Is Co-ownership a Solution to the Housing Accessibility Crisis in Canada? Here’s What Canadians Think.

March 31, 2022

By David Coletto

For video interviews by Skype or Zoom or audio interviews, please contact David at 613-884-4730 or david@stagesite.abacusdata.ca

To say that housing accessibility and affordability are a problem in Canada has become a massive understatement. According to the Canadian Real Estate Association, the average home price in Canada hit $816,720 in February – a 20% increase from the previous year. Since February 2020, the average home price has increased by 50% from $542,286.

Given the rapid increase in prices, more and more Canadians are feeling “locked out” of the dream of ever owning a home. The gap between those who can buy and those who can’t is growing wider by the month.

When there is near consensus that a serious problem exists and the desire to achieve an outcome (owning a home) persists, the appeal of innovative solutions – like co-ownership – grows.

Earlier this year, Abacus Data was commissioned by the Key, a Canadian real estate tech company, to conduct a national public opinion survey to understand how Canadians are feeling about the housing market and to test their reaction to a new co-ownership model offered by Key that help people get on the property ladder.

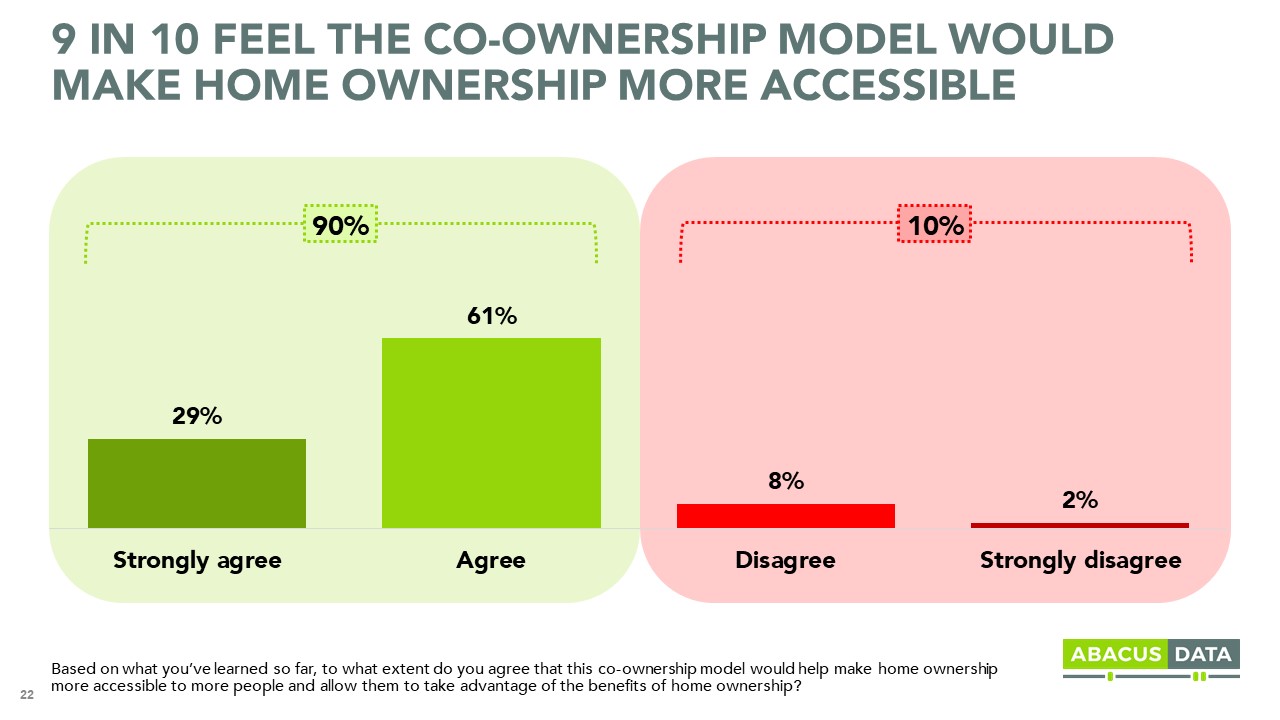

The survey finds that 80% of Canadians believe every Canadian should have the opportunity to own a home, yet almost all Canadians believe homeownership accessibility is a problem in Canada, including 9 in 10 aspiring homeowners who feel “locked out” of owning a home someday. When informed about Key’s co-ownership model, 90% feel it would make homeownership more accessible.

