Canadian Politics Update: A more competitive political landscape

October 26, 2017

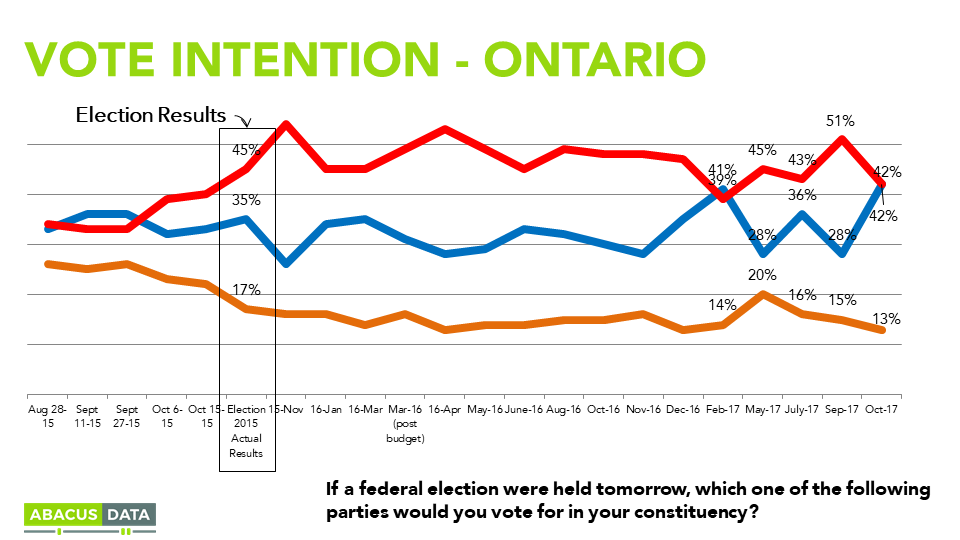

Over the late summer, Canada’s political situation became more competitive, as Liberal Party support dipped, and the Conservatives saw gains. Today, an election would see 39% vote Liberal, 35% Conservative and 15% NDP.

