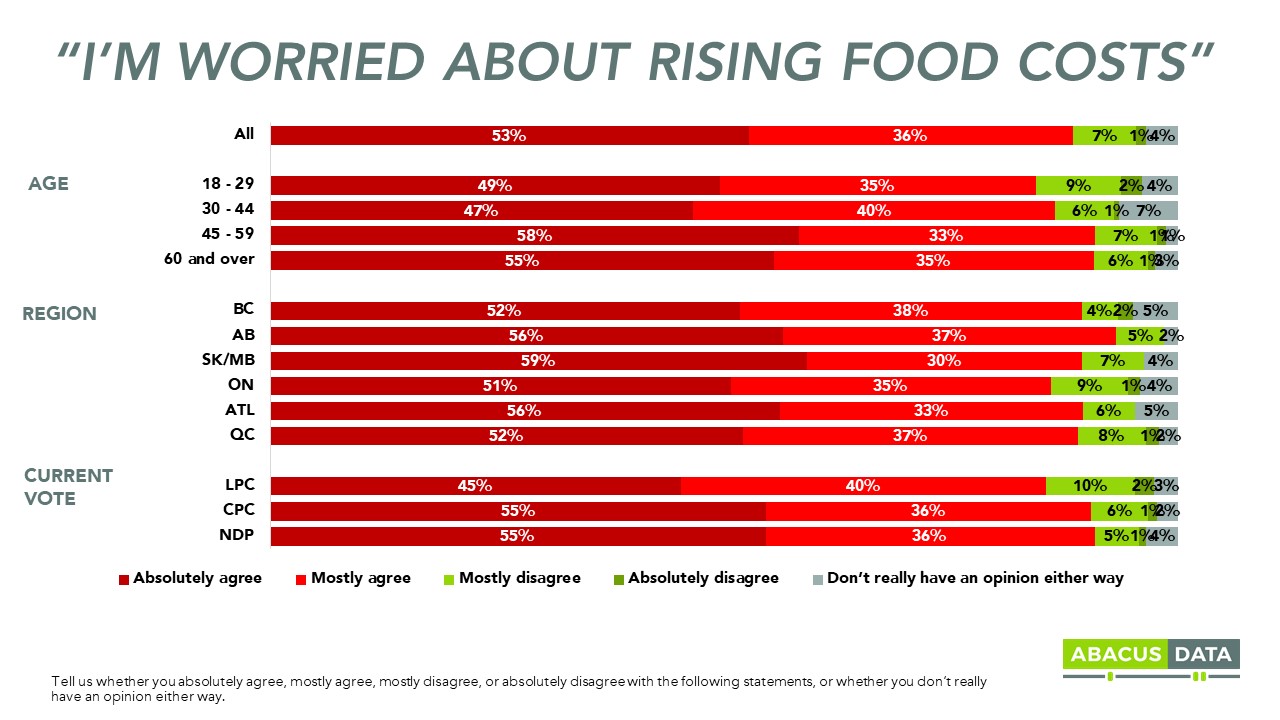

Rising food costs worry 89% of Canadians

June 18, 2019

On behalf of Food & Consumer Products of Canada, Abacus Data conducted a national public opinion survey of a representative sample of 2,500 Canadians. The study explored public attitudes towards rising food prices and implications to consumers if the government doesn’t help the food, beverage, and consumer product sector respond to the challenges the industry is facing in Canada.

Here’s a highlight of what we found:

Almost 9 in 10 Canadians are worried about rising food costs.

Rising food costs concern almost all Canadians across the country. 89% agree that they are worried about rising food costs while 8% disagree.

Concern about rising food costs is consistent across the country and across every age group with those age 45 and over express more intense concerns. There’s also political consensus on the issue. Liberal, Conservative, and NDP supporters all agree that they are worried about rising food prices.

