Canadians think their tax system is unfair and support new revenue tools that bring down the deficit and reduce inequality now.

August 4, 2021

Pour l’analyse de la langue française, cliquez ici

In mid-July, the Broadbent Institute and the Professional Institute for the Public Service of Canada commissioned Abacus Data to conduct a national public opinion survey to explore attitudes and opinions about tax fairness in Canada. These questions were part of a larger survey exploring opinions about tax fairness, affordability, and the impact of the pandemic on household finances.

The survey found:

1. Most think the pandemic has increased inequality in Canada. More than half of Canadians believe that the pandemic has increase inequality in Canada while 34% think it is about where it was before the pandemic started.

2. Most think Canada’s tax system is unfair. 62% of Canadians describe Canada’s tax system as unfair while only 14% believe it is fair.

3. Tax fairness ≠ “I have to pay more taxes”. Almost all believe that if the tax system was made fairer the amount of taxes they pay would not increase

4. Why do people feel the tax system is unfair? 70% or more feel that large corporations and wealthy Canadians do not pay their fair share in taxes while 40% feel that lower- and middle-income Canadians pay more than their fair share. Most Canadians feel that small businesses pay their fair share in taxes.

5. Now is the time to tackle wealth inequality: A clear majority (82%) believe now is the time to tackle wealth and income inequality by increasing taxes on wealthy Canadians and large, profitable corporations. And we find broad and deep support for several ideas.

6. There is wide support for several tax measures to reduce inequality and raise revenue. The survey also tested support for several ideas to raise revenue to help pay for the pandemic and the post-pandemic recovery.

a. 92% support closing tax loopholes used primarily by the wealthy to lower their overall income tax rate.

b. 92% support making it harder for corporations to strategically book profits in tax havens when no economic activity happens there.

c. 89% support (50% strongly support) a wealth tax paid by the richest Canadians every year.

d. 89% support (44% strongly support) increasing the income tax rate for those who earn $750,000 or more to 37%.

e. 87% support (43% strongly support) an excessive corporate profit tax paid by businesses whose profits are extraordinarily high during the pandemic.

7. Support for these ideas is deep and broad-based: Most telling, support for these ideas cross regional, demographic, and political groups in Canada. For example, when it comes to a wealth tax, 83% of those intending to vote Conservative support the idea, as does 91% of Liberal supporters, 93% of NDP supporters, 96% of BQ supporters, and 95% of Green Party supporters.

8. Tax fairness is a low-risk proposition to most Canadians. When asked to assess the potential impact of increasing taxes on the wealthiest Canadians and large, profitable corporations, most felt that it the quality of life for all Canadians would improve, the federal government wouldn’t have to make as big spending cuts to reduce the deficit and there would be little impact on the Canadian economy.

9. The Trudeau government hasn’t done enough. Most think the Trudeau government hasn’t done enough to make life more affordable, ensure everyone pays their fair share in taxes, and reduce income and wealth inequality in Canada, including a sizeable proportion Liberal Party supporters.

10. Tax Fairness is politically powerful. Almost all Canadians (89%) say they would definitely would consider (33%) or probably would consider (56%) voting for a party that promised to “take real and concrete action in making sure everyone pays their fair share and increasing taxes paid by the wealthiest Canadians and large, profitable corporation.” This view was shared by 97% of NDP supporters, 92% of Liberal supporters, and 84% of Conservative supporters.

11. No Leader or party has a clear advantage on tax fairness or affordability: When asked which party or leader would do the best on affordability, inequality, and tax fairness, no party or leader was the clear preference. When it comes to tax fairness, 21% felt Justin Trudeau and the Liberals would be best, the same percentage who felt that way about Jagmeet Singh and the NDP. Erin O’Toole and the Conservatives were third at 15%. Over 1 in 3 were unsure.

The same was true for who people felt would be best at reducing income and wealth inequality in Canada. Jagmeet Singh and the NDP have a marginal advantage over the Liberals and Mr. Trudeau (24% to 22%) but 1 in 3 are unsure.

Even when it comes to making life more affordable, no leader has a clear advantage with Trudeau coming slightly ahead of Singh (24% vs. 20%) with Erin O’Toole back in third at 17%.

For all the results with breakouts by region, demographics, and political support, please download the full report here.

UPSHOT

The COVID-19 pandemic put a spotlight on the inequalities that exist in our society and most Canadians believe the pandemic has increased income and wealth inequality.

Recognizing that paying for the pandemic and the post-pandemic recovery will mean higher public debt, there’s a near public consensus that increasing taxes on the wealthiest people and large corporations not only will help reduce the deficit but also decrease inequality in Canada.

