Abacus Poll: Support for oil workers is expected, across the country

March 26, 2020

Abacus Data Bulletins are short analyses of public opinion data we collect. For more information or media interviews, contact David Coletto.

*Note: In an earlier version of this release, some of the data in the charts below were incorrect. They have been correct.

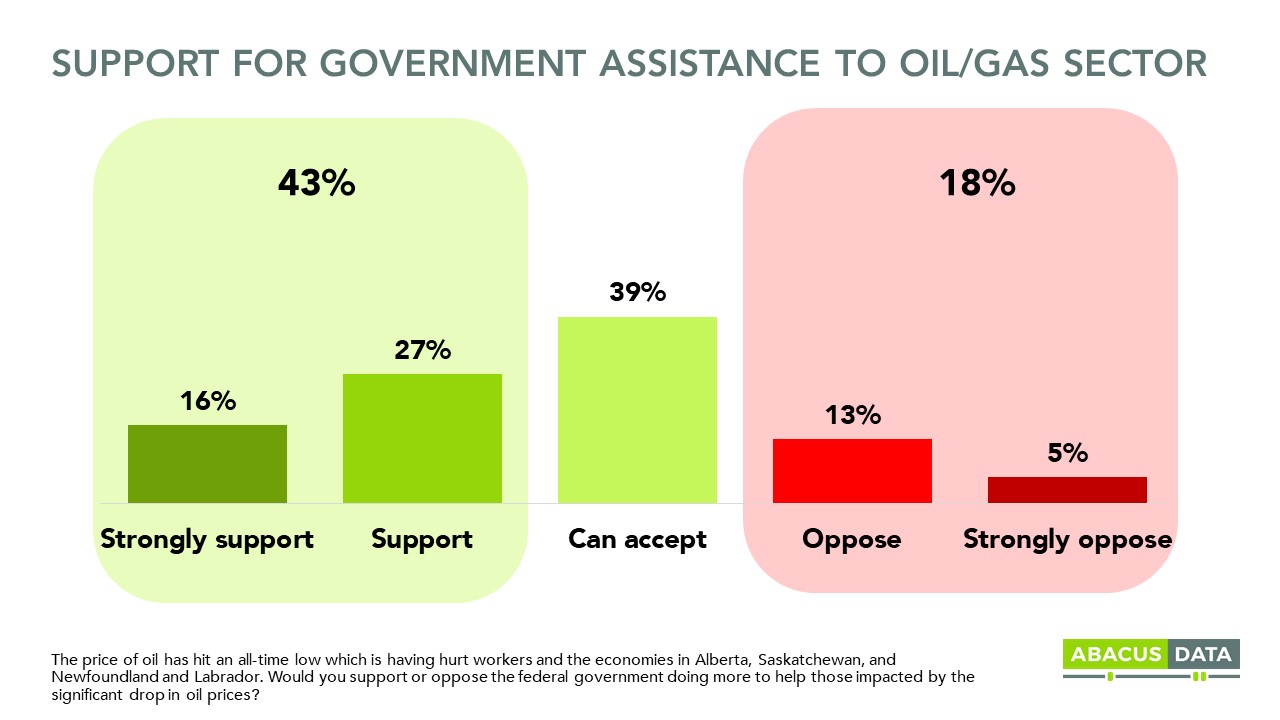

As the federal government considers different policy measures to support hard-hit sectors of the economy, the oil industry in Canada is facing unique headwinds caused by global competitive dynamics. We measured the appetite of Canadians to see federal measures to support the sector given the dramatic drop in oil prices.

