Precarity – the Defining Mindset of 2025

December 5, 2025

At the start of 2025, we witnessed a noticeable shift in the national mindset – a growing sense that life in Canada was becoming more fragile, more volatile, and harder to navigate. Over the course of the year, this feeling has not only persisted but deepened, driven by unrelenting cost pressures, global instability, climate disruptions, and rapid technological change. These forces have created a constant undercurrent of uncertainty that touches nearly every aspect of daily life. For some Canadians, this has meant a steady rise in background worry; for others, it has reshaped financial decisions, delayed major life milestones, and altered their expectations of what the future might hold.

Our latest look at how Canadians are feeling shows just how deeply these pressures have taken hold. Many report profound fatigue from trying to keep pace with rising costs, a heavy mental burden tied to concerns about the future, and a growing sense that they are nearing – or have already reached – a personal financial tipping point. Nearly half feel they are ending the year barely hanging on. This persistent, cumulative strain defines the emotional landscape as Canadians close out 2025 and prepare for the uncertainty ahead.

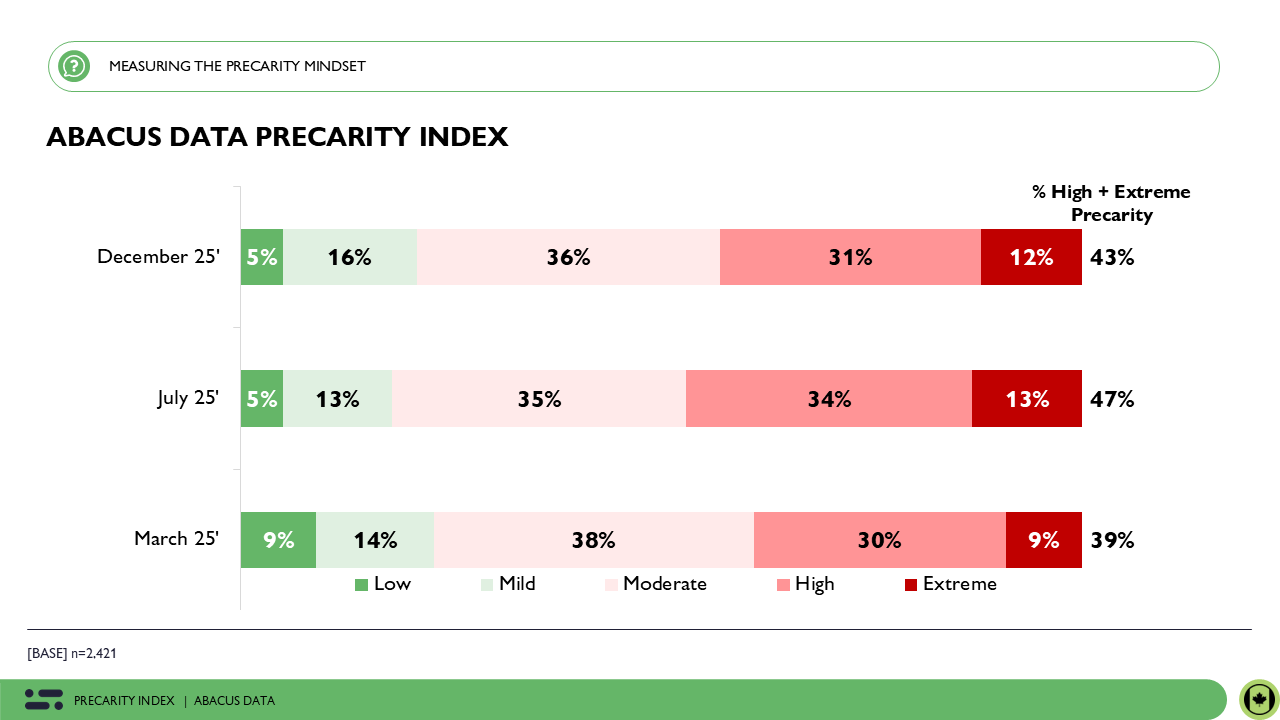

Update on the Precarity Index: Anxiety Levels Remain Elevated as Canadians Navigate an Unsteady Year

As 2025 comes to a close, our Abacus Data Precarity Index shows that feelings of instability, uncertainty, and vulnerability remain deeply embedded in the Canadian mindset. While the overall distribution of precarity levels looks similar to earlier this year, the emotional intensity behind these perceived precarity segments continues to deepen.

