Only a third of Canadians feel they are better off now than they were in their childhood.

May 30, 2024

The 2024 federal budget focused on generational fairness, and helping young Canadians get ahead. But a sense of fairness and getting ahead is hard to come by these days. In part, because more Canadians than ever are finding it difficult to save, and fewer feel they are on their way to future financial success either.

The findings below are from an online survey of n=1,500 gen pop adults in Canada from April 11th to 16th. This survey was paid for by Abacus Data.

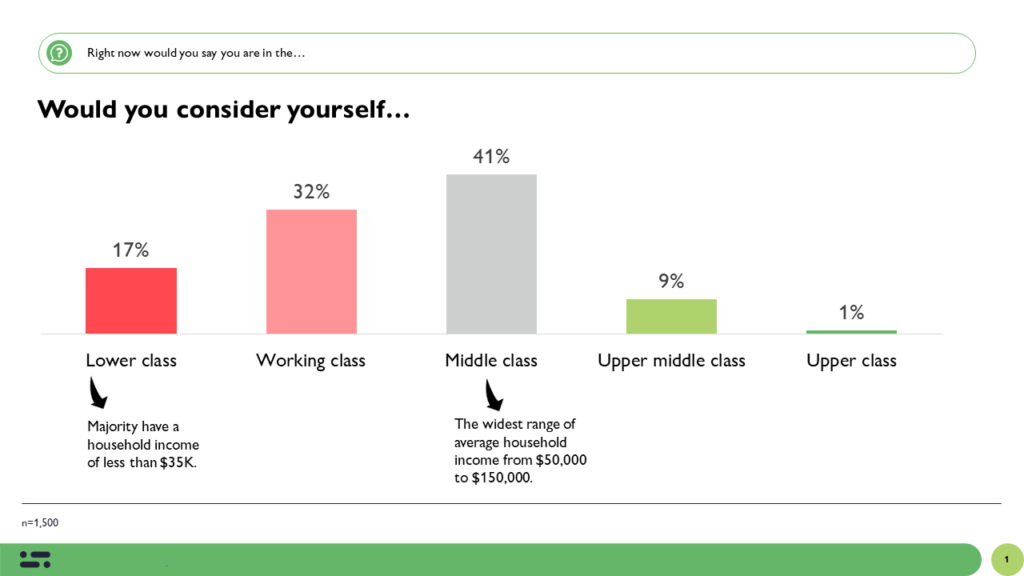

To lay some groundwork for the conversation, more Canadians consider themselves middle-class (41%). Very few Canadians consider themselves any higher. Those living in Quebec are more likely to say they are living in the middle-class than others. Those in Atlantic Canada are more likely to say they are lower class.

Household income does align with reported class- but middle-class has the widest range of household income. Half of those making $50-75K, $76-100K, and $100-150K consider themselves to be middle class.

