As the Ontario Liberals prepare to announce new leader, Ford PCs open up an 18-point lead over the NDP.

December 1, 2023

From November 23 to 28, 2023, Abacus Data conducted a survey of 1,500 Ontario adults exploring their views on provincial politics and government. This survey was part of our regular national omnibus surveys.

Introducing Abacus Data MRP A game-changing tool for GR, advocacy, and digital campaign targeting. A must for anyone in GR, campaigning, advertising, digital public affairs

Find out more

Ontario’s political scene is currently a fascinating study in resilience, redemption, and opportunity.

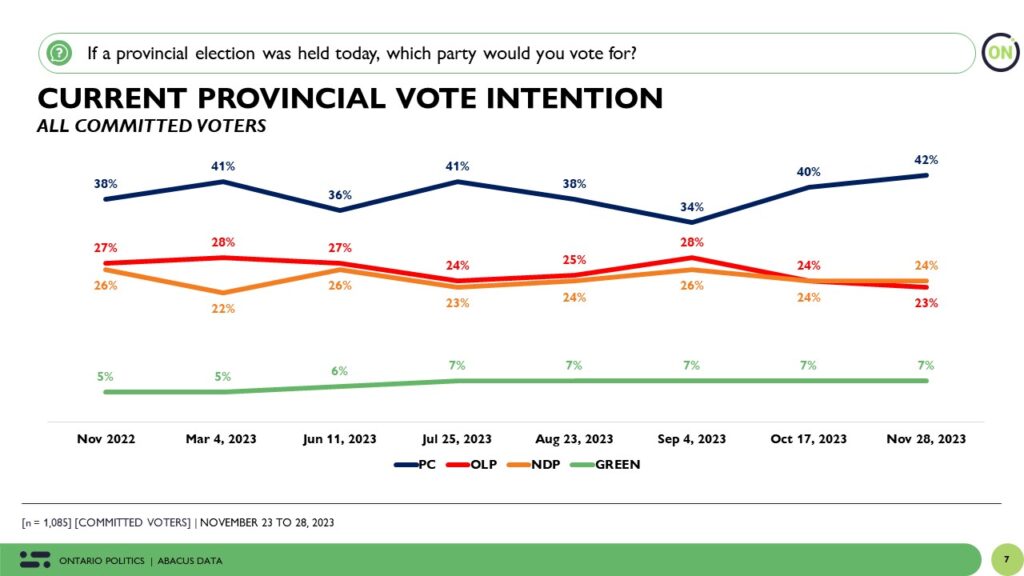

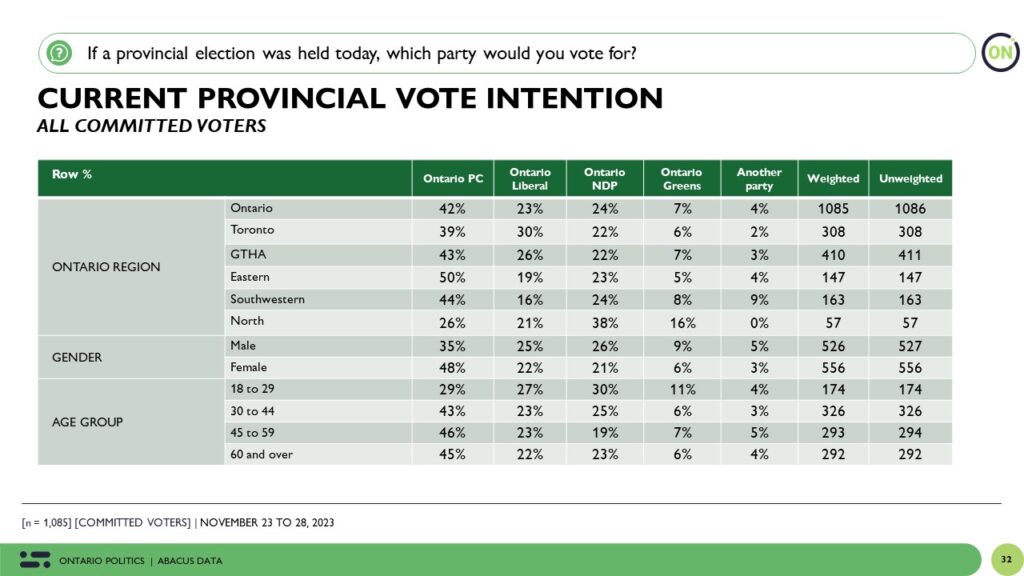

The Progressive Conservative Party, under Doug Ford’s leadership, has reversed a drop in support and currently has almost a 20-point lead in vote intention, despite recent controversies, notably the Greenbelt land swap issue. The Ontario Liberal Party, meanwhile, is on the cusp of a potentially transformative leadership change, poised to reshape its future.

