Cannabis is Mainstream, Public Support is Strong, and Canadians Want the Sector to Grow

October 29, 2025

Findings from a national survey conducted by Abacus Data for Organigram Global Inc.

Seven years after cannabis was legalized in Canada, a new survey from Abacus Data conducted for Organigram Global reveals that cannabis has firmly taken root in Canadian society. Cannabis use is widespread across age groups, and the sector is broadly seen as a valuable contributor to the national economy. Most Canadians support the idea of modernizing regulations to help the industry grow—and critically, very few see any political downside to doing so.

At a time when economic headwinds are blowing north from Washington—driven by U.S. protectionism and a trade war sparked by the Trump administration—many Canadians appear ready to double down on homegrown economic sectors that can offer stable jobs and export potential. Legal cannabis is increasingly viewed not only as a normalized consumer product but as a sector worth investing in, supporting, and growing. The data reveals a clear political opening for federal leaders: cannabis is not a liability; it’s an opportunity.

Legal Cannabis Is a Part of Everyday Life

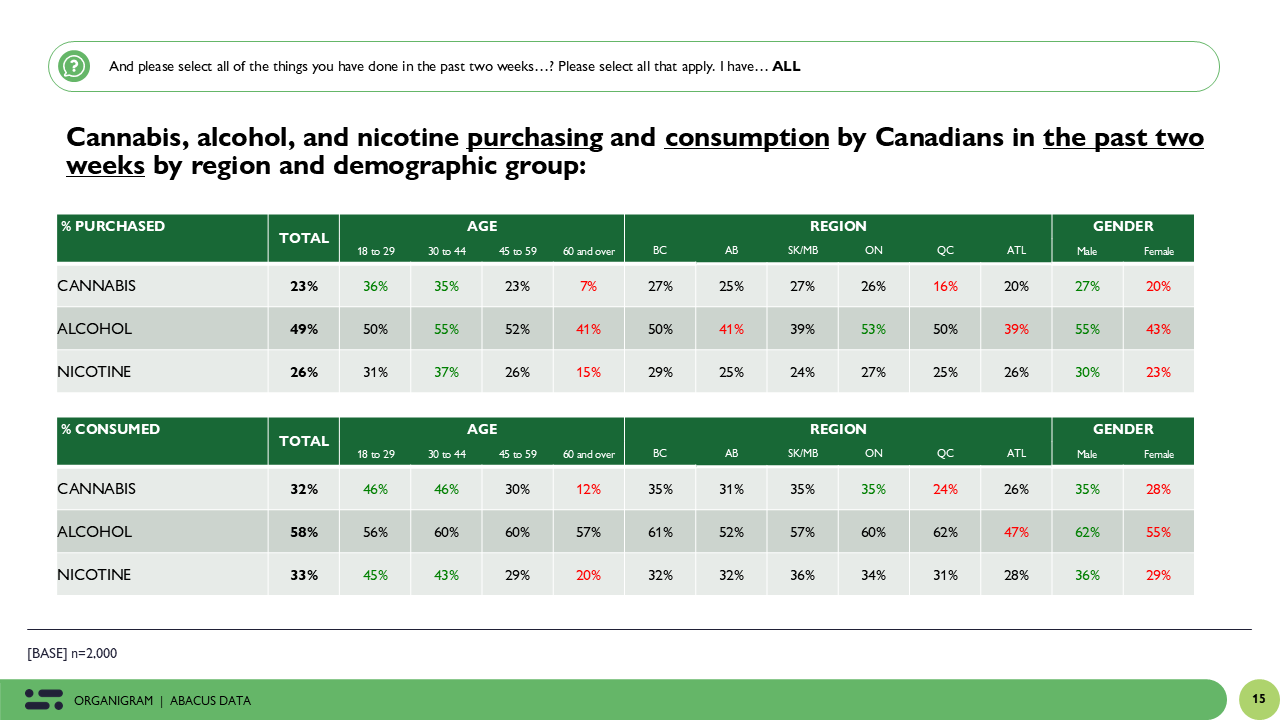

Cannabis use in Canada is not niche—it’s mainstream. More than one in three Canadian adults (35%) report using cannabis in the past six months, and 32% say they’ve used it in just the last two weeks. Usage is even higher among younger Canadians: half (50%) of those under 45 have used cannabis recently, and more than a third have used it in the past two weeks.

