Canadians See Economic Clouds Gathering But Still Hold Out Hope for Progress

November 4, 2025

As Mark Carney’s government prepares to release its first budget today, Canadians remain far more likely to believe the economy will get worse before it gets better. Yet despite this macro pessimism, many hold steady expectations for their own finances, revealing a cautious but resilient public mood.

This survey was done in partnership with The Logic.

Canadians Expect the Economy to Worsen, But Feel a Bit Better About Themselves

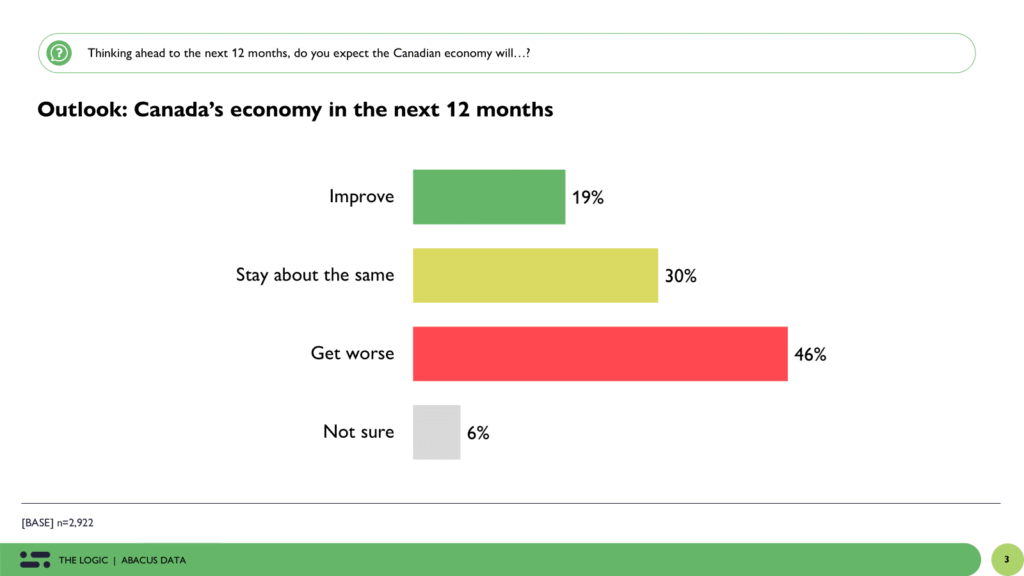

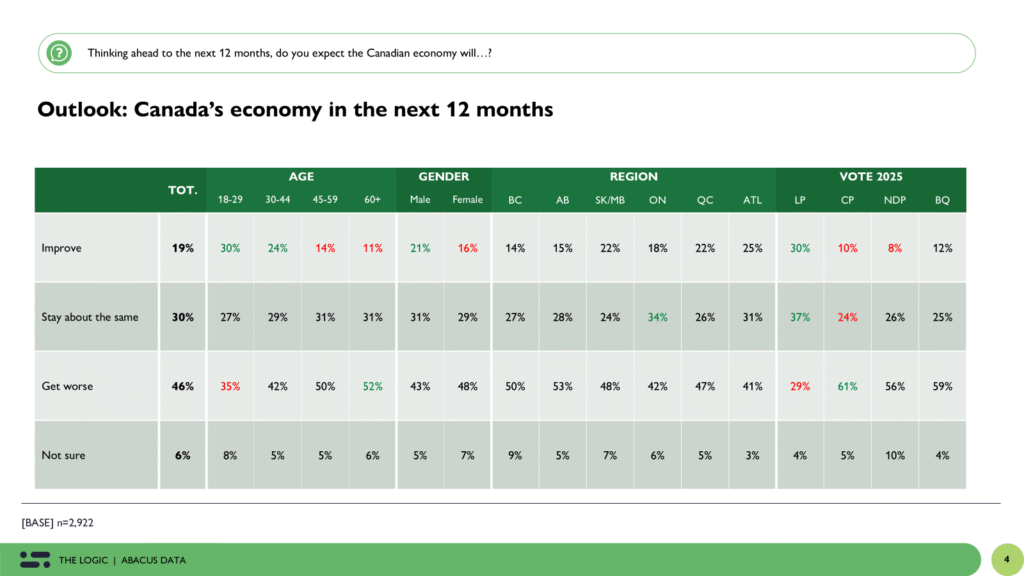

Nearly half (46%) of Canadians expect the national economy to get worse over the next 12 months, compared to only 19% who think it will improve.

