Public Attitudes on Oil, Pipelines, Climate, and Change

September 9, 2017

We’ve been tracking opinion about oil, energy, pipelines and climate change for several years and late this summer returned to that subject in a nationwide study. Here are the highlights of our findings:

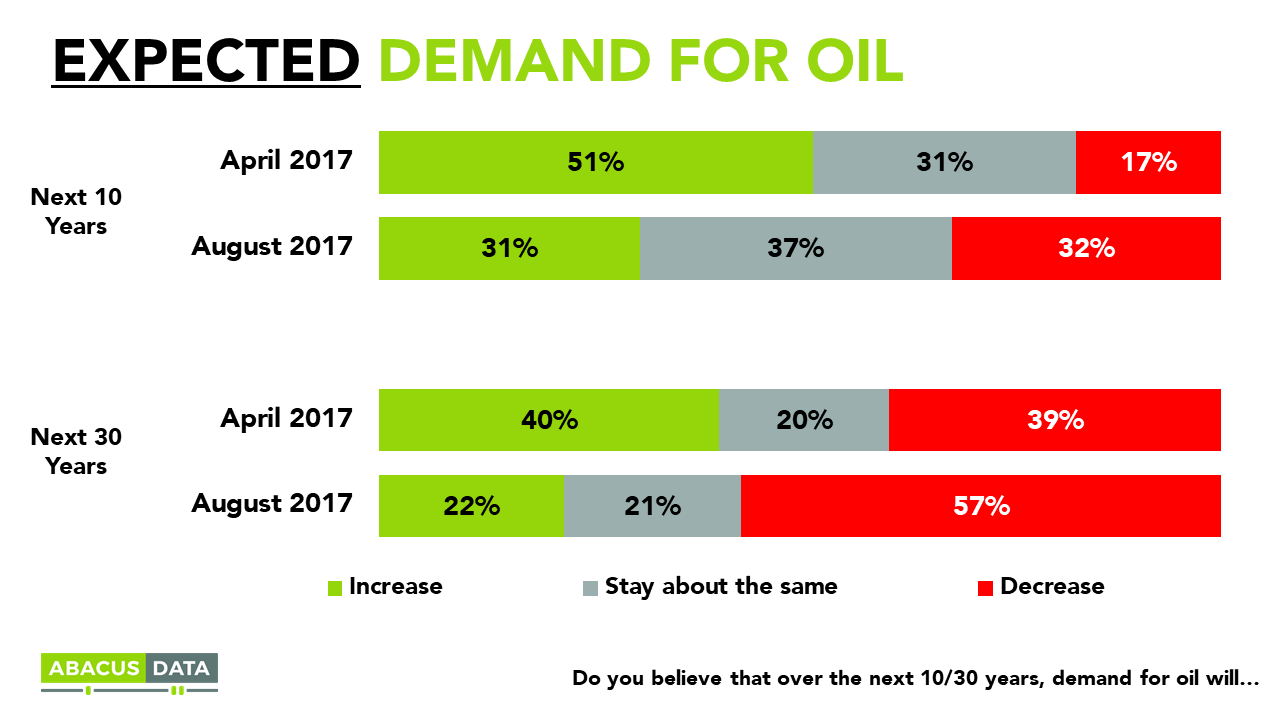

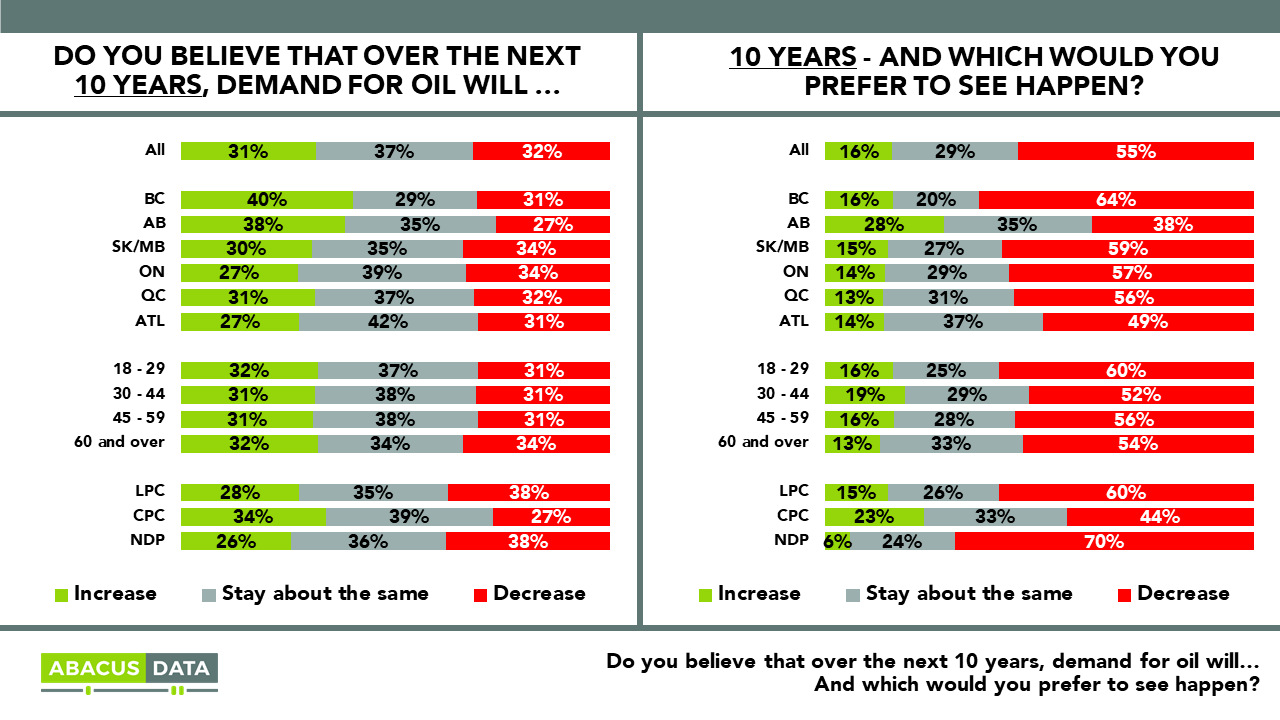

Canadians are becoming more convinced that oil will experience a decline in demand in the next few decades. Ten years from now, equal numbers believe demand for oil will be rising (31%) as believe it will be falling (32%). This represents a striking 15-point increase in the number who believe demand will be falling, compared to our result in April of this year.

Thirty years from now, a majority (57%) now believe that demand for oil will be falling, compared to just 22% who think it will still be increasing. This is an 18-point increase in the belief that demand will be falling.

