9 in 10 Canadians are Concerned About the State of Housing in Canada Today

October 10, 2025

Recently, Abacus Data partnered with the Canadian Real Estate Association (CREA) to conduct a comprehensive national survey examining the current state of housing in Canada. This report is the first in a new series exploring how Canadians are experiencing the housing crisis, with a focus on the growing challenges of affordability and accessibility that have become defining concerns across the country.

As the Carney government prepares its first federal budget, housing stands out as a defining test of performance. Few issues cut as deeply across the country or affect as many aspects of daily life as housing. Alongside broader cost-of-living and affordability pressures, housing has become the lens through which Canadians are judging progress, and the measure by which they’ll gauge whether relief is truly within reach.

The Pressures Mounting on Canadians

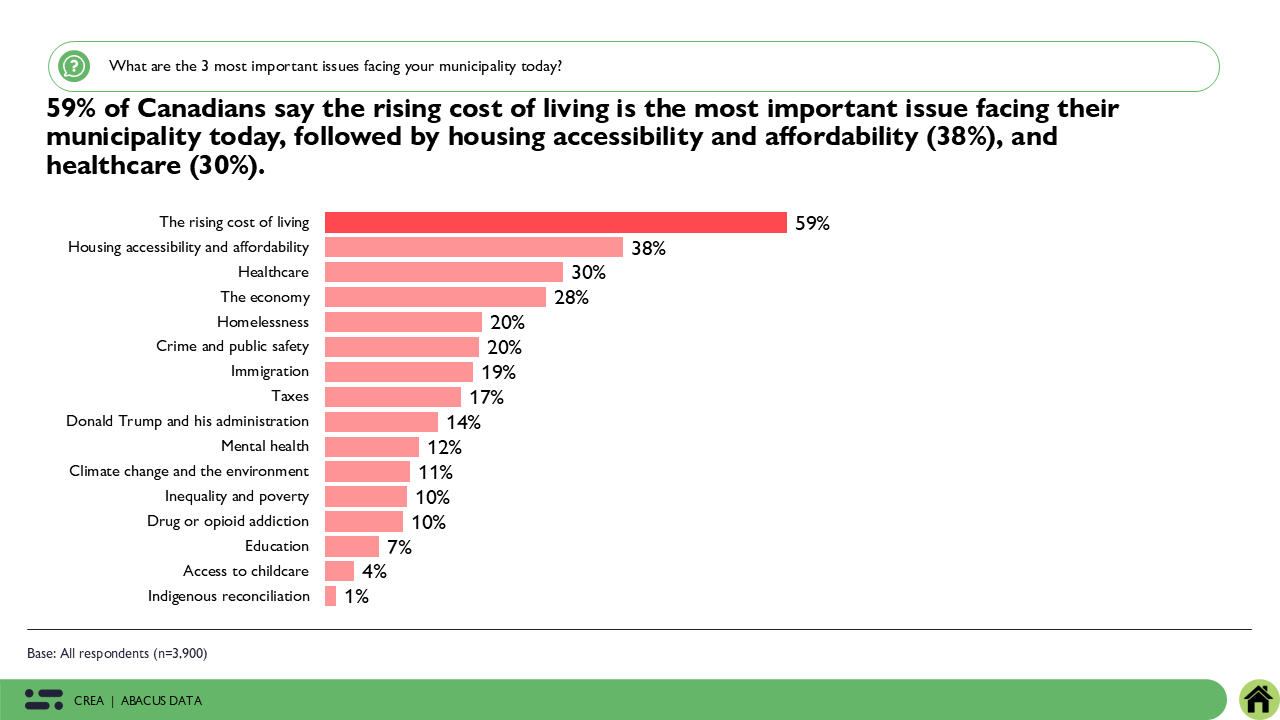

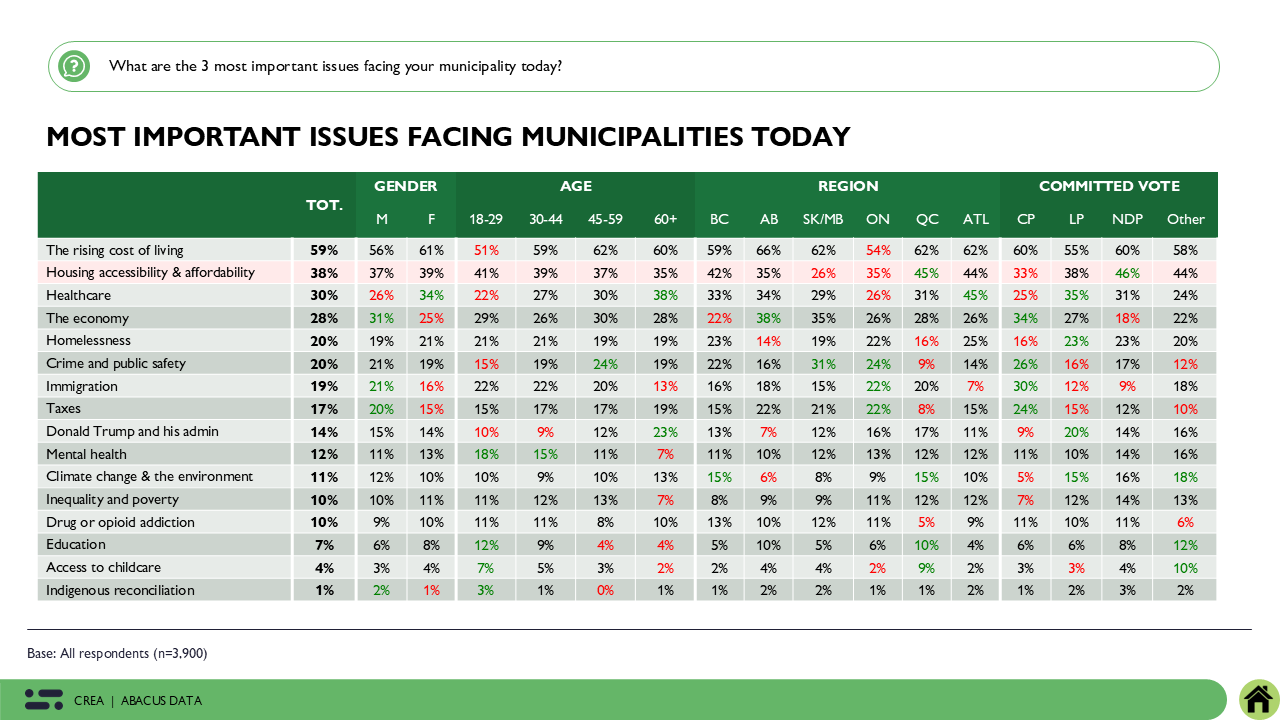

