GameStop, Hedge Funds, and the Financial Market: What Canadians think and know

February 5, 2021

Unless we’re talking massive sectoral job losses, fat Sienna Senior Living dividends, or a former US President gloating on Twitter, it is hard for a story about financial markets to burst into the consciousness of everyday Canadians. Let alone one about the performance of a single stock. And yet this is the 2021 new cycle, and that’s exactly what happened when a Reddit forum met hemorrhaging strip mall video game retailer GameStop.

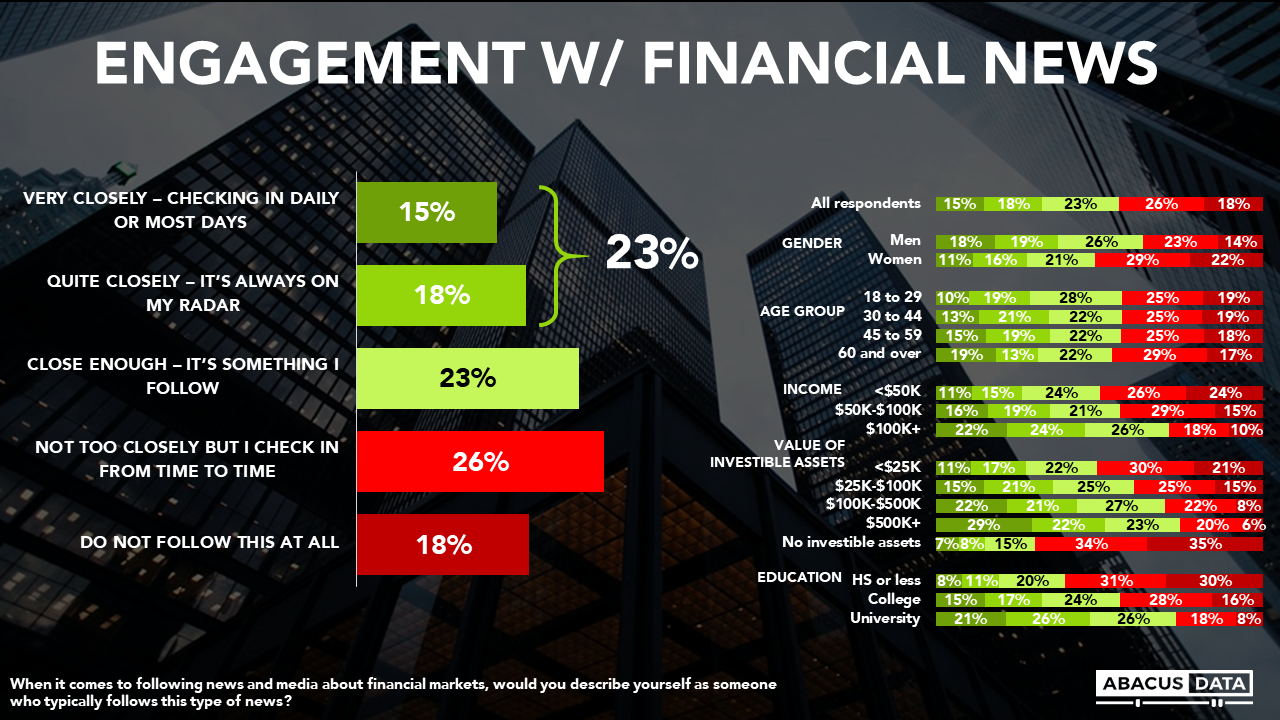

Very few Canadians follow the financial markets – or even understand its basic mechanics. Only 28% of Canadians follow financial news closely/actively. They tend to be overrepresented in wealthier, university-educated demographics with much more investable assets than most Canadians.

And yet by way of a David vs. Goliath narrative set up, the GameStop story burst through the financial news bubble, compelling vast attention from everyday Canadians who still need to work for a living.

