Abacus Nova Scotia Poll: Houston’s PCs Maintain Commanding Lead as Fall Session Opens

September 22, 2025

From September 16 to 18, 2025, Abacus Data surveyed 600 adults in Nova Scotia. The results provide a clear picture of the political environment as as provincial politicians return to Province House for the fall session.

PCs Continue to Dominate the Political Landscape

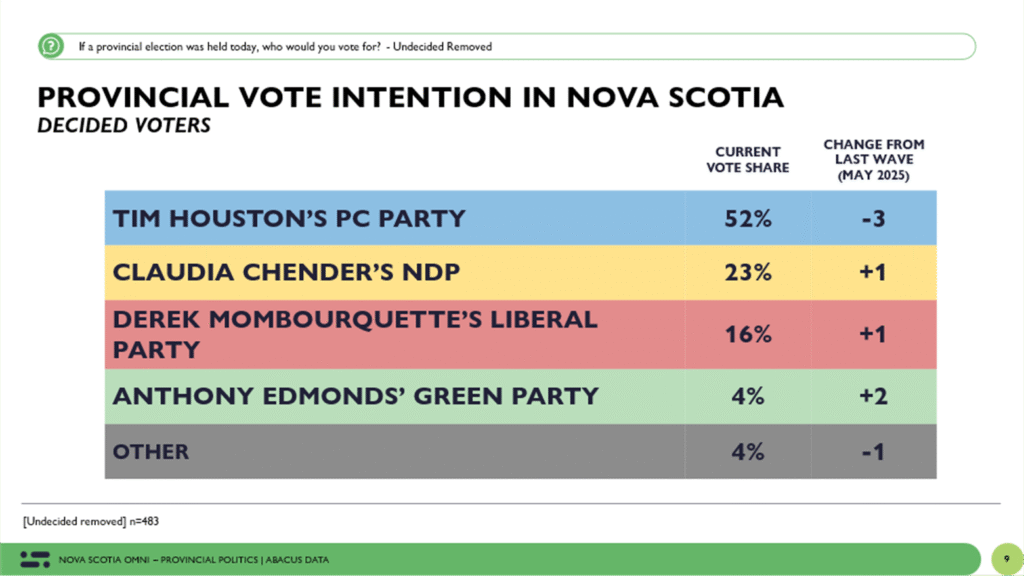

Premier Tim Houston’s Progressive Conservatives remain well ahead of the opposition parties, with support levels holding close to their 2024 election performance. The PCs currently sit at 52 percent province-wide, down three points since May but just one point below their “supermajority” result in 2024.

The opposition remains divided. Claudia Chender’s NDP records 23 percent, only a point above their May level and the same as their 2024 election result. Derek Mombourquette’s Liberals are at 16 percent, also up a single point since May but far below their 2024 result under former leader Zach Churchill. The Green Party is at 5 percent. With these numbers, the PCs continue to benefit from a fractured opposition, maintaining a 29-point lead over their closest rival.

Regional and Demographic Patterns

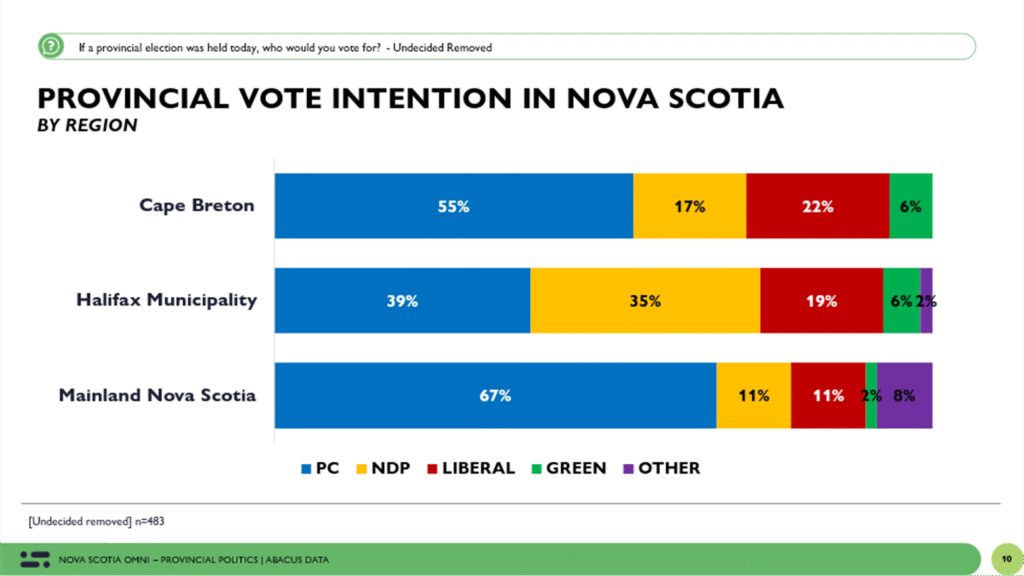

The PCs continue to lead across most of the province. In Mainland Nova Scotia, they hold 67 percent support, leaving the NDP and Liberals tied at 11 percent. In Cape Breton, they remain ahead with 55 percent, followed by the Liberals at 22 percent and the NDP at 17 percent.

