Canadians Continue to Broadly Support a Pipeline to the West Coast but Backing Is Conditional

January 16, 2026

Between January 9 and 14, 2026, Abacus Data surveyed 1,850 Canadian adults to assess public opinion on the prospect of a new oil pipeline from Alberta to the West Coast in British Columbia.

Almost two months have now passed since the federal government and the Government of Alberta signed a memorandum of understanding to explore a new pipeline to tidewater. In that time, the immediate political reaction has faded and the issue has shifted from symbolism to substance. The conversation is now being shaped by trade uncertainty, concerns about market access, and a renewed focus on Canada’s long term energy security, especially after events in Venezuela.

This research was designed to understand where public opinion stands once the initial reaction to the MOU has settled, and to test how support changes as realistic conditions are introduced.

The topline result is clear. A majority of Canadians support the idea of a new pipeline to the West Coast. But that support is not fixed. As details emerge and trade offs become clearer, opinion becomes more conditional.

Baseline Support Is Clear but Not Uniform

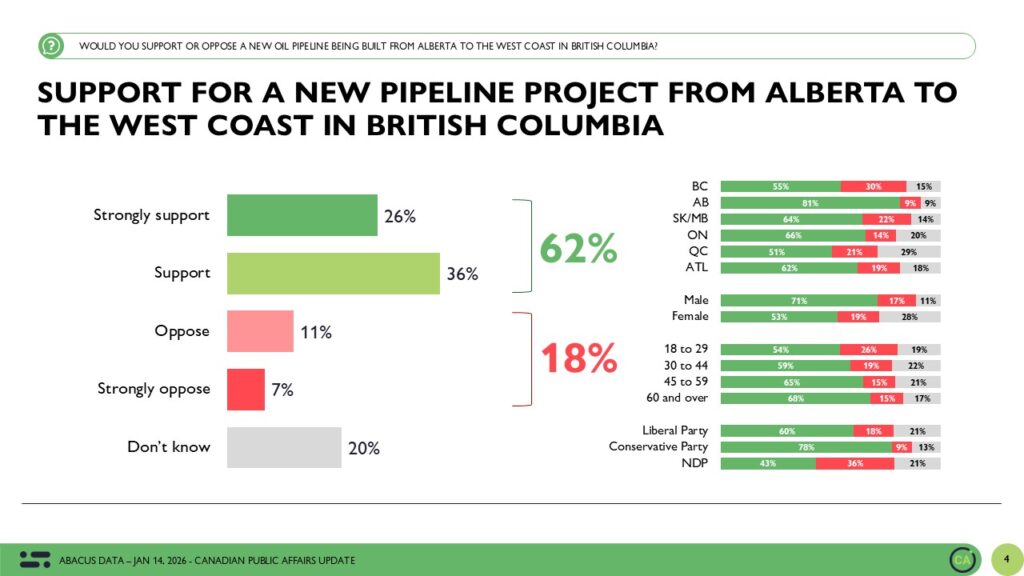

Asked directly whether they would support or oppose a new oil pipeline being built from Alberta to the West Coast in British Columbia, 62 percent of Canadians say they support the project, while 18 percent oppose it. The remainder are unsure.

Support is strongest in Alberta, where more than eight in ten are in favour, and remains high across the Prairies. Majorities also support the project in Ontario and Atlantic Canada. In British Columbia, opinion is more divided, with a narrow majority supportive and a sizable minority opposed. Quebec is closely split.

Men are more likely than women to support the pipeline, and support increases with age. Younger Canadians are more cautious, with higher levels of opposition and uncertainty. By 2025 election vote, support is highest among Conservative supporters and lowest among those who support the NDP, while Liberal supporters fall closer to the national average.

