Abacus Data Poll: A First Look at the Political Opinion Impact of the Canada–Alberta Energy MOU

December 3, 2025

The political news cycle moved quickly last week as the federal and Alberta governments announced a wide-reaching memorandum of understanding on energy and climate policy. The agreement includes a federal green light for a new oil pipeline from Alberta to the British Columbia coast, a pause on clean electricity rules in Alberta, and a shared commitment to net-zero emissions by 2050. Reactions came swiftly from political leaders, provincial premiers, and Indigenous communities, with strong words both in support and opposition. But what about the public?

We went into the field less than 24 hours after the MOU was signed to gauge awareness, initial reactions, and whether this deal has changed the political landscape. The short answer is: not yet.

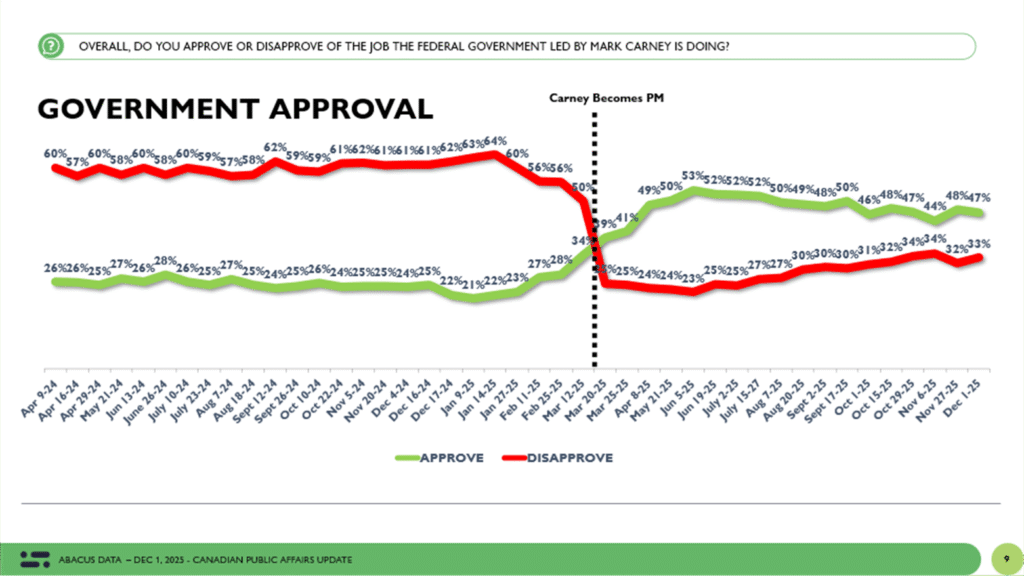

There is little evidence of any immediate shift in vote intention or leader impressions, and approval of the Carney government held steady. But beneath that stability, the data reveals the contours of a national debate that may define energy politics heading over the next several years. The deal hasn’t moved votes, but it might just redraw the lines along which the next energy and climate battle will be fought.