Legal cannabis is not just consumed frequently—it’s used in diverse forms. In the past six months, 25% of Canadians consumed edibles, 16% used dried flower, and others reported using vaping devices, oils, and beverages. In some product categories, consumption is on par with, or even preferred to, alcohol. Among cannabis users, 30% say they prefer it over alcohol, and another 29% view the two equally.

Cannabis is no longer a subculture: it’s a consumer choice as normal as ordering a craft beer or a glass of wine.

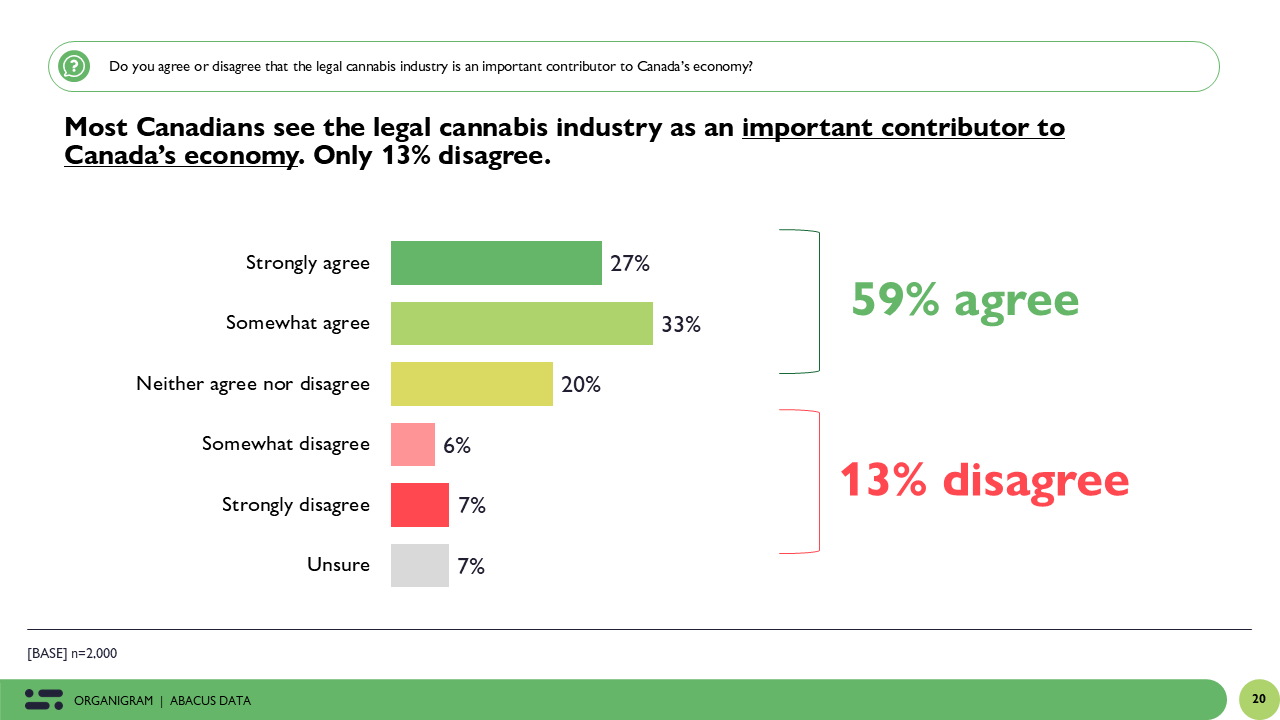

Canadians See the Economic Value of Legal Cannabis

A strong majority—59%—say the legal cannabis sector is an “important contributor to Canada’s economy.” That view cuts across region, gender, and political affiliation. The highest levels of agreement are found in Ontario (65%) and Atlantic Canada (66%), as well as among Canadians aged 18 to 44 (65%).

There is also little political difference. 69% of recent Liberal voters and 58% of recent Conservative voters agree that legal cannabis industry is an important contributor to Canada’s economy.

In today’s global context, this support takes on greater significance. With Canada facing threats of economic disruption from U.S. trade policy, support for industries that provide resilient, domestic jobs matters more than ever. Legal cannabis is increasingly seen as part of Canada’s economic diversification strategy and Canadians are on board with that vision.

