Renting: Smooth Sailing or Jumping Ship?

November 4, 2021

In our most recent survey, we looked at how Canadian renters are doing. Are they renting happily ever after or are they looking for greener pastures by purchasing a home as soon as possible? What is the current market outlook for renters right now? How is the rental market doing in terms of affordability and availability? Here is what we found:

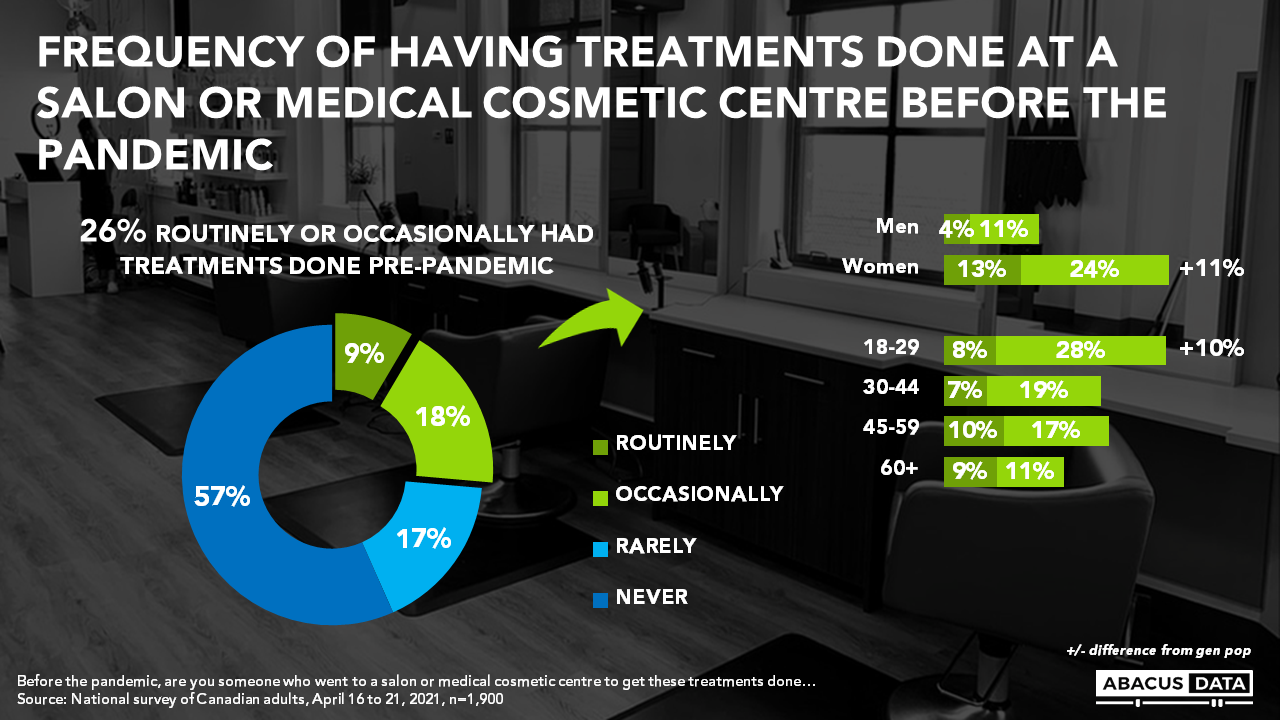

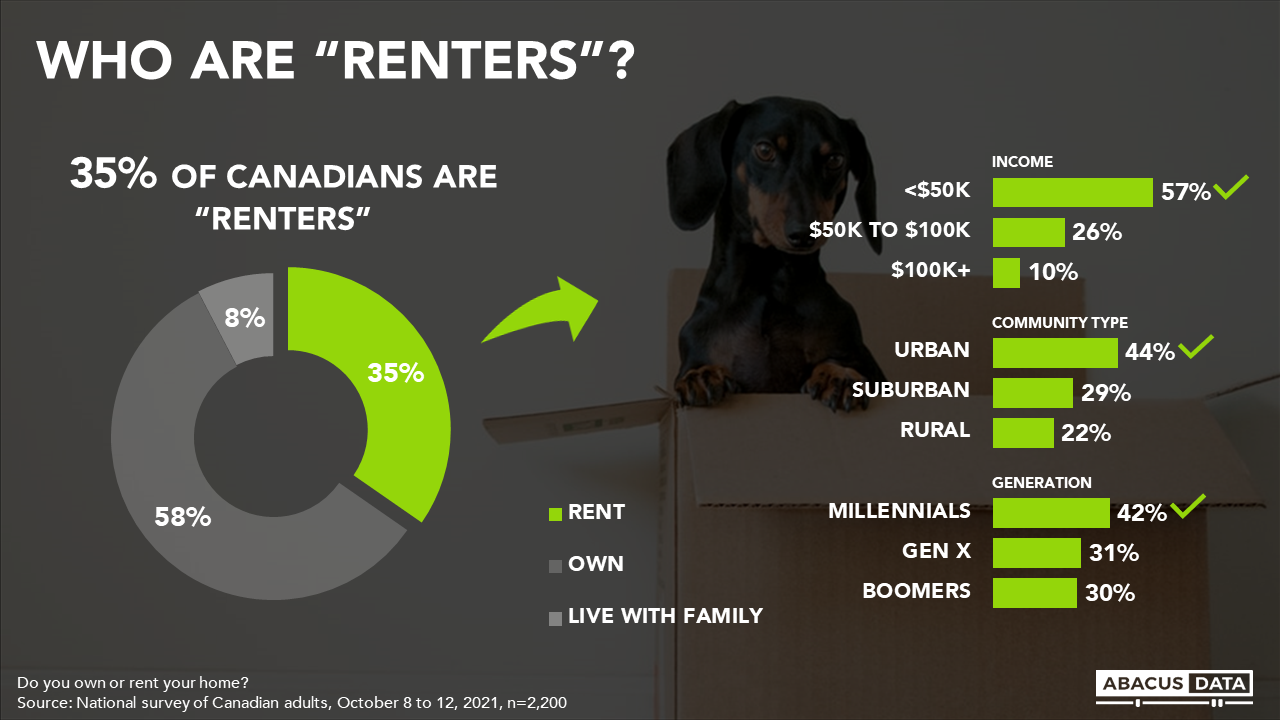

Who are “renters”? A third (35%) of Canadians fall under the category of “renters”. Renters are most likely to be Millennials, have lower incomes, and live in urban areas. 44% of renters live alone (55% men vs. 35% women live alone), 30% live with a partner (girlfriend, boyfriend, spouse, etc.), 20% live with family, and 6% live with a roommate.

