The Housing Hardship: Low-income renters and Canada’s affordability crisis

October 12, 2023

We continue our month-long investigation of the housing crisis in Canada partnering with the Canadian Real Estate Association (CREA), to carry out a comprehensive nationwide survey involving 3,500 Canadian adults aged 18 and above, conducted from September 22 to 28, 2023. In this report, the second installment of our investigation, we delve into the repercussions of the housing crisis on low-income renters, specifically those with a household income of $50,000 or less. The data paints a bleak picture of the challenges and apprehensions confronting this vulnerable demographic, as they grapple with the surge in housing costs and the eroding affordability of shelter.

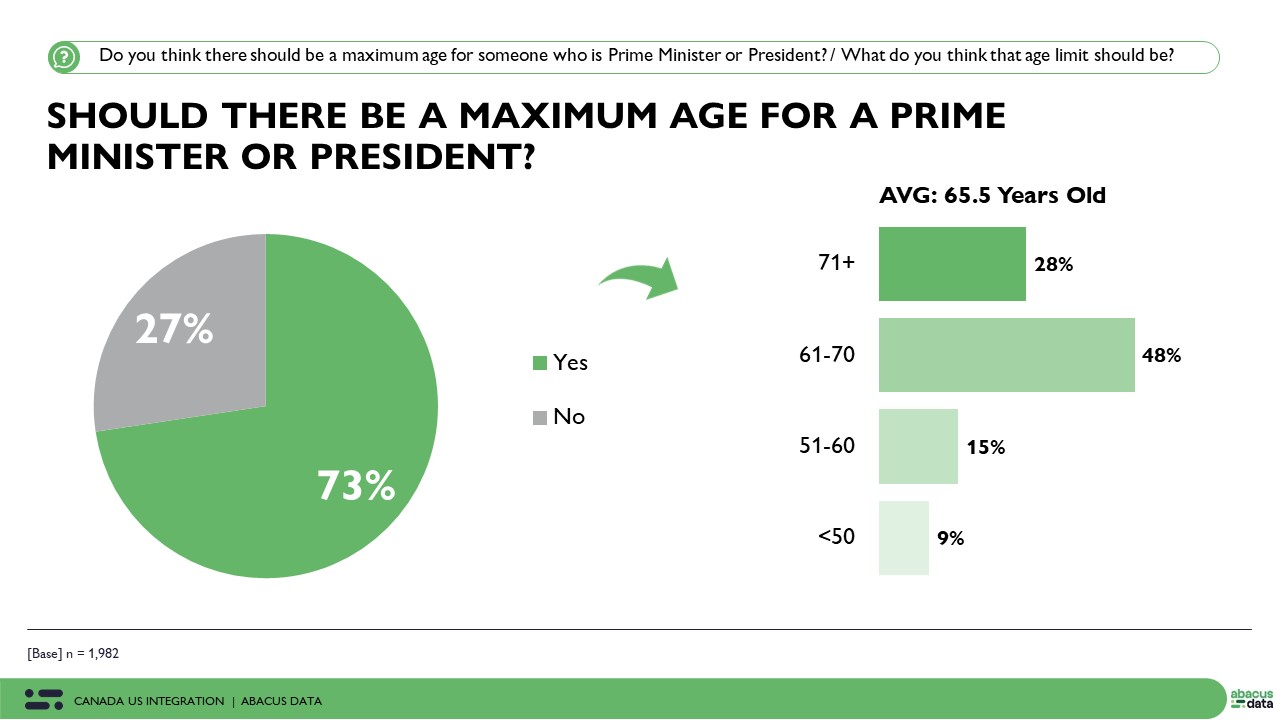

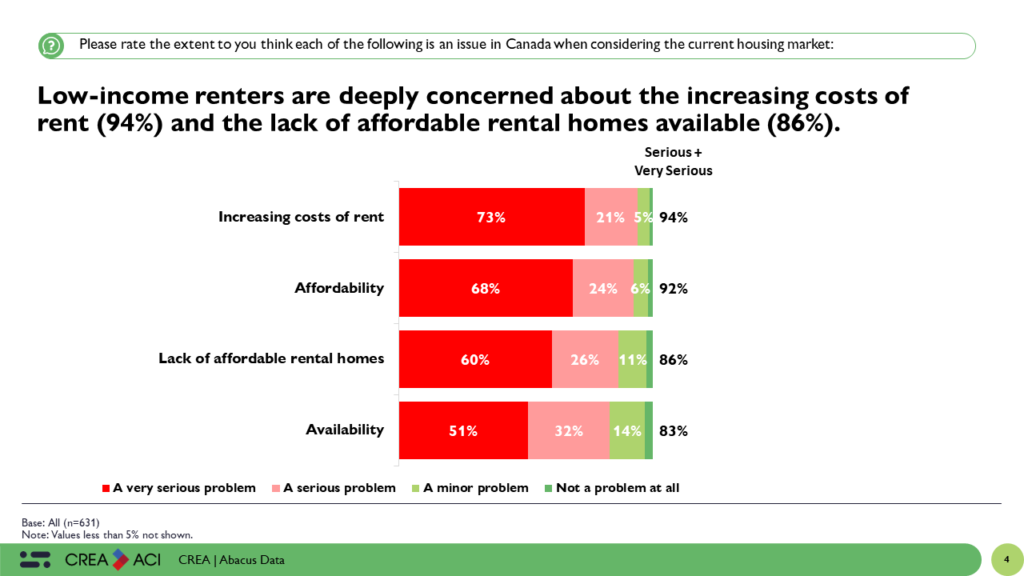

Concerns with Affordability

