Public perspectives on Canada’s oil resources

November 24, 2016

In our latest national public opinion survey (conducted November 11 to 13), given the contemporary debate about oil, pipelines, climate and carbon, we explored some current views about the development of oil resources in Canada.

Here’s what we found:

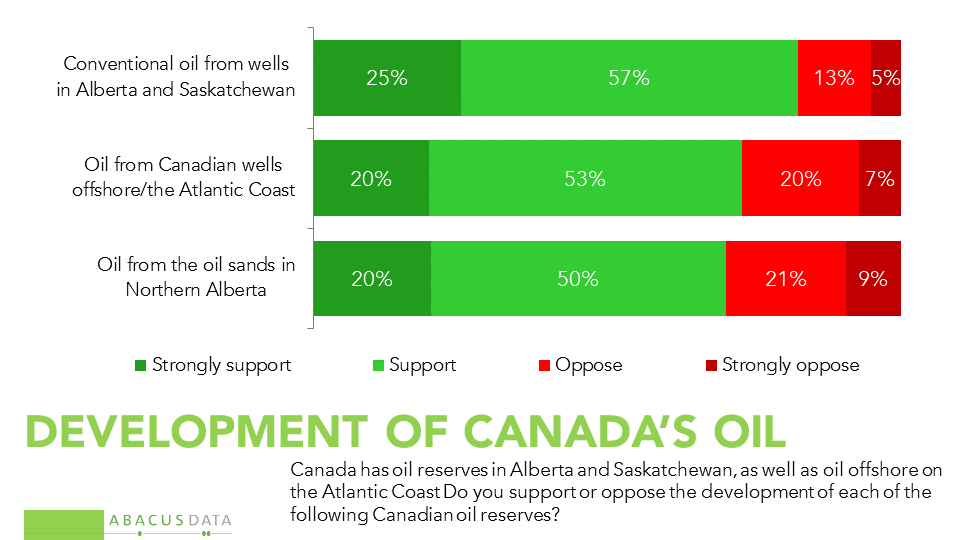

• Our recent polls have demonstrated a Canadian desire to shift energy production and consumption towards renewable and lower carbon sources. However, these results make it clear that most prefer a transition, rather than an abrupt stop when it comes to the development of domestic oil.