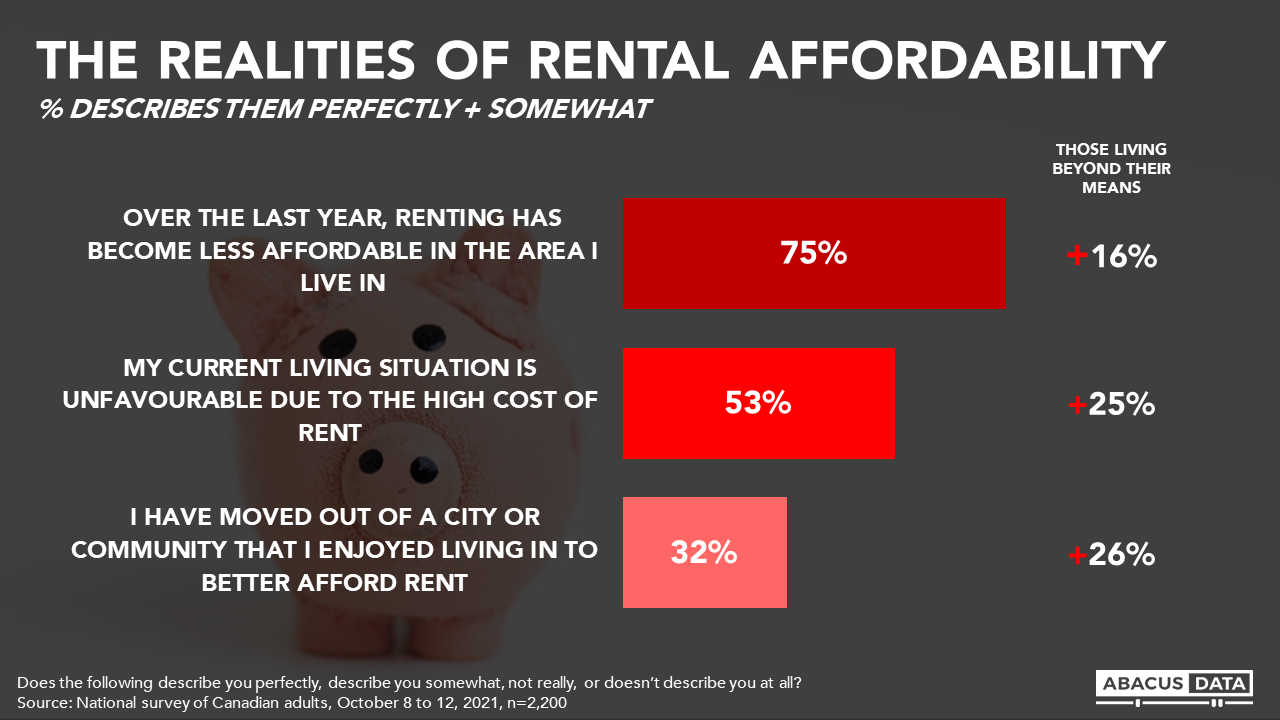

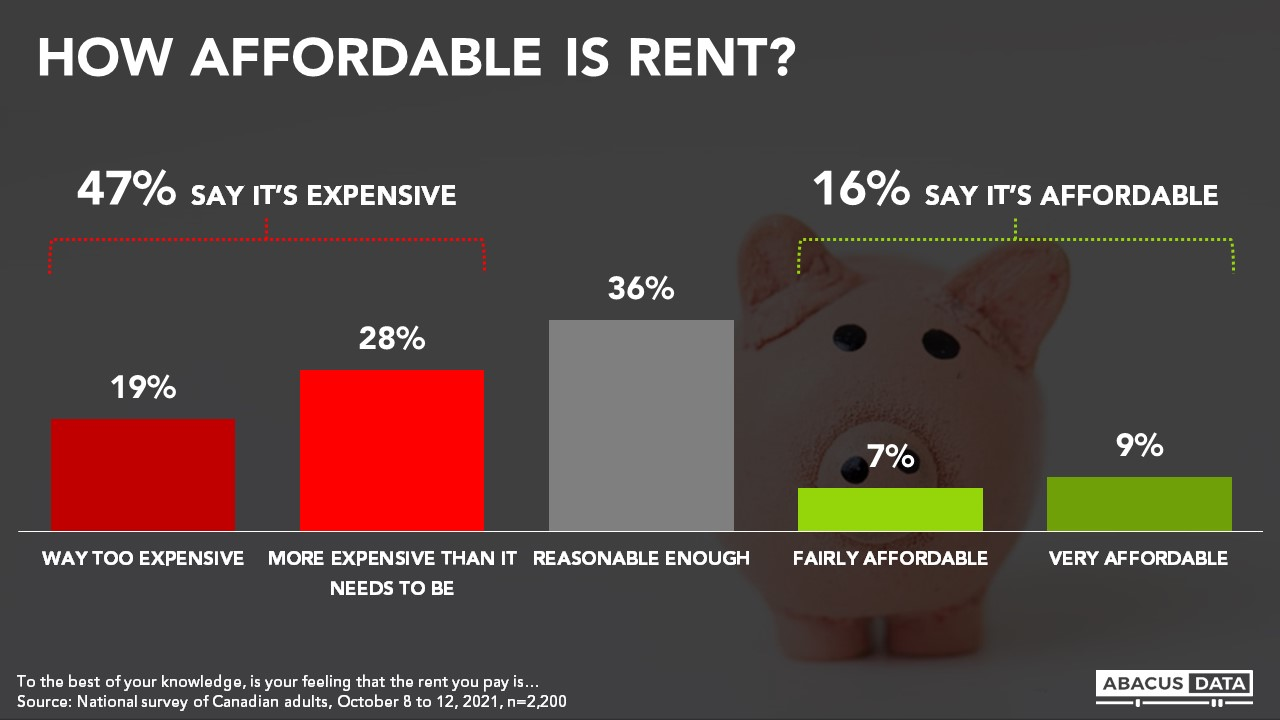

How do renters feel about affordability? After the last couple of years of the skyrocketing housing market, it’s understandable that there is a growing conversation about the affordability of all kinds of housing. The housing crisis impacts more than just buyers. 75% of renters feel that renting has become less affordable in the area they live in – 91% of those who are living beyond their means feel this way. This is especially true for those living in metropolitan areas like Montreal (85%) and Toronto (82%). Just under half (47%) feel that the rent they pay is more expensive than it needs to be. In addition, just over half (53%) of renters admit that their quality of life is suffering because of the high cost of rent.

As a result, a third of renters (32%) have moved out of a city or community that they enjoy living in to better afford rent – especially those who are living beyond their means (58%).