Here are some details from the survey:

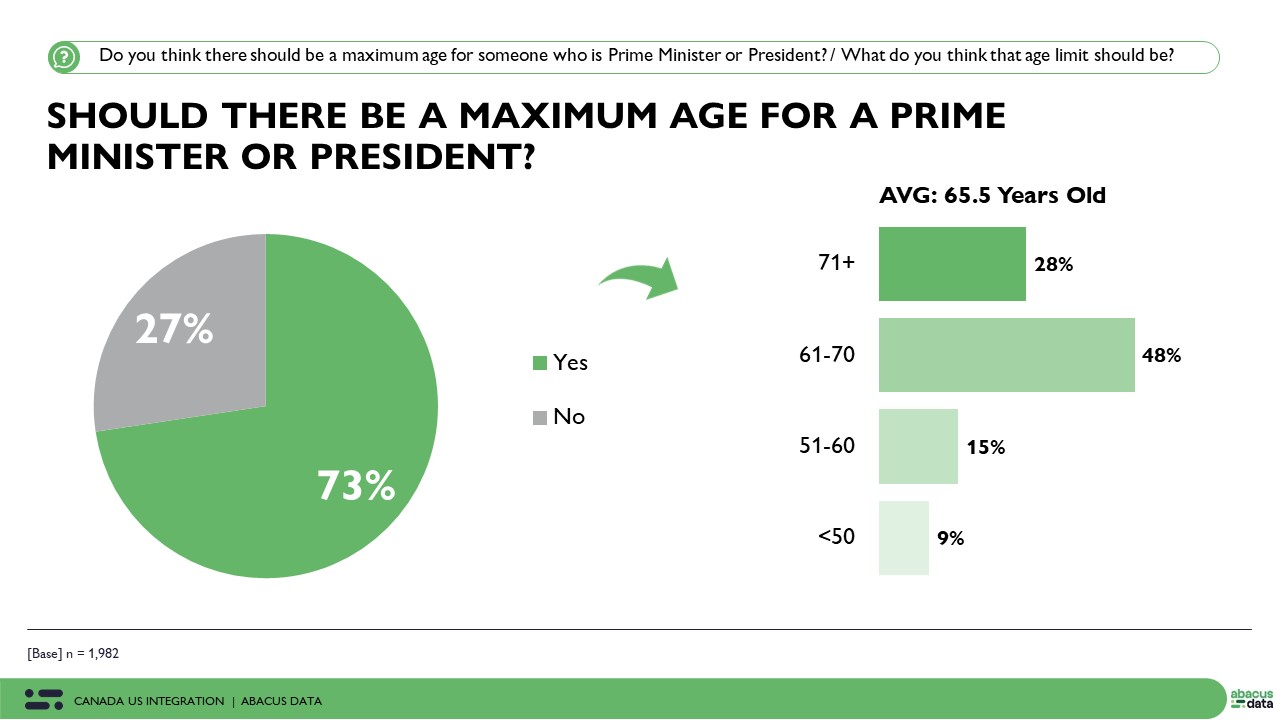

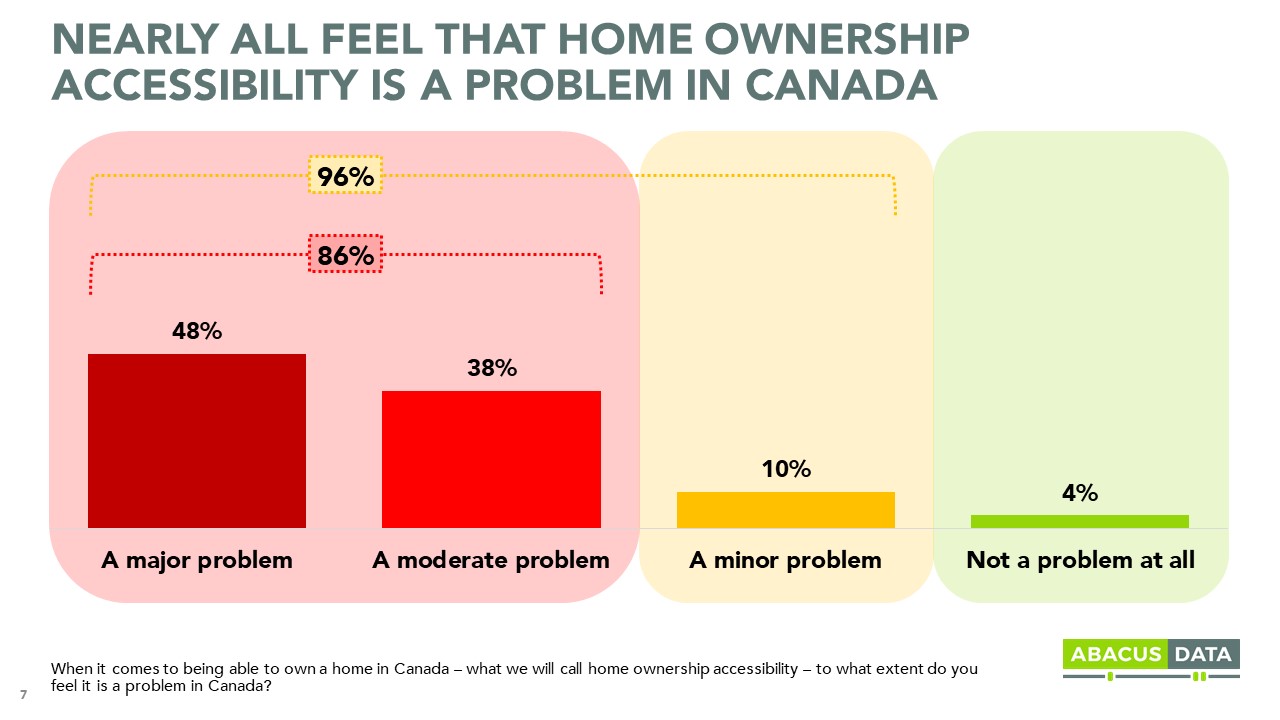

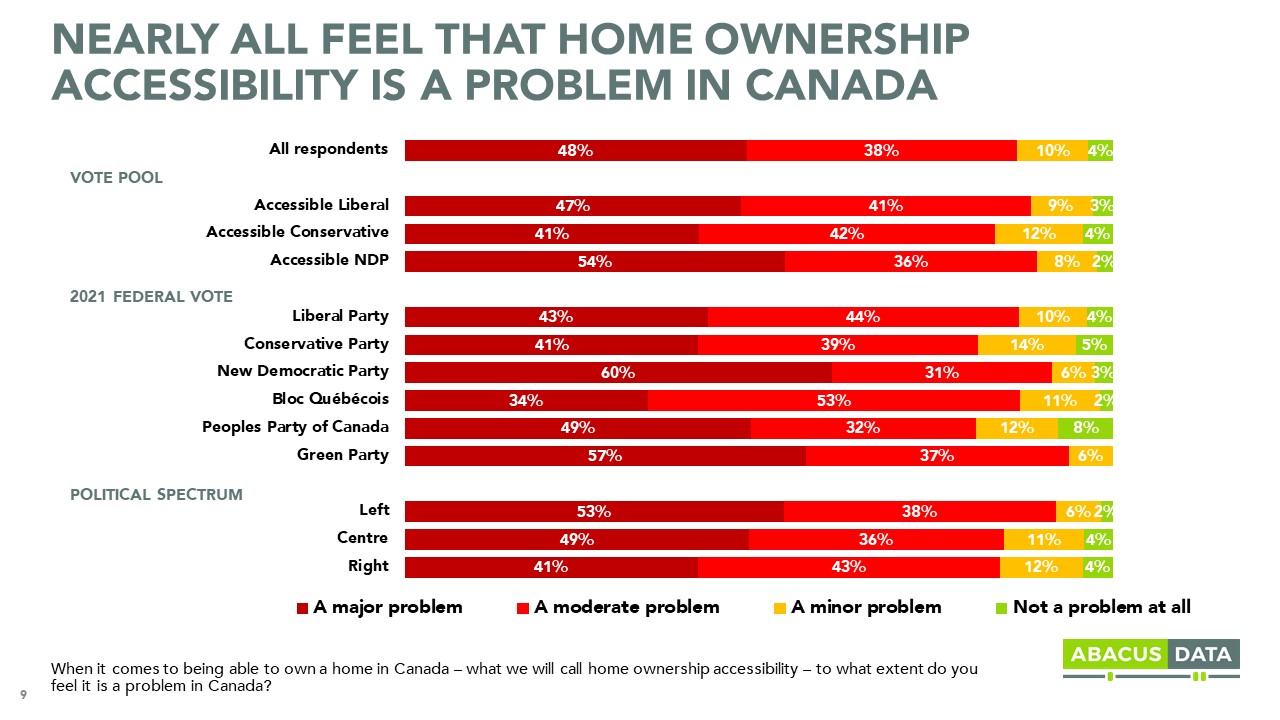

NEARLY ALL CANADIANS FEEL HOMEOWNERSHIP ACCESSIBILITY IS A PROBLEM IN CANADA.

An overwhelmingly majority of Canadians believe that home ownership accessibility – the ability to own a home – is a problem in Canada. In fact, almost half describe the issue as a major problem.

This view is shared by Canadian in all parts of the country, across all age groups, and across the political spectrum. But we do find that those living in BC and Ontario are somewhat more likely to feel housing inaccessibility is a major problem than those in other parts of the country.

Politically, differences across the political spectrum are not significant with Liberal, Conservative, NDP, and Bloc Quebecois supporters all agreeing that housing accessibility is a problem in Canada.