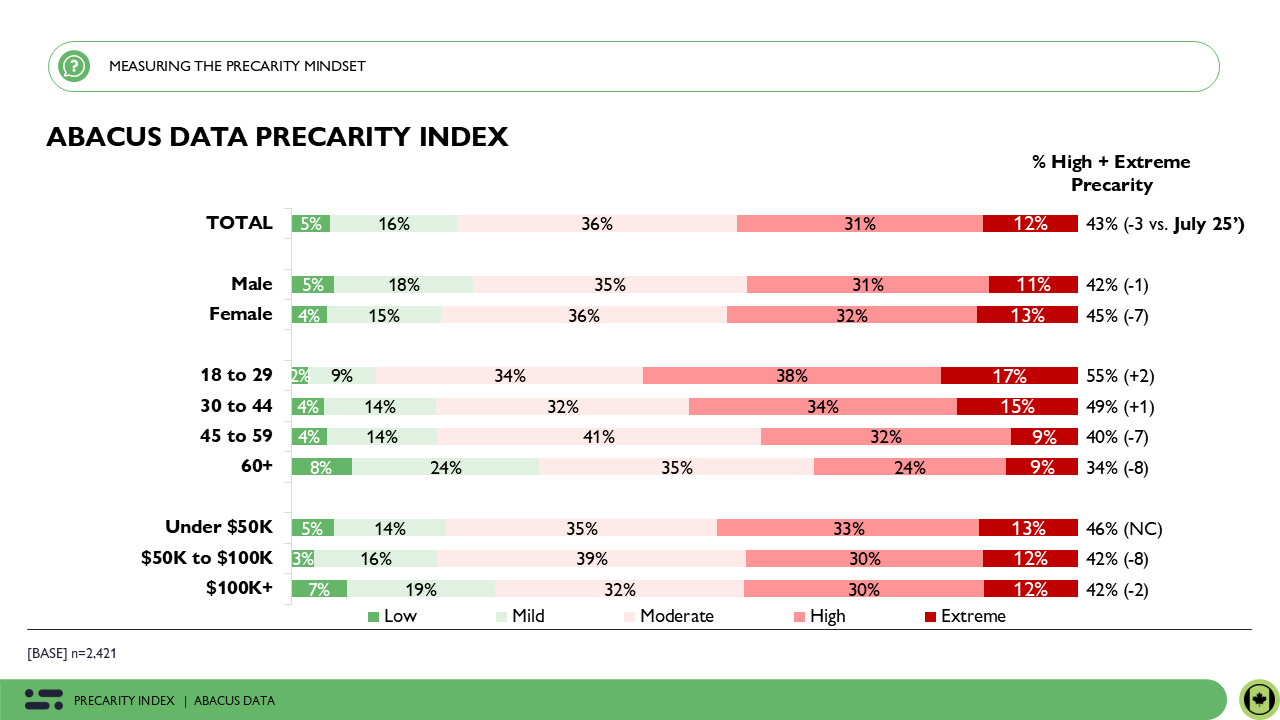

We again observe five distinct groups defined by how intensely they experience precarity:

- Low Precarity (5%) – unchanged from July 2025. These Canadians remain the most confident – or disconnected – believing that sudden shifts pose little personal threat.

- Mild Precarity (16%) – up slightly from July. They acknowledge some challenges but feel equipped to manage them.

- Moderate Precarity (36%) – the largest perceived precarity segment, largely unchanged. They feel regular anxiety about the future but haven’t fully tipped into crisis mode.

- High Precarity (31%) – down slightly, though still significant. Stress about finances, climate, and rapid technological change meaningfully shapes daily decisions.

- Extreme Precarity (12%) – a deeply anxious group that fears disruptions – economic, social, environmental – could upend their lives entirely.

Across age, gender, and income, precarity has risen since March 2025. Younger adults (18–44) are disproportionately represented in the high and extreme perceived precarity segments, women continue to show slightly higher precarity than men, and lower-income households remain the most exposed. Yet worryingly, even many households earning over $100,000 are reporting elevated levels of stress.

