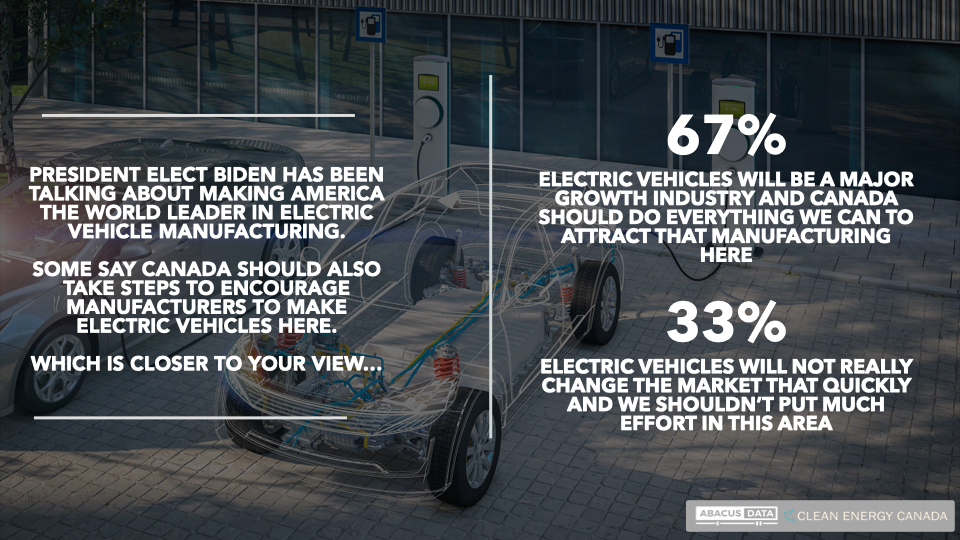

Electric vehicles are picking up speed in public support

December 15, 2020

In the latest round of survey work by Clean Energy Canada and Abacus Data, two out of three people in Canada (67%) believe that President Biden’s election will help make electric vehicles a growth industry and that Canada should do everything we can to attract electric vehicle manufacturing here. Only 33% think the market won’t change very quickly and that we shouldn’t put much effort in this area.

A similar majority (64%) hope electric cars become the majority of vehicles that consumers drive, and even more believe that will be the case (76%). The number of people who foresee a day when electric vehicles are the majority of vehicles on the road has increased 6 points in the last 18 months.

In terms of the expected time frame for this transition, just over half (52%) of those interviewed think this will happen in 15 years or less.

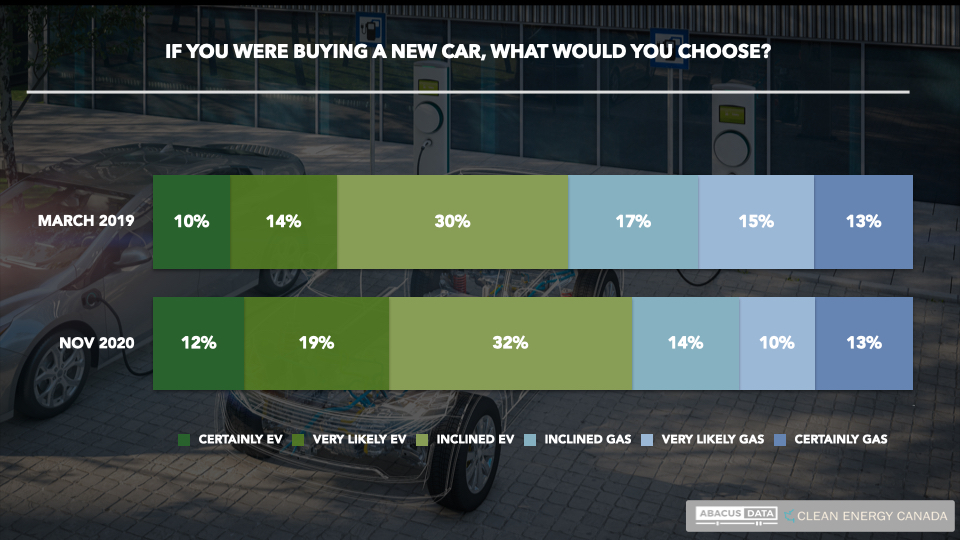

Personal interest in purchasing an electric vehicle is on the rise, with a 9-point increase since March of 2019 in those who say their next car is more likely than not to be an electric vehicle.

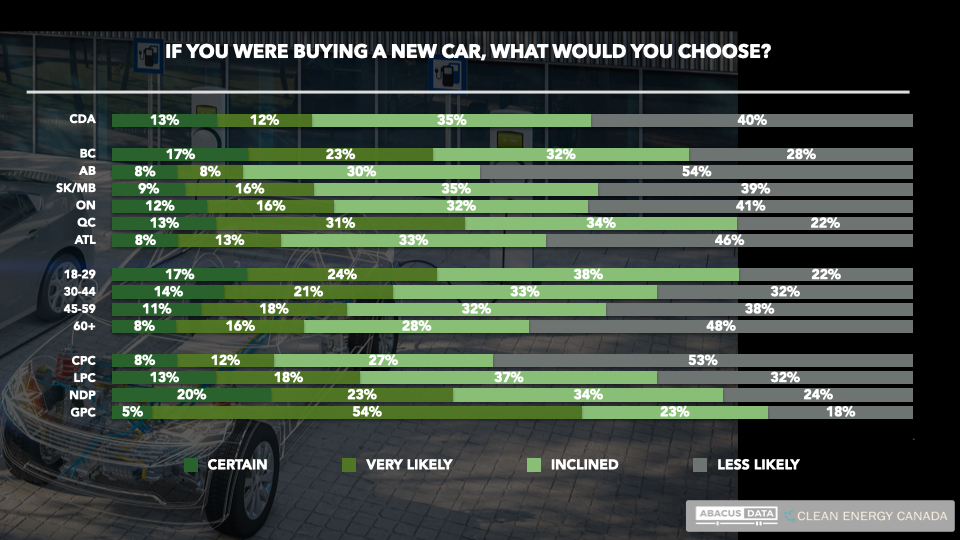

The interest in electric vehicles is high across the country. Albertans show lower levels of interest, but even in that province, just under half say they are leaning or likely to buy an electric vehicle next. Conservative voters show a similar pattern.