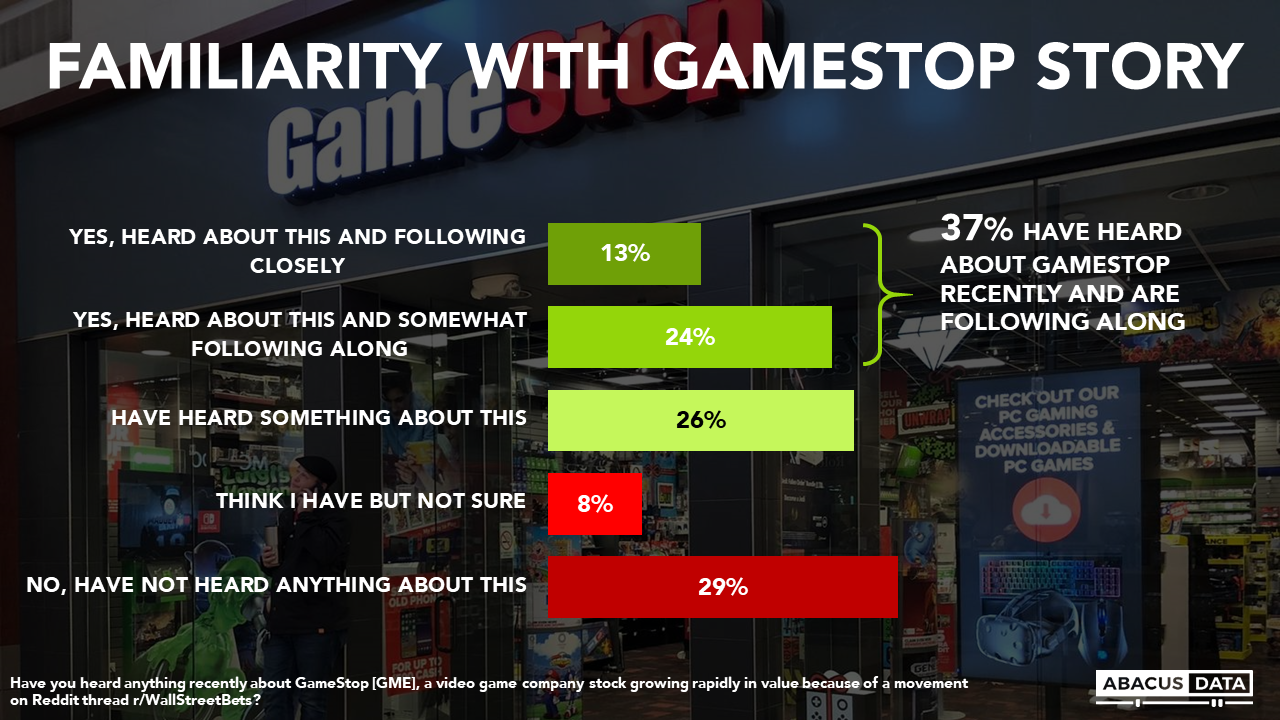

Fully 63% of the Canadian public have heard something about the story, while 4 in 10 are actively following along. Remarkably only 3 in 10 reports having heard absolutely nothing of the saga.