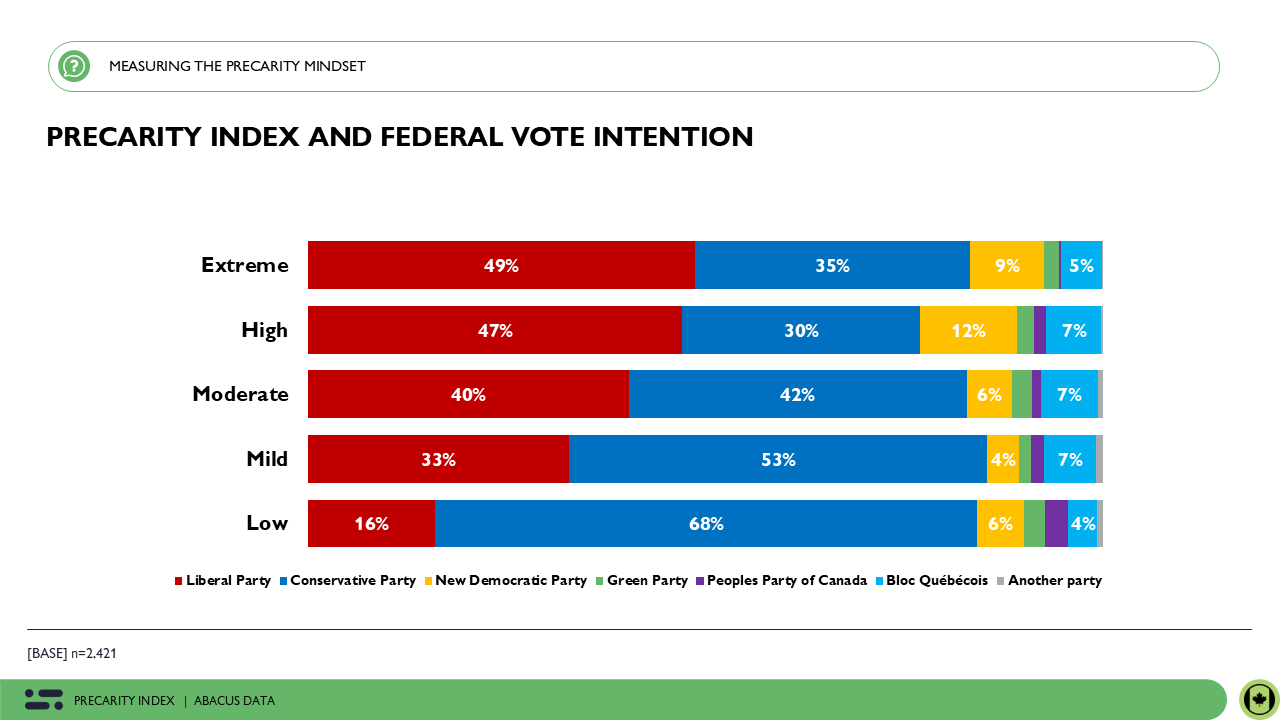

Precarity also remains tightly connected to political orientation. Nearly half (49%) of those in extreme precarity say they would vote Liberal – suggesting the most anxious Canadians view the Carney-led Liberals as the safest option in turbulent times. In contrast, Conservative vote intention is highest among those experiencing low (68%) or mild (53%) precarity. The political divide, in other words, continues to map closely onto emotional and economic fault lines.

How Canadians Felt About 2025: A Year of Exhaustion, Delay, and Approaching the Breaking Point

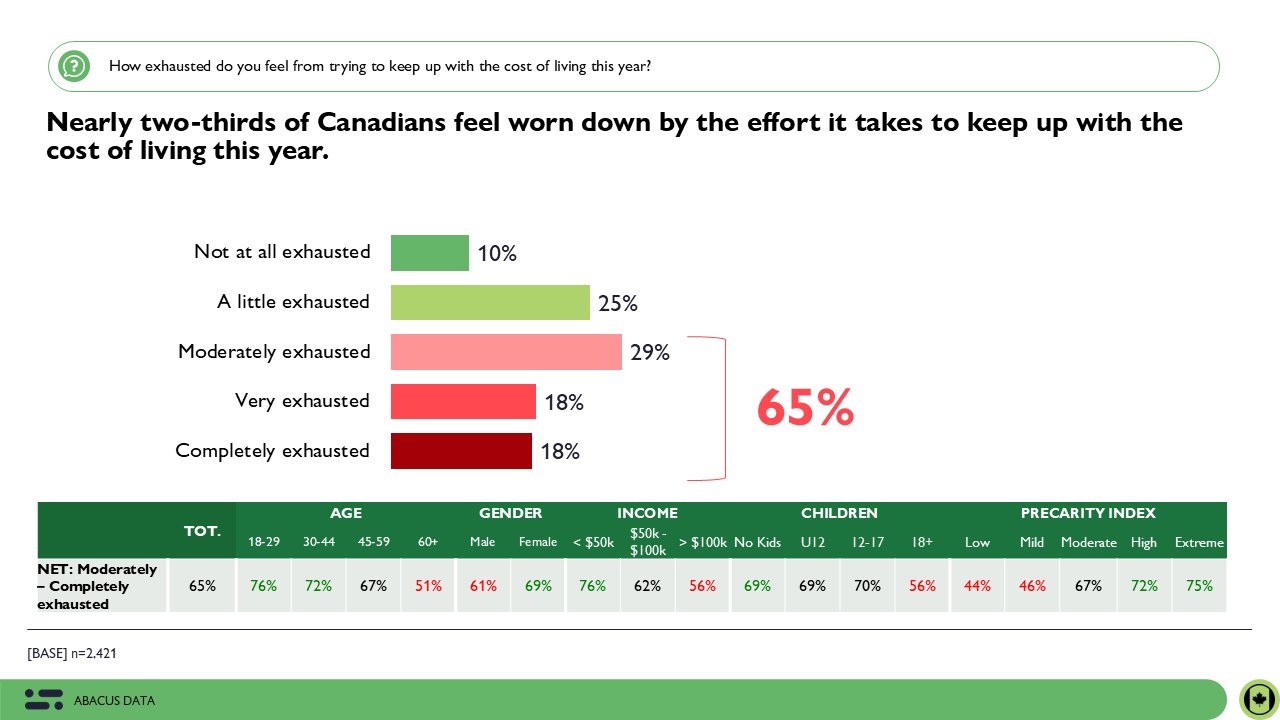

The emotional toll of 2025 is unmistakable. Nearly two-thirds of Canadians (65%) say they feel worn down by the effort required just to keep up with the cost of living. This fatigue is especially pronounced among younger Canadians, lower-income households, and families with children – groups already more likely to fall into high or extreme precarity. Among those in extreme precarity, three-quarters report feeling exhausted by the struggle to stay afloat.

