The Canadian Consumer Mindset in the Age of Permacrisis

We are already a month into the year, and it seems we are still holding our collective breath about what is to come financially for 2023. The labour market is still tight, inflation is running high (although it seems to be turning around expect for food and rent), interest rates jumped again just last week and may be holding for a while, and the shortage economy continues to cause disruption. As we brace for some kind of impact, Canadians are starting to make changes for a potential downturn.

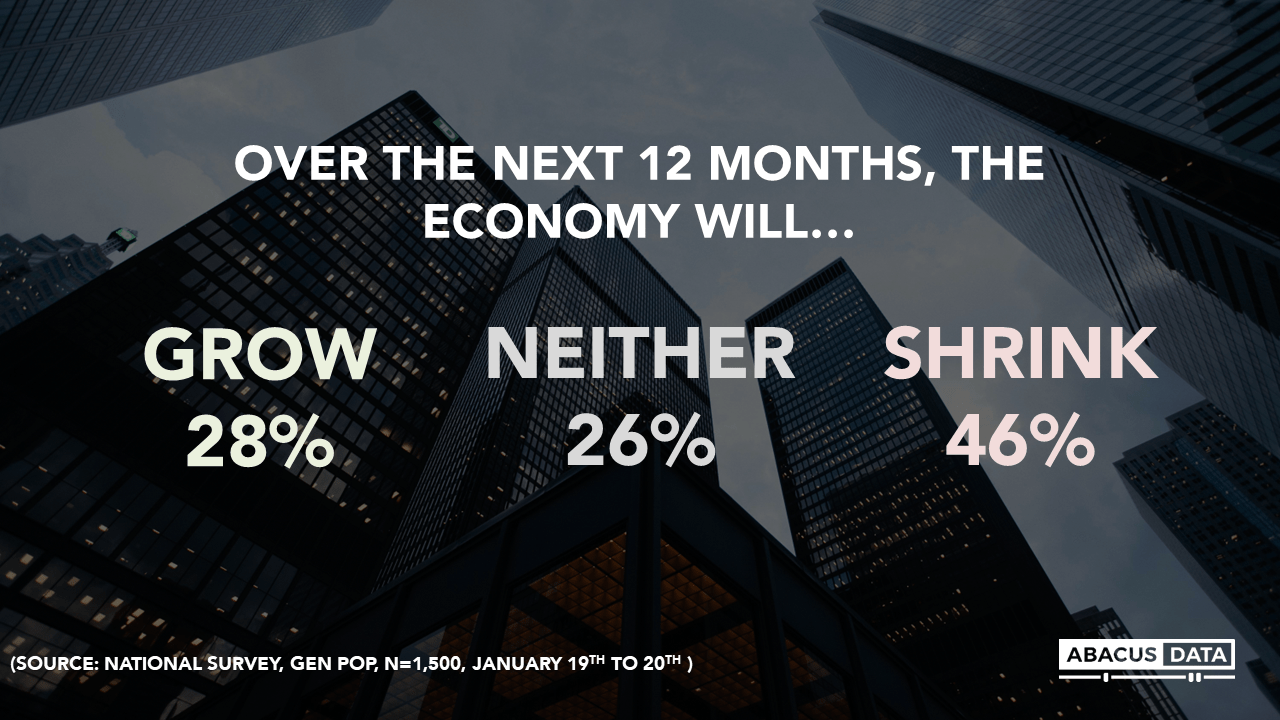

We conducted a national survey in mid-January to better understand how Canadian consumers are feeling as the year started. As researchers, we know how important perceptions are for understanding opinions and behaviour. And as it stands, the majority of Canadians aren’t confident about the economic big picture. Most Canadians predict a recession will hit in the next year- 46% predict the economy will shrink over the next 12 months.