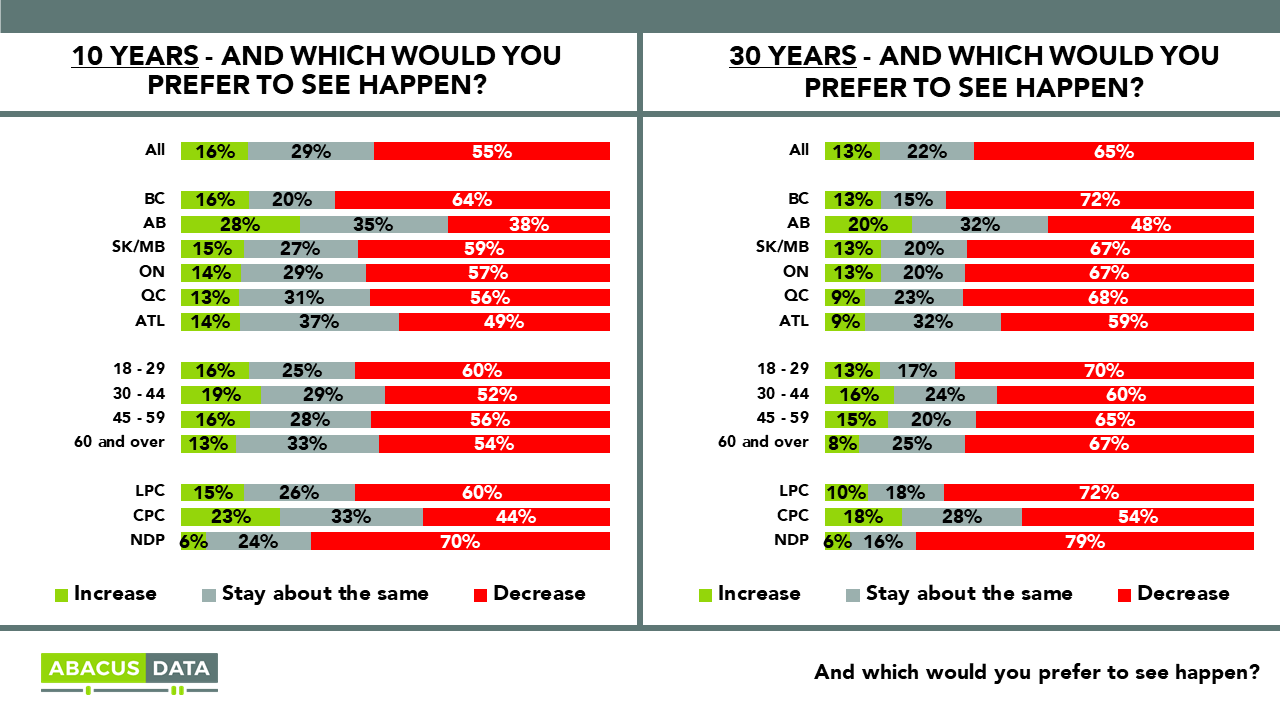

In terms of what people would prefer to see happen to demand for oil, a majority (55%) would prefer to see demand in decline in 10 years (55%, up from 44% in April) and fully two-thirds would like to see demand declining in 30 years (65%, up from 55% in April).

In Canada’s top oil producing province of Alberta, more people would like to see demand for oil declining (38%) in 10 years as would like to see it increasing (28%). Looking out 30 years, 48% would prefer to see oil demand in decline, compared to 20% who would like to see it increasing.