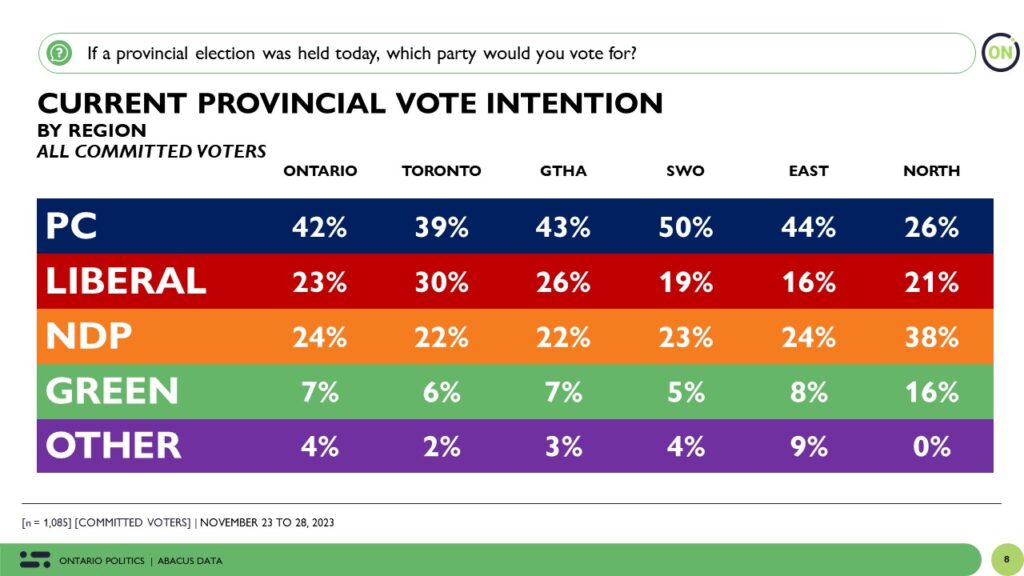

PC’s Steady Ascendancy and Regional Dominance

If an election were held today, the PCs would likely clinch another majority with 42% of committed voters’ support, reflecting a significant rebound from their lowest point in September. This 8-point recovery is not just a numerical uptick; it’s a testament to the party’s strategic recalibrations and Premier Ford’s ability to apologize and for a sizeable portion of his supporters and non-supporters to accept his mistakes and move on.