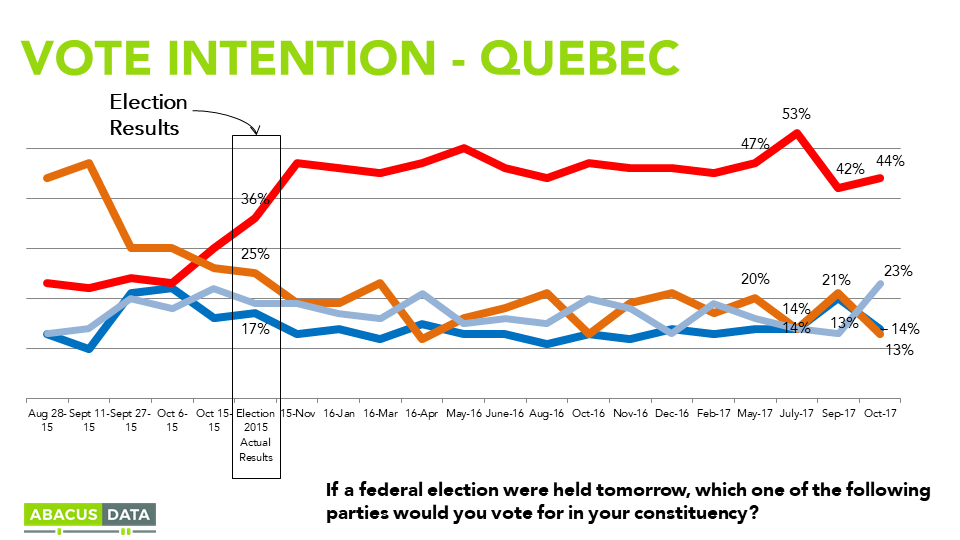

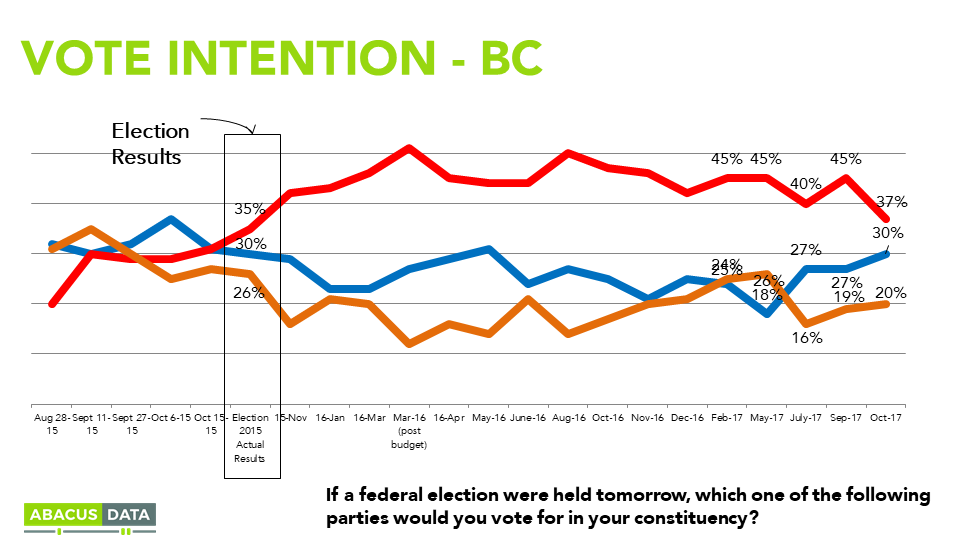

The biggest regional races show a dead heat in Ontario, a narrowing Liberal lead in BC, while in Quebec the Liberals continue to lead by 21 points, although we do see a rise in BQ support.

