Canadians Enter the Fall with Heightened Anxiety About Stability and the Future

September 12, 2025

For many Canadians, September is a time to reset. Kids and students head back to school. Parliament resumes after the summer break, and now troubling headlines about a slowing economy and rising unemployment fill news reports. These moments, while familiar, feel different this year. They come against a backdrop of deepening uncertainty, where families are being forced to make harder choices and where even small disruptions can create cascading effects on household budgets and future plans.

Earlier this year, we introduced the concept of a precarity mindset: a growing feeling that stability is fragile and the next disruption always feels close at hand. Our recent release revealed how this mindset has taken root, showing a sharp rise in the number of Canadians reporting high and extreme levels of perceived precarity.

This follow-up looks at how that growing sense of precarity is playing out in the day-to-day lives of Canadians. It explores what families are feeling as back-to-school costs pile up, how financial fragility is forcing people to delay major life milestones, and how anxiety about the future is leaving many feeling emotionally exhausted as the fall political season begins.

What we find is clear: precarity is no longer just a set of economic indicators or a mood in the polling numbers – it is a lived, daily reality for millions of Canadians. And as Parliament returns, leaders will face the challenge of not just managing short-term crises, and building for the long-term, but rebuilding confidence that the systems Canadians depend on are strong enough to weather what comes next.