Political Opportunity, Not Political Risk

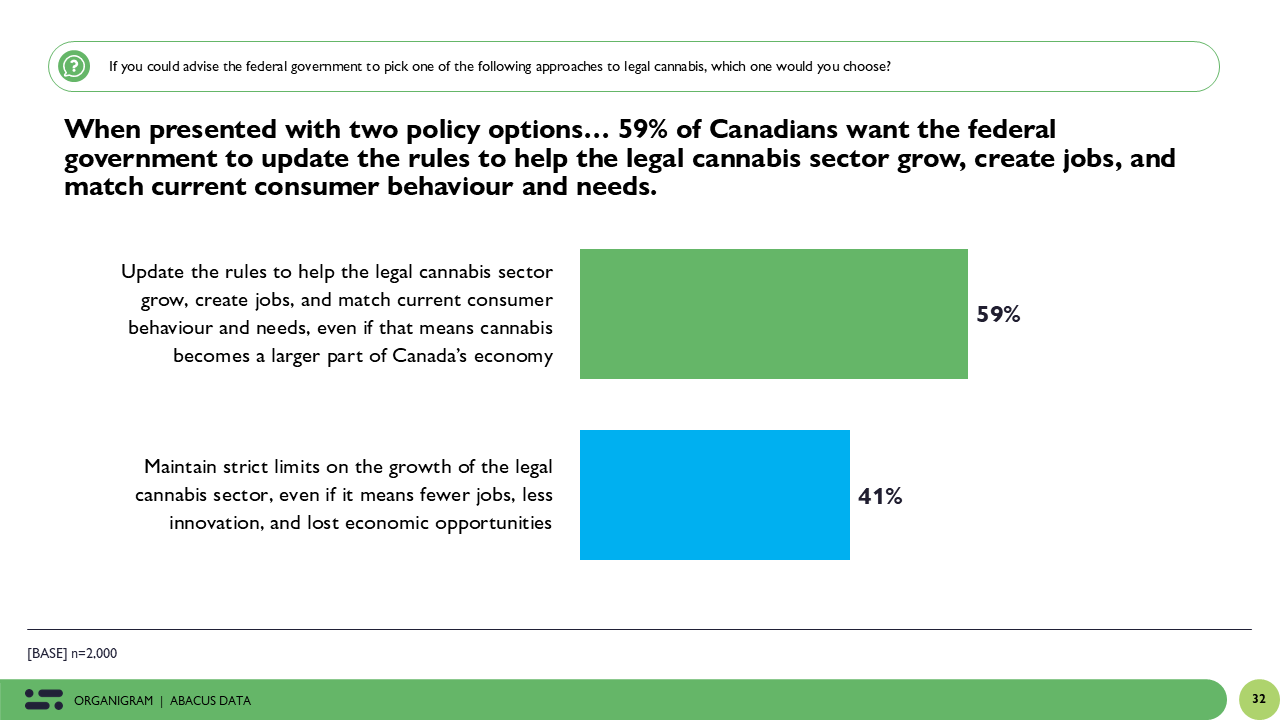

When presented with two options for federal cannabis policy, nearly six in ten Canadians (59%) chose “updating the rules” to support economic growth and consumer needs, rather than maintaining strict limits.