But perhaps the most powerful indicator of forward momentum is the influence of generational attitudes. Only one in five of those under 30 would be inclined to buy a combustion engine vehicle, and only one in three of those 30-44.

While younger generations show much stronger levels of inclination to purchase, that is not to say that the market for electric vehicles isn’t strong among older people too. Among those 60 or older, 52% indicate they are more likely than not to buy an electric vehicle next.

UPSHOT

According to Bruce Anderson: “Ten years ago, there were less than 20,000 electric cars on the road. Last year, the number passed 7 million. Demand for e-vehicles is stronger than it has ever been and as technologies improve, range anxiety decreases with longer battery life and more charging stations, the pace of change looks ready to accelerate. Younger people want zero-emission vehicles to be the norm and don’t feel like buying one is an experiment that might or might not work out – for them it is what they expect from manufacturers and what manufacturers are promising to offer. Alongside this most Canadians expect the government to help our auto sector evolve in this direction so that Canadian workers can be fully engaged in this remarkable and rapid transformation.”

According to Merran Smith, Clean Energy Canada’s executive director: “Canadians are excited about electric vehicles. And for good reason: EVs save drivers thousands of dollars a year on fuel and maintenance while also cutting pollution and improving air quality. But more than that, as EVs hit roads around the world in record numbers, they also offer an opportunity to revitalize Canada’s auto sector. It’s clear that Canadians see an electric future—and that they want their government to ensure we stay up to speed.”

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

Find out more about what we are doing to help clients respond to the COVID-19 pandemic.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

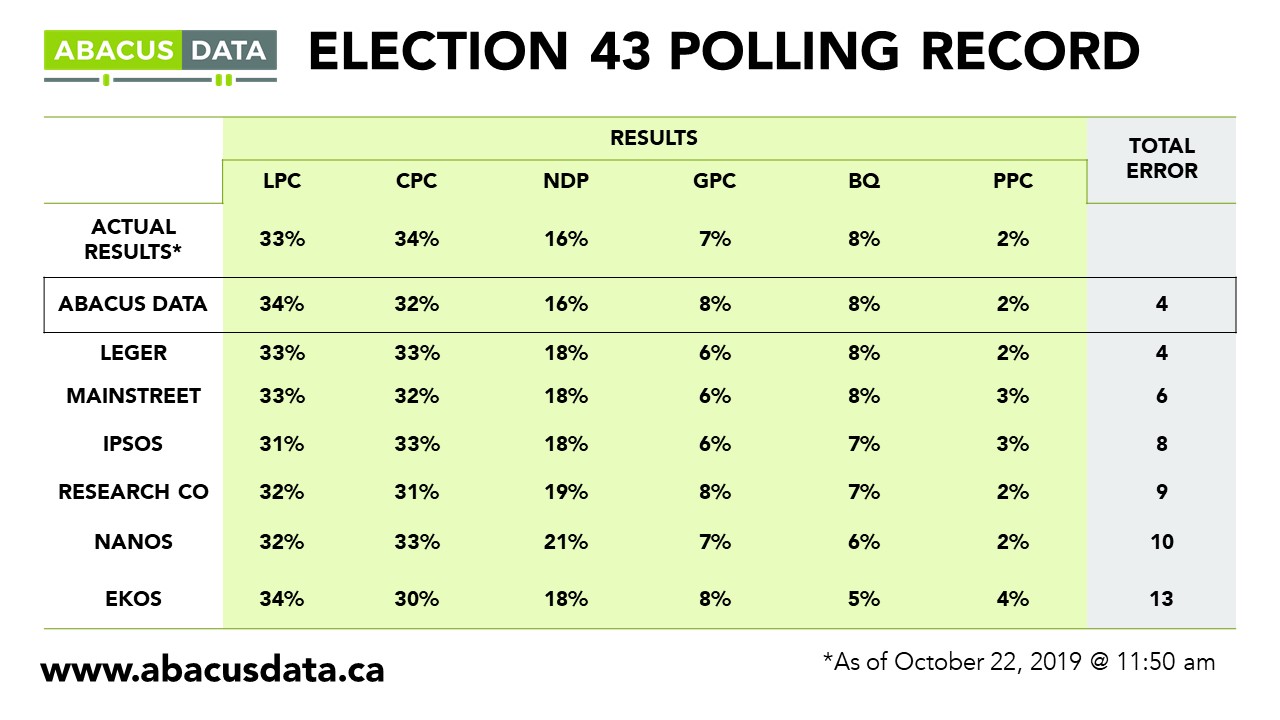

We were one of the most accurate pollsters conducting research during the 2019 Canadian Election.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.

METHODOLOGY

The survey was conducted with 1,419 Canadian adults from November 26 to December 1, 2020. A random sample of panellists was invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.