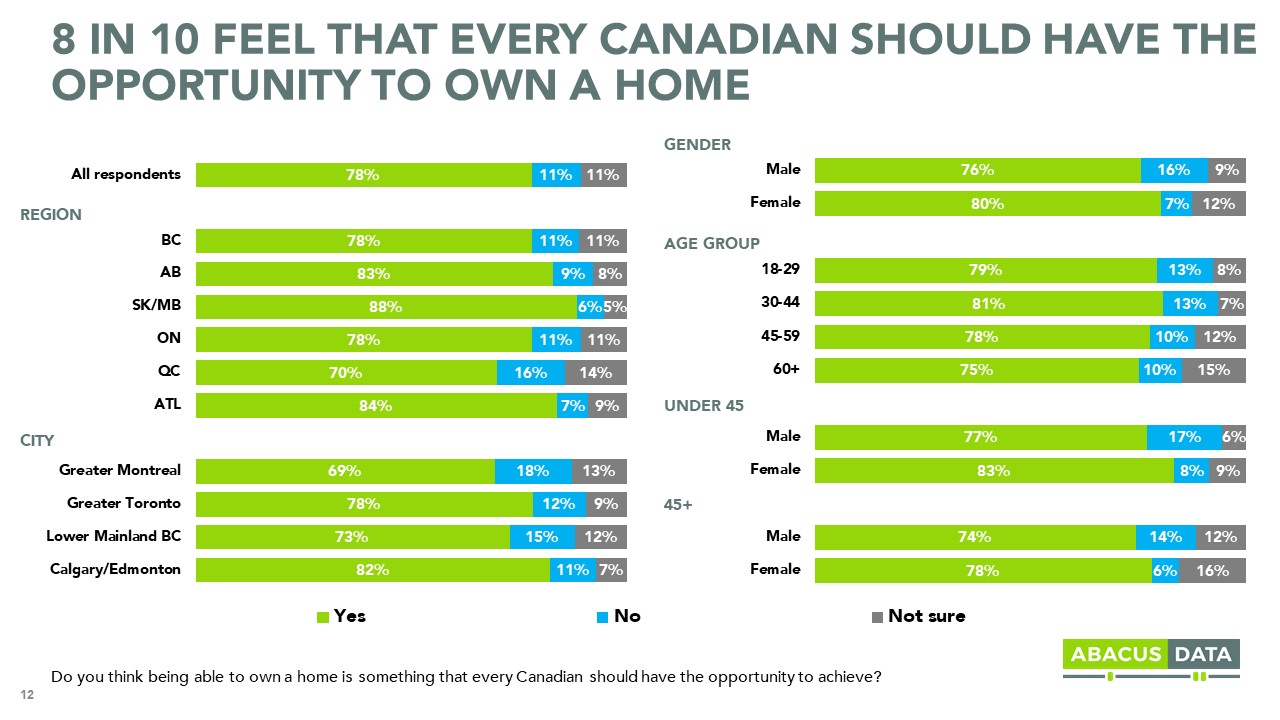

CANADIANS BELIEVE THAT EVERY CANADIAN SHOULD HAVE THE OPPORTUNITY TO OWN A HOME.

The concern about homeownership accessibility is so widespread and deeply held because most Canadians (78%) believe that every Canadian should have the opportunity to own a home.

Again, this view is shared by Canadians in all regions of the country, across demographic groups, and across the political spectrum.