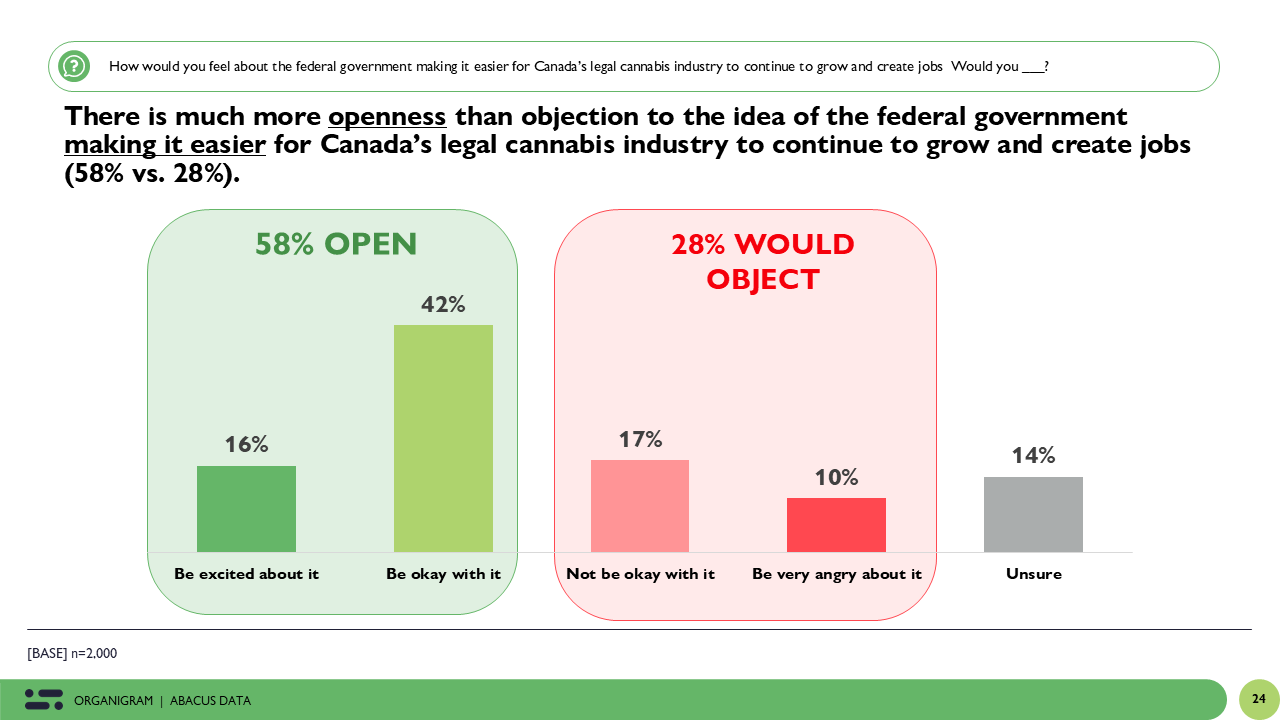

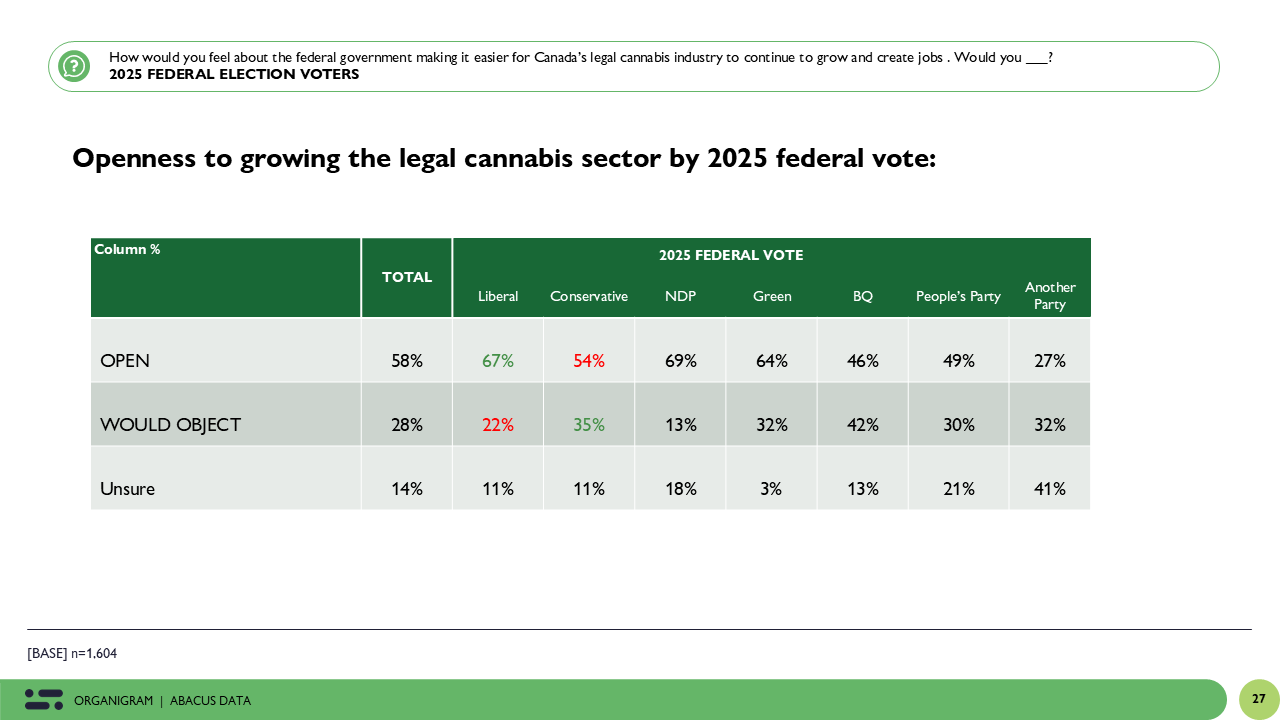

The same proportion (58%) say they would be excited or okay with the government making it easier for the sector to grow and create jobs. Just 28% would object.