Across the country, housing has become one of the most urgent issues Canadians face, reflecting a growing sense of strain in both affordability and accessibility. Nearly four in ten (38%) identify housing as a top concern in their community – behind the rising cost of living (59%) and ahead of healthcare (30%). Together, these pressures are shaping a climate where basic needs – having a home, affording daily essentials, and accessing care – feel increasingly out of reach for many Canadians.

Younger Canadians are particularly attuned to housing challenges: 41% of those aged 18 to 29 and 39% of those aged 30 to 44 rank it among their top local issues. Regionally, housing worries peak in Quebec (45%), Atlantic Canada (44%), and British Columbia (42%), reflecting where affordability pressures are most acute.

A Crisis Everyone Feels

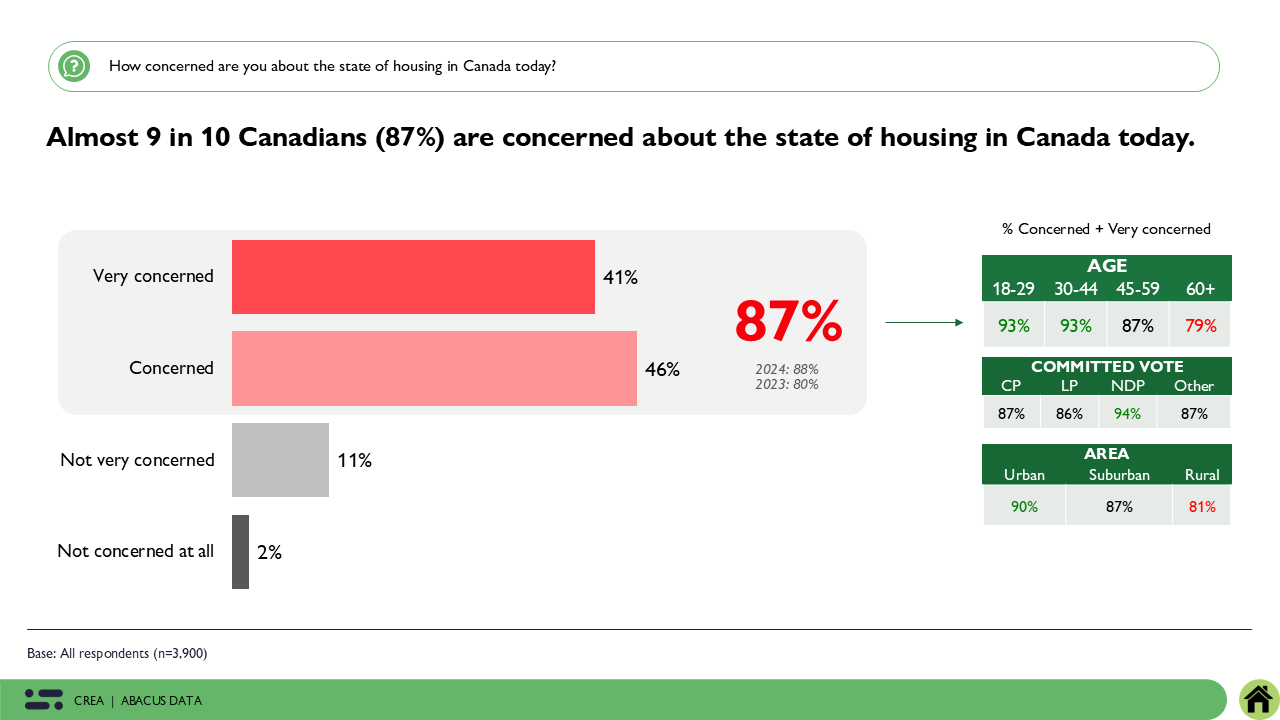

Housing is one of the few issues that cuts across generational, geographic, and political lines. Nearly nine in ten Canadians (87%) say they are concerned about the state of housing today. This concern transcends party lines – shared by 87% of Conservative, 86% of Liberal, and 93% of NDP supporters.