Awareness and Familiarity: A Soft Landing So Far

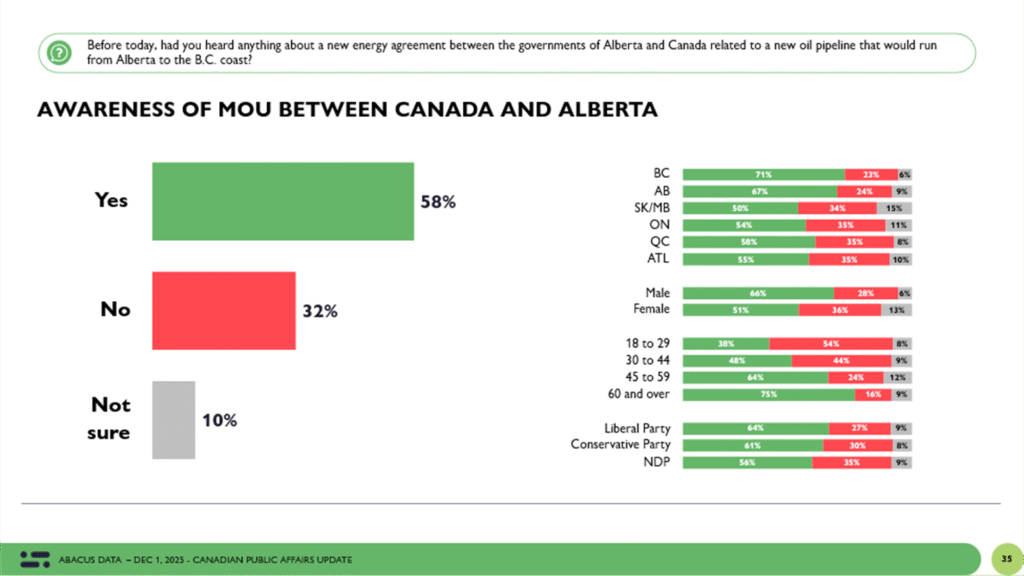

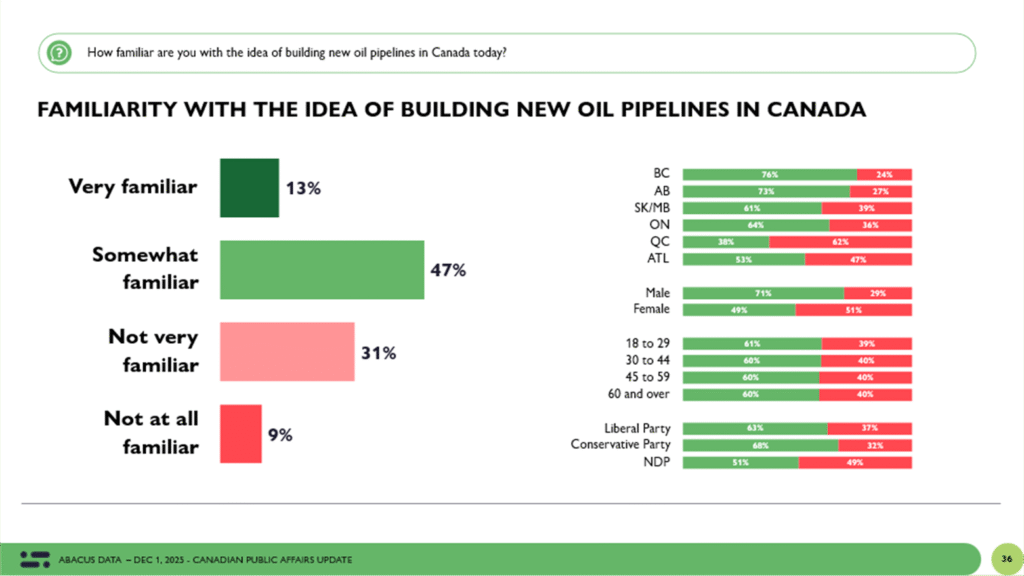

Awareness of the deal is reasonably high given the short timeline. Nearly 6 in 10 respondents said they had heard about the new agreement between Alberta and the federal government, with awareness highest among older Canadians, British Columbians, and Albertans. Familiarity with the broader idea of building new pipelines remains widespread, with 60% of Canadians saying they are at least somewhat familiar with the concept.

Initial reactions (post MOU) to the idea of building a new pipeline from Alberta to the West Coast are modestly supportive. Nationally, 55% said they either strongly or somewhat support the idea, while 18% were opposed. Strong support was higher in Alberta (74%) and among Conservative voters (72%), and significantly lower in Quebec (42%) and among NDP voters (22%). In British Columbia, 53% support it while 30% oppose it. But more importantly, among those who would vote for the BC NDP, 37% support it while 47% oppose it demonstrate the sharp fault running right through David Eby’s voting coalition. Among BC Conservative supporters, 76% support a pipeline compared with 11% who are opposed.

In Alberta, 92% of UCP supporters approve of the pipeline compared with 53% of Alberta NDP supporters.

Among 2025 federal Liberal voters, support outpaced opposition by a roughly 2-to-1 margin. It is important to note that support for the idea of a pipeline to the west coast found more support than opposition in every region of the country. Among those aware of the MOU, 66% support a pipeline while 19% are opposed.

Put simply, most Canadians are open to the idea, and few feel strongly opposed at this stage. That said, the deal’s reception is still shaped by some regional dynamics and prior political commitments.