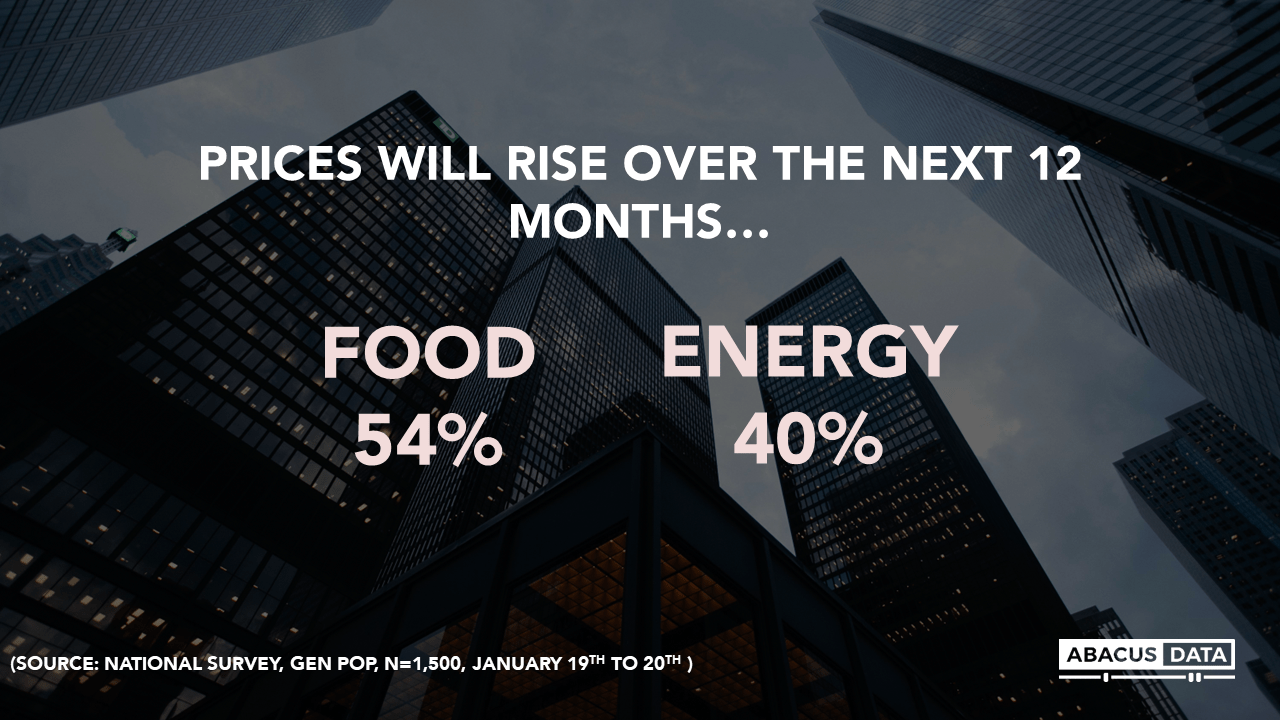

History tells us that prices of consumer goods tend to drop during recessionary periods, but Canadians anticipate high prices will continue throughout the year. 54% say the price of food will continue to rise over the next year. 40% say energy prices will rise over the next 12 months.

As a result, Canadians are making changes to their spending and savings habits to brace for what is to come.

