What Canadians think about interest rates and inflation

August 3, 2023

From July 20 to 25, 2023, Abacus Data conducted a national survey of 2,486 adults exploring several topics related to Canadian politics and current events as part of our regular national omnibus surveys.

In this survey, we explored Canadian views and perceptions on inflation and interest rates. The results reflect a complex interplay of understanding, beliefs, perceptions, and ideological biases, demonstrating that the public’s opinion is nuanced and multifaceted.

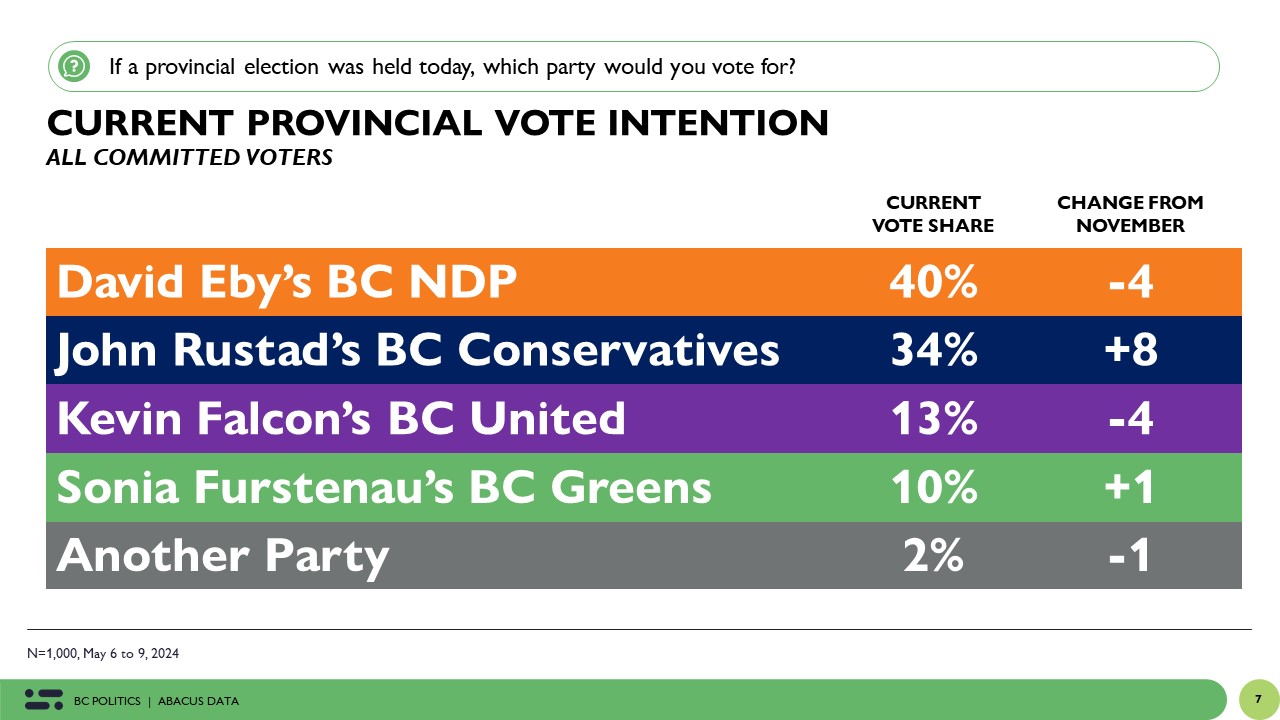

Understanding of Interest Rates and Government Influence

A key finding of this survey shows the mixed understanding of the mechanisms and influences behind interest rates. Around 4 in 10 Canadians believe that the federal government wields some influence on these rates. While some understanding of the Bank of Canada’s role is apparent, given that 41% believe it bears sole responsibility for setting rates, a large proportion (36%) think it works under directives from the federal government. This demonstrates a lack of clarity in understanding the independent role of the Bank of Canada in setting interest rates.

