Carney Government Report Card: Canadians Still Prioritize Cost of Living and Housing as Support for Carney Government’s Agenda Holds Steady

December 2, 2025

When Mark Carney became Prime Minister earlier this year, he promised a new way of governing. A leadership built on strategic discipline, clearer expectations, and a tighter focus across a sprawling federal system. Rather than issuing dozens of mandate letters, Carney set out a unified set of seven national priorities meant to guide every minister and every department. The message was unmistakable: Canadians should judge this government not by its announcements, but by its progress.

Over the fall, that approach has begun to take shape. The government delivered its first budget, introduced several high‑profile initiatives, and attempted to map out a more cohesive economic agenda. But the past few months have also raised questions, particularly around Canada’s relationship with the United States, where mixed signals and shifting emphases have left the public unsure about the government’s direction. Add to that the ongoing pressures of affordability and housing, and the clarity of the seven priorities has only increased expectations for results.

More than ever, what Canadians perceive matters. Clear priorities create clarity, but they also create accountability. When the public knows what the government says it’s trying to accomplish, they’re better positioned to notice whether it falls short or reward it when it succeeds.

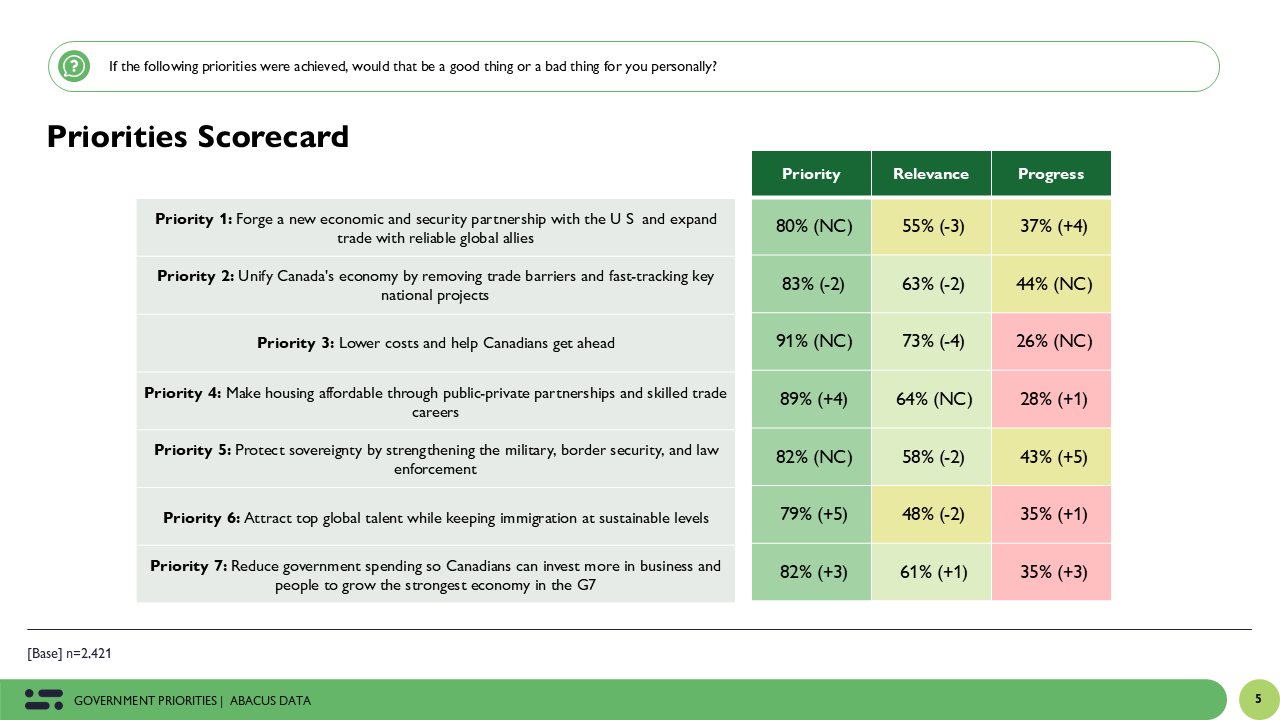

Back in June, we began tracking how Canadians view the importance, personal relevance, and progress on each of these seven priorities. We followed up in August. Now, after the government’s first budget and a consequential fall agenda, we present the latest results from late November.

