Canadian Support for Ukraine Assistance Growing in Light of Russian Invasion

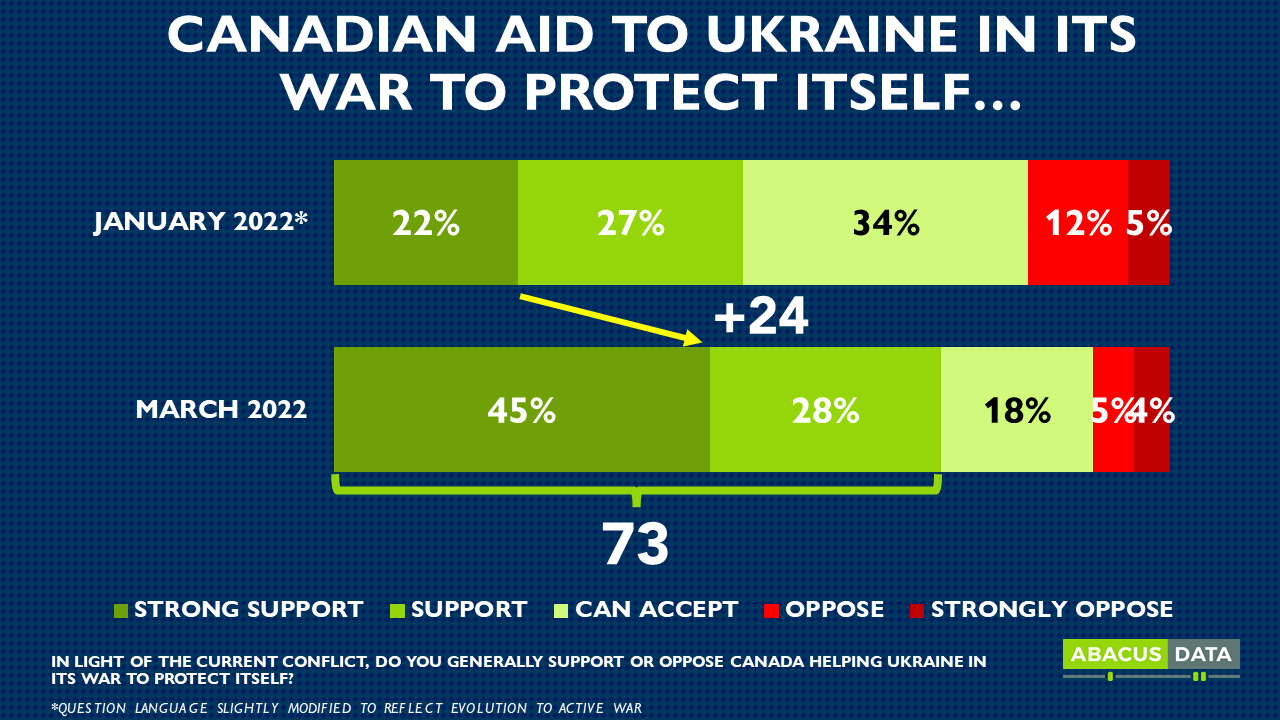

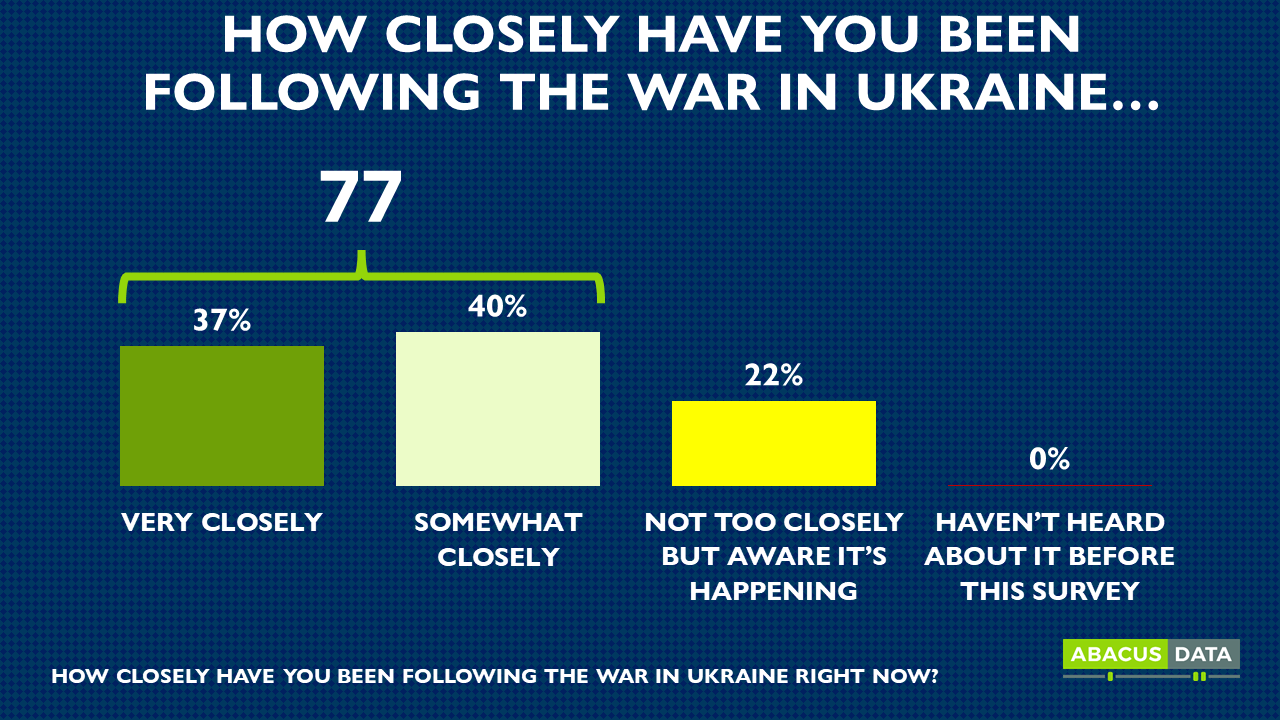

Canadians have been closely following Russia’s invasion of Ukraine, with 7 in 10 outright in support of Canadian assistance to Ukraine’s defense efforts today and only 1 in 10 opposed. This represents a significant shift from support recorded in January of this year.

