Canadians and Health Care: Workplace and Group Insurance Plans

April 6, 2023

On behalf of the Canadian Life and Health Insurance Association, Abacus Data and Spark Insights conducted a nationwide survey of 1500 adult Canadians. The interviewing was done online between February 20 and 25th, 2023. This is #5 of a series of 5 releases highlighting key findings from that study. More information can be sought from Susan Murray of CLHIA or Bruce Anderson bruce@sparkadvocacy.ca

GROUP AND WORKPLACE INSURANCE BENEFITS

- The majority (64%) of Canadians have insurance plans that help them with the costs of things like eye care, prescriptions and dental care. A total of 41% (or more than 12 million adults) obtain benefits through an employer plan. Another 14 % participate in another form of group plan, and 9% purchase this type of insurance privately.

- 88% of those who have a benefits plan place either a great deal of value (46%) or quite a bit of value (42%) on having access to that plan. 84% say that their benefits plan has been very (36%) or quite helpful (48%) in saving them money.

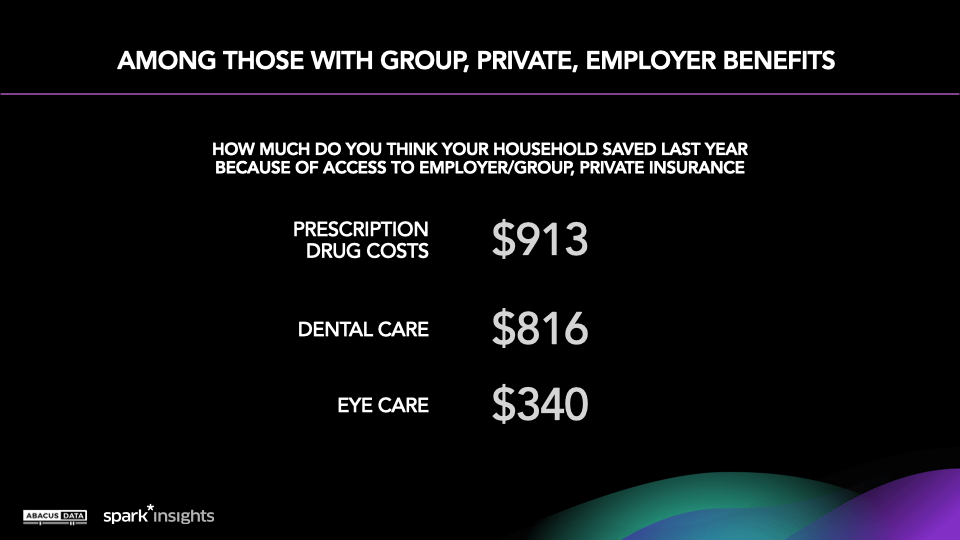

- The average plan user estimates that their plan saved their household $913 in prescription drug costs last year, $816 in dental care costs, and $339 in eye care costs.

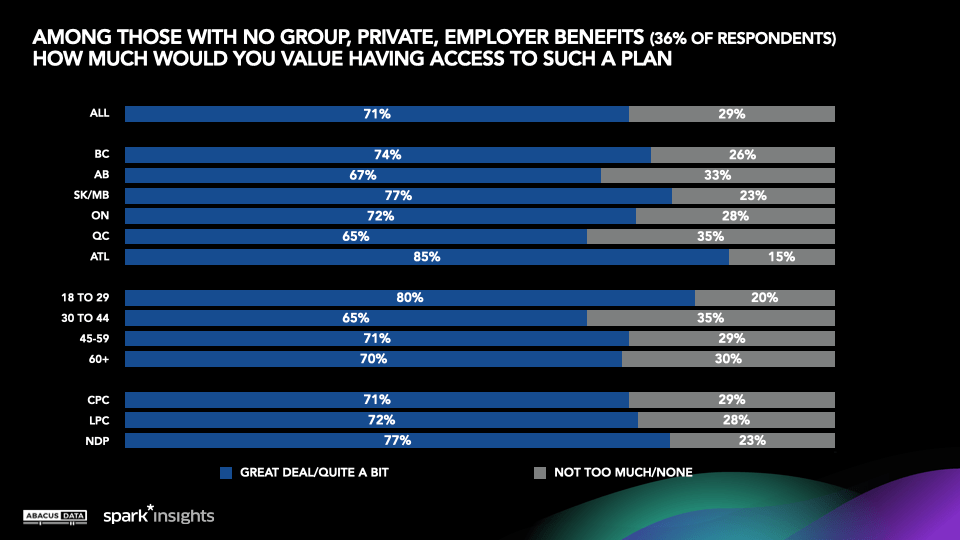

- 71% of those who don’t have access to such a plan, say they would value having one a great deal (38%) or quite a bit (33%).