A staggering 94% of low-income renters agree that the surging rental costs in Canada pose a serious problem. Furthermore, 86% express deep concern regarding the lack of affordable rental properties in the country. The weight of mounting rent expenses is especially burdensome for those aged 51-65 (97%) and those aged 66 and above (98%).

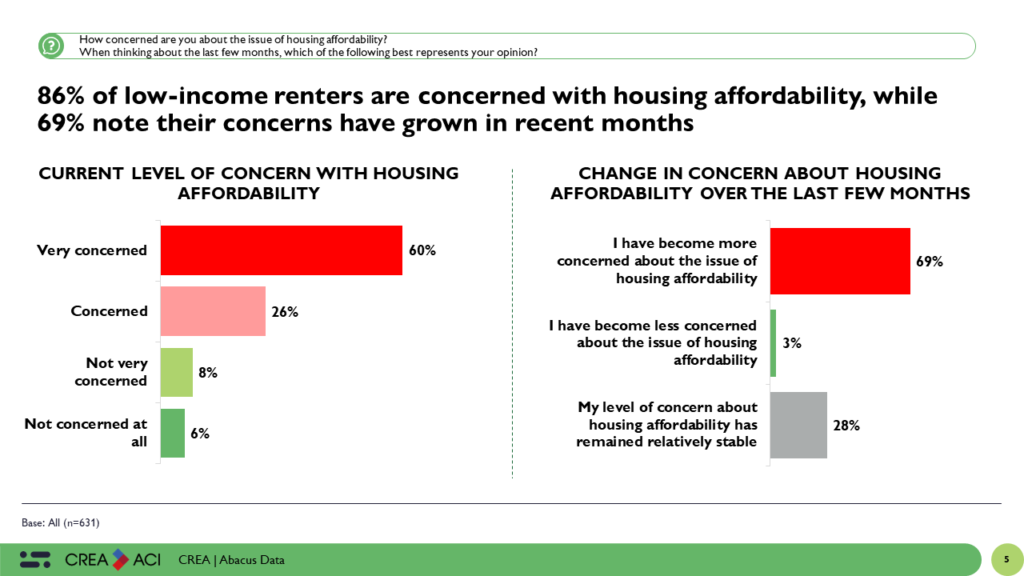

The anxiety surrounding housing affordability is emphasized by the fact that 86% of renters are concerned about this issue. Furthermore, 69% of renters have witnessed their worries about housing affordability escalate in recent months. The obstacles to entering the housing market are disheartening for potential homeowners, particularly those with constrained incomes, marking the crisis’s deepening nature and underscoring the need for action to address its root issues.