Affording the Basics

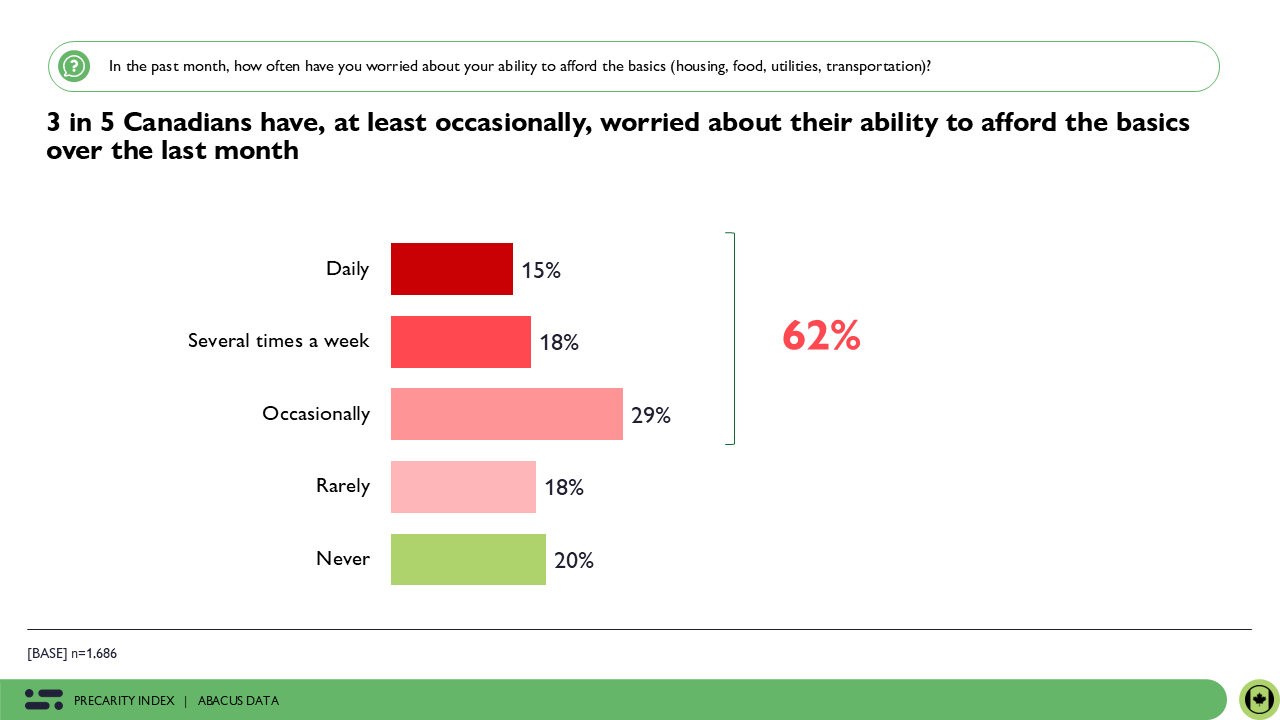

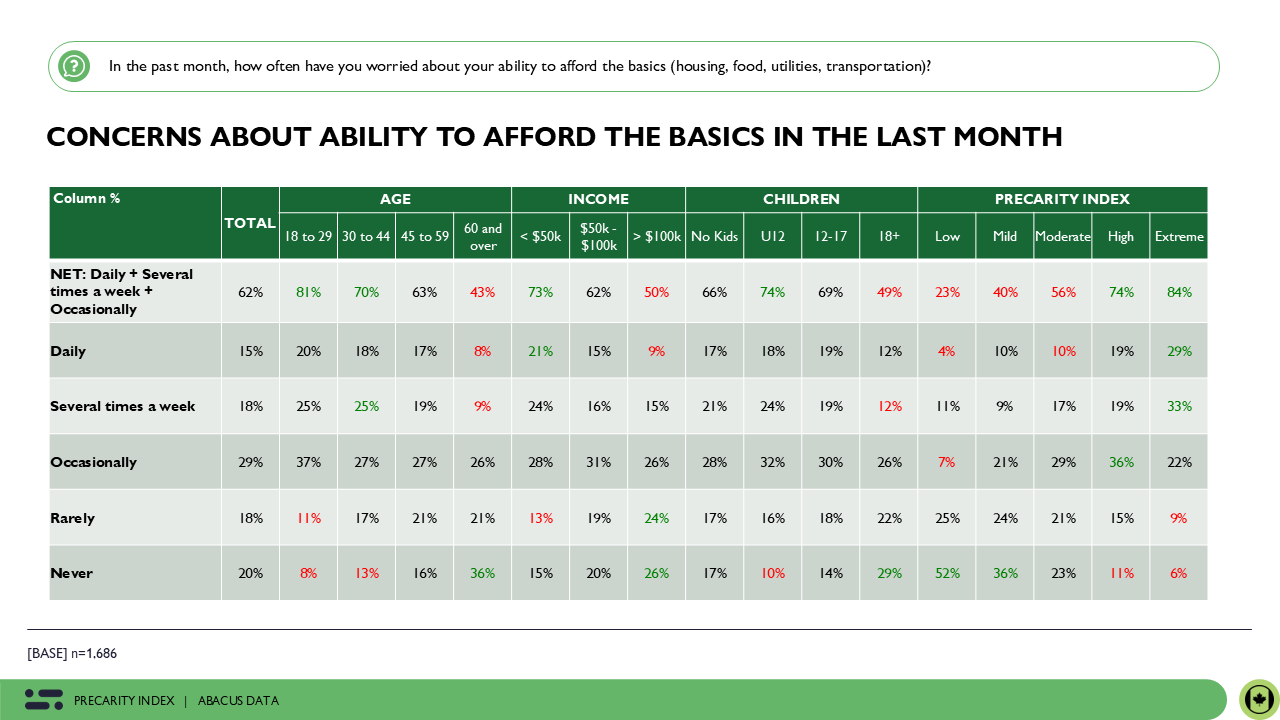

For many Canadians, precarity isn’t an abstract concept, it’s a lived, daily reality that shows up every time they open their wallets. Nearly two-thirds (62%) report worrying, at least occasionally, about their ability to afford the basics in the past month, and one in three (33%) say this worry strikes several times a week.

This anxiety cuts sharply across age, income, and family life. It’s highest among younger Canadians – 81% of those 18–29 and 70% of those 30–44 worry regularly about covering essentials. Families with children under 12 are also deeply affected (74%), especially during back-to-school season when added costs for supplies and activities spike stress. Lower-income households (73%) face similar strain, highlighting how financial pressure hits hardest for those already struggling.

The link to precarity levels is unmistakable. Among Canadians with a high level of perceived precarity, nearly three-quarters (74%) worry about affording the basics, while that figure jumps to 84% among those in feeling extreme precarity. These numbers reveal how economic unease is concentrated most heavily among those already living closest to the edge, where even small disruptions, like a missed paycheck or unexpected expense, can quickly spiral into crisis.