As Mark Carney’s new Liberal government continues to roll out its agenda, our latest wave of tracking data offers a clear picture: public priorities remain remarkably consistent, and while Canadians see value in almost all seven focus areas, belief in government progress is still limited.

The survey, conducted with 2,421 Canadians from November 20–27, 2025.

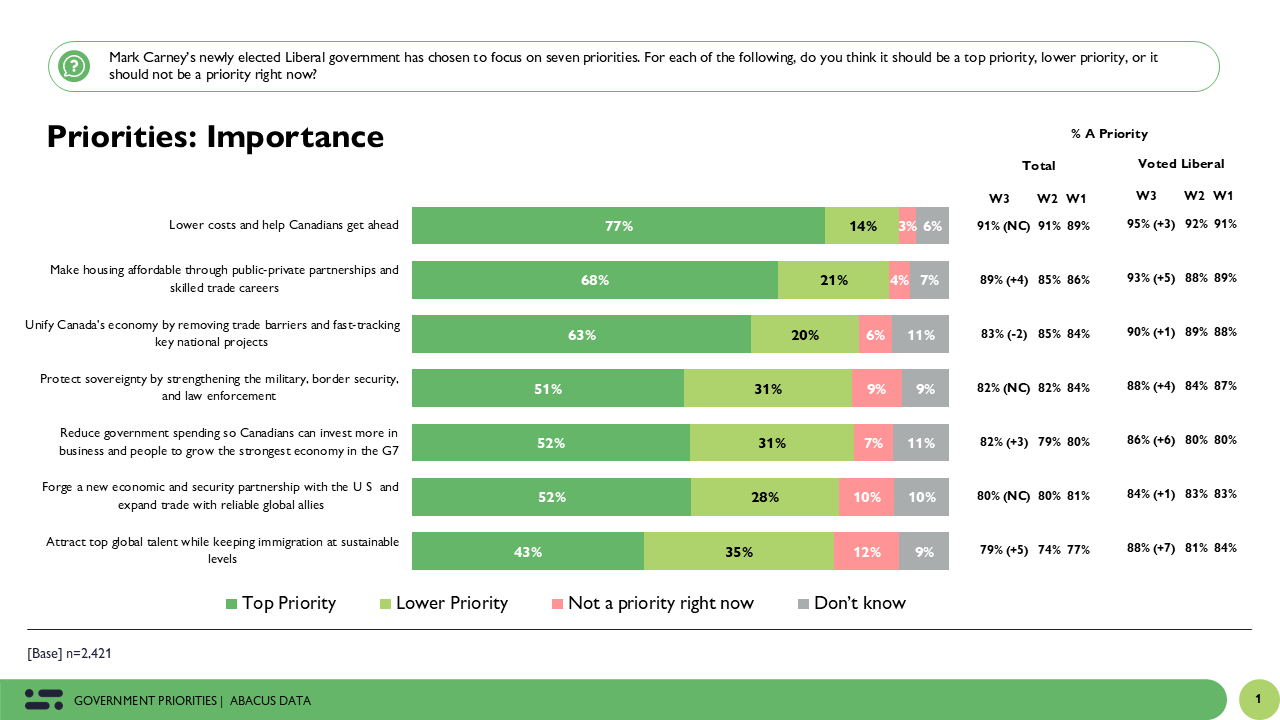

Priority Importance: A Stable Hierarchy of What Matters Most

Little has shifted in terms of what Canadians want the government to focus on most. The top priorities from previous waves remain at the top today.

- 91% say lowering costs and helping Canadians get ahead should be a priority (NC).

- 89% say making housing affordable is a priority (+4).

There is little change among the mid-tier priorities:

- 83% say unifying the economy is a priority (-2).

- 82% say protecting sovereignty is a priority (NC).

- 82% say reducing government spending is a priority (+3).

- 80% say forging a new economic & security partnership with the U.S. is a priority (NC).

Attracting talent, perhaps to stimulate the economy, has grown in importance since the summer.

- 79% say attracting global talent at sustainable immigration levels is a priority (+5).