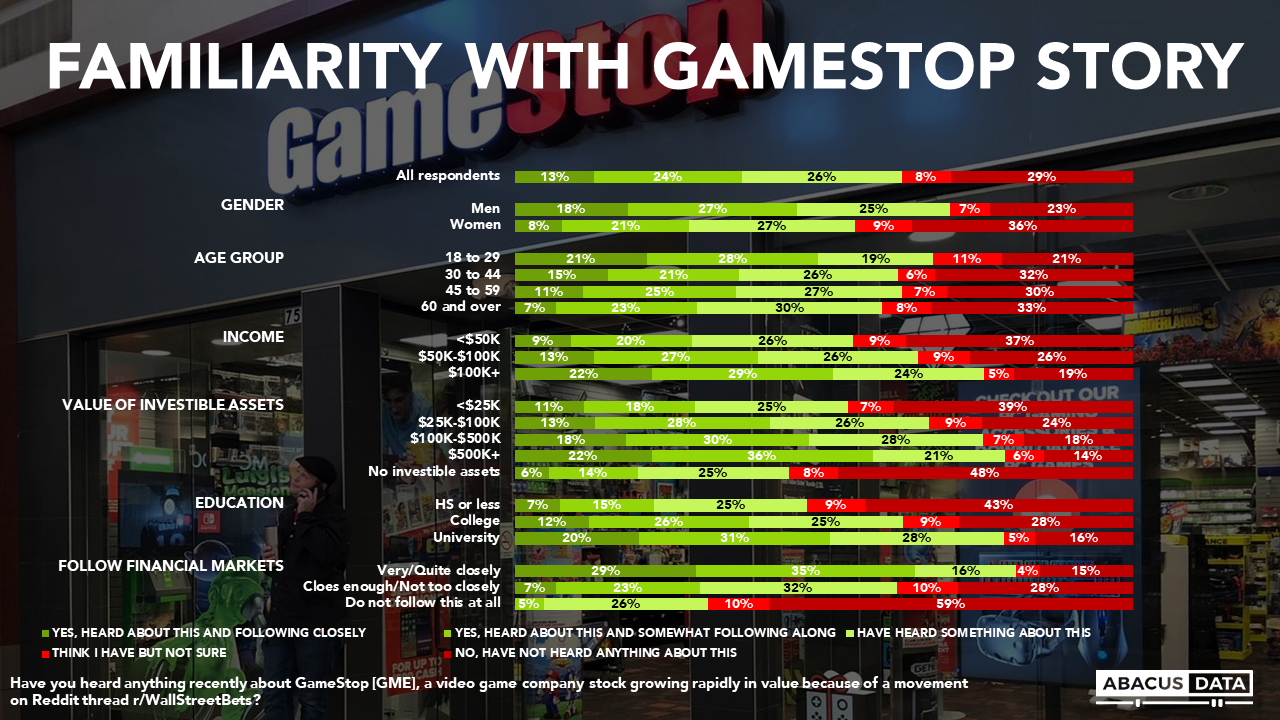

Segmenting this data between financial media consumers and normal people, we see significant proportions of each demographic following along, including 1 in 3 Canadians who do not follow financial news at all.

The story has especially captured the interest of younger, internet-savvy investors with high incomes and investable assets to spare. It’s a uniquely millennial saga, spurred by the forces of technological disruption and internet culture. And while its evolved to be much more complicated than the initial Joe Public takes on Wall Street write up, there are clear assumptions being made on the part of onlookers.

