Rented dreams: The truth behind millennial home ownership

May 6, 2019

80% of millennials want to own a home. 80% is a staggering figure, especially when we are routinely told that millennials are a generation of perennial renters, opting to pay rent over paying down a mortgage. Now, the stereotype of the eternal renter is not unfairly painted, currently, only 27% of millennials own the homes they live in. The remaining 73% either rent (40%) or live with their parents (33%). So why the discrepancy between desire and attainment?

To understand this better let’s remove the wheat from the chaff. While 80% of millennials hope to be homeowners one day only 43% are looking to buy a home in the next 5 years. So using that as our benchmark we are going to look at these ‘in-market’ millennials who are on the prowl for a place to call their own and to understand what’s stopping them from fulfilling their dream of a home sweet home.

IN-MARKET MILLENNIALS

First, let’s get to know these millennials a little better. In-market millennials (those looking to buy a home in the next 5 years) are made up of an equal number of singles and those who are in long-term relationships. For their first home, a third are looking to move into a fully detached home while a quarter are seeking-out apartments or condominiums. A much smaller number of millennials want to stay in townhomes or semi-detached homes (17% each). When we look at the average in-market millennial we find that she would like her first home to have 3 bedrooms and 2 baths, all for the sweet price of $300,000 or less.

For those who are familiar with the price of an average home in Canada you will have done the math and realized that her desire is a tall order to fill. Perhaps if this millennial lives in Atlantic Canada or the Prairies she could find her dream home. However, if she wanted to live in the hot housing markets of Vancouver, Toronto, or Montreal, she will find a stark reality facing her.

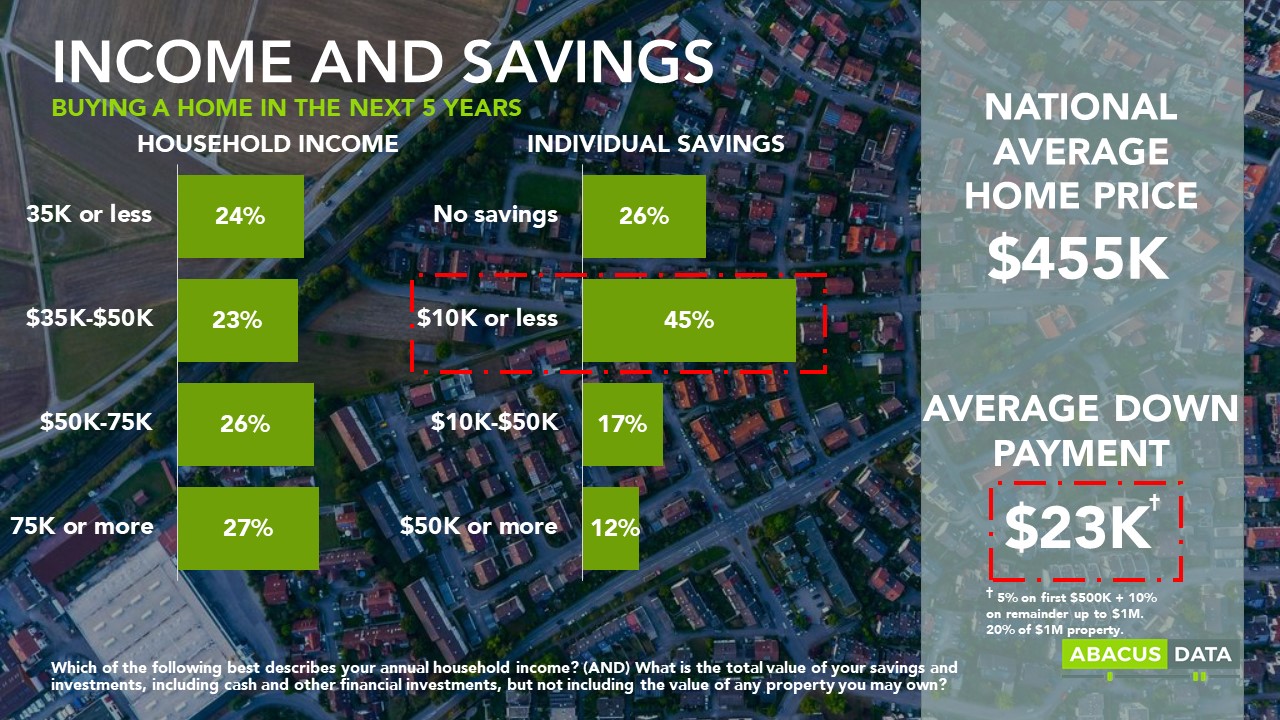

The average price of a home in Canada according to MLS is $455,000 meaning that with the current mortgage rules the minimum down payment for a typical Canadian home would be approximately $23,000. This might seem like a reasonable sum for our home-seeking millennial, however, with an income of $75,000 or less and a savings account of only $10,000, a $23K price tag can quickly become unattainable. This is the case for nearly three-quarters of all in-market millennials in Canada.

Low wages and limited savings seem to be some of the largest stumbling blocks that prohibit millennials making the leap from rented accommodations or chez mom and dad to a home of their own. Nevertheless, 27% of millennials have managed to make that down payment and are now homeowners. So how did over a quarter of this cohort manage to purchase their first home?

HOME OWNERSHIP

Nearly half of the current millennial homeowners make over $75,000 and many make over $100,000 a year. This is significantly higher than non-home owners and confirms that there is a correlation between higher income and home ownership.

However, as mentioned above, income only explains how half of these millennials purchased their home, which leaves the other half up for questions. To answer this, we turn to their parents. Parents of current homeowners are 10% more likely to have household incomes of around $100,000 or more. What we also see is that regardless of their own personal income, millennials with wealthier parents are nearly 11% more likely to own their home. This suggests two things. The first is that if mom or dad are well-off you are more likely to follow in their financial footsteps and that also includes homeownership. Secondly, for those who make less but have parents with the means to assist, the bank of mom and dad is open for business.

Where does this leave millennials who lack parental assistance and make an average millennial income ($62,500 or less) with a typical savings account ($10,000 or less)? Most will not be able to own a home without government assistance, the help of alternative lenders, or significantly more time to save.

With persistently high property prices home ownership seems to be the privilege of the wealthy and well-positioned and millennials who work for depressed wages will have to keep waiting and saving until they can finally afford the home of their dreams.

At Abacus we strive to understand the nuances of generational change and how it impacts you and your business. The Canadian Millennials Report is the largest syndicated study of millennials in Canada. We survey 2,000 millennials twice a year on a range of topics including politics, social values, and consumer trends. If you are interested in learning more about this generation, reach out to us and we would be happy to connect.