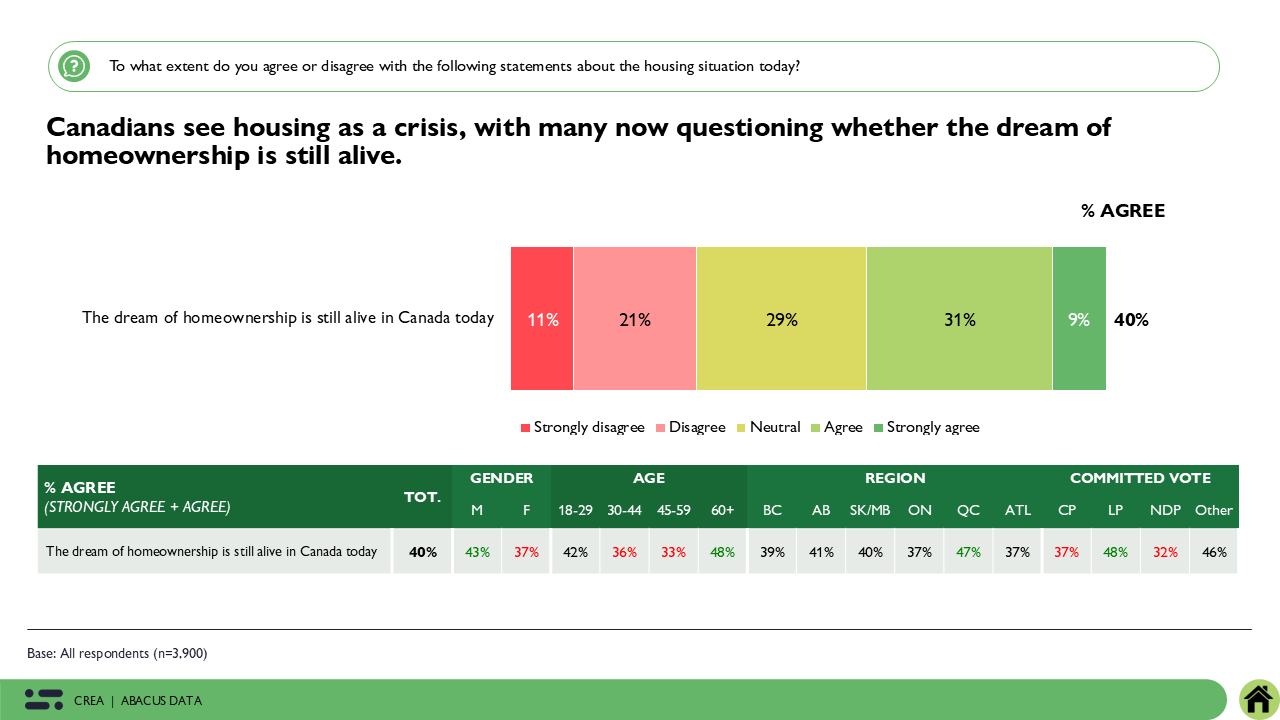

Perhaps the most sobering finding is that only four in ten Canadians (40%) believe the dream of homeownership is still alive in Canada today. Among those aged 30 to 59 this sentiment is even weaker, with just a third believing the dream remains attainable.