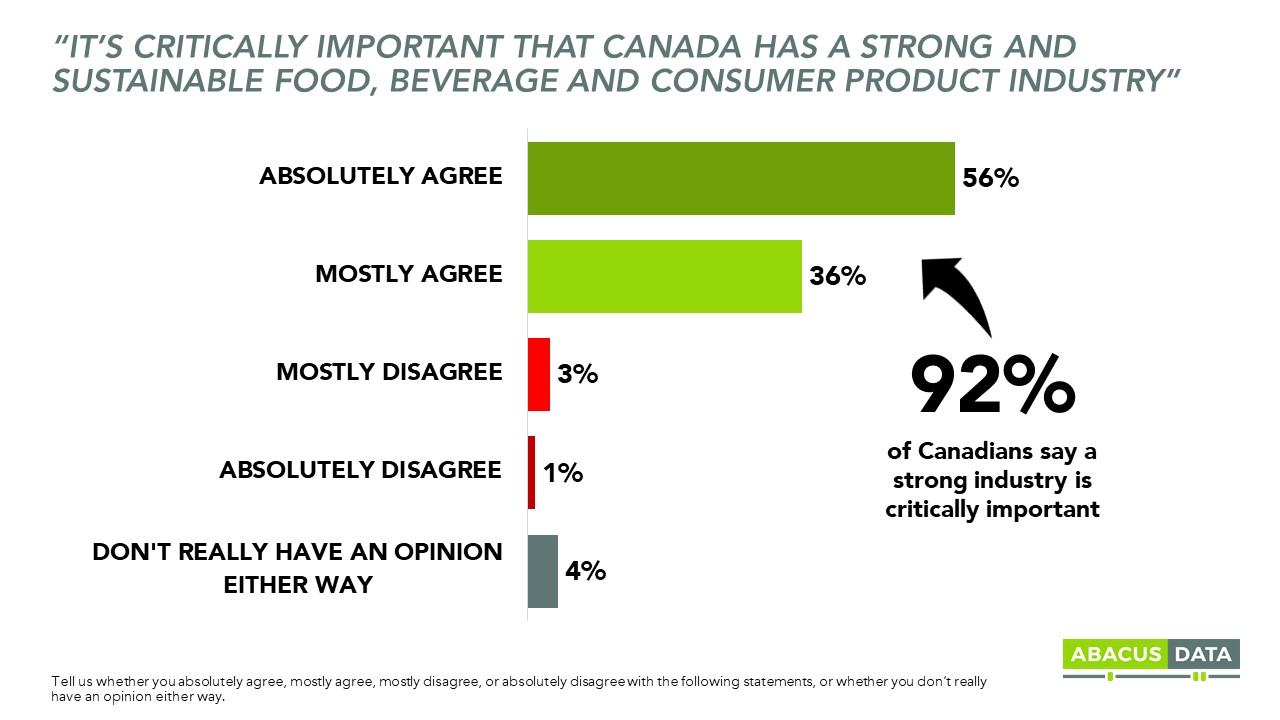

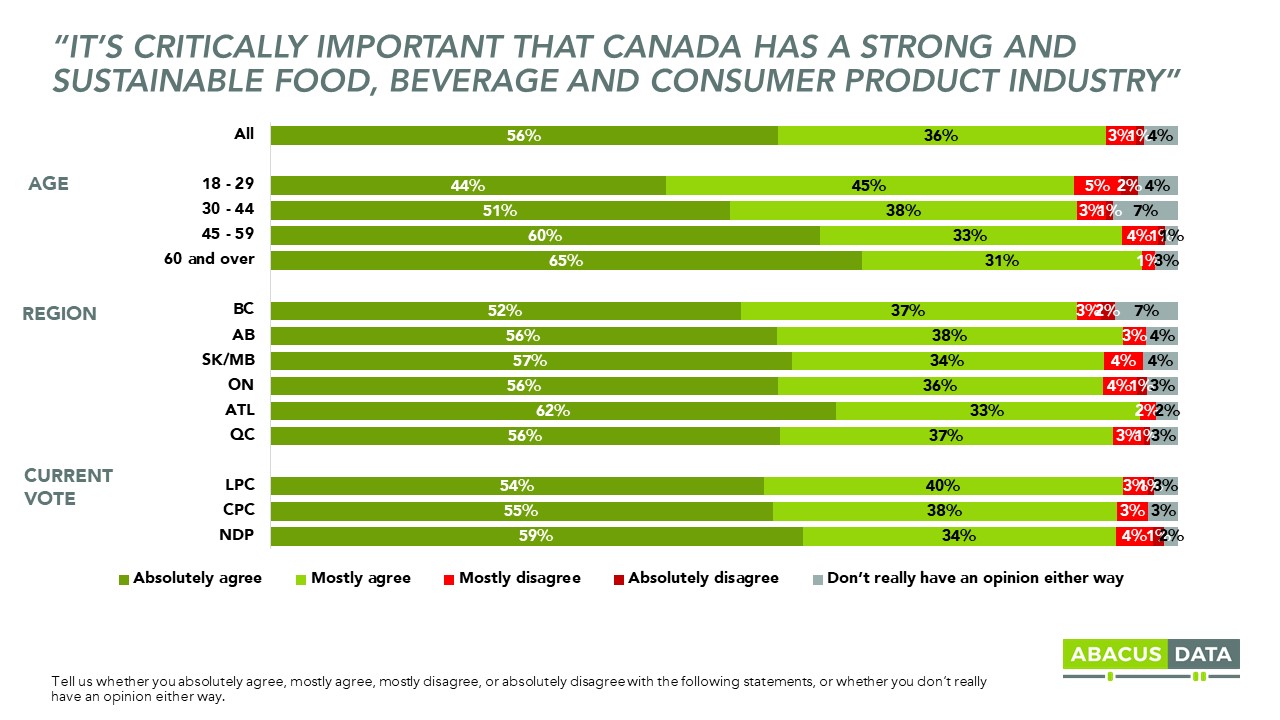

Almost all Canadians agree that it’s critically important that Canada has a strong and sustainable food, beverage, and consumer product industry.

While rising food prices are worrying most Canadians, there’s also nearly a consensus that Canada should have a strong and sustainable food, beverage, and consumer product industry. 92% of Canadians agree while only 4% disagree.

This view is also shared across the country and across political tribes. Older Canadians are more likely to absolutely agree than younger Canadians, but this is more a difference of degree rather than direction.

