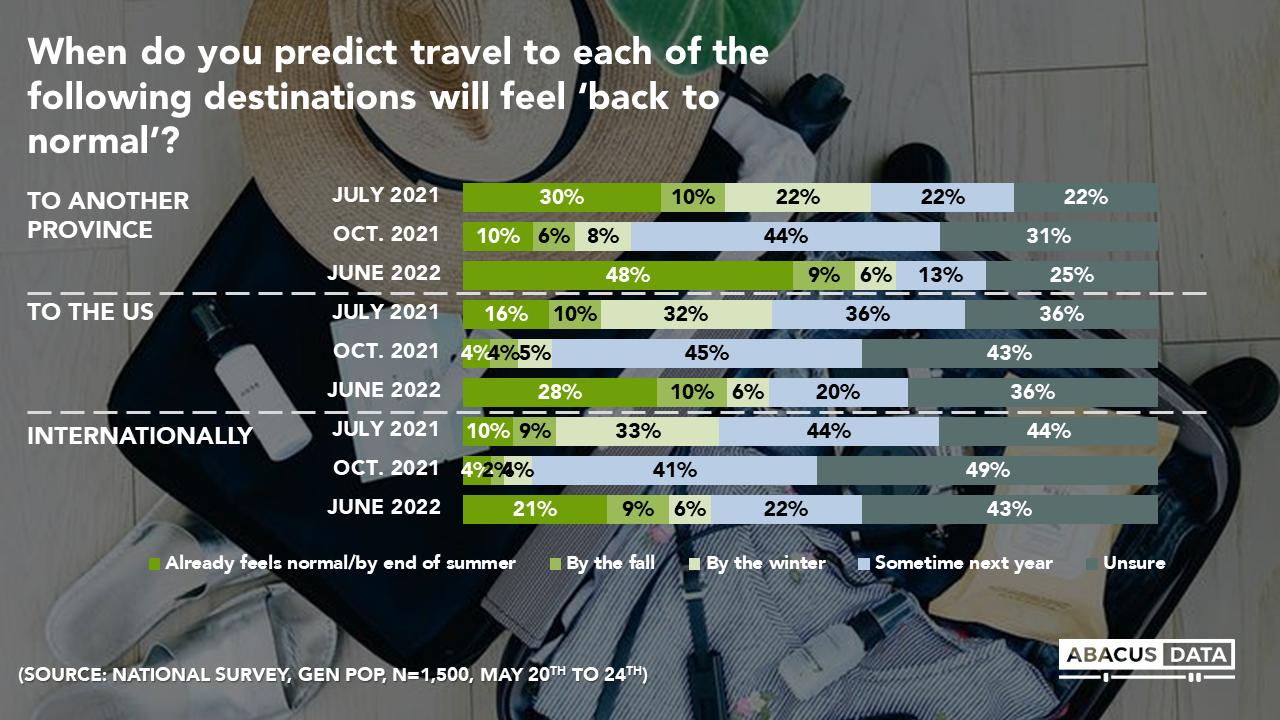

Travel within Canada is also looking up. 48% say travelling to another province in the country already feels normal, a 38-point jump since October 2021.

Travel to the US and international travel have seen just as impressive jumps, but they still remain well behind travel within our borders. 28% say travel to the US already feels normal (this sat at just 4% back in October 2021) and 21% feel the same way towards travel to international destinations.

For these destinations, just waiting another season isn’t likely to resolve their laggard numbers. Folks aren’t convinced that all will be well in just a few months. Instead, they don’t see a return to normal until next year, or are unsure of a timeline altogether.