What’s Driving the Crisis

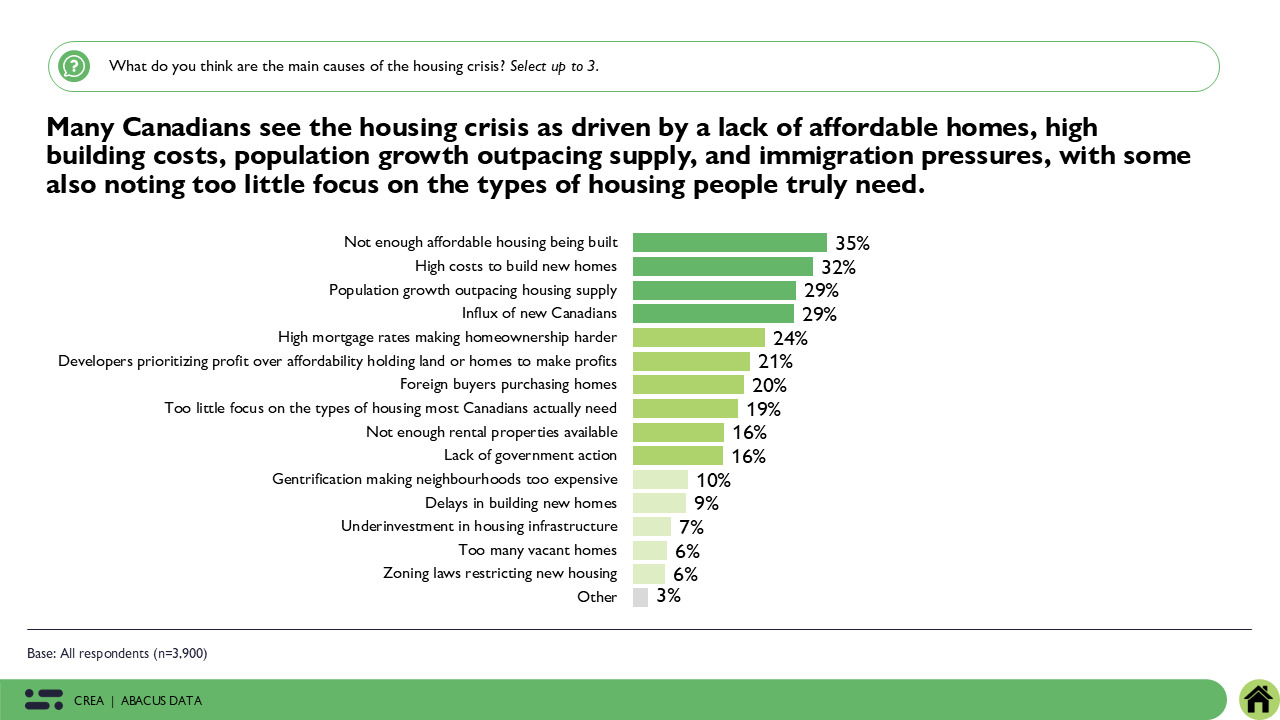

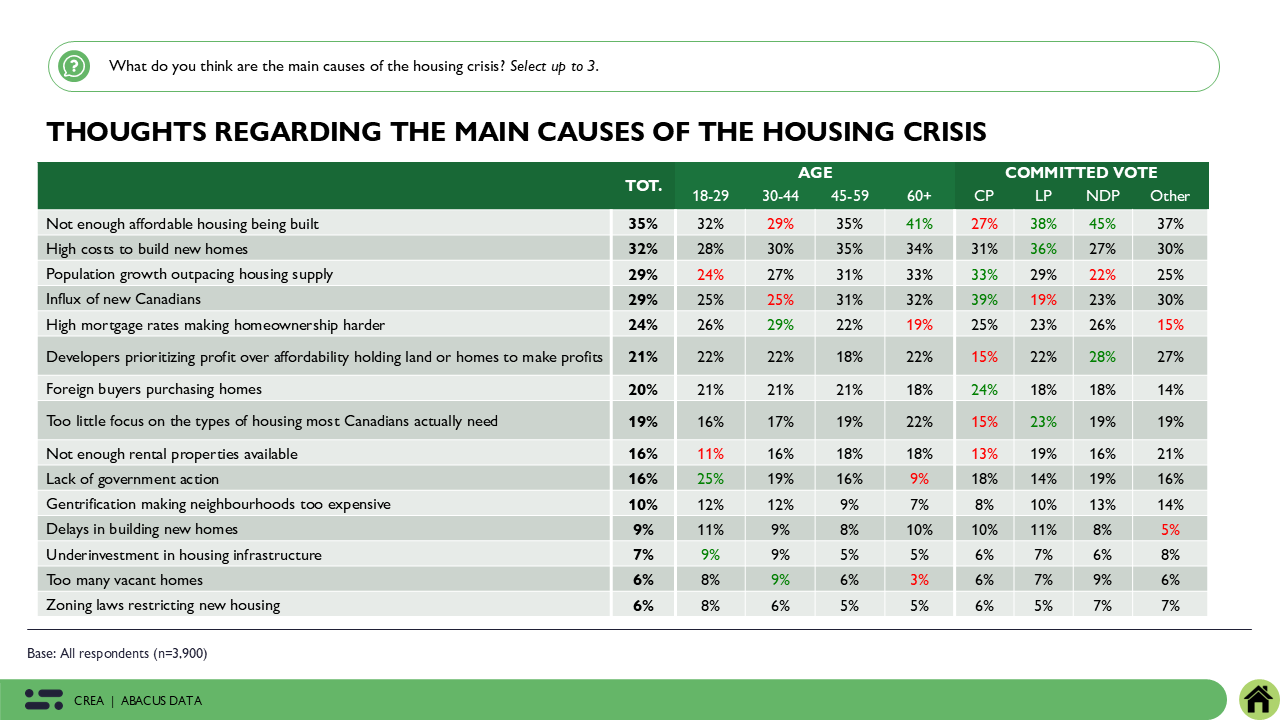

When Canadians look for causes, they point to both supply and systemic barriers. A third (35%) say not enough affordable housing is being built, while another third (32%) point to the high costs of building new homes. Others highlight the pace of population growth outpacing supply (29%) and an influx of new Canadians (29%) as contributing factors.

There are also political nuances in how people understand the problem. Conservative supporters are more likely to point to immigration and foreign investment pressures, while Liberal supporters emphasize construction costs and the lack of housing that meets Canadians’ actual needs. Younger Canadians, meanwhile, are more likely to express frustration with government inaction, underscoring growing generational tension around the issue.