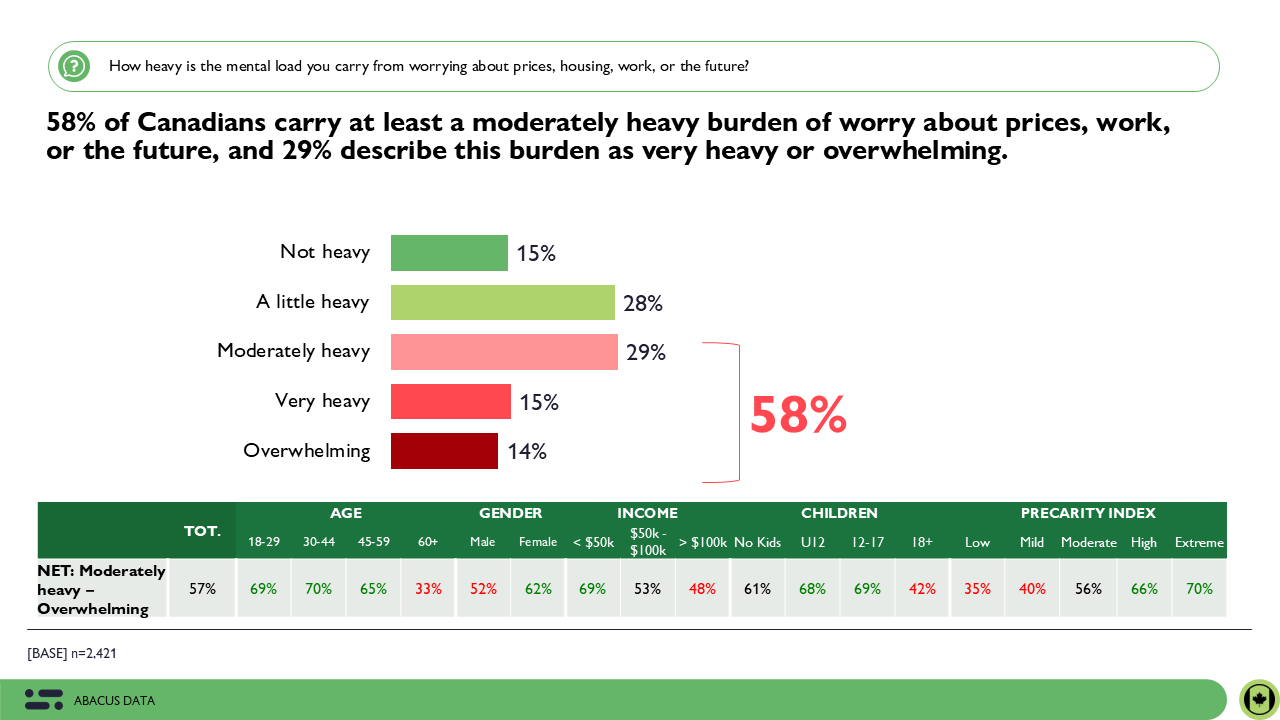

The year was defined not just by financial strain, but by the mental load of constant vigilance. A majority (58%) say they carry a moderately or very heavy burden of worry about prices, work, or their future – and nearly one-third (29%) describe that burden as very heavy or overwhelming. Again, younger Canadians, women, lower-income households, and parents report the heaviest load.

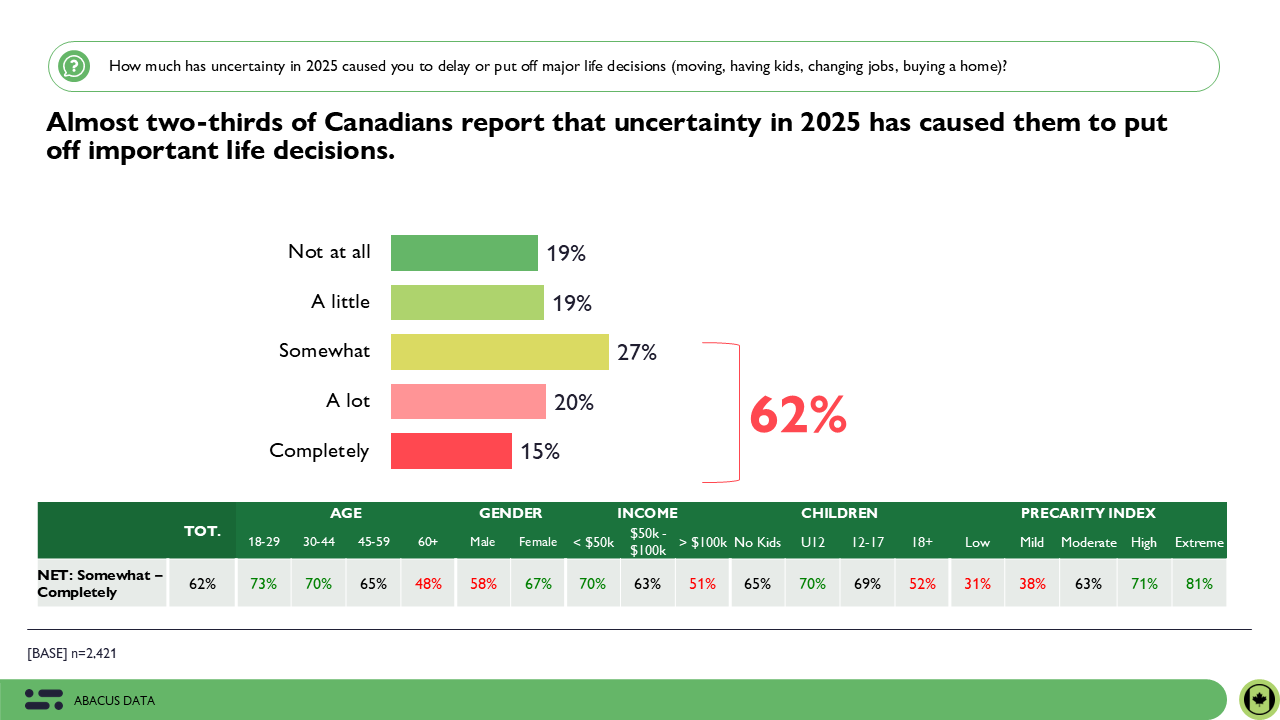

Uncertainty has also forced many Canadians to hit pause on major life choices. Almost two-thirds (62%) say that unpredictability in 2025 caused them to delay important decisions – from moving to changing jobs to starting a family. For younger adults, this hesitation is even more widespread: more than seven in ten say they have put off a major step this year.

