To reduce the deficit, Canadians want increased taxes on the wealthy and large corporations

August 11, 2021

88% WANT TO SEE A WEALTH TAX INCLUDED AS PART OF A POST-PANDEMIC RECOVERY PLAN.

Pour l’analyse de la langue française, cliquez ici

In mid-July, the Broadbent Institute and the Professional Institute for the Public Service of Canada commissioned Abacus Data to conduct a national public opinion survey to explore attitudes and opinions about the federal deficit and the post-pandemic recovery.

The survey found:

HOW TO DEAL WITH THE DEFICIT

1. To reduce the deficit, most think that taxes on lower- and middle-income households will rise and programs and services will be cut, but most want to see loopholes closed and taxes increased on the rich and corporations. A majority of Canadians think that in order to reduce the deficit, the federal government will need to increase taxes on lower- and middle-income Canadians and cut programs and services. But, when asked to rank their preferred way to reduce the deficit, overwhelming majorities would like to see taxes on large corporations and wealthy people raised and loopholes closed. Increased enforcement of existing tax laws and natural economic growth with the next highest-ranked options.

A majority of Liberal, Conservative, and NDP supporters rank increasing taxes on large corporations and wealthy people as a top priority when it comes to reducing the federal deficit.

2. Few Canadians think tax increases on large corporations and wealthy people will negatively impact them. When asked whether the same ideas for reducing the deficit will have a positive or negative impact on them personally, only 6% felt that raising taxes on large corporations and wealthy people will have a negative impact on them. The same is true for closing loopholes or increasing enforcement of existing tax laws. In fact, a majority feel raising taxes on the rich and large corporations and closing loopholes will have a positive impact on them.

3. But most think program and service cuts and tax increases on lower- and middle-income people will have a negative impact on them. In contrast, most think that if taxes were raised on lower- and middle-income people or if programs and services were cut to deal with the deficit there would be a negative impact on their lives.

4. Most Canadians don’t think you can reduce the federal deficit and pay for the pandemic without increasing taxes. Although most people don’t want taxes raised on lower- and middle-income households, most Canadians don’t think it’s possible to reduce the deficit and pay for the pandemic without some form of tax increase. This view is consistent across the political spectrum. 58% of Liberal, 59% of Conservative, and 63% of NDP supporters feel this way.

WHAT CANADIANS WANT IN A POST-PANDEMIC RECOVERY PLAN

1. Don’t cut healthcare, education, or other important social programs. 92% of Canadians say that a post-pandemic recovery plan should include a promise not to cut funding for healthcare, education, or other important social programs. 54% say it is a must have.

2. 88% want to see a wealth tax of 1% paid by the wealthiest Canadians included in a post-pandemic recovery plan. 54% say a wealth tax is a must have while another 34% say it is a nice to have. A wealth tax is as popular an idea as not cutting health or education spending.

3. Reduce health-related costs, build more affordable housing and don’t raise the HST. Beyond promising not to cut health and education spending and bringing in a wealth tax, Canadians also want to see a plan to reduce health-related costs, more affordable housing, and a promise not to raise the HST in a plan to pay for the post-pandemic recovery and make life more affordable.

UPSHOT

As a federal election call looms, Canadians believe that it won’t be possible to reduce the deficit without some form of tax increase. While they worry that lower- and middle-income households will be asked to pay more, the overwhelming view is that those who have the most – large corporations and the wealthiest Canadians – should be asked to pay more to help reduce the deficit and pay for the post-pandemic recovery.

The survey results confirm the cross-partisan nature of public opinion on these questions. Conservative supporters are almost as likely as NDP or Liberal supporters to support implementing a wealth tax or raising taxes on the rich or large corporations.

And as the debate about what to do about the deficit and paying for the post-pandemic recovery heats up, there’s a warning in these numbers. Canadians don’t want to see cuts to cherished programs and services, they don’t want an HST increase but they do want governments to tackle affordability issues – around housing and health-related costs – and ask the richest and largest corporations to pay their fair share.

A plan that raises taxes on the wealthy, closes loopholes, and increases enforcement of existing taxes laws are politically low risk, high reward solutions. Few think they will be hurt by those measures and many think they will benefit in the long run.

METHODOLOGY

Our survey was conducted online with 1,500 Canadians aged 18 and over from July 13 to 19, 2021. A random sample of panellists was invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

Find out more about what we are doing to help clients respond to the COVID-19 pandemic.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

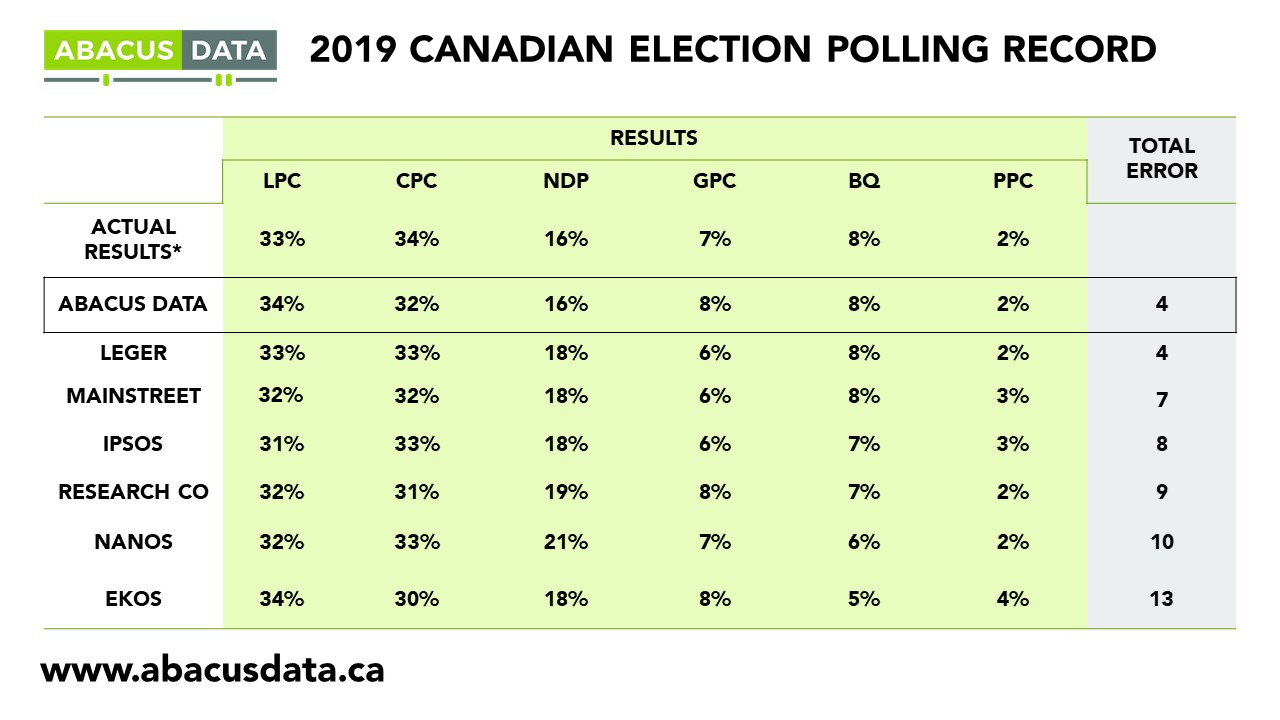

We were one of the most accurate pollsters conducting research during the 2019 Canadian Election.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.