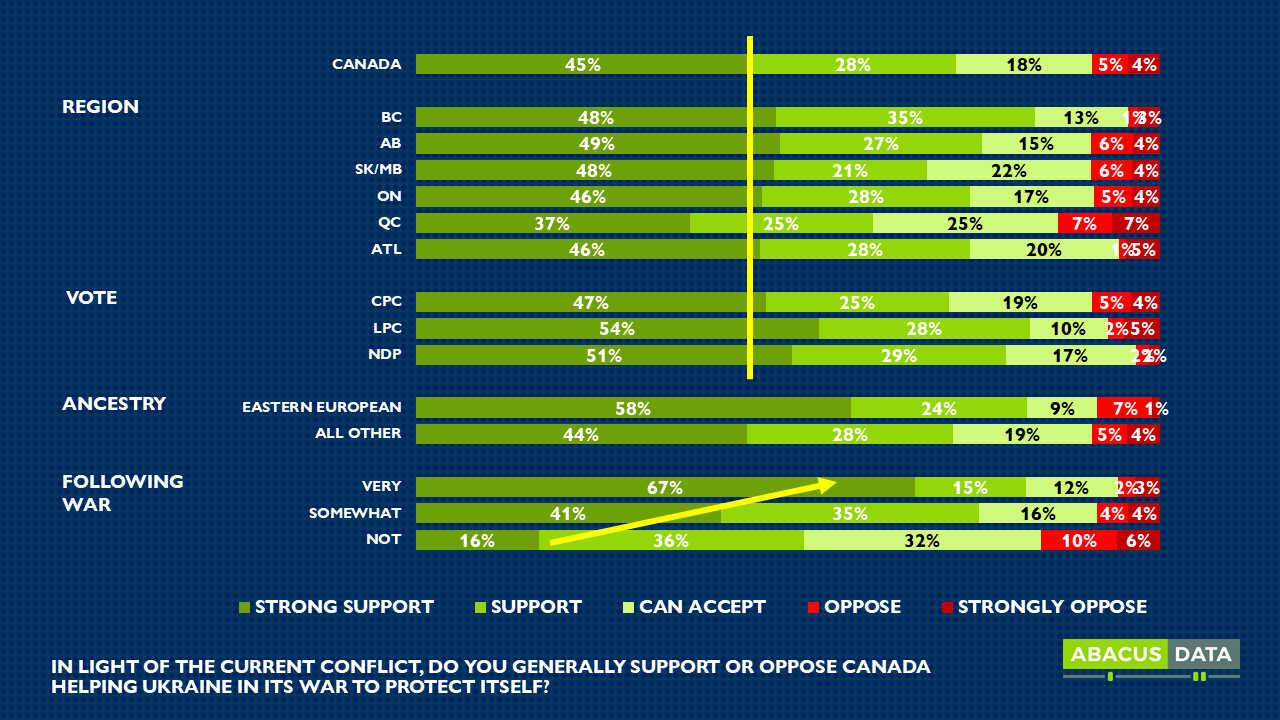

We also find a fairly clear consensus on Ukraine assistance. It is cross partisan and spans geography