Consider the near-universal appeal of a wealth tax, closing loopholes, or increasing personal and business income taxes on wealthy people and large corporations. Few fear that making the tax system fairer will result in them paying more in taxes. This confirmed there’s little political risk in moving ahead on this agenda.

For the Liberal government, this data indicates some vulnerability. Most, including many Liberal supporters, feel the Trudeau government hasn’t done enough to address inequality or ensure everyone pays their fair share. And Mr. Singh and the NDP are seen as the best option on achieving those outcomes as Mr. Trudeau and the Liberals are.

As we enter a likely election campaign this summer and debates about how we will pay for the pandemic and recovery start, the appeal of a tax fairness agenda is clear – for all political parties.

Canadians think their tax system is unfair. They know we need to raise more revenue and, as a future release of this survey will show, they think spending cuts will have a negative impact on their lives. Asking those who have the most and have benefited from the pandemic seems like a reasonable and low-risk solution to almost all of them.

Tax fairness could become the lens by which the next election is fought and what impacts the vote choice of millions of voters.

For the full report and additional analysis, visit the Broadbent Institute’s website

METHODOLOGY

Our survey was conducted online with 1,500 Canadians aged 18 and over from July 13 to 19, 2021. A random sample of panellists was invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

Find out more about what we are doing to help clients respond to the COVID-19 pandemic.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

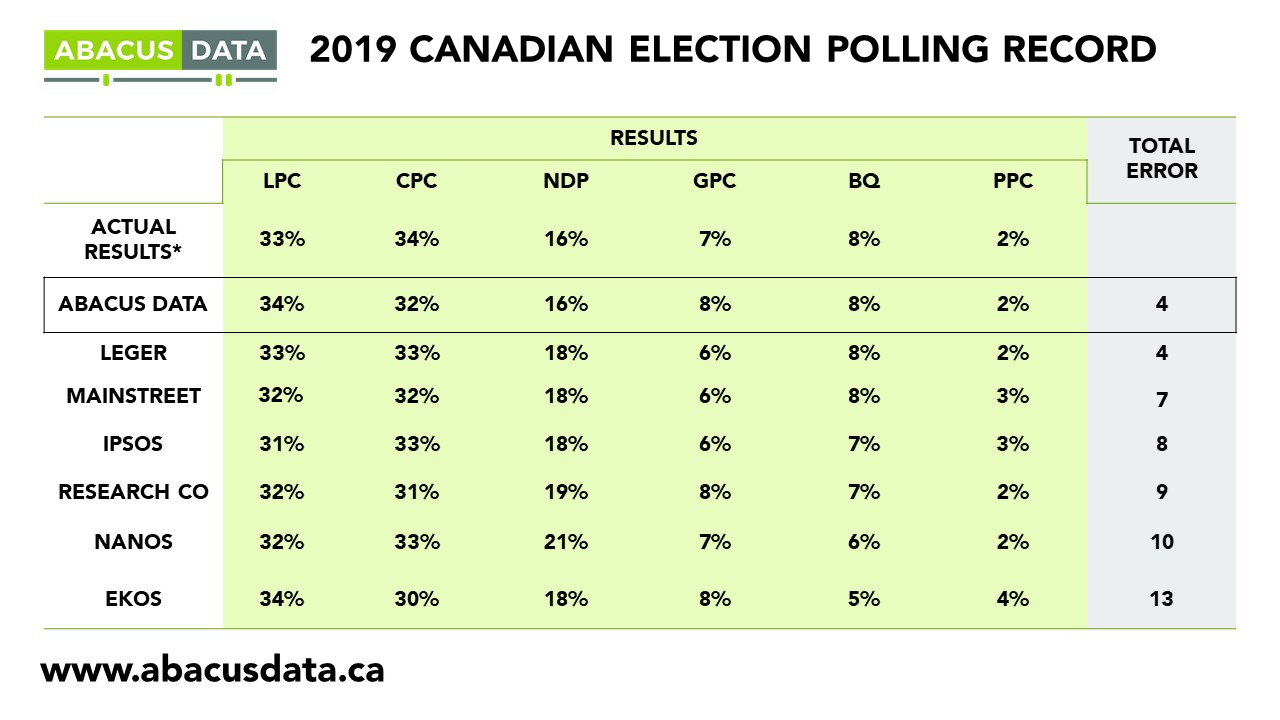

We were one of the most accurate pollsters conducting research during the 2019 Canadian Election.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.