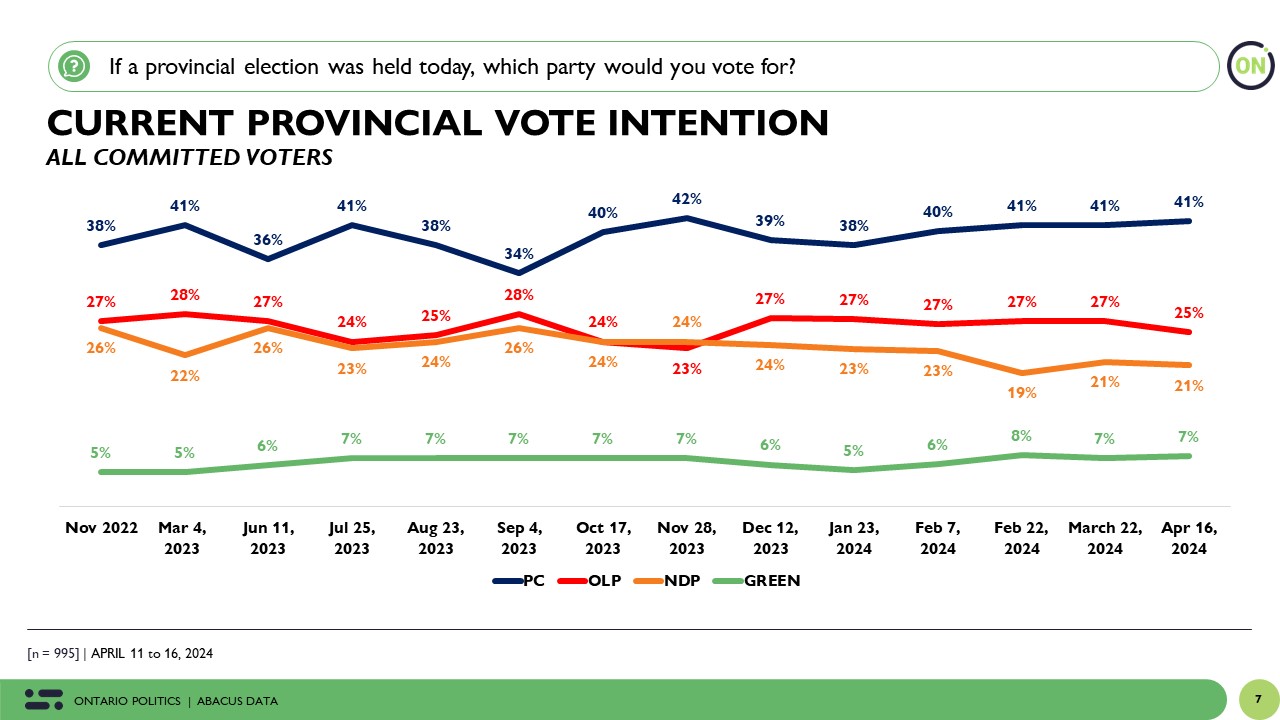

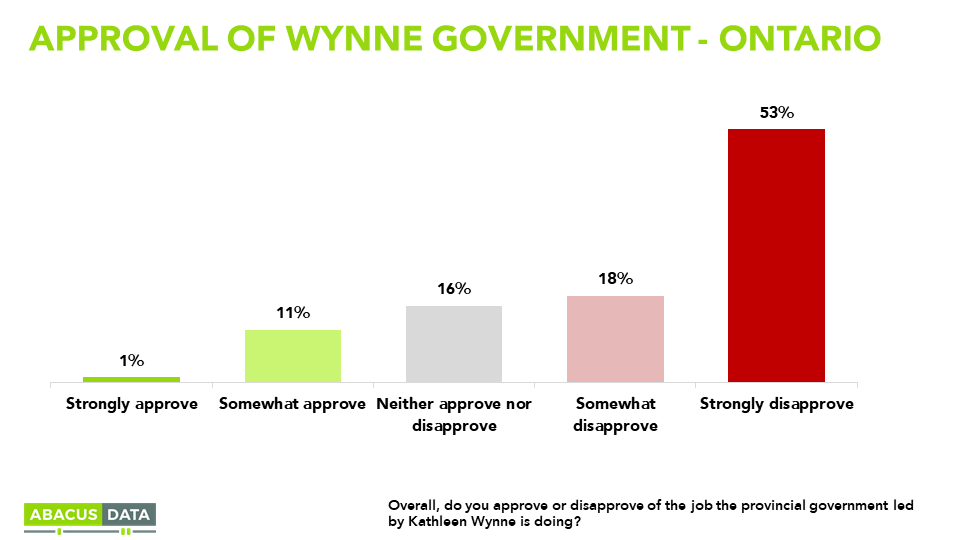

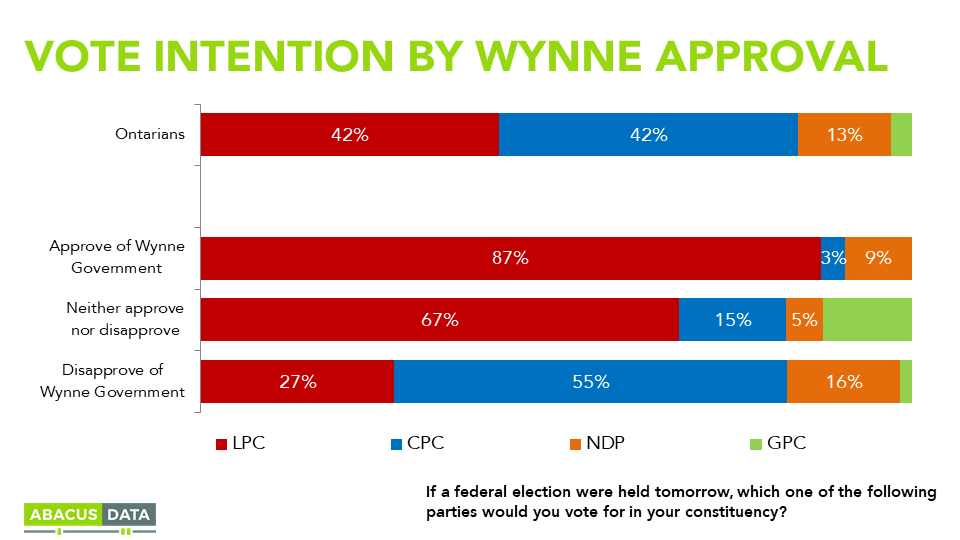

One factor that hampers federal Liberal fortunes in Ontario is the unpopularity of Premier Wynne’s Liberal provincial government. Fully 71% in the province disapprove of the job being done by the Liberals provincially, and among those people, the federal Liberals trail the federal Conservatives by a whopping 28 points.

