Is the Canadian public primed on what to expect from Budget 2025?

September 23, 2025

In mid-September, we surveyed over 2,200 Canadians to understand how people are thinking about the federal government’s upcoming fiscal plan. What do they expect to see? Who do they think will benefit? And how do they assess the broader state of federal finances?

We asked these questions not because public opinion sets the budget but because managing expectations is as much a part of policy making and politics as managing reaction to an announcement or the policy itself. When expectations and reality diverge sharply, the risk of negative public reaction grows. If the government fails to socialize its choices in advance, even broadly reasonable decisions can land poorly.

This research gives us a clear picture of where public opinion stands now and what that means heading into a high-stakes fall for the Carney government.

A Country Expecting Action But Unsure of the Trade-offs

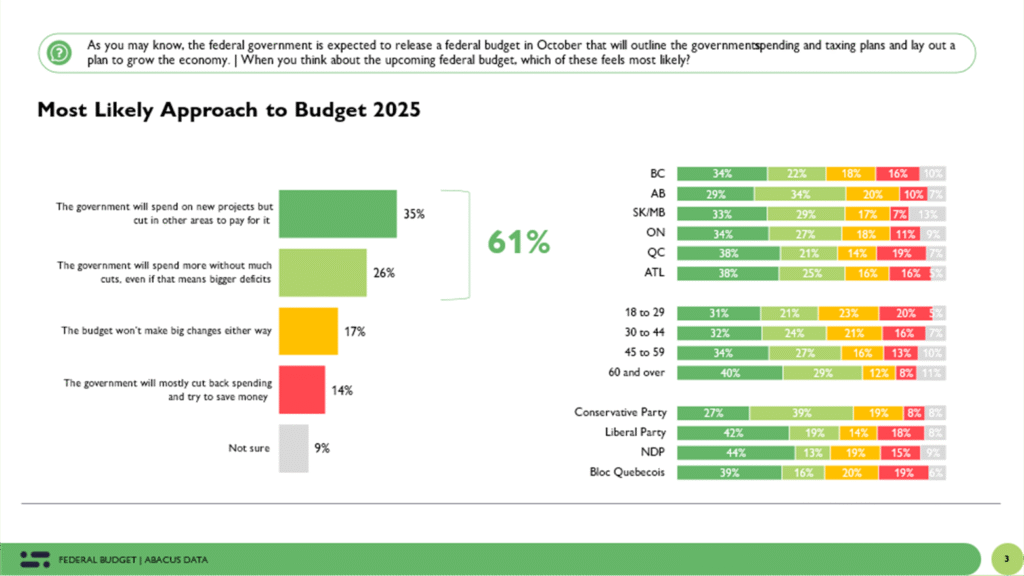

When asked what kind of budget they think is coming, Canadians show a strong belief that something substantial is on the way but they differ in how they imagine the government will approach the country’s economic and fiscal challenges.

A plurality, 35%, believe the government will spend on new projects but find savings in other areas to help pay for them – the main message the government has been trying to communicate. This group expects targeted investments, but within a frame of relative restraint. Another 26% think the government will simply spend more across the board without any cuts, regardless of whether it increases the deficit. Fewer than one in five expect little to change, and only 14% anticipate a budget dominated by cuts.

Interestingly, we don’t see much difference regionally or across age groups. Older Canadians (60+), who we know are paying more attention to politics through traditional channels, are the most likely to think the budget will spend on new projects but cut in other areas.

Politically, Liberal and NDP voters are more likely to expect a mix of investment and austerity, whereas Conservative supporters are more likely to think the government will spend more without many cuts.