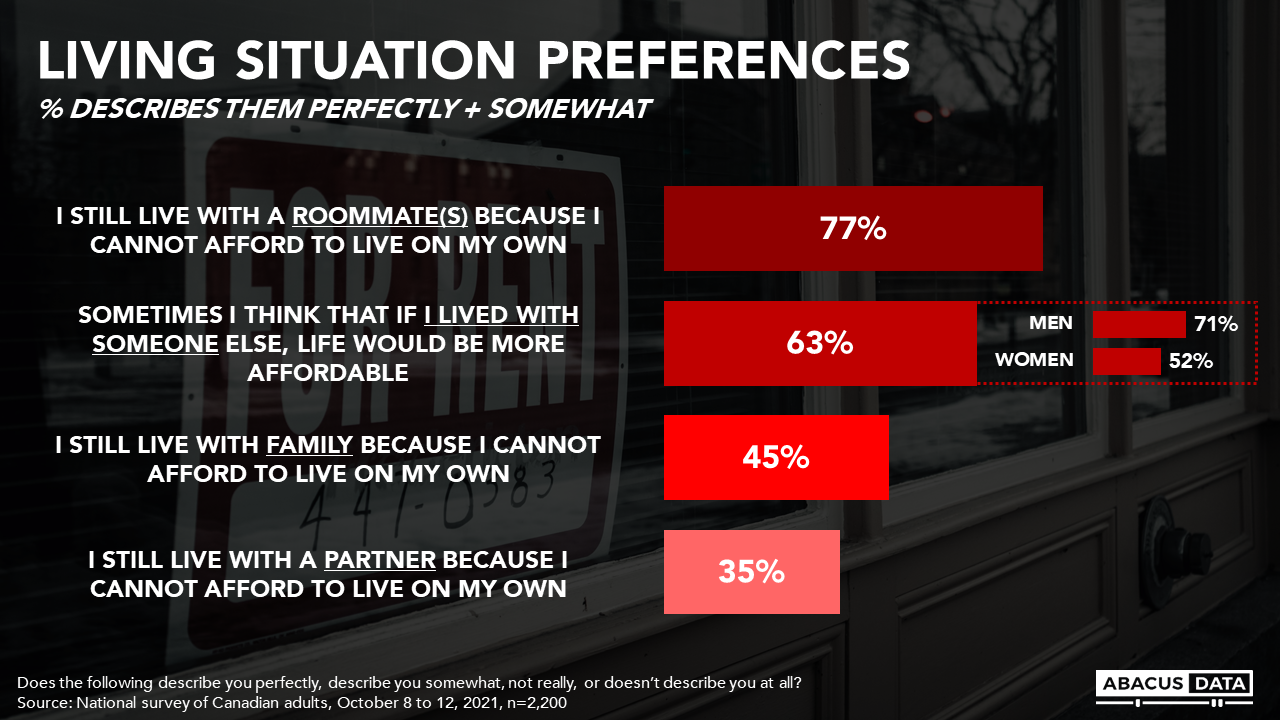

Affordability can play a role in renters feeling stuck or choosing to stay in unfavourable living situations. We asked Canadian renters who live with a roommate, a partner or family, if they are in their current living situation because of affordability issues. We found that 77% of those who live with a roommate do so because they cannot afford to live on their own, and about half (45%) still live with family for the same reason. A large majority of renters that live with a partner don’t consider affordability as a reason they live together, but a third (35%) do. Though overall this is not a large portion of renters, it’s sizeable when considering this group would choose to not live with their partner if living alone were more affordable.