RUSSIAN INSTIGATION WELL UNDERSTOOD

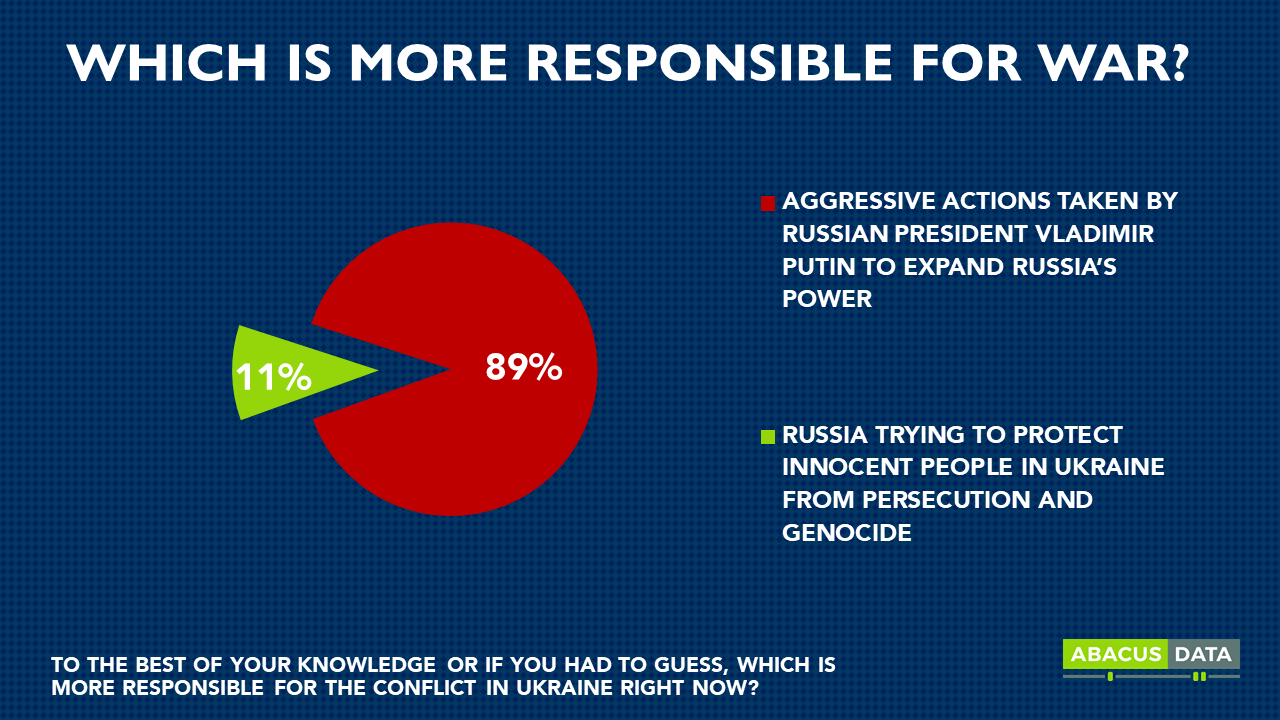

Most Canadians’ understanding of the war is that Russian President Vladimir Putin invaded to expand Russia’s power. Few believe Russia’s stated goal of trying to protect innocent people in Ukraine from persecution or genocide is the cause of the invasion.

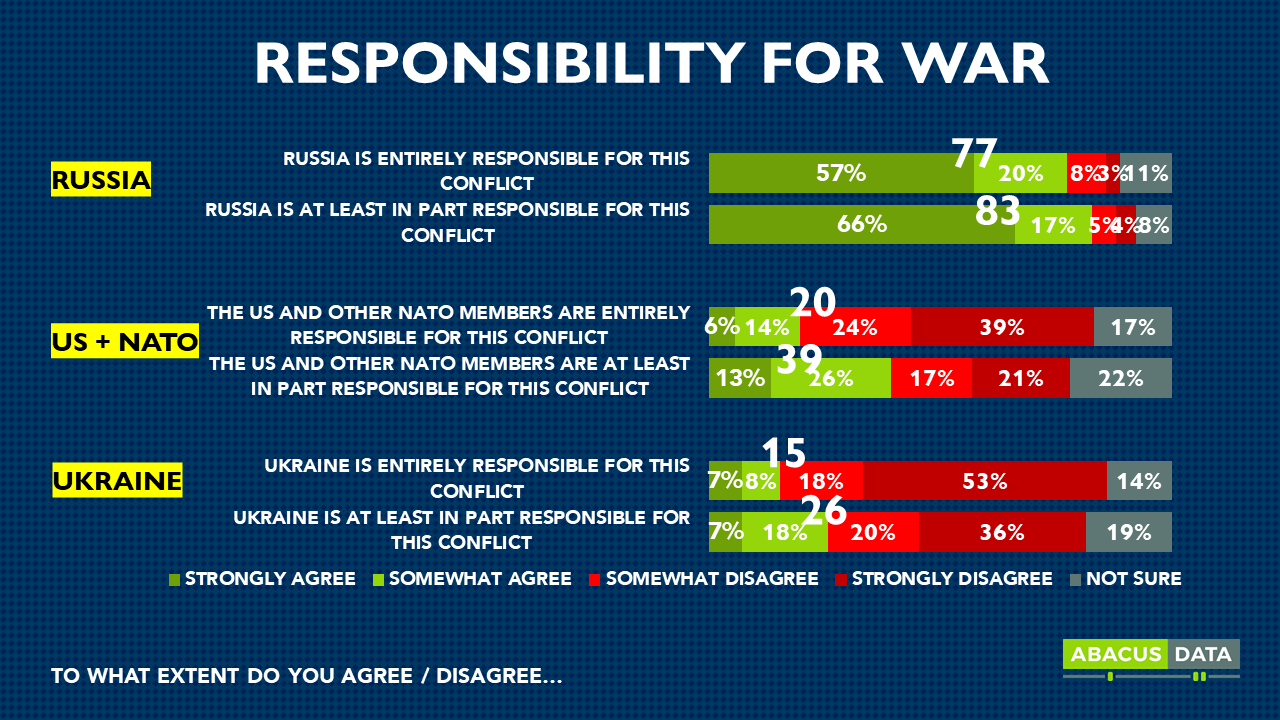

Canadians are aligned on Russia’s responsibility for the conflict, with only some marginal, soft agreement that the US or Ukraine hold some responsibility for the war.

STRONG SUPPORT FOR ECONOMIC SANCTIONS, ASSET SEIZURE & LARGE-SCALE AID EFFORTS

In looking to understand public support dynamics, we tested several simple policy ideas, some of which have been pursued in one form or another since we began fielding our survey.