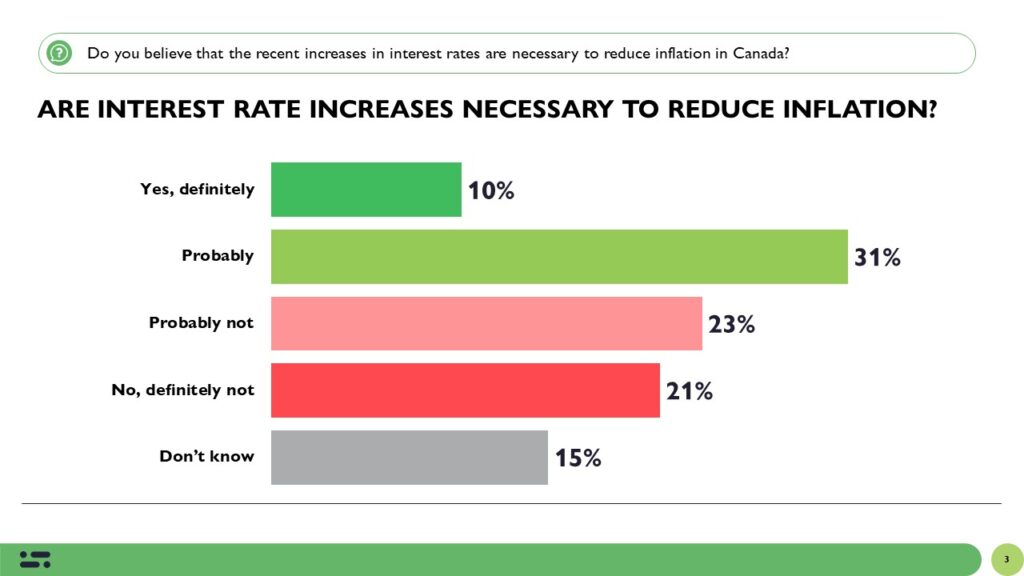

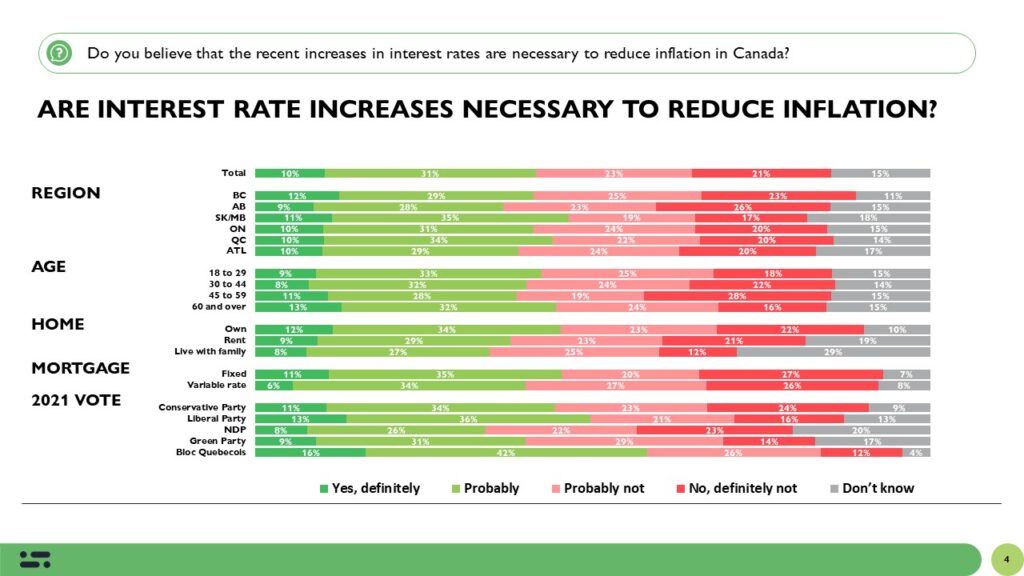

Perceived Necessity of Interest Rate Increases

As to the question of necessity, Canadians are divided on whether they believe recent interest rate hikes are required to curb inflation. The fact that 44% think it’s probably or definitely not necessary suggests skepticism about the Bank of Canada’s actions. This skepticism could be stemming from a lack of understanding of the intricacies of economic policy or dissatisfaction with the current economic climate. Furthermore, with more than a third of Liberal Party voters deeming interest rate hikes unnecessary for curbing inflation, it is clear this could be a driver in the government’s declining poll numbers.

