Abacus Data Poll: Budget Lands Softly as Political Deadlock Continues

November 10, 2025

Between November 5 and 6, 2025, Abacus Data surveyed 1,916 Canadian adults about the federal political landscape. The poll was conducted in the days following two major political developments: the release of the federal budget on November 4 and the defection of a Conservative MP to the Liberal caucus. These events had the potential to reshape the political narrative. Instead, they seem to have landed with a thud, leaving the broader dynamics of public opinion largely intact.

The federal race remains tight. Approval of the Carney-led government continues to erode. And Canadians remain laser-focused on pocketbook issues, particularly the cost of living, which has risen again as the top issue.

Public Mood: Restless but Unchanged

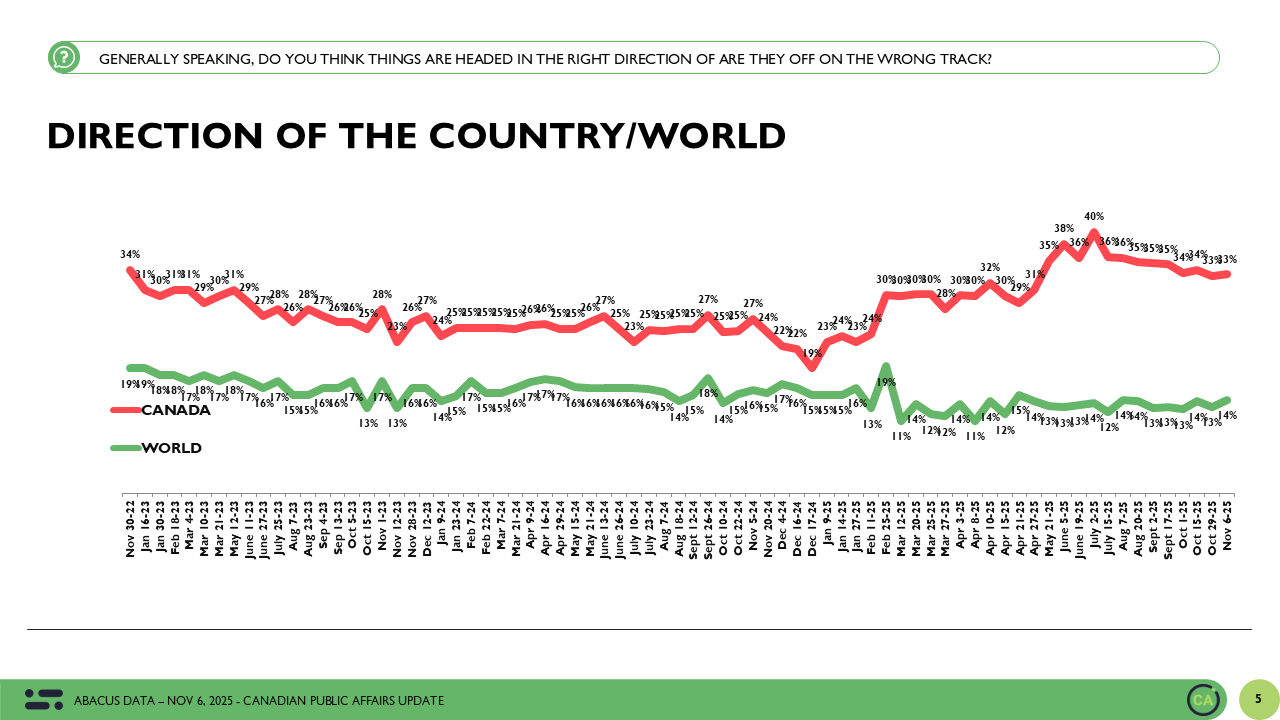

One in three Canadians (33%) feel the country is heading in the right direction. Half (49%) believe it is off on the wrong track. These numbers have been consistent for weeks and reflect a deep-rooted sense of frustration without much volatility. The budget hasn’t lifted optimism across the country.

Views about the state of the world (14% right direction) and the United States (13%) remain overwhelmingly pessimistic, underscoring a broad international anxiety that frames domestic political expectations.