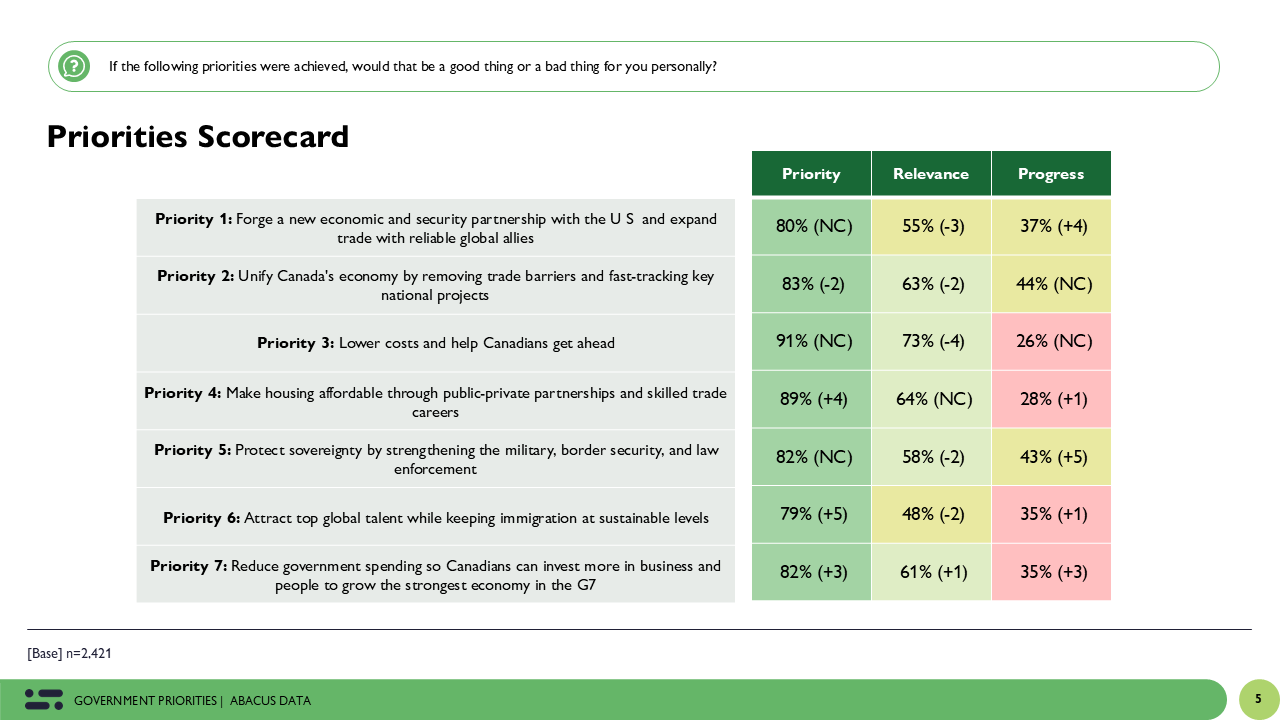

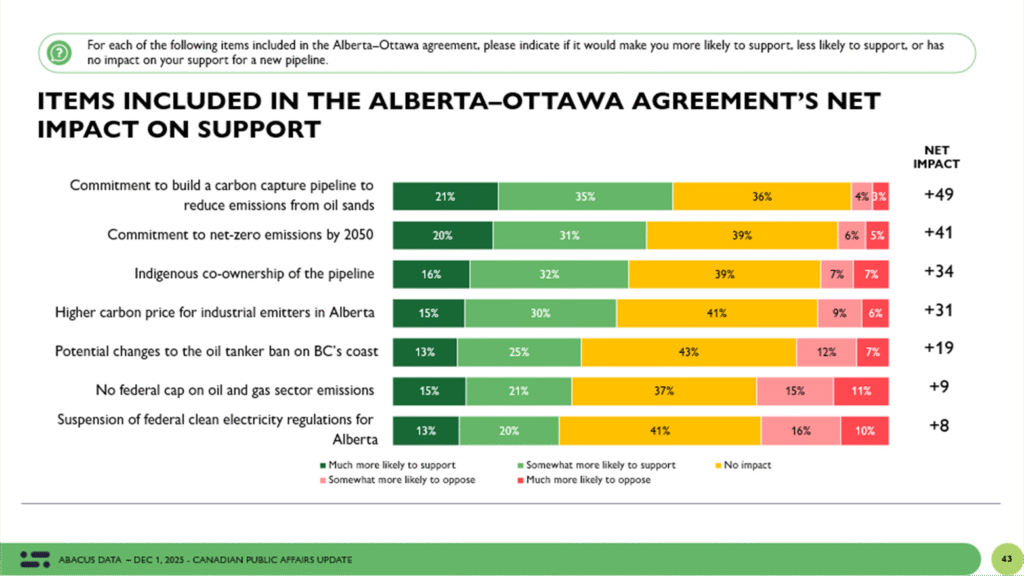

One reason the Canada–Alberta MOU may have landed relatively smoothly is that many of its core components generate more support than opposition. Items like building a carbon capture pipeline, committing to net-zero by 2050, and Indigenous co-ownership of the project all produce strong positive net impacts on support. Even elements that might be more contentious — such as changes to the oil tanker ban or suspending clean electricity rules for Alberta — are met with more ambivalence than resistance. The package as a whole offers a mix of climate, economic, and Indigenous reconciliation goals that appear to resonate with a broad cross-section of the public, and may be helping to blunt potential backlash and frame the deal as a pragmatic compromise.

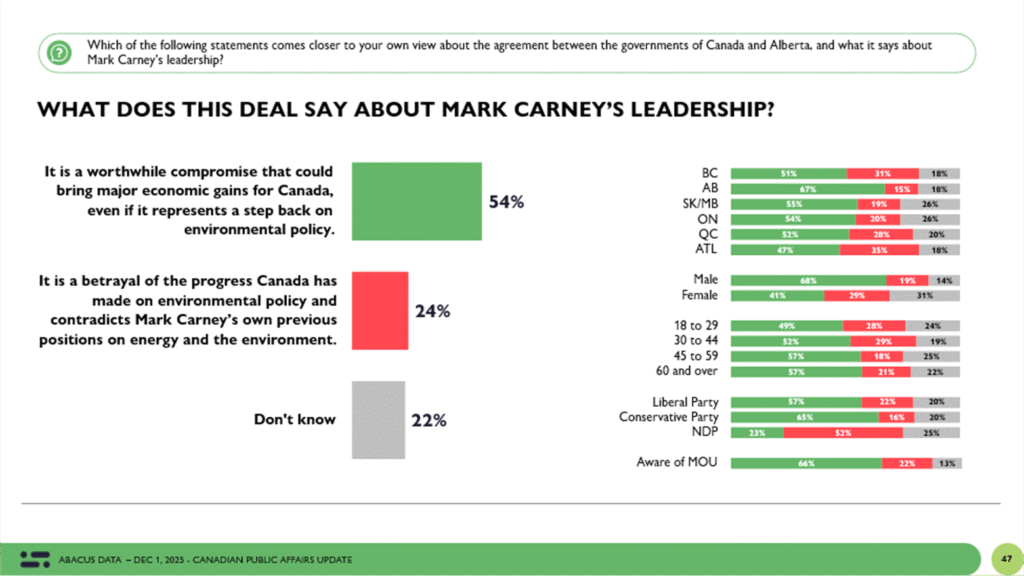

When asked what the agreement says about Mark Carney’s leadership, most Canadians described it as a worthwhile compromise rather than a betrayal of environmental progress.

Over half the country sees the deal as a pragmatic move that could deliver economic benefits, even if it walks back some environmental commitments. That sentiment is strongest in Alberta, where two-thirds agree with the compromise framing, and weakest in Atlantic Canada, B,C., and Quebec, where skepticism is somewhat higher. Among those already familiar with the MOU, support for the compromise jumps to 66%, suggesting that greater exposure may work in Carney’s favour.

The deal also finds more support among men and older Canadians, while younger respondents and women are more divided. Politically, it is endorsed by majorities of both Liberal and Conservative voters, but rejected by a majority of NDP supporters. While this does not appear to be a polarizing moment in the electorate overall, the reaction does highlight the early contours of how Canadians might come to judge Carney’s leadership style in high-stakes negotiations, pragmatic and results-oriented to many, but not without consequences on his left flank.