That pessimism cuts across every region and demographic, but the intensity varies. Younger Canadians (18–29) are the least gloomy, with one-third (30%) expecting improvement, while pessimism peaks among those 60+, where 52% expect things to deteriorate.

Regionally, Alberta (50%) and Saskatchewan/Manitoba (53%) lead the negativity pack, while Quebec and Atlantic Canada are marginally less downbeat. Political affiliation also colours perception: 61% of Conservative voters think the economy will worsen, compared to only 29% of Liberals.

When it comes to their personal finances, Canadians are less fatalistic. 21% expect their situation to improve and 41% think it will stay about the same, while 34% anticipate decline.

Younger respondents are again more upbeat, 38% of those 18–29 foresee gains, while pessimism is concentrated among older and Conservative voters (43% of Conservatives expect their situation to worsen).

In short: most Canadians expect national turbulence, but many still believe they can weather it personally.

2. Carney’s ‘Getting Things Built’ Agenda: Hopeful but Not Yet Convinced

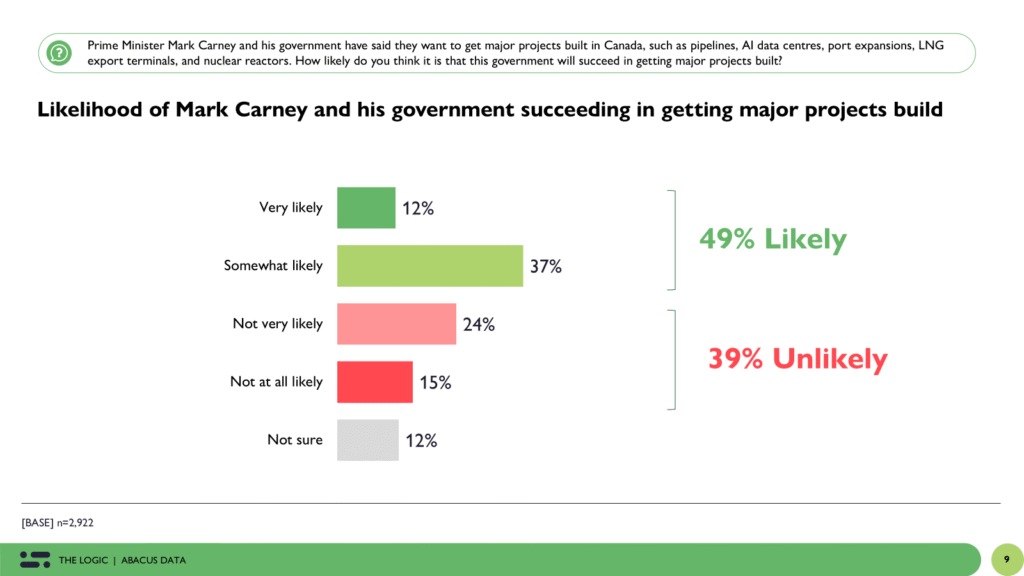

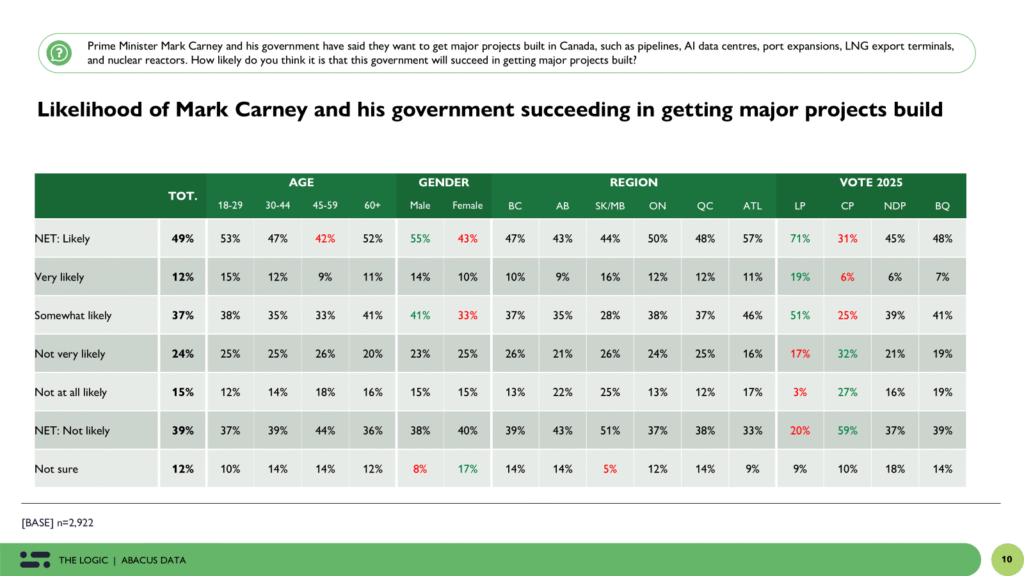

Asked how likely it is that Prime Minister Mark Carney’s government will succeed in getting major projects built, half the country (49%) say it’s likely, yet only 12% are very likely to believe so.

That slim confidence margin tells a nuanced story: Canadians are open to optimism but remain unconvinced by government delivery.

Liberal supporters are predictably confident (71% likely), while just 31% of Conservatives share that view. Still, the partisan divide isn’t absolute: almost half of NDP voters (45%) and Bloc voters (48%) also fall into the “somewhat likely” camp, signalling mild optimism without firm conviction.

Regionally, belief in Carney’s ability to deliver projects runs highest in Altantic Canada (57%), Ontario (50%) and Quebec (48%) and lowest in Alberta (43%) and Saskatchewan/Manitoba (43%). The pattern reinforces a familiar divide — central Canada’s cautious confidence versus Western Canada’s enduring skepticism about Ottawa.