Halifax looks different. Over the summer, the gap between the PCs and the NDP has significantly narrowed. The governing party is now at 39 percent in the municipality, a ten-point drop since May, while the NDP is at 35 percent, up four points. The Liberals also improved in Halifax, climbing to 19 percent. The PCs now lead the NDP by only four points in the province’s most populous region.

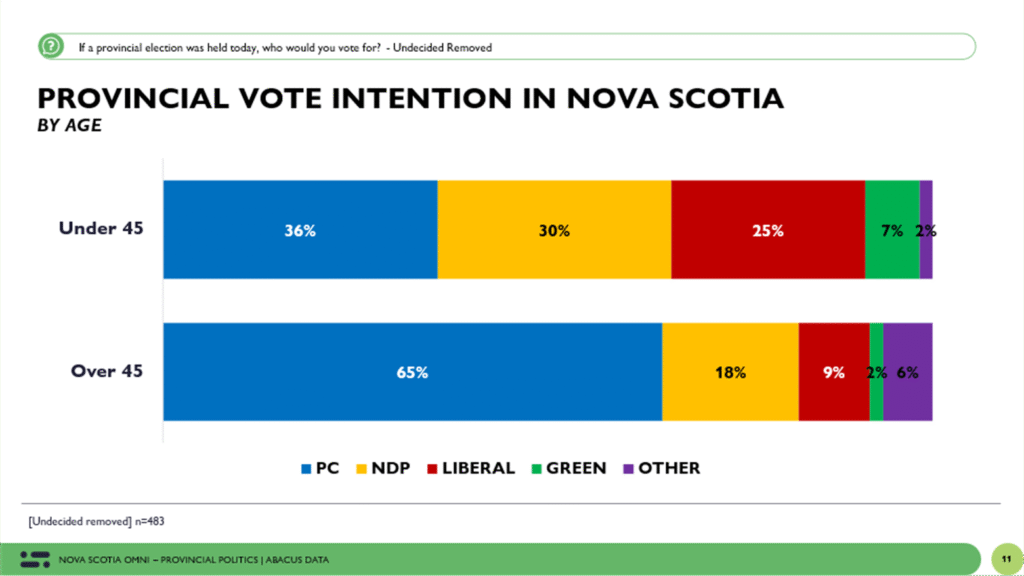

The PCs also continue to lead among both men and women, with stronger support among women at 58 percent compared with 46 percent among men. They lead in every age group, with their strongest backing among older Nova Scotians. Sixty-five percent of those aged 45 and over say they would vote PC, while 36 percent of those under 45 would do the same. Among younger voters, the NDP has gained ground, climbing to 30 percent.

The tightening in Halifax and among younger voters suggests potential areas of vulnerability for the PCs, even as they remain far ahead overall and dominate outside of the HRM.