Fragile Financial Security

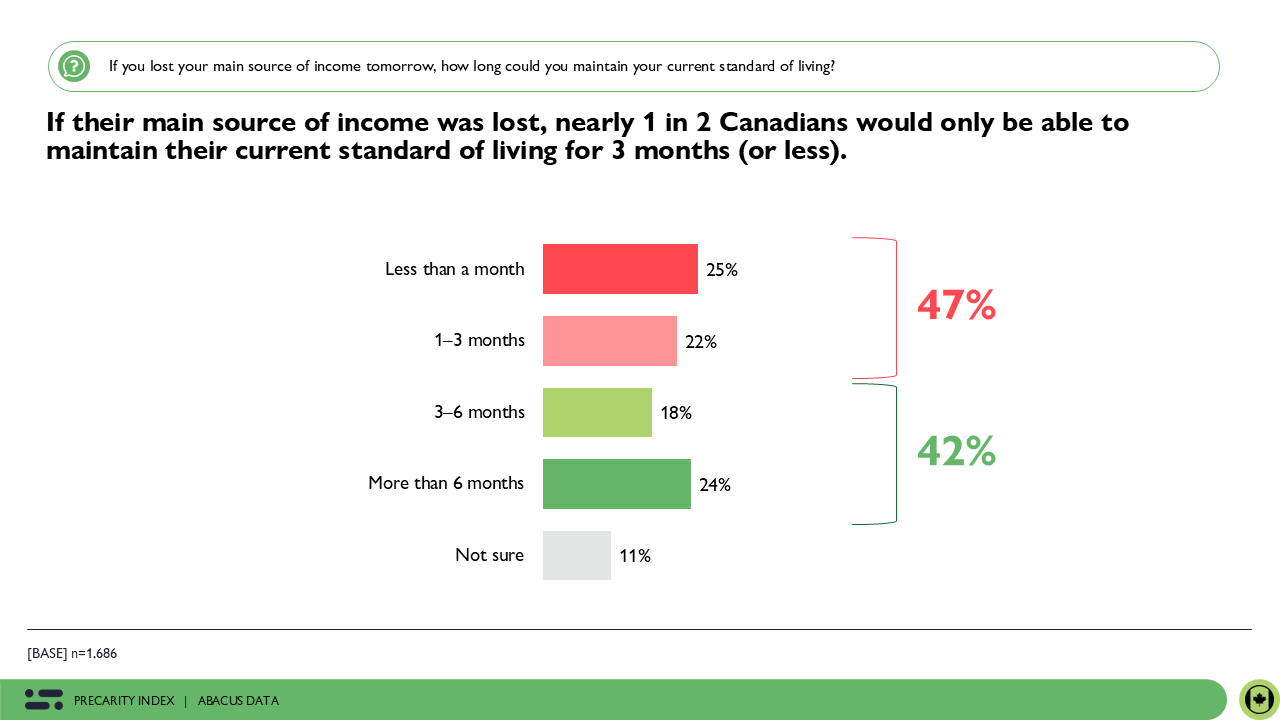

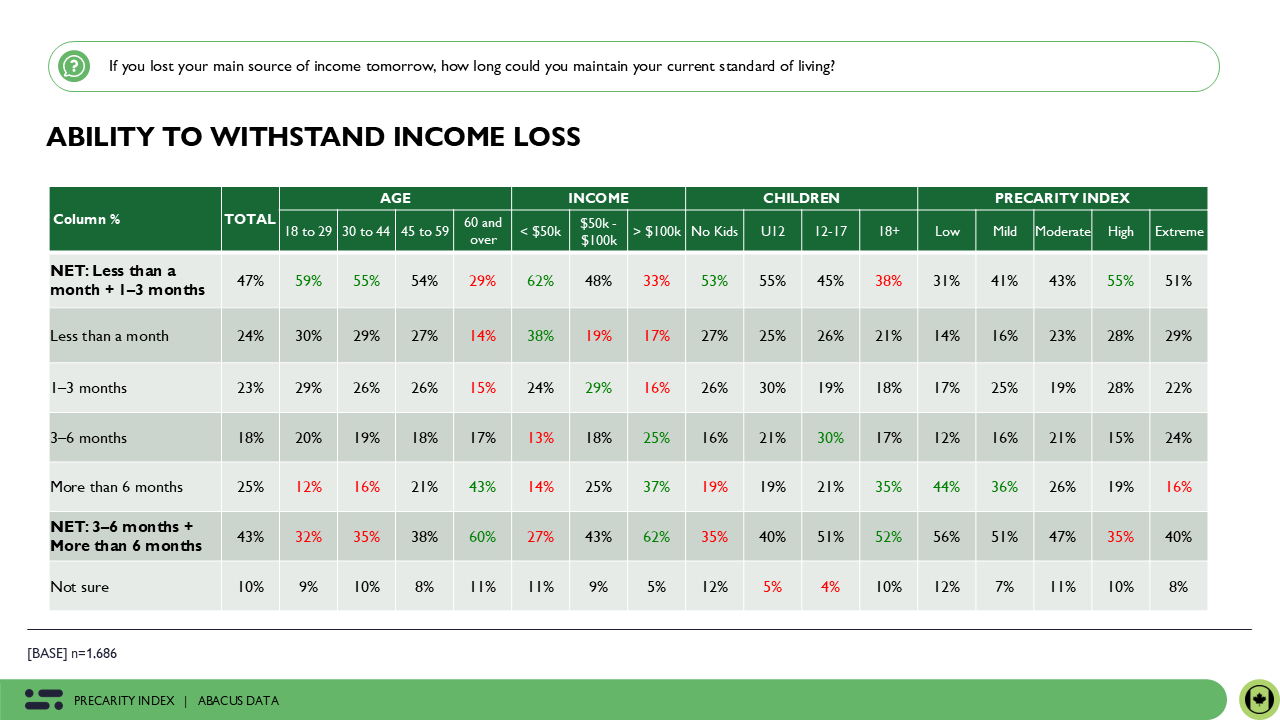

When asked how long they could maintain their current standard of living if their main source of income was lost, almost half of Canadians (47%) say less than three months. This financial fragility is greatest among younger Canadians – 59% of those 18–29 and 55% of those 30–44 say they could not sustain their lifestyle beyond that window. Lower-income households earning under $50,000 are even more exposed, with 62% reporting they could not last three months.

Here again, the precarity lens sharpens the picture. Those in our high precarity (55%) and extreme precarity groups (51%) are far more likely to acknowledge their limited financial runway, showing how precariousness translates into an immediate sense of insecurity about the future.

This financial fragility underscores how precarity is not just about attitudes – it reflects a very real vulnerability to economic disruption.