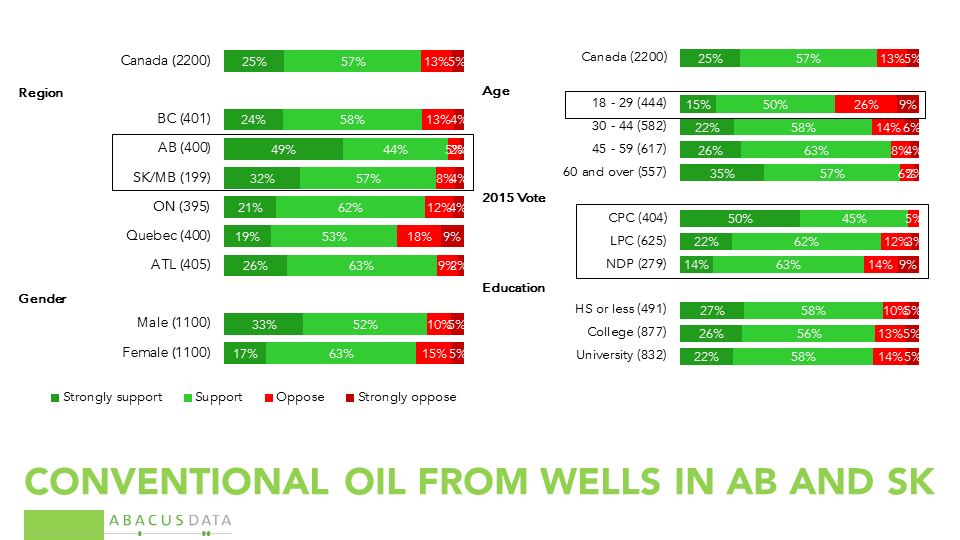

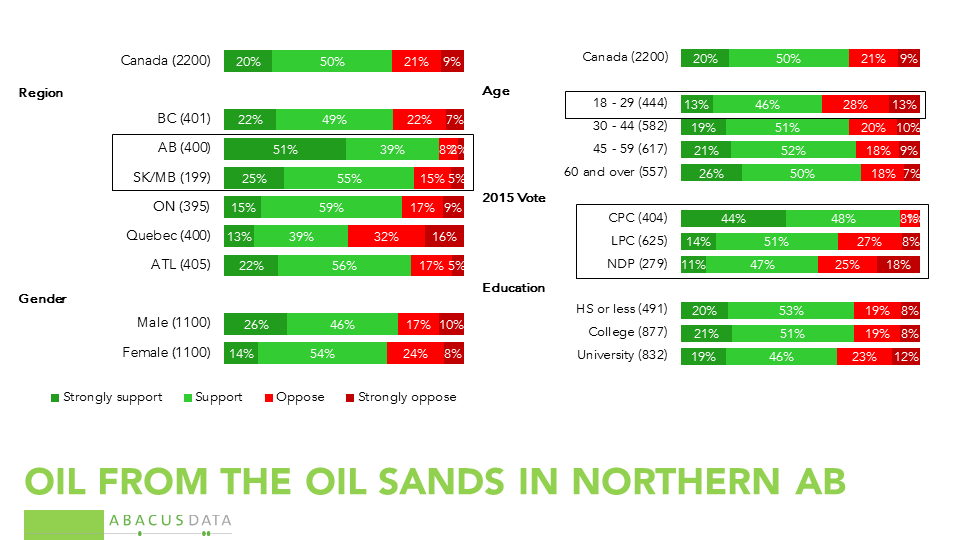

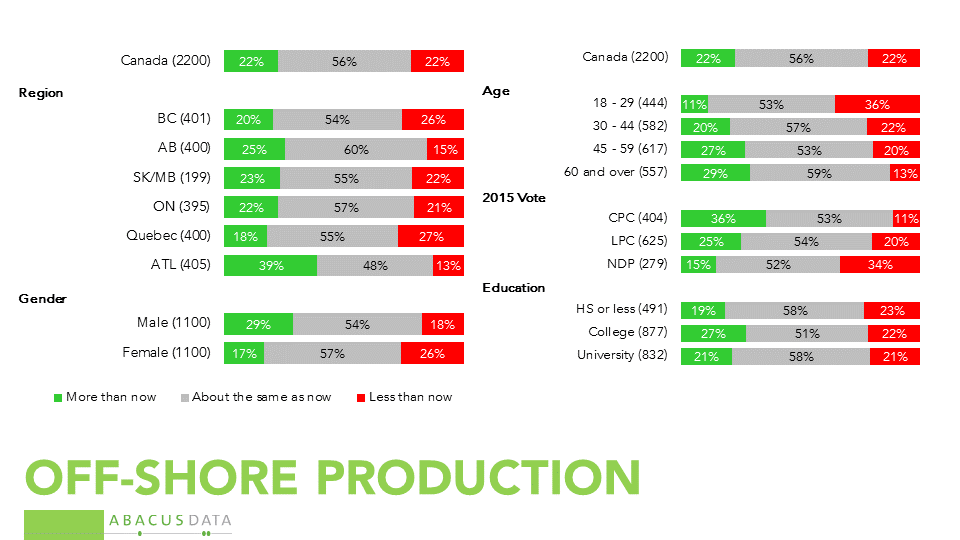

Broad majorities support the development of oil reserves from conventional oil wells in AB and SK (82%), from Canadian wells offshore in the Atlantic (73%) and from the oil sands in Northern Alberta (70%).

• Support for developing conventional oil is highest in the two producing provinces and among Conservative voters, but it is relatively lower in Quebec (72%) and among those who voted NDP (77%), two subgroups that tend to be less supportive of oil use generally.

• Support for developing off-shore oil reserves is highest in Atlantic Canada (88%) and in Alberta (86%) and lowest in Quebec (62%).

• Continued oil sands development finds majority support in every region of the country, although Quebecers are split almost equally. As with other types of oil development, younger Canadians are less supportive than older Canadians. Conservative voters are most enthusiastic about developing the oil sands (92% support, 44% strongly), but most LPC (65%) and NDP (58%) voters also support developing this resource.

• A small portion (9%) of the population supports conventional and offshore oil but opposes development of the oil sands.