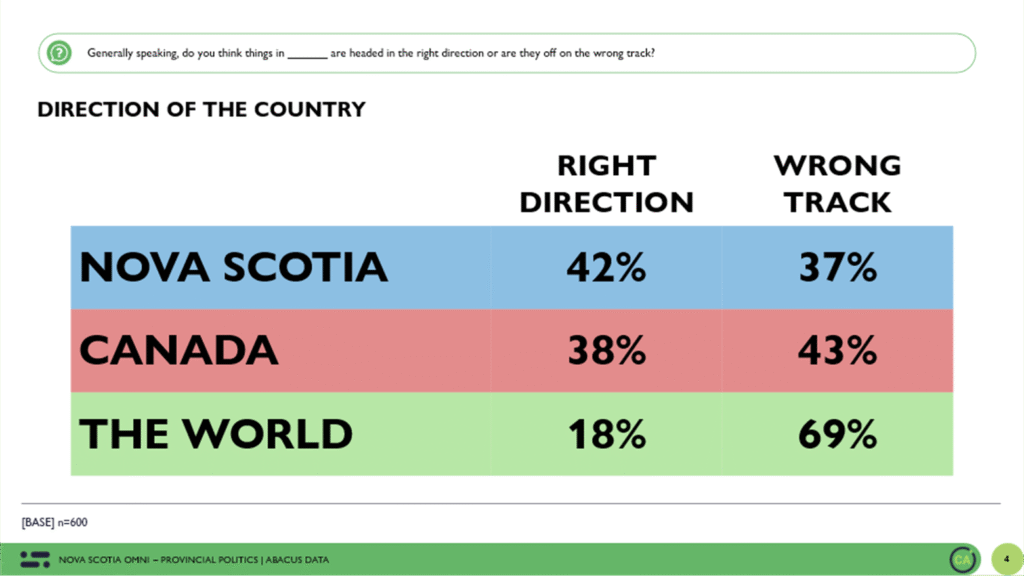

Public Mood: Positive for Province, Negative for Country and World

Nova Scotians remain more optimistic about their own province than about Canada or the wider world. Forty-two percent believe things in the province are headed in the right direction compared with 37 percent who say the wrong track. By contrast, only 38 percent believe Canada is headed in the right direction, while a majority feel the country is off track. Views of the world are even more pessimistic, with just 11 percent saying things are headed in the right direction.

This contrast highlights how Nova Scotians separate their provincial context from the broader national and global environment, which continues to be viewed through a more negative lens.

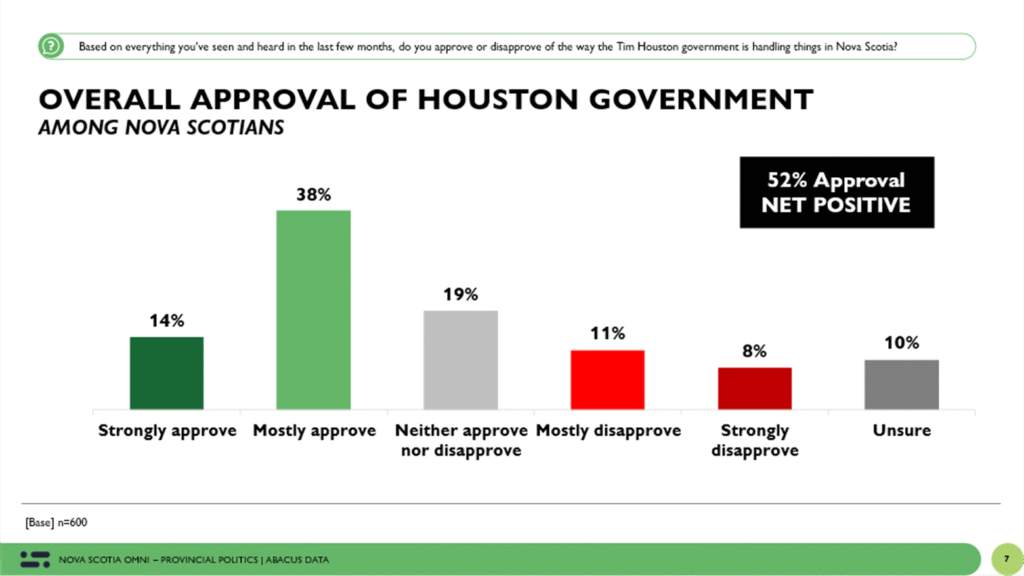

Government Approval Remains Strong Overall, But Issue-Specific Weaknesses Persist

Overall, 52 percent approve of the Houston government’s performance, compared with 20 percent who disapprove. This level of approval is consistent with the government’s continued electoral strength.

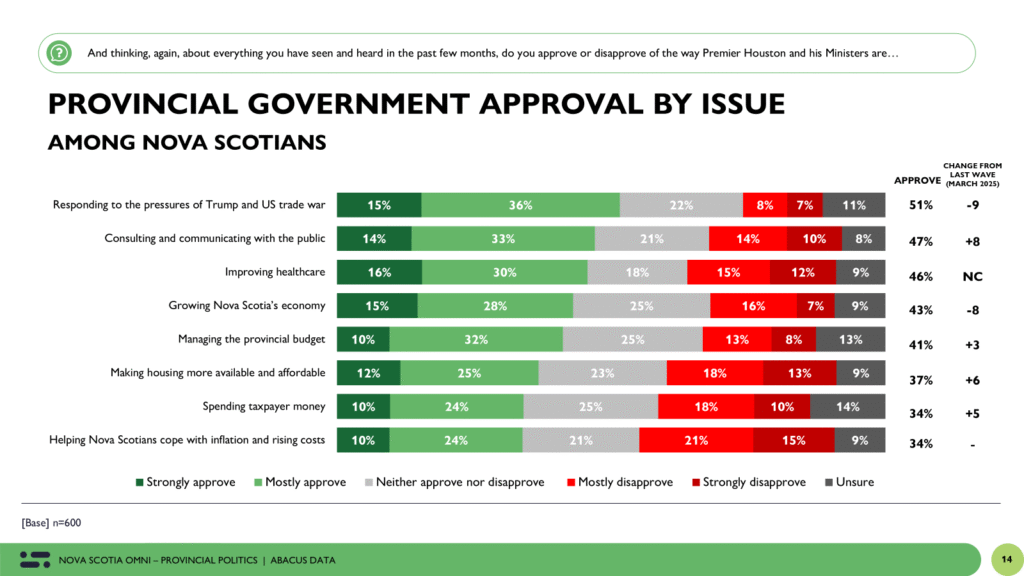

Approval varies across issue areas. Half approve of the government’s handling of the U.S. trade dispute and Donald Trump (although down 9 since March), 46 percent approve of its performance on healthcare (unchanged), and 43 percent approve of its handling of the provincial economy (down 8 since May). Evaluations are lowest on affordability, spending taxpayer money and housing, with only about a third of Nova Scotians currently approving of the government’s record in those areas.