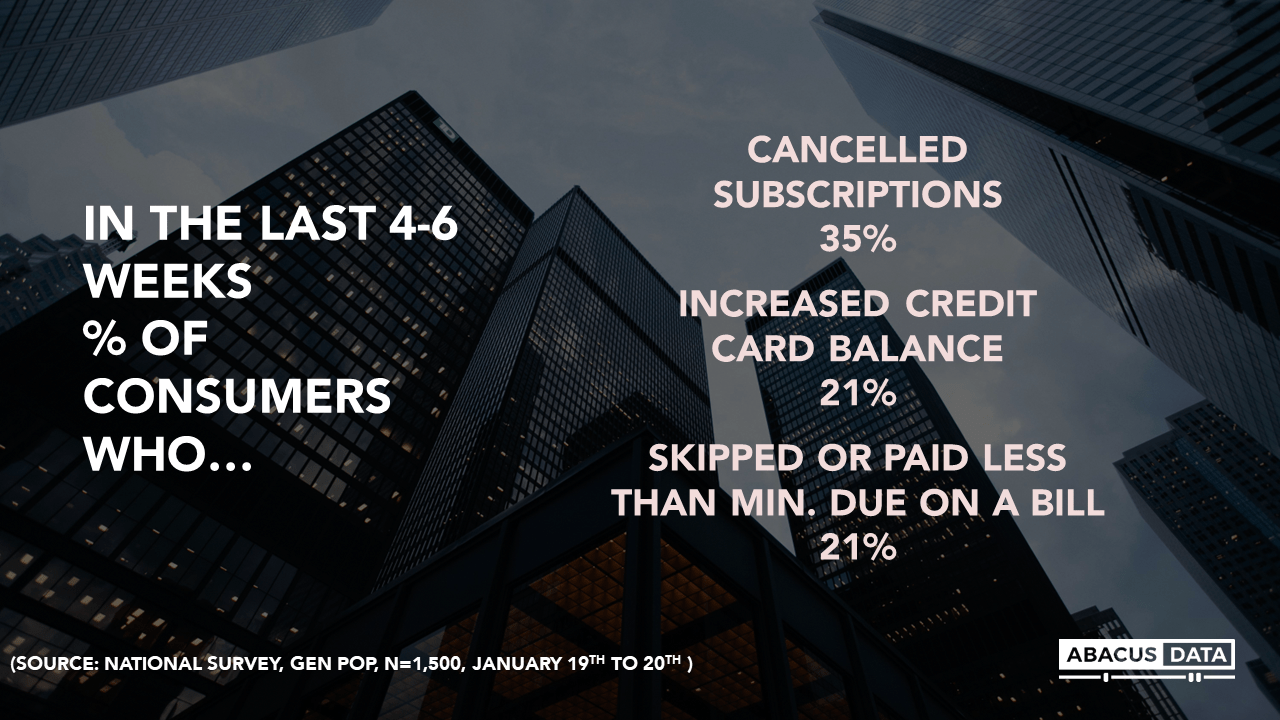

On the savings front, reoccurring expenses are being targeted. A third of Canadians have cancelled a monthly subscription in the last 4 to 6 weeks. But most Canadians are already at their limit, and rather than cutting expenses are looking on how to stretch their money further.

One in five Canadians have skipped a bill or paid less than minimum due for a bill in the last 4 to 6 weeks. A fifth have also increased their credit card balance to cover essential expenses.