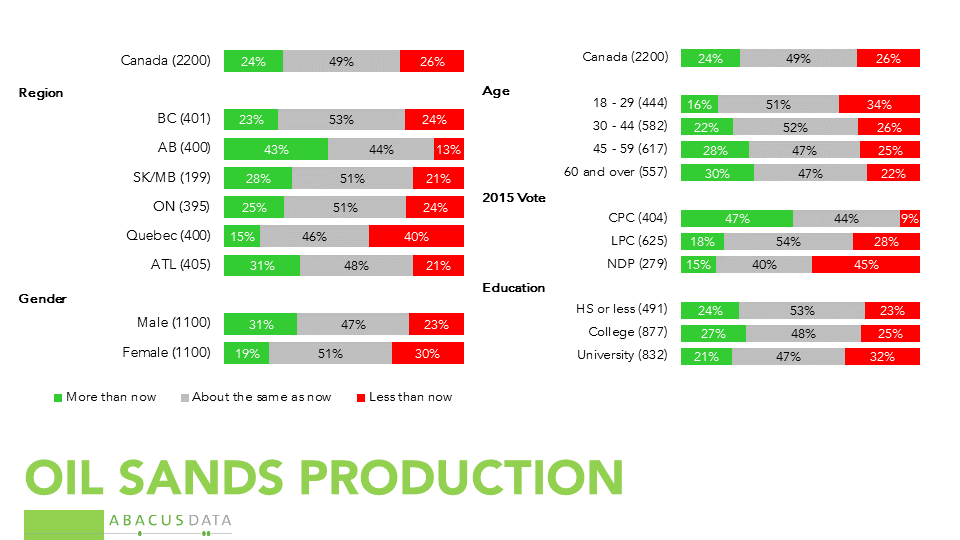

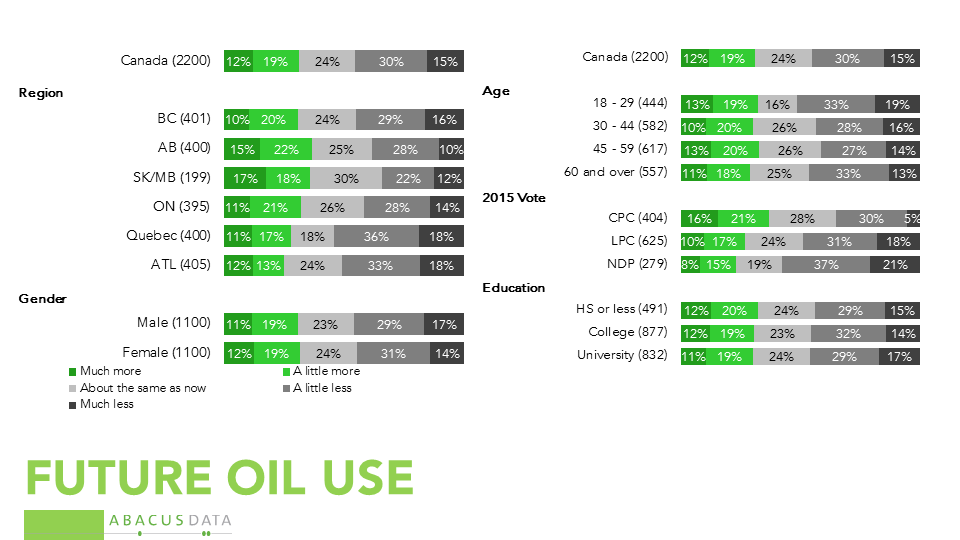

• When asked whether they would like to see increased or decreased production from the oil sands and from off-shore reserves, the plurality prefers no change in production levels. About one in four felt Canada should produce less than now while a similar number felt production should be increased.

• Support for expanding oil sands production was highest in Alberta (43%) and lowest in Quebec (15%). 40% of Quebecers want oil sands production to be reduced, the highest in the country. In BC, 23% want oil sands production expanded, 53% prefer the status quo, while 24% want production reduced.

• 47% of Conservative voters favour expanding oil sands production, while 44% prefer no change, and 9% would like to see a reduction.

• Liberal Party voters prefer production levels as they are now (54%) with 28% favouring a reduction and 18% an increase.

• NDP supporters tend (45%) to favour reducing oil sands production, but the majority prefers the status quo (40%) or even expansion (15%).

• 36% of Conservative voters favour expanding off-shore production, only 11% want a reduction. Among NDP voters, 15% favour expansion, 52% favour the status quo while 34% want off-shore oil production to be reduced.