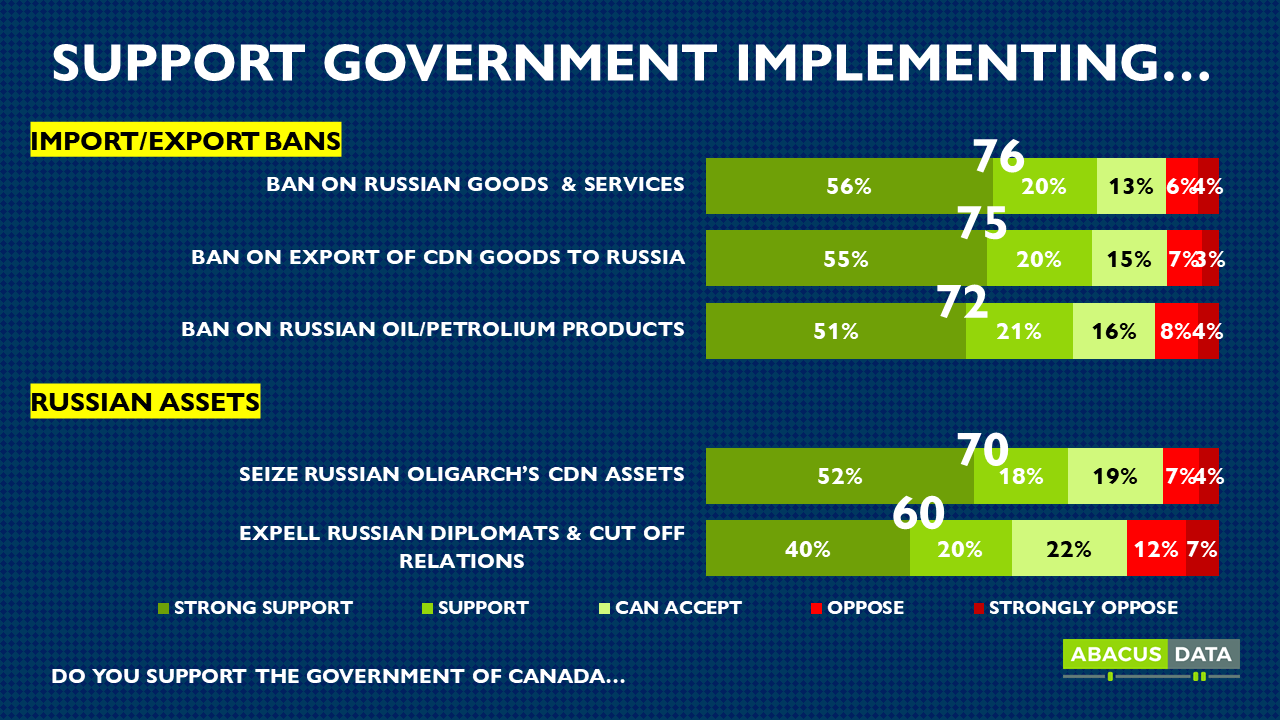

We find widespread public appetite for the Canadian government enforcing economic measures like banning the import and use of Russian goods and services, or the banning of Canadian exports to Russia.

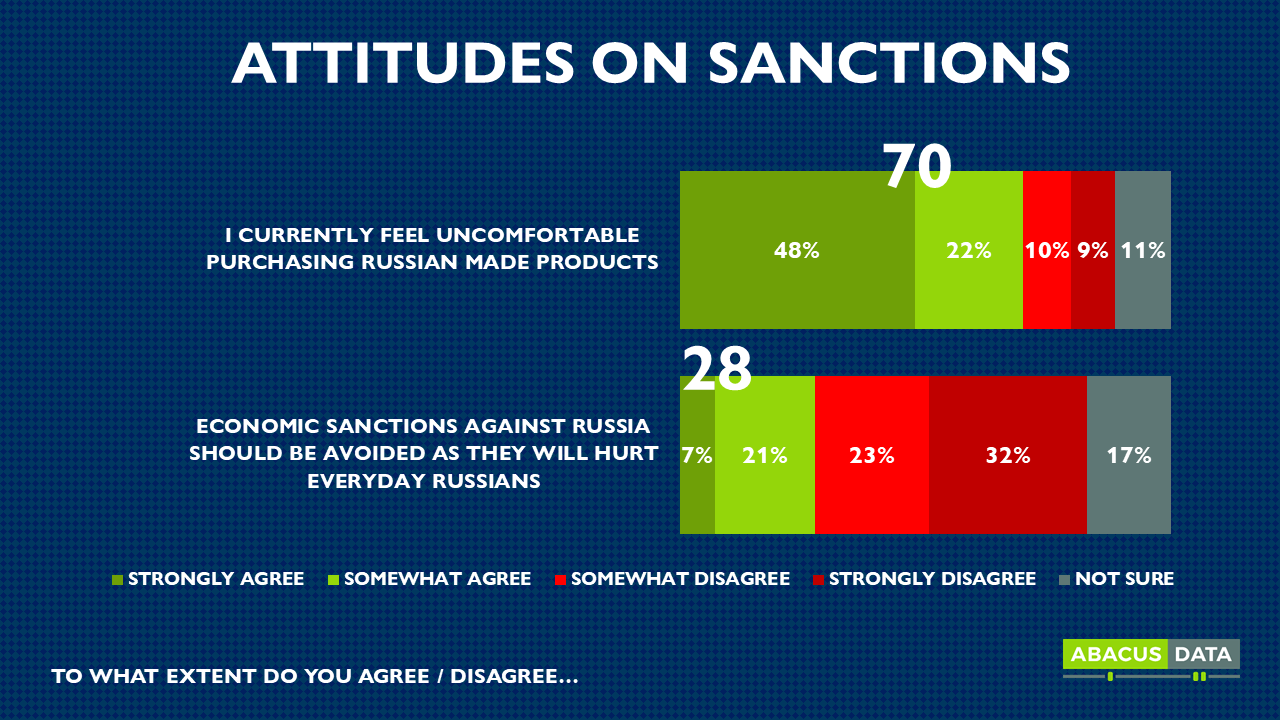

Most Canadians specifically support a Canadian import ban on the use of Russian oil and associated petroleum products. Few see a downside to trade-specific sanctions. Most Canadians also feel uncomfortable purchasing Russian products today, and few agree that sanctions should be avoided due to their detrimental impact on everyday Russians.