Two-thirds (63%) of renters that do live alone admit that they sometimes think about living with someone else to help make life more affordable (71% men vs. 52% women).

This is the crux of rental affordability: Those who live with someone sometimes wish they could afford to live alone for a number of reasons, and those that live alone are considering the prospect of splitting the cost with someone else.

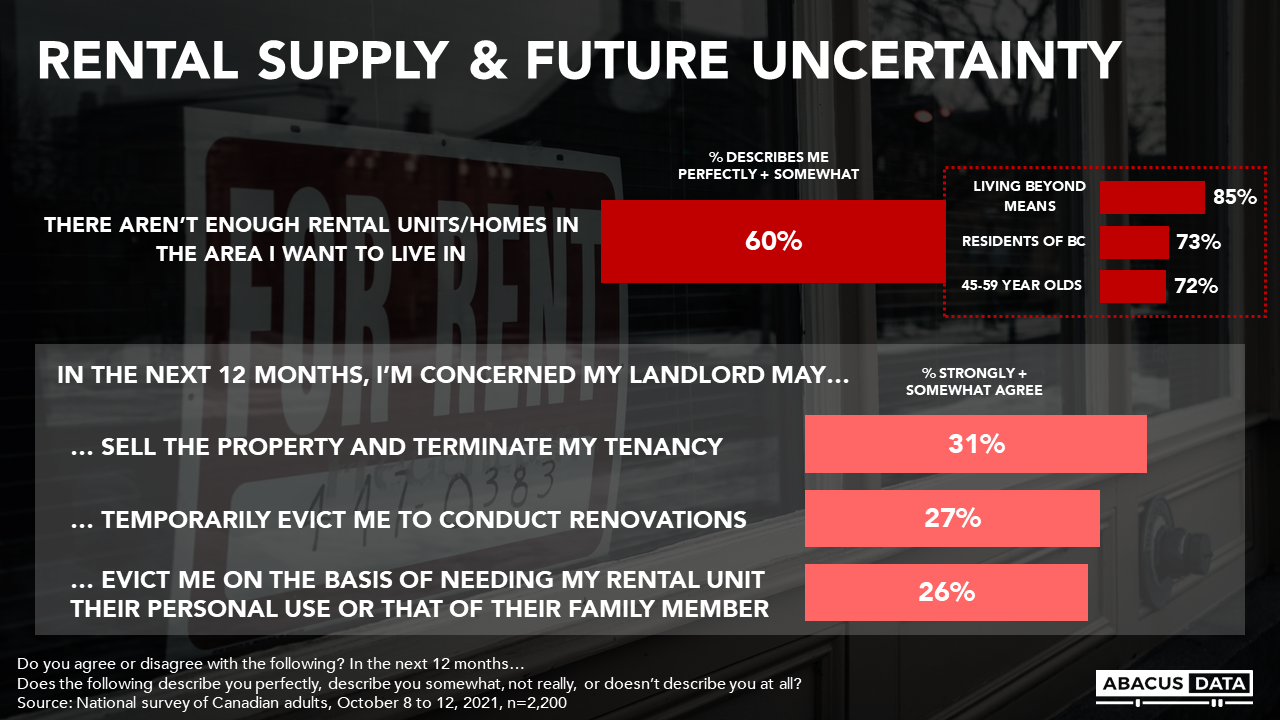

What about supply? Not only are renters’ budgets being challenged by high prices, availability of rental units or homes is also limited. 6 in 10 (60%) renters feel that there aren’t enough rentals available in the area they want to live in. This particularly rings true for those living in British Columbia, those 45-59, and those living beyond their means.