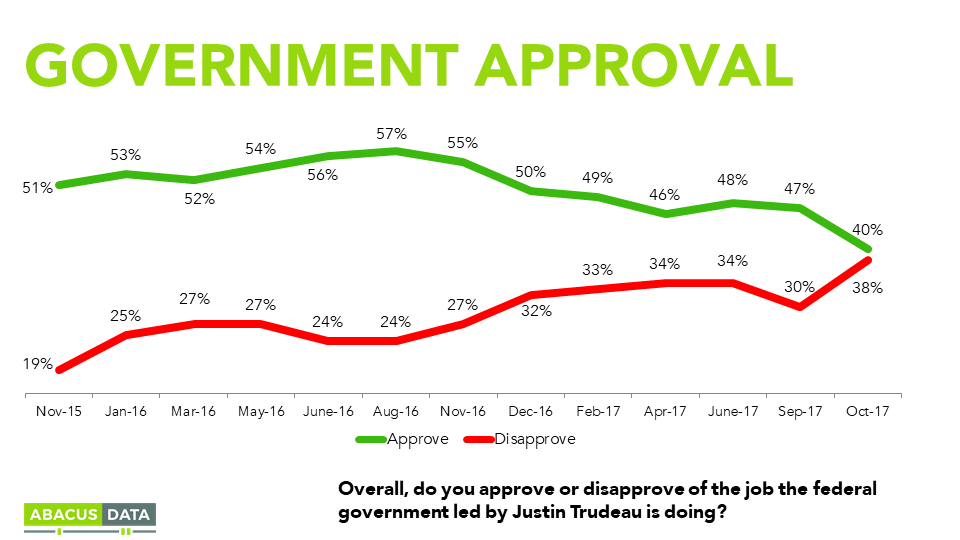

However, the challenges of the Wynne government are only part of what’s diminished federal Liberal support. Approval levels for the Trudeau government have dipped to 40% with 38% indicating disapproval. This level of disapproval is up a sharp 8 points since our reading in September.