Worries About Housing Security

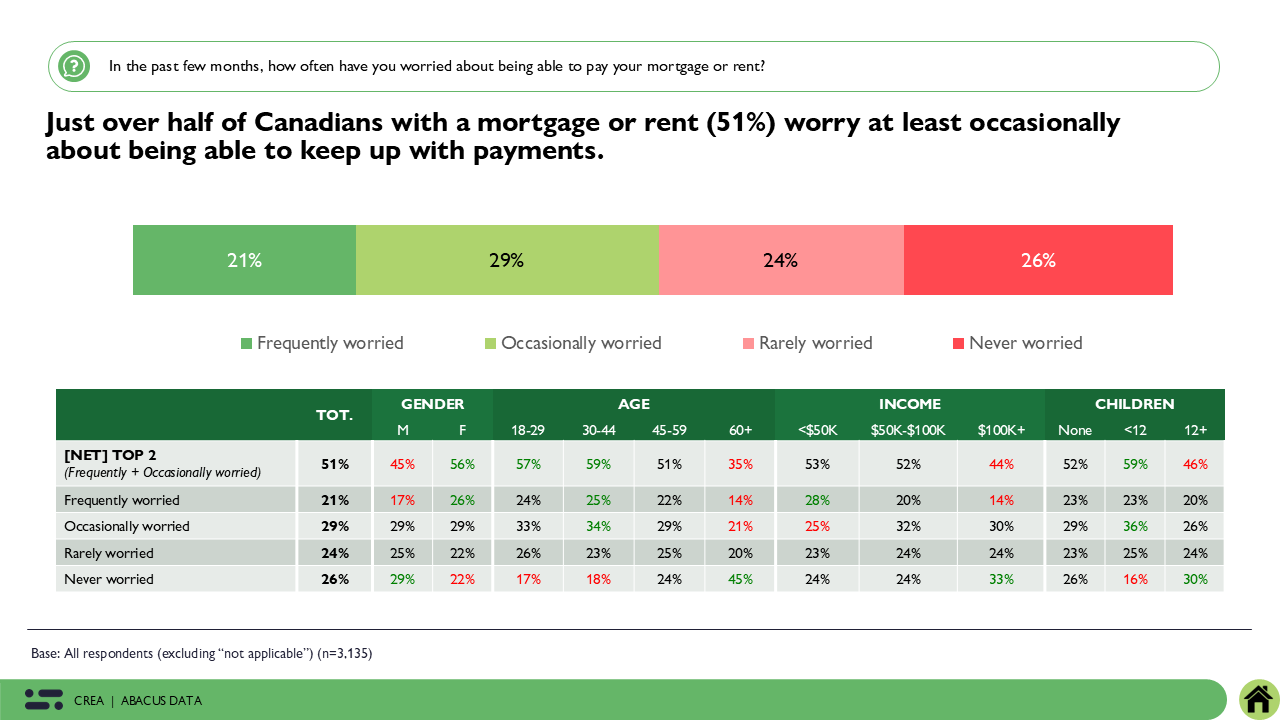

Among those who own or rent, the sense of stability is fragile. Just over half (51%) worry about keeping up with mortgage or rent payments, a concern that cuts across much of the population. It’s felt most by younger Canadians (57% of those aged 18–29 and 59% of those aged 30–44), lower-income households (53% earning under $50,000), and families with young children (59%). These findings show how financial strain and uncertainty have become defining features of the housing experience, especially for those still building their futures.