3. What Should Be Built: Housing Tops the List, But Energy and Infrastructure Follow Close Behind

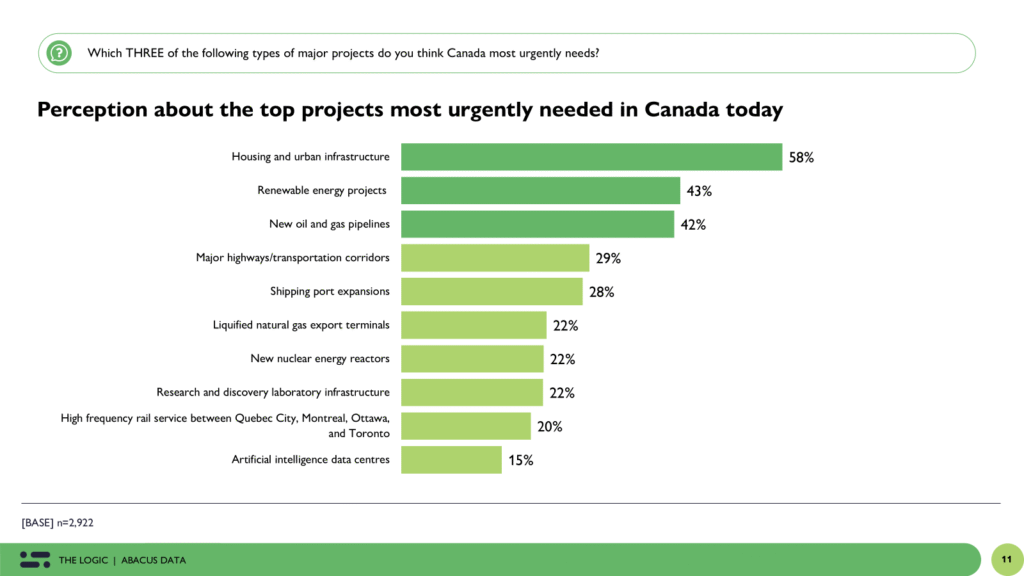

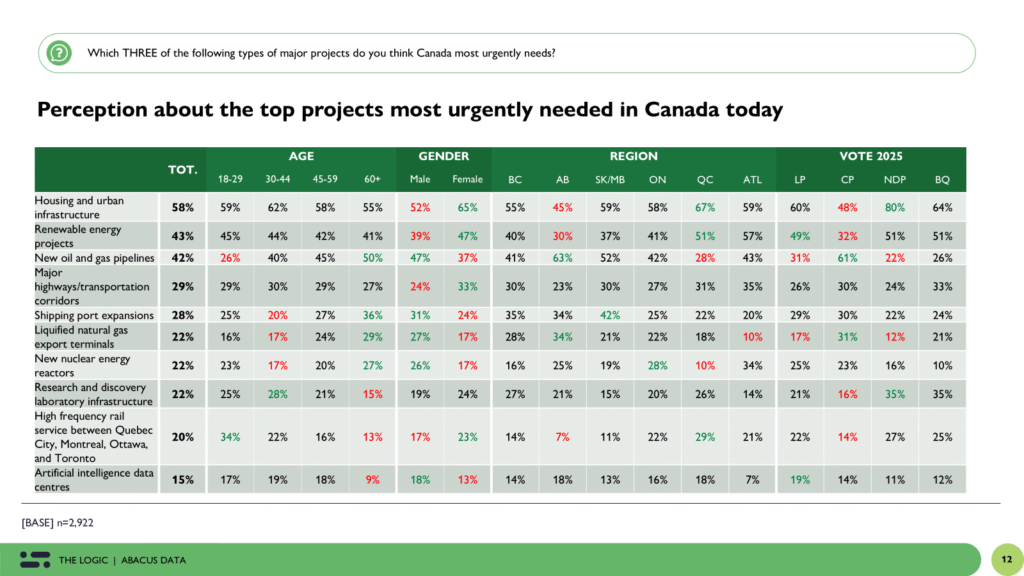

When asked which major projects Canada needs most urgently, the top three reflect both current anxieties and long-term priorities: Housing and urban infrastructure (58%), renewable energy projects (43%), and new oil and gas pipelines (42%).

All other categories including highways, ports, LNG terminals, and nuclear reactors trail in the 20–30% range, suggesting broad but shallow support for a variety of initiatives.

Regional divides are sharp: two-thirds of Albertans (63%) want new pipelines, compared to only 28% in Quebec. The reverse is true for renewable energy, where half of Quebecers prioritize it, compared to just 30% in Alberta.

Meanwhile, Ontarians (28%) are most likely to say new nuclear reactors should be a priority, a reflection of that province’s energy mix and pragmatic climate policy debate.