TAX CREDIT TO EXPAND GROUP BENEFITS UPTAKE

- The large majority (93%) are open to (32%) or support (61%) the idea of government providing a tax credit for smaller and medium businesses that offer benefits for employees to help cover the costs of eye care, dental care, physiotherapy and mental health services. The appeal of this idea is broad across all regions, generations and across party lines.

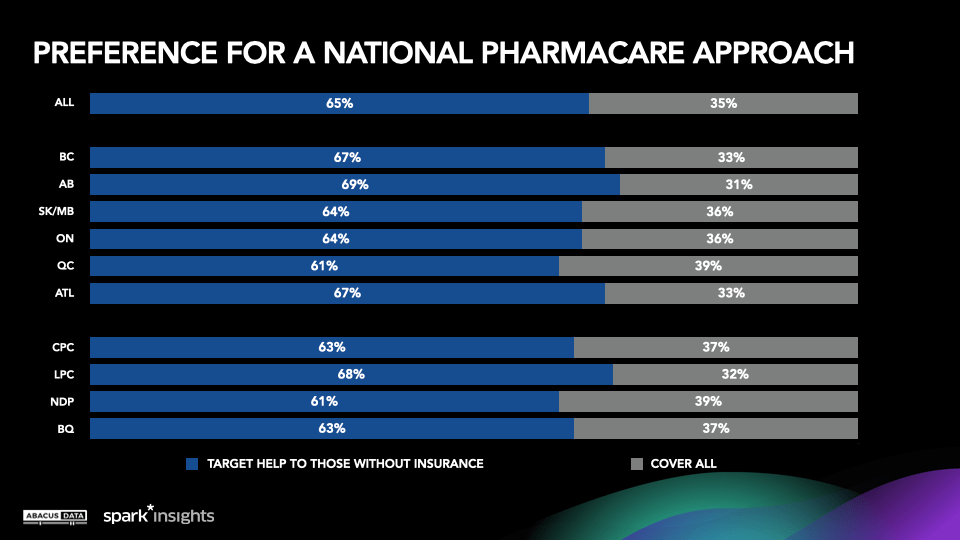

- When it comes to the future of pharmacare policy in Canada, most people (65%) believe the best approach would be to target help to those who currently have not drug coverage through an insurance plan today.

- 90% believe that group or employer insurance coverage that helps people with the costs of health services has been an example of private involvement in health care that has been a positive.

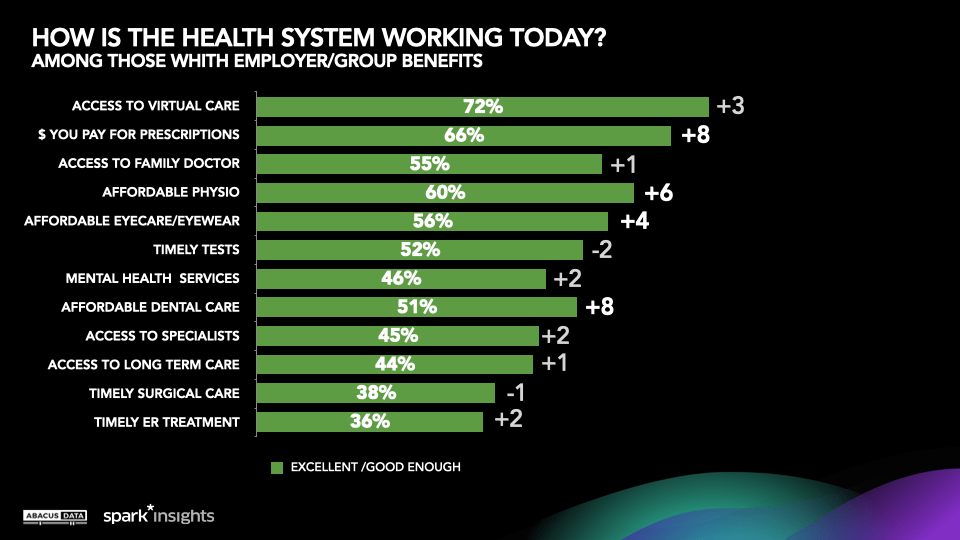

- In general, those who have access to employer or group benefits rate the performance of the health care system somewhat more highly than average, especially when it comes to the cost of prescriptions, physiotherapy, eye care and dental care.

SUMMARY

For most Canadians there are two forms of insurance that provide help with health care costs – provincially run health systems and additional benefit insurance that they have access to, most often through an employer or workplace. These additional benefit plans are highly valued as they save the average household considerable amounts of money each year. Those who don’t have access to such a plan would like to, and there is broad openness and majority support for the idea of a tax credit to stimulate take up among small and medium businesses.

METHODOLOGY

The survey was conducted with 1,500 Canadian adults from February 20 to 25, 2023. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by the Canadian Life and Health Insurance Association.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.