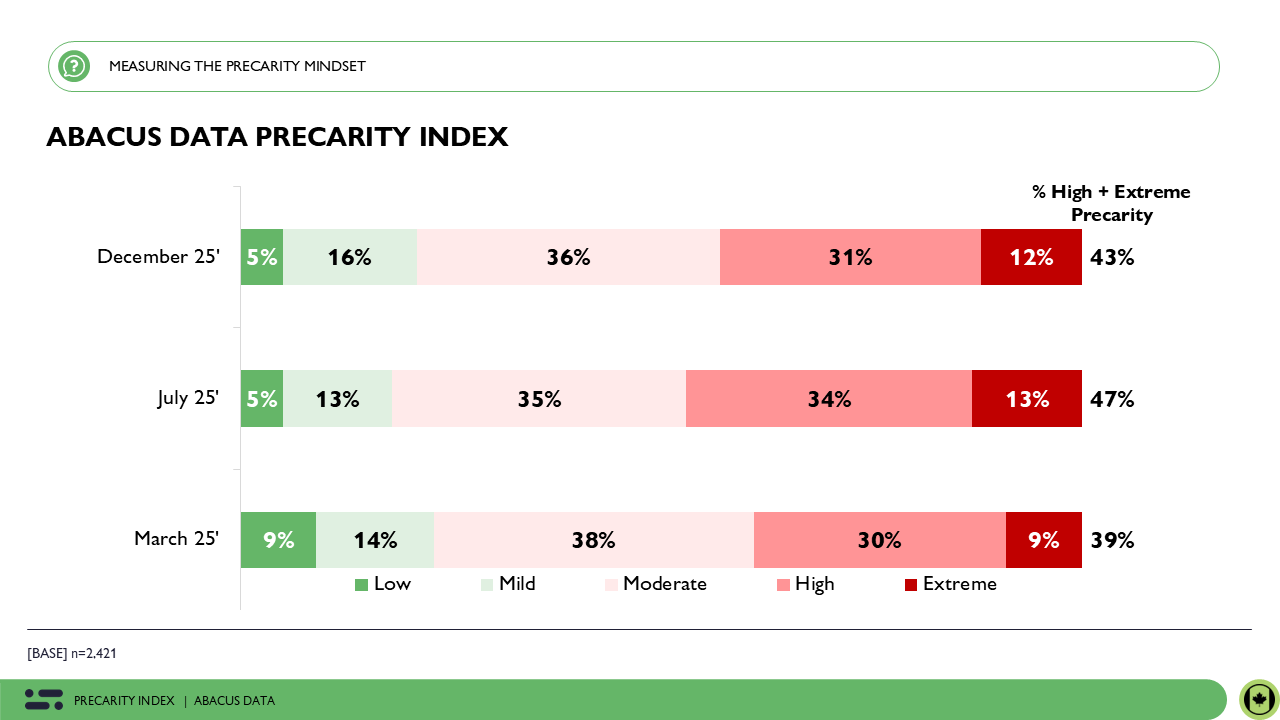

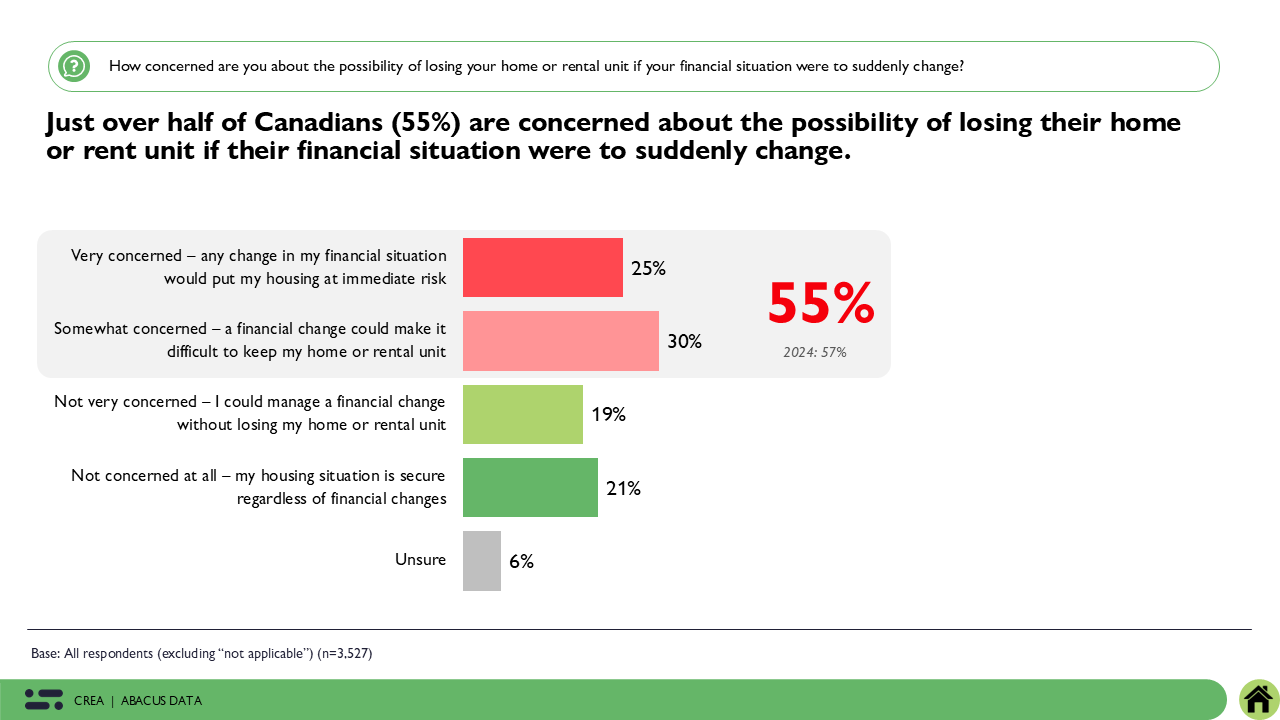

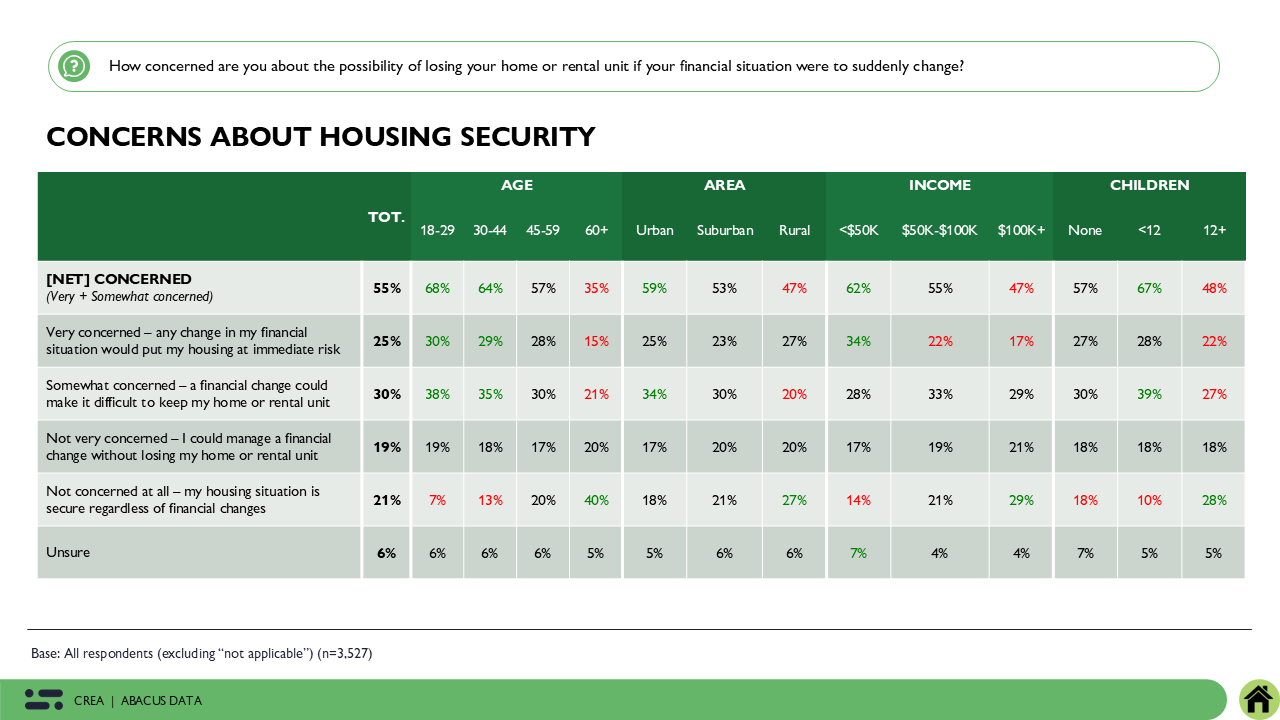

Meanwhile, 55% of Canadians worry about losing their home or rental if their finances were to suddenly change, a reminder of how fragile housing security has become. Concern is highest among younger Canadians (68% of those aged 18–29 and 64% of those aged 30–44), lower-income households (62% earning under $50,000), and families with children under 12 (67%). Together, the data underscores how precarious housing has become for those already stretched the most – young Canadians, families, and those living closest to the financial edge.