Rental Market Struggles

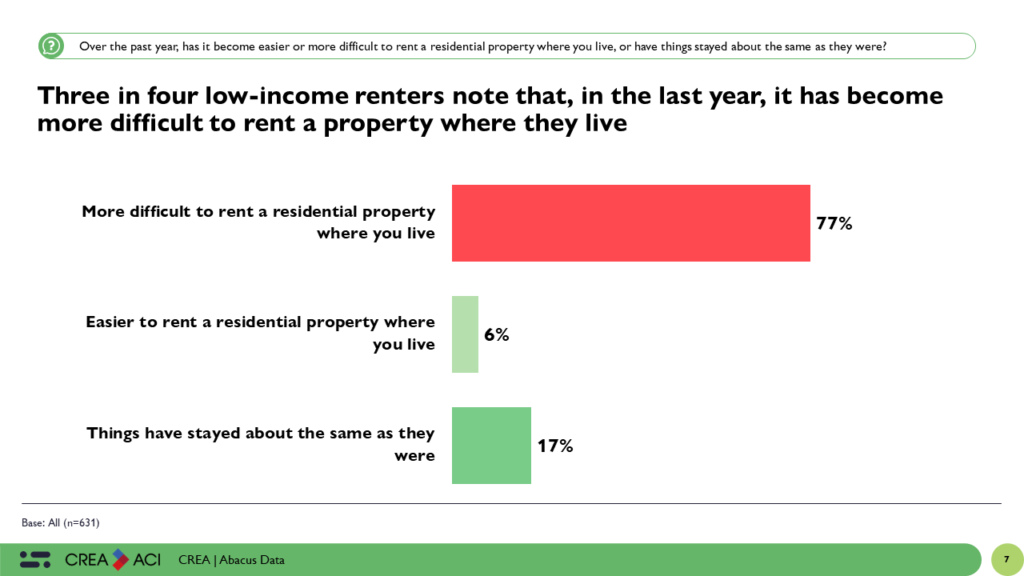

Low-income renters are also grappling with challenges in the rental market. A significant 77% reveal that over the past year, locating affordable rental properties in their area has grown notably more challenging. This exacerbates the already daunting task for low-income individuals and families in their quest for secure and stable housing.

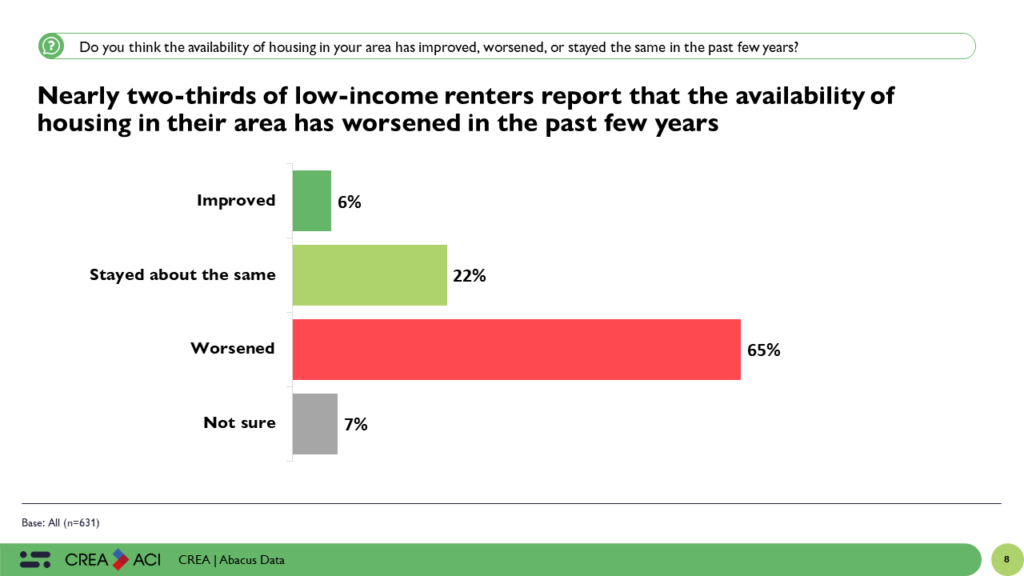

In conjunction with this, there is a concerning trend of diminishing housing availability. A significant 65% of renters acknowledge that over the past few years, the accessibility of affordable housing options has worsened. This signals a (perceived) widespread shortage of such housing options throughout the nation, thereby limiting renters’ choices. This can pose intricate challenges for renters, especially those with lower incomes, as their housing alternatives become significantly more restricted compared to their counterparts.