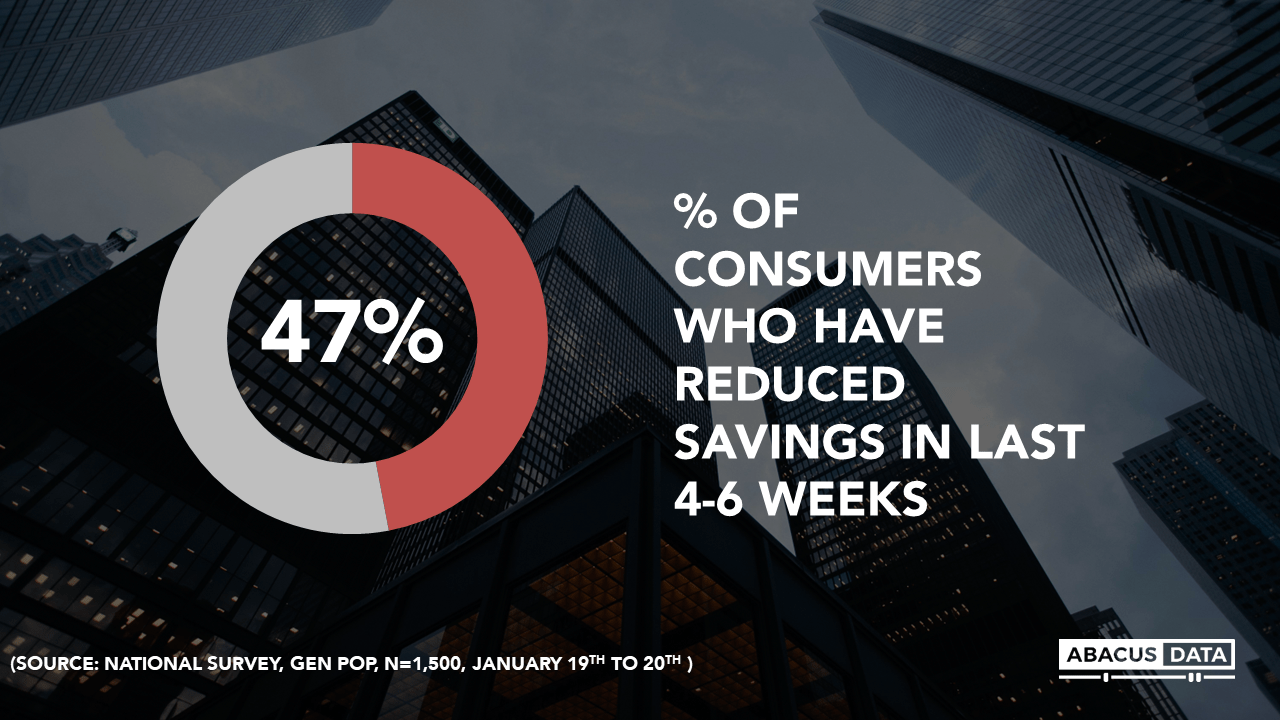

These pressures are also impacting our savings habits both in the short term and long term. For the past 12 months, half of Canadians have reduced their savings (either drawing from savings, or reducing the amount added). Families making $50K or less and parents of children under 18 are most likely to be dipping into their savings to make ends meet.

Canadians are also making changes to the funds left in savings. Of those with investible assets, 7% told us they lowered the risk profile of their investment savings in the last 4 to 6 weeks. Another 24% of Canadians are considering it. Among Canadians with investment savings, nearly half (43%) have reduced the risk profile of their investments or are considering doing so.

It’s clear that the financial outlook is impacting consumer behaviour but what if it were to quickly take a turn for the worse?