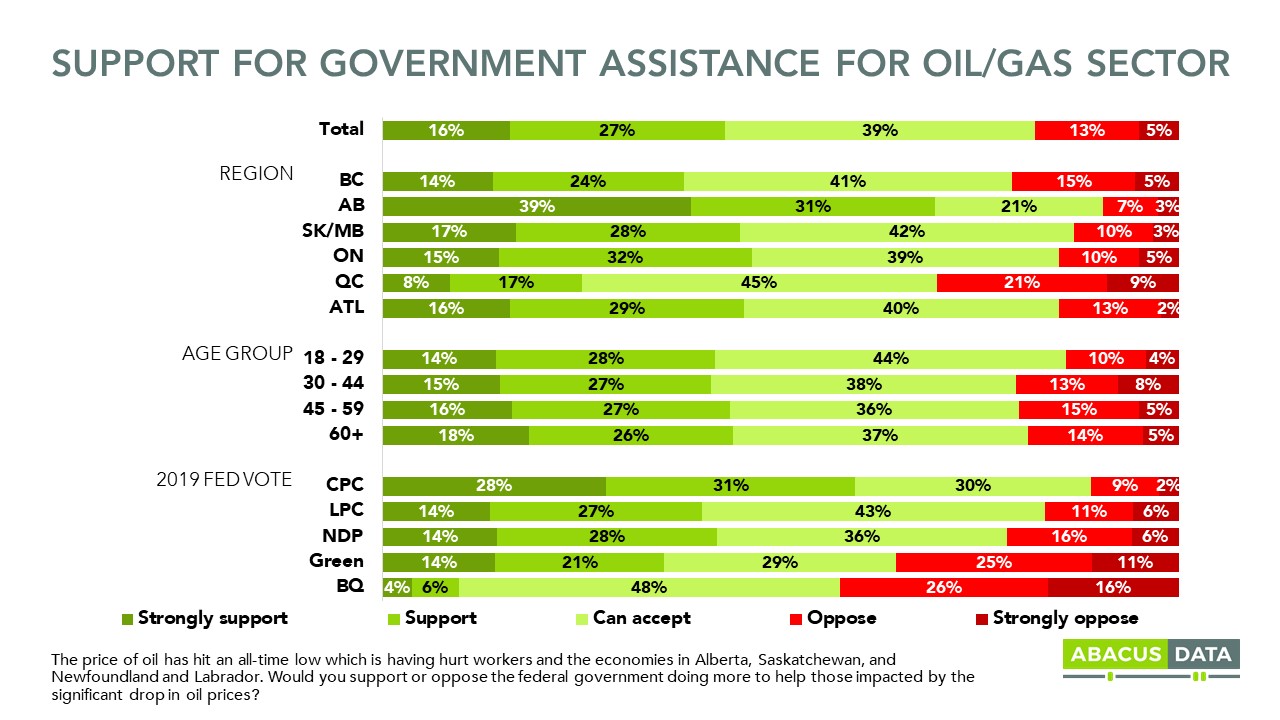

In keeping with the general desire of Canadians to see government policy used to support a staggering economy, most are willing to go along with a support package for this sector. Outright opposition is only 18%, declared support is 43%, and the plurality says a support package is something they can accept.

While one might expect sharp regional differences on this question, it is striking that this is not the case right at the moment. The number of Albertans who are willing to support an oil assistance package is much higher than other regions, but there’s clear majority acceptance in all regions of the country, even in Quebec that has traditionally been the province that has the most hesitancy about oil.

There are often sharp partisan differences when it comes to policy related to oil but not on this question, not right now. NDP supporters are almost as likely as Conservatives to support or accept a package. Only BQ voters (and our cell size suggests some caution be used in interpreting this result) are significantly below average in their support for a package.