The limited supply of rental units and homes is further challenged by renters’ uncertainty over the future of their current tenancy. In terms of unexpected events and landlords upsetting renters’ current situations, we learned that 3 in 10 are concerned that their landlord may do anything ranging from selling the property and terminating their tenancy (31%) or evicting renters to conduct renovation (27%) or on the basis of needing their rental unit for personal use for them or a family member (26%).

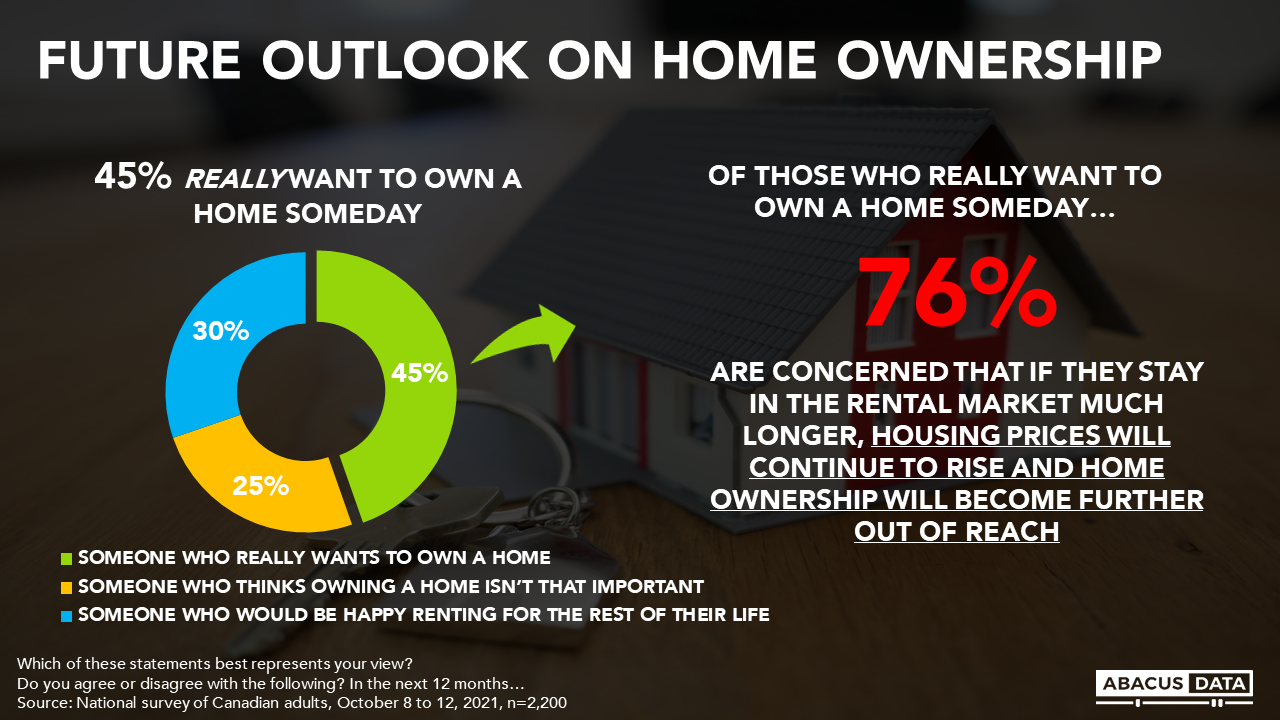

How are renters feeling about the future? With rental prices at an all-time high, and supply not meeting demand, renters are left with an impossible decision to make: Do I continue to rent and contribute to someone else’s mortgage, or should I bite the bullet and buy? Nearly half (45%) really want to own a home someday (49% women vs. 40% men), but the other half is split between those who don’t think owning a home is that important and those who would be happy renting the rest of their life.