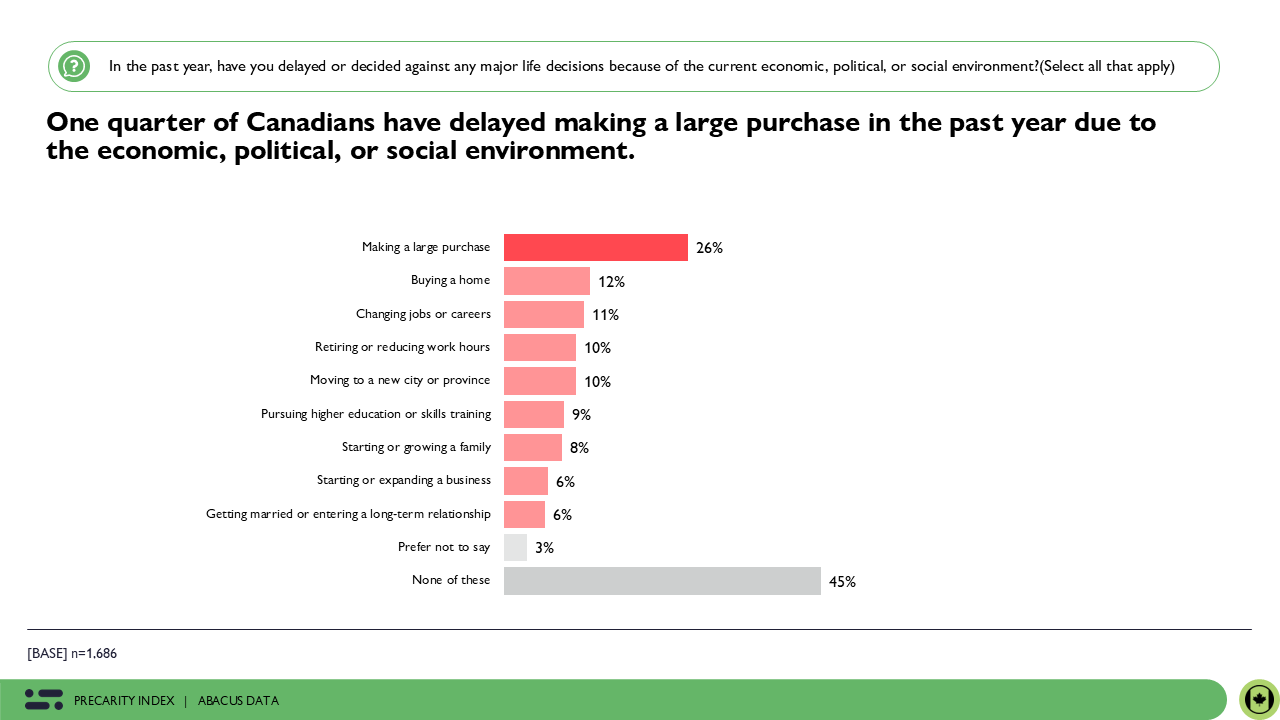

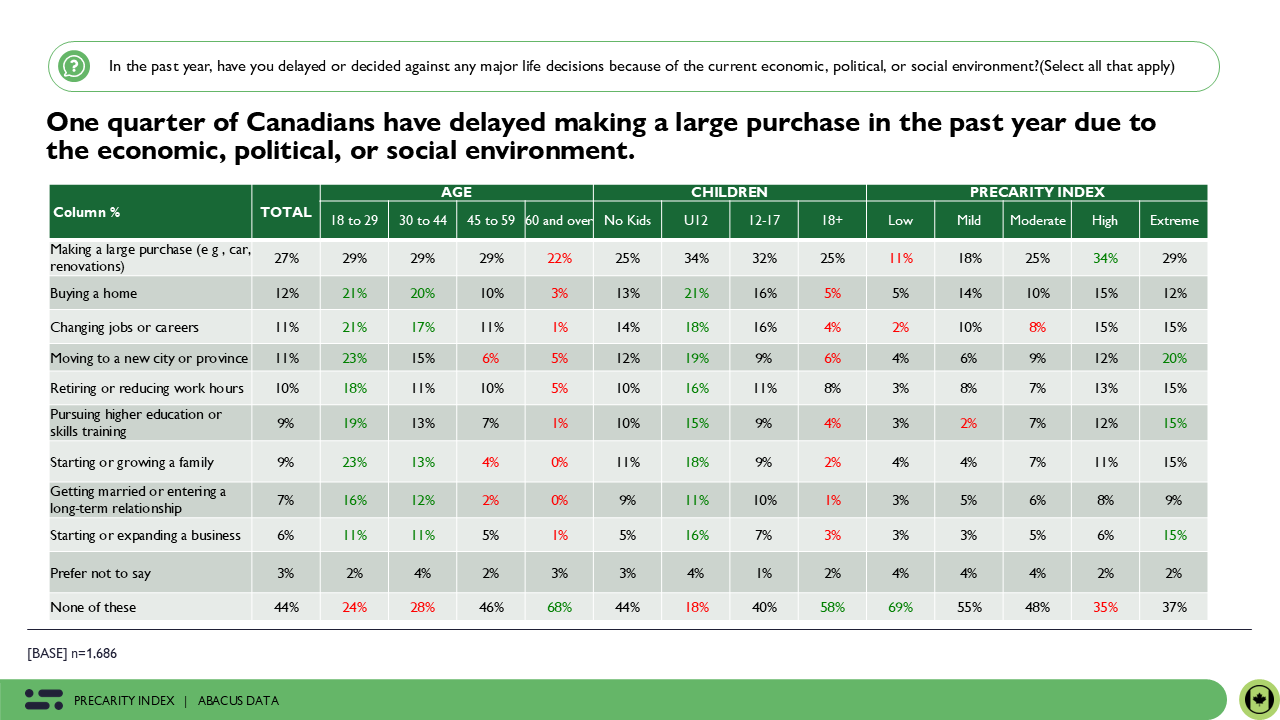

Life on Hold: How Precarity Delays Major Decisions

The current economic, political, and social climate is causing many Canadians to put their lives on pause. Across the country, 27% say they’ve avoided making a major purchase, 12% have delayed buying a home, and 11% have postponed changing jobs or careers due to uncertainty.

However, a closer look at the data reveals that younger Canadians and young families are feeling this pressure most acutely. Among those aged 18–29:

- 23% have postponed starting or growing their family.

- 23% have postponed moving to a new city or province.

- 21% have delayed buying a home.

- 21% have held off on changing jobs or careers.

- 19% have delayed pursuing higher education or skills training.

The same trend is seen among households with young children, highlighting how today’s environment is disproportionately impacting those at pivotal life stages. For young adults and parents alike, precarity isn’t just about day-to-day stress – it’s reshaping the milestones that define adulthood, forcing many to hold off on decisions that could shape their futures.