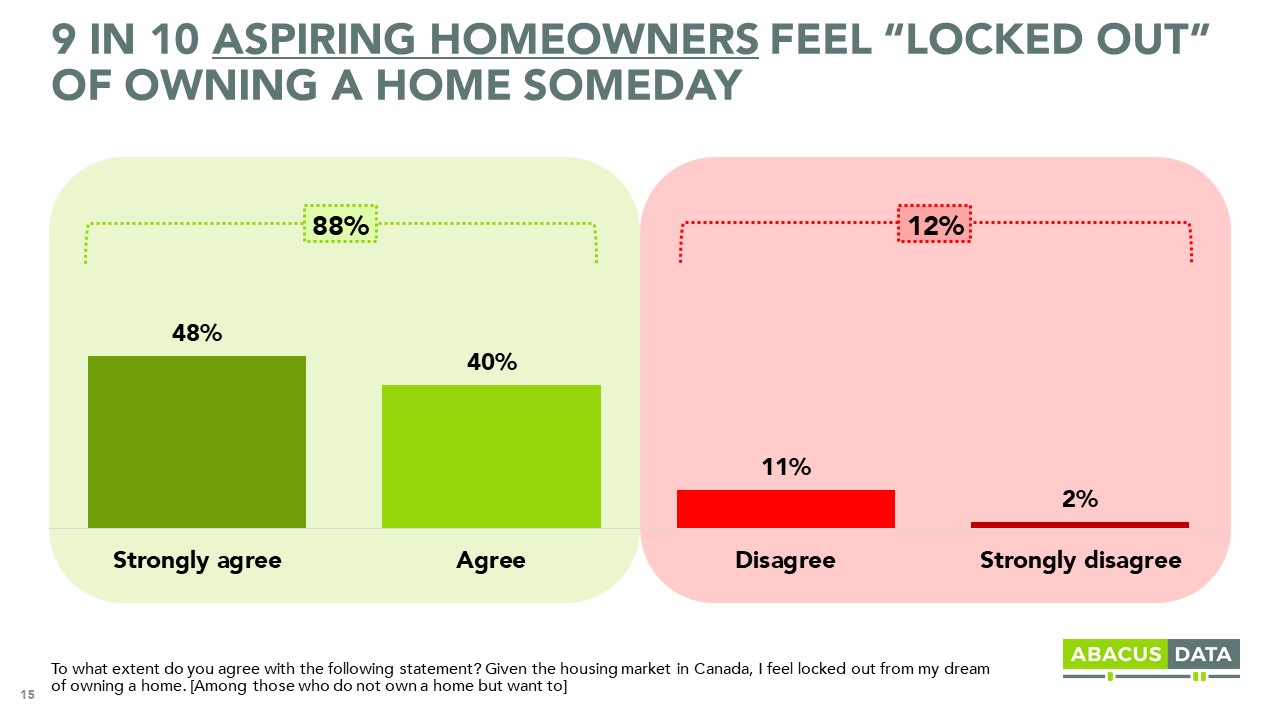

9 IN 10 ASPIRING HOMEOWNERS FEEL “LOCKED OUT” OF OWNING A HOME SOMEDAY.

Among those who don’t currently own a home, 88% agree with the statement “given the housing market in Canada, I feel locked out from my dream of owning a home.”

The feeling of being “locked out” is shared by aspiring homeowners across the country but is more strongly felt by those in BC and especially Ontario where 63% strongly agree with the statement.

Politically, 86% of Liberal voters, 79% of Conservative voters, and 93% of NDP voters agree with the statement.

HOW DO CANADIANS FEEL ABOUT KEY’S CO-OWNERSHIP MODEL?

Not surprisingly, few Canadians are familiar with the co-ownership model. Right now, about 1 in 5 say they are familiar with it with almost half (44%) saying they had not heard about it before.

Familiarity with co-ownership is higher in Quebec (80%) than in any other part of the country – largely because the model is more widely used than in other parts of the country.

But despite the low familiarity with it today, when respondents are informed about different aspects of co-ownership, reaction is generally positive.

Respondents were shown the following details:

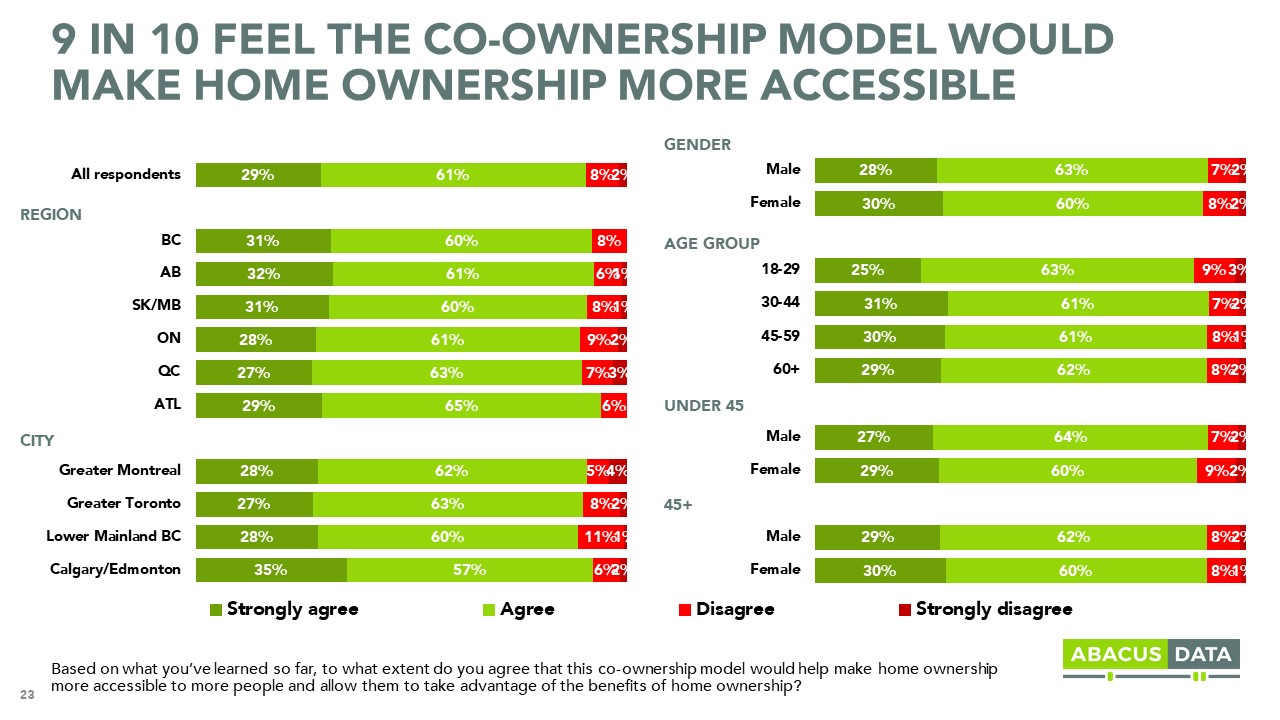

After informing them about the co-ownership model offered by Key, 90% agreed that “this co-ownership model would help make homeownership more accessible to more people and allow them to take advantage of the benefits of homeownership.”

