Canadian Fashion Trends and How They Influence Our Spending

July 21, 2022

In case you missed it, Paris Haute Couture Fashion Week took place from July 3rd-7th, and saw celebrities, influencers, and fashion fanatics from all over the world gather to see some of the most innovative and daring designs to ever hit the runway. While the event doesn’t focus on trends, fashion houses such as Balenciaga, Fendi couture, and Christian Dior strive to change the way we wear fashion forever.

As a life-long fan of fashion, I am naturally very interested in trends’ influence on our personal styles and spending habits. I remember back in high school, driving to three different stores just to find the pair of Nikes everyone was wearing at the time. Fashion is often associated with individuality and self-expression, but, for others like me, it can also mean fitting in and feeling like you belong.

We fielded some questions on our latest Omnibus survey of 1,500 Canadians to gain a sense of the current styles and accessories trending in Canada.

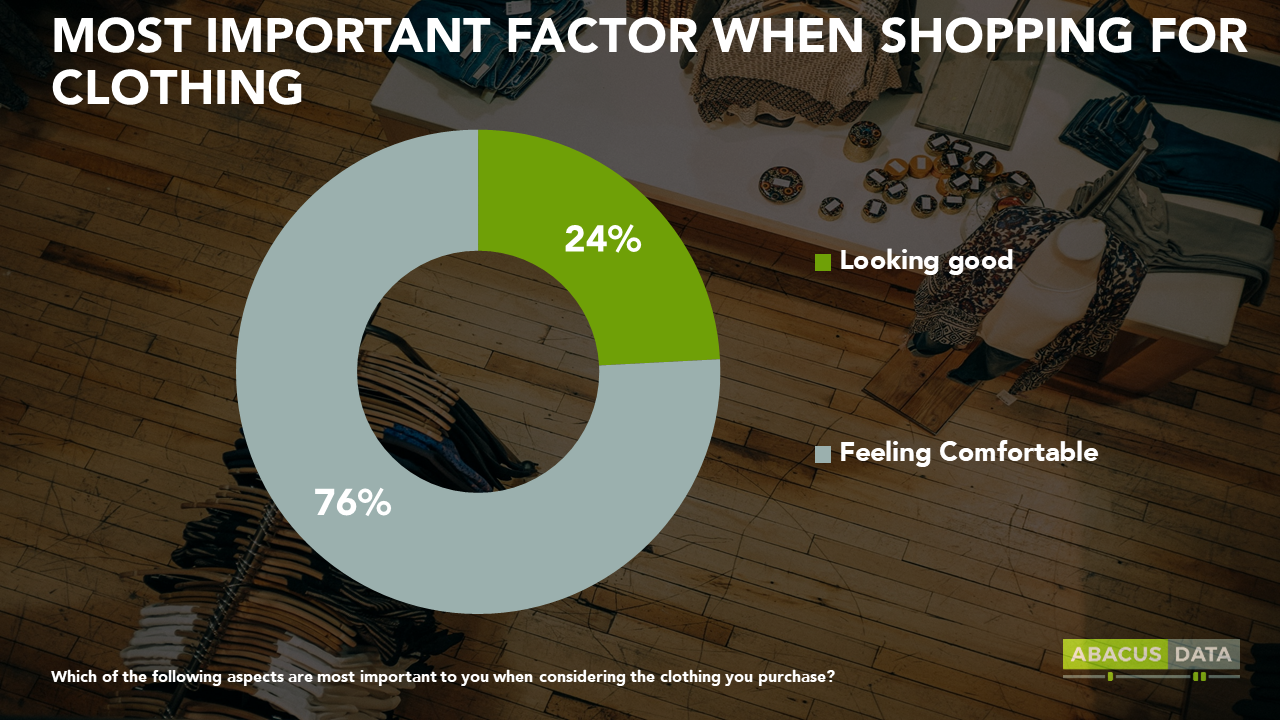

Have you ever looked at someone’s outfit and thought to yourself, “Man, that looks really uncomfortable.” Well, chances are it was. When asked to choose whether feeling comfortable or looking good was more important to them when considering the clothing they purchase, 76% of Canadians chose feeling comfortable. Interestingly, that leaves 24% of us who assign more value to looks over comfort. I guess for this group, looking good is feeling good.