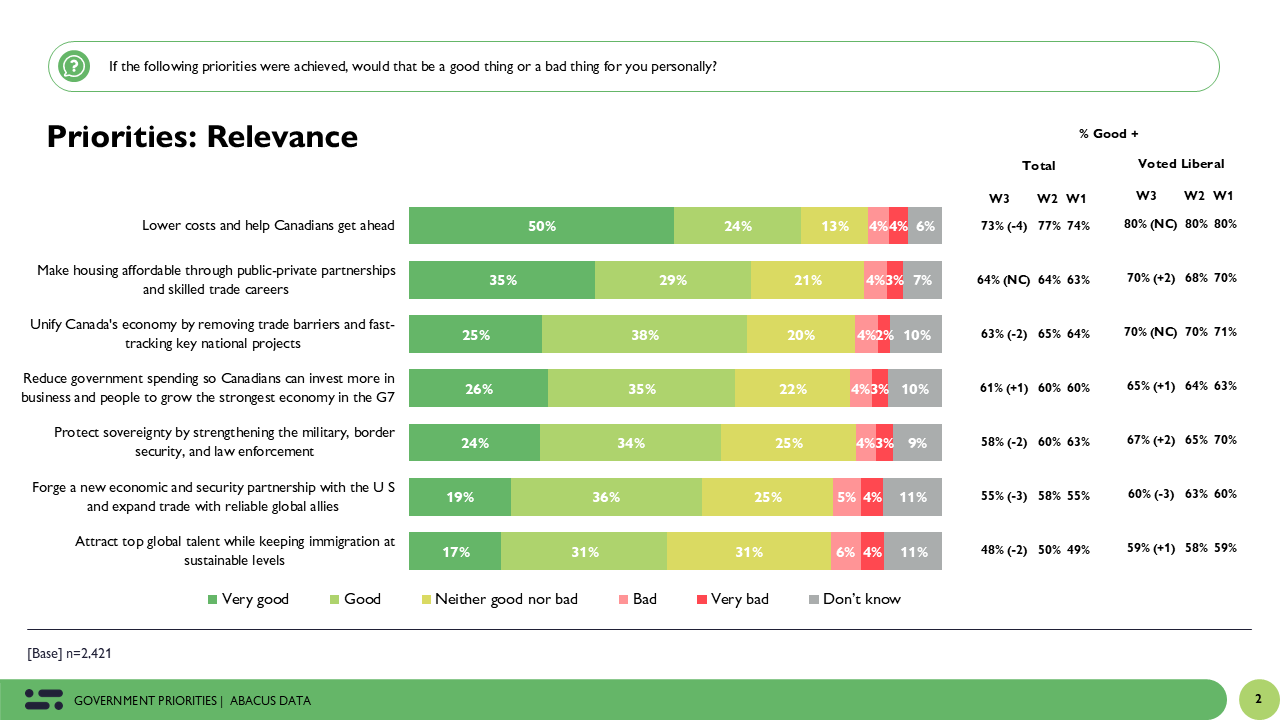

Personal Relevance: Good Outcomes, but Declining Intensity

Canadians overwhelmingly believe these priorities would be beneficial, but enthusiasm has softened.

The biggest shift is in lowering costs, perhaps a critique of the current economic approach proposed by Carney and his first budget.

- 73% say lowering costs would be good personally (-4).

Other changes down the list are negligible.

- 64% say the same for improving housing (NC).

- 63% believe unifying the economy would help them (-2).

- 61% say reducing government spending would benefit them (+1).