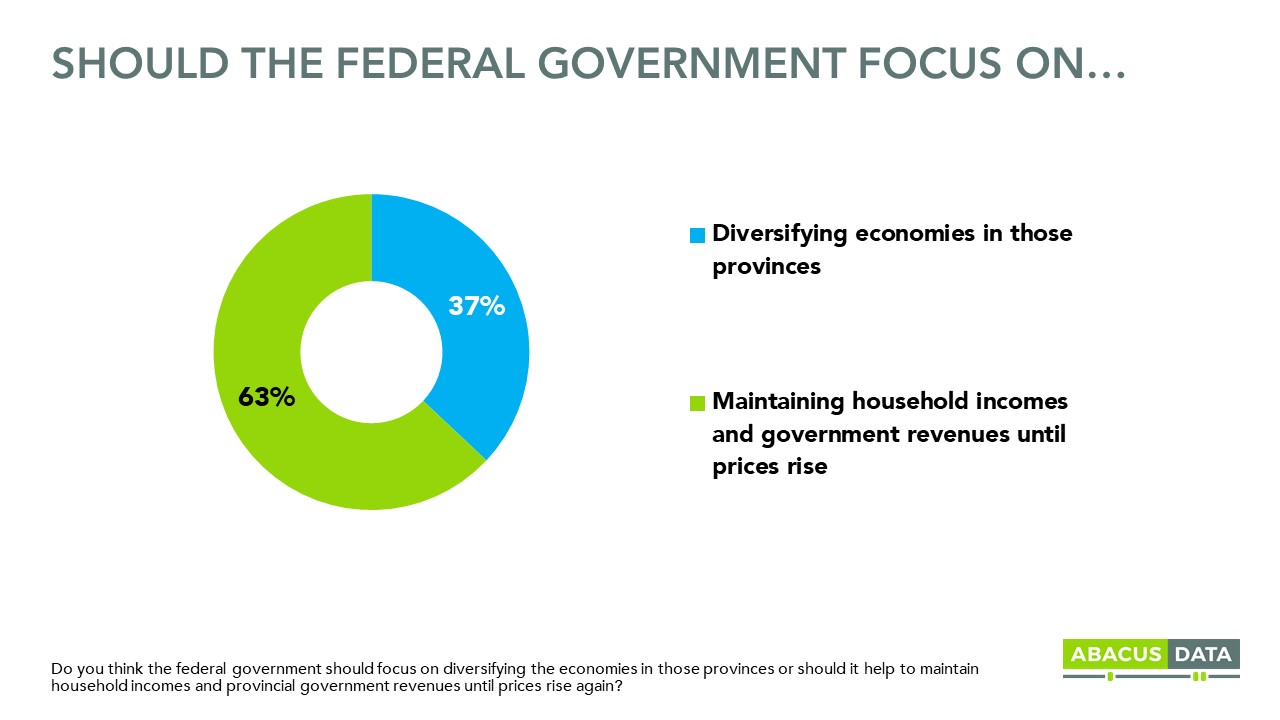

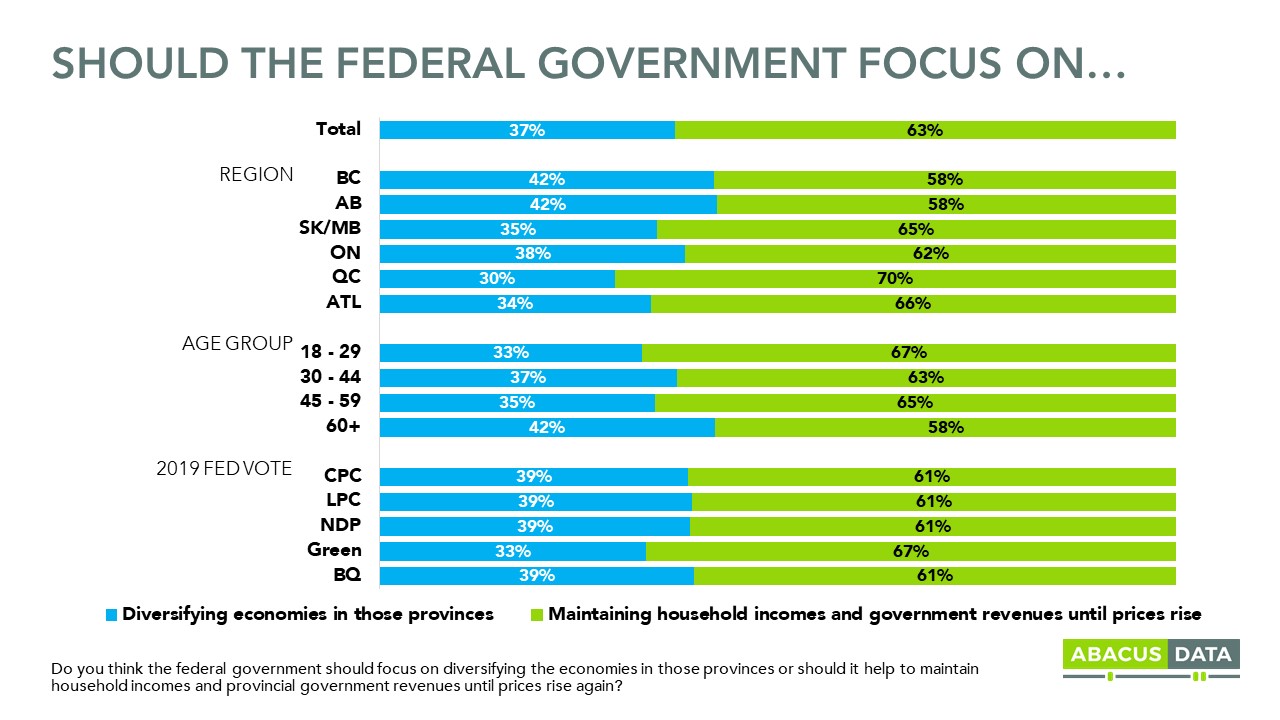

When asked if the focus of a relief package should be on maintaining incomes or diversifying the economy, the general preference was for maintaining incomes (63%) until prices rise, but it bears noting that 37% favour a push for diversification, including 42% in Alberta, and 39% among Conservative voters.