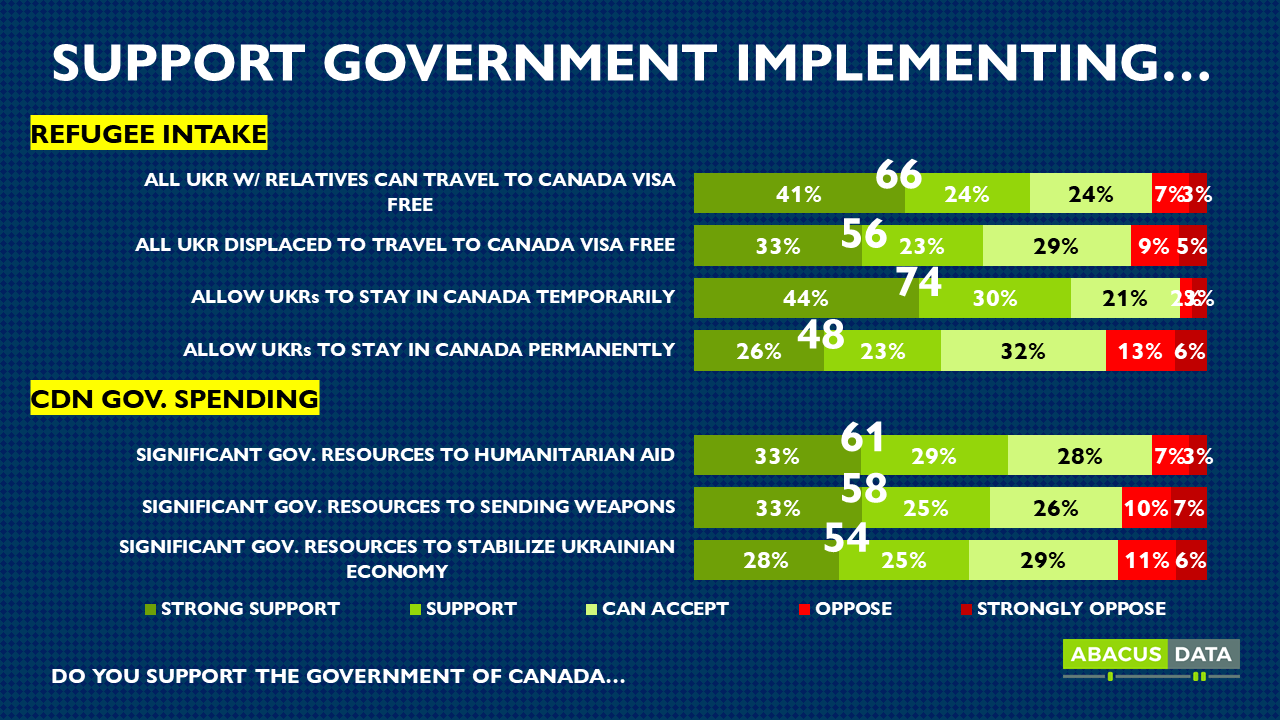

There is likewise clear popular support for seizing the assets of Russian oligarchs in Canada, and intaking displaced Ukrainian refugees into Canada on at least a temporary basis. Beyond those consensus points, a clear majority of Canadians either accept or outright support:

- Spending significant government resources on humanitarian, economic, and military equipment aid to Ukraine.

- Expelling Russian diplomats from Canada and cutting off diplomatic relations.

- Allowing all Ukrainians displaced by the war to stay in Canada permanently.