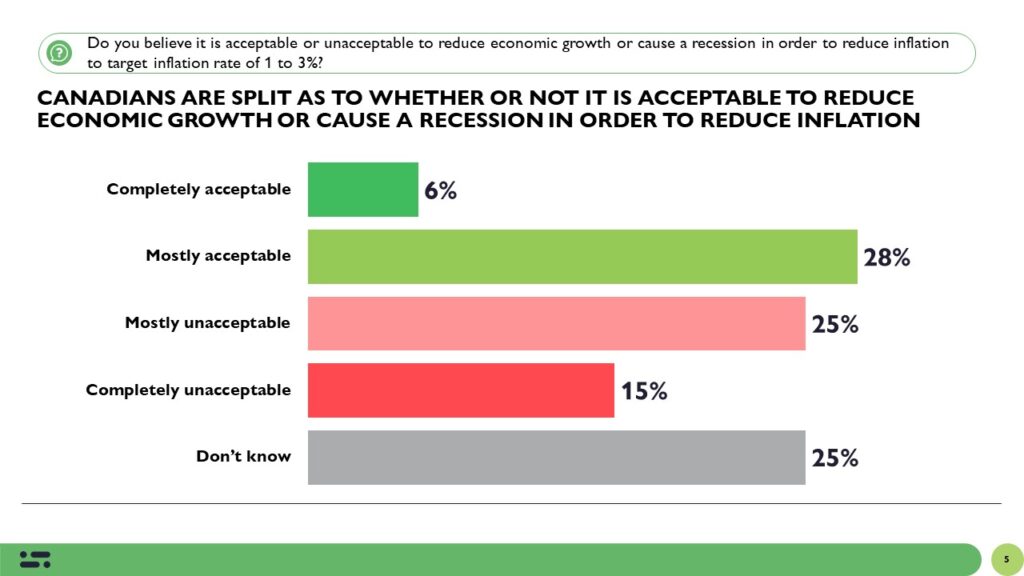

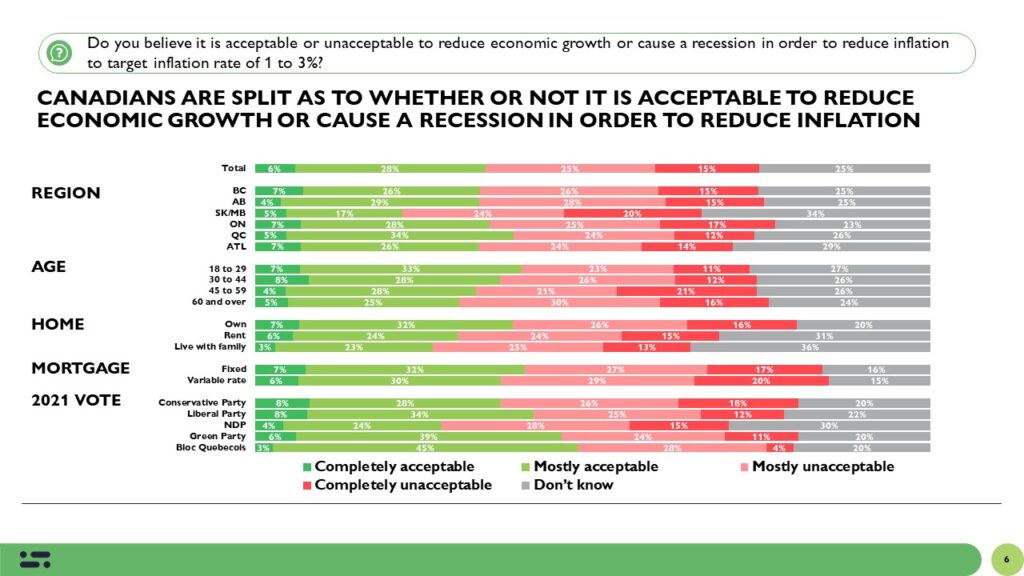

Acceptability of Economic Slowdown for Reducing Inflation

The acceptance of a possible economic slowdown or recession as a means to combat inflation is a contentious issue among Canadians. Only 34% find this strategy acceptable, while 40% deem it unacceptable. This indicates that Canadians are not ready to accept significant economic sacrifices for inflation control. The NDP voter group’s particular reluctance underlines how these perspectives can differ along partisan lines and presents an opportunity for the NDP.

