Canadians React to Budget 2025: Split Views, Muddled Message, and a Test of Trust in Carney’s Leadership

November 9, 2025

A new post-budget survey from Abacus Data, the first of its kind since the Carney government tabled its 2025 federal budget, finds the country divided on the plan, uncertain about the direction, and unclear on the story behind it. While many of the measures tested were well received on their own, the overall narrative remains fractured.

The results point to a muddled first impression. Awareness was solid, but understanding was limited. The response was emotionally mixed and thematically scattered. And while many Canadians support individual components, fewer are convinced that this budget offers a clear, credible path to a stronger economic future.

Awareness Was High, but Familiarity Lagged Behind

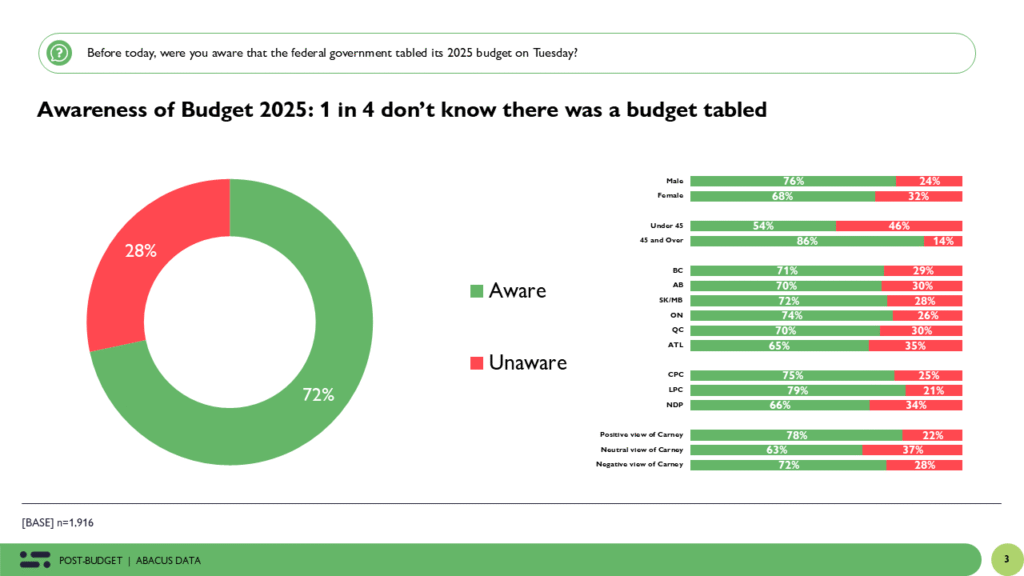

About 72% of Canadians were aware that the federal government had introduced a new budget, a reasonably high figure for a policy event. Awareness was higher among older respondents and those with a more positive view of the Prime Minister. Just over half of those under 45 were aware there was a budget tabled this week.

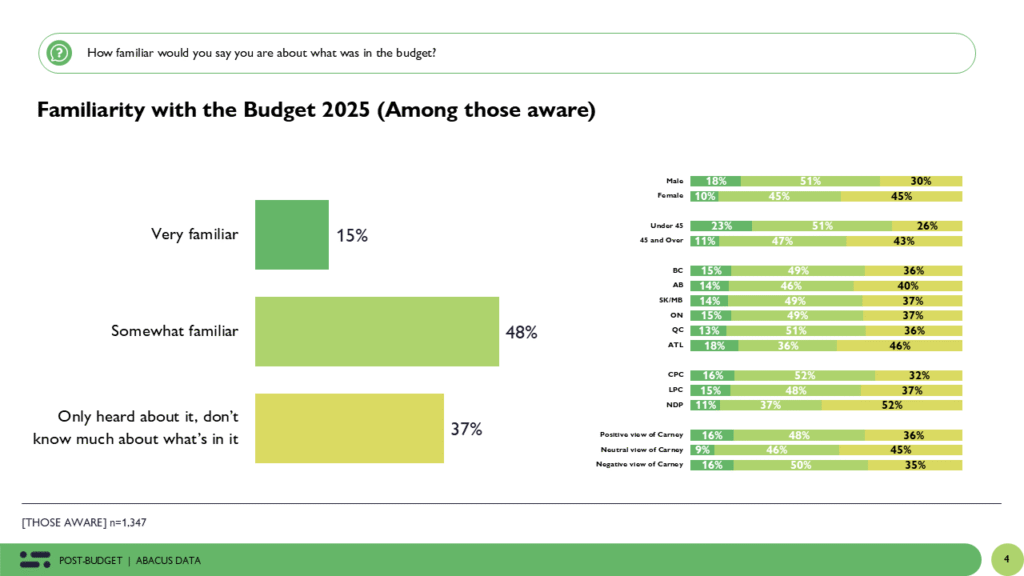

Familiarity with the content of the budget was more limited. Just 15% said they were very familiar with what was in it, while 48% said they were somewhat familiar. The remaining 37% had heard about the budget but could not speak to the specifics.