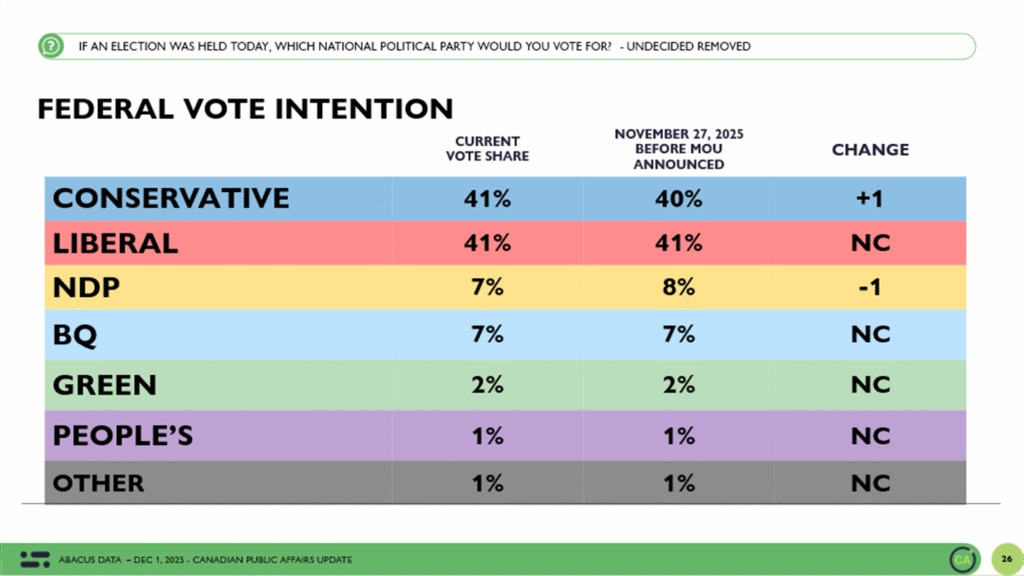

Political Impact: No Shift in Vote or Mood

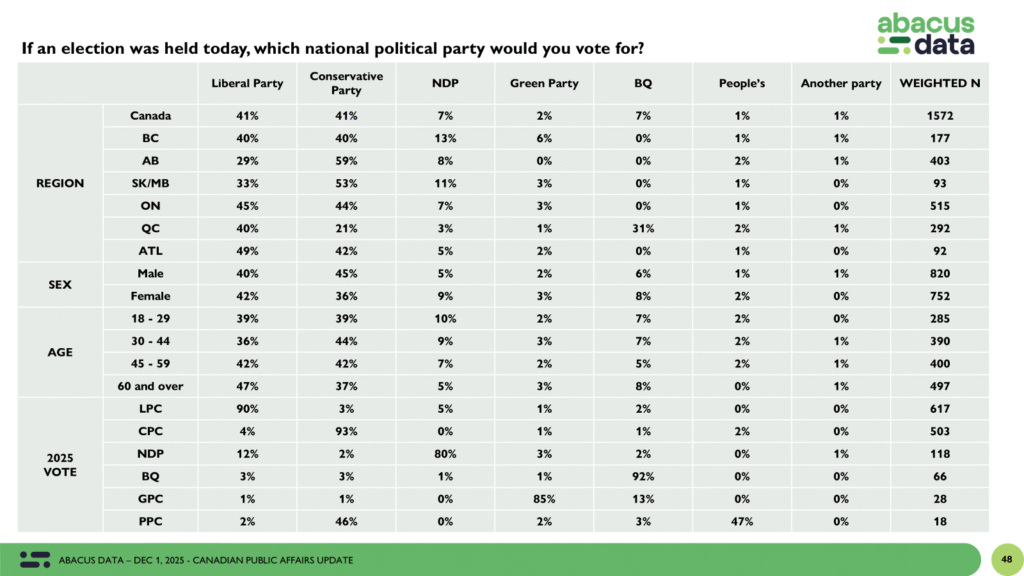

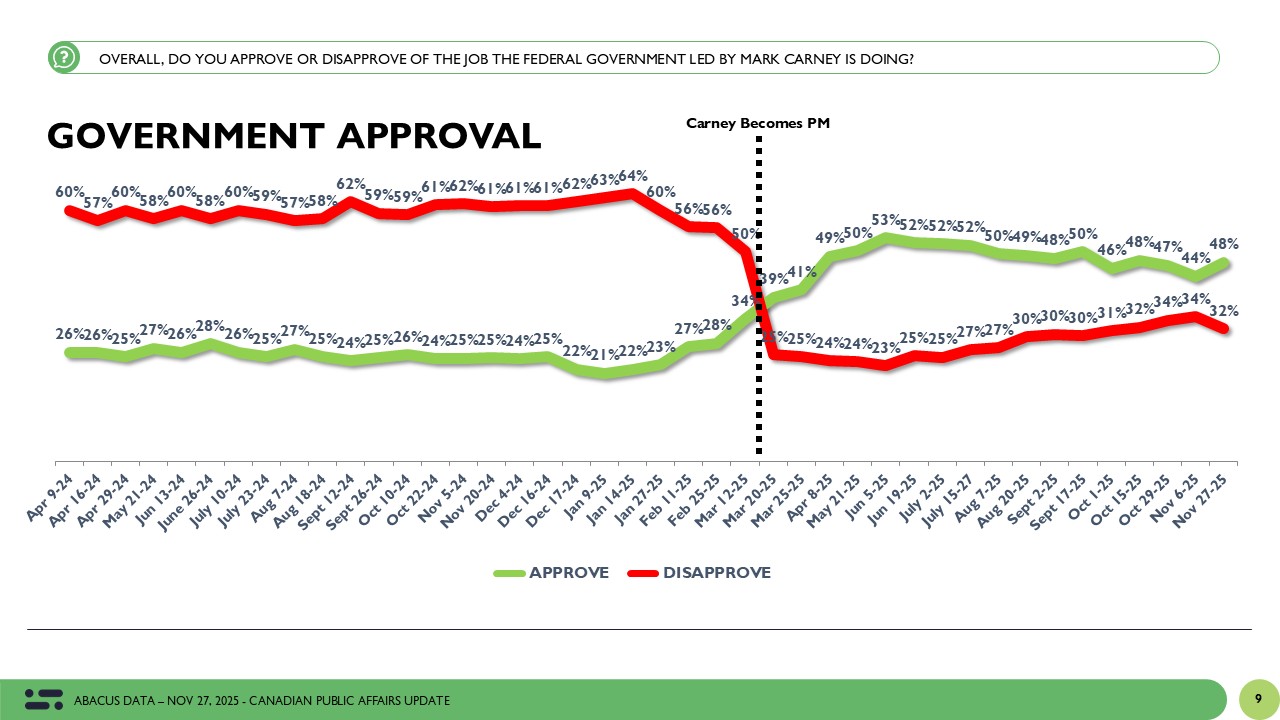

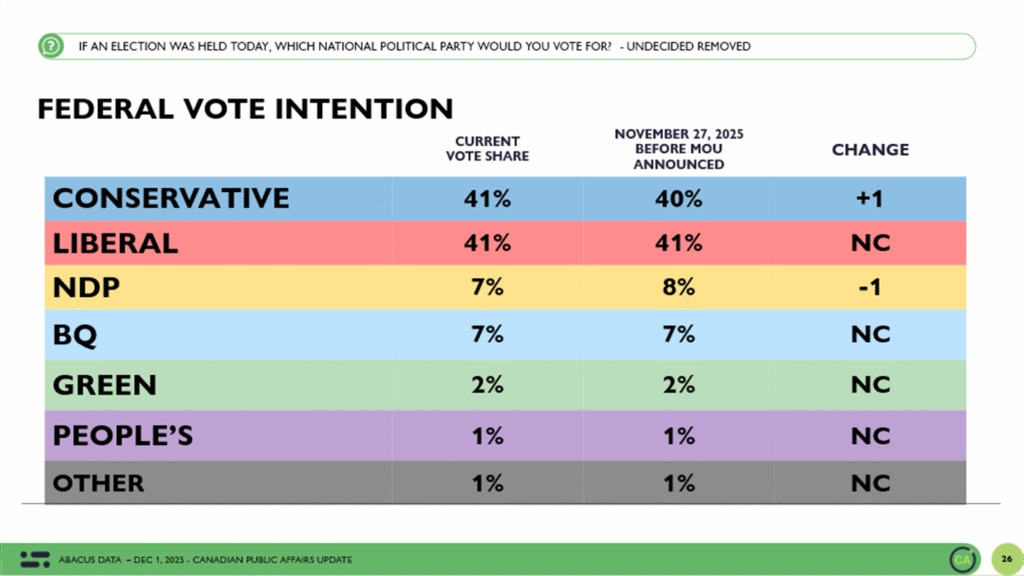

When it comes to vote intention, the political landscape remains unchanged from earlier in the week. The Liberals and Conservatives are tied at 41%, with no statistically significant movement following the announcement of the MOU. Approval of the federal government is also steady, with 47% approving and 48% disapproving of the job the Carney government is doing. These are almost identical to numbers recorded prior to the deal, suggesting no bounce, no backlash, and no measurable change in how Canadians feel about the direction of the country.

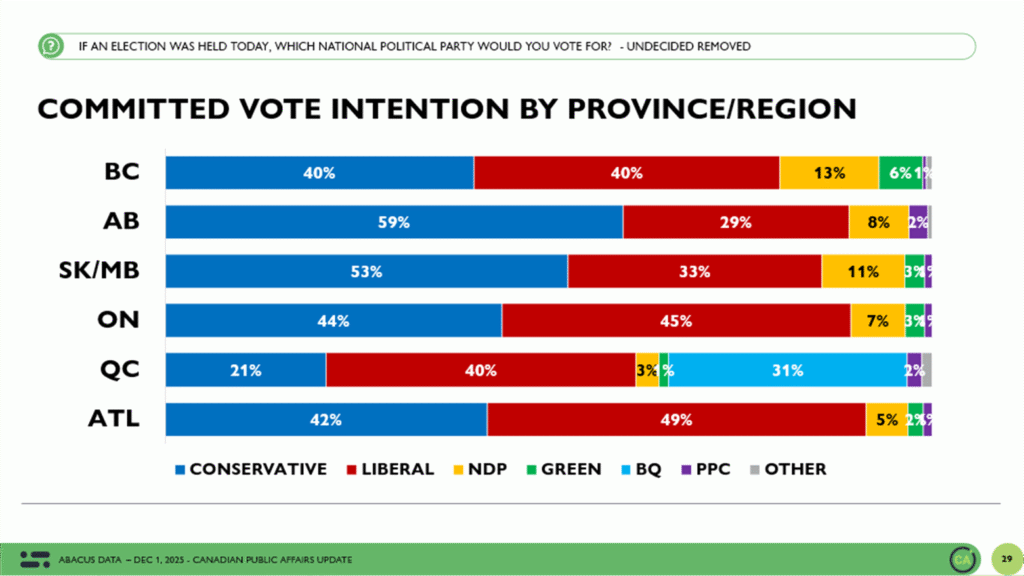

Among key regional battlegrounds, vote preference also remains stable. The Liberals continue to lead in Ontario (45% to 44%), while the Conservatives dominate in Alberta (59%) and the Prairies (53%). In Quebec, the Bloc holds a 31% share, followed by the Liberals at 40%. Even in British Columbia, where the proposed pipeline terminus would lie and where Premier David Eby voiced strong opposition, there’s no discernible movement in support for any party.

So, in answer to the first two questions this poll was designed to answer — how did Canadians react to the news and has it shifted the political terrain — the answer is a fairly firm “it hasn’t.” But that does not mean the political risks are evenly distributed or that the deal won’t matter down the road.