The data suggest that while Nova Scotians broadly support the government, performance assessments on housing, affordability, and fiscal management remain weaker points.

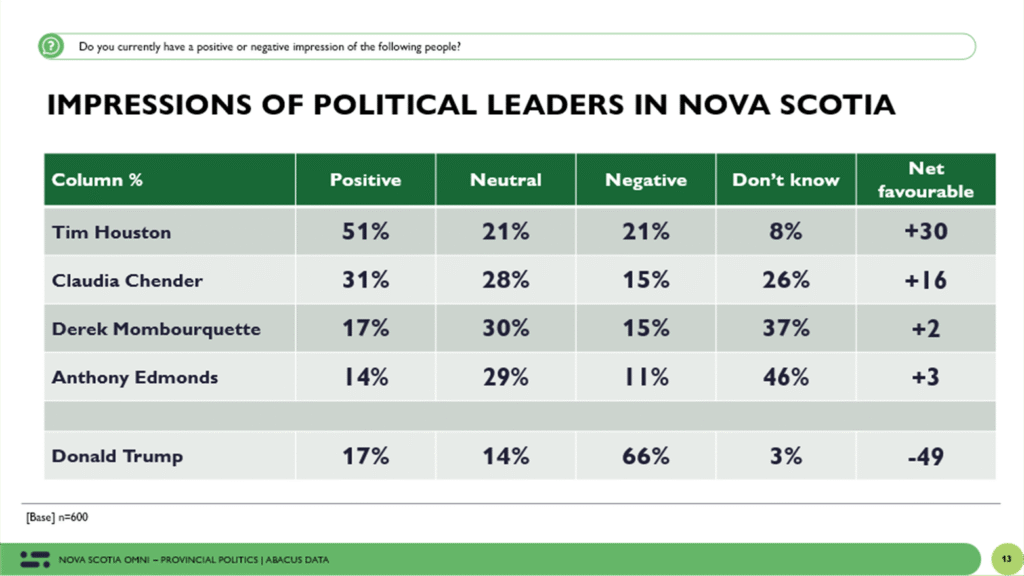

Leader Impressions

Premier Tim Houston remains well regarded, with a net impression score of plus 30, a strong result for any incumbent. Claudia Chender also records a positive net score of plus 16. Mombourquette and Green leader Anthony Edmonds are less well known and therefore have higher neutral and unsure results.

THE UPSHOT

Premier Tim Houston and the Nova Scotia Progressive Conservatives remain firmly in control of the province’s political landscape. Despite some slippage since May, support for the PCs sits almost exactly where it did on election night in 2024, underscoring the resilience of their coalition and the weakness of a divided opposition.

The mood of the province adds to the government’s advantage. More Nova Scotians believe things are headed in the right direction than the wrong track, a sharp contrast with far gloomier assessments of Canada and the world. Combined with a solid 52% approval rating for the government and Houston’s strong personal numbers, the PCs enter the Fall Session in a commanding position.

But the picture is not without warning signs. Approval of the government’s performance is far weaker on core bread-and-butter issues like housing, affordability, and fiscal management. These files remain the pressure points for the Houston government heading into the Fall legislative Session. The narrowing race in Halifax, where the PCs’ lead over the NDP has now shrunk to just four points, also shows that the governing party is not invulnerable, especially among younger voters who are increasingly drawn to Claudia Chender’s NDP.

For the opposition, however, small incremental gains are not enough. The Liberals, in particular, are struggling to recover under Derek Mombourquette’s interim leadership and not benefitting from Prime Minister Carney’s personal popularity in Atlantic Canada and a stronger Federal Liberal brand across the country.

Heading into the Fall Session, the Progressive Conservatives enjoy the rare combination of a popular leader, a supportive public mood about the province, and an opposition divided between two parties still searching for growth and momentum. Unless affordability pressures intensify and the NDP’s younger voter base continues to grow, the Houston government remains the province’s dominant political force.

Methodology

This research was conducted by online survey with 600 adult Nova Scotians (age 18+) from September 16 to 18, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 4.1%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

The survey was paid for by Abacus Data Inc.

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.