Notably, detailed familiarity did not appear to be necessary for support. Among those with a positive view of Mark Carney, just 16% were very familiar with the budget contents. Yet this group offered some of the most supportive responses across every measure tested.

That speaks to the power of the Carney brand. Many Canadians have delegated trust to the Prime Minister and believe he has the experience and judgment to manage the economy effectively. For those who trust him, the budget is seen not as a set of policies to be examined line by line but as a signal of competent leadership.

Two Competing Narratives: Investment or Indulgence?

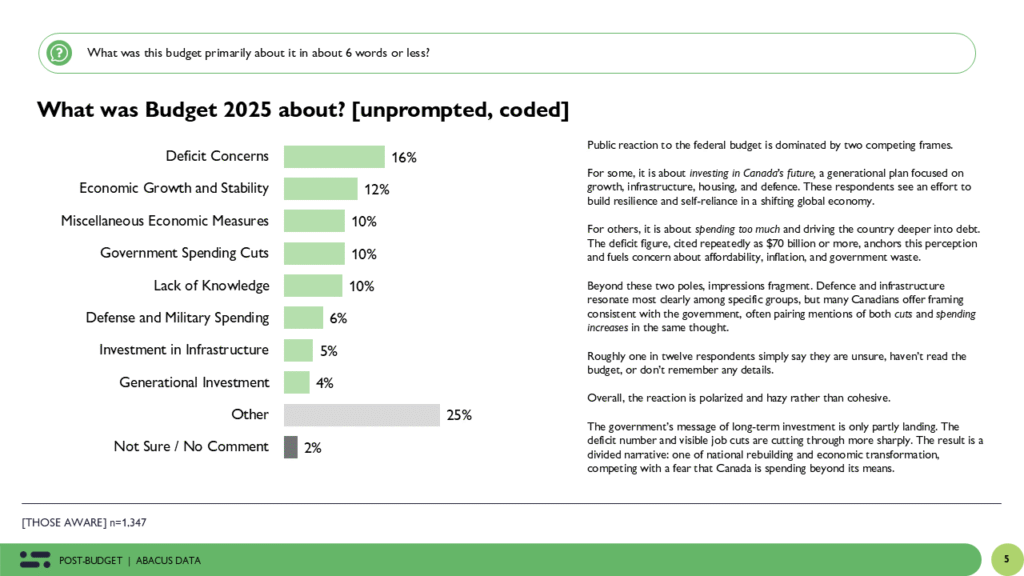

Asked in their own words what the budget was about, Canadians gave answers that reflected two dominant narratives.

One is rooted in long-term investment. This group saw the budget as a generational effort focused on housing, infrastructure, defence, and economic renewal. Their language reflected optimism and intent.

The other group focused squarely on spending. These respondents described a government losing control of the books, citing the $78 billion deficit and warning about rising debt, inflation, and economic fragility.

Both stories exist in the public mind, but neither has emerged as dominant. About 10% said they did not know what the budget was about at all, and another 25% offered a wide array of mixed, non-specific responses. That lack of narrative clarity is one of the government’s biggest challenges going forward.