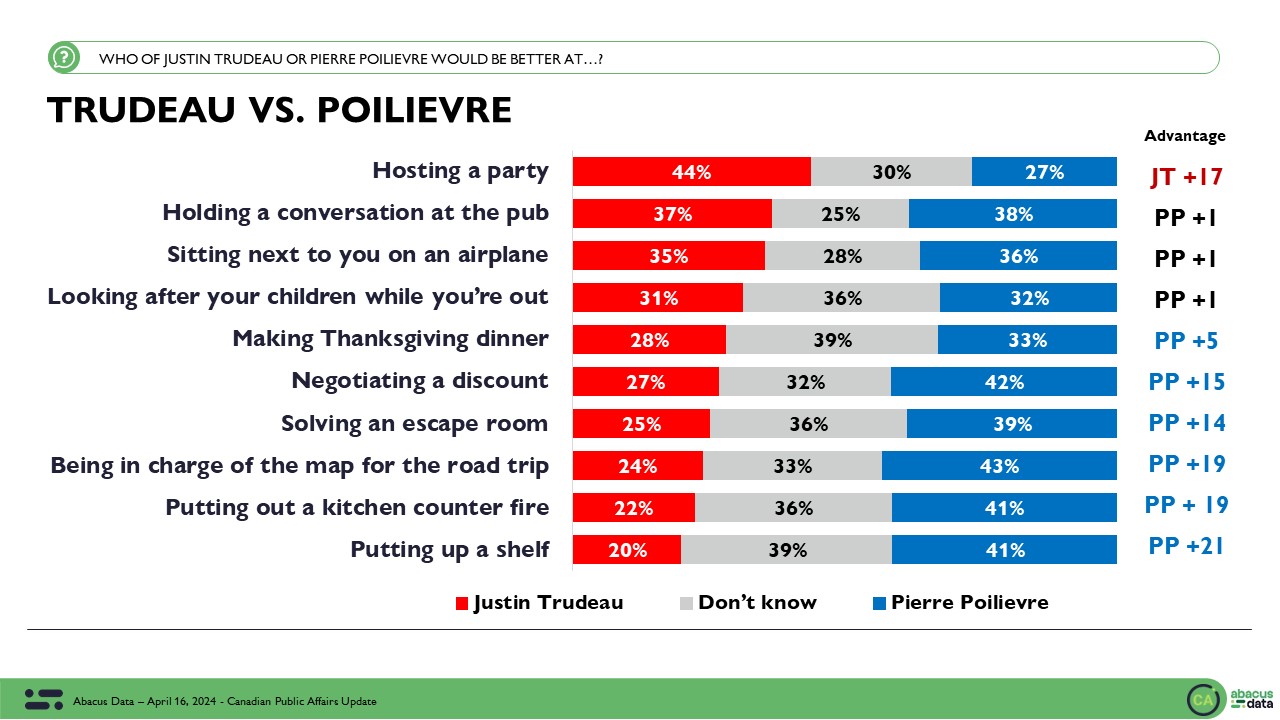

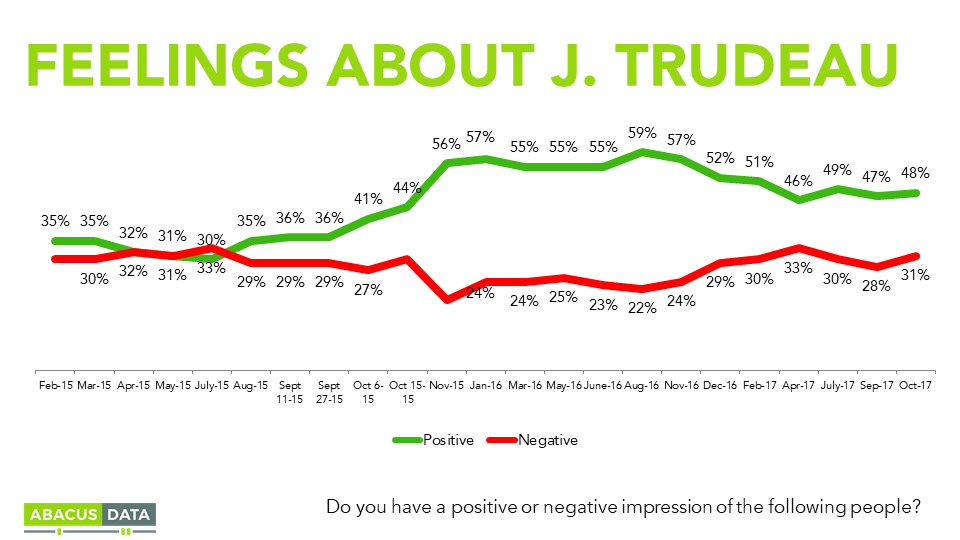

While support for the Liberal Party and approval of the Trudeau government has slipped, impressions of the Prime Minister himself have remained relatively steady, and positive. Today, 48% say they have a positive view of Mr. Trudeau, 31% negative.