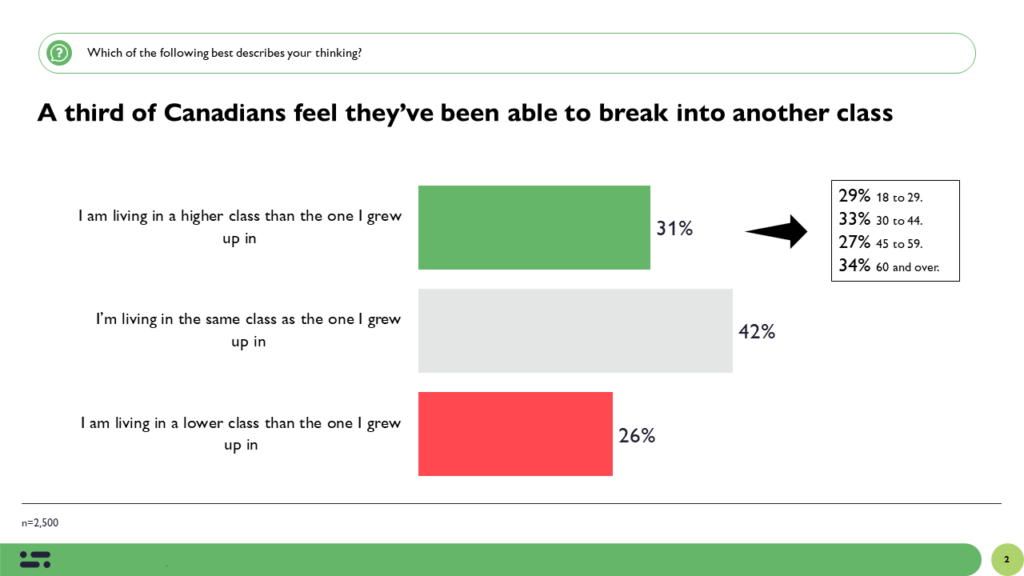

One in three Canadians feel they have made it into a better class than the one they grew up in. A quarter say they are living in a lower class than they grew up in. Interestingly, those who have had more time to build generational wealth and break into a new class are no more likely to say they’ve made it. The distribution of lower to upper class looks the same among 18 to 29 year olds as it does for those 60+.

Instead, owning a house is a much stronger predictor of class. 72% of those in an upper class own a home, compared to 45% of those working class or below.

About half of those in the working and middle class say they’ve had little to no class mobility over their lifetime. Those on either end have seen more movement but not always positive- 73% of those in the lower class say it’s lower than the class they grew up in, and 75% of those in an upper class say it’s a higher class than they grew up in.

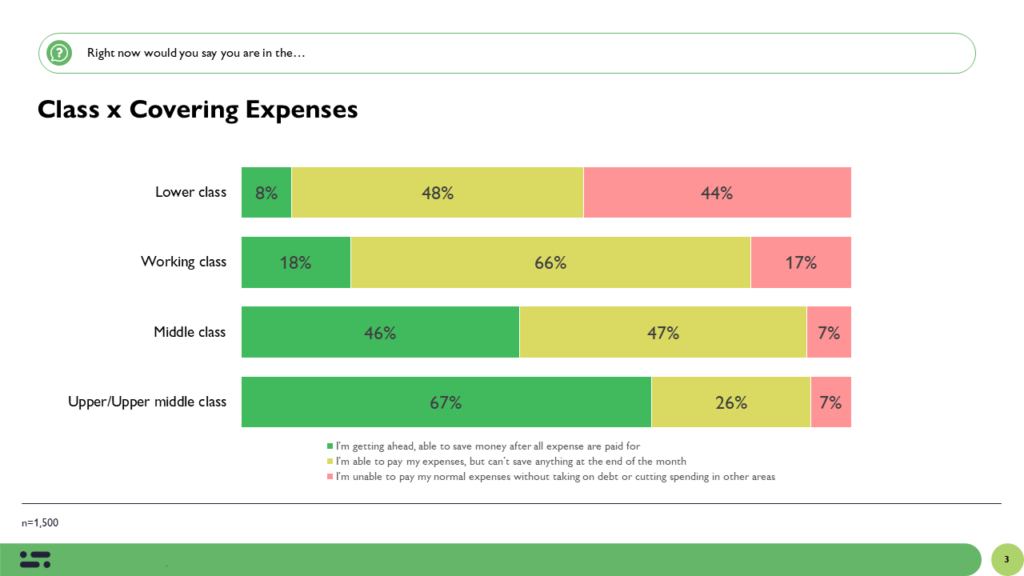

Self-prescribed class can be interchangeable with feeling like you are able to get by financially day to day or put aside funds for saving or discretionary spend. We see some alignment between class and getting ahead, but there are still a sizeable number of individuals in each class who feel they are financially limited. And even more important, a large number of those below the middle class who say they aren’t even able to make ends meet.

Only 8% of those in the lower class say they are able to put money aside to cover expenses. 44% say they are unable to make ends meet. On the other ends of the scale, two thirds of those in the upper classes are saving, but a third are stretched too thin either just making their payments or falling behind.

The Upshot

The recent economic uncertainty in Canada has left many feeling financially challenged, both in the short and long-term. Canadians (particularly in the lower class, but also middle and upper) feel stretched financially day-to-day, which influences their ability to pay bills today, envision financial stability in the future, and more broadly, feel like Canada is on the right track and that there is enough to go around.

In the long-term, achieving financial success and even stability takes time, but time alone isn’t responsible for accumulating wealth. Assets, in particular home ownership, are one of the main drivers for class mobility and financial wealth. Helping more Canadians get ahead will be about addressing these perceptions (and reality) of both short-term and long-term financial success.

Methodology

The survey was conducted with 1,500 Canadian adults from April 11 to 16, 2024. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.53%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in the 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.