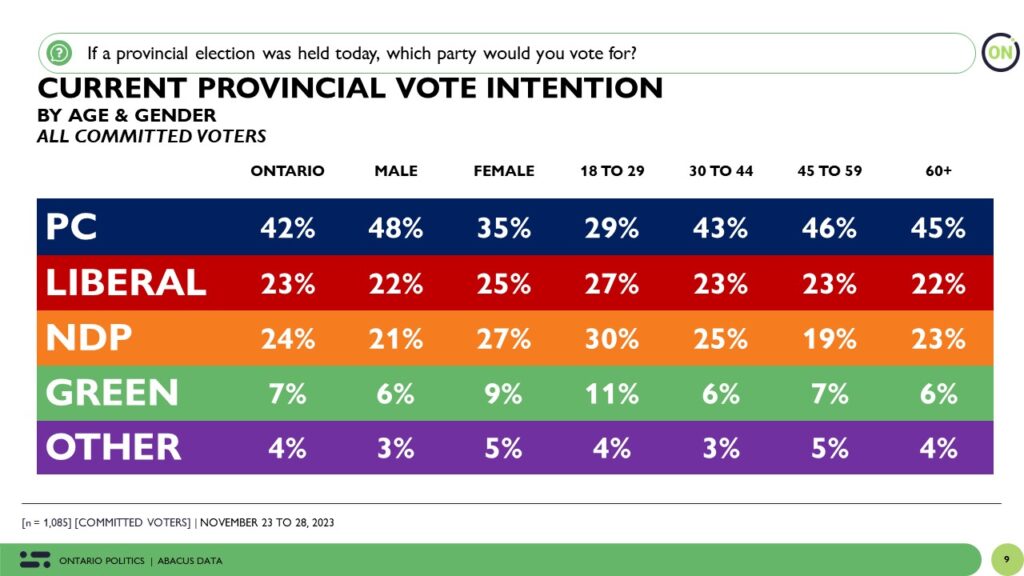

Analyzing the data demographically and regionally, the PCs lead convincingly across almost all groups. The only exception is the under-30 demographic, where they are neck-and-neck with the NDP and Liberals. This widespread appeal across various segments of society underscores the party’s successful outreach and policy resonance with a diverse electorate.