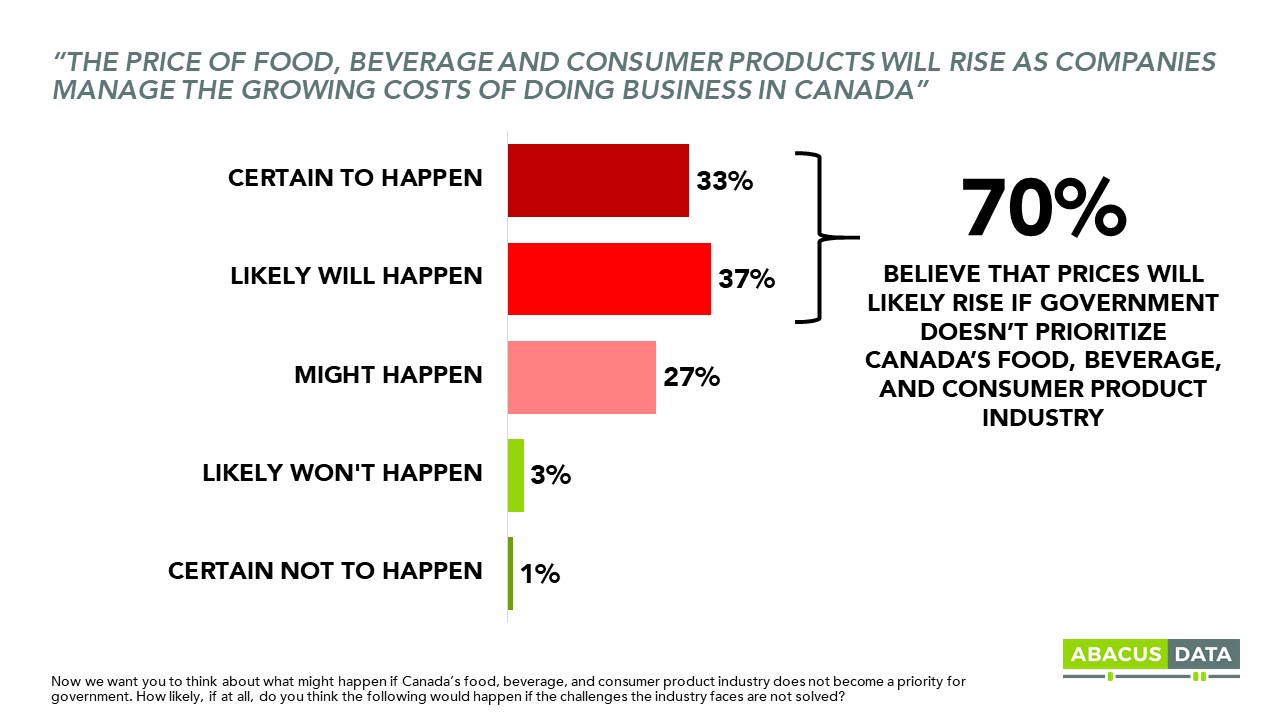

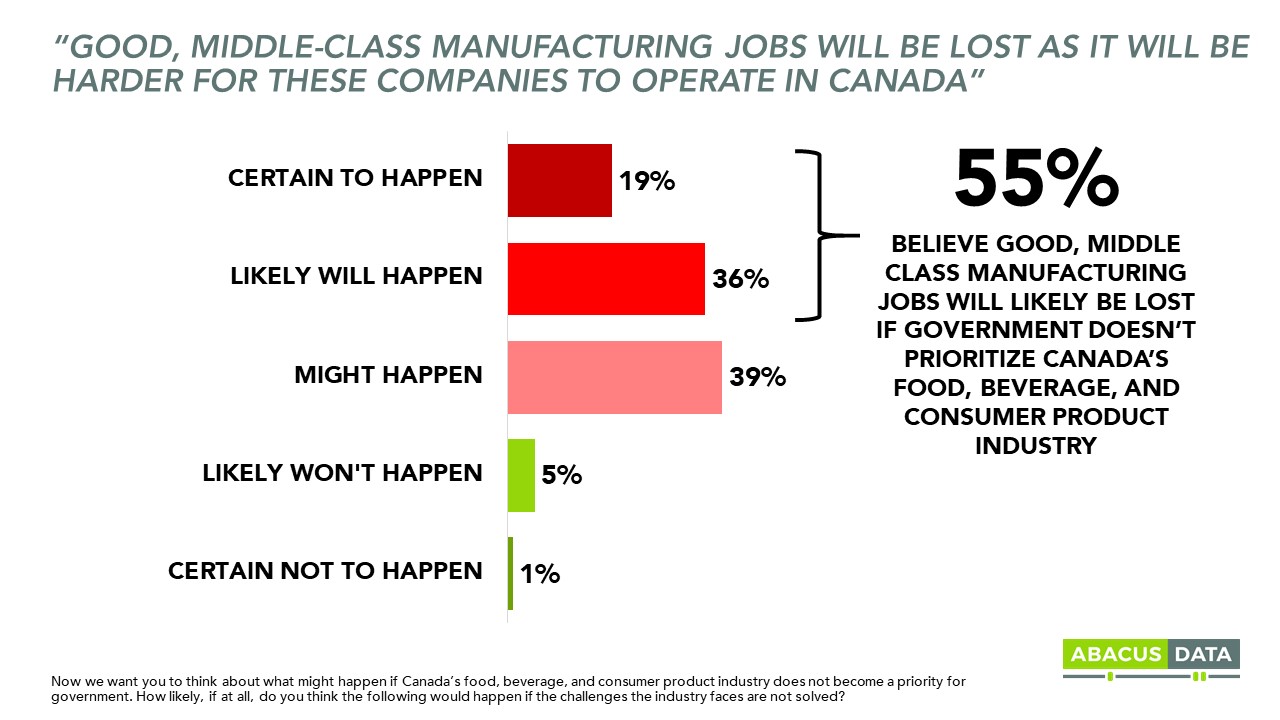

Canadians believe that if the food, beverage, and consumer product industry’s challenges are not a priority for the government, food prices are likely to rise, middle-class manufacturing jobs will be lost, and fewer Canadian grown food products will be used in food and beverage products made in Canada.