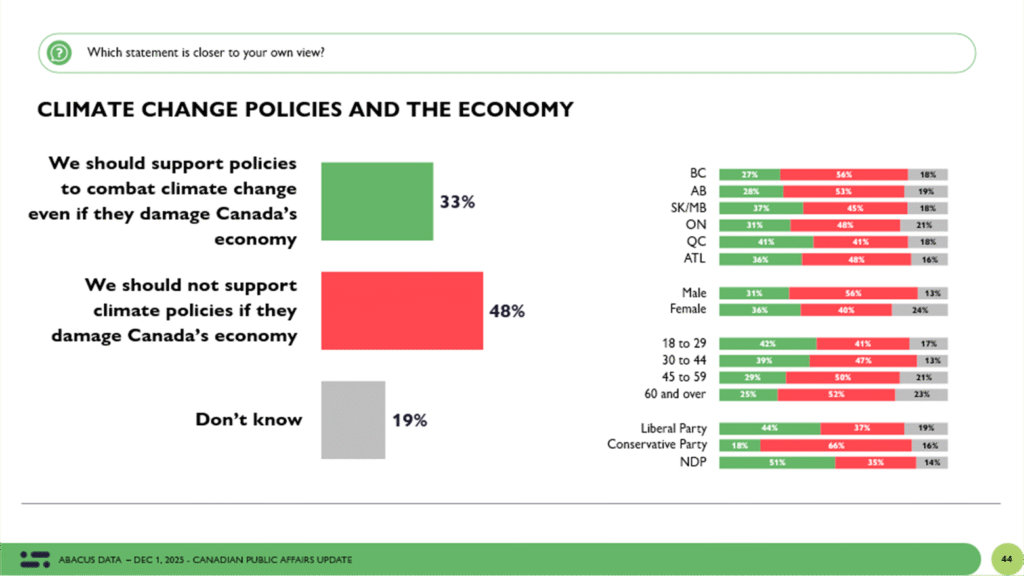

The Canada–Alberta MOU lands in a political environment where economic concerns still outweigh environmental ones for many Canadians. Just one in three believe climate policies should move ahead even if they harm the economy, while nearly half reject that trade-off outright. This view is especially pronounced among Conservative voters, where two-thirds oppose economic costs for environmental gain. Among Liberal and NDP voters, there is more room to manoeuvre — with 44 percent and 51 percent respectively favouring strong climate action despite the economic risk. Regionally, Quebec stands out as the most climate-forward, while Alberta and BC show greater hesitation.

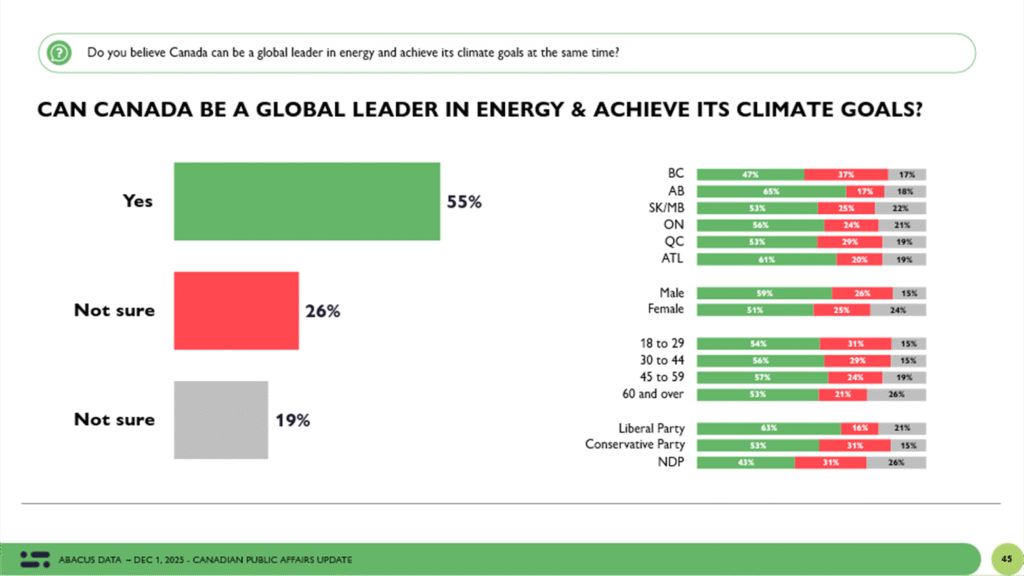

At the heart of the MOU is a core question: can Canada lead on energy while still delivering on climate goals? Most Canadians believe the answer is yes. A clear majority think the country can do both, with optimism highest in Alberta and among Liberal voters. Even in Quebec, where environmental concerns tend to be more pronounced, over half agree this dual path is possible. While skepticism exists, especially among NDP supporters and younger Canadians, the broad belief in compatibility between energy leadership and climate ambition helps explain why the deal is not viewed as contradictory by much of the public. This sentiment provides political room for the Carney government to argue that economic and environmental priorities can move forward together.