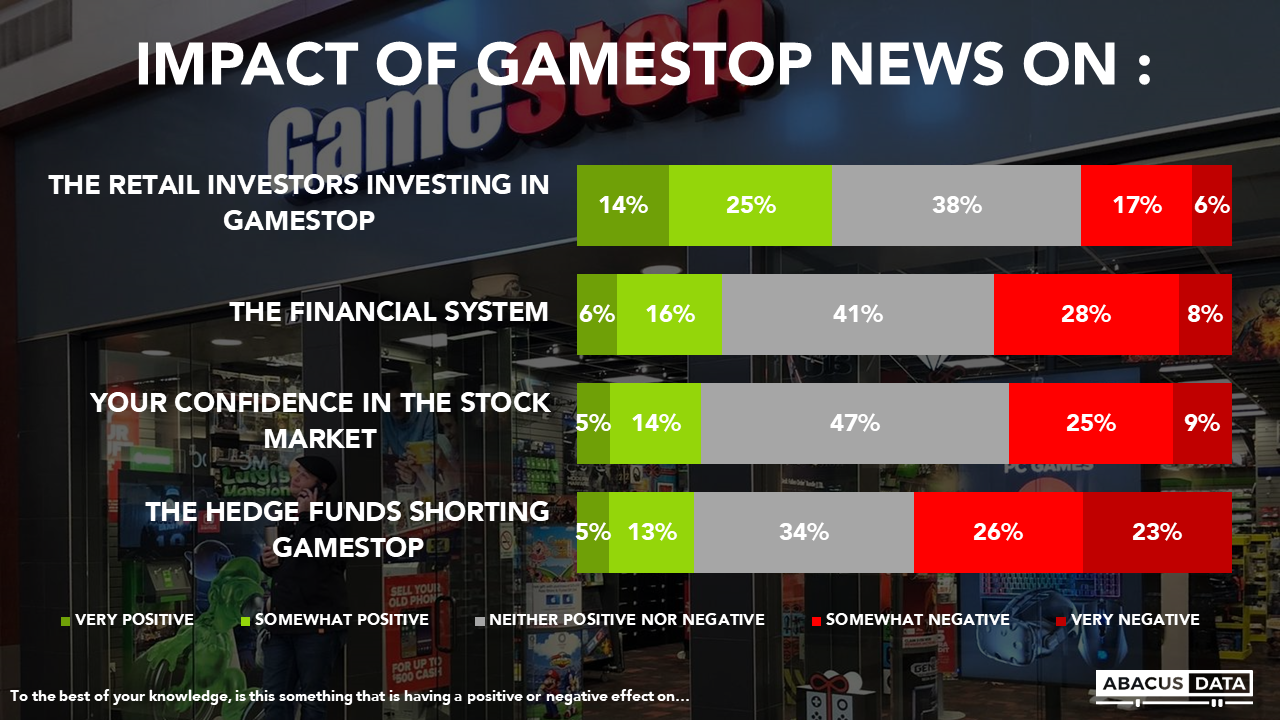

The prevailing worldview skews towards assuming that hedge funds shorting GameStop are on the losing end while the retail investors who invested in GameStop came out on top.

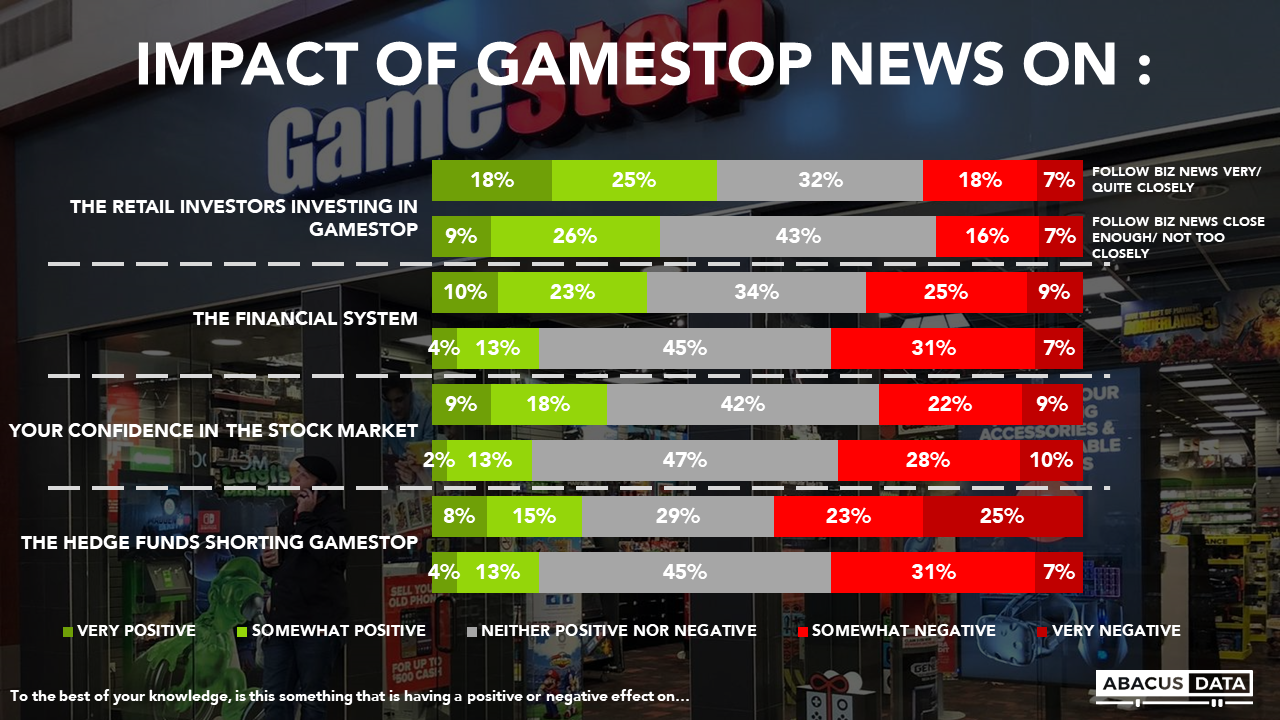

Additionally, 1 in 3 Canadians today believe the saga has had a negative effect on both the financial system generally, and moreover, on their personal confidence in the stock market specifically.

These views don’t differ much based on self-reported financial news consumption. One difference seems to be that more sophisticated news consumers are twice as likely to believe that this is a positive development for the financial system and that their confidence in the stock market has been improved. However, both segments seem clear on who the winners and losers are.

UPSHOT

The narrative arc of the GameStop story pierced the Wall Street bubble, growing into a general interest political narrative of David versus Goliath. It highlighted both elements of market manipulation and double standards in our financial system as well the emerging influence of retail investors.