The Enduring Aspiration of Homeownership

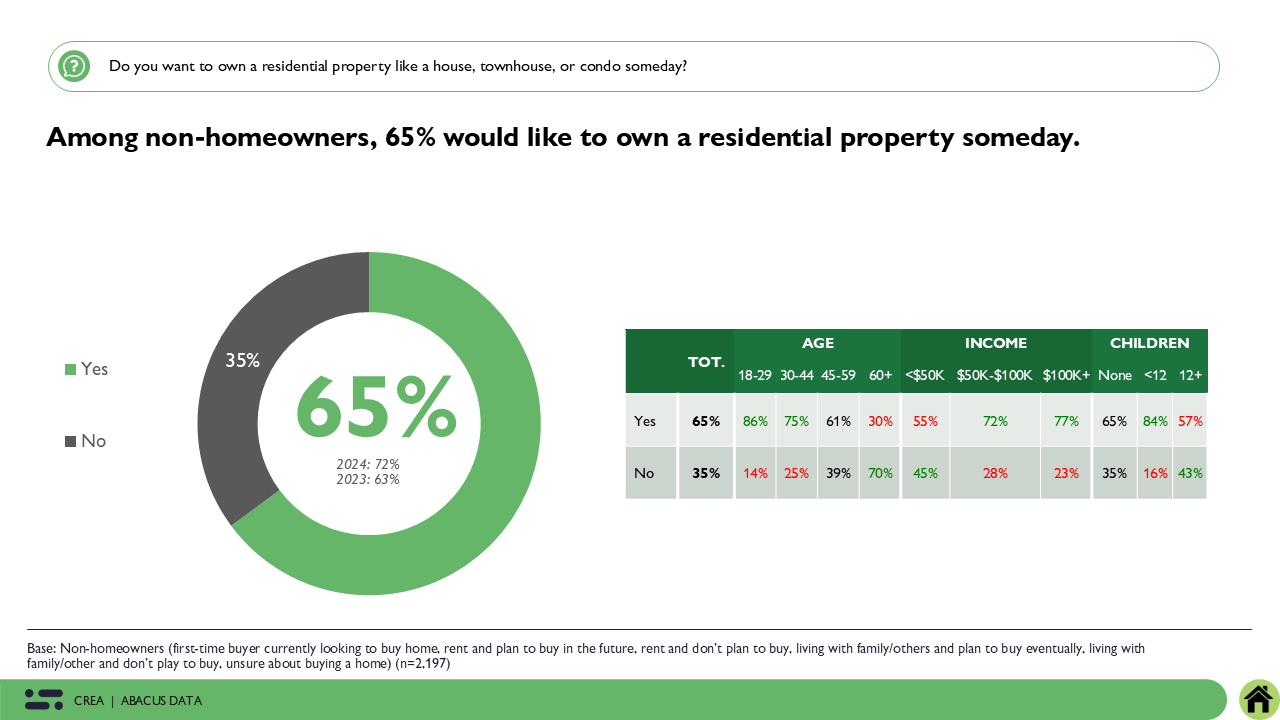

Despite these challenges, the aspiration to own a home remains strong. Among non-homeowners, nearly two-thirds (65%) say they would like to own a residential property someday. This jumps to 86% among those aged 18 to 29 and 75% among those aged 30 to 44, clear evidence that the goal of homeownership persists, even as it feels increasingly out of reach.