The Financial Hardships Faced by Low-Income Renters

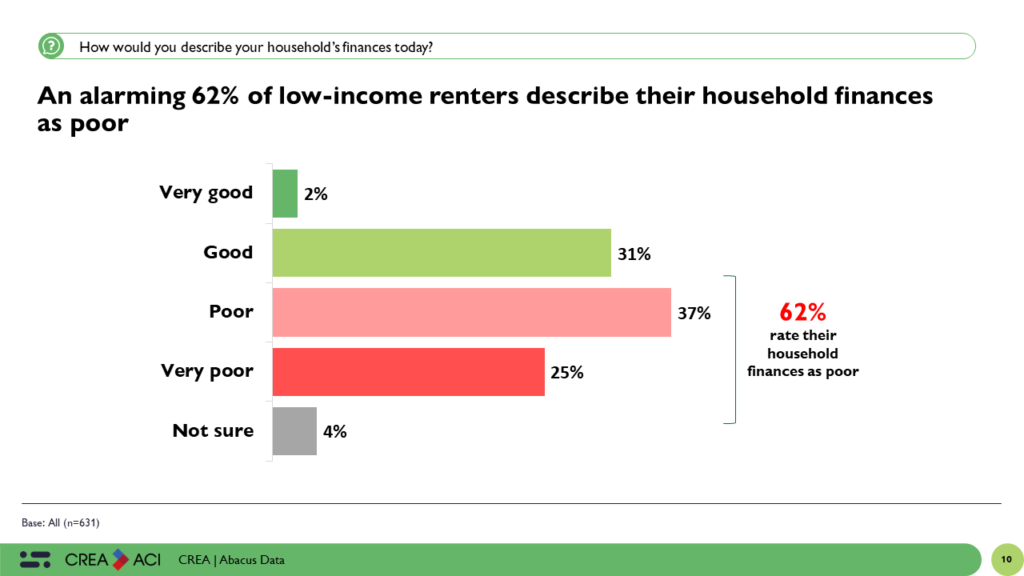

A substantial 62% of low-income renters categorize their household finances as poor. This financial fragility is most pronounced among those aged 51-65, with 73% indicating the dire state of their financial affairs. Notably, individuals between the ages of 35-50 aren’t far behind, as 65% also describe their household finances as poor.

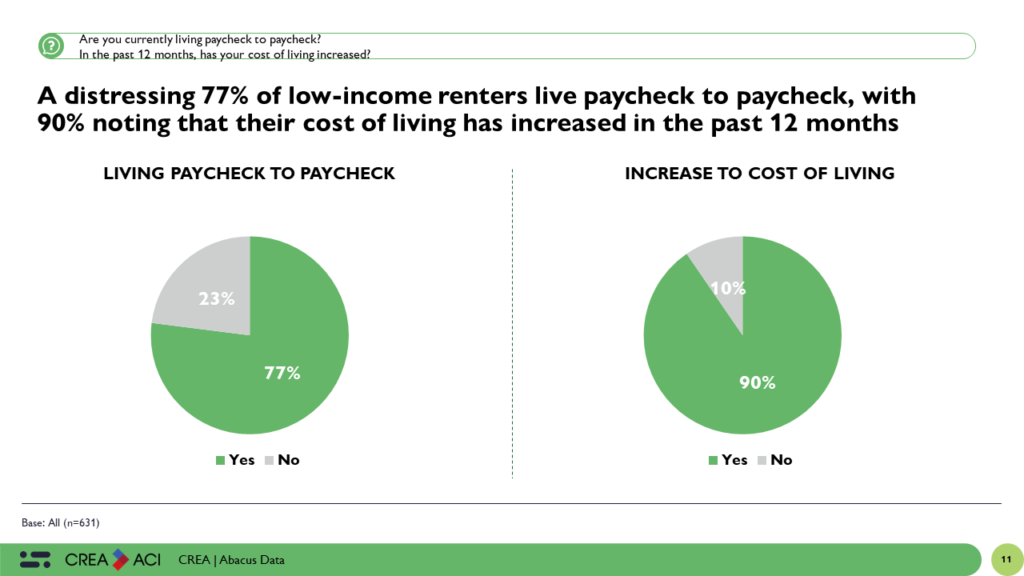

Moreover, a distressing 77% of renters earning $50,000 or less find themselves living paycheck to paycheck, grappling to make ends meet. This precarious financial situation is especially prevalent among those aged 35-50 and 51-65, where a striking 85% of individuals in both age groups find themselves in this delicate predicament.