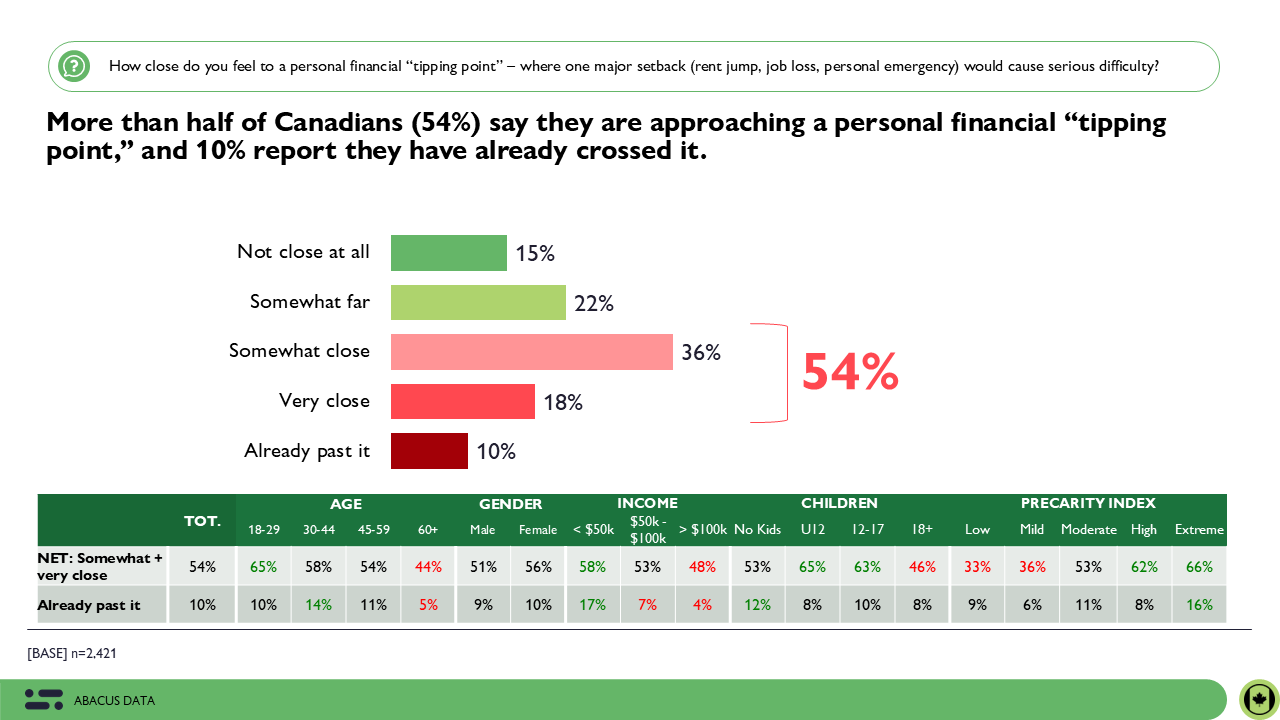

Financially, a majority (54%) say they are nearing a personal tipping point – and 10% say they have already crossed it. Young Canadians, low-income households, and those experiencing extreme precarity are especially likely to report they are at or near crisis.