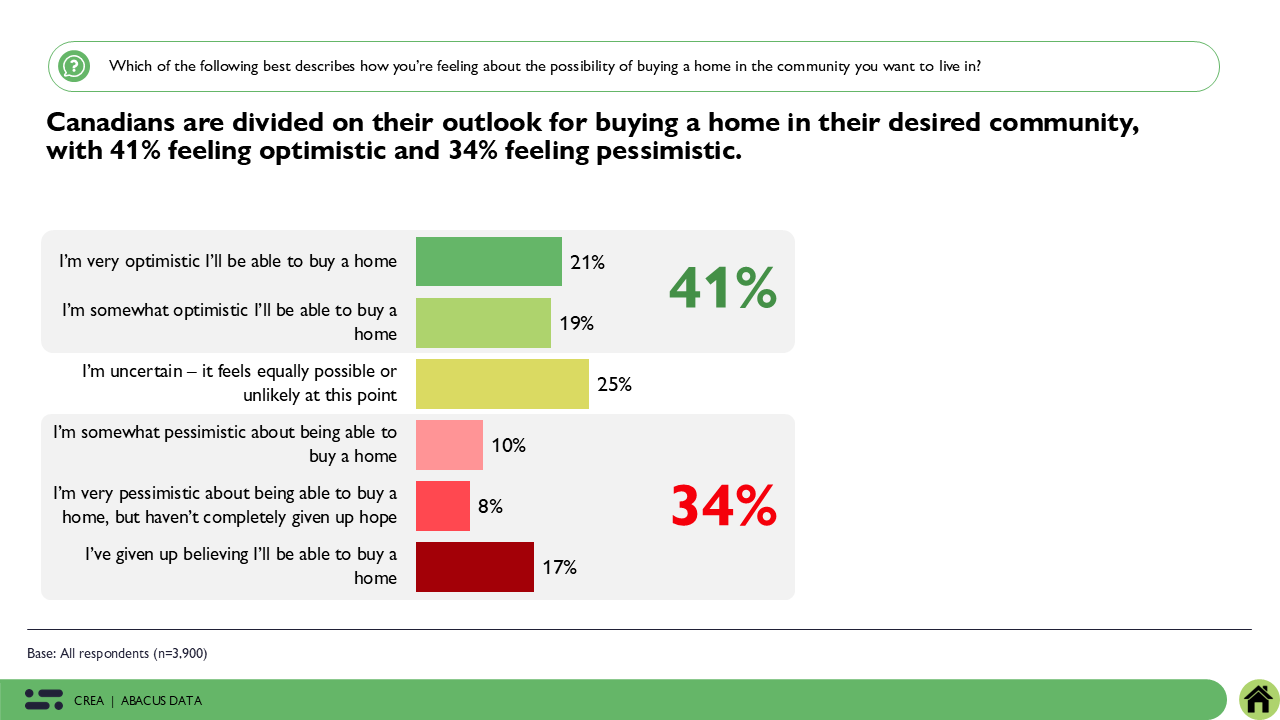

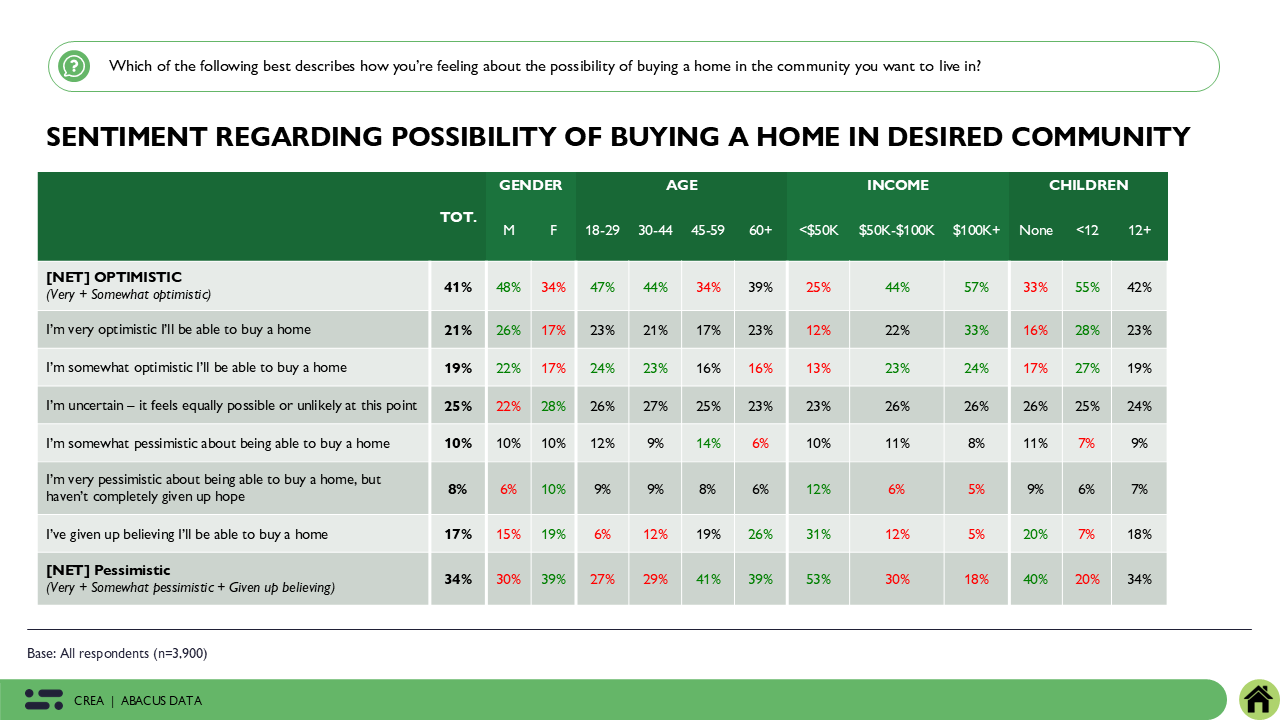

Optimism varies. Four in ten Canadians (41%) feel hopeful about being able to buy a home in their desired community, while a third (34%) feel pessimistic. Encouragingly, optimism is strongest among younger Canadians – 47% of those aged 18–29 and 44% of those aged 30–44 – and among those with higher household incomes, including 44% of those earning $50–100K and 57% earning over $100K. These groups may still see a path forward if conditions improve, but for many others, the goal of homeownership feels increasingly out of reach.

The Upshot

The findings reveal a country living in a state of precarity, where stability feels fragile and the future uncertain. Canadians aren’t just worried about being able to afford a home; many are anxious about keeping one. This is no longer only an issue of affordability, it’s about security, control, and confidence in the systems meant to sustain opportunity.

The housing crisis has become the most visible expression of this broader anxiety. For many, especially younger Canadians and young families, it represents the breaking point of a social contract that once promised stability through effort. The goal of homeownership still exists, but it is increasingly accompanied by doubt, a quiet worry that doing “everything right” may no longer be enough.

For governments, this presents both a challenge and an opportunity. Canadians are no longer judging success solely by the scale of investment or the number of units promised, but by whether they can feel the difference in their own lives, whether housing, affordability, and community stability begin to feel within reach again. Restoring that sense of confidence will require more than policy reform; it demands a visible, sustained commitment to making life feel predictable and secure once more.

Until that happens, the housing crisis will remain not just a policy problem, but a public mood, one that shapes how Canadians see their country, their communities, and their own futures.

METHODOLOGY

The survey was conducted with 3,900 Canadian adults from September 5 to 16, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 1.57%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by the Canadian Real Estate Association.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.