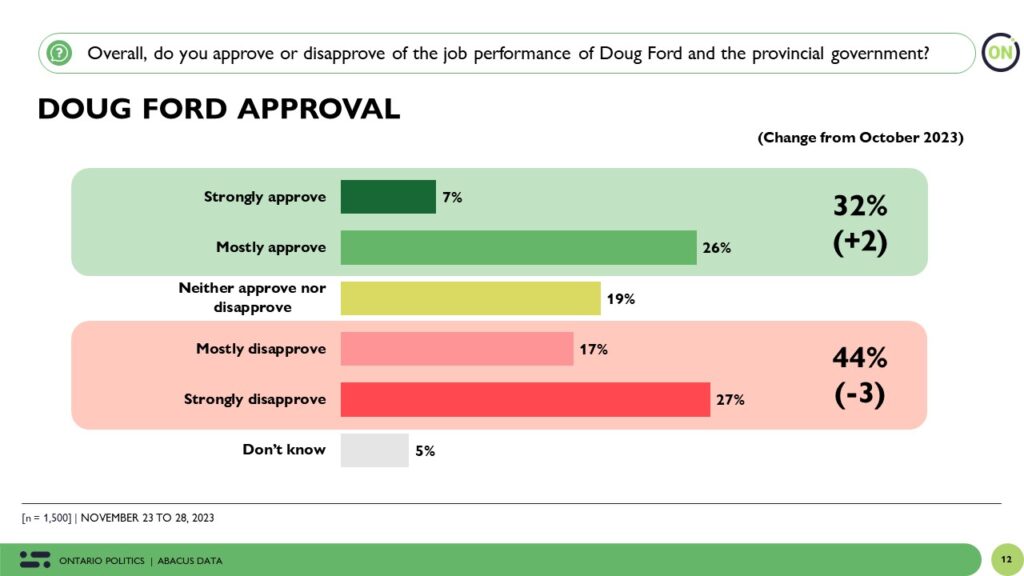

Public Perception of Doug Ford and Policy Decisions

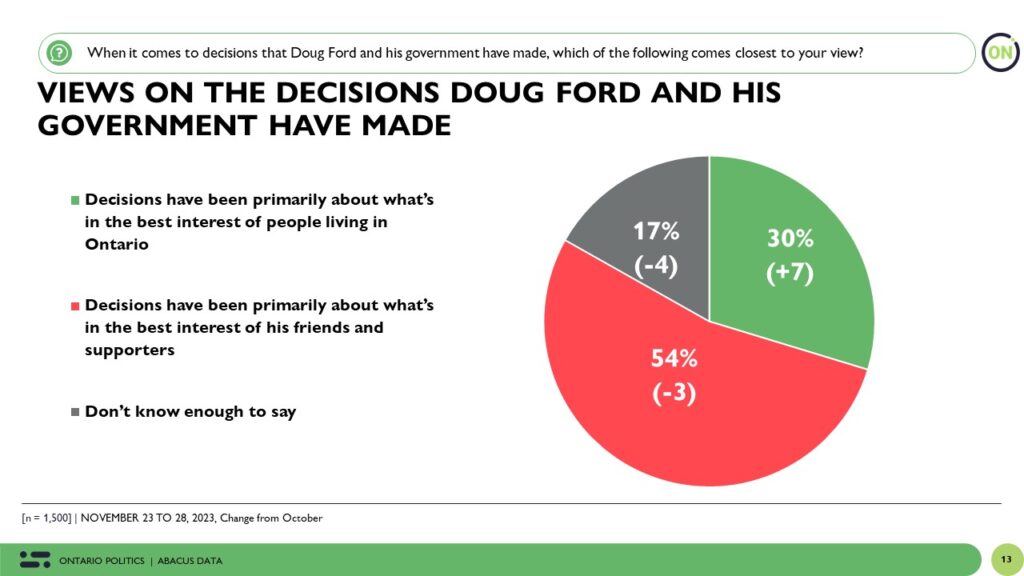

In terms of leadership perception, 32% approve of Doug Ford’s job performance, with a notable decrease in disapproval ratings. This shift indicates a recovering confidence in his governance, further bolstered by a 7-point increase since October in Ontarians who believe Ford prioritizes the province’s interests over personal or partisan gains.