What’s Expected to Be in the Budget

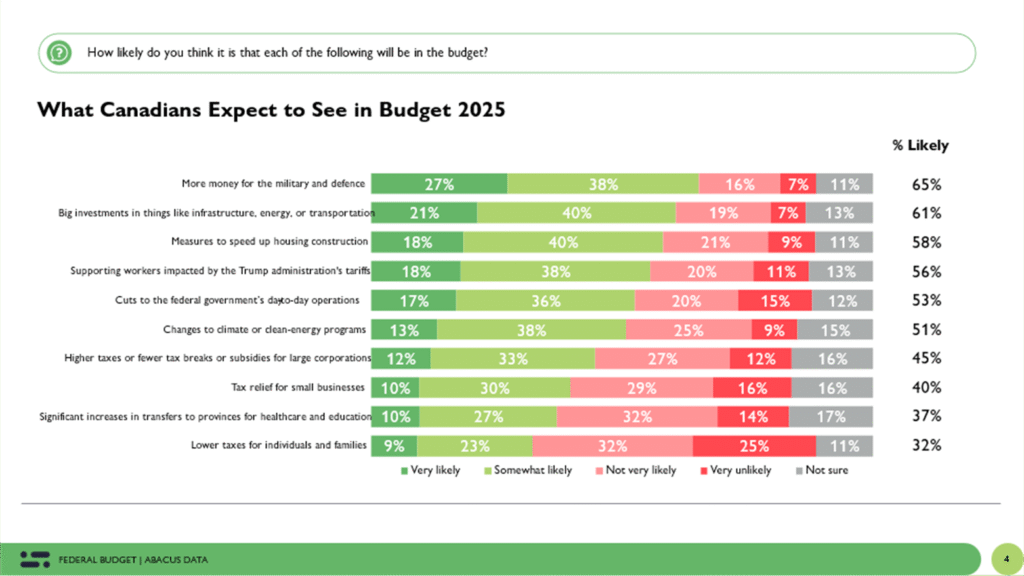

When Canadians imagine the content of the upcoming budget, three themes dominate: investments in defence, infrastructure, housing and support for those impacted by tariffs.