Top Issues: Cost of Living Dominates Again

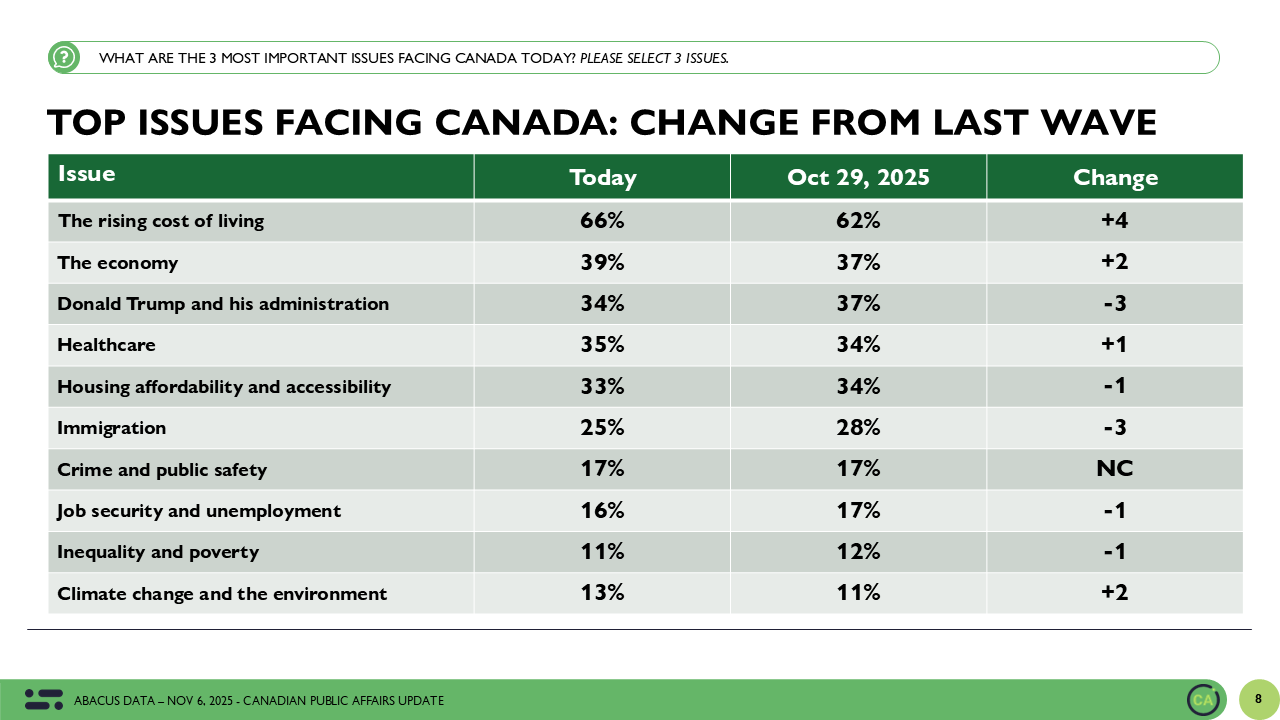

The cost of living continues to be the most pressing issue. Sixty-six percent of Canadians cite it as one of their top three concerns, up four points from the previous wave. The economy (39%) and healthcare (35%) follow, while concern about Donald Trump and his administration has dropped slightly to 34%.

This is the highest level of concern about the cost of living recorded in 2025 and reinforces the salience of affordability issues in the federal political debate.