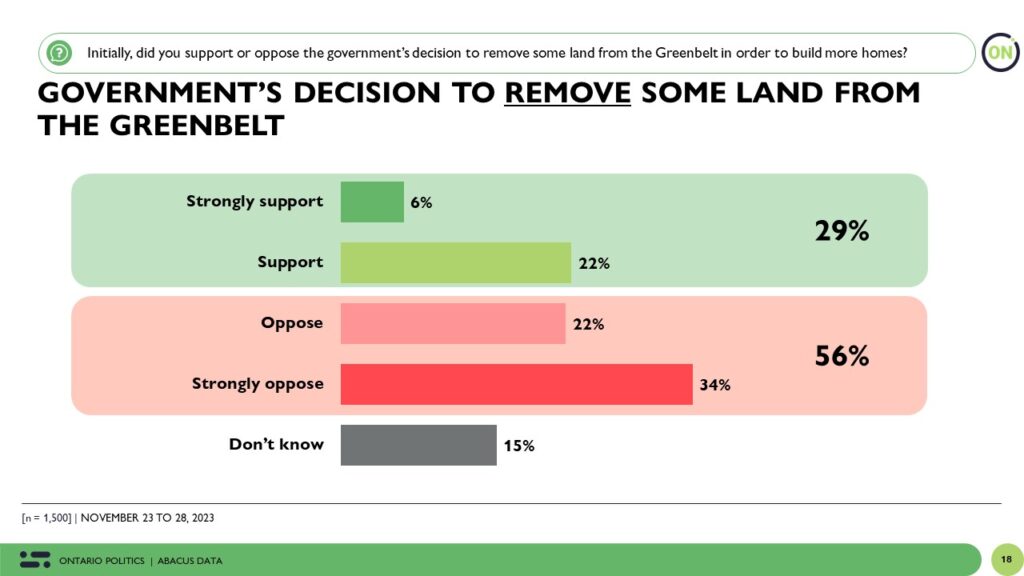

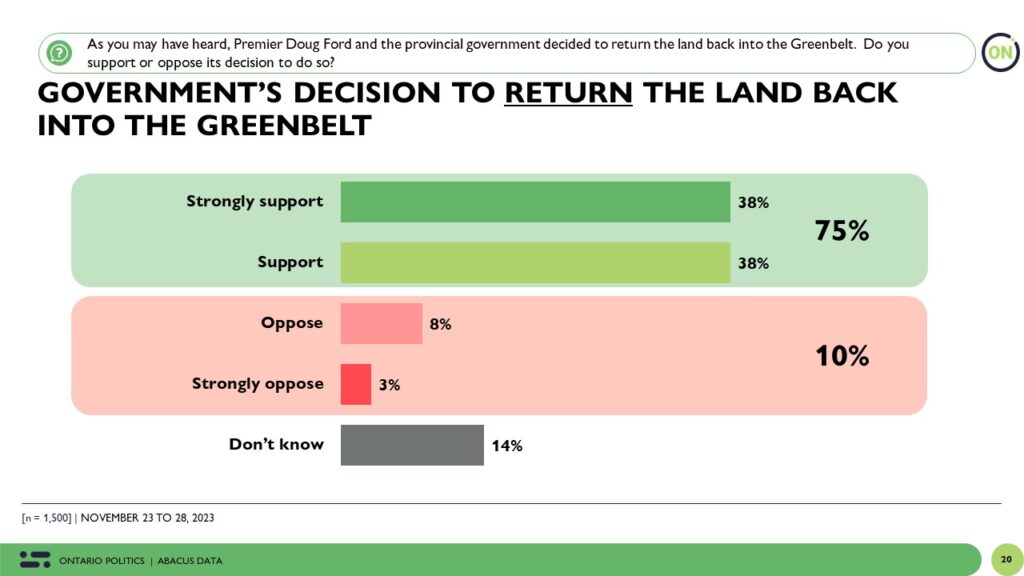

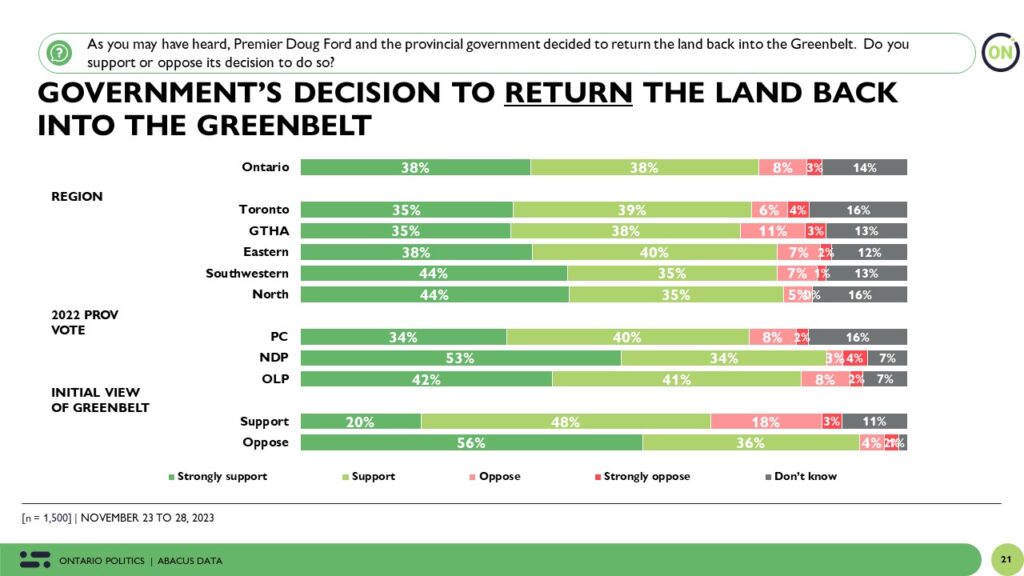

The Greenbelt land swap controversy has been a pivotal issue, initially met with widespread opposition. However, the government’s decision to reverse this plan and return the land to the Greenbelt was met with overwhelming approval, demonstrating Ford’s ability to respond to public sentiment and potentially mitigate political fallout.