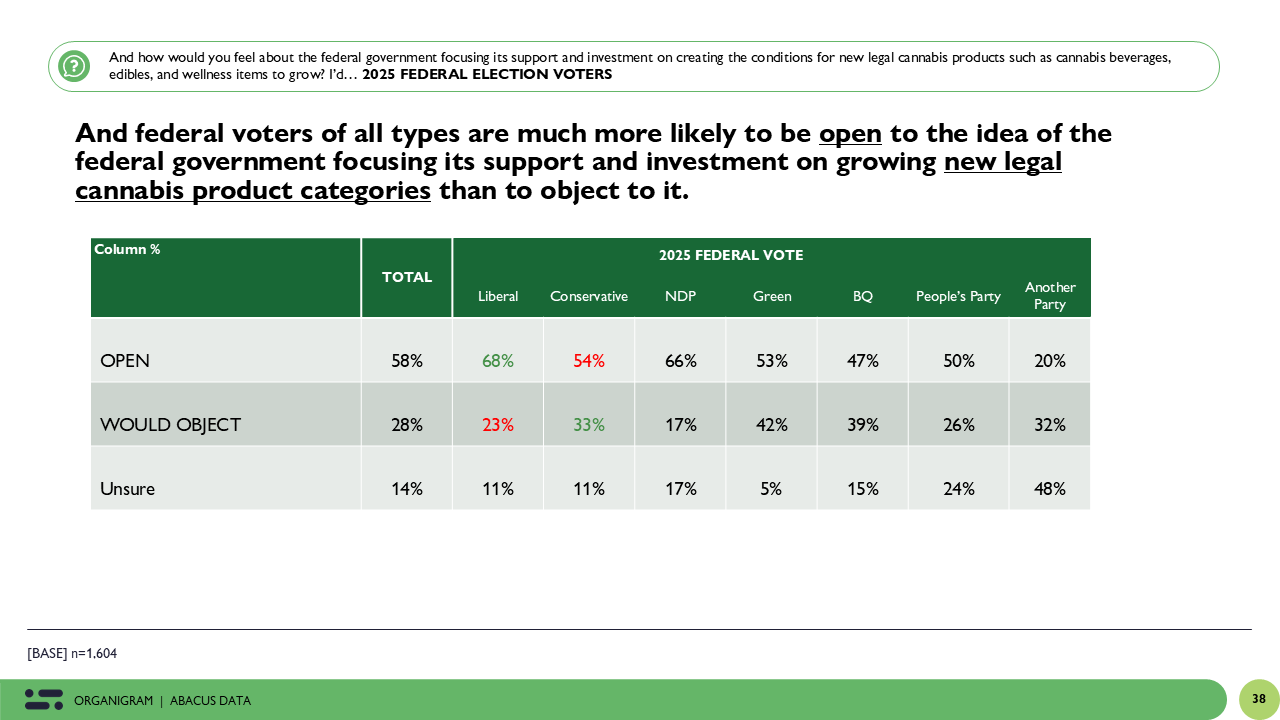

Notably, Liberal voters are especially supportive. Two-thirds (67%) of Carney Liberal voters back making it easier for the industry to grow, and 68% are open to federal investment in expanding new product categories. Support also spans other parties, including NDP (69%), Green (64%), and even a slim majority of Conservative voters (54%).