CANADIANS SEE DEVASTATING IMPACT ON CIVILIANS; THINK WORST IS YET TO COME

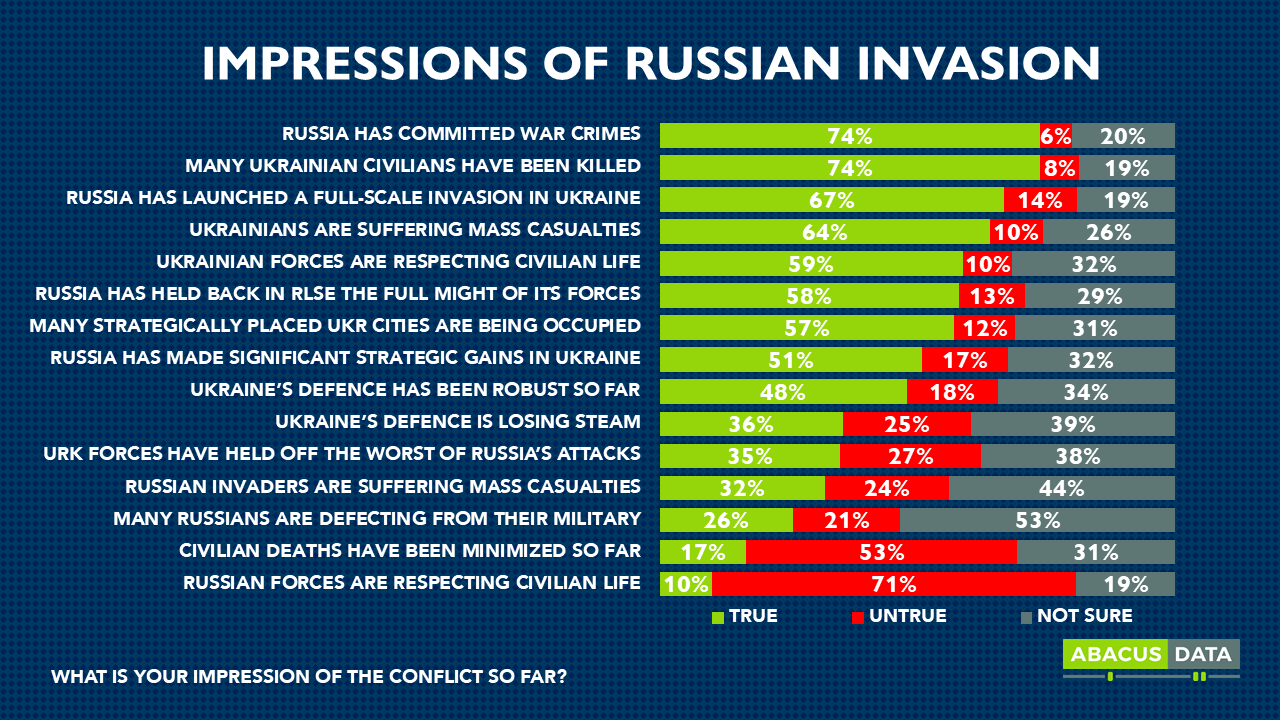

In asking the public to assess whether or not a series of statements about the war are true or false, we find that Canadians understand that this is not merely a war between armed groups relegated to disputed border areas, but that Russian forces are actively engaging in a full-scale invasion, committing war crimes and causing mass civilian casualties.

And despite these tragic outcomes, most believe that Russia is yet holding back releasing the full might of its forces.

There is less consensus on how strong or effective Ukraine’s defense has been and how long it will hold, with most assuming Russia has made important strategic gains in Ukraine.

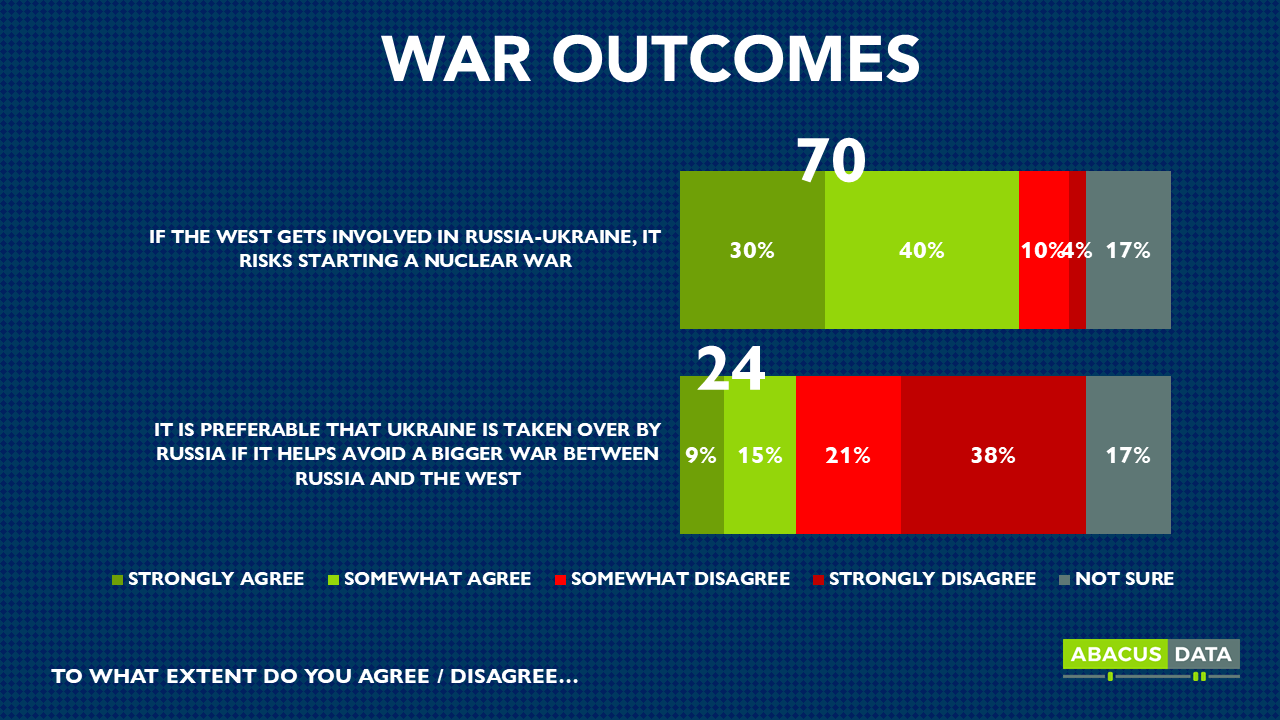

Few Canadians are comfortable with Ukraine folding for the sake of wider peace, with only 1 in 4 agreeing that Russia effectively conquering Ukraine is preferable if it avoids a bigger war between Russia and the west. At the same time, Canadians appreciate that western involvement in the Russian war on Ukraine risks starting a nuclear conflict.

PUBLIC PREFERENCE FOR A NO-FLY ZONE; MANY SEE SCENARIO FOR CDN BOOTS ON GROUND

Despite this, most Canadians would opt for enforcing a no-fly zone. Mindful to stress the consequences of NATO enforcement, we framed a no-fly zone tradeoff as:

“Some people say that NATO should institute a no-fly zone over Ukraine in order to safeguard Ukrainians from Russian air attacks.

Others say the risk is too great and that NATO should not institute a no-fly zone, as enforcement would inevitably lead to a direct conflict between NATO & Russia, resulting in an even greater war.

Which is closer to your view?”

2 in 3 Canadians support NATO enforcing a no-fly zone over Ukraine even at the risk of provoking a greater conflict between NATO and Russia. Even Canadians who believe nuclear war is a risk in this conflict support the no-fly zone, suggesting the trade-offs of a no-fly zone are well appreciated by the Canadian public.