THE UPSHOT

According to Bruce Anderson: ”Health anxiety and economic trauma have created a new normal in terms of policy preferences – and very rapidly. Gone are sharp regional and party lines around oil and gas, replaced by a desire to see one another get through this challenging time and to expect governments to intervene as needed to help.

What is probably unique about support measures to deal with the collapse of oil prices is some uncertainty about what is the best way to support Albertans, and whether the solutions should feel like a bet on a product that can be volatile and may have a challenging future, even when the Covid crisis is behind us. There’s a slight warning signal to policymakers contemplating support – the public will want measures that help people, and not necessarily steps designed to help shareholders or bet on the long term future of oil.”

METHODOLOGY

Our survey was conducted online with 2,309 Canadians aged 18 and over from March 20 to 24, 2020. A random sample of panellists was invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.1%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

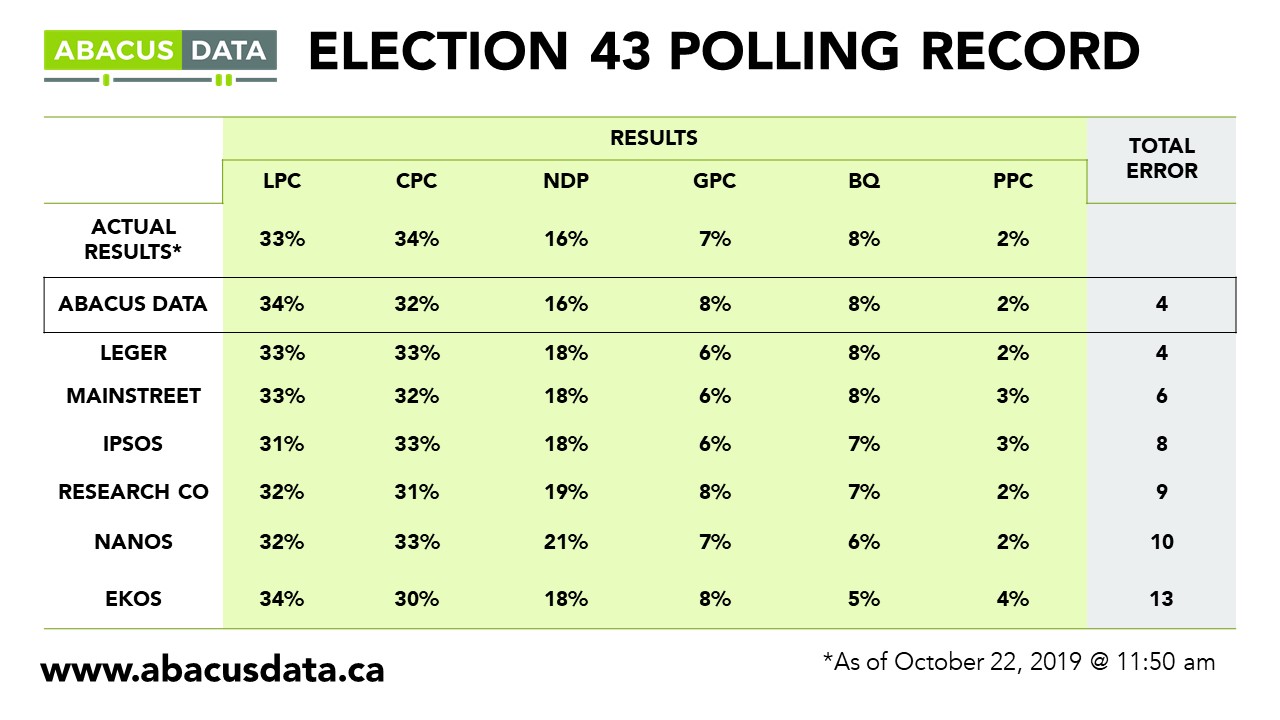

We were one of the most accurate pollsters conducting research during the 2019 Canadian Election.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.