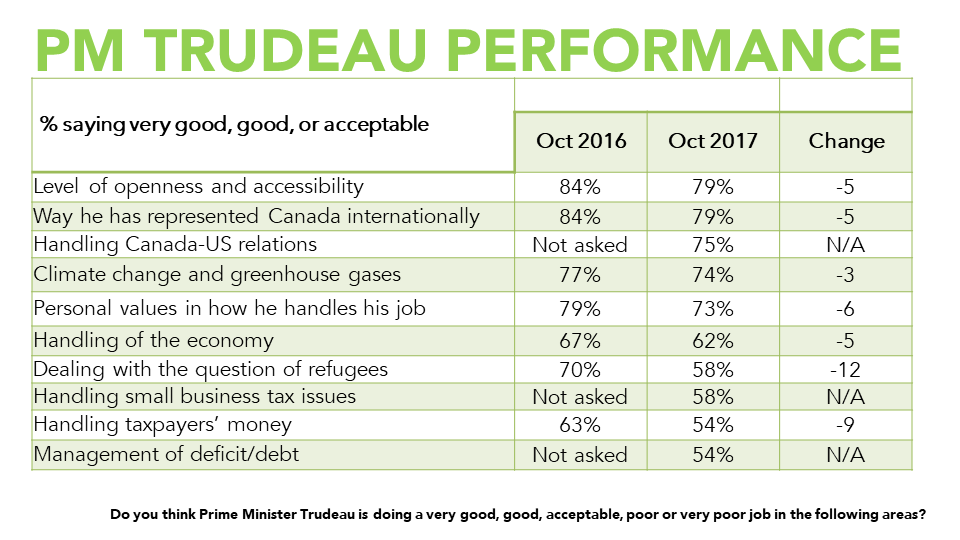

Probing on the PM’s performance across a range of issues reveals that his job ratings slid roughly 5 points on several items, while dropping 12 points on the question of refugees and 9 points on handling taxpayers’ money.

The strongest ratings for the Prime Minister are for openness and accessibility, his representation of Canada internationally and in the Canada US sphere, on climate change and his personal values. A healthy majority give him good marks for handling the economy. Weakest ratings are on refugees, taxes and fiscal management.

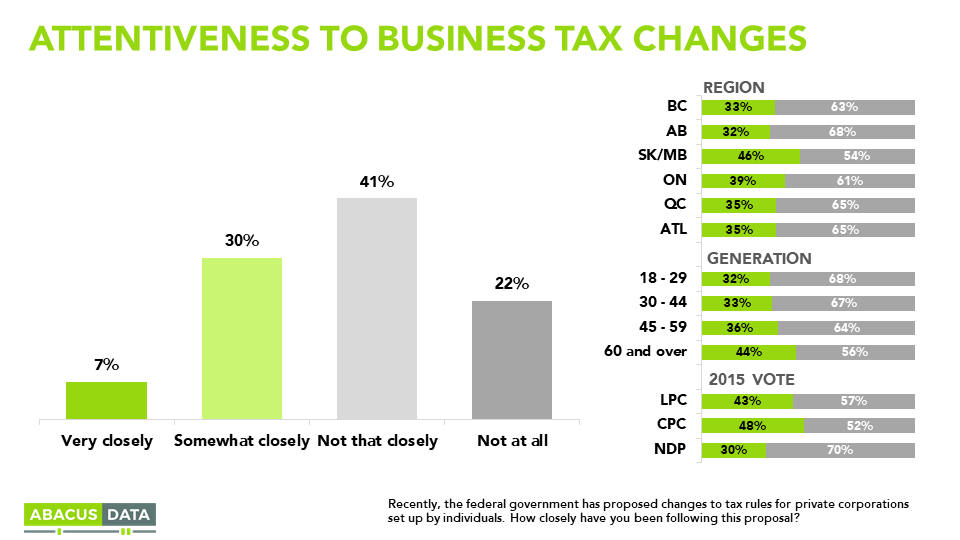

One of the highest profile issues in recent months has been the proposed changes to tax rules for privately incorporated individuals. Our probing on this issue reveals that 37% have been following this debate at least somewhat closely, but most have not.