Canadians Want Policy Change with an Economic Lens

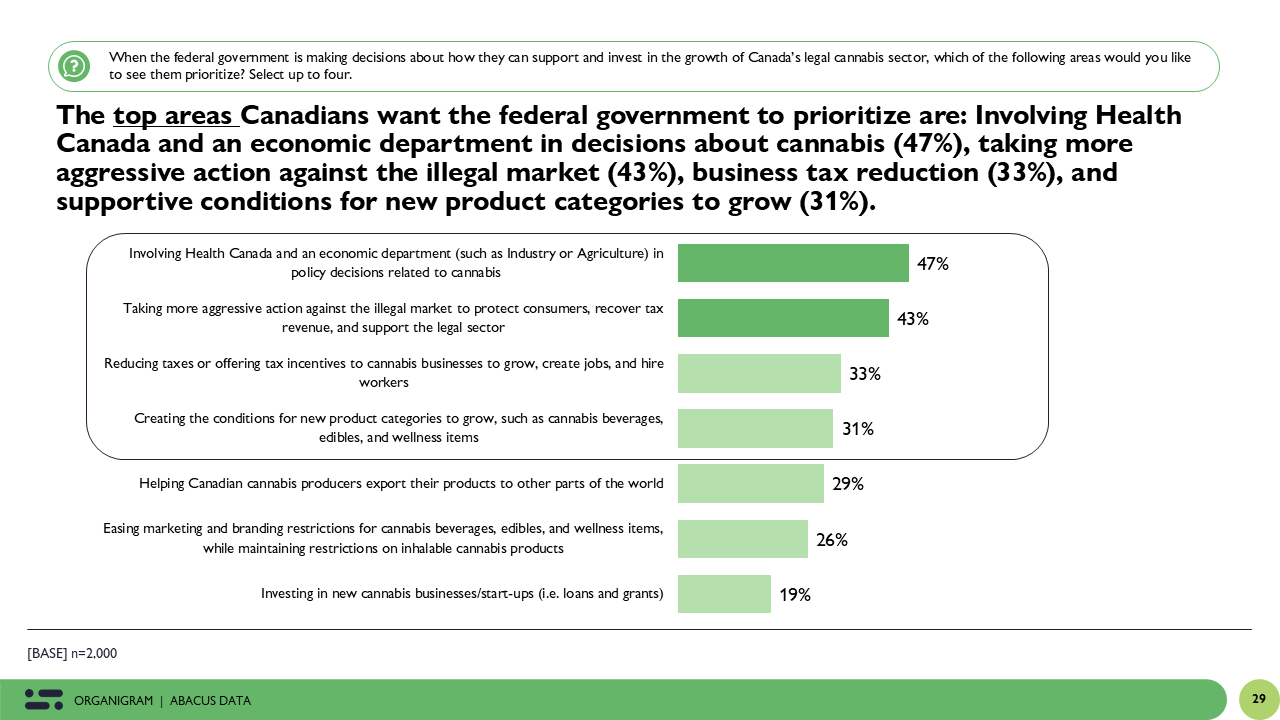

Asked what the federal government should prioritize to support the legal cannabis sector, Canadians point squarely to economic development:

- 47% want economic departments like Industry or Agriculture involved in cannabis policy decisions alongside Health Canada.

- 43% want tougher enforcement against the illegal market.

- 33% want lower business taxes for producers.

- 31% want the government to support new product categories like edibles, beverages, and wellness items.

Importantly, support for economic-focused cannabis policy is consistent across the country and especially strong among cannabis users and younger Canadians. The data shows Canadians want a smarter regulatory environment that enables innovation and competitiveness, especially as other countries begin to explore legalization themselves.