An overwhelming 90% of these renters affirm that their cost of living has risen over the past few months. The increasing expenses related to essential necessities like groceries, utilities, and transportation compound the financial challenges they already endure due to housing costs.

These elevated percentages signify that a significant portion of this demographic is unable to set aside savings for the future or withstand unforeseen financial crises. This paints a stark picture of economic instability, with many renters teetering on the brink of financial distress.

Widespread Concerns of the Current Rental Market

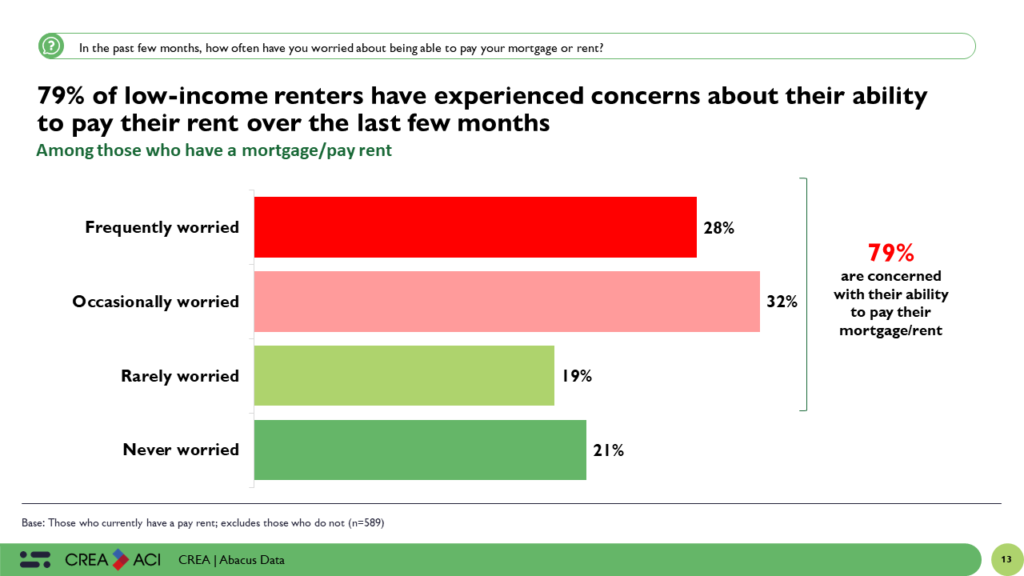

A significant 79% of low-income renters express concerns about their ability to pay their rent. This pervasive worry is most acute among younger renters aged 18-34, with a striking 93% voicing these concerns. However, it is essential to note that these concerns are not limited to the young; they are also prevalent among those aged 35-50 (80%), underscoring the widespread anxiety surrounding rental affordability.