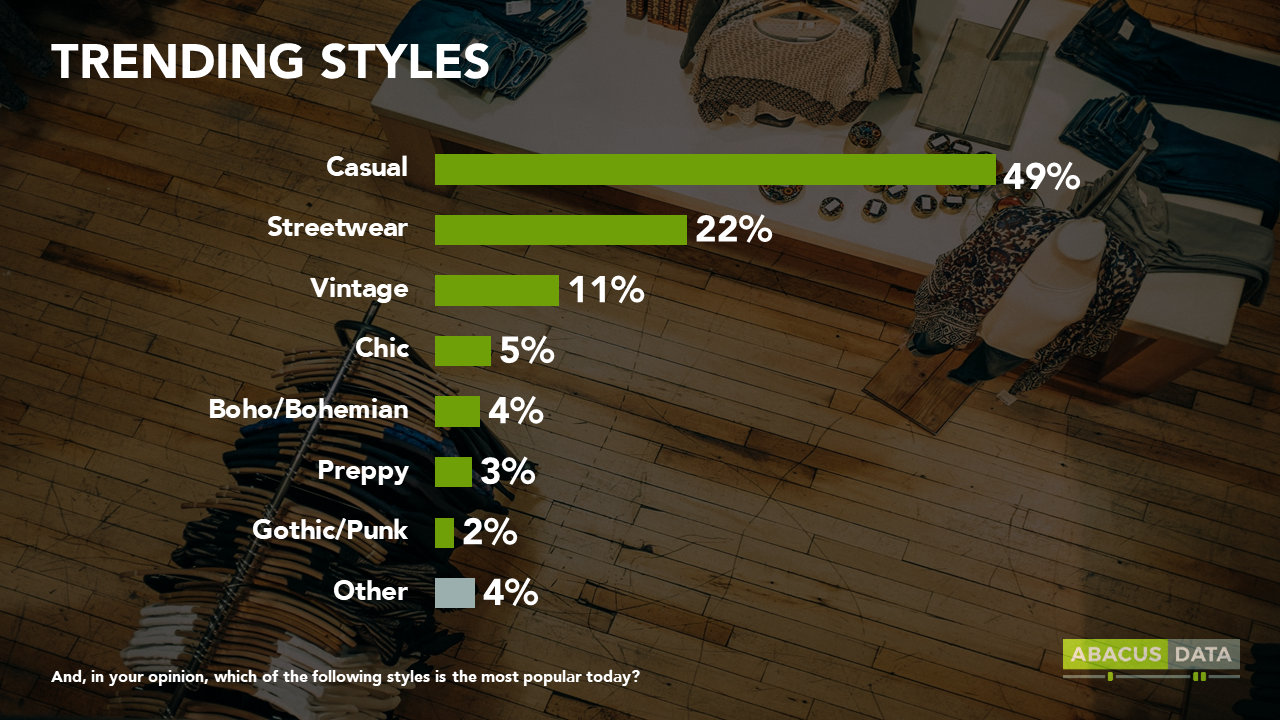

But what looks good? We’ve all looked back at old photos and cringed at our outfits or hairstyles. But remember, at one point in time that’s what style was trending. When we asked Canadians about what style they felt was most popular today, most chose casual (49%). This was followed by streetwear (22%) and vintage (11%), with Chic (5%), Boho (4%), Preppy (3%), and Gothic (2%) styles trailing behind.