While NDP and Liberal voters are more inclined to want to see a decline in demand for oil, a striking 44% of Conservative voters would like to see oil in decline in 10 years, and 54% feel that way on a 30 year out basis.

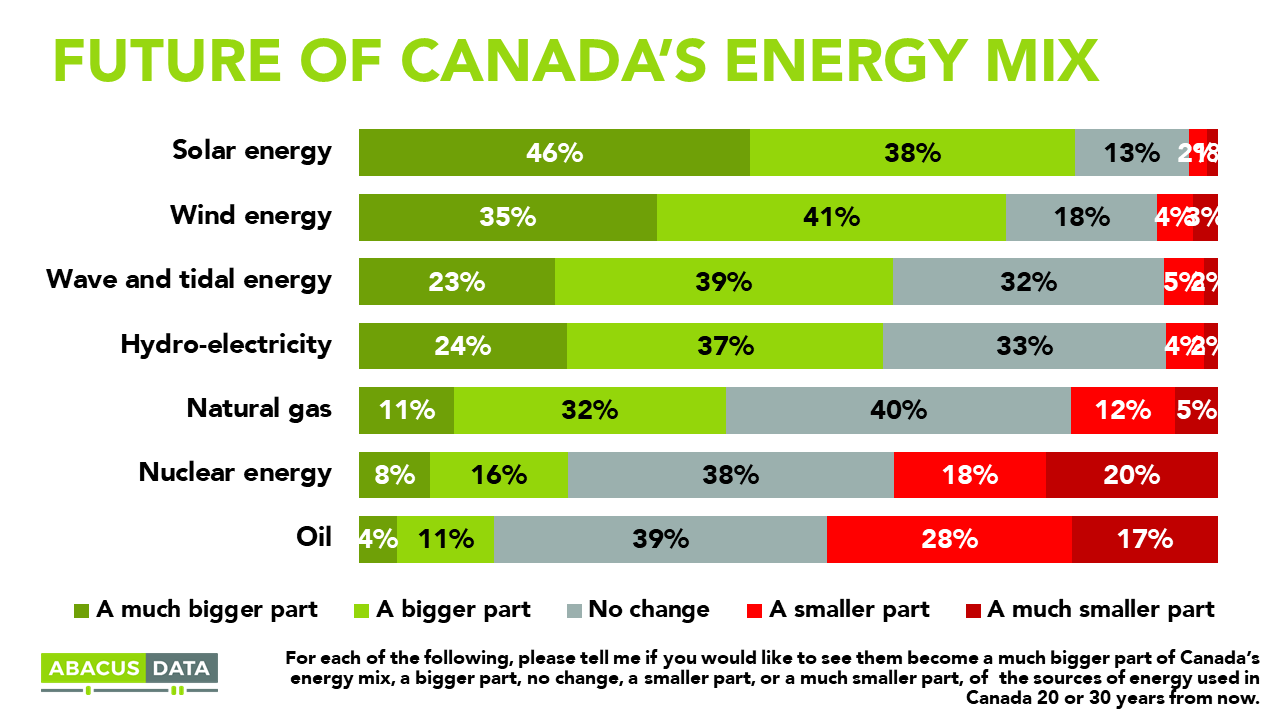

When asked what they would like to see in terms of the energy mix for Canada 20 or 30 years from now, the results show a strong desire for Canada embrace more renewable sources of energy, with solar and wind energy at the top of the wish list. Majorities would also like to see increased use of wave and tidal and hydro electricity. When it comes to fossil fuels, natural gas is much more positively regarded than oil: 44% say they would like to see more use of natural gas compared to 15% for oil.