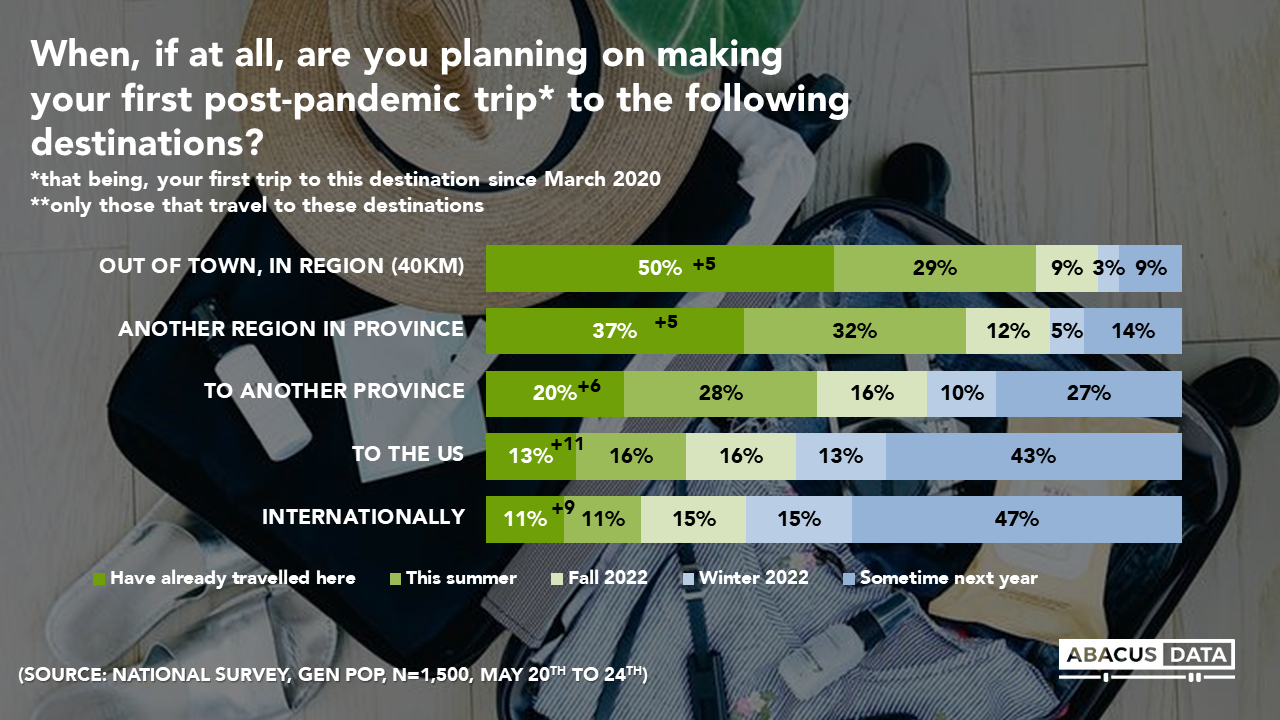

Perhaps then, it is no surprise that Canadians are still far more likely to be exploring our own backyard. Local travellers are far more likely to be easing into their old habits than international, US travellers.

Travel to the US and international destinations have seen the biggest uptake but still lag behind travel within our borders. Travel within one’s own province continues to be the most likely destination.

Aside from lacking a feeling of normalcy, the shifts in our pocketbooks over the last few months are impacting how we feel about travel spending and whether it’s worth it to take the leap back in.

Just under two thirds of Canadians would prefer to hold off on travel spending as prices rise. Given how long they’ve gone without it, 39% of Canadians are comfortable spending money on travel and leisure while 61% would prefer to hold off and wait to spend on travel since things are getting more expensive.

Those that are prioritizing travel spending tend to be younger (+8 pts among 18-29 year olds, +7 pts among 30 to 44 year olds), from higher-income households ($100K+), and parents of children under 18 (presumably trying to make the most of the years for family memories, or getting the kids out of the house).

THE UPSHOT

According to Oksana Kishchuk: All of our data indicates the return to travel continues on its slow and steady trajectory. Canadians aren’t interested in letting go of vacations and travel memories altogether, but we aren’t seeing an urgency to return that was once predicted.

According to Oksana Kishchuk: All of our data indicates the return to travel continues on its slow and steady trajectory. Canadians aren’t interested in letting go of vacations and travel memories altogether, but we aren’t seeing an urgency to return that was once predicted.

Local travel (first within our province, but also within Canada) will likely continue to dominate for a few more seasons (especially as leaving the country through any airport continues to look like a big headache.