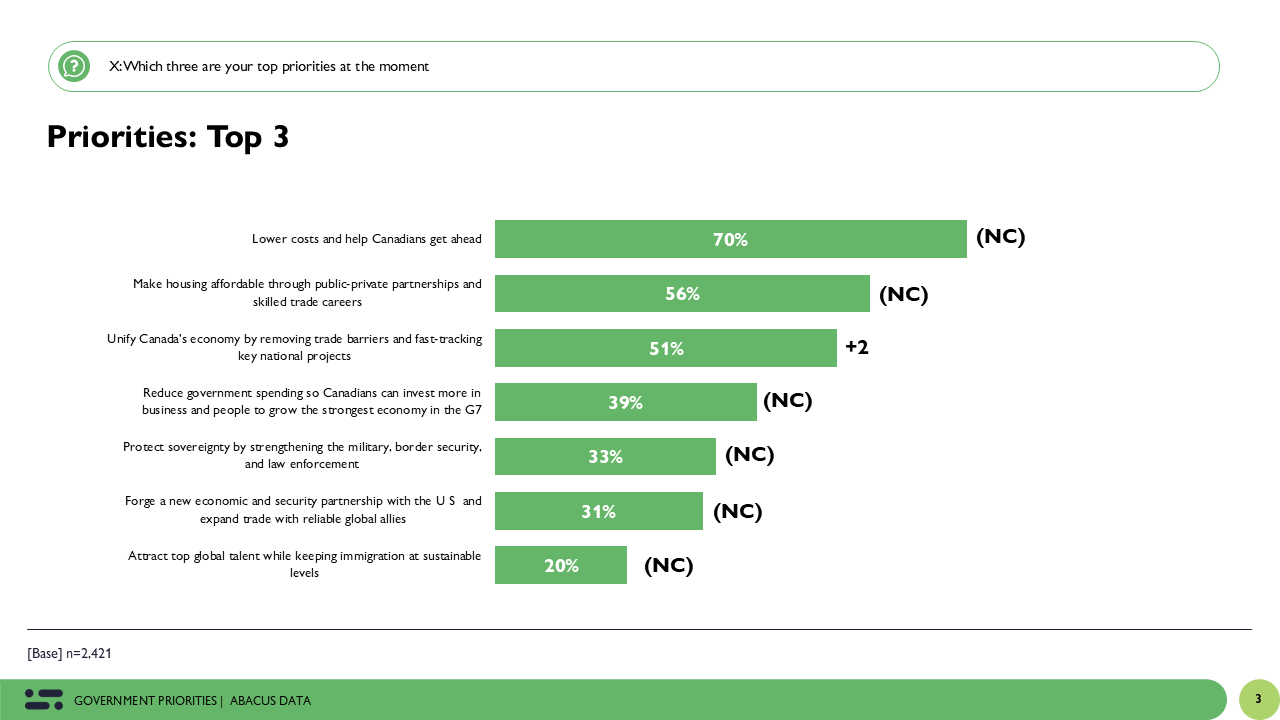

Asked to pick their current, top three priorities, lower costs is a clear front runner- 70% place it in the top three. It is also a unifier; the top issue across age, vote, and region of the country.