The desire to see more use of solar and wind energy is widespread in every region, across all age groups, and among supporters of all three major political parties.

VIEWS OF PIPELINES

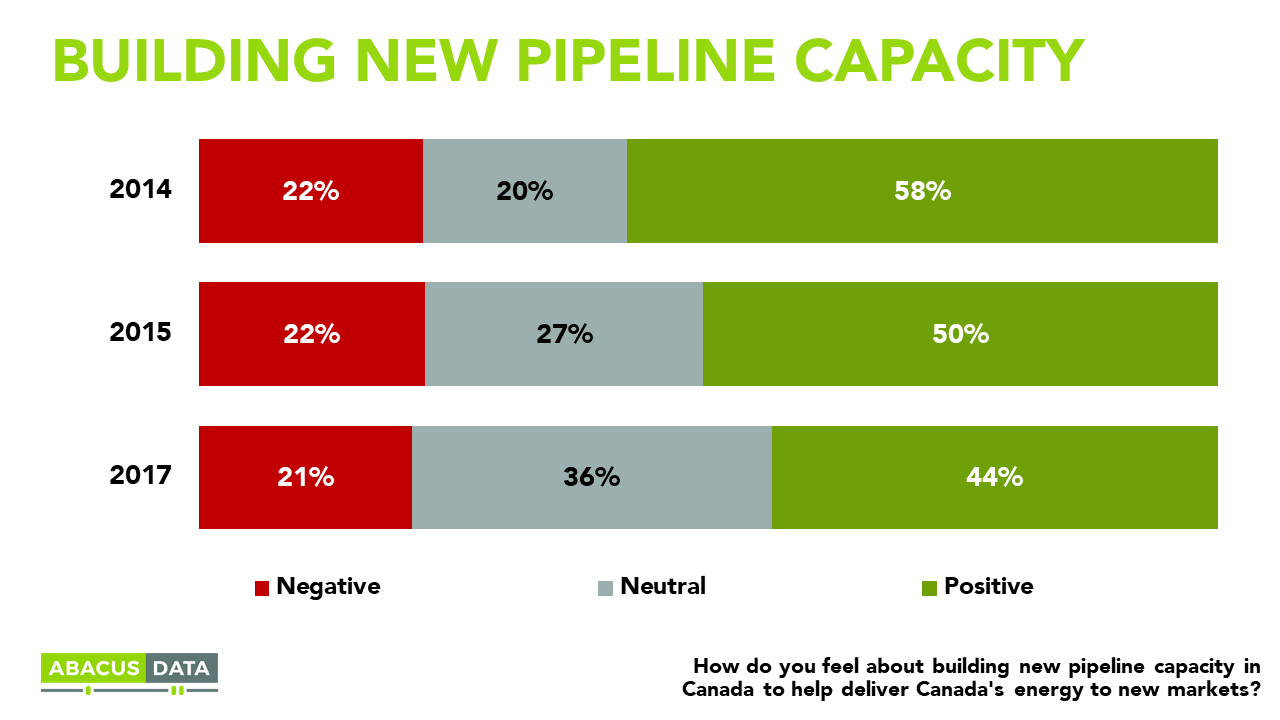

Over the last 3 years, feelings about the construction of new pipelines to deliver Canadian energy to new markets have shifted. Negative feelings have not grown (21%), but positive feelings (44%) have dropped, while more people take a neutral stance (36%).

Discomfort with the idea of new pipelines is higher than average in BC (29%) and Quebec (29%) while positive feelings are much higher in Alberta (67%). Differences by generation and partisanship are also noticeable when it comes to pipeline attitudes. Younger people are less positive and more neutral compared to older people. Conservatives (69%) are much more positively disposed towards new pipelines, compared to Liberals (45%) and New Democrats (25%).

Worth noting is that the public debate, or at least the news coverage of it, may tend to leave the impression that most people have very strong views – however our results show that strong positive views tend to be more isolated to Albertans and Conservative voters, and strong negative views are less than 15% even in BC and Quebec.

When asked to choose between two alternatives: building new pipelines while pursuing efforts to reduce emissions, or building no new pipelines to avoid contributing to climate change, the large majority continues to support a transition strategy, as was the case in 2016.

Worth noting is that 64% in BC and 51% of NDP voters believe that the country should continue to add pipeline capacity while investing in efforts to reduce emissions. Quebecers are evenly split on this question.

