Canadian Public Opinion on Nuclear Energy

September 29, 2025

On September 19, I was invited by Ontario’s Minister of Energy to moderate a panel discussion with some of the country’s leading energy executives. As part of that panel, I delivered a short briefing on some new polling I did to prepare for the Energy Summit. This research was independently designed and was paid for by my company Abacus Data. Here’s a summary of what I see in public opinion around nuclear energy.

—

The debate over nuclear power in Canada is no longer taking place in the abstract. As electrification accelerates and concerns about emissions intensify, Canadians are increasingly aware that their provinces will need far more electricity than they do today. This expectation is reshaping how people view nuclear power: not as a relic of the past, but as a potential tool to solve future energy challenges.

Our September 2025 of 3,000 Canadian adults survey finds a Canadian public that is pragmatic, divided, but shifting. Roughly four in ten Canadians (38%) describe their feelings towards nuclear as positive, while 22% are negative, and the rest fall into neutral or indifferent camps. Importantly, when asked how they would react if their province announced a major investment in nuclear, support rises to 43% compared with 23% opposed. A substantial share remain in the middle, open to persuasion if concerns about safety, cost, and waste are credibly addressed.

Electricity Demand and Perceptions of Capacity

The starting point for this debate is the widely held belief that demand will grow. Seventy-one percent of Canadians expect their province will need more electricity within 10 years, rising to 72 percent over 20 years. Only a small minority expect less. Quebec stands out, with nine in ten residents predicting rising demand. Alberta, British Columbia, and Saskatchewan also lean heavily toward growth expectations. By contrast, Atlantic Canadians are somewhat less convinced.

Younger Canadians (18 to 29) are the most skeptical. Only 58 percent think their province will need more electricity in the next decade, compared with 82 percent of those over 60. This generational gap is central to understanding how nuclear fits into the future. Older Canadians, perhaps because they have lived through debates about energy shortages, are more attuned to the risks of under-supply.

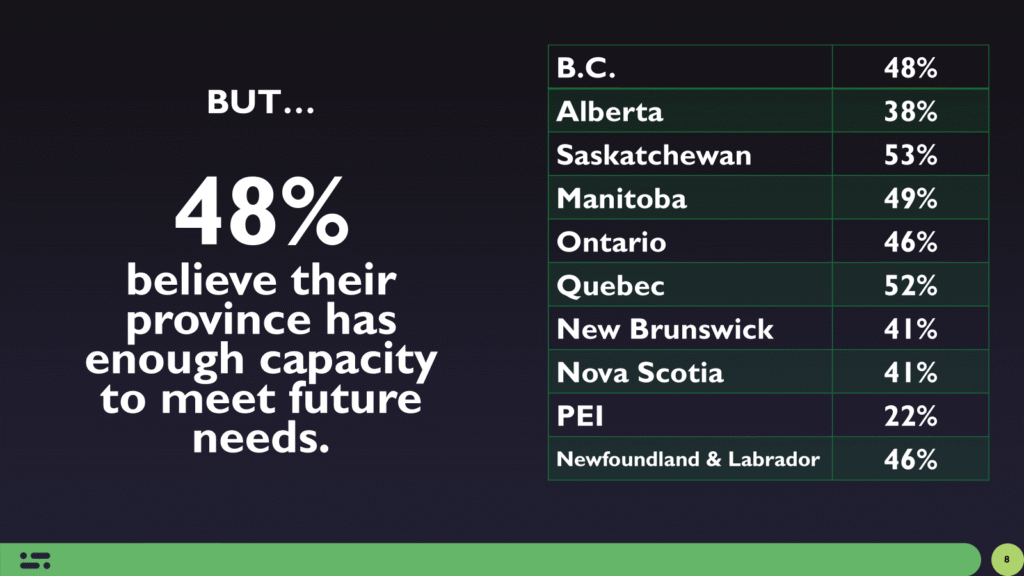

When asked whether provinces currently have enough generating capacity, opinion splits almost evenly. Forty-eight percent say yes, 36 percent no, with 16 percent unsure. After respondents were reminded of expert projections about electrification and population growth, confidence weakened. Only 45 percent still believed capacity was sufficient. This suggests that once Canadians link future demand with current supply, they begin to question whether existing tools will be enough but more needs to do to tell that story and socialize people to the reality of what’s coming.