New Product Categories Have Strong Public Support

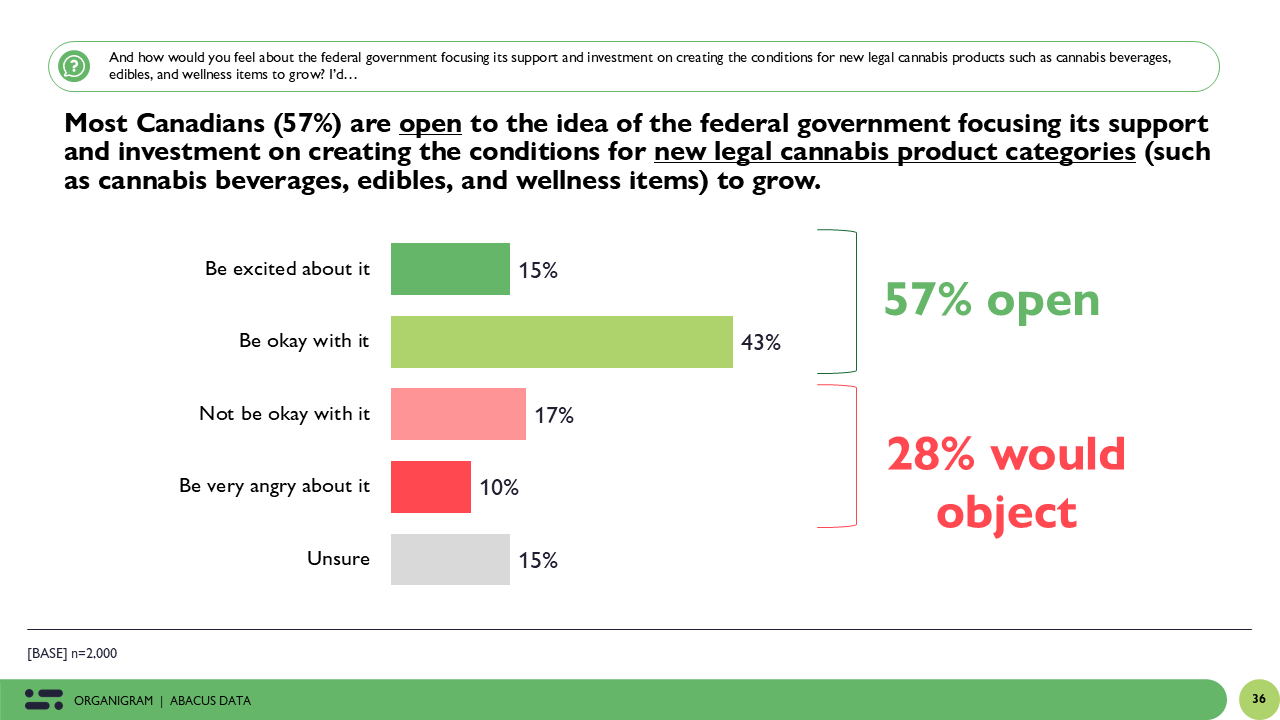

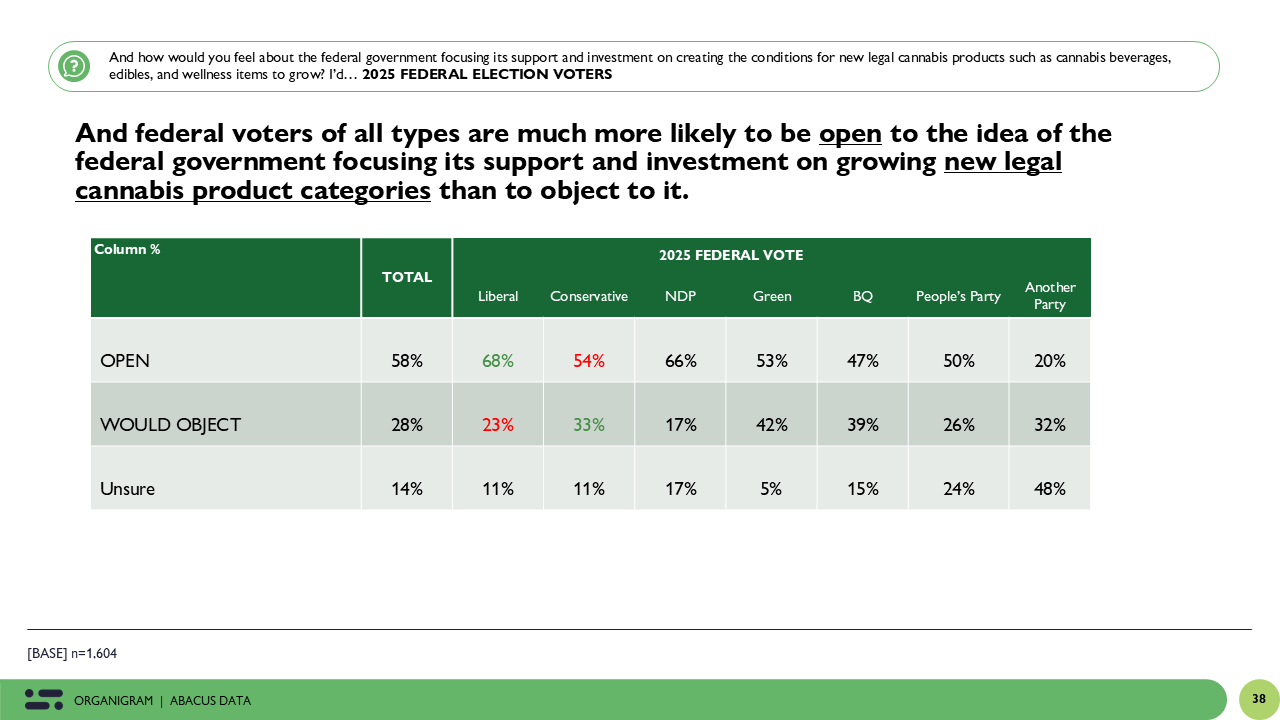

One of the clearest takeaways from this study is the untapped potential in emerging cannabis categories. A majority (57%) of Canadians say they’re open to the federal government investing in the growth of cannabis beverages, edibles, and wellness products. Only 28% would object.