Support Softens When Context Is Introduced

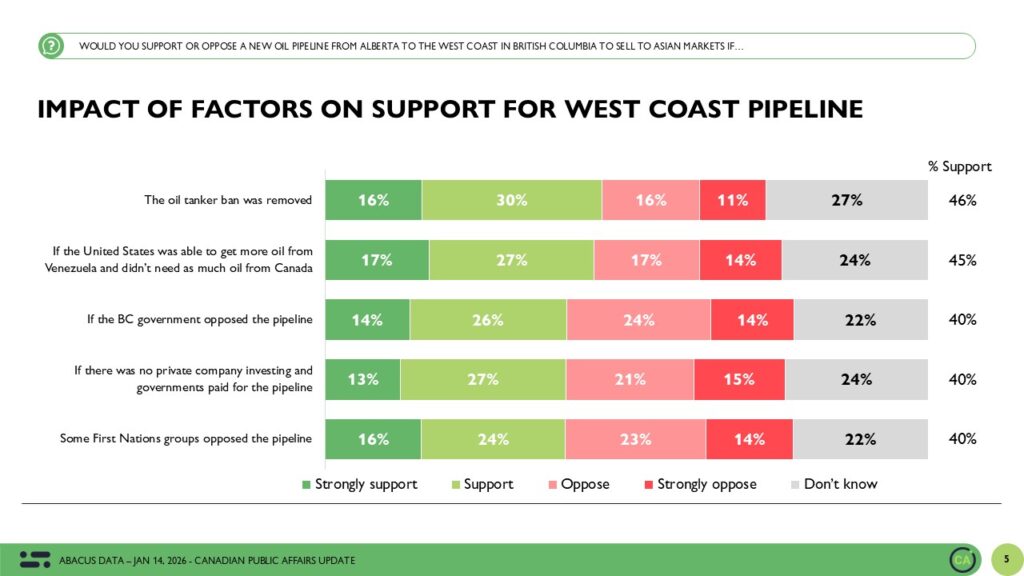

While baseline support is solid, it becomes more fragile as additional conditions are considered.

When Canadians are told that the oil tanker ban on the West Coast was removed, support declines modestly to 46 percent. While lower than the baseline, this still represents a plurality, suggesting this legislative change alone does not fundamentally undermine support.

Support also drops when the market case is questioned. If the United States were able to secure more oil from Venezuela and therefore needed less from Canada, support falls to 45 percent nationally. In this scenario, uncertainty increases, particularly among Liberal and younger voters, indicating that perceptions of global demand matter.

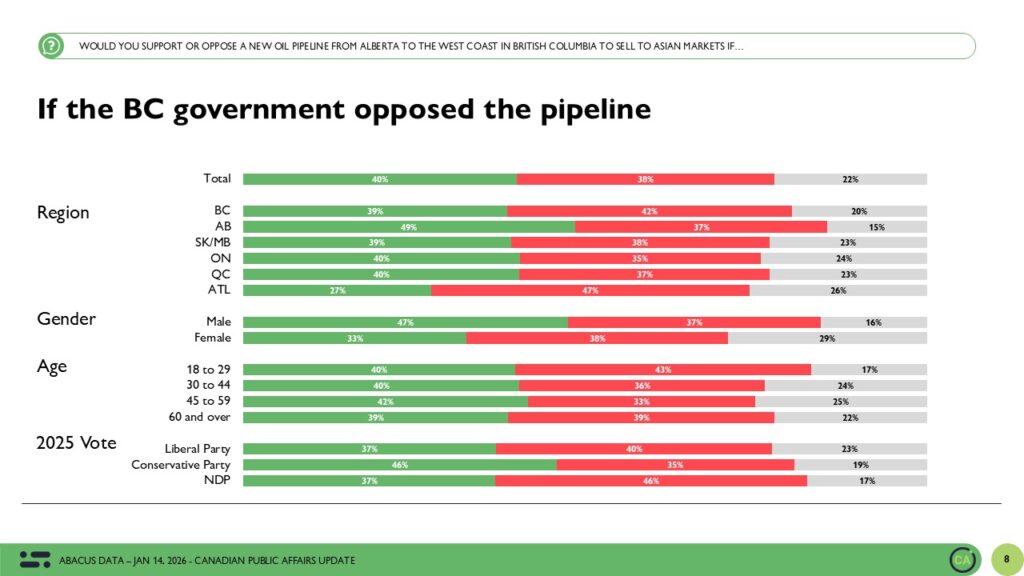

Political opposition along the route also has an impact. If the British Columbia government opposed the pipeline, national support declines to 40 percent. This effect is most pronounced in British Columbia and Quebec, but is visible across regions. Opposition from a provincial government introduces doubt even among some who otherwise support the project.