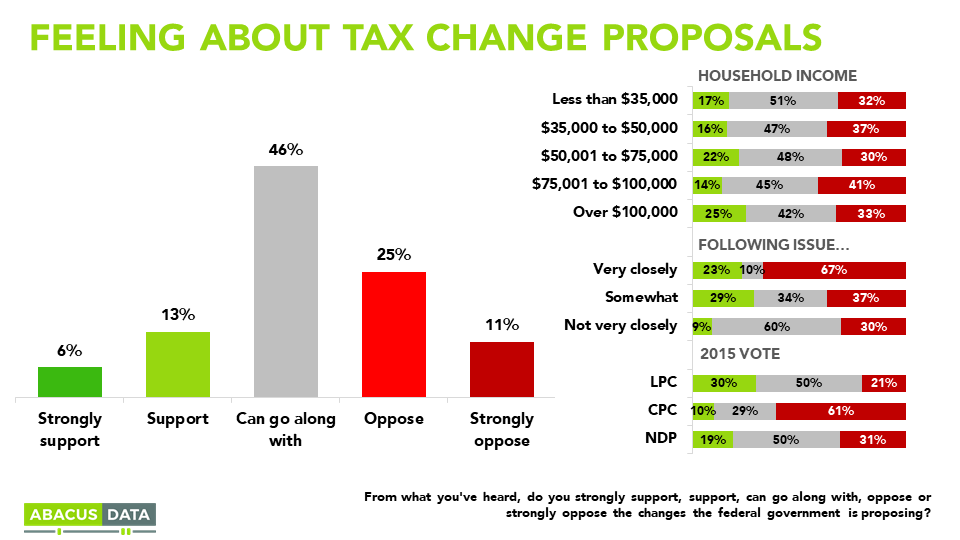

There is more opposition to (36%) than support (19%) for the proposed changes, while a plurality indicates they “can go along with” the changes. Among those who are following this debate most closely, opposition is far greater than support. Among those who’ve only been following it somewhat closely, 37% oppose, while 29% support the moves.

Among those who voted Liberal in 2015, 30% support the government’s proposals, 21% oppose, and 50% say they “can go along with” the ideas. Opposition is greater than support among NDP voters as well.

UPSHOT

According to Bruce Anderson: “At the mid-way point in their mandate the Liberals enjoy good levels of support in Atlantic Canada, Quebec, BC, and substantial support in Ontario. The Prime Minister remains personally quite popular. At the same time, these numbers reveal a tighter, more competitive situation is developing, especially with the Conservative Party of Canada.

Approval levels for the government are relatively good on international affairs and economic management, but weaker on fiscal, tax and the question of refugees, suggesting that some of the core issues that were animating to Conservative voters are a large part of what’s causing a more competitive situation to develop. Premier Wynne’s very low approval ratings are also a challenge for the federal Liberal brand in Ontario today.

Reaction to the proposed tax changes on individual private corporations have been a drag on Liberal support, both because they animated Conservative Party supporters and because the fairness proposition of the government has failed to generate enthusiasm among Liberal and NDP voters.”

According to David Coletto: “While Liberal Party support is roughly at the level the party earned in the last election, the challenges the government has faced the past month has had an impact on its support. Liberal vote intention is down four nationally and we have seen a sharp drop in the government’s job approval. Despite this, the Prime Minister remains a popular figure and his personal numbers have not been affected – 48% have a positive impression of him. The numbers confirm he remains a strong asset for his party and the government.

The Conservatives can take some solace in these numbers. They have hit a high mark in our vote intention tracking since the election and the government seems a bit more vulnerable today than only a few weeks ago. But as a future release will highlight, Andrew Scheer remains a largely unknown figure and despite having a fertile environment to increase familiarity with him, most Canadians know very little about the Leader of the Opposition.

The data also confirms the considerable headwinds the NDP and its new leader, Jagmeet Singh, face. We find no “bounce” in support for the NDP after his win and instead see troubling signs in Quebec (support down 8), tepid support in Ontario (down to 13%) and little growth in BC. This doesn’t mean that NDP support can’t or won’t grow. But given the challenges the Liberals have faced recently and the opportunity a new, exciting, and interesting leader affords a party, I would have expected a bounce in NDP support.”

METHODOLOGY

Our survey was conducted online with 1,500 Canadians aged 18 and over between October 20th to October 23rd, 2017. A random sample of panelists was invited to complete the survey from a large representative panel of over 500,000 Canadians.

The Marketing Research and Intelligence Association policy limits statements about margins of sampling error for most online surveys. The margin of error for a comparable probability-based random sample of 1,500 is +/- 2.6%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

ABACUS DATA INC.

We offer global research capacity with a strong focus on customer service, attention to detail and value-added insight. Our team combines the experience of our Chairman Bruce Anderson, one of Canada’s leading research executives for two decades, with the energy, creativity and research expertise of CEO David Coletto, Ph.D.