4. Trading Independence: Carney’s Push for New Partners Finds Broad Support

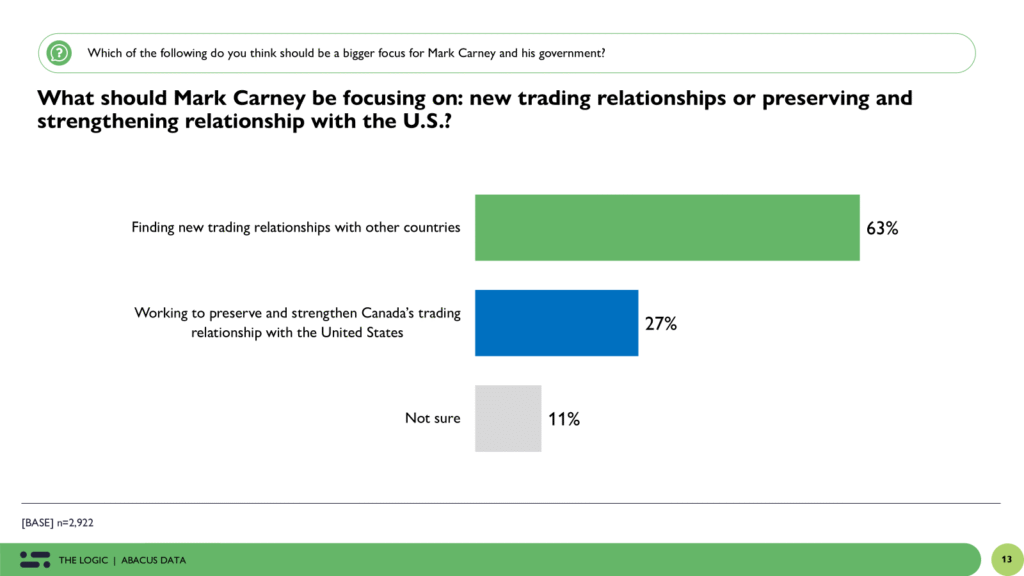

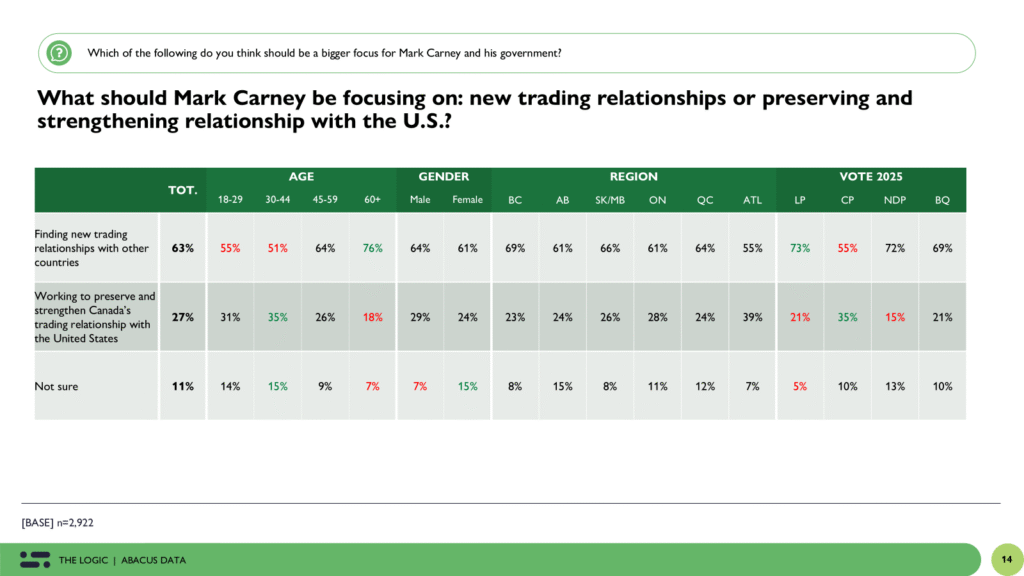

On trade, the consensus is unusually strong. 63% of Canadians want Carney to prioritize finding new trading relationships, while just 27% prefer to focus on preserving ties with the U.S..

Support is especially high among older Canadians (76% of those 60+), a reminder of how much Baby Boomers lead the “elbows up” constituency.