Reading the Risks: Carney, Poilievre, Smith and Eby

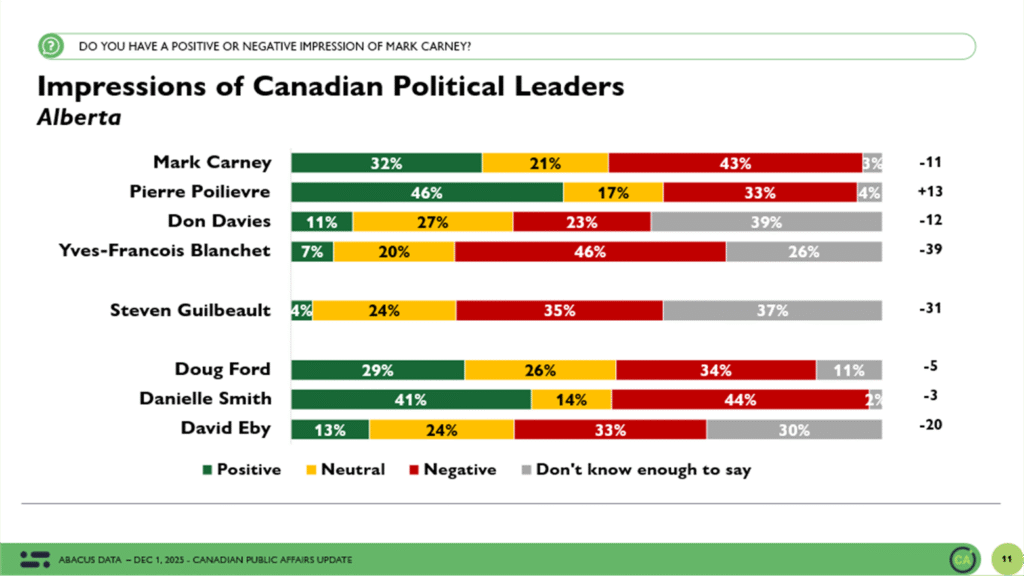

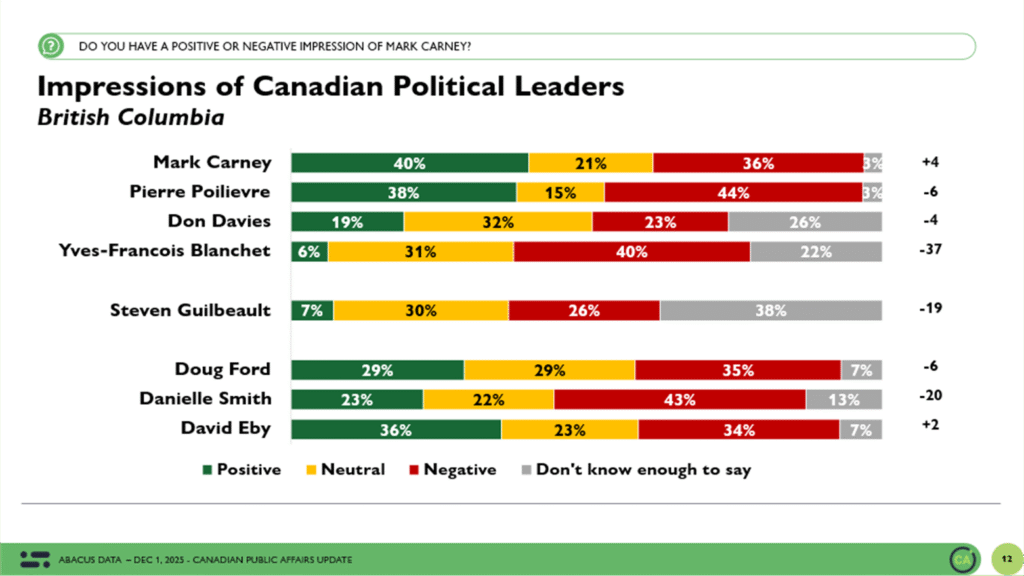

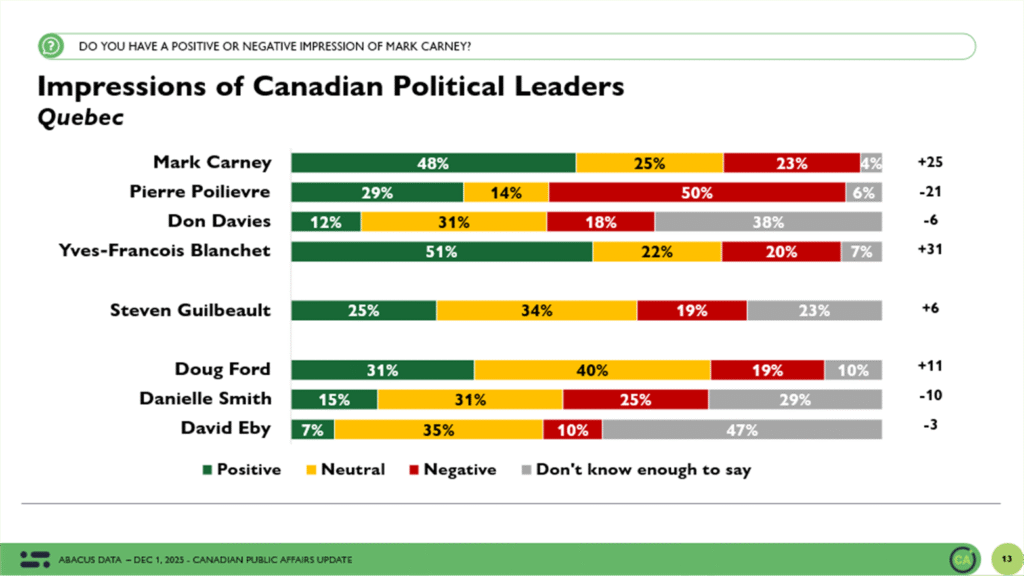

For Mark Carney, the announcement and its immediate aftermath can be read as a net neutral political moment. He retains a net positive impression nationally (+13), and approval of his government remains in the high 40s (unchanged from the survey we released on Sunday). But the regional breakdown tells a more complicated story. Carney is viewed favourably in Quebec (+25) and Ontario (+14), and even holds a slim positive margin in British Columbia (+4), where is negatives are up 7 points from 29% to 36%. But he remains underwater in Alberta (-11) although his favourables are up 9-points.