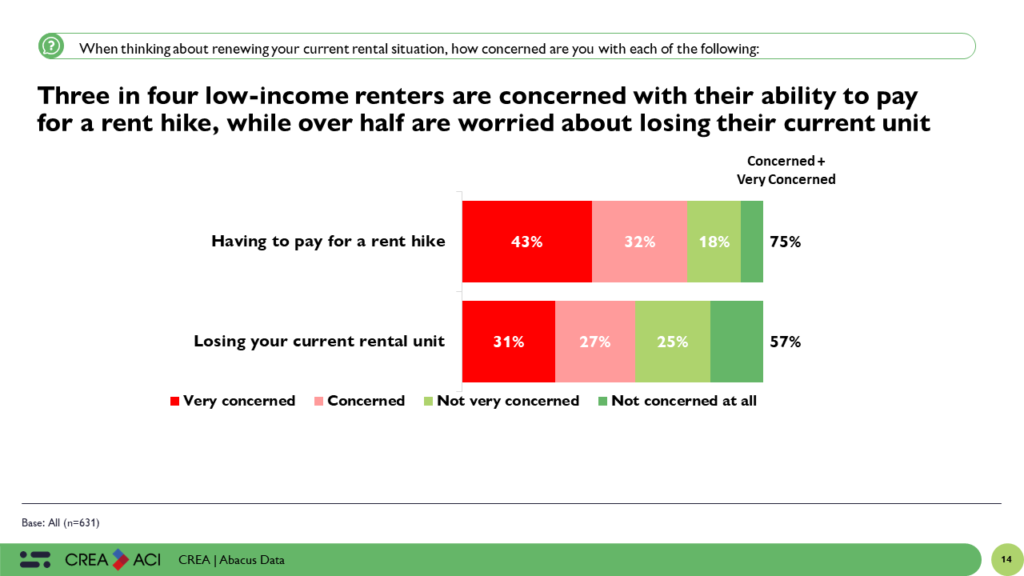

In addition to these pressing affordability challenges, three out of four low-income renters harbor apprehensions about their ability to handle potential rent increases. Beyond the issue of affordability, a substantial 57% of low-income renters worry about the possibility of losing their current rental units. These fears reflect the vulnerability of this group to any upward adjustments in rental costs, which could result in severe financial hardship or, worst-case scenario, eviction.

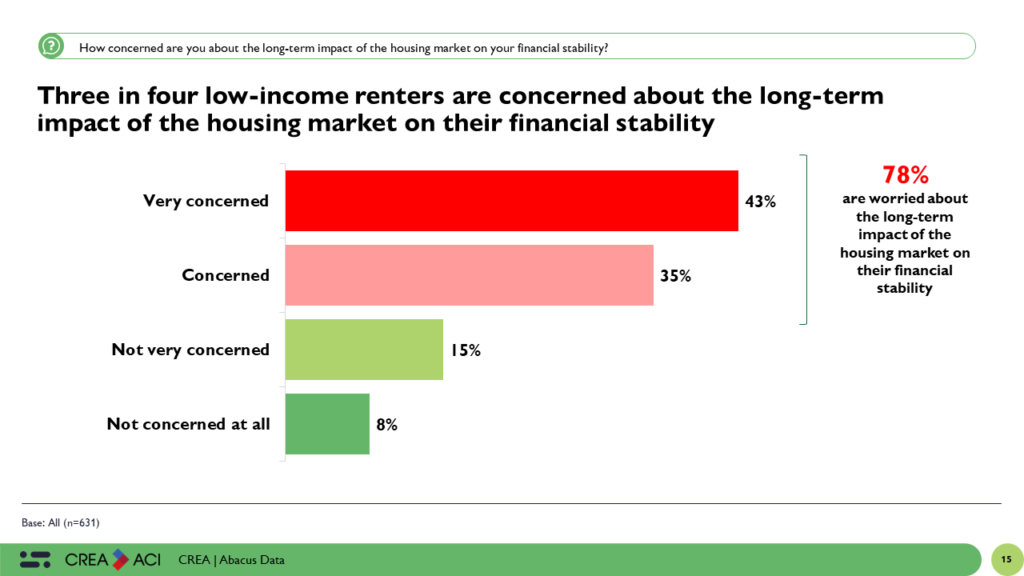

A distressing 78% of low-income renters express concerns about the long-term impact of the housing market on their financial stability. Once again, younger renters aged 18-34 (81%), those aged 35-50 (80%), and those aged 51-65 (80%) are particularly worried. These figures shed light on the broader implications of the housing crisis for the financial well-being of low-income Canadians, as it erodes their ability to save, invest, and plan for the future.

The data makes it clear: the housing crisis is not only about the immediate affordability challenges; it is also causing long-term financial instability and pervasive anxieties about housing security. Urgent and comprehensive solutions are needed to address this crisis, ensuring that low-income renters can find relief and stability in an increasingly turbulent housing market.