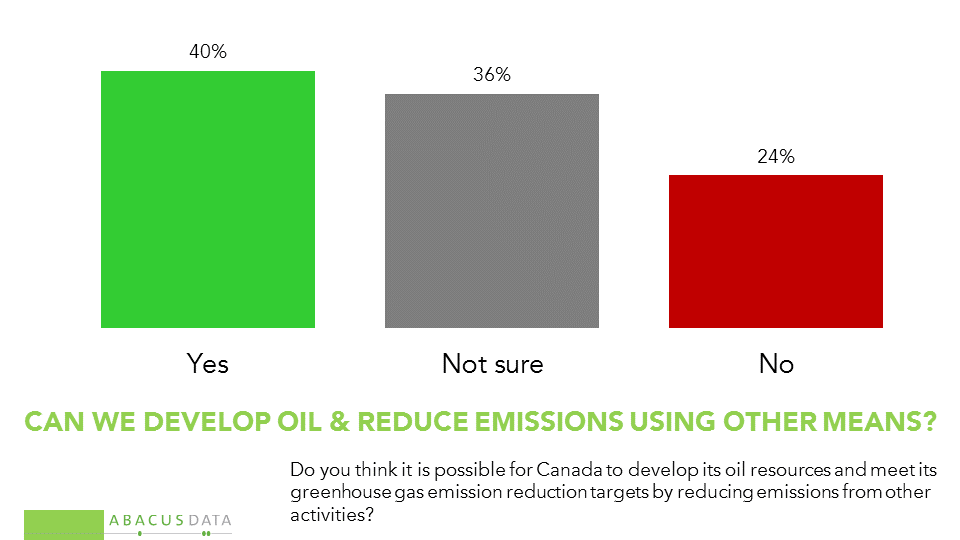

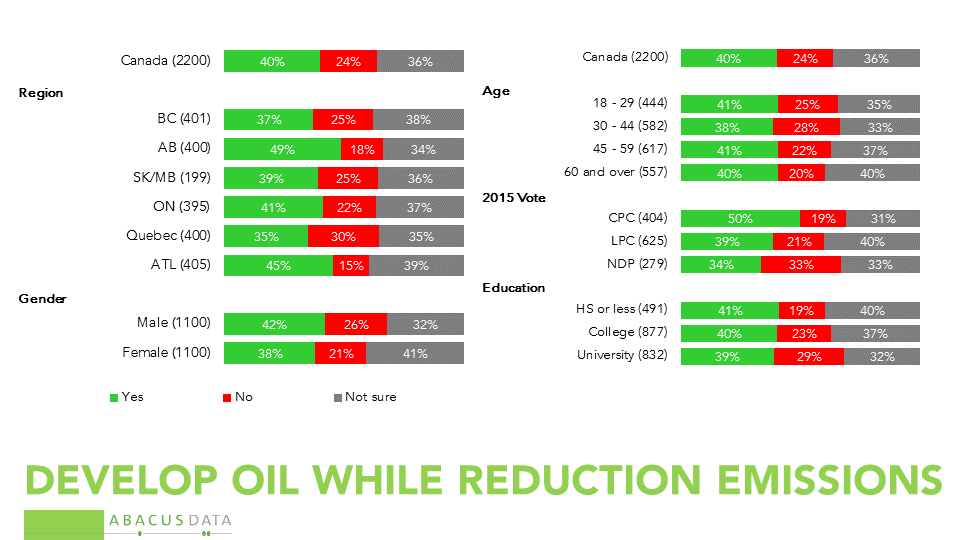

• One reason people continue to support the development of Canada’s oil resources is that they have not concluded that doing so would make it impossible for the country to meet its emission reduction targets.

40% think it is possible for Canada to develop its oil resources and meet its greenhouse gas emission reduction targets by reducing emissions from other activities, while 24% do not think this is possible and 36% are not sure.

• The views of Canadians about oil production are conditioned by a sense that global demand for the product will decline at some point. When asked what they thought the world market would look like in 20 years’ time, 46% said demand would be lower than it is today, compared to 31% who believe demand will be greater.

Even in Alberta (38%) and Saskatchewan (36%) and among CPC voters (35%) almost four in ten believe that demand for oil will be lower in 20 years.