Among renters who really want to own a home someday, 3 in 4 (76%) are concerned that if they stay in the rental market much longer, housing prices will continue to rise, and owning a home will become even more out of reach.

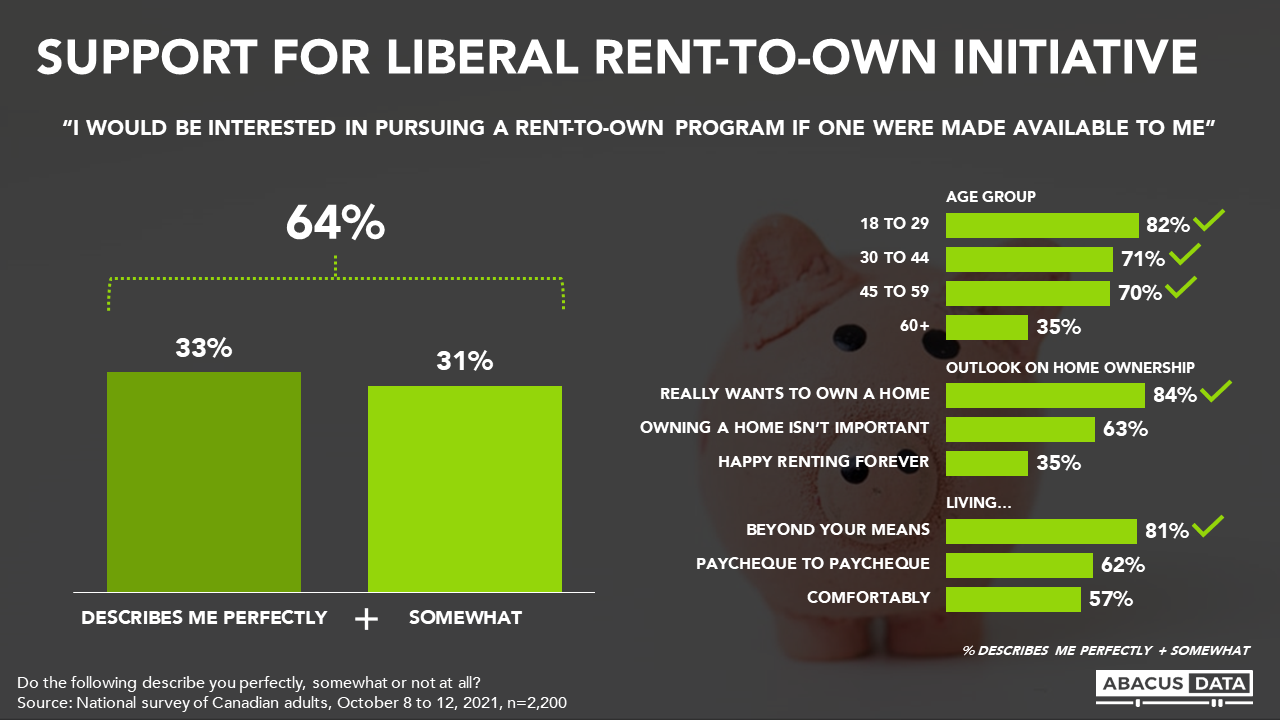

Are there supports for renters? Until the housing market fizzles and prices stabilize, renters are stuck with high prices and limited alternatives. One option we tested was interest in a rent-to-own program that was included as part of the Liberal platform in the 2021 Election. We found that 64% of renters would be interested in taking advantage of this. Among those that really want to own a home someday, interest in a program of this kind jumps up 20-points. We can speculate that renters see this kind of program as a legitimate stepping stone to help them reach their goal of owning a home. It would be worth further exploring this program among renters to see what kind of terms would be useful or not useful.