Emotional Reaction: A Split Between Hope and Hesitation

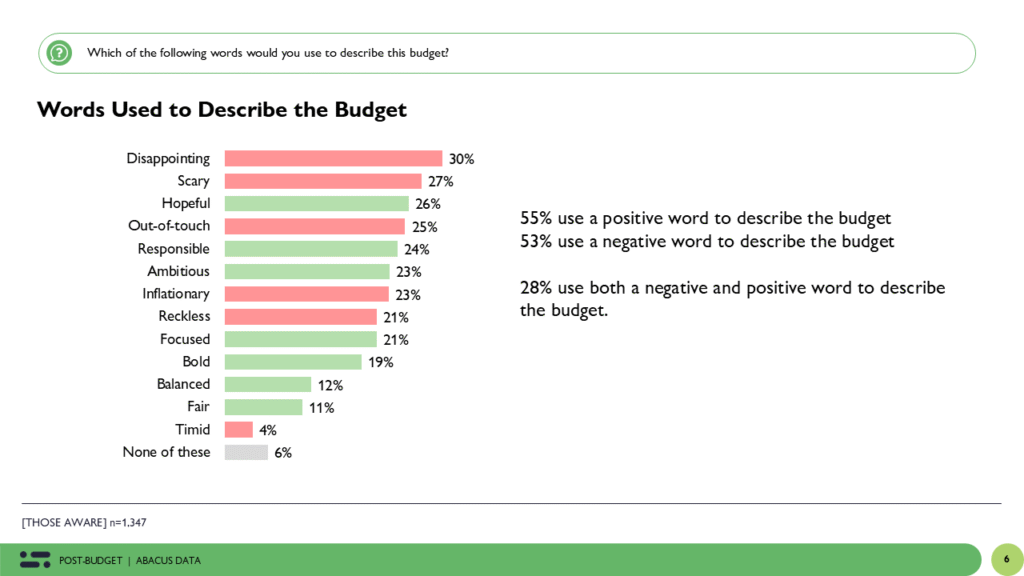

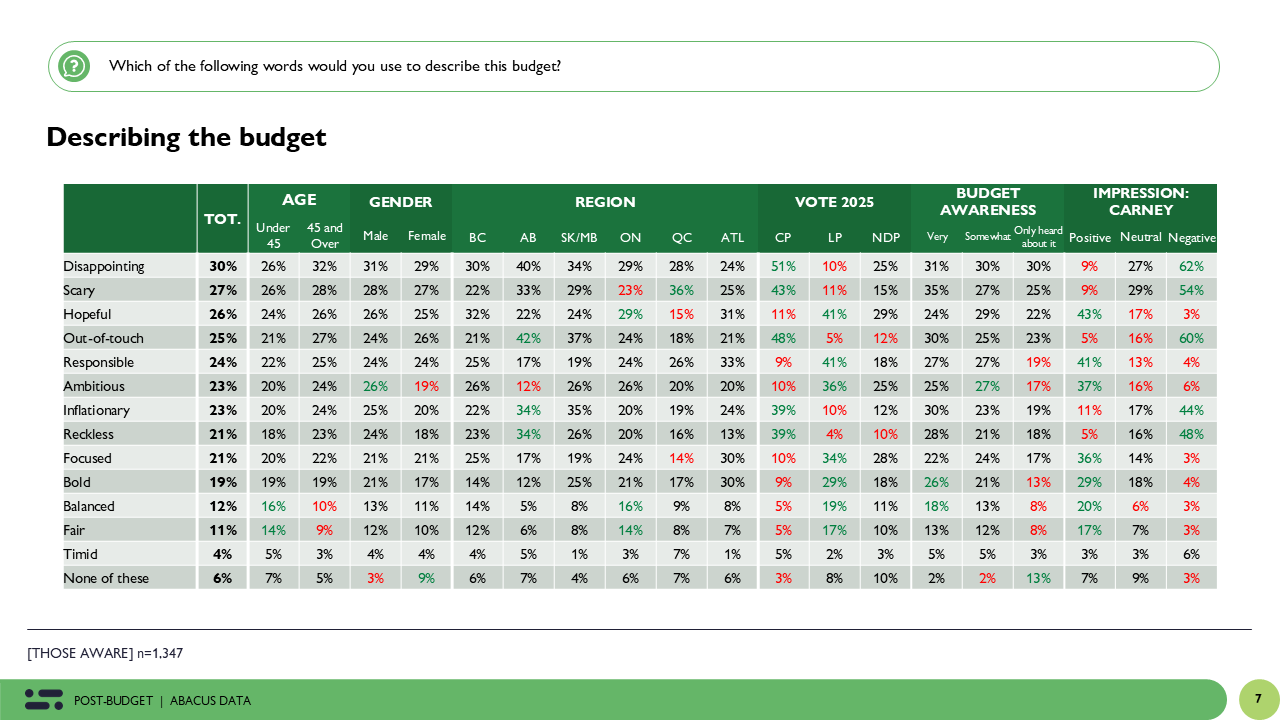

When Canadians were asked to pick from a list of words that describe the budget, the results showed a stark divide. Some of the most common words were “disappointing” (30%), “scary” (27%), and “out-of-touch” (25%). But just behind them were “hopeful” (26%), “responsible” (24%), and “ambitious” (23%).

In fact, 55% of Canadians chose at least one positive word to describe the budget, while 53% chose at least one negative word. About 28% selected both.

This suggests a country with mixed feelings. Canadians are looking for reassurance but are wary of overspending. Many see the budget as attempting something worthwhile but question whether it will work.