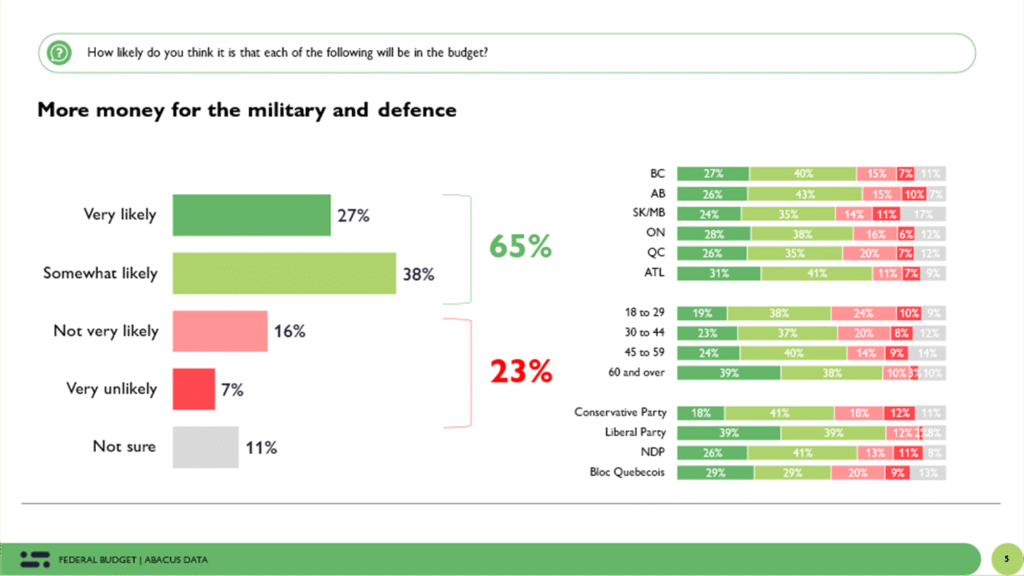

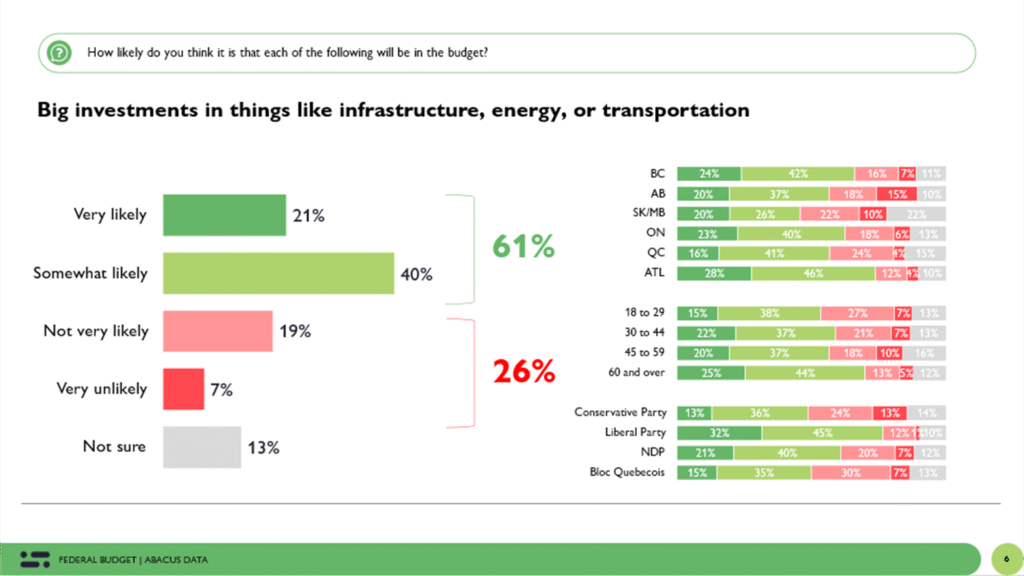

Sixty-five percent believe the budget is likely to include more funding for the military and defence likely a reflection of the ongoing global security environment and the clear signals the government has sent about Canada’s NATO commitments. Sixty-one percent expect to see large-scale investments in infrastructure, energy, or transportation.

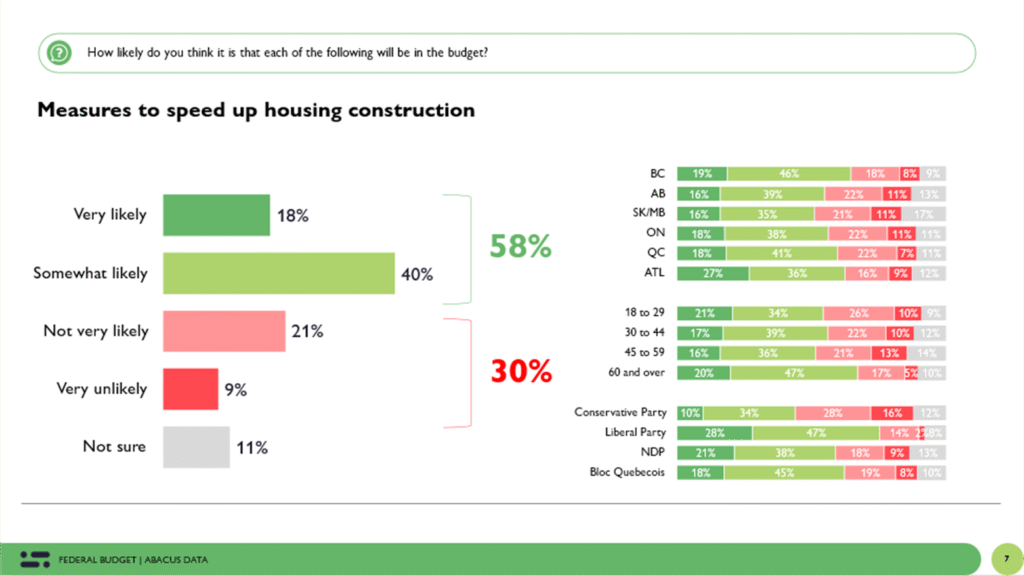

And notably, 58% anticipate specific measures to speed up housing construction. With affordability challenges dominating political conversation and personal finances alike, this isn’t surprising. These three items – defence, major projects, and housing – have been front and centre in communications and so far, that work has been largely successful in socializing the public to what’s coming.

There are lower expectation in other areas. Just over half think there will be cuts to day-to-day federal operations. At the same time, only a third believe personal income taxes will go down (although they already have earlier this year) and most do not expect sweeping tax relief for small businesses or individuals.

The pattern here is consistent with a public that recognizes fiscal pressure, but still wants the government to show it can respond to urgent needs. There’s no single dominant policy item people are counting on but the expectation is that the budget will not be status quo.

Who Canadians Think Will Benefit

One of the clearest signals from this research is the widespread skepticism about who the federal budget is actually going to serve.