Government Approval: Downward Slide Resumes

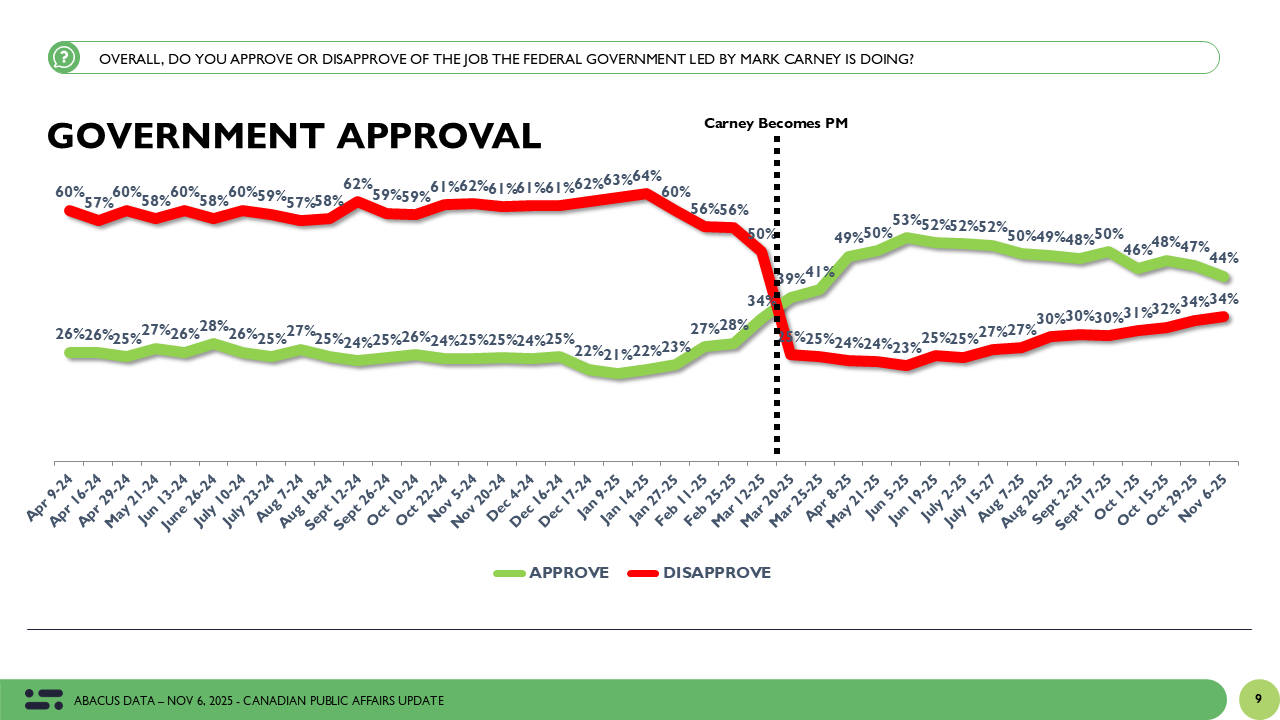

Approval of the Carney government is now at 44%, down from 52% since June. Disapproval has risen to match it at 34%. This is the lowest approval rating for the Carney government since the April federal election.

This latest data suggests the budget has not arrested the longer trend of softening support for the Liberals. Instead, it appears to have passed without significantly changing perceptions of the government’s performance.

