Feeling the pinch or not sparing an inch? 2022 Holiday spending

December 21, 2022

We may be more cost conscious this year, but December is usually a time to spend a little more, with inflation chasing us all year long we wanted to see whether it has caught up with our holiday spending.

Most are holding steady on holiday spend, a quarter are spending less. 55% say they will be spending the same as usual on holiday gifts this year, which amounts to just over $600 on average. Those with more names on their list (older Canadians, those with a partner) and a greater household budget plan to spend a lot more.

Women and those in BC are most likely to be paring back on their holiday spending.

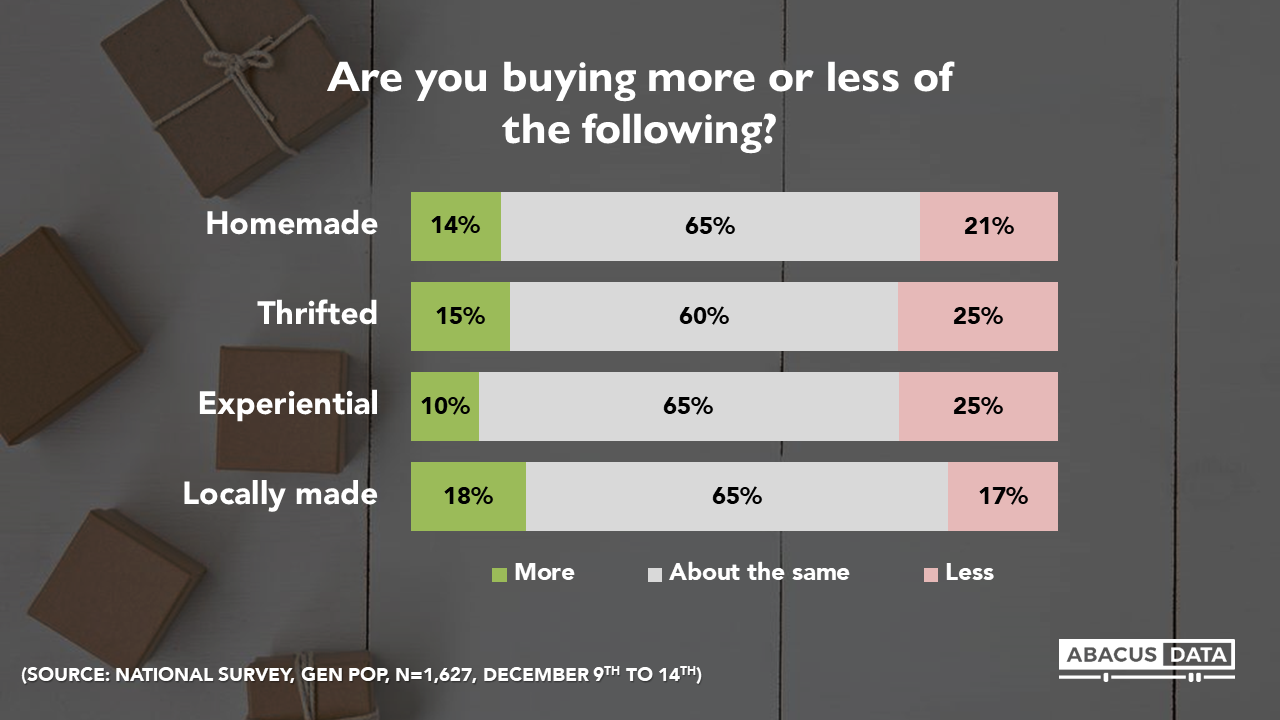

Aside from a bit more interest in locally made gifts the average Canadian gift giver is sticking with what they know. But younger consumers, especially Gen Z, are going less materialistic, more cost-conscious this holiday season. A quarter are increasing the number of thrifted, homemade, and experiential gifts they give.