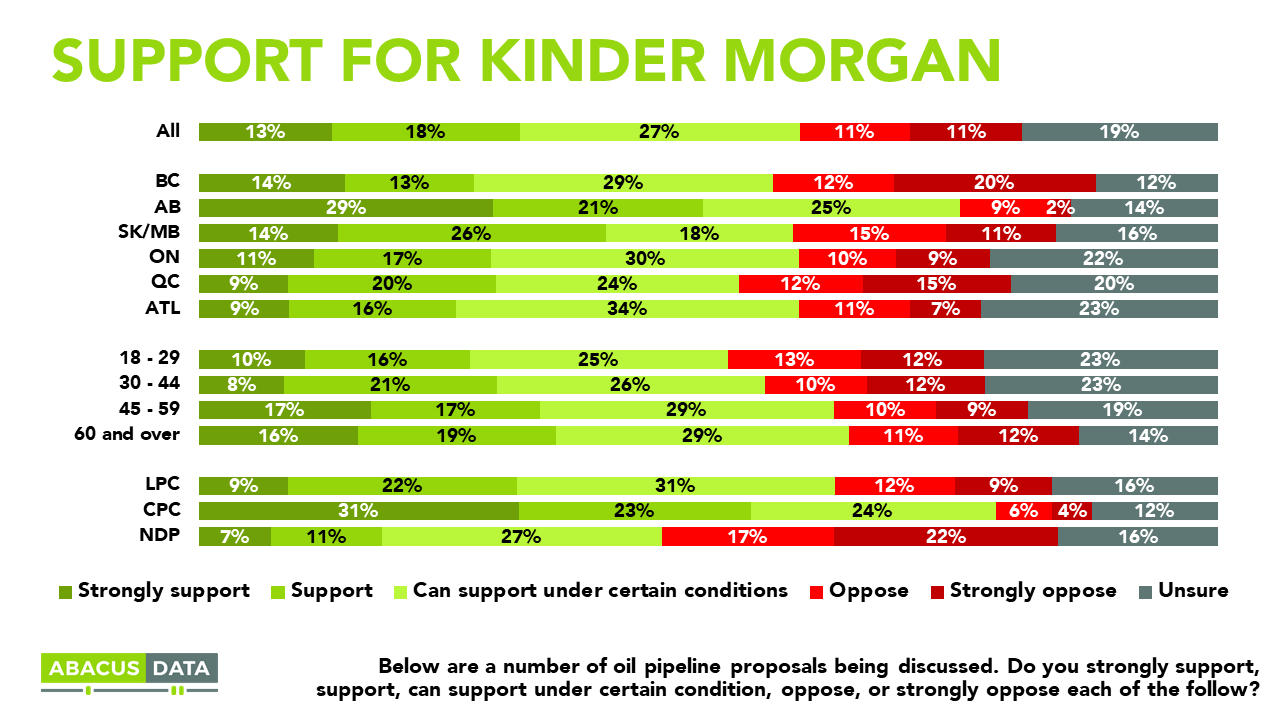

On one of the most prominent pipeline projects in recent years, Kinder Morgan’s Trans Mountain, opinion has not really changed since our measurement last year.