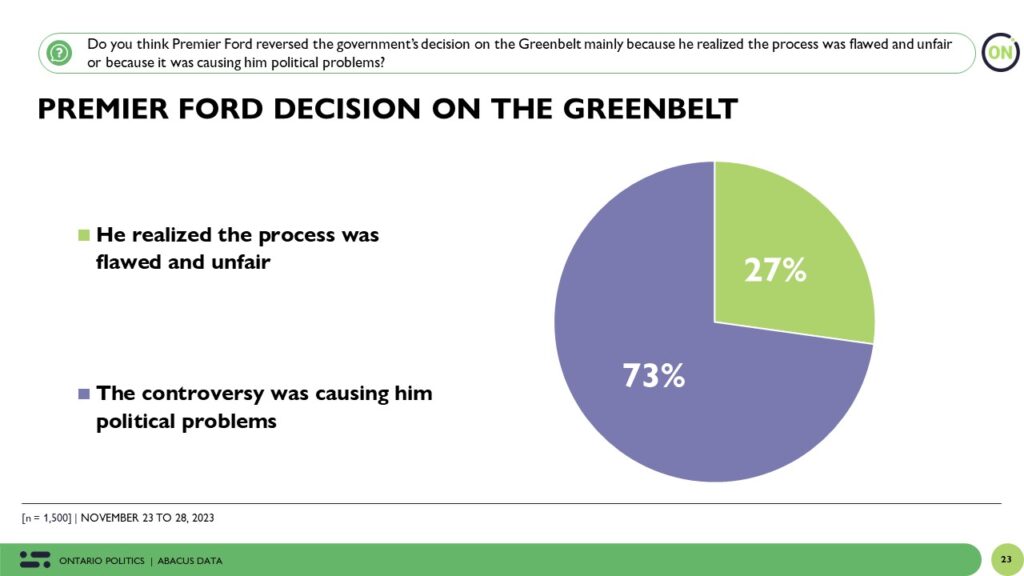

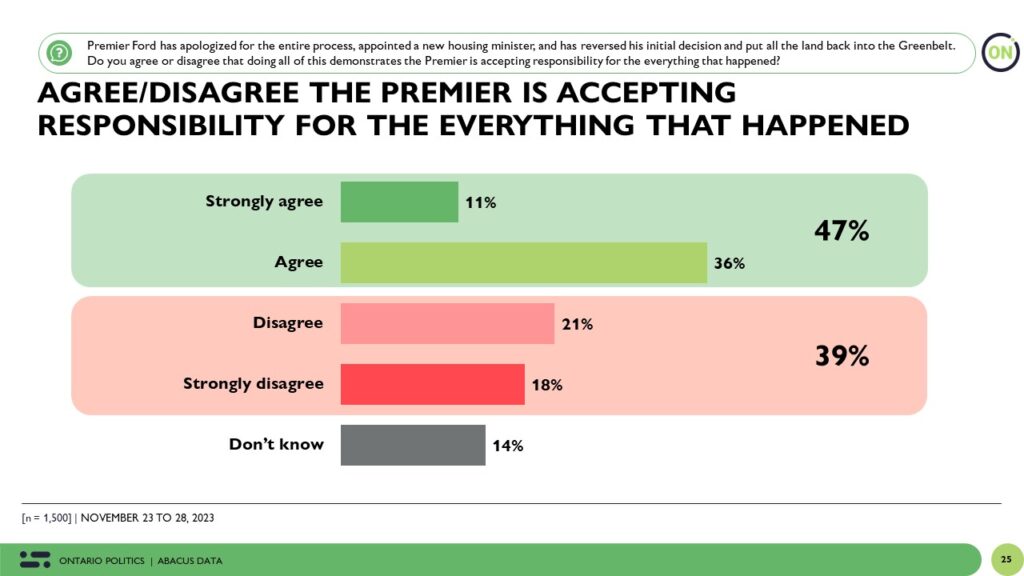

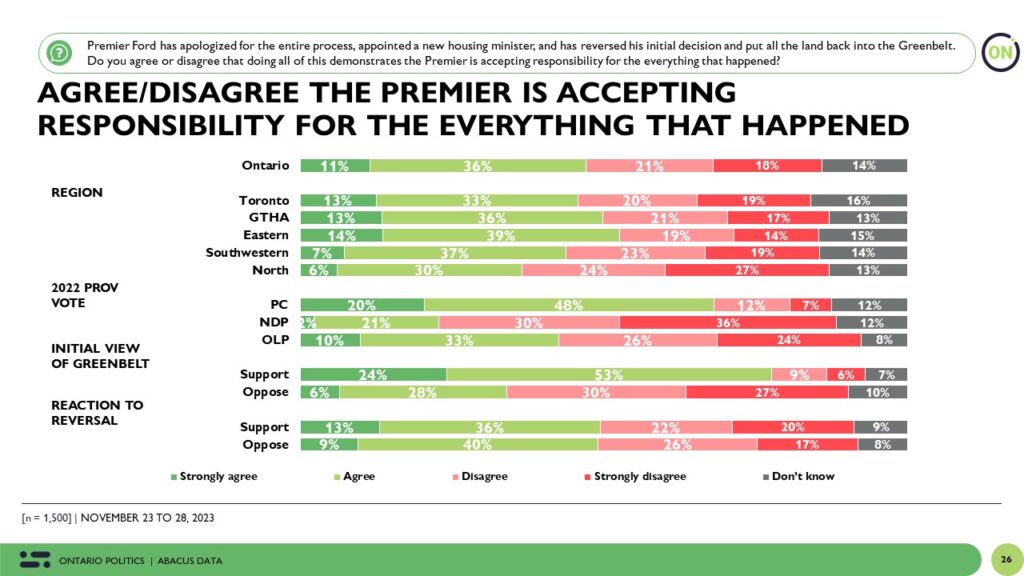

Political Calculations and Public Trust

The perception of political motivation behind Ford’s reversal decision is significant, with a majority viewing it as a move to alleviate political pressure. However, nearly half of Ontarians also perceive recent government decisions as indicative of Ford’s willingness to accept responsibility, a sentiment strongly shared among PC voters. This duality of public perception highlights the complex interplay between political strategy and leadership accountability.