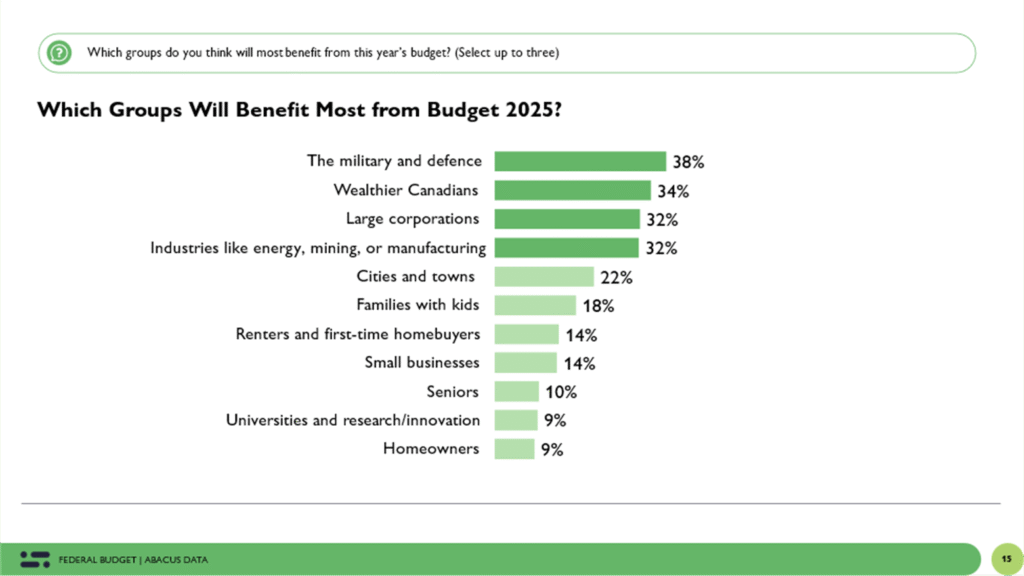

When we asked Canadians to identify up to three groups they believe will benefit most, the most common answers were the military (38%), wealthier Canadians (34%), large corporations (32%), and industries like energy, mining, or manufacturing. A full third of the public expects the biggest winners of this budget to be those who already wield the most power and influence.

Far fewer Canadians expect the budget to prioritize families with kids (18%), renters or first-time homebuyers (14%), or small businesses (14%). Just one in ten believe seniors will benefit meaningfully. In short, the public expects a budget that will target certain sectors and will benefit those who are already well off.

There are stark political differences here. NDP and Bloc supporters are more likely to believe the wealthy and corporations will benefit, while Liberals are somewhat more likely to expect help cities and towns, the energy, mining, and manufacturing sectors, and small businesses. Conservative voters expect defence and major corporations to be benefit the most.

Financing the Plan: More Borrowing, Some Cuts, Little Clarity

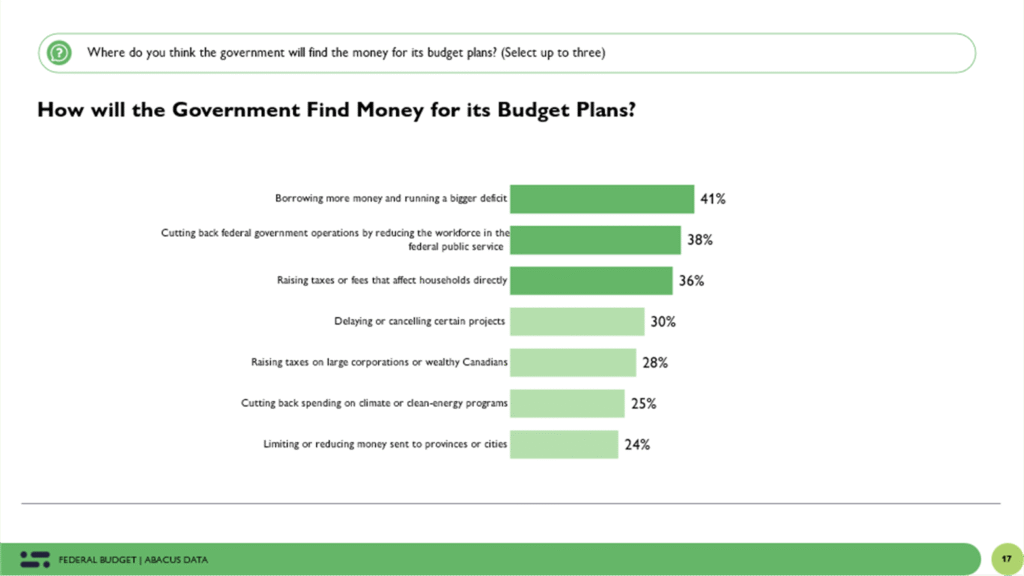

We also asked people where they think the government will find money for its budget plans. The most common answer, chosen by 41%, is that the government will simply borrow more and run a bigger deficit. Another 38% expect the government to cut federal operations, likely by trimming the public service. A third expect higher taxes or fees that affect households directly.