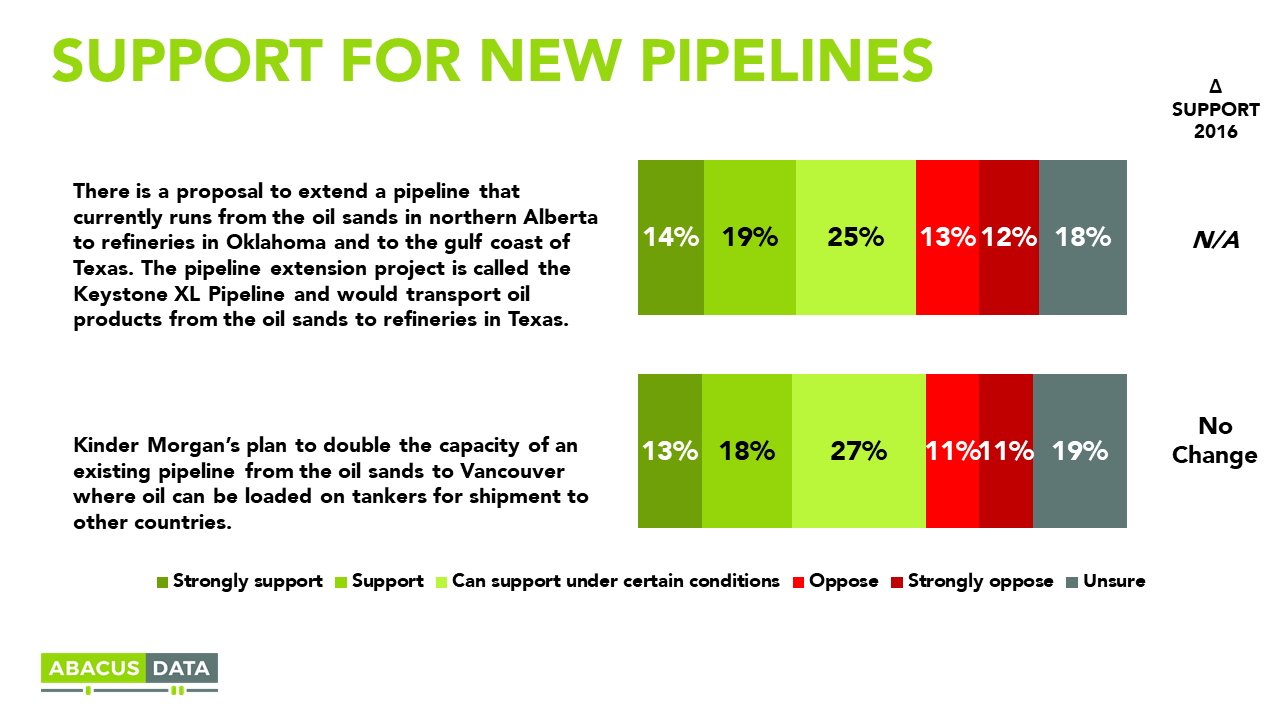

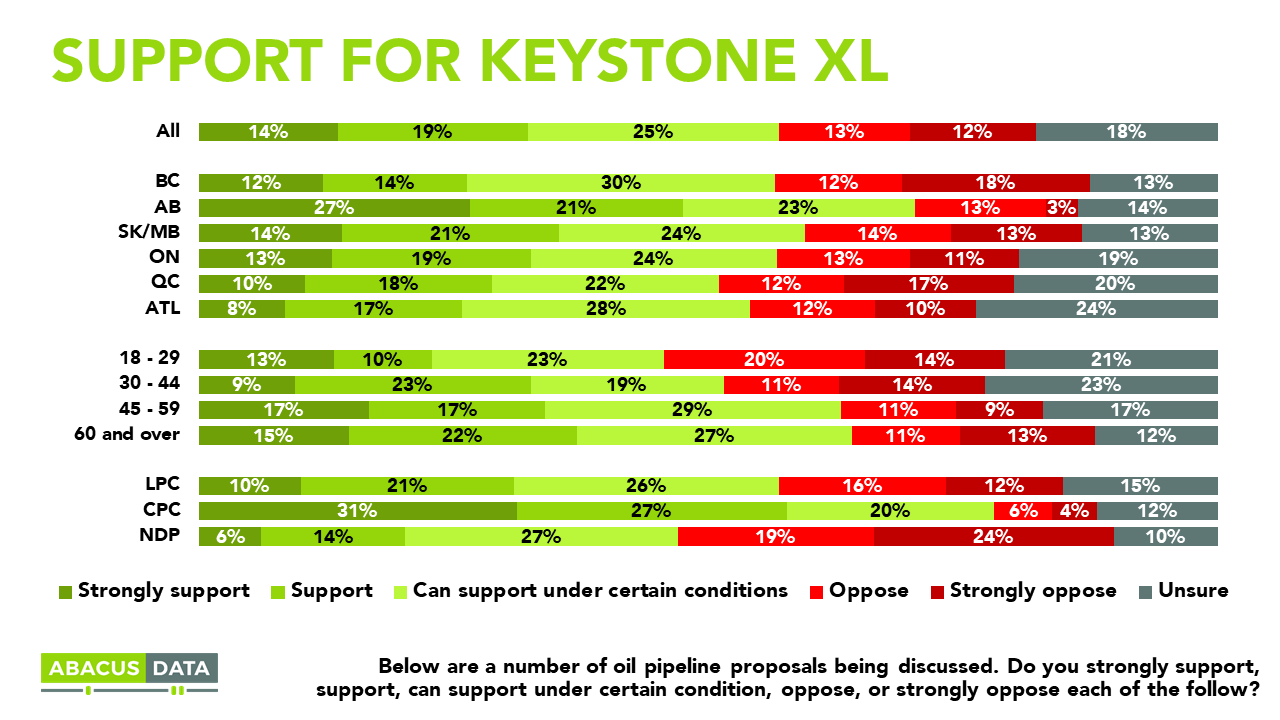

On Keystone, 33% support, 25% oppose, and 25% say they can support the project under certain conditions. For the Kinder Morgan project, 31% support, 22% oppose, and 27% can support the project under certain circumstances.

For the Kinder Morgan project, opinion in BC is different from what we find in other parts of the country, but perhaps not to the extent that might be imagined. In that province, 27% support, 32% oppose and 29% say they can support the project under some circumstances. Opposition to the project is strongest among NDP voters, among whom 39% oppose the project.