Potential Improvements to the Rental Market

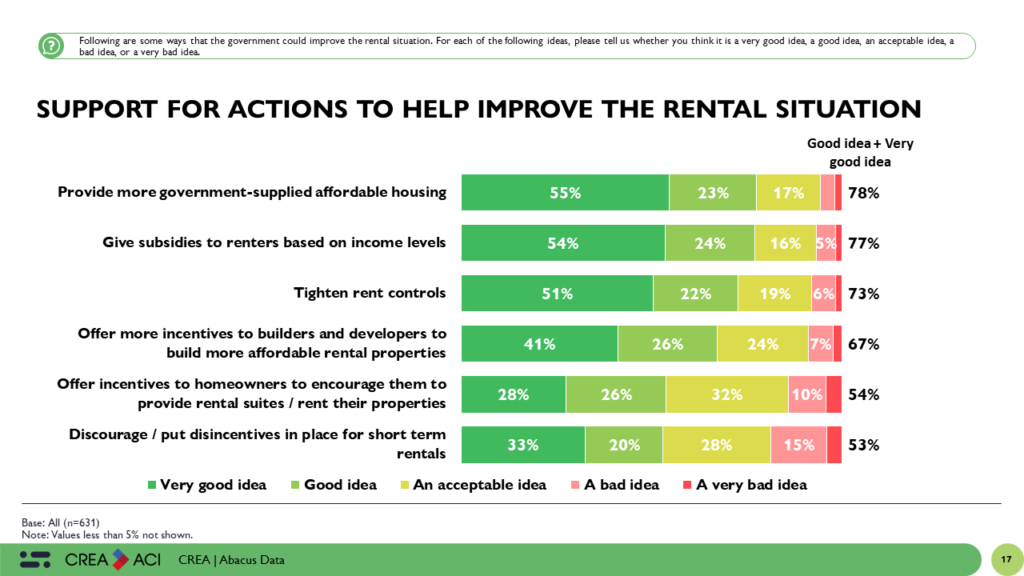

In addressing the housing crisis, low-income renters advocate for several key solutions. Specifically:

- 78% call for increased government-supplied affordable housing, recognizing the need for stable and affordable options;

- 77% support income-based subsidies to provide targeted assistance to those grappling with housing costs;

- 73% advocate for stricter rent controls, offering a safeguard against steep rent hikes and ensuring stability; and,

- 67% emphasize the importance of incentivizing developers to create affordable rental properties, which could expand the supply of rental units.

These results highlight the fact that low-income renters actively seek solutions that involve both government intervention and private sector involvement, underscoring the urgency of addressing housing affordability. Policymakers at all levels of government should heed these recommendations, working towards a more inclusive and just housing market where housing is a fundamental right accessible to all, regardless of income.