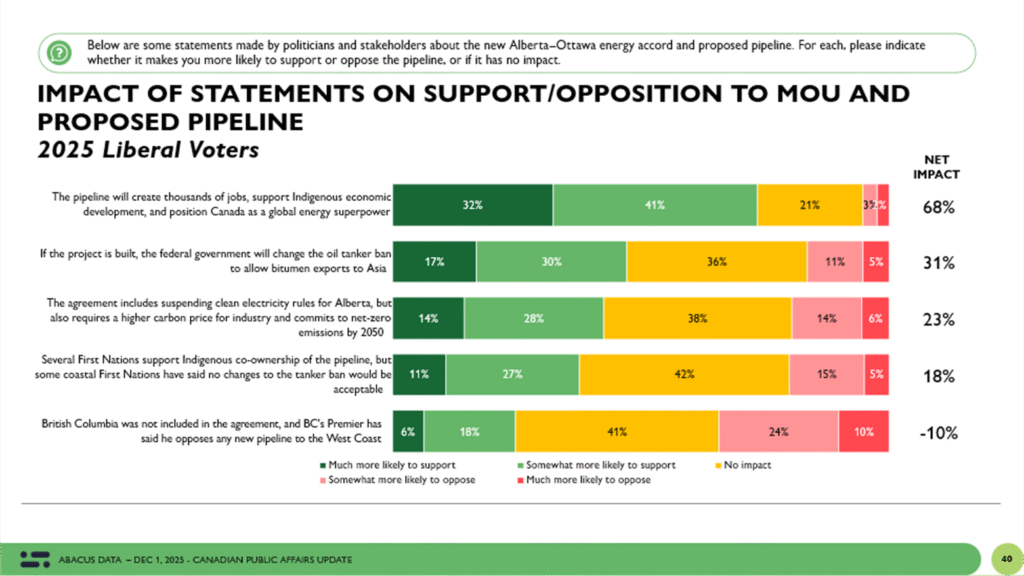

That said, among 2025 Liberal voters, support for the pipeline initiative is strong. Nearly 7 in 10 said the job-creation and energy security framing made them more likely to support the project, and 57% said Carney’s decision to pursue this deal shows leadership and pragmatism but a sizeable group (1 in 5) of Liberal voters saw it as a betrayal of environmental values.

For Pierre Poilievre, the MOU does little to shift his standing. His national net favourability remains in the negative at -7, with particularly weak numbers in Quebec (-21) and British Columbia (-6). But his brand is stronger in Alberta (+13), where he remains the most popular political figure. While the deal could, in theory, pose a challenge to Poilievre’s claim to sole ownership of the pro-pipeline lane, it’s not yet showing up in his numbers. Supporters may take a wait-and-see approach before judging whether Carney’s move on energy is strategic triangulation or mere political opportunism.

Danielle Smith may face the least immediate political risk. Alberta voters were the most supportive of the pipeline, the most likely to see the deal as a good economic compromise, and the least worried about potential climate trade-offs. The deal allows her to claim a rare win in intergovernmental affairs without alienating much of her base (at least for now).

David Eby finds himself in a more difficult position. While 63% of British Columbians said they are at least somewhat supportive of the pipeline when told it would create jobs and boost Indigenous economic development, the inclusion of language around changing the federal oil tanker ban on BC’s coast generated a negative net impact on support in the province.

More than half of British Columbians were opposed to loosening the tanker ban, and 48% said the fact that BC was excluded from the agreement made them less likely to support it. That puts the provincial government on the defensive, especially among voters who otherwise lean Liberal or NDP.

Guilbeault’s Exit: No Uprising in Quebec, Muted Reaction Elsewhere

Steven Guilbeault’s resignation from cabinet in response to the MOU offers a clear test of how Canadians balance climate ambition against energy development. On the surface, Guilbeault’s departure might have been expected to inflame opinion, particularly in Quebec where his political identity is most strongly rooted. But the data suggests his influence is limited.

Only 25% of Quebecers hold a positive view of Guilbeault, and he has net negative impressions across the rest of the country. In Alberta, his net score is a staggering -31, and even in Quebec, it’s barely positive at +6. Nationally, his net impression sits at -12, putting him well behind Carney, Poilievre and even Danielle Smith.

So far, there’s no indication his resignation has hurt the Carney government among Quebec voters where the Liberals hold a 9-point lead over the BQ (similar to what we found prior to the MOU announcement). In fact, only 22% of Canadians said the deal represents a betrayal of climate values. That includes just 28% of Quebecers.

The climate constituency is still vocal, but it has not galvanized around this moment. If the pipeline is ever approved for construction and tanker ban changes move ahead, that could change. But Guilbeault’s departure alone does not seem to have shifted the political map.

Climate change simply does not rank as a top concern for most Canadians right now. Just 13 percent selected it as one of the country’s top three issues, well behind the cost of living, housing, and health care. In the future, this deal could come back to haunt the Liberals if climate change rises up the list, but for now, the public appears more anxious about the economy and willing to look past what amounts to a wholesale shift in the federal government’s climate posture.

The Upshot

This MOU thus far has not changed the game, at least not yet. Vote intention, government approval, and leader impressions are largely unchanged in the days following the announcement. For the Carney government, that’s a short-term success — they launched a high-stakes policy shift without immediate political backlash. For their opponents, the deal hasn’t yet offered the kind of political wedge that shifts public sentiment either.

But beneath the surface, there are hints of future tension. In British Columbia, opposition to changes in the tanker ban could create problems for both federal Liberals and the provincial NDP. In Quebec, Carney’s strong personal brand and the region’s muted reaction to Guilbeault’s departure suggest the Liberals may be able to weather a potential storm, but the Bloc could still press the case for greater environmental ambition. Among Conservatives, the deal may soften the party’s claim to exclusivity on energy development, though not enough yet to change the narrative. And for progressives, especially younger voters and NDP supporters, how this MOU is implemented could shape trust in Carney’s climate credentials moving forward.

The next round of data will tell us more once the details begin to roll out and opposition parties sharpen their arguments. For now, the political environment looks remarkably stable but the ground beneath it may not be.

Methodology

The survey was conducted with 1,802 Canadians from November 28 to December 1, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.3%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, and region. Totals may not add up to 100 due to rounding.

The survey was paid for by Abacus Data Inc.

Download the full report here.

Additional tabulations can be purchased from Abacus Data. Send a note to David Coletto for more information.