Anxiety about pipelines is a function of two types of concern: for 27% it is a concern about the risk of spills, but for more people (37%) it has to do with a desire to see a shift away from fossil fuels. Those opposed to Kinder Morgan and Keystone specifically tend to be much more likely to feel there is a high risk of spills (46%-44%), while very few supporters feel the same way (13%-14%).

In BC and Quebec, concerns about spills are higher than average, while among younger people, hesitation is more likely tied to a desire to see a shift away from fossil fuels.

SURROUNDING ATTITUDES ON PIPELINES

Most Canadians (70%) believe that “pipelines play an essential role in delivering the energy we all use every day” and an essential role in the economy of Canada (68%). People are far more likely to agree (63%) than disagree (22%) that pipelines deliver a huge amount of energy across Canada with few incidents.

The majority believes that Canadian pipeline companies put a lot of effort into ensuring safe operation and that pipelines are subject to rigorous oversight by government. Confidence in the oversight by the government has increased 7 points since our last measurement in 2015.

SURROUNDING ATTITUDES ON OIL

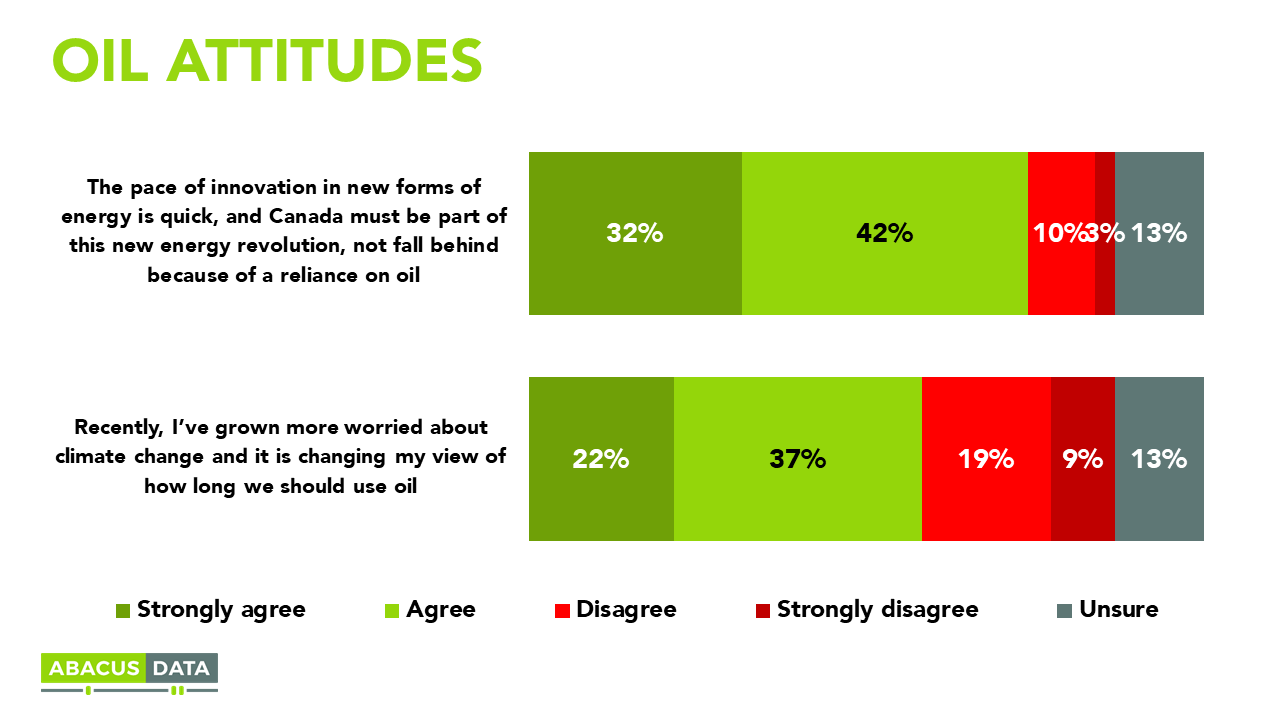

Attitudes about oil are increasingly being shaped by concerns about climate change and also a sense that energy innovation is happening quickly and that Canada cannot afford to fall behind this trend because of a reliance on oil.