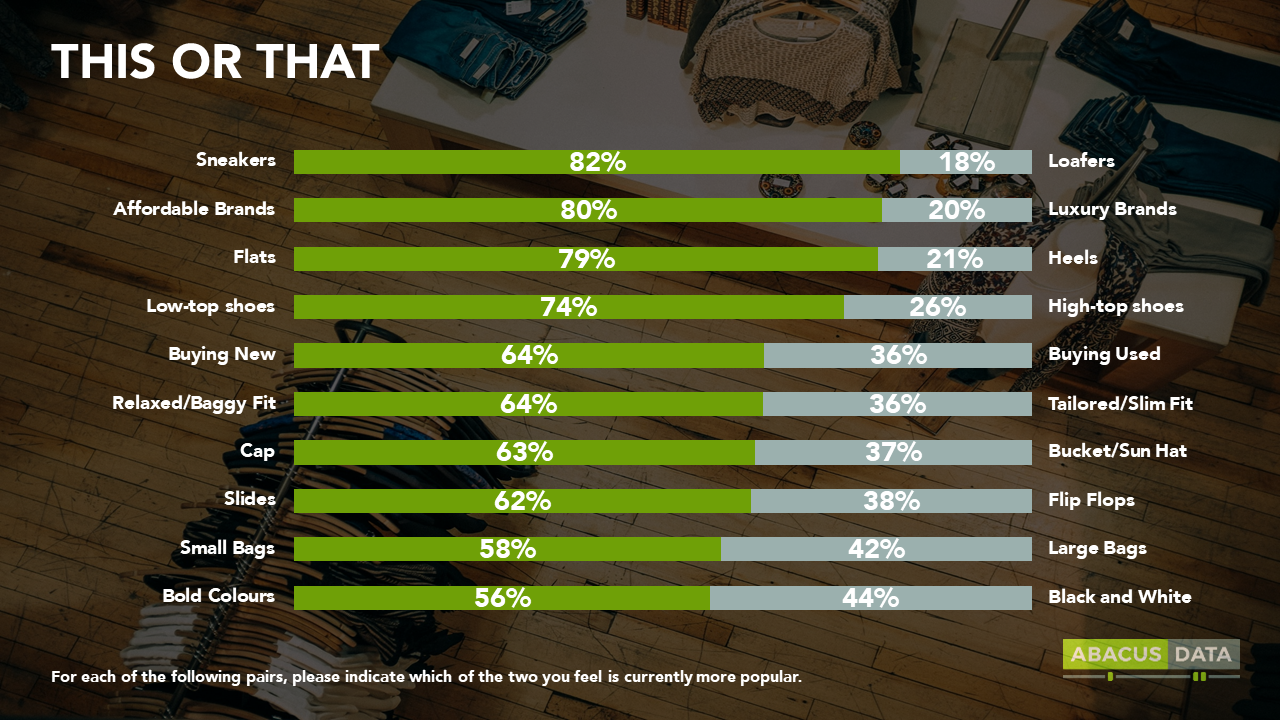

Now we know what style is trending, but what exactly are Canadians wearing? We presented Canadians with different fashion pairs and asked them to select which they felt was currently most popular. Canadians are currently choosing sneakers (82%) over loafers (18%), affordable brands (80%) over luxury brands (20%), flats (79%) over heels (21%), and baggy fits (64%) over tailored fits (36%). Interestingly, Canadians are significantly less decided on things such as small (58%) versus big ( 42%) bags, or bold colours (56%) as opposed to black and white (44%).