Support for Individual Measures Was Often Strong

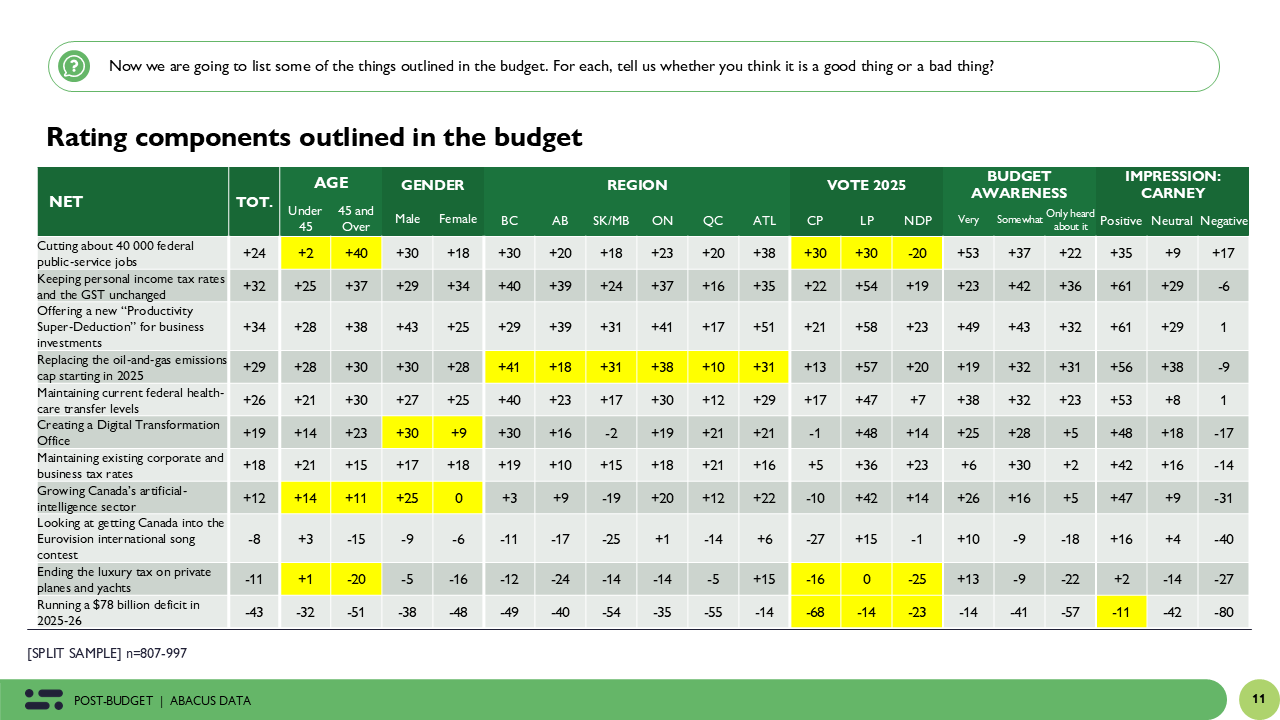

When it came to specific components of the budget, many were met with broad support. The most popular measures included:

- A “Buy Canadian” procurement rule (+62 net support)

- Reducing temporary foreign workers and international students to ease housing and job pressure (+54)

- New funds for Canadian businesses to reach global markets (+48)

- New housing and infrastructure programs (+45 to +48)

Cuts to the federal public service also found more support than opposition overall (+24). However, that figure conceals important variation. Younger Canadians were significantly less supportive of these cuts than older ones. Among those under 45, net support was just +2, compared with +40 among those over 45.

Support also fractured around defence spending. While the overall net rating for increased defence investment was +35, this measure was notably less popular in Quebec and among younger Canadians.

One of the least popular moves was the decision to eliminate the luxury tax on private planes and yachts. It received a net rating of -11, making it the second most unpopular policy tested after the deficit. Older Canadians, Liberal and NDP voters, and even many Conservative supporters were not impressed. Among Liberal supporters, views were split, with no clear support advantage.