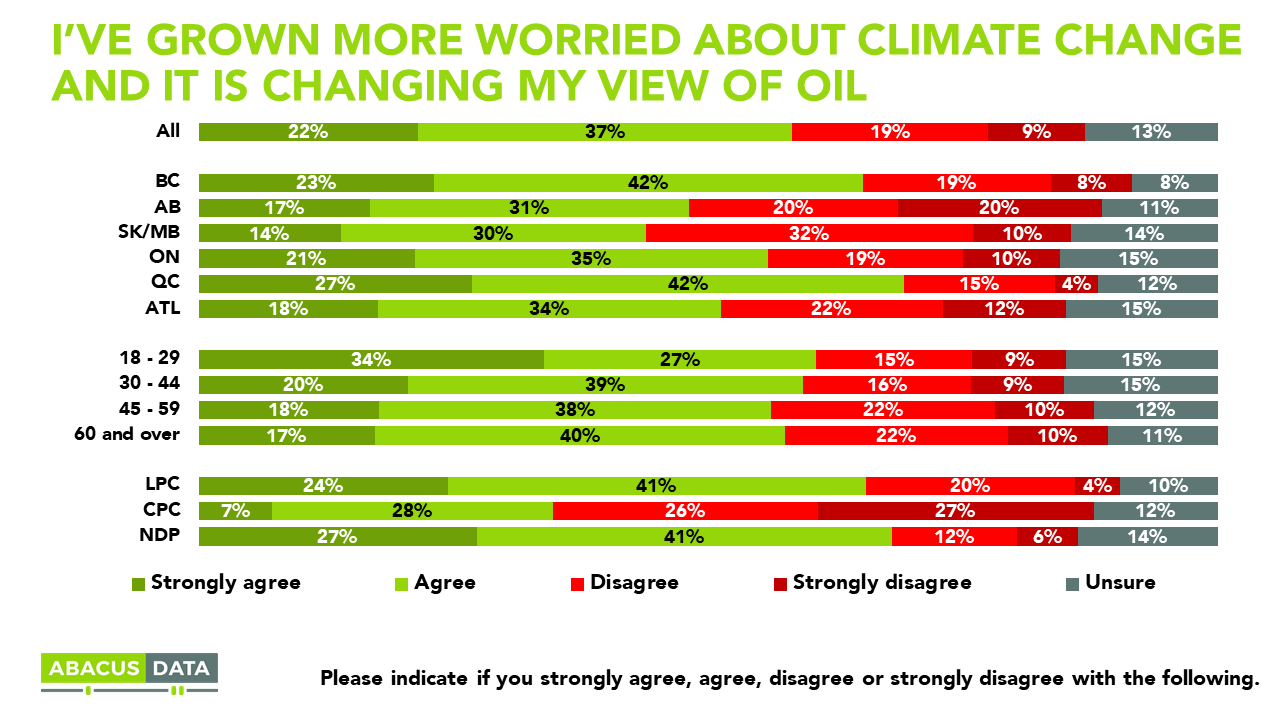

A majority is “recently growing more worried about climate change and it is changing my view of how long we should use oil”, including 48% of Albertans, and 35% of Conservative voters. And 3 out of 4 people don’t want to see “Canada fall behind in the race to innovate with new forms of energy because of a reliance on oil”, including 70% in Alberta and 69% of Conservative voters.

UPSHOT

According to Bruce Anderson: “Energy, pipeline and climate issues have been among the most highly charged political debates in Canada for several years. What we are seeing in our numbers now is an evolution of opinion: concerns about climate change have deepened, and belief that the world is going to transition away from oil has grown.

Canadians remain broadly inclined to believe that the right strategy for the country is to continue to harness our petroleum resources and to build pipeline capacity if needed, even while ramping up investments and policies that will see the country shift towards more reliance on renewable forms of energy.

Tensions around pipelines are evident but the public opinion data shows somewhat less strong opposition than might have been expected in BC.

Maybe the strongest signal of all, for governments, is the widespread feeling, including in Alberta, that Canada should not stand apart from the race to innovate with cleaner forms of energy, due to a reliance on oil. Canadians sense both an environmental and moral urgency and an economic wave that they want to be part of as well.”

METHODOLOGY

Our survey was conducted online with 2,036 Canadians aged 18 and over from August 4 to 7, 2017. A random sample of panelists was invited to complete the survey from a large representative panel of over 500,000 Canadians.

The Marketing Research and Intelligence Association policy limits statements about margins of sampling error for most online surveys. The margin of error for a comparable probability-based random sample of 2,036 is +/- 2.2%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

ABACUS DATA INC.

We offer global research capacity with a strong focus on customer service, attention to detail and value-added insight. Our team combines the experience of our Chairman Bruce Anderson, one of Canada’s leading research executives for two decades, with the energy, creativity and research expertise of CEO David Coletto, Ph.D.