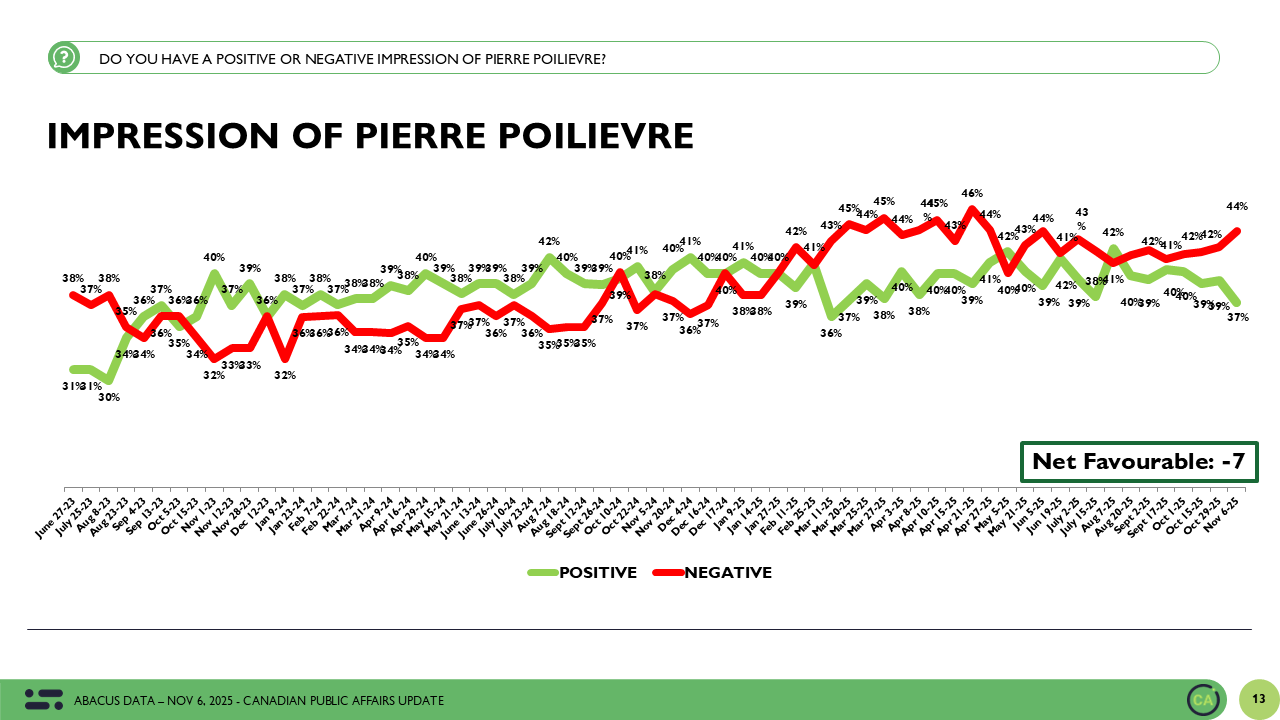

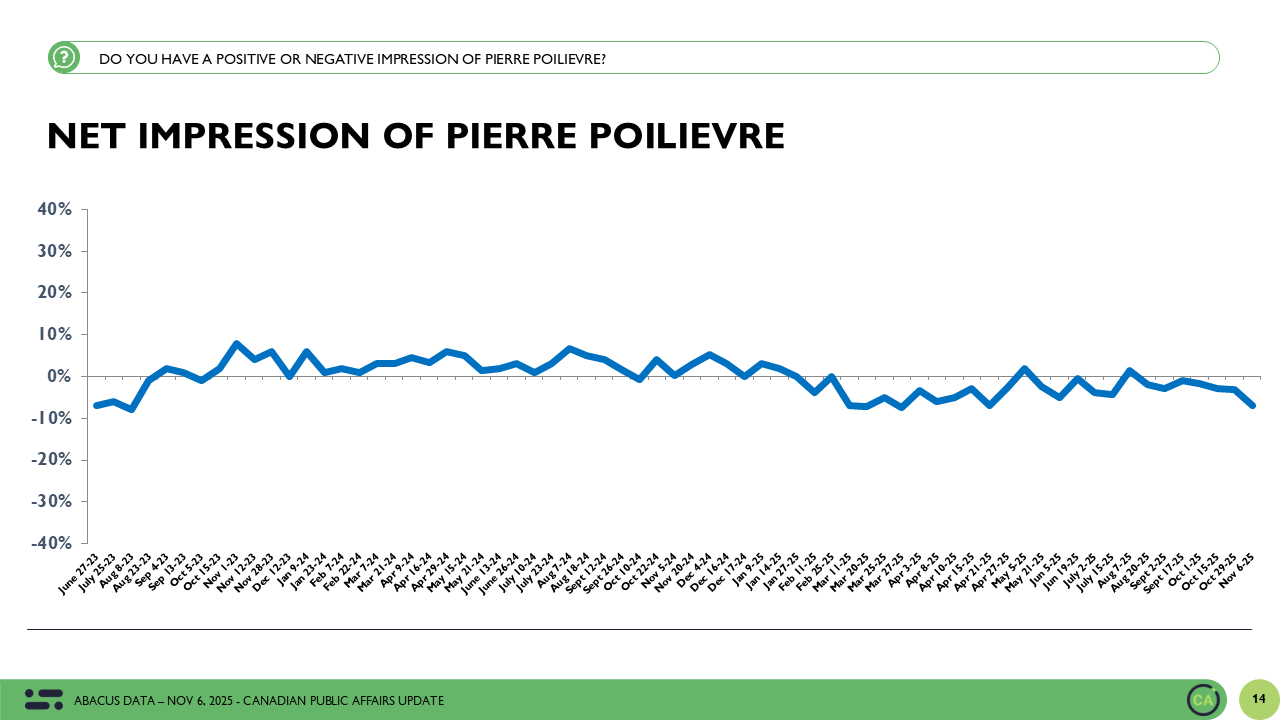

Leader Impressions: Carney Treads Water, Poilievre Slides

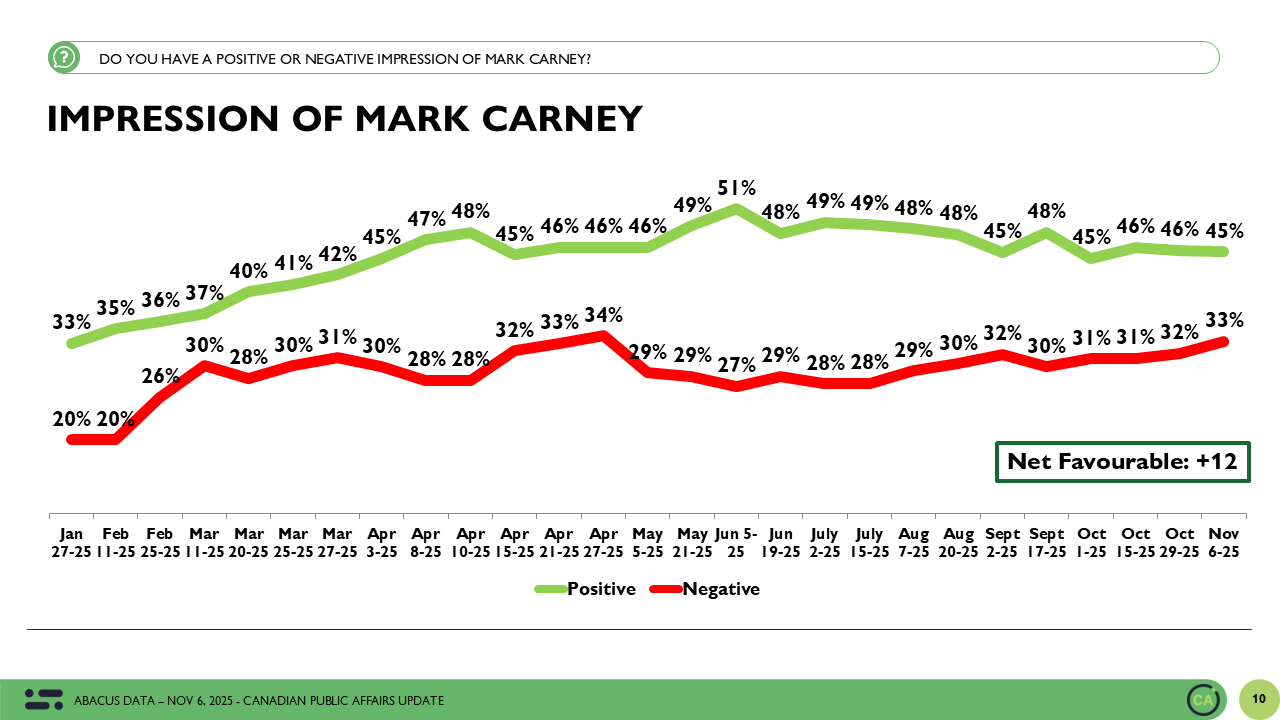

Mark Carney’s favourability remains positive overall, with 46% viewing him positively and 34% negatively, yielding a net favourability of +12. This is unchanged from the previous wave.

Pierre Poilievre, however, has seen his net impression score fall to -7, the lowest it has been in over a year. Just 37% of Canadians view him positively, while 44% have a negative impression. This shift follows a week that included the unexpected defection of a Conservative MP to the Liberals. While the full impact of that event is still unfolding, it appears to have bruised Poilievre’s personal brand.