Among those favour increasing production of the oil sands, 37% say that oil demand will be shrinking in 20 years while 39% think it will grow.

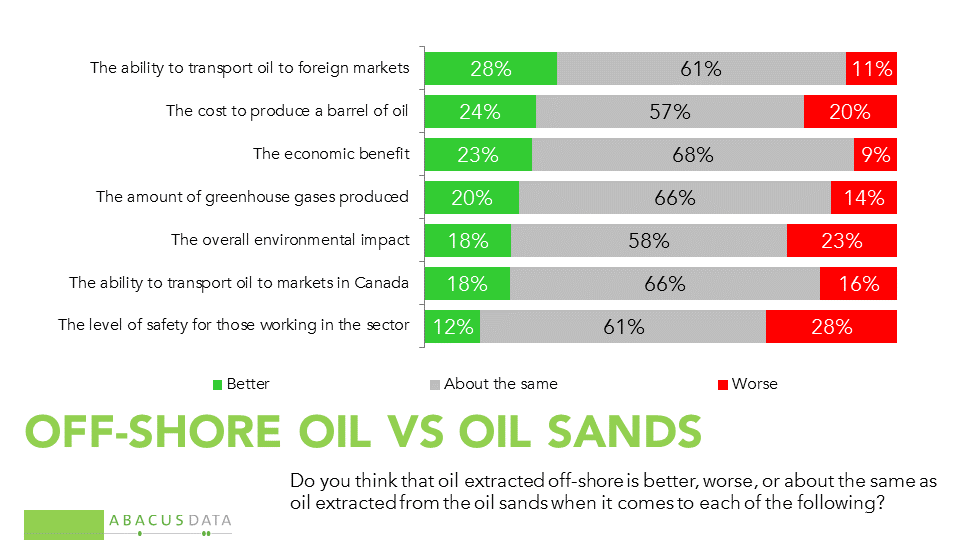

• We asked about perceived differences between offshore and oil sands production. There were a few points of differentiation:

o There was a slight tendency to feel that offshore production is better than oil sands when it comes to getting the product foreign markets, the impact on GHG emissions, and economic benefits but perhaps slightly inferior in terms of overall environmental impact and worker safety. However, these differences were modest – the tendency was to see both forms of oil production as similar.

o Regionally, there was little variation in perceptions. Apart from Atlantic Canadians being more likely to think that off-shore is better than oil sands in terms of emissions and Quebecers being more likely to think off-shore is better than oil sands in terms of economic benefit, the same views about the two production methods were held in different regions of the country.

UPSHOT

According to Bruce Anderson:

“Canadians generally believe that the future will see and should see a reduction in reliance on fossil fuels and non-renewable energy. They embrace an environmental imperative and also sense potential economic opportunity in the growing market for clean energy solutions, or a risk of losing ground to competitors that shift to more sustainable energy sources more quickly.

But the pragmatic nature that defines Canada on many issues is clear when it comes to our energy resources: most people do not want an abrupt shift, but a measured, ambitious transition.

Mainstream voters reject arguments that are overly binary: right or wrong, moral or immoral, now or never. They are far more drawn to ideas about how to marry their environmental aspiration with their economic goals and to achieve economic renewal and growth based on cleaner forms of energy.”

According to David Coletto:

“Canadians generally support continuing to develop of our oil resources and few discriminate their support across different types of development be it conventional, oil sands, or off-shore production. Quebecers are the most resistant, but even a majority in the province support the development of the oil sands.

When it comes to comparing off-shore and oil sands production, few Canadians see a difference in terms of economic benefit, safety, and environmental impact. Although one type of production may have advantages over another, few Canadians can recognize them at this point.”

METHODOLOGY

Our survey was conducted online with 2,200 Canadians aged 18 and over from November 11 to 13, 2016. A random sample of panelists was invited to complete the survey from a large representative panel of over 500,000 Canadians.

The Marketing Research and Intelligence Association policy limits statements about margins of sampling error for most online surveys. The margin of error for a comparable probability-based random sample of 2,200 is +/- 2.1%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

ABACUS DATA INC.

We offer global research capacity with a strong focus on customer service, attention to detail and value-added insight. Our team combines the experience of our Chairman Bruce Anderson, one of Canada’s leading research executives for two decades, with the energy, creativity and research expertise of CEO David Coletto, Ph.D.