The Budget’s Political Impact: Some Gains, Some Risk

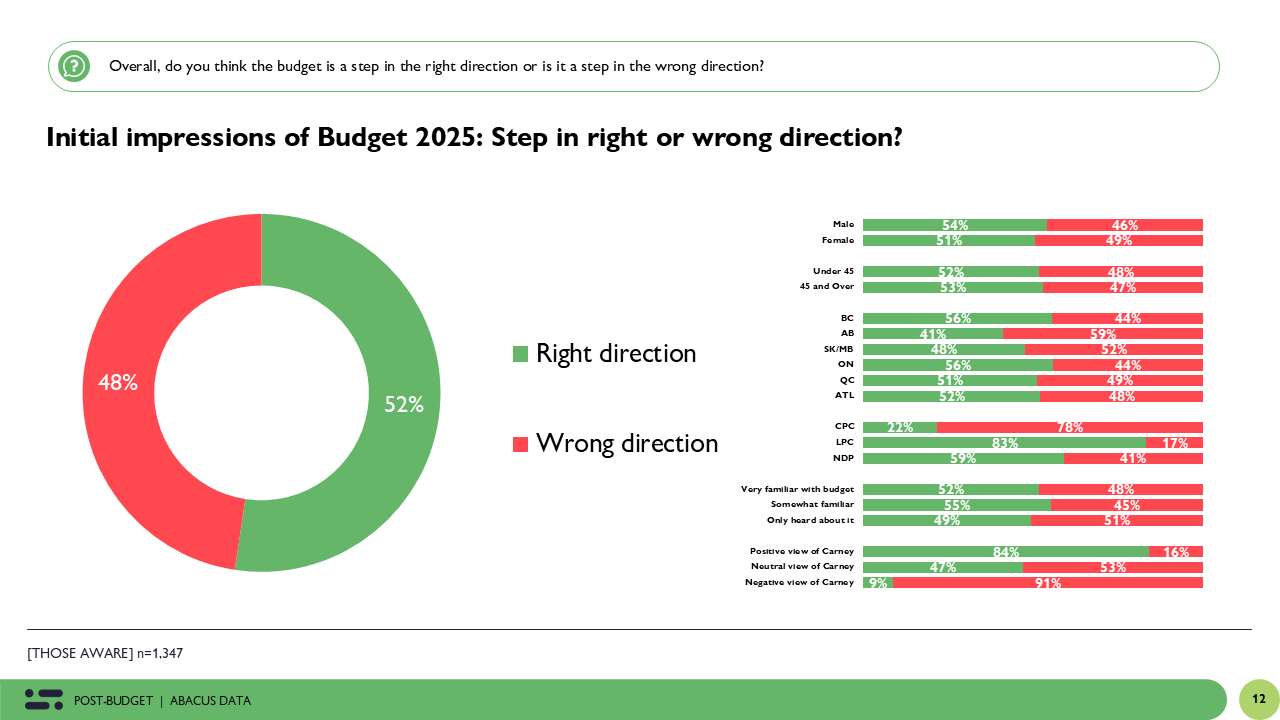

At a macro level, 52% of Canadians who were aware of the budget said it was a step in the right direction. The other 48% said it was a step in the wrong direction.

Among those with a favourable view of Carney, 84% said the budget was moving in the right direction, and only 18% said it fell short of their expectations. Among those with a negative view of Carney, just 9% said it was heading the right way.

But cracks are emerging even within the Liberal base. Among those who voted Liberal earlier this year, 19% say the budget fell short of their expectations and another 31% are unsure. About 19% of Liberal voters also said the budget would make them worse off personally, and the same proportion said it made them less confident that the government has a clear economic plan.

That group may not be abandoning the party yet, but their hesitation reveals a vulnerability.

Confidence in the Government’s Economic Plan Remains Shallow

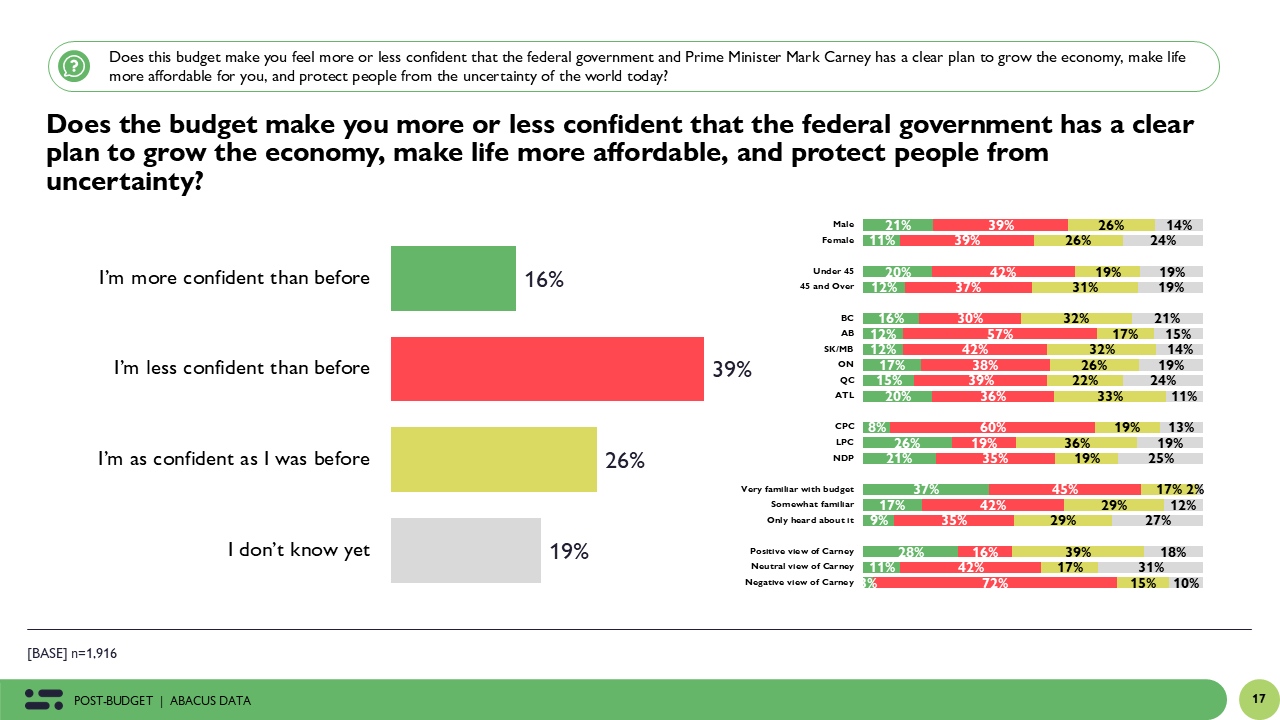

When asked whether the budget made them more or less confident that the government has a clear plan to grow the economy, make life more affordable, and protect Canadians from global uncertainty, only 16% said it made them more confident. A much larger group — 39% — said it made them less confident.