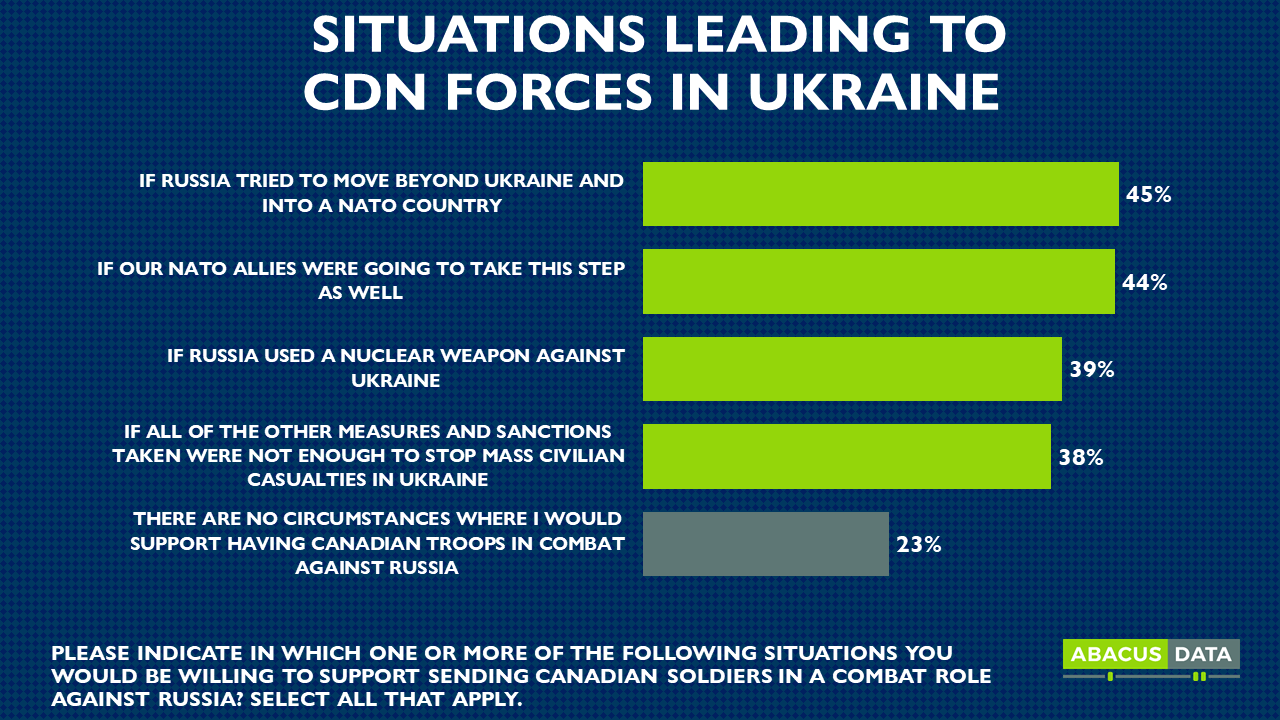

When might Canadians find sending Canadian soldiers into Ukraine in a combat role against Russia appropriate?

7 in 10 would be willing to support sending in the Canadian Forces in some circumstances, particularly if Russia moved beyond Ukraine and into a NATO country, or if our NATO allies were already planning to move in their own troops. Many would also support this direct intervention should nuclear weapons be used in Ukraine, or once all other measures taken prove to be insufficient in deterring Russia.