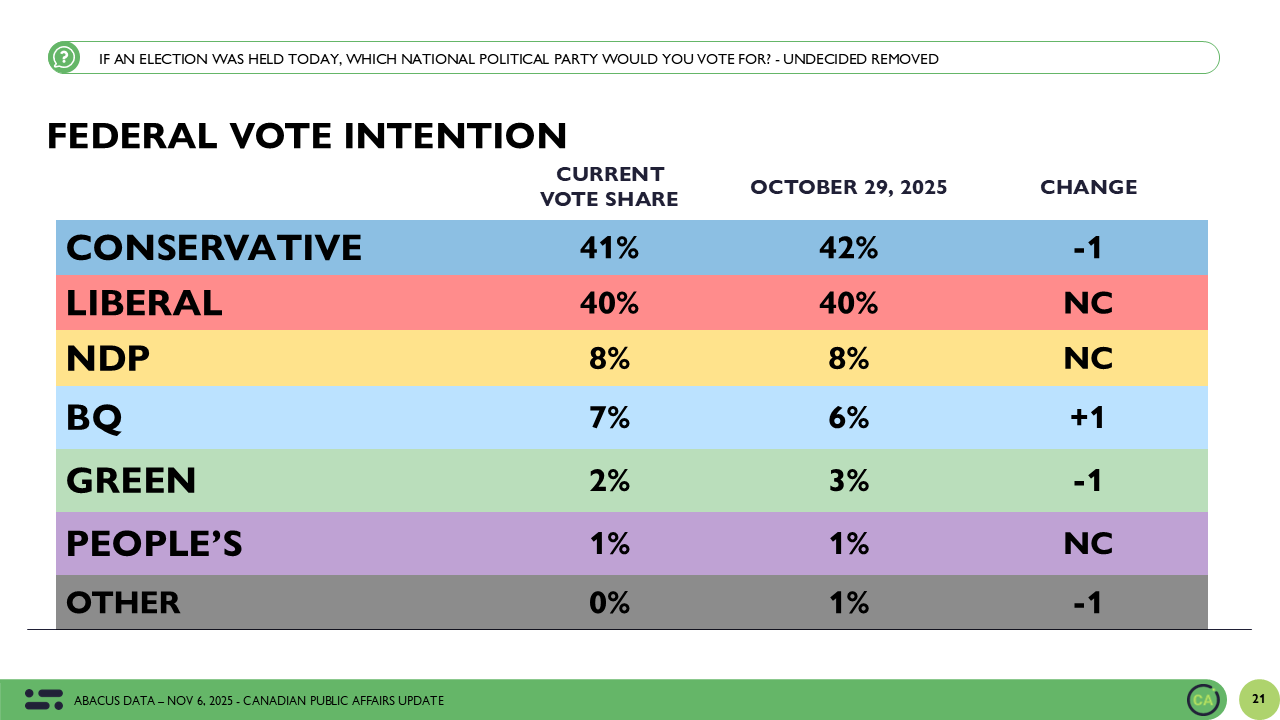

Vote Intention: A Neck-and-Neck Race

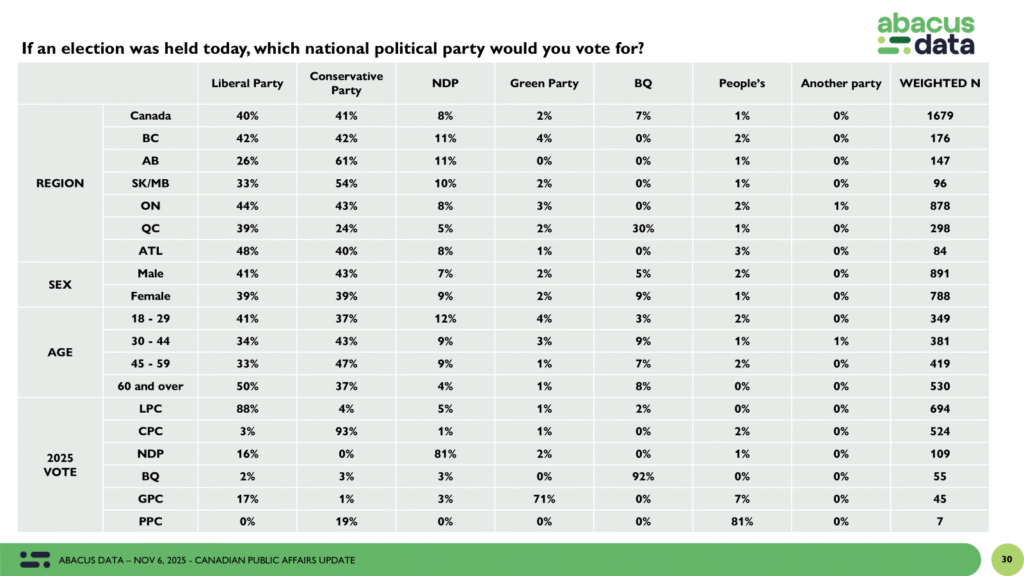

If an election were held today, the Conservatives would earn 41% of the vote, while the Liberals would capture 40%. Support for the NDP is steady at 8%, the Bloc at 7%, and the Greens at 2%.

Among those most likely to vote, the Conservative lead widens slightly to 43% compared to 40% for the Liberals.