Partisan gaps exist but are not extreme: 73% of Liberals and 55% of Conservatives back diversification.

This suggests a shared appetite for economic resilience amid U.S. political uncertainty, even if the meaning of “independence” varies across the spectrum.

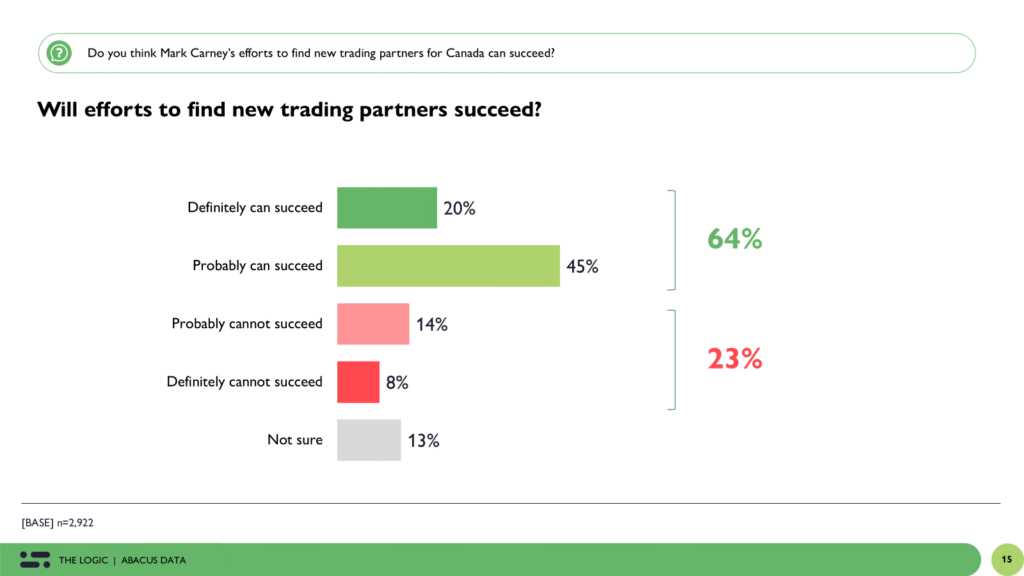

Confidence in Carney’s ability to deliver on this front is mixed: 64% believe his efforts to find new trade partners can succeed, though only 20% are confident enough to say definitely.

That optimism climbs to 87% among Liberals but drops to 45% among Conservatives.