This view was consistent across the country, across demographic groups, and across the political spectrum. In fact, Liberal and NDP voters were more likely to strongly agree with the statement than supporters of any other party – although at least 89% agreed across all party supporters.

When asked whether co-ownership should be included as one of the ways to make units in new housing projects more affordable, 68% agreed while 8% said it shouldn’t. 24% were unsure.

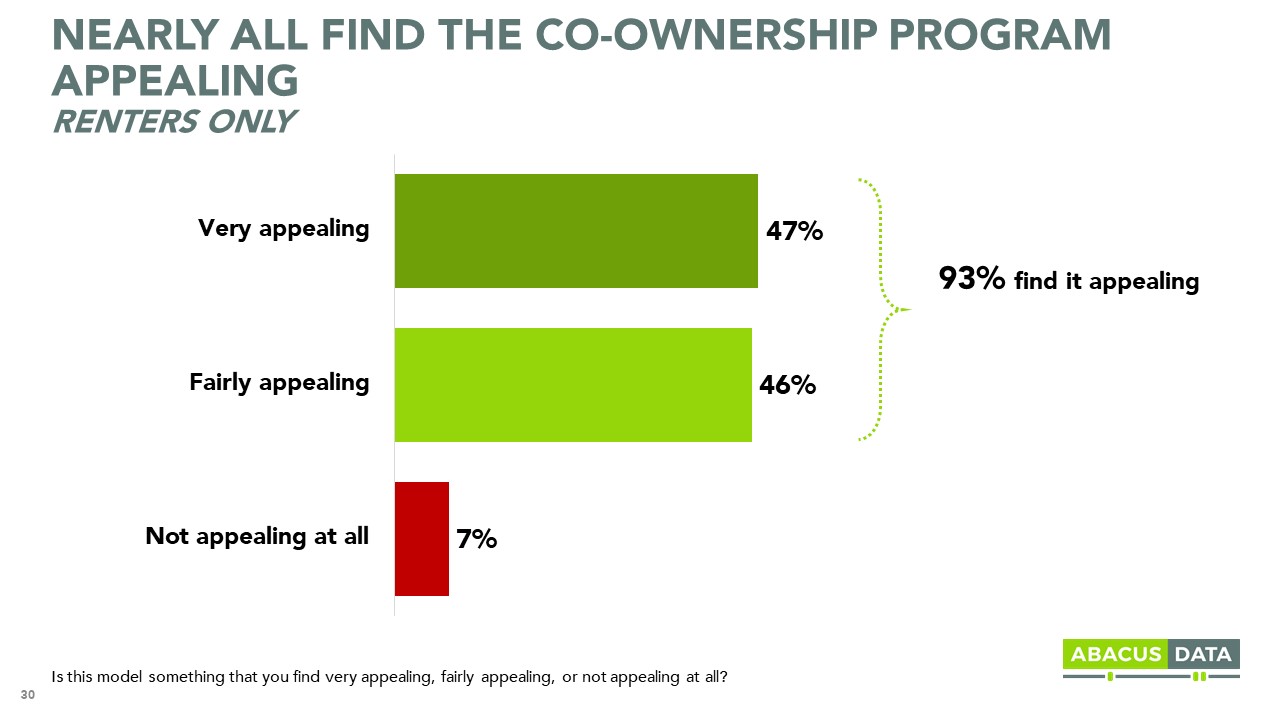

Among renters, 93% said they found the co-ownership program at appealing, including half who said it was very appealing.