This is one of the most important numbers in the dataset. Despite a slate of ambitious programs, big-ticket investments, and strategic messaging, most Canadians do not feel more reassured about the government’s economic leadership.

That gap between intent and impact is where the next political contest will unfold.

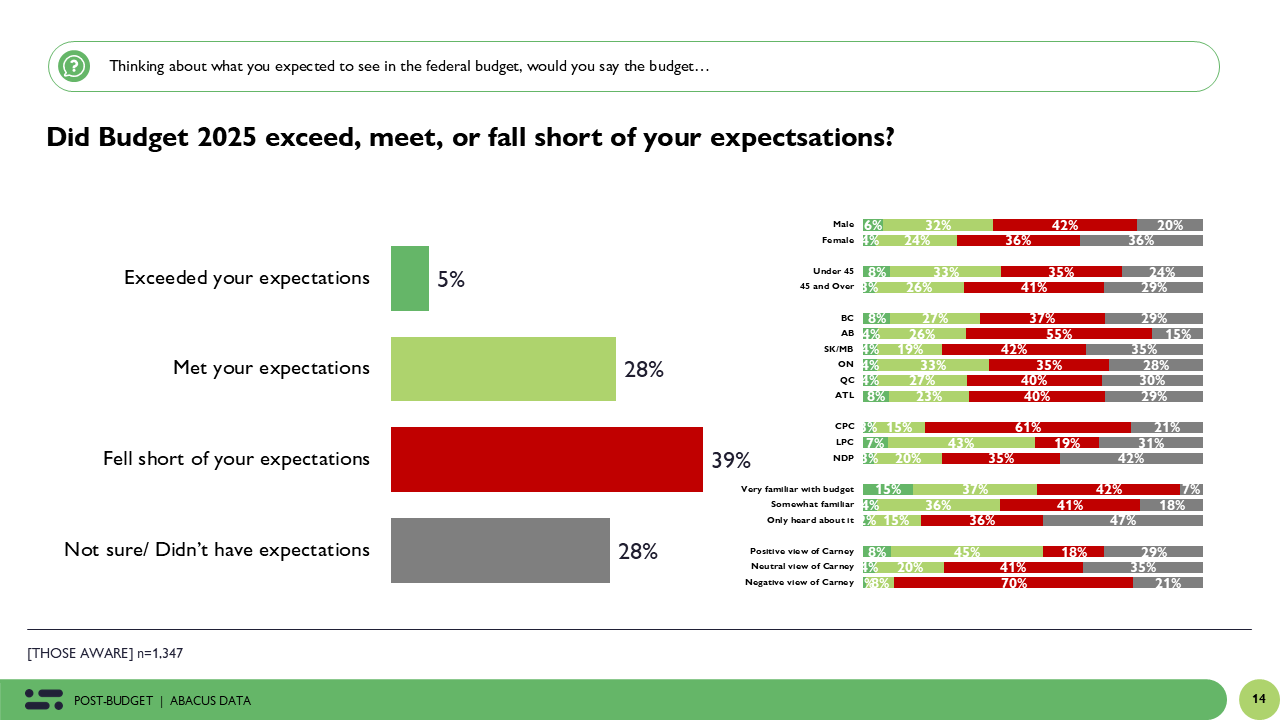

Expectations: A Budget That Left Many Wanting More

Asked whether Budget 2025 exceeded, met, or fell short of expectations, most Canadians came away underwhelmed.

Only 5% said the budget exceeded their expectations. Another 28% said it met them. But the largest group — 39% — said it fell short. An additional 28% were unsure or had no clear expectations going in.

Disappointment was especially high among Conservative voters (61%) and Canadians in Alberta (55%) and Saskatchewan-Manitoba (42%). But the reaction was not limited to opposition supporters. Among Liberal voters, 19% said the budget fell short, and another 31% were unsure, signs of soft support even within the party’s own ranks.

There was also a clear link between familiarity and disappointment. Among those who were very familiar with the budget, 42% said it fell short. For those somewhat familiar, 41% said the same. Those who had only heard about it were more likely to say they didn’t know, suggesting limited exposure softened criticism but did not generate enthusiasm.

The Prime Minister’s brand provided some insulation. Just 18% of those with a positive view of Carney said the budget failed to meet expectations. By contrast, 70% of those with a negative view said it fell short.

Overall, the expectations test offers an important signal. While a core group of government supporters are aligned with the direction, the budget has not delivered the kind of surprise or clarity that might energize broader public support. Many Canadians either expected more or were unsure what to expect at all.