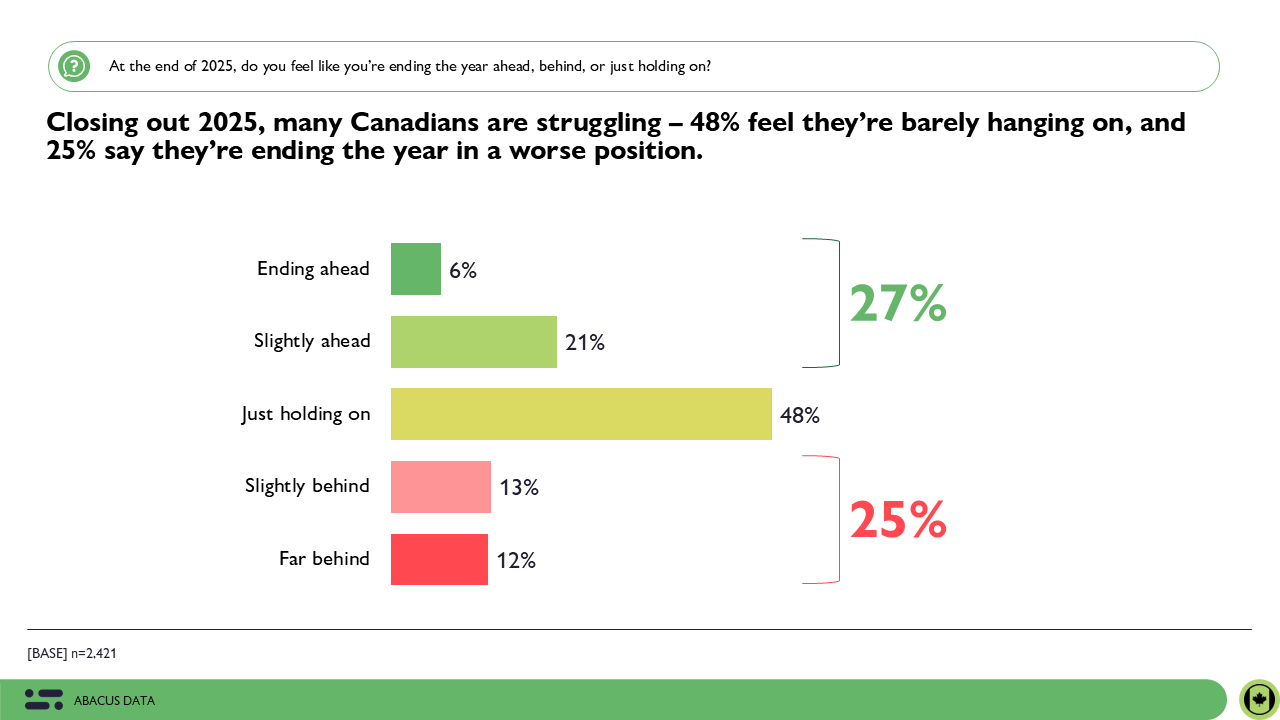

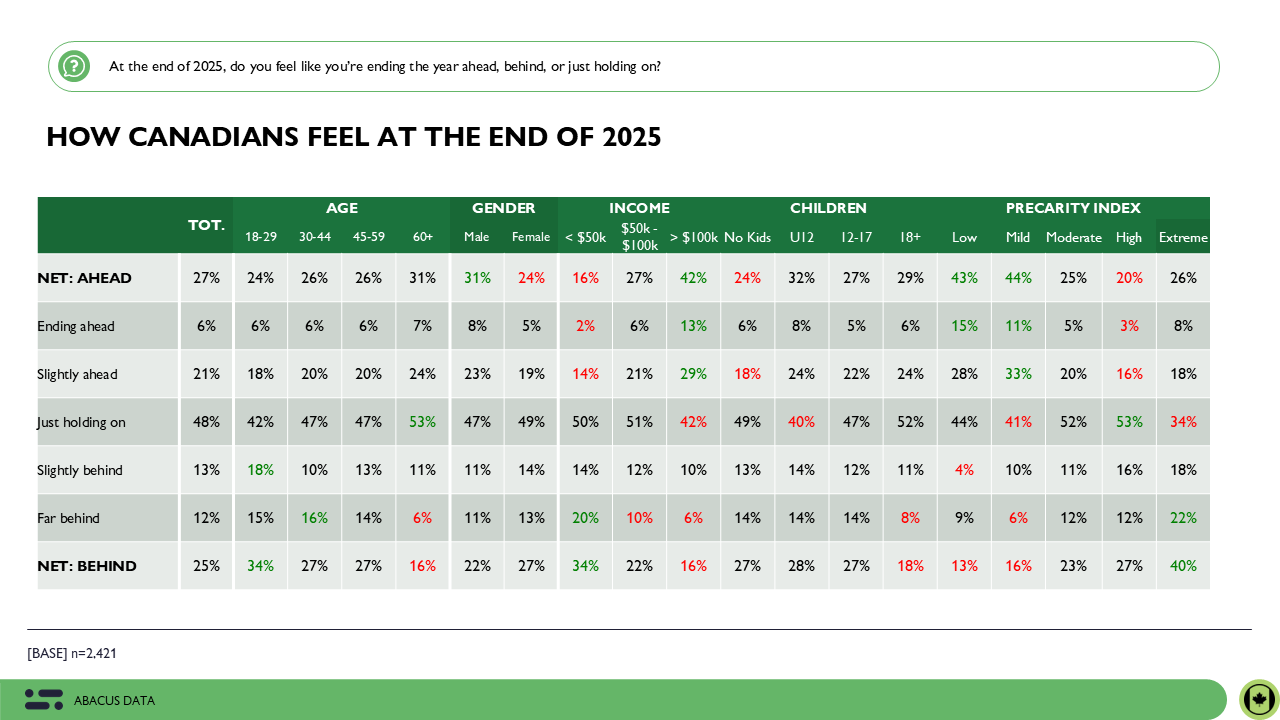

When asked how they are ending the year, 48% say they are barely hanging on, and a quarter (25%) say they are worse off than they were at the start. Younger Canadians and those with lower household incomes are most likely to feel they are falling behind. Further, those with high or extreme precarity overwhelmingly say they are just holding on.

A smaller portion of Canadians feel they are ending the year ahead – and these Canadians tend to be older, higher income, and experiencing low or mild precarity. This widening emotional and financial gap is one of the clearest indicators of how unevenly the pressures of precarity are being felt.