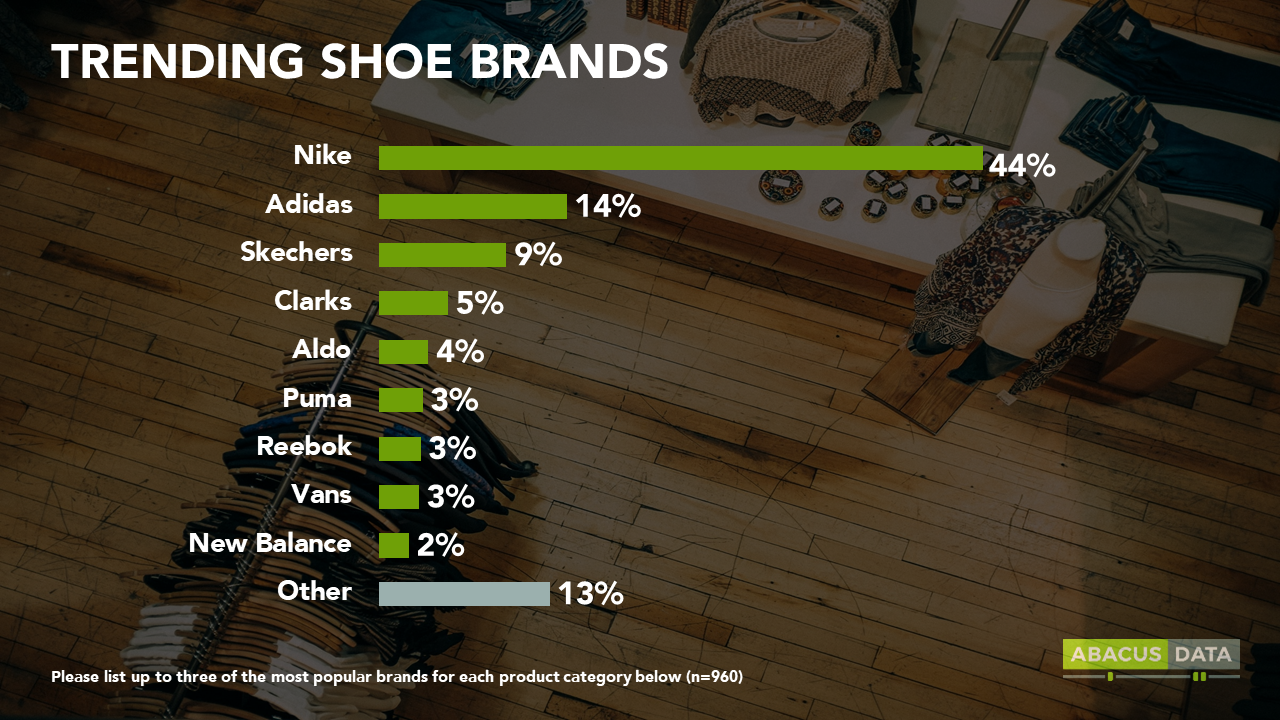

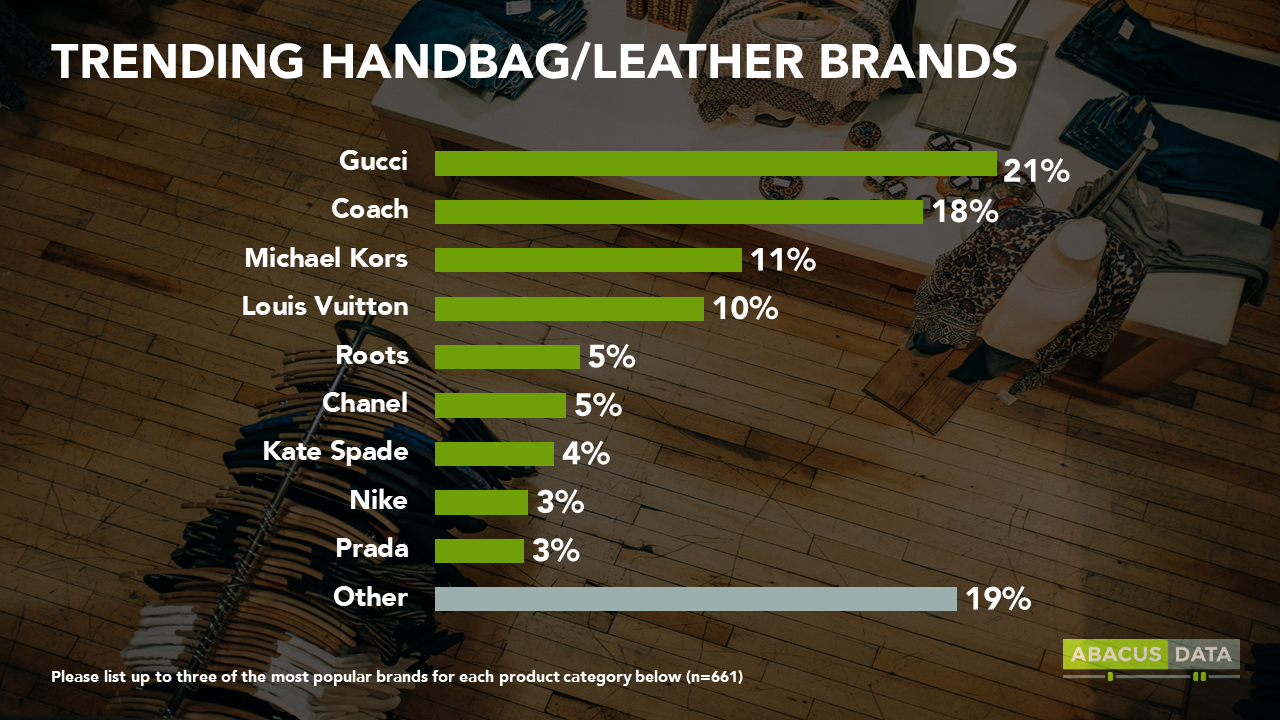

Continuing from the pairings, we also asked Canadians to share some of the most popular brands for several fashion categories. When considering shoe brands, Canadians have their hearts set on Nike (44%)with the clear lead. This was followed by Adidas (14%), Skechers (9%), and Clarks (5%). When considering the different brands of handbags/leather goods, Canadians feel that Gucci (21%) is the most popular, followed by Coach (18%), Michael Kors (11%), and Louis Vuitton (10%).