Bedfellows as strange as Ted Cruz and AOC came together to denounce Robinhood and other retail investment apps for their decision to freeze further buying of the equity, and day by day we are learning more about the role of moneyed interests on both sides.

What we can conclude with confidence today is that the traditional cultures of and access to financial markets are being disrupted by technology and widening consumer awareness. Episodes like this will only reinforce the political will to explore both welcomed and unwelcomed solutions to protect consumers from market manipulation, while at the same time introducing new retail investors to these DIY platforms. The democratization of financial market participation, already spurred by fintech players and bolstered by content creators and communities on Reddit, Twitter, and TikTok, ensures that this may not be the last time we encounter meme-spurred market volatility.

Interested in a deeper dive on the latest polling in the run-up to a possible election? Register today for David’s new webinar series inFocus with David Coletto on February 9, 2021.

And don’t miss any of our research and analysis, plus get our weekly Worth A Look newsletter. Sign up today.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

Find out more about what we are doing to help clients respond to the COVID-19 pandemic.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

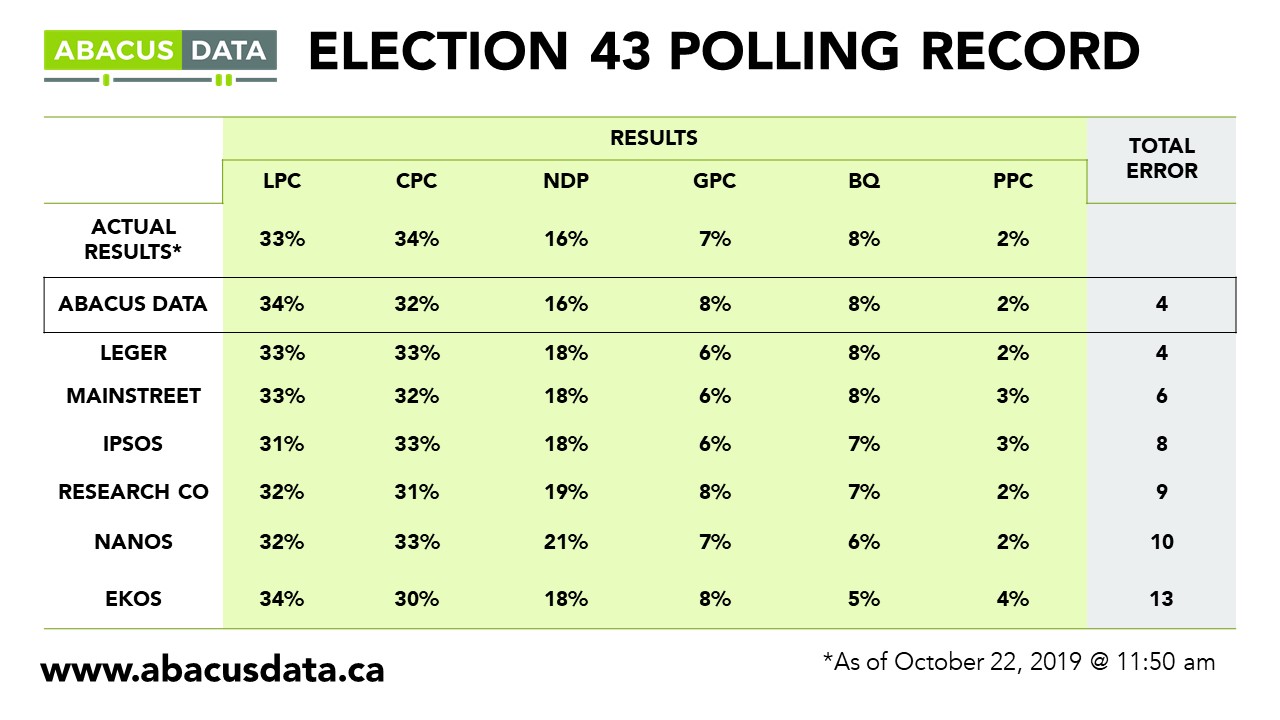

We were one of the most accurate pollsters conducting research during the 2019 Canadian Election.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.

METHODOLOGY

The survey was conducted with 2,200 Canadian adults from January 29 to February 3, 2021. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.1%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.