Varied Attitudes Toward Homeownership

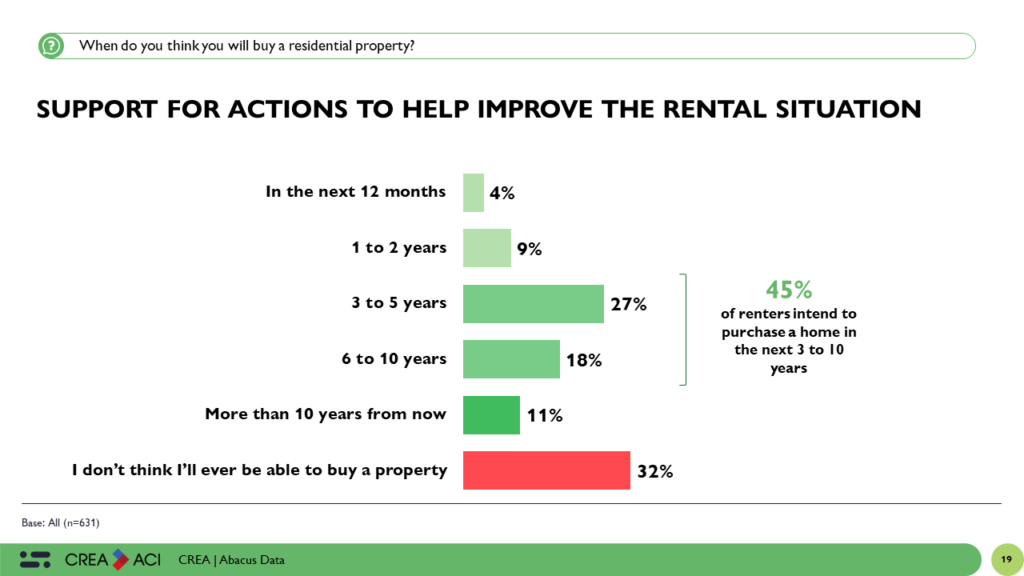

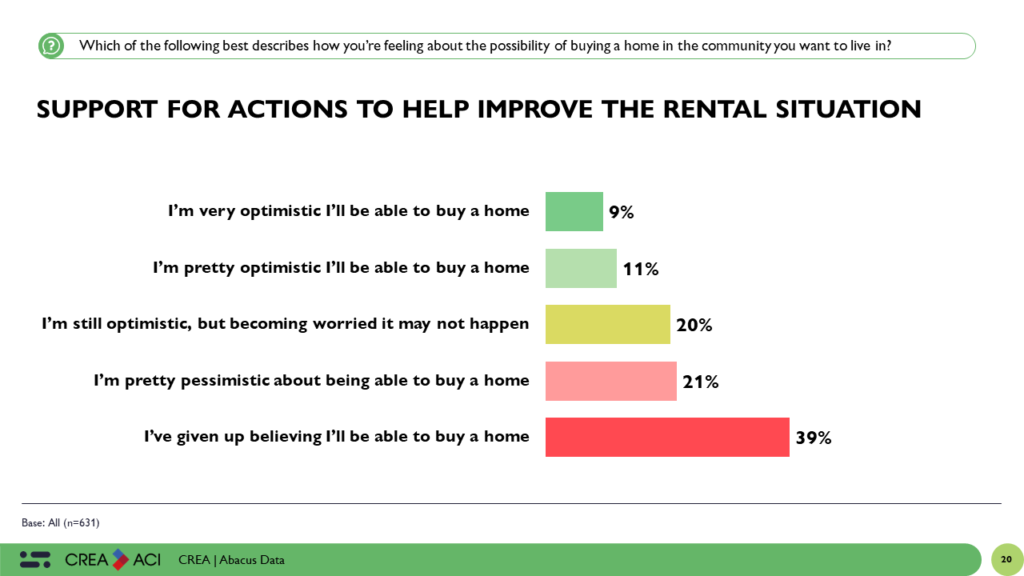

Among low-income renters, a striking 57% express a desire to own a home someday. When contemplating a home purchase, 45% of renters with annual household incomes of $50,000 or less note that they are likely to purchase a residential property within the next 3 to 10 years. However, 32% hold the belief that they may never be able to buy a property, underlining the persistent affordability challenges in the current landscape. Furthermore, over one-third of low-income renters have resigned themselves to the notion that homeownership may elude them (39%). This sentiment is particularly prevalent among older renters, with 65% of those aged 66 and above and 59% of those aged 51 to 65 sharing this perspective.

Conversely, younger renters, aged 18 to 34, retain a certain level of optimism regarding their prospects for future homeownership, with 40% expressing optimism in their ability to purchase a home. Nevertheless, 29% of younger renters concede that their optimism is gradually waning. This revelation underscores the imperative need for action to confront the housing crisis, as the dream of homeownership slips further from the reach of low-income renters.

The Upshot

In conclusion, the information presented here highlights the significant political implications of the housing crisis among low-income renters. This crisis is not merely a matter of political expediency; it represents a moral and societal imperative. The potential political consequences are twofold: short-term and long-term. In the short term, low-income renters are likely to demand swift and meaningful action to address their pressing needs. Their urgency for affordable housing has become a critical issue that politicians at all levels of government must grapple with as they seek the support of these voters.

In the long term, the political implications are equally significant. If the housing crisis persists, it threatens to deepen societal divides and exacerbate inequalities, leading to long-term discontent among low-income renters. It undermines their financial security, mental health, and overall quality of life. Over time, this discontent could crystallize into a mobilized political force advocating for comprehensive solutions to rectify the issue. The longer the crisis persists, the more intense this advocacy is likely to become.

The housing crisis among low-income renters is not just a challenge to be managed; it’s a call to action. It’s a test of our commitment to equity and the welfare of some of our most vulnerable citizens. We must listen to this call and work towards a more just and inclusive society, where access to safe and affordable housing is recognized as a human right that transcends income levels. The political landscape is shifting, and addressing the housing crisis is both a moral imperative and a political necessity for a better and fairer future.

Methodology

The survey was conducted with 3,500 Canadian adults from September 22 to 28, 2023. The current results focus on 631 low-income renters (i.e., household income of $50,000 or less). A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 3.90%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by the Canadian Real Estate Association (CREA).

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

About Abacus Data

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions

Find out more about how we can help your organization by downloading our corporate profile and service offering.