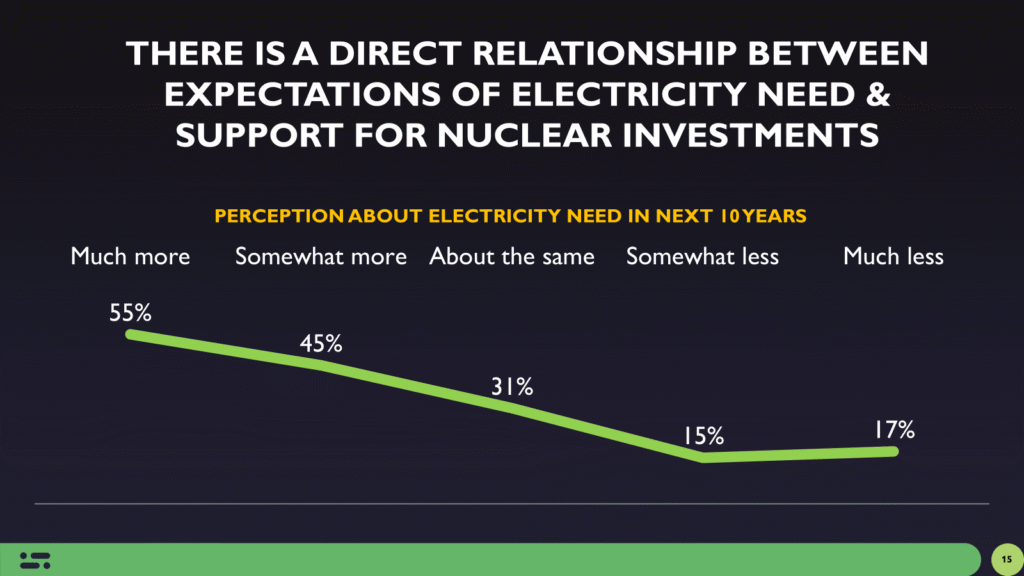

Linking Need to Nuclear

Among those who think their province will need much more electricity, almost half (44 percent) hold positive views of nuclear power. Among those who think their province will need less, a majority (55 percent) are negative. Recognition of rising demand is strongly correlated with openness to nuclear. The politics of nuclear are, at their core, the politics of scarcity.

This intuitive link between more demand and greater openness to nuclear creates a clear pathway for advocates. The more vivid and credible the story of future demand becomes, the more nuclear is seen as necessary rather than risky. Those who remain neutral or uncertain about demand are correspondingly lukewarm about nuclear.

Provincial and Regional Differences

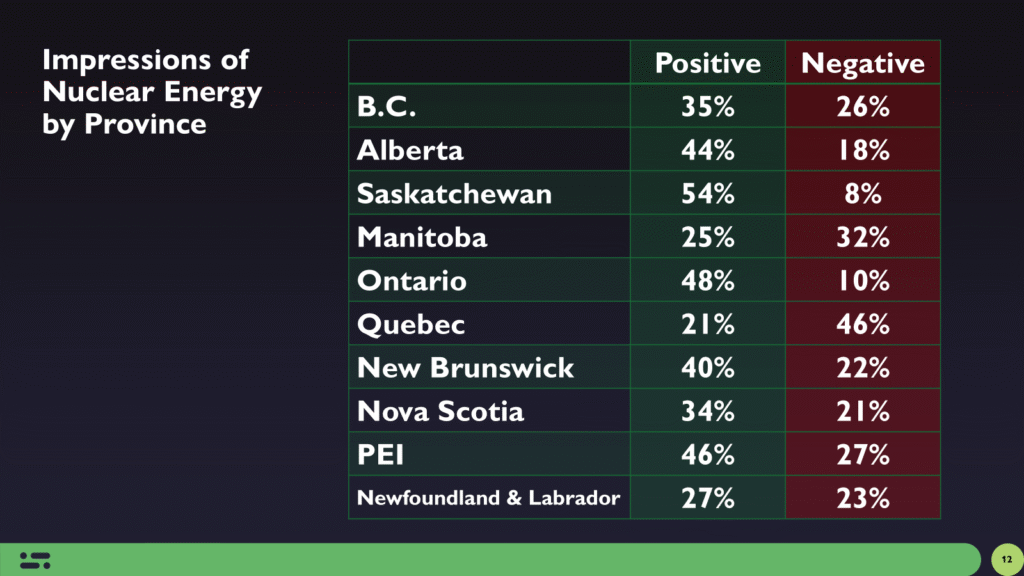

Perceptions of nuclear vary considerably by province:

Ontario and Saskatchewan: Both show relatively high positivity toward nuclear (48 and 54 percent). These provinces have established nuclear industries, and familiarity appears to breed support.

Quebec: Despite near consensus that more electricity will be needed, attitudes toward nuclear are more divided, with negativity running higher. The Hydro Québec legacy of abundant hydro may leave little appetite for nuclear.

Atlantic Canada: Views are fragmented, with positivity in New Brunswick reaching 40 percent, but somewhat lower in Nova Scotia (34%).

Manitoba and Alberta: Both provinces have sharply different views, with Alberta at 44 percent positive and Manitoba at 25 percent (hydropower impact).