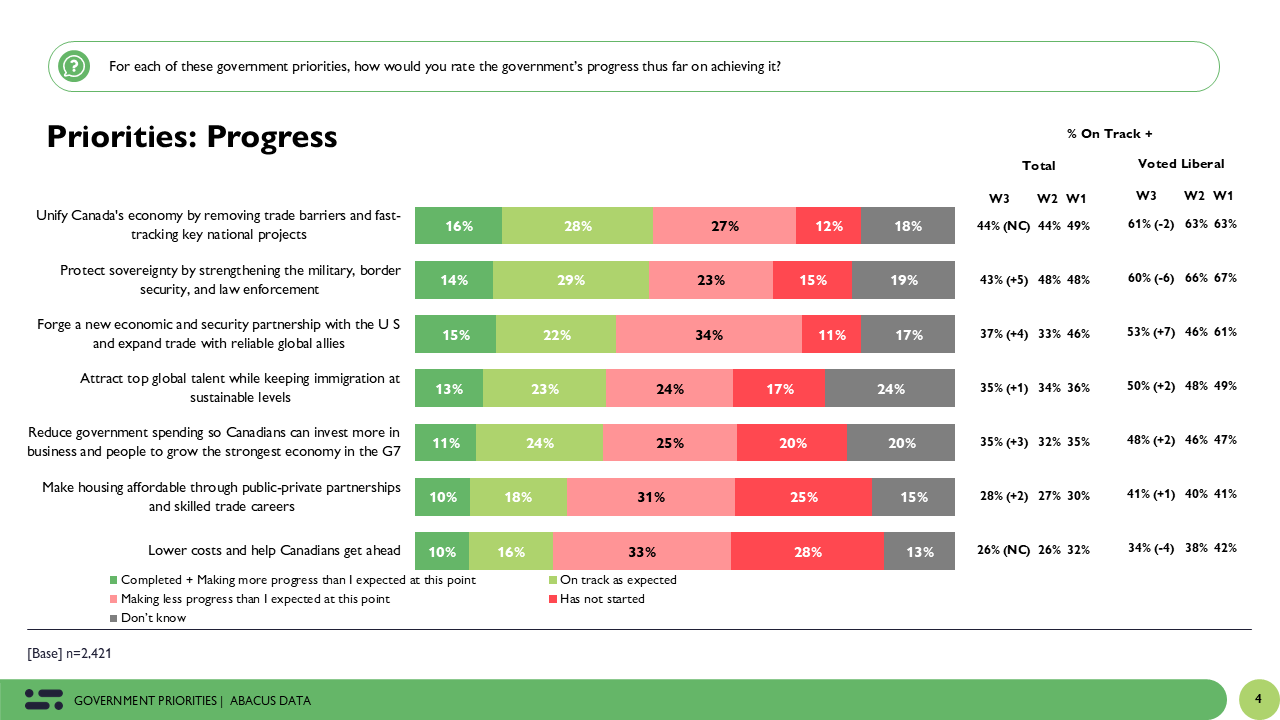

Progress: A Persistent Weak Spot for the Carney Government

Despite the movement we’ve seen on some priorities, the overall story on progress is one of moderation rather than momentum. Canadians aren’t punishing the government for failing to deliver, but they’re not rewarding it either. Most people still feel things are roughly where they were a few months ago—and in politics, that kind of stasis can be just as risky as decline.

Part of this is structural. The problems Canadians most want solved, lowering costs and making housing more affordable, are the very problems least likely to produce quick wins. But expectations remain sky-high, and when people don’t see visible, tangible improvements in their day-to-day lives, even steady or incremental progress can feel like no progress at all.

Another factor is narrative clarity. While the government has been busy with budget rollout, new initiatives, shifting geopolitical messages, Canadians aren’t yet connecting that activity to results. Progress doesn’t just need to happen; it needs to feel like it’s happening. And right now, most people are still waiting for that feeling.

Progress perceptions remain modest, with three areas seeing progress since the summer:

- 43% say protecting sovereignty is on track (+5).

- 37% say forging a U.S. partnership is on track (+4).

- 35% say reducing government spending is on track (+3).

Scorecard Summary

The good news for the Carney government is that the floor hasn’t dropped out. Canadians continue to give the benefit of the doubt on several files, and many remain open to the idea that progress is possible. But the lack of major shifts suggests a public that is watching closely, growing more impatient, and increasingly in “show me” mode. In this environment, stability isn’t failure—but it’s not success either. It’s a holding pattern, and holding patterns don’t last forever.

Bottom Line

The Carney government retains a strong mandate on its chosen priorities. Canadians continue to endorse the direction, the focus, and the disciplined approach the Prime Minister has laid out. But the gap between what people want and what they think is actually happening remains stubbornly wide and even as the government has taken steps to demonstrate progress, the public hasn’t yet caught on.

Over the past few months, there have been clear moments where the government tried to signal movement: the first budget, a series of major policy announcements, and a renewed emphasis on economic coordination with provinces and allies. These were intended to show Canadians that the priorities were more than words on paper. Yet for most people, those signals haven’t translated into a sense that progress is being made especially on the issues they feel most acutely, like the cost of living and housing.

Part of this disconnect may be timing. Progress on large, complex files takes time to materialize, and the impacts of budget measures or regulatory changes often lag the announcements themselves. But part of it is perceptual: Canadians don’t yet feel, see, or experience enough change to update their views. The result is a government that is active and busy, but still struggling to convince people that its activity is producing results.

For the Carney government, this creates both a challenge and an opportunity. The challenge is that patience is not unlimited. High expectations, once unmet, can quickly turn into doubts about competence or credibility. The opportunity, however, is that Canadians still want the government to succeed on these priorities and remain open to believing it can.

Methodology

The survey was conducted with 2,421 Canadians from November 20 to 27, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 1.99%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, and region. Totals may not add up to 100 due to rounding.

About Abacus Data

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.