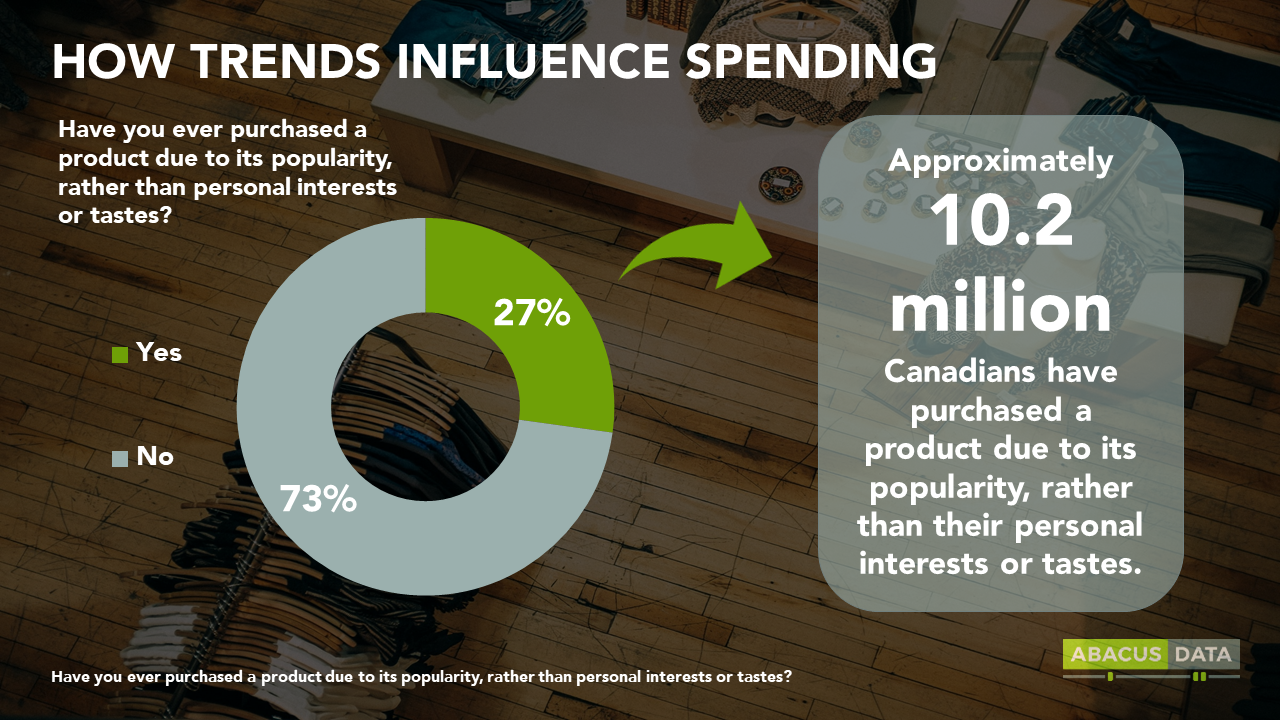

However, fashion trends aren’t just about looking good. Our survey finds that 27% of Canadians (or the equivalent of 10.2 million) have purchased a product due to its popularity rather than personal interest or taste, highlighting how trends directly influence the shopping habits of Canadians.

UPSHOT

The right outfit can turn any day into a great one, and trends undoubtedly play a major role in the outfits we choose. From celebrity culture to royal influence, there is always something making waves in this ever-evolving industry.

But, at the end of the day, trends come and go. With almost a third of us saying they’ve purchased something because it is popular, rather than personal interest or taste, I just want to remind everyone that it is always best to buy things because you love them, not because they’re trending.

METHODOLOGY

The survey was conducted with 1,500 Canadian adults from July 11 to 17, 2022. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.6% 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.