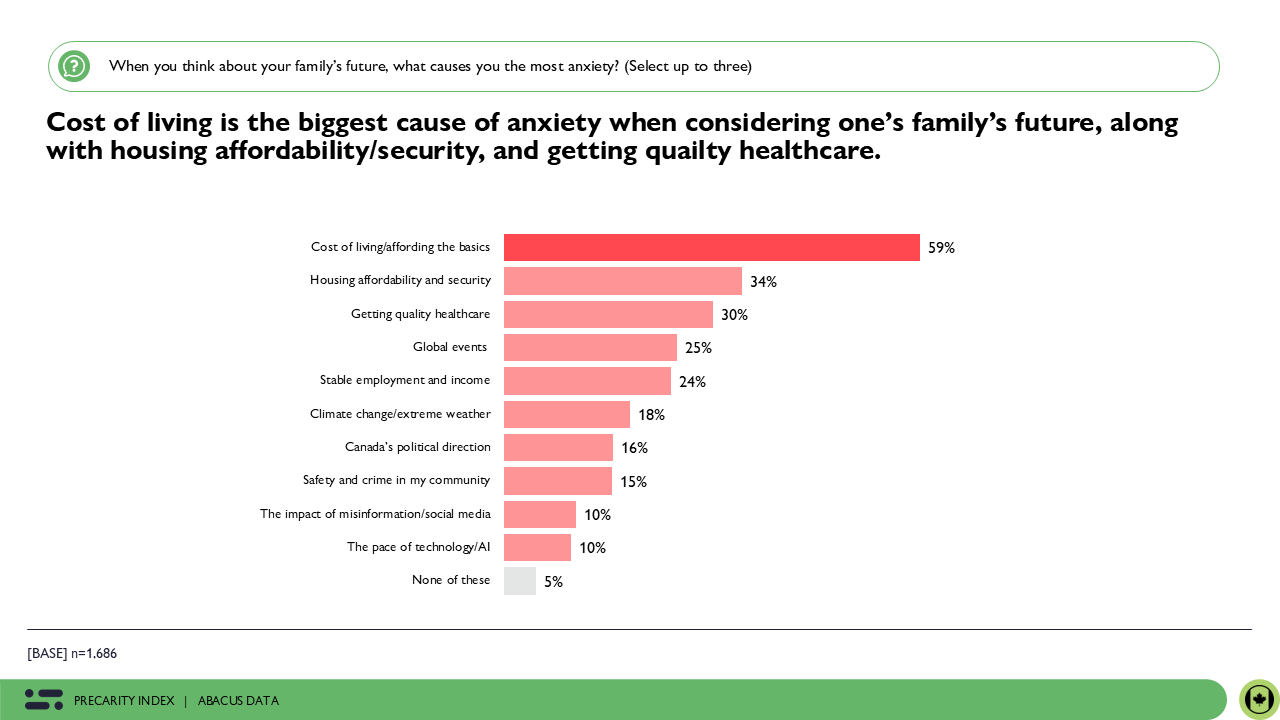

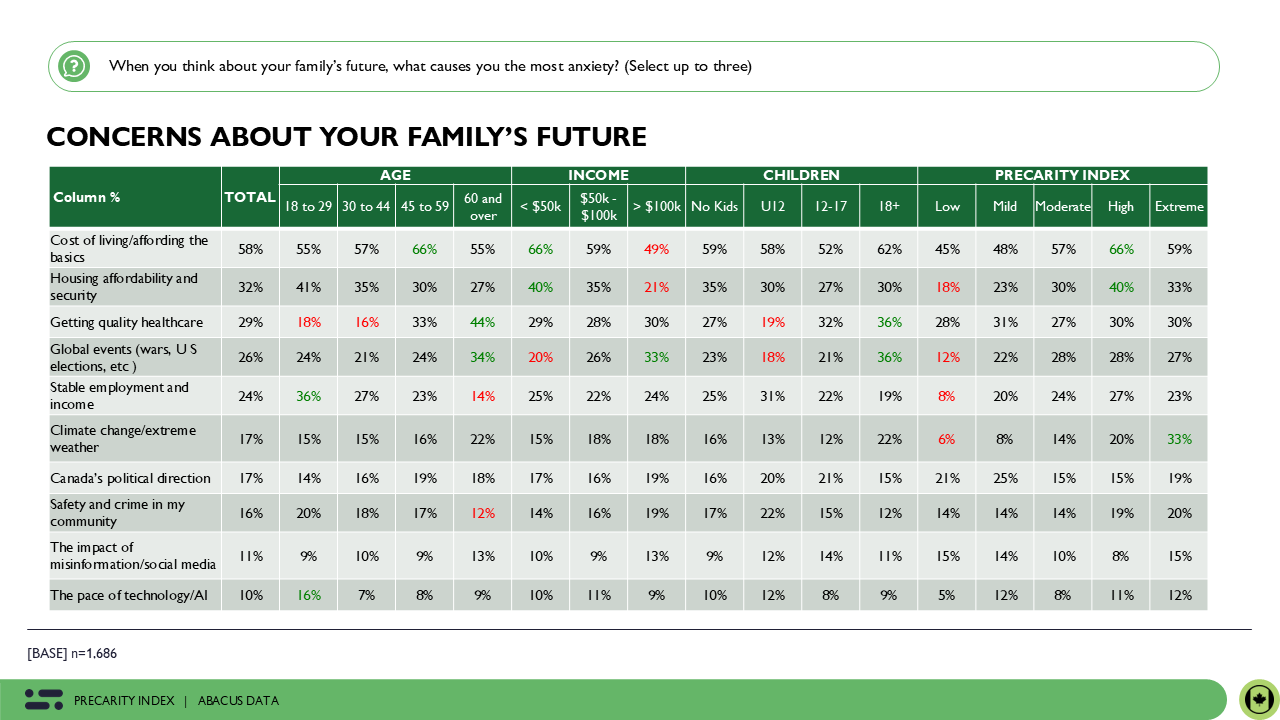

What Keeps Canadians Up at Night

When Canadians think about their family’s future, cost of living looms largest – 59% cite it as their greatest source of anxiety. Housing affordability and security follows at 34%, alongside concerns about access to quality healthcare (30%), global events (25%), and stable employment or income (24%).