Survey respondents were shown a list of challenges facing the industry that were identified by an independent report produced for FCPC. After reviewing the report’s findings, respondents were asked whether a number of consequences were likely to happen as a result.

70% felt that the price of food, beverage, and consumer products will likely rise as “companies manage the growing costs of doing business in Canada.”

55% believed that it is likely that “good, middle-class manufacturing jobs will be lost as it will be harder for these companies to operate in Canada.”

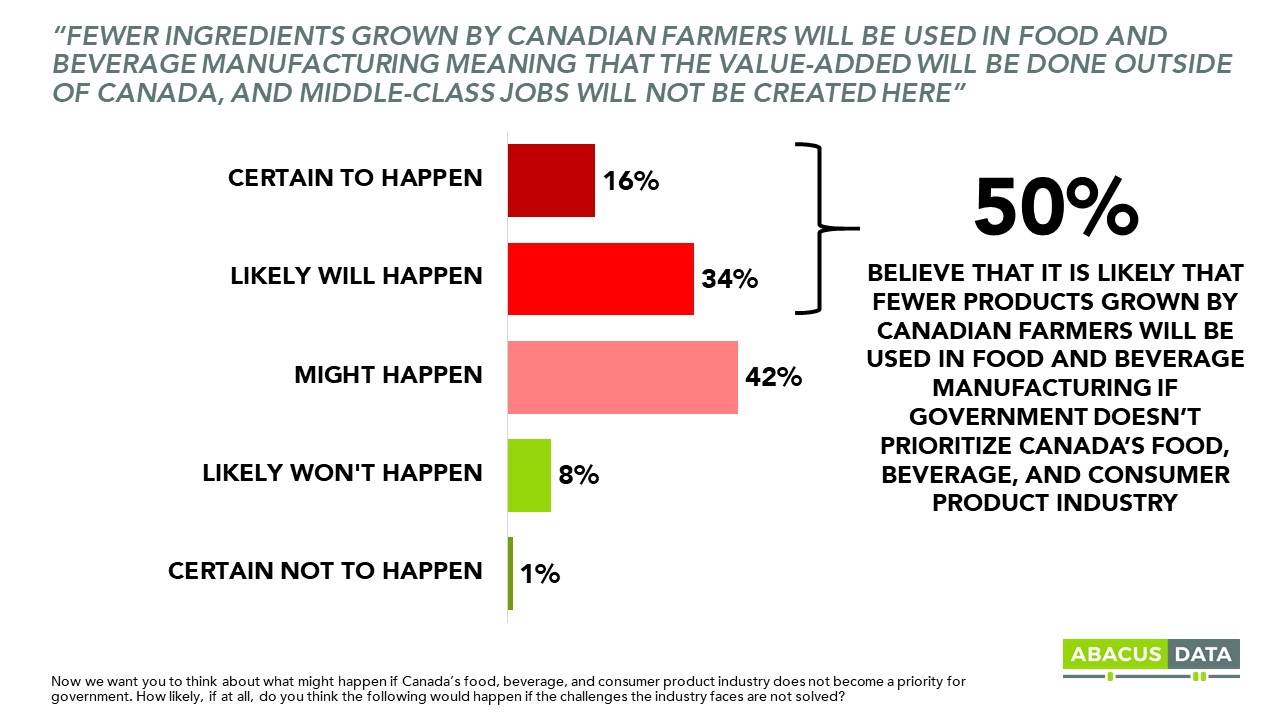

50% felt that it is likely that “fewer ingredients grown by Canadian farmers will be used in good and beverage manufacturing meaning that the value-added will be done outside of Canada, and middle-class jobs will not be created here.”