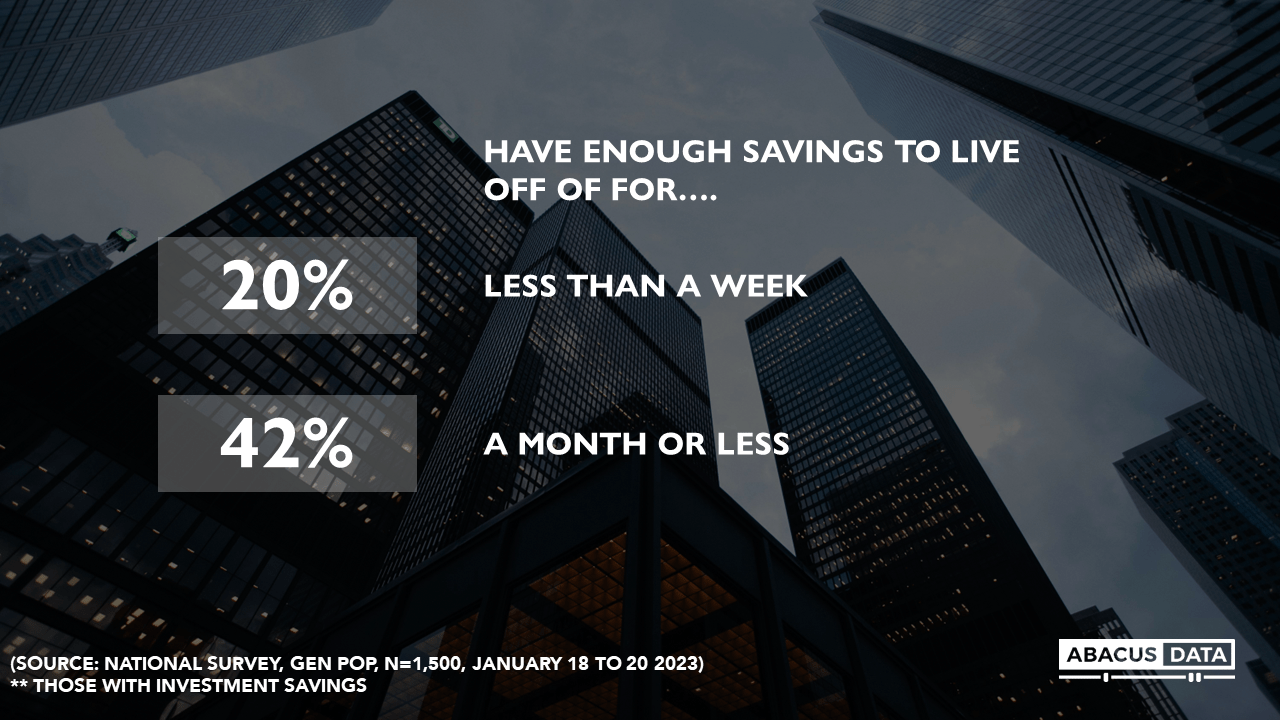

If they lost their job tomorrow, 20% of Canadians would only be able to live for a week on their savings. 42% wouldn’t be able to make it past a month. Millions of Canadians are living at their financial limit, even with their efforts to pinch pennies. Assessing the impact of this new consumer mindset – one where far more are being asked to do more with less while also balancing the pent up demand left over from the pandemic – is more important than ever for business leaders and policy makers.

THE UPSHOT

“There are a number of reasons to be concerned about the current financial outlook but one reason is just how many Canadians are living on the edge. One in five aren’t able to keep up with payments, even after making cuts to their spending. And very few Canadians are able to make adjustments on the savings front- 20% don’t even have enough savings to last more than a week. Consumers are well aware of the position they are in- governments and institutions should be paying attention to.”

“There are a number of reasons to be concerned about the current financial outlook but one reason is just how many Canadians are living on the edge. One in five aren’t able to keep up with payments, even after making cuts to their spending. And very few Canadians are able to make adjustments on the savings front- 20% don’t even have enough savings to last more than a week. Consumers are well aware of the position they are in- governments and institutions should be paying attention to.”

“The Canadian consumer mindset today is one of a split brain. Millions are having to cut back their day-to-day spending to respond to rising interest rates, inflation, and the prospect of a recession. At the same time, we also know that many also have big plans – things they want to do but couldn’t because of the pandemic. Some have called it “revenue inflation spending” – when consumers cut spending on day-to-day products and services but continue to splurge on travel, experiences, and luxury items.

“The Canadian consumer mindset today is one of a split brain. Millions are having to cut back their day-to-day spending to respond to rising interest rates, inflation, and the prospect of a recession. At the same time, we also know that many also have big plans – things they want to do but couldn’t because of the pandemic. Some have called it “revenue inflation spending” – when consumers cut spending on day-to-day products and services but continue to splurge on travel, experiences, and luxury items.

Most important to any consumer facing brand is the need to deliver exceptional customer service when labour and product shortages make this harder to do. A hospitality mindset, focused on delighting customers will drive revenue and profitability, especially when almost half of Canadian consumers believe that customer service generally has gotten worse over the past few years.”

For more information about this data, or to schedule a briefing with your team, please reach out to Oksana Kishchuk.

METHODOLOGY

The survey was conducted with 1,500 Canadian adults from January 27 to 30, 2023. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.