Fewer believe the government will raise corporate taxes or taxes on the wealthy. There’s even less expectation that the government will reduce transfers to provinces or municipalities. Only about 1 in 4 expect that to happen.

The upshot is again fairly good priming of what is likely coming in the budget. Among Liberal Party supporters, about half believe the budget will cut back federal government operations by reducing the workforce in the federal public service. But there are many who don’t know much about how the government will finance new investments. People anticipate trade-offs, but they don’t necessarily believe those trade-offs will be explained clearly or made fairly. There is also a real risk that if the government announces cuts without accompanying investments in high-salience areas like housing or affordability, public reaction could skew sharply negative.

Fiscal Credibility: Low Expectations for Discipline

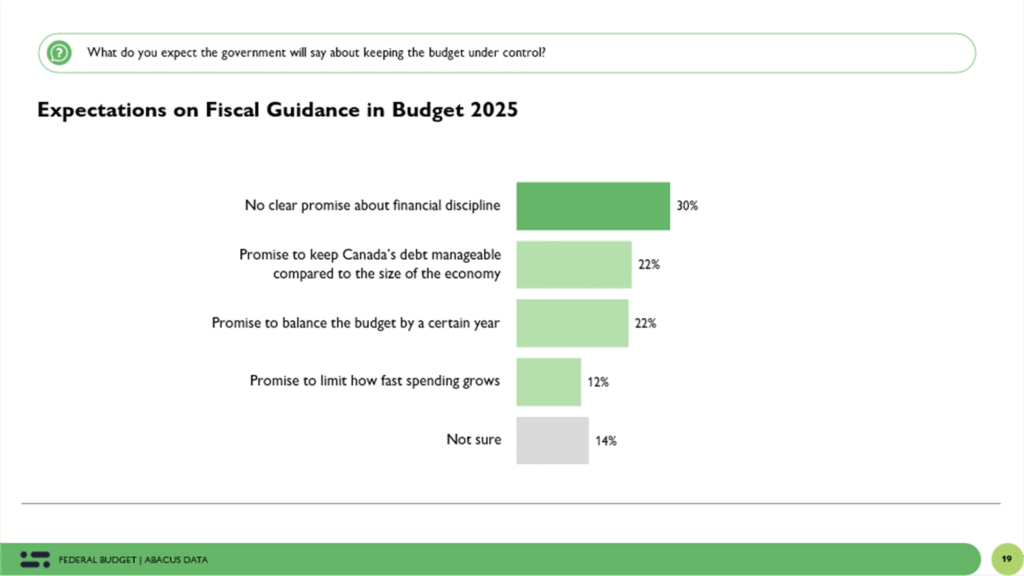

When we asked what Canadians expect the government to say about fiscal responsibility in the budget, the top answer — selected by 30% — was that the government won’t make any clear commitment at all.

Only about one in five expect the government to promise to keep Canada’s debt manageable relative to GDP. Another 22% think there will be a pledge to balance the budget by a certain year, but few expect the promise to be immediate or binding. Just 12% believe there will be any constraint on future spending growth.

This suggests that while many Canadians are concerned about fiscal sustainability, they do not expect it to be a major feature of the budget’s message. That opens the government up to criticism from those looking for reassurance on long-term fiscal discipline, particularly among older and more conservative respondents. But it also means that the public already expects a large deficit number.

