Interest rates and Inflation: Most Canadians are cautious about the future

June 27, 2024

Many Canadians saw the Bank of Canada cut interest rates earlier this month and felt it is a step in the right direction. But how do they feel about the real consequences of these cuts and who do Canadians believe is responsible for somewhat persistent inflation?

The findings below are from an online survey of n=1,550 gen pop adults in Canada from June 6th to June 13th 2024. This survey was paid for by Abacus Data.

First, how are Canadians feeling about inflation and the cost of living? Cost of living remains the top issue for Canadians overall and for voters of the three main parties by a 10 point + margin. Affordability is still clearly a challenge for most Canadians.

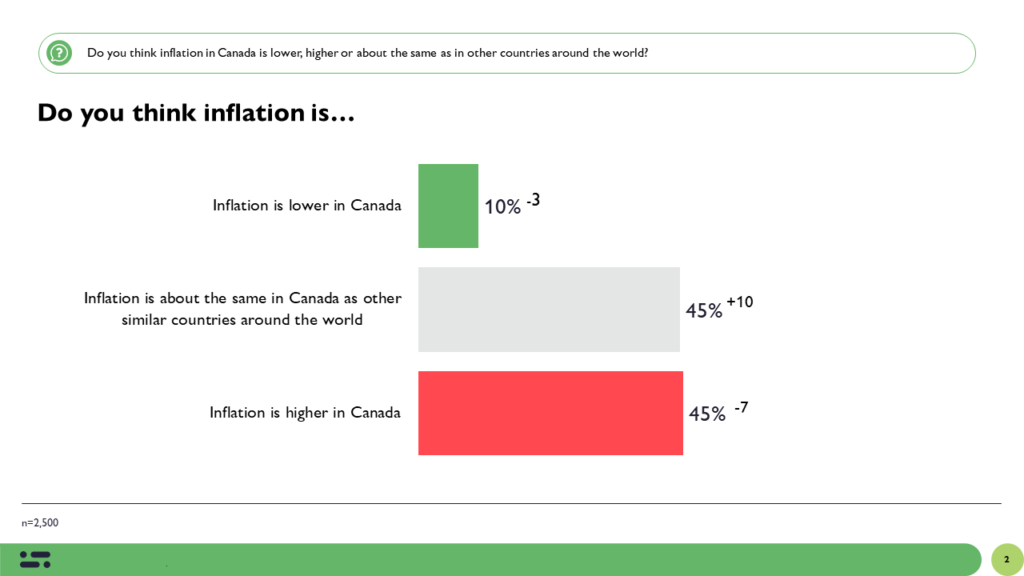

Last summer, right after the final interest rate hike to 5%, we asked Canadians how they felt about inflation. As with last summer, few Canadians believe inflation in Canada is lower than other countries in the world signalling a continued disconnect between perceptions and reality. Now however, more say we are in line with others.

If anything, Canadians seem to have the world view that inflation challenges have yet to ease, and the cost of living challenges that come with it are still here to stay for some time, for everyone.

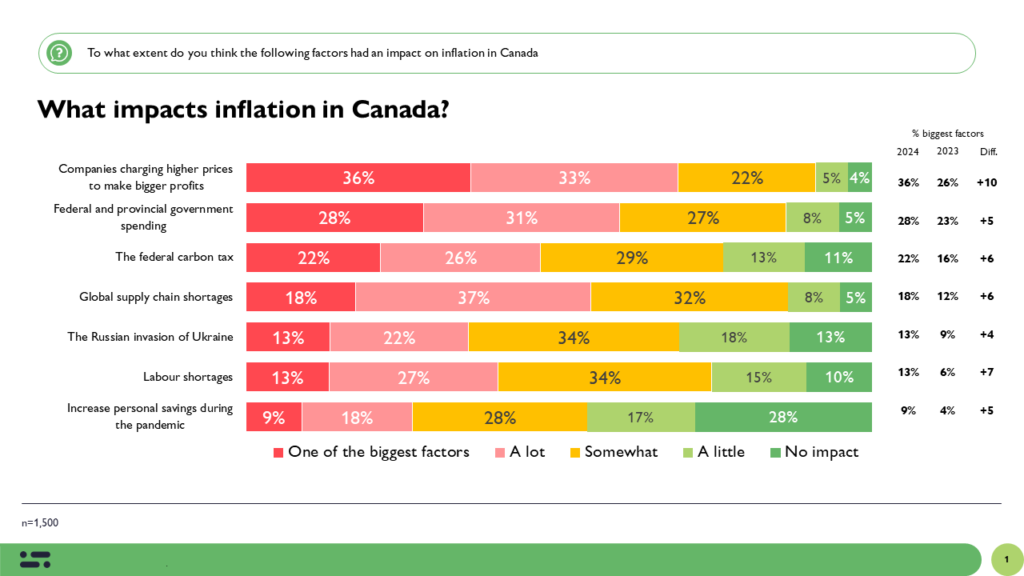

Canadians still believe companies charging unnecessarily high prices and government spending are the biggest contributors to high inflation. And the intensity of these beliefs has increased considerably since last summer.

36% say companies charging higher prices for bigger profits is one of the biggest factors, up ten points from last summer. 28% say increased government spending is one of the biggest factors up 5 points.

Other factors are up to, like the federal carbon tax (up 6 pts since last summer, now 22%) and global supply chain shortages.

The longer inflation goes on, the more Canadians believe it’s caused by a number of factors, though the blame is placed on companies and governments the most.