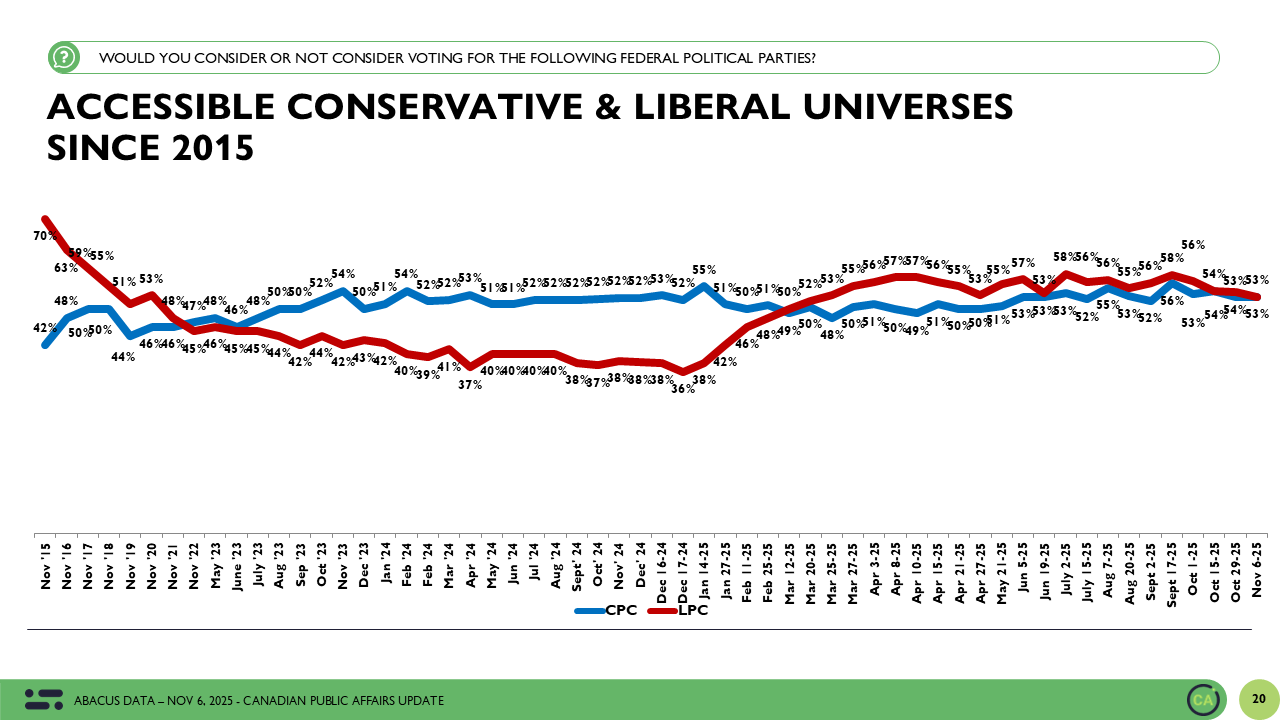

Accessible Voter Pools: Still Evenly Matched

Despite significant shifts in approval and leader impressions, the accessible voter universes for the Liberal and Conservative parties remain exactly tied at 53% each. This symmetry reinforces the competitive nature of the current landscape and shows that no party is pulling away decisively on voter openness.

Regional and Demographic Trends: Familiar Patterns Hold

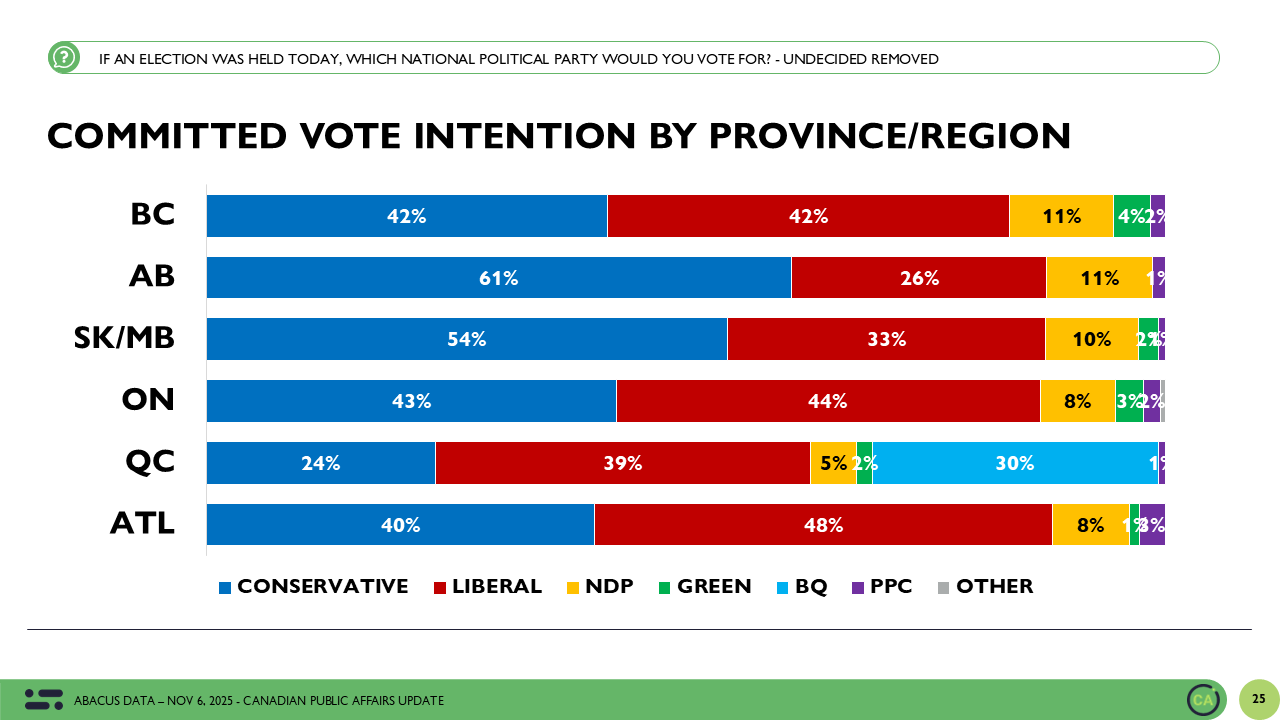

Ontario continues to reflect the national picture, with the Conservatives at 43% and Liberals at 44%. Alberta remains deep blue, with the Conservatives holding 61%. In Quebec, the Liberals lead with 39%, ahead of the Bloc at 30% and the Conservatives at 24%.