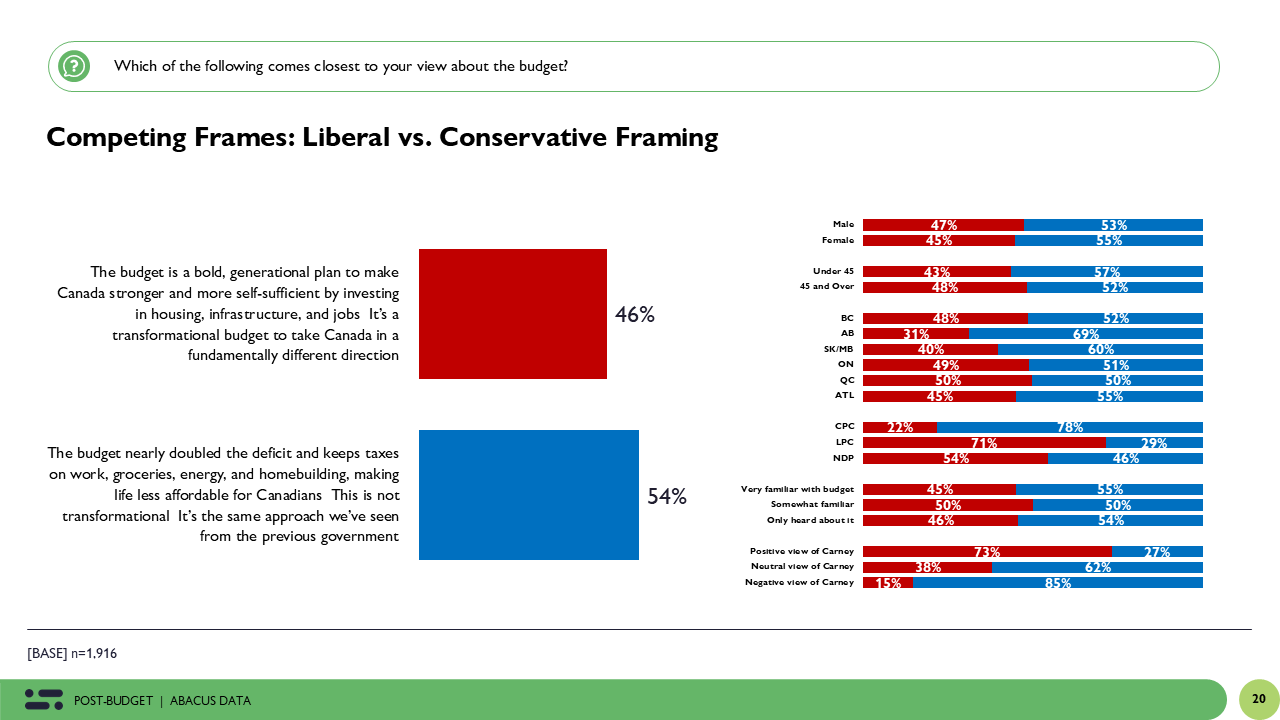

Framing the Budget: A Nation Divided on the Story It Tells

To test how Canadians are interpreting the competing political narratives, the survey presented two sharply different characterizations of the budget.

One, aligned with the government’s messaging, described the plan as a bold, generational effort to make Canada stronger and more self-sufficient by investing in housing, infrastructure, and jobs. The other, reflecting opposition framing, portrayed it as a fiscally reckless move that nearly doubled the deficit and raised taxes, making life less affordable without delivering transformational change.

Overall, 46% chose the government’s framing while 54% sided with the Conservative narrative.

While this result reflects a modest tilt toward the opposition view, the story is more nuanced when broken down:

Among those very familiar with the budget, the split was 45% for the government’s frame and 55% for the opposition’s.

Those who had only heard about the budget were similarly split (46% government, 54% opposition).

Among those with a positive view of Carney, 73% chose the government’s framing, a strong endorsement.

By contrast, 85% of those with a negative view of Carney adopted the opposition’s version.

Politically, 71% of Liberal supporters adopted the government’s framing, while 78% of Conservative supporters leaned toward the opposition narrative. Among NDP voters, views were more evenly divided.

Regionally, Alberta (69%) and Saskatchewan-Manitoba (60%) leaned toward the Conservative message, while Ontario and Quebec were split evenly.

The fact that even those most familiar with the budget split almost identically to the national average suggests that understanding the details does not dramatically shift interpretation. Partisan identity and leader perception remain the dominant forces shaping how the budget is being framed in the public mind.