While we will still experience a long tail of the COVID-19 worries and concerns on the travel sector, I think the bigger challenge to the travel and tourism industry will be budgets and spending.

There are two ways to look at the last chart. On one hand- Canadians are seeing rising costs, and warning signs of an economic downturn up ahead, and are closing their pocket-books on items that are considered discretionary spending, like travel.

But on the other, we have close to 40% of Canadians who likely still see these rising prices, but are willing to consider spending on travel as more of an essential good, as they have been without travel experiences for so long.

We will continue to track this trend, and others, closely in the coming months.

For more insights on tourism and COVID-19, please reach out to Oksana, Director of Strategy & Insights at: oksana@stagesite.abacusdata.ca

METHODOLOGY

This survey was conducted with 1,500 Canadian adults from May 20th to 24th. The margin of error for a comparable probability-based random sample of the same size is +/- 2.5%, 19 times out of 20.

The survey was conducted using a random sample of panelists invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The data was weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. This poll was conducted and paid for by Abacus Data.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

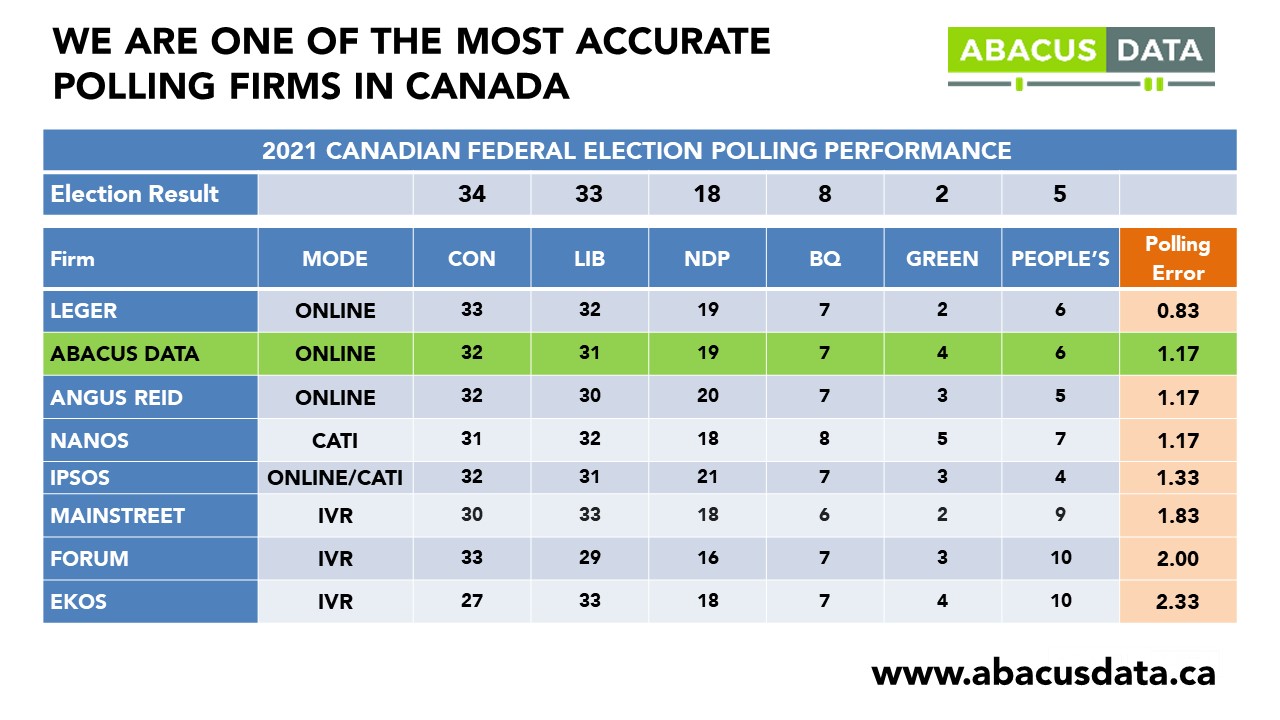

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.