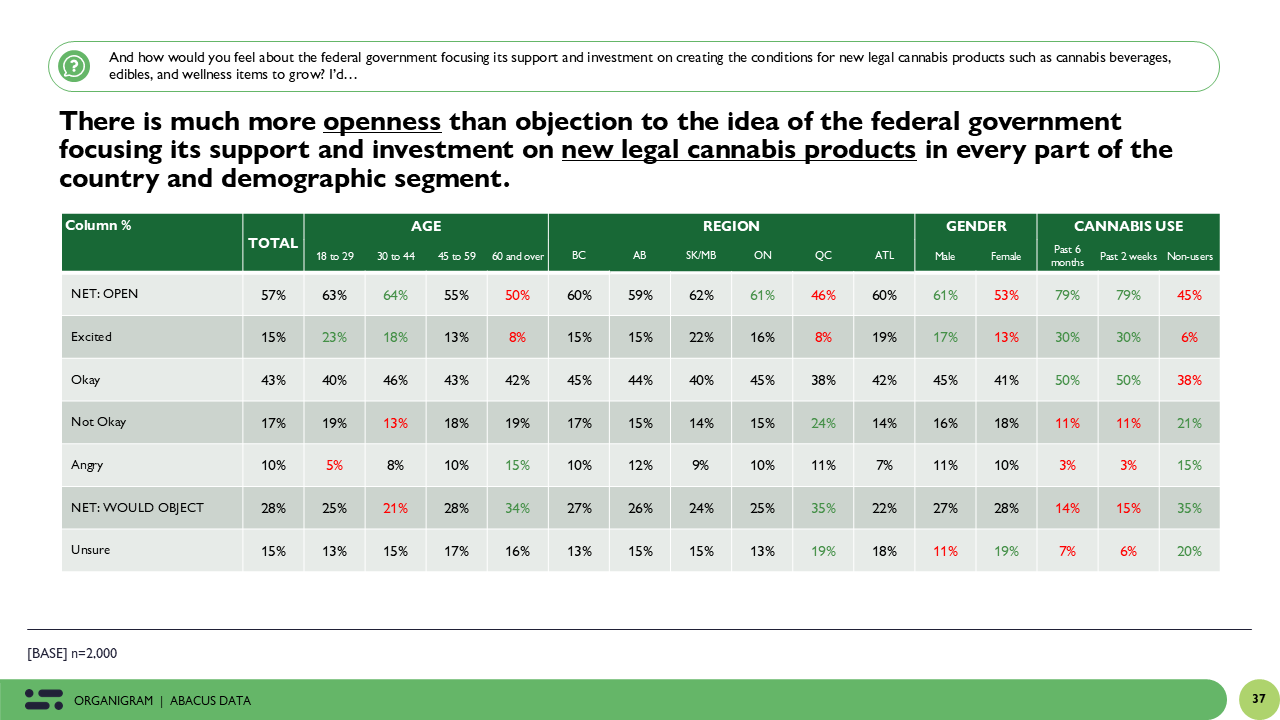

Openness is even higher among key demographics:

- 64% of Canadians under 45 support investment in new product categories.

- Among Liberal voters, that number climbs to 68%.

- Even in more traditionally cautious regions like Quebec and Atlantic Canada, public openness still outpaces resistance.

Canadians Envision a Cannabis-Driven Economic Future

When asked to imagine what could happen if governments updated cannabis rules, Canadians were overwhelmingly positive. More than 70% say it would be a good or okay thing if Canada created tens of thousands of new jobs in farming, retail, and manufacturing, or became a global leader in wellness-focused cannabis products.

Three-quarters would welcome breakthroughs in cannabis-based pain and anxiety treatments. The same number support a future in which legal cannabis generates $5 billion in tax revenue to help fund social services and reduce the cost of living.

Even more culturally transformative ideas—like people drinking cannabis beverages instead of alcohol, or those products being available at spas, bars, and restaurants—receive more support than resistance. The desire for change isn’t just about economics. It’s about culture, health, and quality of life.

The Upshot

Cannabis is no longer a question mark for Canadian society, it’s a known quantity. One-third of adults use it regularly, half of younger Canadians do, and most are perfectly comfortable with the idea that it will become a bigger part of our economic and cultural life.

The data paints a clear picture: the legal cannabis industry has broad social license, visible economic value, and political upside for federal decision-makers. Updating cannabis policy is not a risk. It’s a low-resistance opportunity to create good jobs, expand a homegrown sector, and chart a more resilient economic path in an increasingly volatile global economy. And it’s cross-partisan.

In the face of trade pressure and economic threats from abroad, Canadians are ready for the federal government to back sectors that make sense at home.

Methodology

The survey was conducted with 2,000 Canadian adults (aged 18+) between June 25 and July 2, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.19%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, and region.

This survey was commissioned by Organigram Global.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here:

https://canadianresearchinsightscouncil.ca/standardsnadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in the 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.