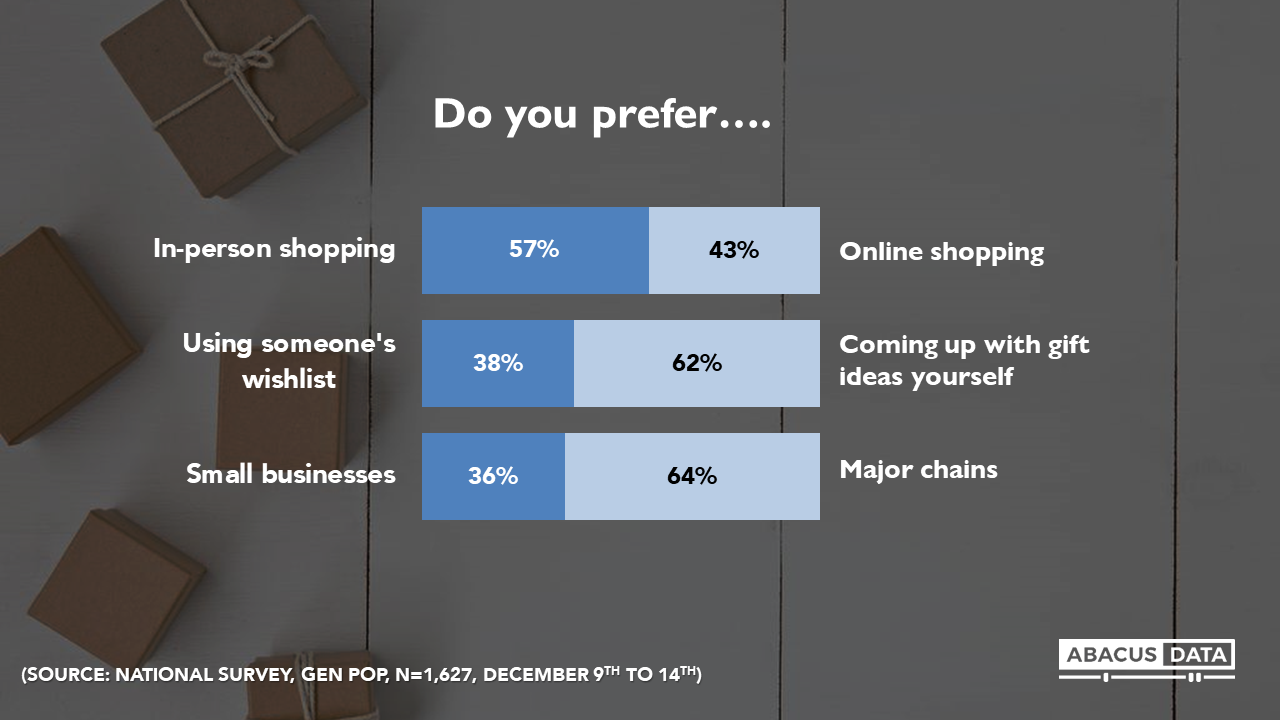

When it comes to our gift giving habits, we also have the following preferences:

- An immersive shopping experience– in person shopping (57%) vs. online shopping (43%)

- A personal touch– coming up with gift ideas yourself (62%) vs. using someone’s wish list (38%)

- Going big– 64% major chains vs. 36% small businesses

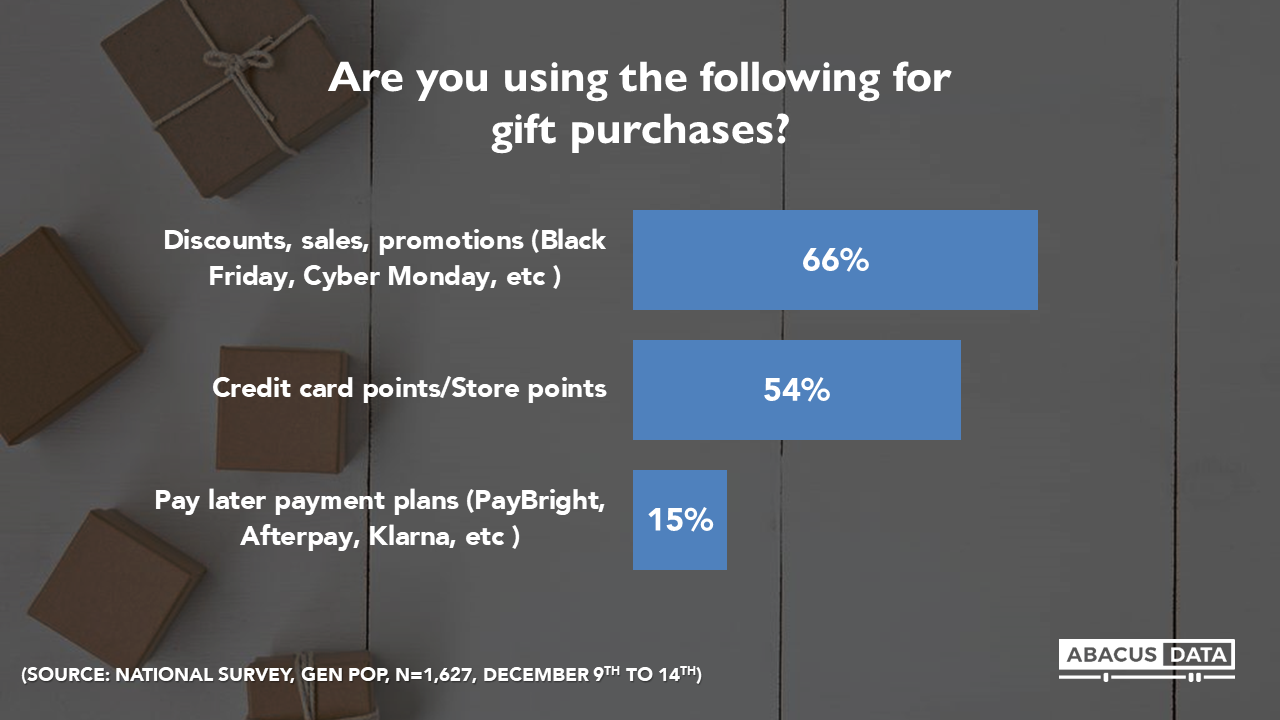

Though we may be spending the same this year, many Canadians are looking to stretch their dollars during holiday shopping. Two-thirds of Canadians are using discounts, sales, and promotions for their holiday shopping. Half are cashing in on their credit card or store points. And 15% are signing up for pay later payment plans- up to 28% among 16–29-year-olds.