A Budget Clouded by Pessimism about the Country’s Fiscal Position

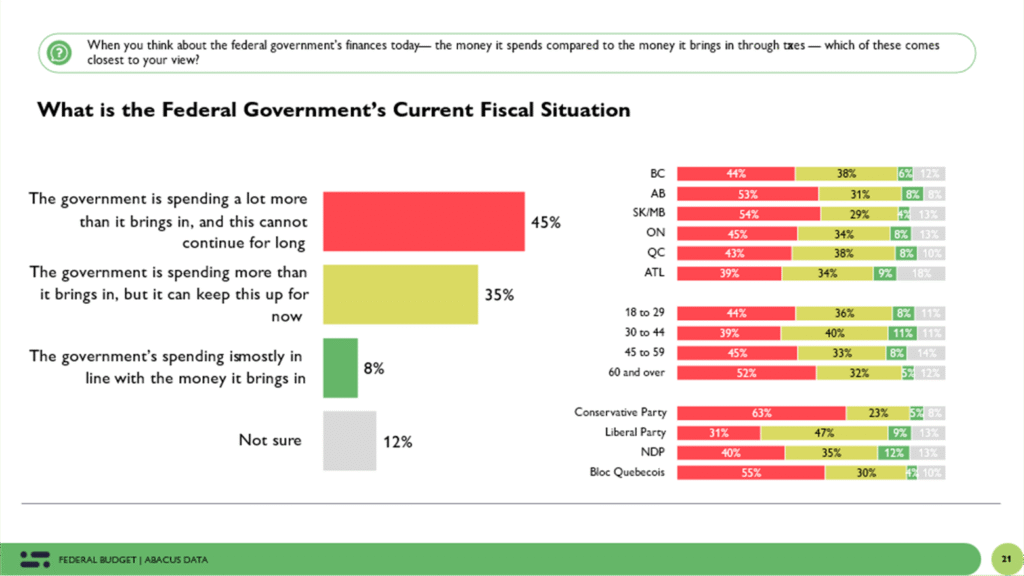

Most believe the federal government is spending more than it brings in and a clear plurality think the gap is growing. Only 8% believe the government’s spending is closely aligned with revenues.

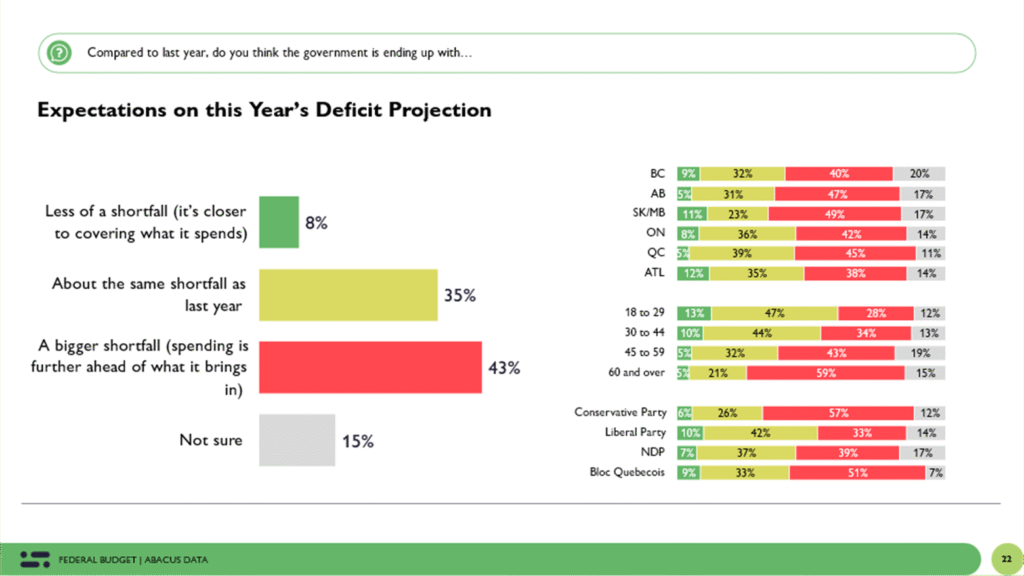

In a similar way, a plurality expect Budget 2025 to deliver a larger deficit or shortfall while 35% expect the same as last year. Liberals and Conservatives differ on expectations.