Looking Ahead to 2026: Hope, Hopelessness, and Rising Unpredictability

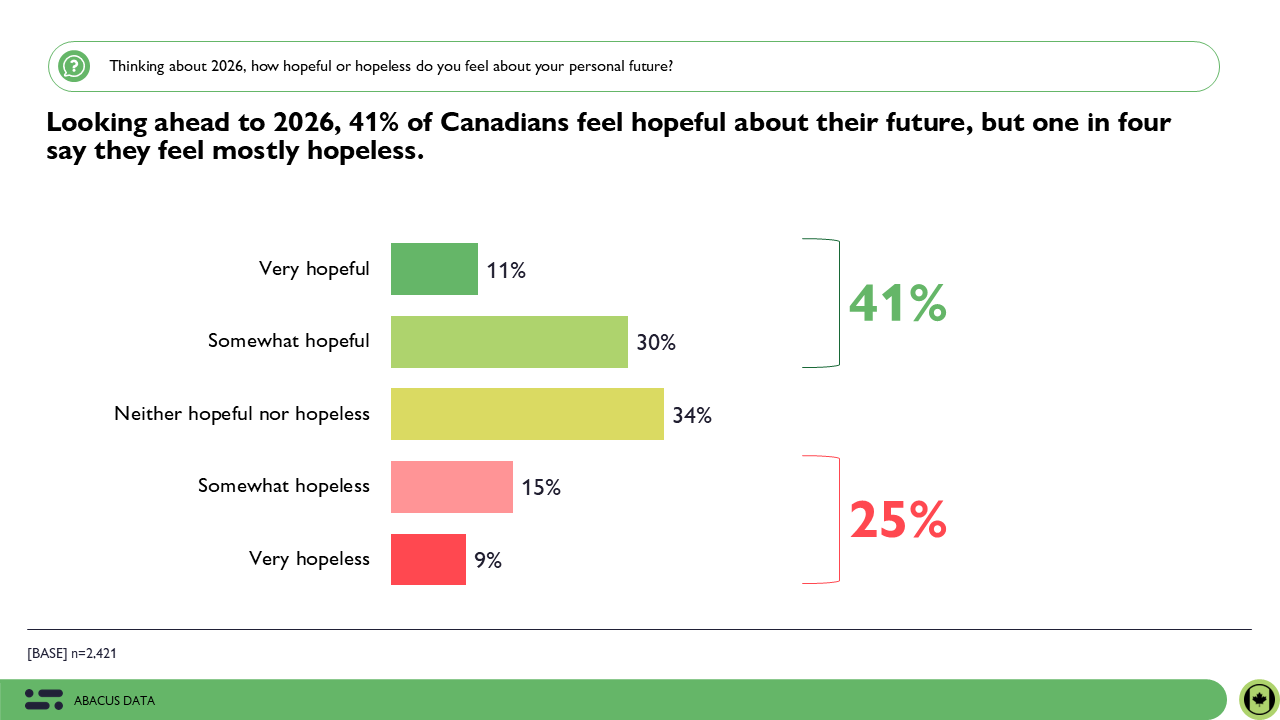

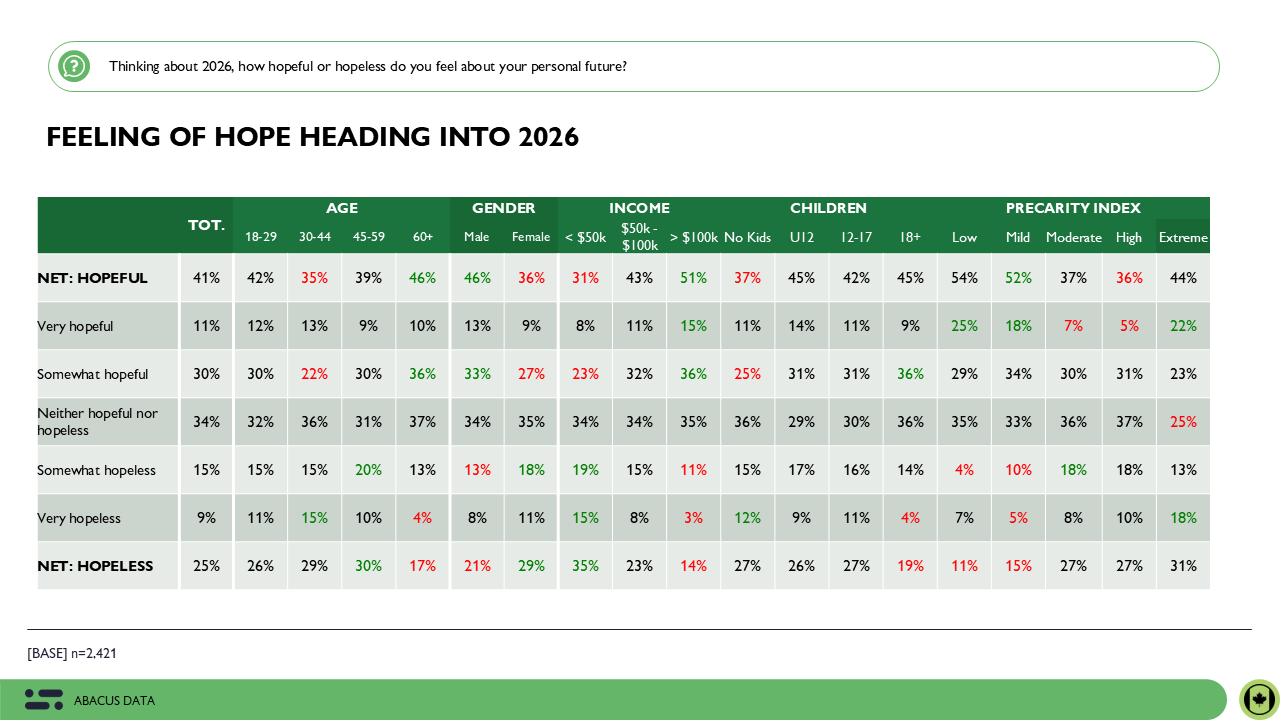

Despite the challenges of the past year, 41% of Canadians feel hopeful about their future heading into 2026. Hope is strongest among older adults (60+), men, and higher-income Canadians – groups generally less likely to experience high levels of precarity.