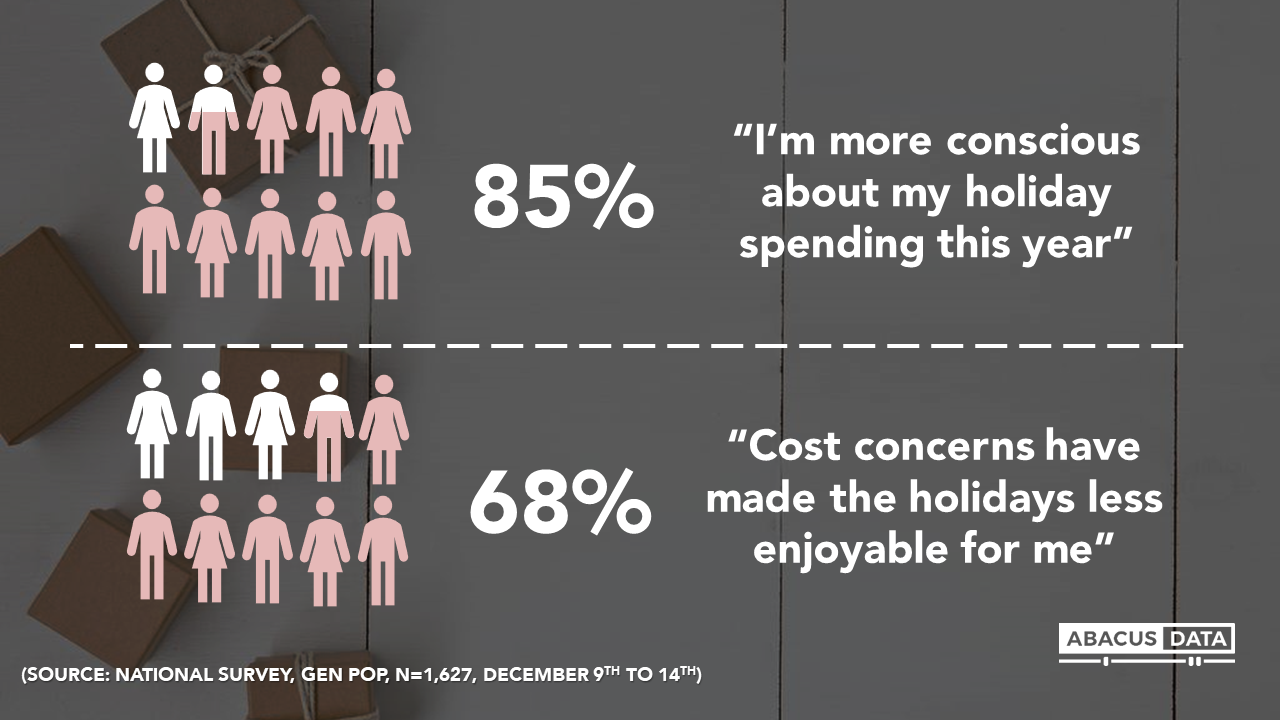

Regardless of spending habits, cost concerns are in the back of everyone’s mind. 85% of us are paying more attention to what we spend this holiday season. And for two-thirds, they say these concerns are impacting their ability to enjoy the holidays.

Close to half of Canadians are coping by spending now and worrying later. Despite money being on everyone’s mind, many of us are choosing to make it a 2023 problem and worry about the consequences in the new year. Two-thirds of young Canadians hold this belief.

THE UPSHOT

The big takeaway this holiday season is that inflation is on the minds of Canadians-but it has not altered the shopping habits of the majority.

The big takeaway this holiday season is that inflation is on the minds of Canadians-but it has not altered the shopping habits of the majority.

Young consumers (especially Gen Z) are perhaps the best example. They are eager to spend more than usual, but also show the most concern about spending too much- both through their habits (choosing thrifted, homemade) and their thoughts (paying more attention to their holiday spend).

What’s helping these young people put their conscious to rest (albeit temporarily) is that they are choosing to make this a 2023 problem- saying they will deal with the consequences in the new year. Perhaps not the best decision for Canadians as we head into a potential recession, and a signal of what is to come.

METHODOLOGY

The survey was conducted with 1656 Canadian adults from Dec 9 to Dec 14. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.408%, 19 times out of 20.

The data was weighted according to census data to ensure that the sample matched Canada’s population. Totals may not add up to 100 due to rounding.