Demographic divides show how different generations process risk. Canadians aged 45–59 are most likely to worry about the rising cost of living (66%), while those 60+ are significantly more concerned with healthcare (44%) and global instability (34%). By contrast, younger adults (18–29) express higher levels of concern about employment and income security (36%).

Overlaying the precarity index reveals sharper differences. Canadians in high precarity are most likely to highlight cost of living (66%) and housing affordability (40%) as pressing issues. Those in extreme precarity are distinct: alongside cost of living, they express significantly heightened concern about climate change (33%), reflecting how their anxieties extend beyond immediate economic stress to broader long-term risks.

The Emotional Toll of Precarity

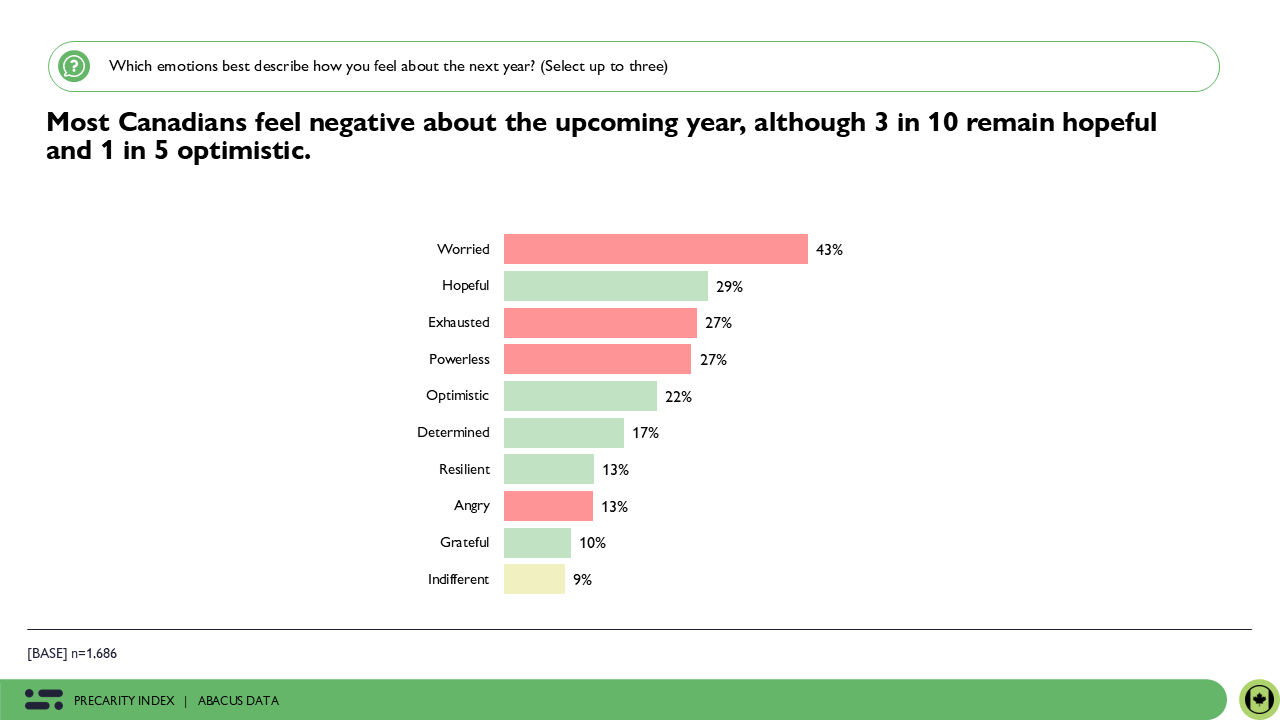

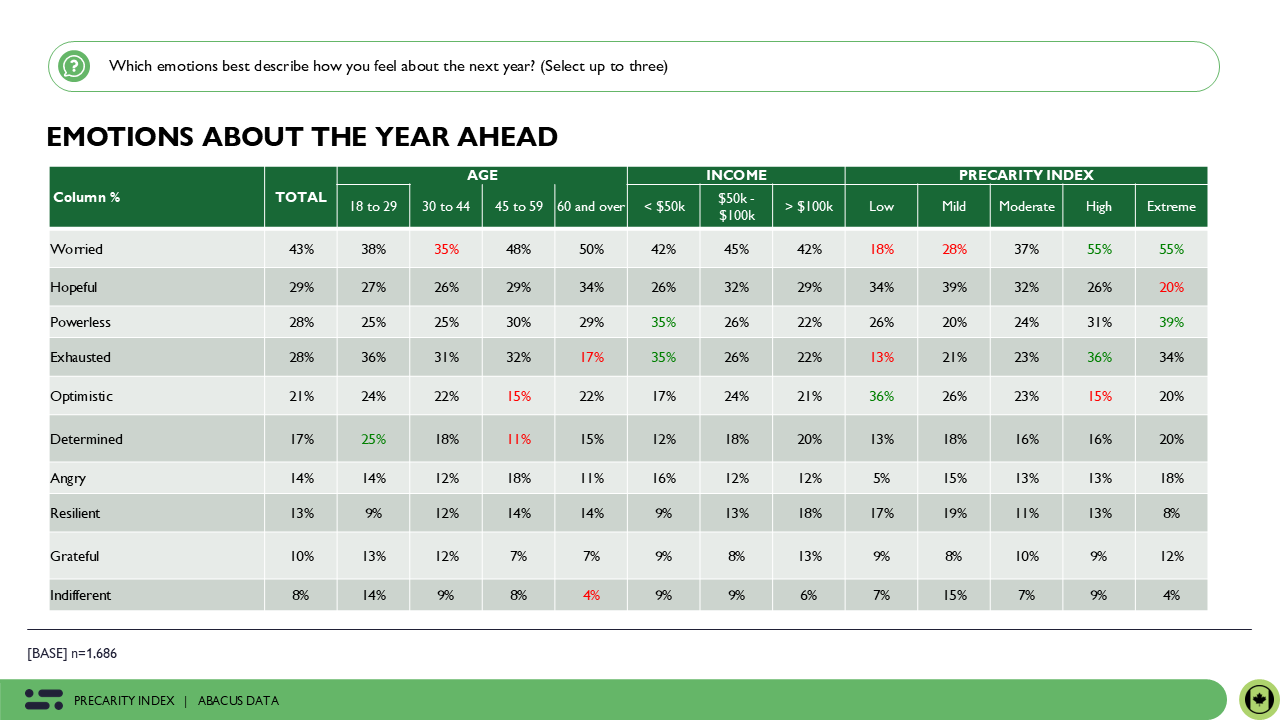

This climate of insecurity leaves a heavy emotional mark. Most Canadians report feeling worried about the year ahead (43%), while roughly a quarter say they feel exhausted (27%) or powerless (27%). Yet there is still resilience – 29% say they feel hopeful about what’s to come.

These emotions map closely to levels of precarity. Those in extreme precarity are most likely to feel worried (55%) and powerless (39%). Canadians in high precarity mirror that worry (55%) but are also more likely to report exhaustion (36%). By contrast, those in low precarity are significantly more optimistic, with 36% saying they feel hopeful about the year ahead.

The balance between worry and hope is defined by how secure – or exposed – Canadians feel in today’s uncertain climate.

The Upshot