THE UPSHOT According to Megan Ross

Whether you’re in the rental market long-term or looking to purchase a home soon, affordability over the last couple of years hit an all-time low. The rental market, in its current state, looks pretty bleak – high prices and limited availability of units/homes in areas that renters want to live in. This has impacted renters’ outlook on the future and living situations.

Being able to afford to live alone – if you want to – is a luxury these days. No one wants to be in an unfavourable living situation. Rental prices are difficult to afford even for those with partners or roommates or family to supplement the cost. Those who strive for independence in the form of having their own place to call home often need support to achieve this.

What can we expect in the coming months or years? A sizeable portion of renters are still looking to own a home someday and express interest in government programs to help them do so. Many will need support to make the transition to homeownership, which, in turn, opens up space for new renters to enter the rental market.

METHODOLOGY

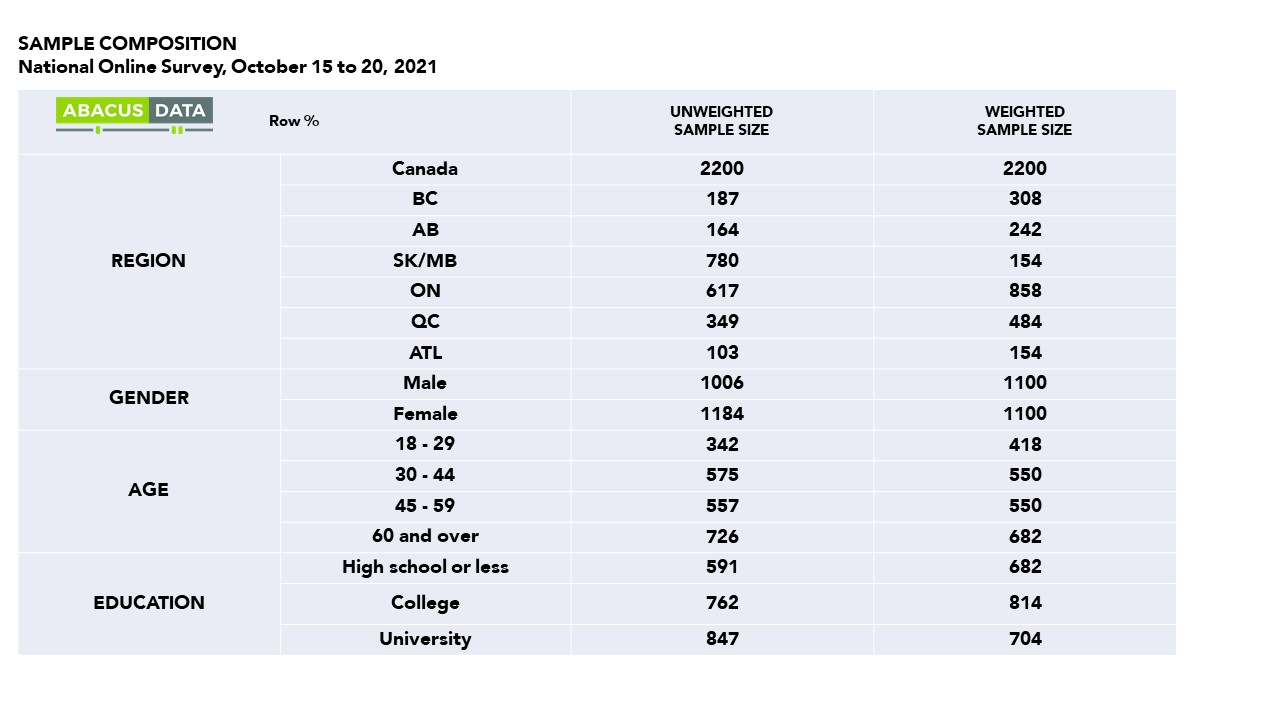

The survey was conducted with 2,200 Canadian adults from October 8 to 12, 2021. A random sample of panelists was invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 1.9%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.