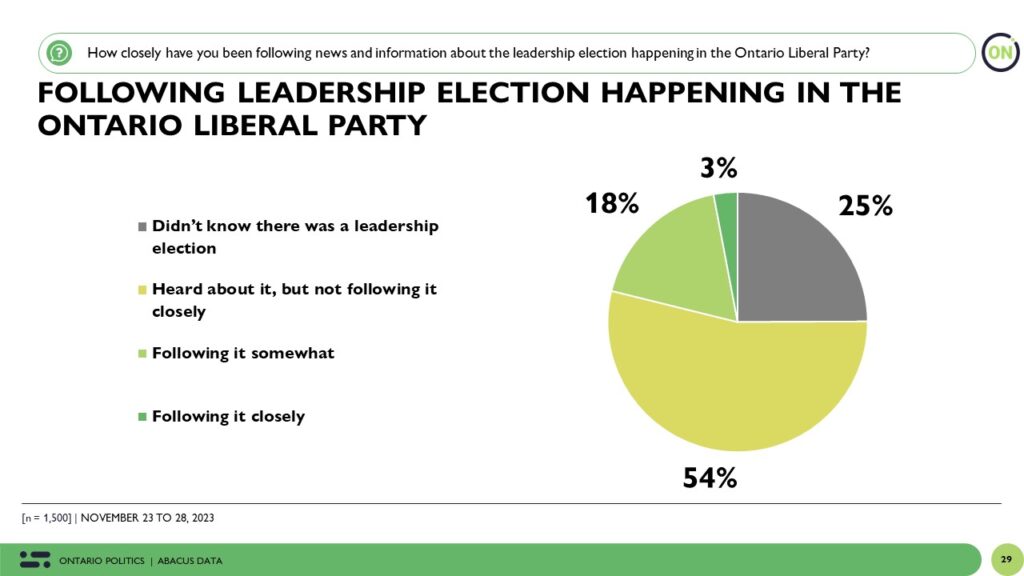

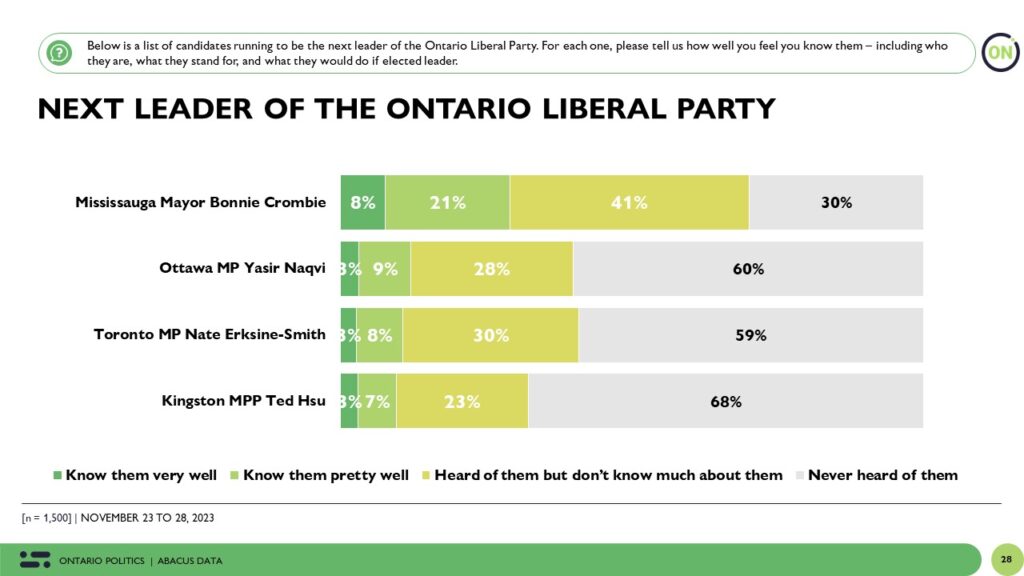

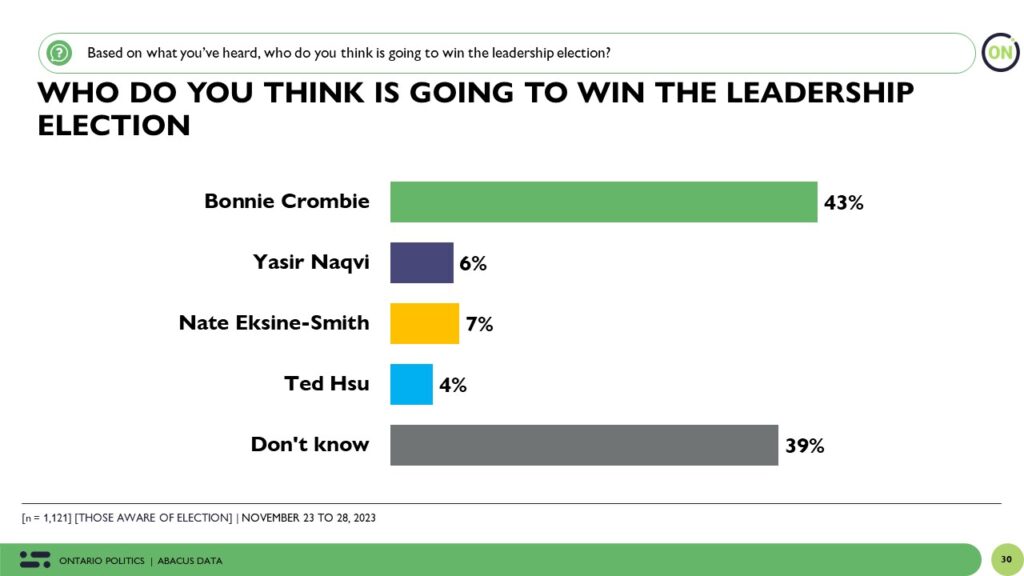

Liberal Leadership Race: Limited Engagement but Bonnie Crombie is by far the most well known candidate

In the backdrop of these developments, the Ontario Liberal Party’s leadership race is unfolding with Bonnie Crombie emerging as the expected winner and most well known. Despite limited public engagement in the race, those aware of it overwhelmingly view Crombie as the likely winner. Her double-fold name recognition advantage over other candidates places her in a uniquely advantageous position, potentially revitalizing the Liberals’ prospects.

Ontario Liberal Leadership Race & the PC dominance: A More Competitive Environment with Bonnie Crombie?

As the Ontario Liberal Party (OLP) prepares to announce its new leader, the spotlight intensifies on the potential candidates, particularly Bonnie Crombie. Her presence in the race brings a dynamic shift. With Crombie at the helm, the survey suggests the gap between the Liberals and PCs could narrow significantly, trimming the PCs’ lead to just 8 points. Crombie’s name recognition and political experience mark her as not just a viable contender but a potential threat to Ford’s stronghold.

The Upshot:

According to Abacus Data CEO David Coletto: “The Ontario political landscape is currently characterized by the PCs’ resilient popularity and strategic adaptability under Doug Ford’s leadership. The party’s recovery and sustained support across diverse demographics highlight how resilient Ford’s brand is in weathering the Greenbelt storm.

Moreover, Ford’s ability to maintain support amidst global inflation can be largely attributed to his longstanding commitment to taxpayer interests. Throughout his political career, Ford has consistently championed policies aimed at reducing financial burdens on the public. Key measures such as lowering taxes, eliminating fees for services like license plate renewals, and removing tolls from highways have resonated positively with his supporters.

These actions have reinforced his image as a leader dedicated to easing the financial strain on citizens, which is particularly significant during periods of economic hardship. While inflation has posed challenges for many incumbent governments, Ford’s consistent focus on financial relief has helped prevent the alienation of his support base, setting him apart from other leaders who have struggled under similar economic pressures. This approach has not only solidified his existing support but also potentially attracted voters who prioritize fiscal conservatism and government actions that directly alleviate personal financial burdens.

The impending leadership change in the Ontario Liberal Party, especially with Bonnie Crombie’s candidacy, introduces an element of competitiveness and potential political transformation.

We may be heading back to a more competitive political environment, especially if Bonnie Crombie wins the leadership. She is by far the greatest threat at the moment to Ford and the PCs in large part because of her name recognition advantage over the other three candidates.”

Methodology

The survey was conducted with 1,500 eligible voters in Ontario adults from November 23 to 28, 2023. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Ontario’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.