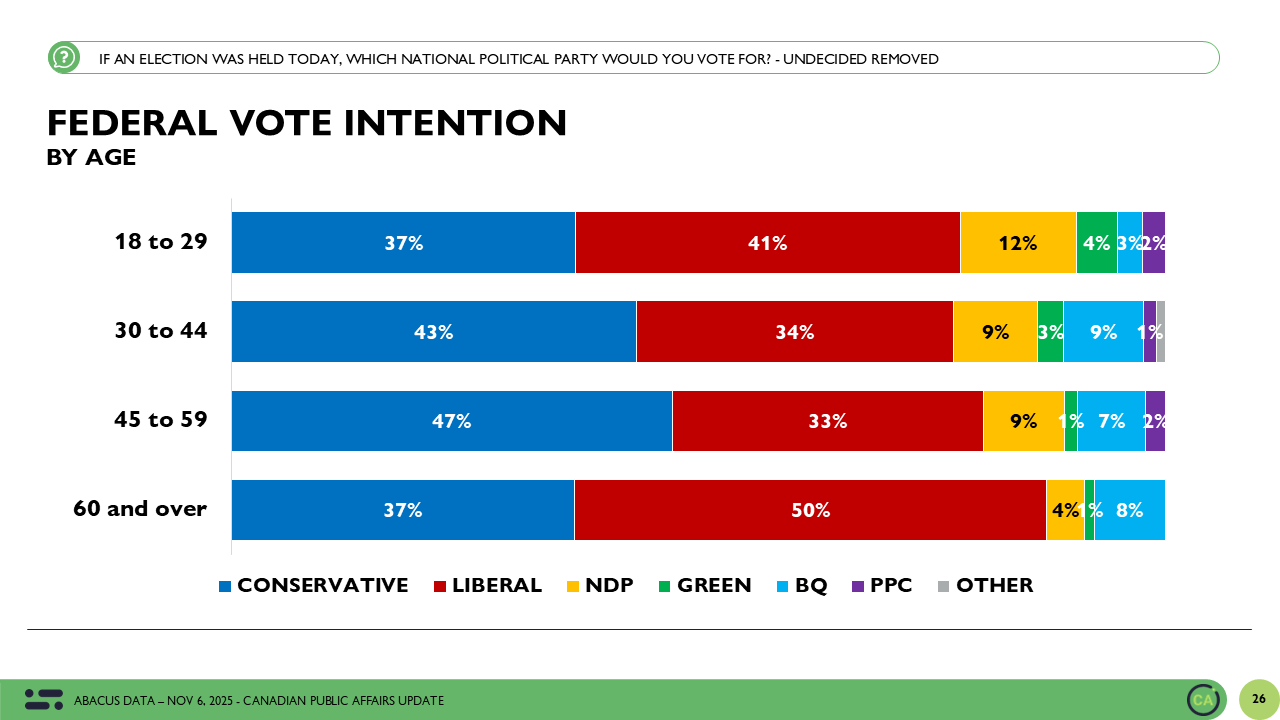

Older Canadians (60+) continue to lean Liberal, with 50% support, while middle-aged voters (45–59) prefer the Conservatives by a margin of 47% to 33%. Younger voters remain more fragmented, with the Liberals slightly ahead among 18 to 29-year-olds at 41% compared to 37% for the Conservatives while the Conservatives lead by 9 among Millennials (aged 30 to 44).

The Upshot

According to Abacus Data CEO David Coletto:

“We are seeing more confirmation than change in this wave of polling. The federal budget has not disrupted the longer trend of softening government approval. While the floor-crossing gave the Liberals a brief boost in media coverage, it may have done more to dent Poilievre’s image than elevate Carney’s.

What is striking is the continued dominance of cost of living concerns. As that number rises, expectations for government solutions do too. The fact that the budget failed to move the needle on approval or leader impressions suggests that Canadians are in a wait-and-see mode, not yet convinced of the budget’s efficacy to tackle the issues they care most about.

This remains a deeply competitive political environment. Both the Liberals and Conservatives have equal-sized accessible voter pools, but each is struggling to break through beyond the group that voted for them in the spring. The coming weeks will reveal whether the budget leaves any lasting impressions, but for now, the deadlock holds.”

Methodology

The survey was conducted with 1,916 Canadians from November 5 to 6, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.2%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, and region. Totals may not add up to 100 due to rounding.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

The survey was paid for by Abacus Data Inc. Inc.

About Abacus Data

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.