But one in four Canadians say they feel mostly hopeless about the year ahead. Hopelessness is concentrated among adults aged 45–59, women, and those in lower-income households – groups showing some of the highest levels of persistent strain.

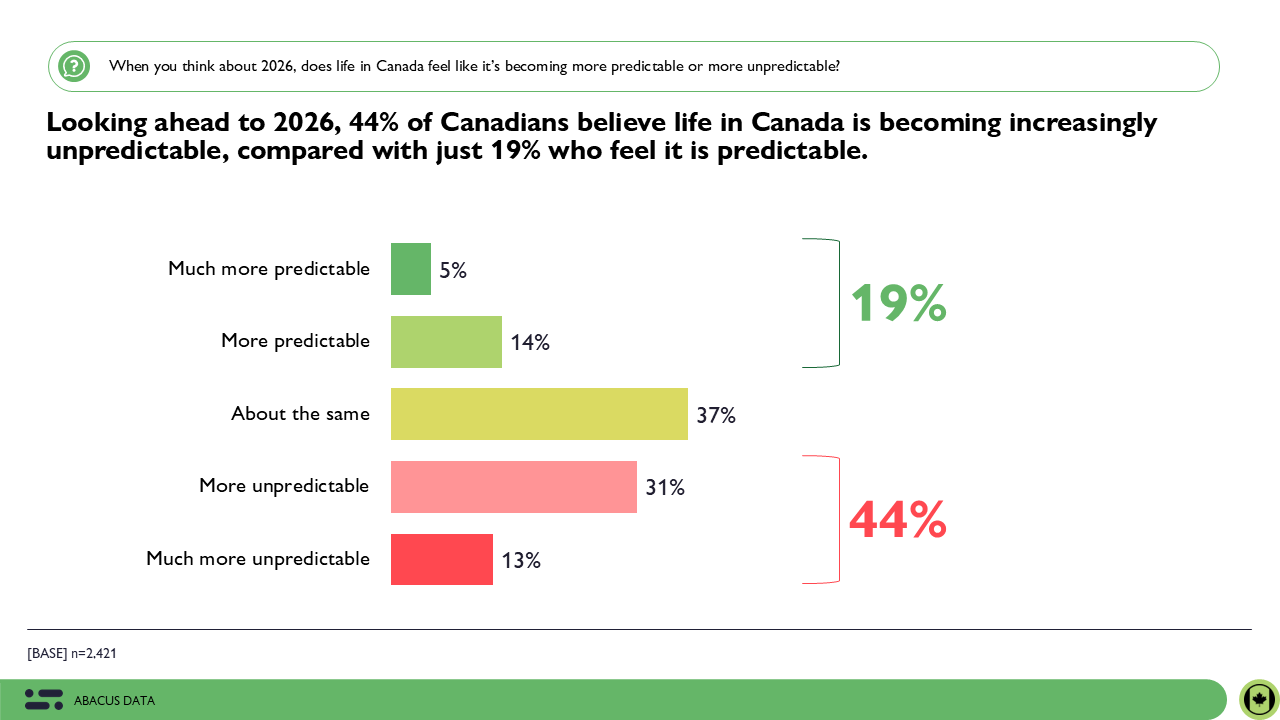

Perhaps the clearest sign of the national mood is Canadians’ perception of predictability. 44% believe life in Canada is becoming increasingly unpredictable, while only 19% say it feels stable or predictable. This sense of volatility is a core hallmark of the precarity mindset: the belief that disruptions are constant, risks are multiplying, and the future feels less secure than the past.

The Upshot

The close of 2025 marks a turning point in how Canadians perceive stability and risk. Precarity has become the dominant lens through which many people interpret daily life – shaping their expectations, influencing their decisions, and redefining what they need from the institutions around them. What stands out most is not just the presence of worry or strain, but how deeply this mindset now runs across the population, and how strongly it is influencing behaviour as we head into 2026.

This moment demands attention from leaders in every sector. For businesses, the emotional context of decision-making has fundamentally changed: consumers are more cautious, more skeptical, and more sensitive to perceived volatility. Trust, clarity, and stability are no longer nice-to-haves, they are the new competitive currency. For employers, the pressures workers carry into the workplace require stronger support systems, more flexibility, and a greater recognition of the mental and financial load many employees are managing. And for governments, the path to restoring confidence lies in demonstrating competence, consistency, and visible progress in a time when unpredictability feels like the norm.

The message is clear: Canadians are looking for anchors – institutions, leaders, and brands that reduce uncertainty rather than add to it. Those who can offer steadiness and credibility in a moment defined by volatility will be the ones who earn trust, loyalty, and influence in the year ahead.

Methodology

The survey was conducted with 2,421 Canadian adults from November 20 to 27, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 1.99%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by Abacus Data.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

About Abacus Data

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions

Find out more about how we can help your organization by downloading our corporate profile and service offering.