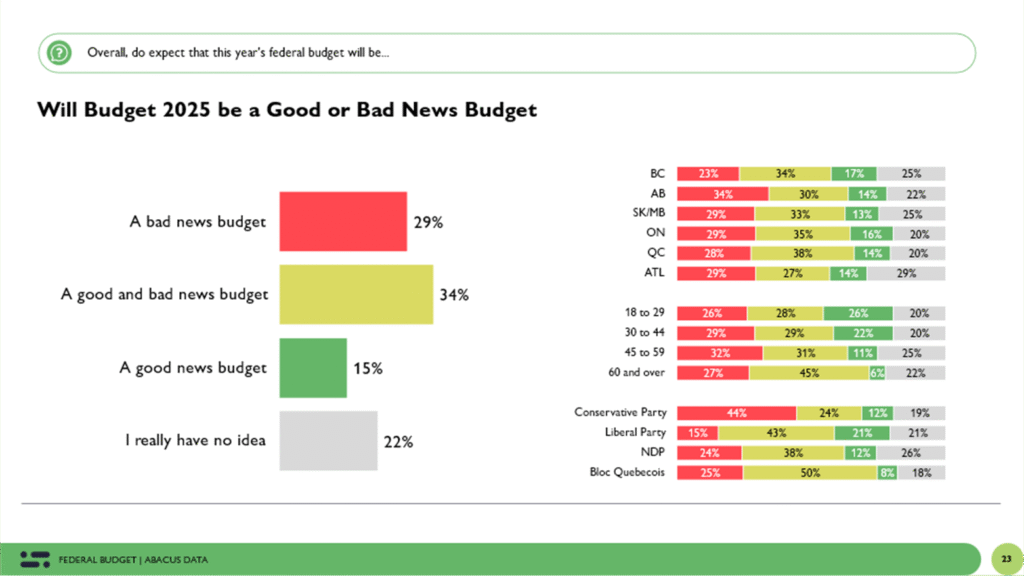

In terms of mood, 29% expect the budget to be bad news. Another 34% say it will be a mix of good and bad. Just 15% are expecting what could be called a “good news” budget.

That kind of backdrop — low confidence in finances, low expectations for equity, and little belief in fiscal discipline — makes the job of messaging and managing the budget rollout all the more critical. It does appear though that so far, the Carney government has done a fairly good job priming public expectations on the budget.

The Upshot

With just over a month to go before Budget 2025 is tabled, the federal government finds itself in a delicate but not unfavourable position: Canadians broadly expect a budget with meaningful investments and some restraint, but few feel confident about who will benefit or how it will all be paid for. The good news for the Carney government is that much of its high-level messaging has landed with some, likely those paying most attention. The less encouraging news is that most people remain skeptical about fairness, clarity, and the fiscal credibility of what’s coming and many don’t have any sense of what to expect from the budget.

The data show that the public expects action on the key files that Ottawa has repeatedly emphasized — housing, infrastructure, and defence. These issues have been sufficiently socialized to prime expectations, and most voters are aligned with the idea of targeted investment alongside operational restraint. That is the frame the government has sought to reinforce, and it is largely succeeding.

But success in shaping what people think will be in the budget doesn’t necessarily translate to support for how it will be delivered or who it will help. A full third of Canadians expect the biggest winners to be those with the most power already — the military, large corporations, and wealthy individuals. Just one in ten expect seniors to benefit, and expectations are similarly low for renters, families, or small businesses. That perception of imbalance — of the budget being skewed toward insiders or instittions — presents a clear political vulnerability. The government needs to connect the dots between its plan and vision and the day-to-day lives of people.

Crucially, there is no dominant belief in any single source of financing. Most expect more borrowing and larger deficits, but fewer believe there will be major tax increases or meaningful corporate contributions. And just 12% expect any real constraint on future spending. That leaves the government exposed on the question of fiscal credibility, particularly with older voters and those outside the progressive coalition.

So, what still needs to happen?

First, the government needs to personalize the upside by showing not just what the budget will contain, but who it’s meant to help. That story is currently vague and uneven. Second, it must begin to lay narrative track for how the budget will be financed, especially if restraint or sacrifice will be required. Third, it must reclaim credibility on fiscal discipline, not with abstract metrics, but through choices that feel targeted, purposeful, and fair.

The groundwork has been laid. But the next four weeks are about converting that expectation-setting into alignment and avoiding the perception that the budget, however well-constructed, simply missed the moment.

Methodology

The survey was conducted with 2,230 Canadians from September 12 to 17, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.1%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, and region. Totals may not add up to 100 due to rounding.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

The survey was paid for by Abacus Data Inc.

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.