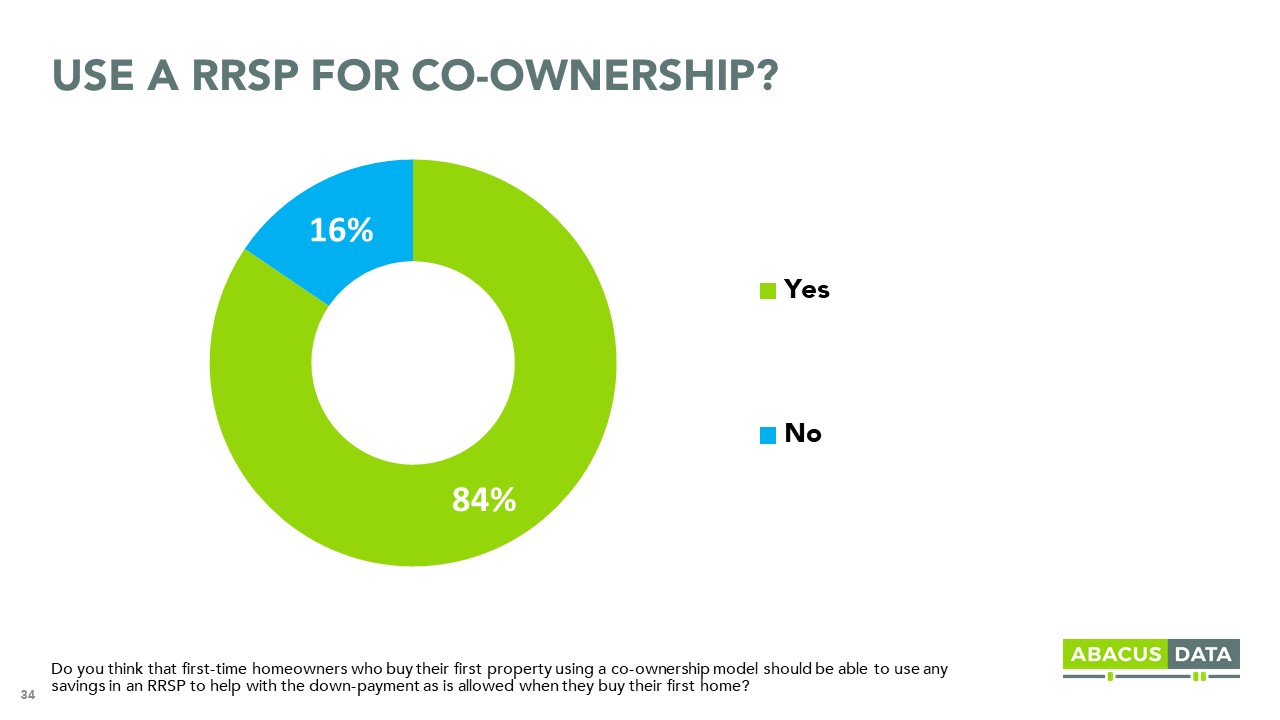

WHAT USING RRSPs FOR A DOWNPAYMENT FOR A CO-OWNED UNIT?

Right now, a first-time homebuyer who buys a co-owned home cannot access their RRSPs to help finance the down payment. But 84% of Canadians think this should be an option. This view is widely shared by Canadians from all regions, demographics, and political orientations.

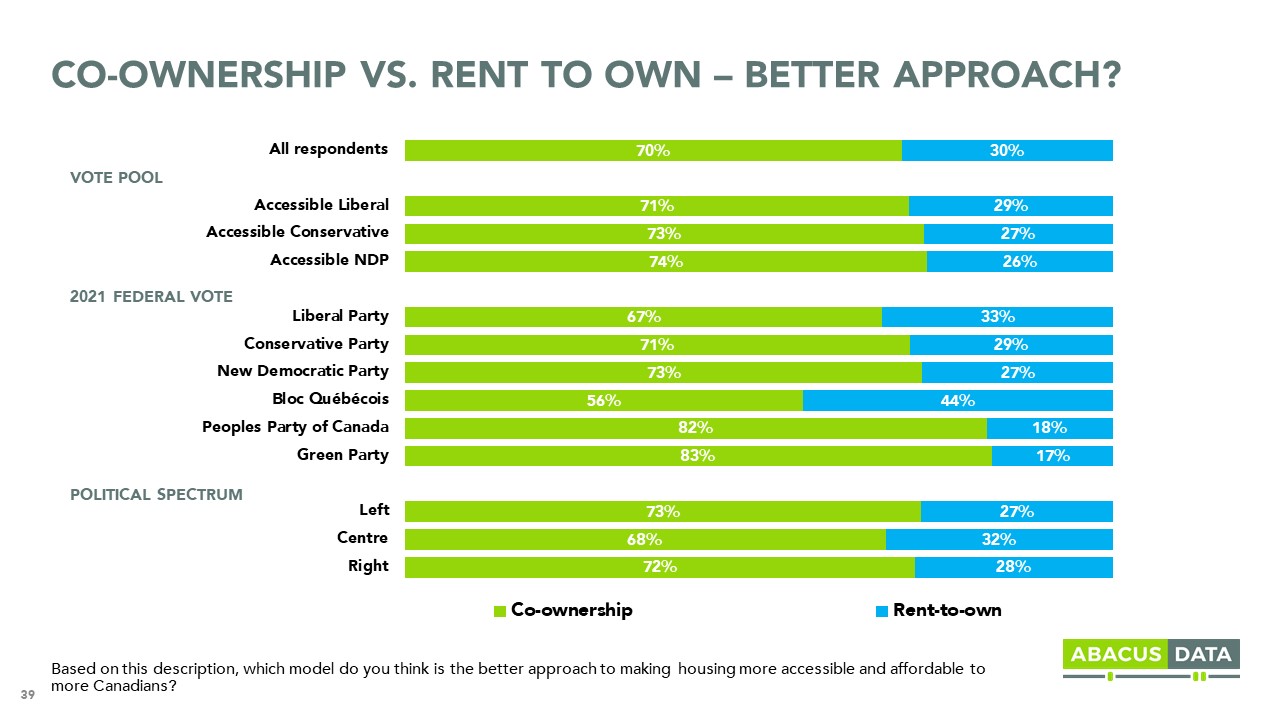

CO-OWNERSHIP vs. RENT-TO-OWN

In the last federal election, the Liberal Party campaigned on a promise to bring in a rent-to-own program. Few Canadians were aware of this promise (19%) including only 22% of those who voted Liberal.