Across the political spectrum, there have also been some changes as to who is to blame. Liberals, Conservatives and NDP supporters feel companies are shouldering a bigger responsibility for inflation, more so than 2023. Perhaps unsurprisingly NDP voters place a particularly large amount of blame on companies.

Governments too are facing more criticisms across the board. 46% of Conservatives feel federal and provincial governments spending is one of the biggest factors of inflation, up 7 points since 2023. Liberal voters are least critical- at only 12%, but this is also up significantly since 2023.

Increased blame also signals impatience- more and more Canadians feel governments and companies are working against them in their struggles with cost of living.

Does the rate cut change things for Canadians today?

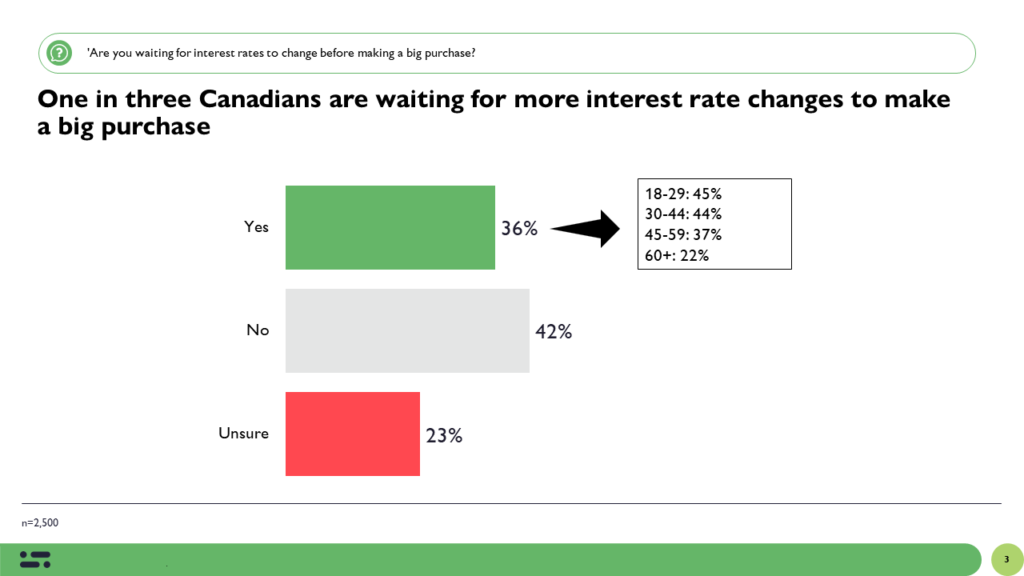

Not yet. A third of Canadians say they are waiting for more changes to the interest rates before making a big purchase. Younger Canadians are particular dependent on changes with 45% saying they will keep waiting before making a purchase.

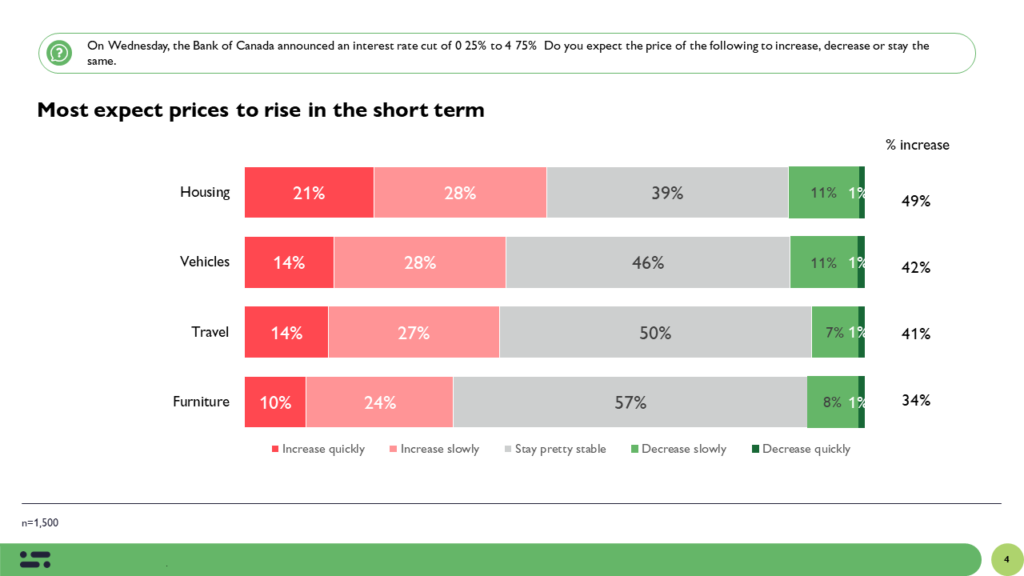

Many Canadians are waiting, likely because they don’t expect to see cost relief anytime soon. In fact, most seem to think prices will rise in the short term, housing in particular. 21% expect housing prices to rise quickly.

Young people are most likely to say prices will rise and continue to rise quickly in the short term.

THE UPSHOT

After a period of rapid rate hikes and rising inflation, Canadians are still sensitive about purchases and cautiously optimistic about any positive trends for cost of living. One rate cut doesn’t appear to be enough to swing Canadians mood towards the positive.

Relief hasn’t been felt yet, many are still withholding purchases (young Canadians in particular). This means Canadians continue to be frustrated and pessimistic about where things are headed, and increasingly frustrated towards those they feel are contributing or standing in the way of easing cost of living challenges. This will likely continue until Canadians feel cost of living is trending in the right direction.

METHODOLOGY

The survey was conducted with 1,550 Canadian adults from June 6 and 13, 2024. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.49%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by the Canadian Telecommunications Association. Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in the 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.