As Parliament prepares to resume, kids head back to school, and headlines about a slowing economy dominate the news, Canadians are entering the fall with a growing sense of uncertainty. What began as concern over rising prices and was disrupted by fears of Trump’s tariffs, has evolved into something deeper: a precarity mindset, where stability feels fragile and the next disruption always seems close at hand.

For households, especially those with young children, precarity has become part of everyday life. Rising costs and fragile finances are forcing families to make difficult trade-offs, while even small disruptions can quickly throw carefully balanced budgets into chaos. This uncertainty goes beyond day-to-day stress; it is reshaping the milestones that define adulthood. Many young adults and families are putting their futures on pause, delaying decisions about buying a home, changing careers, or growing their families because the future feels too unpredictable.

For the economy, this creates a ripple effect. When households focus on survival rather than growth, they spend less, take fewer risks, and hold back on investments, slowing recovery and deepening the very vulnerabilities that caused the hesitation in the first place.

Taken together, these forces signal a pivotal moment. The return to Parliament comes at a time when Canadians are not just grappling with temporary shocks, but with a deeper question: whether the systems they rely on – housing, healthcare, jobs, and education – are strong enough to withstand what comes next. How leaders respond in the months ahead will shape whether this period of heightened precarity becomes a lasting source of division and distrust, or a turning point that restores confidence and stability.

Methodology

The survey was conducted with 1,686 Canadian adults from July 31 to August 7, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.39%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by Abacus Data.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.