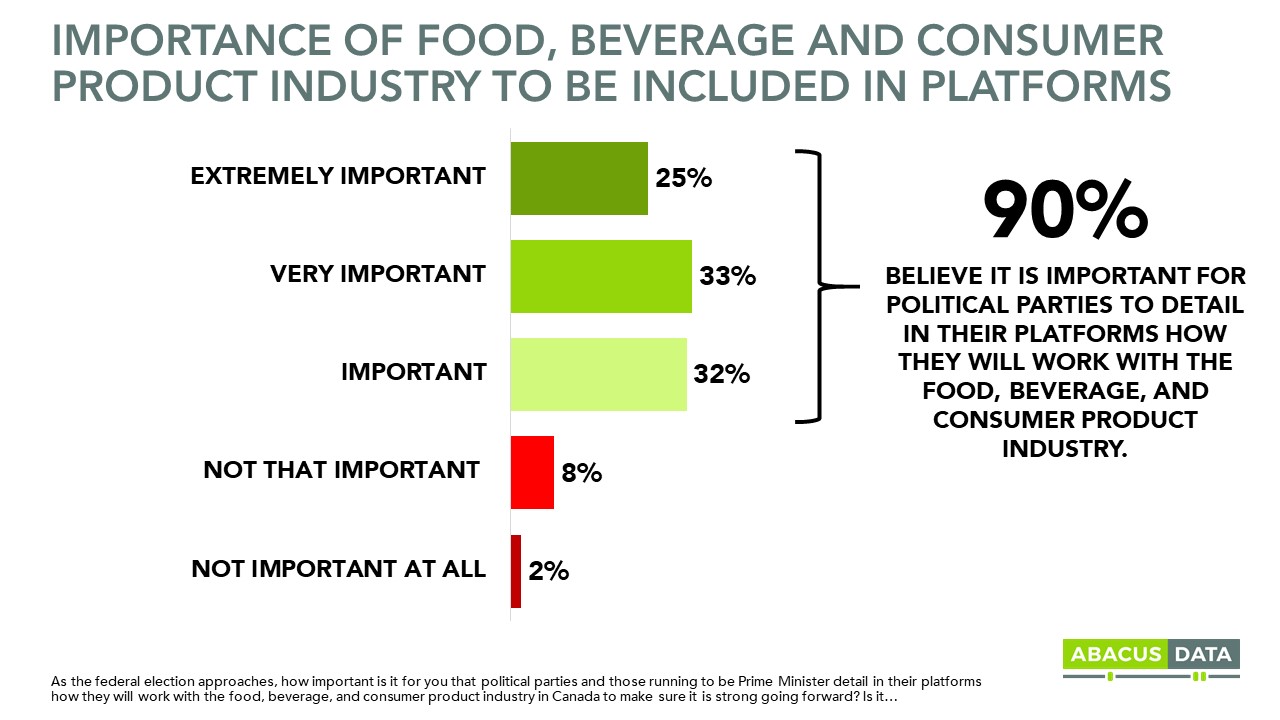

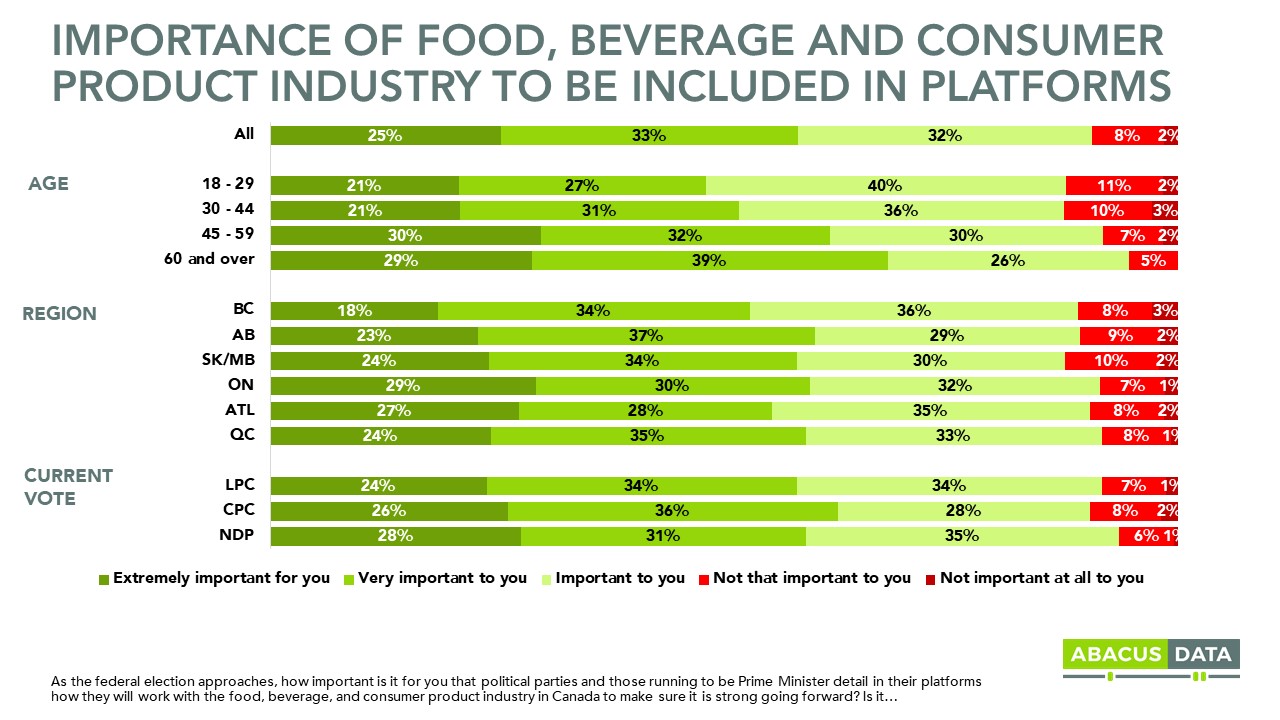

9 in 10 Canadians believe it is important that political parties and those running to be Prime Minister detail in their platforms how they will work with industry to make it strong going forward.

There’s a broad desire by Canadians to see their political leaders outline how they will work with the food, beverage, and consumer product industry to respond to the challenges it faces and help it grow.

This view was shared by Canadians in all regions of the country and more importantly by supporters of the Liberal, Conservative, and New Democratic parties.

UPSHOT

According to David Coletto: “There’s no doubt that Canadians are becoming increasingly concerned about the rising cost of living. Food prices are an important part of that equation and our research finds broad concern about rising food costs.

At the same time, Canadians also want to see a strong and sustainable domestic food and beverage sector that buys and uses ingredients from Canadian farmers.

Canada’s largest manufacturing sector is facing headwinds that are putting pressure on margins and making it difficult to grow. Canadians recognize that there will be consequences if the government doesn’t support the sector and prioritize its challenges. Rising food prices, lost middle-class, manufacturing jobs, and less value-added production is seen as likely to happen if government and industry don’t work together to overcome the challenging business environment.

There is a political opportunity here for political parties as they craft their election platforms to address growing concerns about the cost of food and worries about the future of manufacturing jobs in Canada. There’s an audience for political leadership that sees food security, affordability, and home-grown and made products as central to Canada’s future.”

METHODOLOGY

The survey was conducted online with 2,500 Canadians aged 18 and over from May 8 to 12, 2019. A random sample of panelists was invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.0%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

The study was conducted for the Food & Consumer Products of Canada.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.

Don’t miss any of our releases and receive our weekly “Worth a Look” newsletter by signing up for our email list. We promise no more than 2 emails a week… unless there’s something really important we want to share.