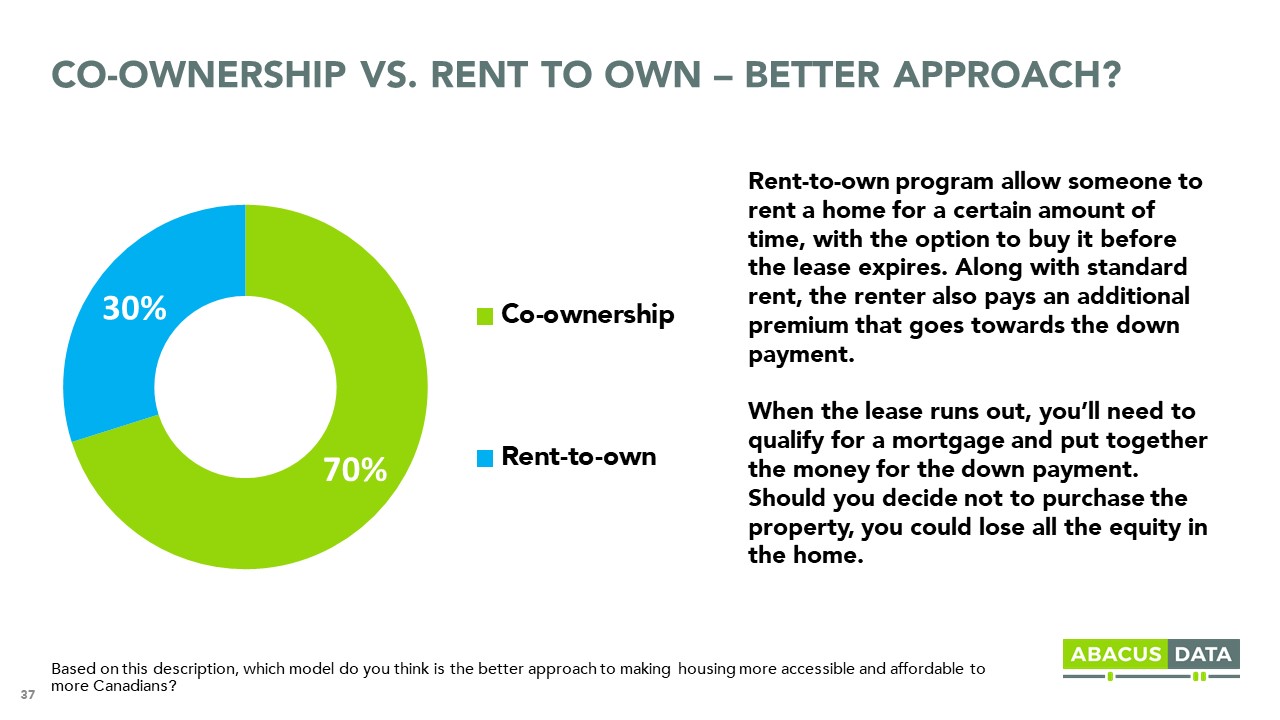

And when we provide information about rent-to-own models and ask whether people think rent-to-own or co-ownership is the better approach to making housing more accessible, 70% chose co-ownership compared with 30% who prefer rent-to-own.

Co-ownership was the preferred option in every region of the country, across all age groups, and across the political spectrum. Even 2 in 3 Liberal voters felt co-ownership would be a better approach to making housing more accessible and affordable than rent-to-own.

UPSHOT

As Canadians watch housing prices rise, there is a growing fear that many will be locked out from ever owning a home. This is especially true for young Canadians, those new to Canada, and those who may not be eligible for a traditional mortgage because of their religion or employment situation. They are looking for innovative solutions to a problem they don’t believe is getting solved by traditional tools.

This survey clearly shows that co-ownership is a model Canadians can support and think would help make homeownership more accessible to many who are otherwise “locked out” from the dream of owning a home. Awareness of the co-ownership model is low, but when people are informed about it, the reaction is overwhelmingly positive.

The data indicates there is little political risk in exploring this model as an option for those looking to get on the homeownership ladder but cannot because either their circumstances make traditional lending/ownership options unavailable or because home price increases continue to outpace their ability to save enough for a down payment.

METHODOLOGY

Our survey was conducted online with 2,000 Canadians aged 18 and over from February 17 to 23, 2022. A random sample of panelists was invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

The survey was paid for by Key.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.