5. A Willingness to Trade Growth for Independence

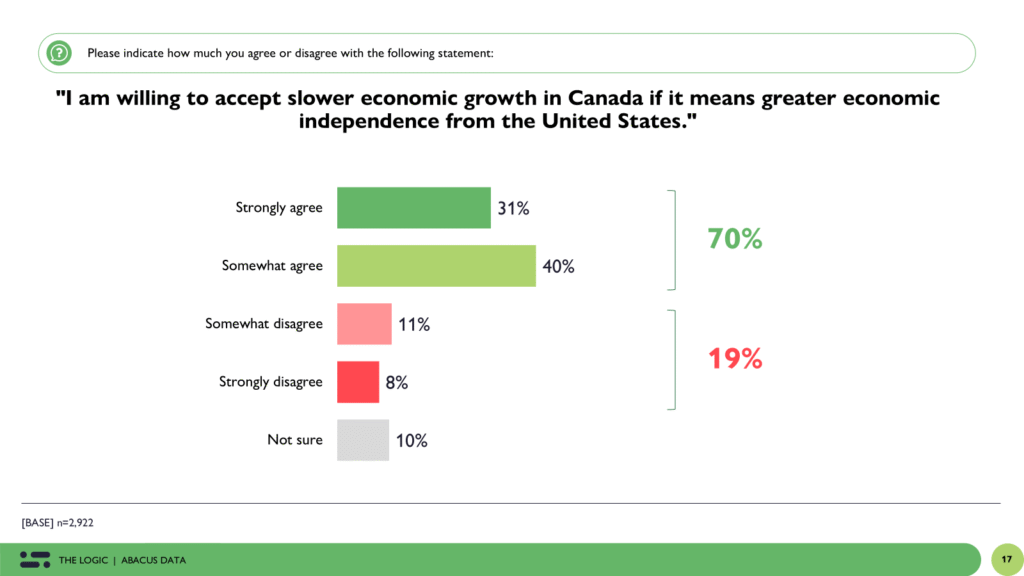

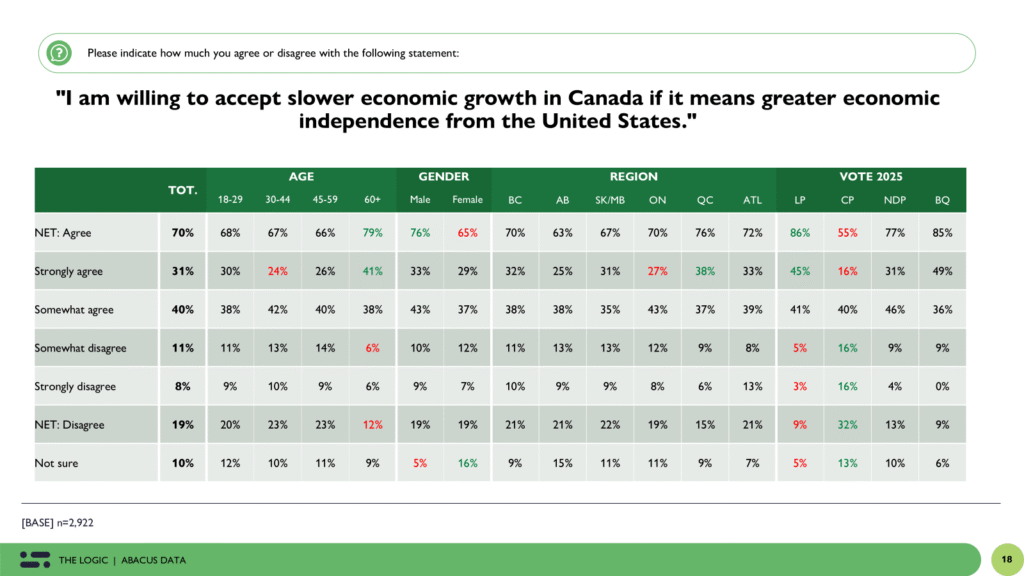

Finally, a striking 70% of Canadians agree that they are willing to accept slower economic growth if it means greater economic independence from the U.S..

Agreement cuts across age, region, and party: even 55% of Conservative voters say they’re prepared to take that trade-off.

This rare consensus reveals something deeper about the national mood. There is a desire for control and self-determination, even at the expense of short-term prosperity.

The Upshot

The mood of late-2025 Canada on the even of the federal budget is defined by guarded realism. Canadians expect economic turbulence and are skeptical that government can deliver on its promises, yet they still crave tangible progress and national resilience.

They want growth that feels earned and secure, not fragile or dependent.

If Carney can combine credibility with delivery, he may find Canadians willing to give him time. But the patience of a cautious public has limits.

Methodology

The survey was conducted with 2,922 Canadians from October 24 to 29, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 1.8%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, and region. Totals may not add up to 100 due to rounding.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

The survey was paid for by Abacus Data Inc.

About Abacus Data

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.