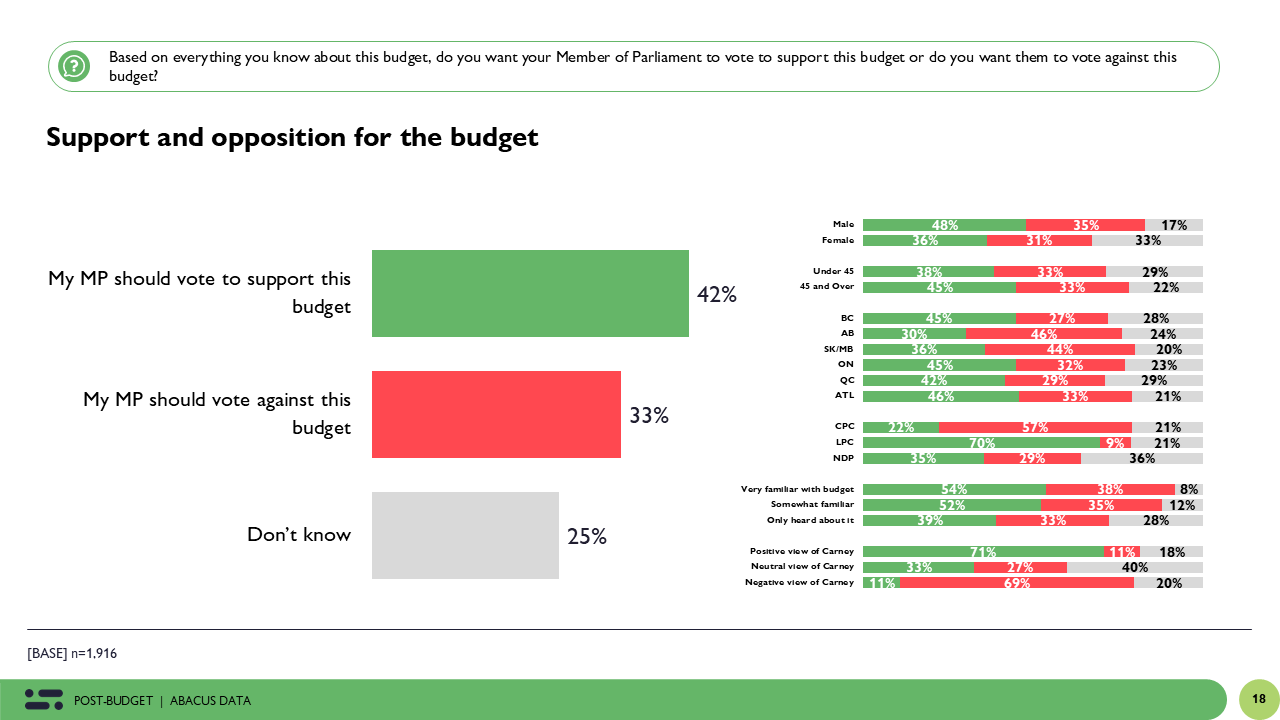

Parliamentary Support: A Divided Mandate

When asked whether their MP should vote to support or oppose the budget, 42% of Canadians said their MP should vote in favour, while 33% preferred a vote against. A sizeable 25% were unsure, a signal that many Canadians are still forming their views.

Support was strongest among Liberal voters (70%) and those with a positive view of Prime Minister Carney (71%). Among Conservative voters, only 22% supported the budget, while 57% said their MP should vote against it. NDP supporters were more mixed, with 35% favouring support and 29% opposed. A full 36% of NDP voters said they were unsure.

Familiarity with the budget played a role. Among those very familiar with the budget, support rose to 54%, while opposition climbed to 38%. Those less familiar were more uncertain, with nearly one in three in the “don’t know” category.

Support was higher among men (48%) than women (36%), and older Canadians were more supportive (45%) than younger ones (38%). Regionally, Alberta and Saskatchewan-Manitoba were most opposed, while Ontario, Quebec, and Atlantic Canada leaned more supportive or were closely divided.

The Upshot

If Budget 2025 was designed to launch a new economic vision and rebuild confidence in the Liberal government’s leadership, the evidence suggests it has so far, fallen short of that goal.

Most Canadians are aware of the budget but few are familiar with the details (yet). The impressions that have landed are contradictory. Some see promise and investment. Others see risk and overspending. Many are unsure what to believe.

The Carney brand remains a powerful asset. Among those who trust him, support for the budget is strong even without detailed knowledge of its contents. But that trust is not universal. It does not extend across the electorate, and even some past Liberal voters are unsure if this is the right approach.

Support for individual measures was often strong, especially when tied to Canadian industry, housing, and economic resilience. But other decisions, such as the luxury tax repeal and public service cuts, risk cutting across the values and expectations of key voter groups.

The most telling data point may be this: just 16% of Canadians say the budget made them more confident in the government’s plan to grow the economy and make life more affordable.

That is not the response one expects to a transformative blueprint. It is the reaction one gets when the message is unclear, the trade-offs are poorly explained, and the public is looking for reassurance and not yet finding it.

The government has its work cut out. The raw material for a compelling story may be there. But that story has not yet been heard.

Methodology

The survey was conducted with 1,916 Canadians from November 5 to 6, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.23%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, and region. Totals may not add up to 100 due to rounding.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements: https://canadianresearchinsightscouncil.ca/standards/

The survey was paid for by Abacus Data Inc.

About Abacus Data

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.