These regional patterns suggest that familiarity with nuclear infrastructure, as in Ontario or New Brunswick, or having much of the world’s uranium, as in Saskatchewan, are critical drivers of support. Where provinces have abundant renewable (especially hydro) resources, nuclear faces steeper skepticism.

Generational and Educational Divides

Generational splits are striking. Positivity toward nuclear is highest among the youngest (54 percent among 18 to 29 year olds), dips to 32 percent for those aged 30 to 44, and then rises again among older groups. The volatility of younger cohorts suggests they are open to arguments about technology and climate solutions, but also susceptible to safety and waste concerns.

Education also matters. University graduates (48 percent positive) are more favorable than those with only high school (37 percent). This may reflect greater exposure to scientific framing of nuclear’s low-emission benefits.

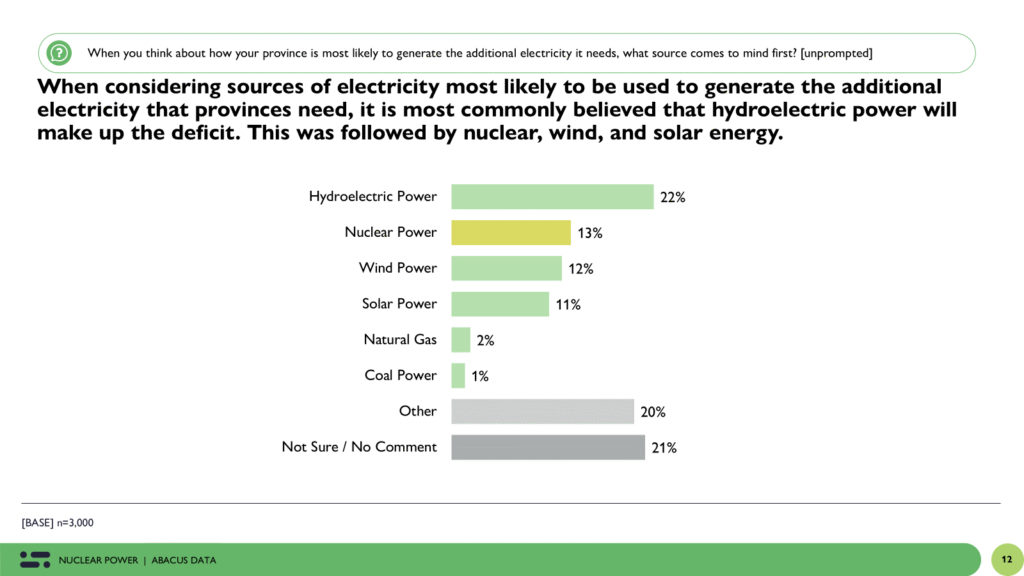

Where Canadians Think New Power Will Come From

When asked, unprompted, which energy sources will fill future demand, Canadians default first to hydroelectricity (22 percent), then nuclear (13 percent), followed closely by wind (12 percent) and solar (11 percent). Natural gas, at just 2 percent, barely registers.

This is a telling hierarchy. Hydro is widely seen as Canada’s comparative advantage, but nuclear sits ahead of other renewables in the public imagination. It suggests that nuclear has earned a place in the shortlist of future power sources, even if it remains divisive.

Implications

The story in these data is one of cautious but growing receptivity. Canadians know demand is rising. They are uncertain about whether existing capacity will suffice. When confronted with this reality, they are more willing to contemplate nuclear as part of the mix.

For governments and industry, three messages emerge:

Make demand real. The more Canadians believe their province will need substantially more electricity, the more open they become to nuclear solutions.

Address safety and cost head-on. Support is higher when benefits are linked to reliability and emissions reduction, but opposition remains rooted in concerns about safety and waste.

Tailor regionally. Ontario and Saskatchewan are the most fertile ground. Quebec and parts of Atlantic Canada will require different narratives, focusing less on scarcity and more on climate or export potential.

The Upshot

Positive views of nuclear energy are not overwhelming, but they are not trivial either. Four in ten Canadians are already favorable, and nearly half would support new provincial investments if announced. The swing middle – those who are neutral, uncertain, or lightly opposed – are watching the demand story closely. If electrification, population growth, and decarbonization remain central to Canada’s economic agenda, nuclear has an opportunity to be repositioned not as an option of last resort, but as a credible, scalable part of the solution set.

The politics of nuclear will follow the politics of electricity demand. Where people believe more supply is essential, nuclear’s appeal grows. Where they believe their province has enough, skepticism hardens. That tension is the key dynamic shaping nuclear’s future in Canada today.

Methodology

The survey was conducted with 3,000 Canadian adults from September 4 to 6, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 1.8%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements: https://canadianresearchinsightscouncil.ca/standards/.

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.