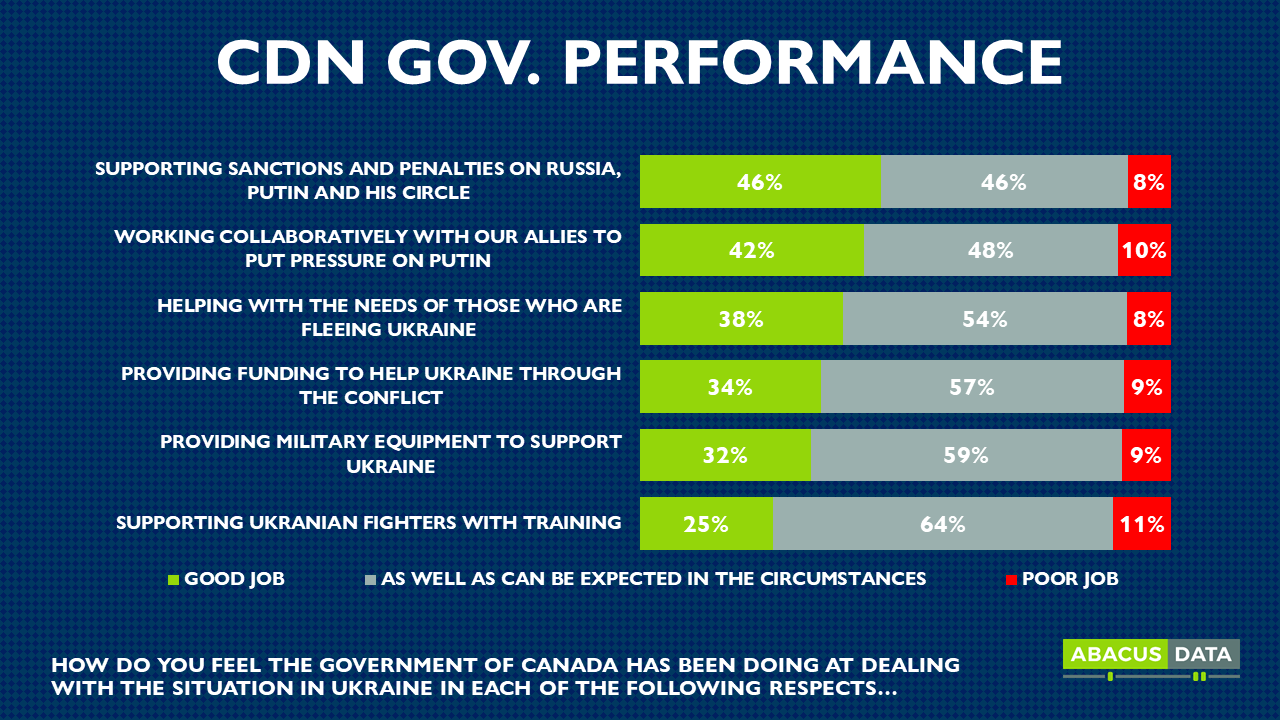

Despite a strong desire to do more, the vast majority of Canadians feel the Government of Canada has at least been doing as well as can be expected on measures to pressure Russia to stop its aggression. Canadians particularly assign high marks to their government’s work on sanctions, collaboration with allies, and humanitarian assistance. Few think the federal government has done a poor job on any item we asked about.

MOST STILL OPTIMISTIC ABOUT OUTCOME

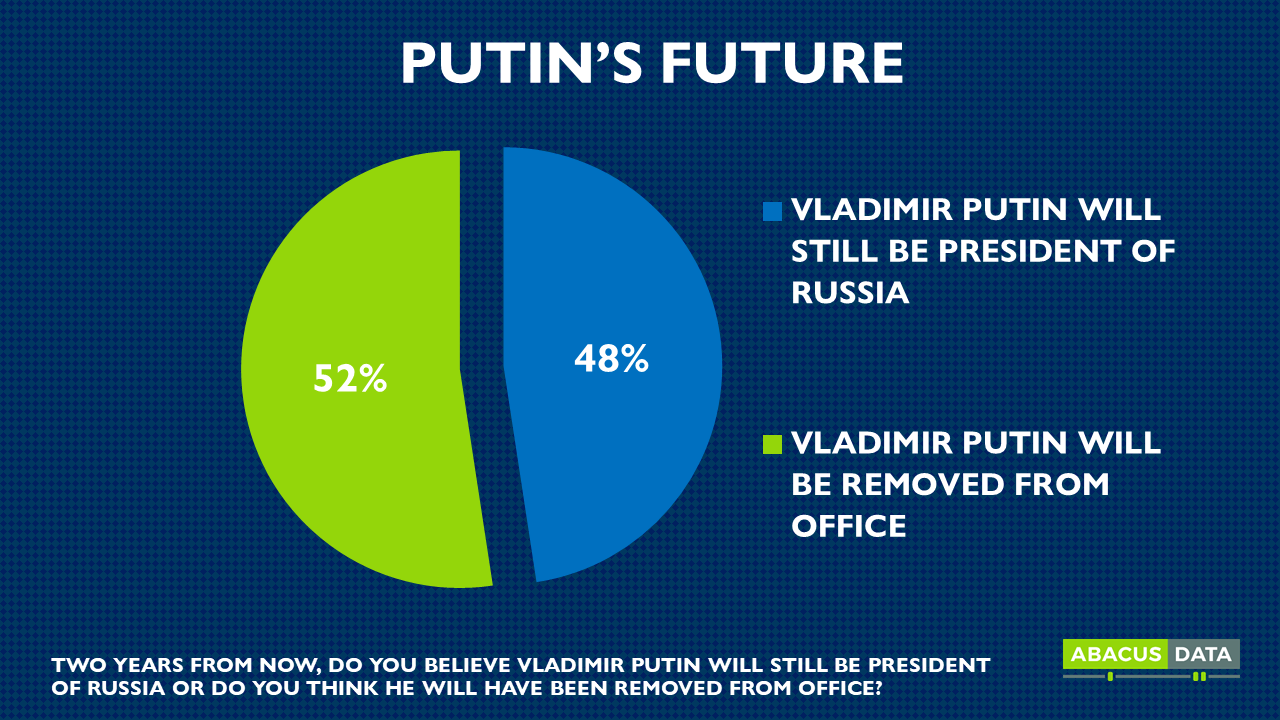

At this time, the Canadian public remains optimistic about the outcome of the war. They believe that either Russia will take Ukraine in the short term but will inevitably exit in the long term, or that Russia will be stopped from its conquest by the international response. There is less consensus on what happens to Vladimir Putin. Half believe 2 years from now, Putin will continue to be President of Russia, while half believe Putin will be removed from office.

THE UPSHOT

The Government of Canada has clear, national and cross-partisan public support to pursue an aggressive pro-Ukraine foreign policy in the context of Russia’s invasion. Support was substantial before the Russian invasion and has only grown since.

Some response measures that seemed unthinkable two weeks ago now feel inevitable, as the conflict continues to rage with few signs of subsiding. Undaunted by the hypothetical risk of greater escalation or nuclear war, the vast majority of Canadians just want to help. They support NATO enforcing a no-fly zone, greater military and humanitarian aid, and have a deep and widespread willingness to welcome displaced Ukrainians to Canada. Most can even see scenarios in which they would support Canadian military on the ground in Ukraine.

This change in tune is a clear response to the atrocities we’ve seen Russia committing against civilians and the unjust nature of the Russian invasion. Canadians understand this war is the result of a cynical and malicious power grab and want both Canada and its allies to respond accordingly.

METHODOLOGY

This survey was conducted with 1,464 Canadian adults from March 4 to 8, 2022. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population. Totals may not add up to 100 due to rounding.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.