Fiscal risk produces a similar response. When respondents are told there would be no private company investing and governments would pay for the pipeline, support again sits at 40 percent. Concerns about public cost and risk exposure appear to temper enthusiasm, particularly among Liberal and NDP supporters although it doesn’t eliminate support.

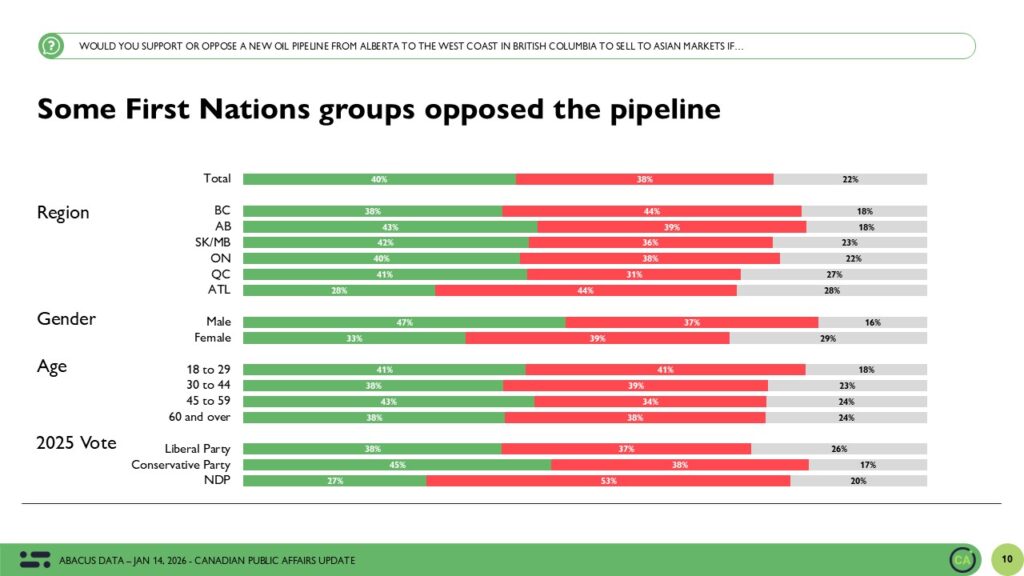

Indigenous Opposition Is a Key Sensitivity

Support is also sensitive to questions of social legitimacy.

If some First Nations groups opposed the pipeline, national support drops to 40 percent. While this does not create majority opposition, it significantly narrows the margin and increases the share who are unsure. The effect is strongest among Liberal and NDP supporters, but even among Conservatives support softens somewhat.

What Holds and What Shifts

Across all scenarios, some patterns remain consistent. Support is always strongest in Alberta and the Prairies. Conservative supporters remain more supportive than other partisans in every version of the question. Younger Canadians and residents of British Columbia remain more skeptical regardless of the framing.

At the same time, no scenario tested produces overwhelming national opposition. Instead, support erodes gradually as uncertainty, political conflict, cost, or social opposition are introduced. Public opinion appears responsive rather than entrenched, and sensitive to how the project is governed, financed, and justified.

The Upshot

Almost two months after the memorandum of understanding between Canada and Alberta was announced, the idea of a pipeline to the West Coast is meeting a more receptive public environment. On the surface, support is broad and crosses regions and partisan lines.

But this research also shows how conditional that support really is. As soon as questions of cost, market need, provincial opposition, or Indigenous consent are introduced, support softens and uncertainty grows. Canadians are open to the idea, but they are not giving any government a blank cheque.

The future of this project will be shaped not just by the case for diversification and energy security, but by how decisions are made, who is at the table, and how risks are managed. As those details evolve, so too will public opinion.

Methodology

The survey was conducted with 1,850 Canadians from January 9 to 14, 2026. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability based random sample of the same size is plus or minus 2.27 percentage points, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, and region. Totals may not add up to 100 due to rounding.

This poll was paid for by Abacus Data.