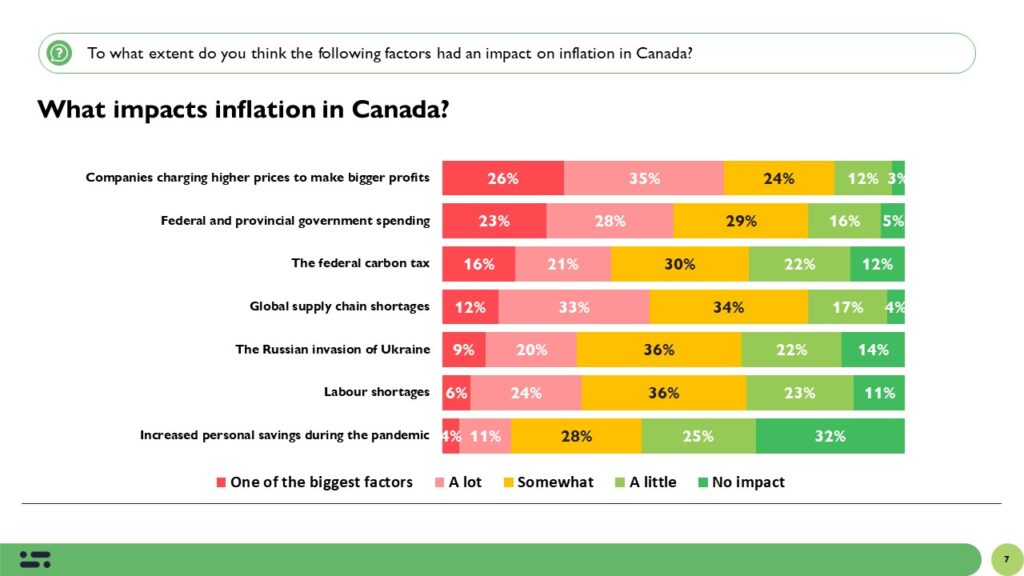

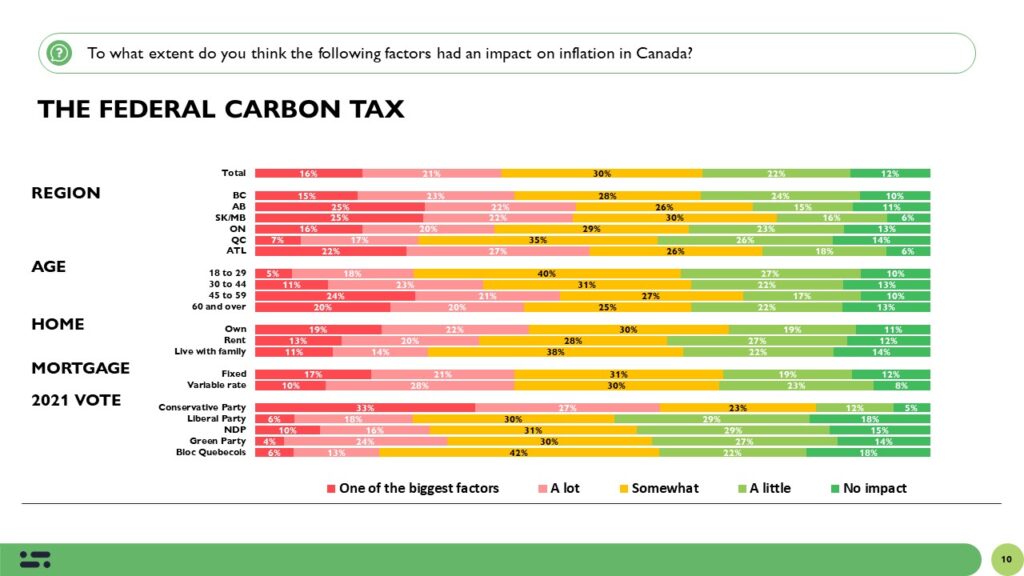

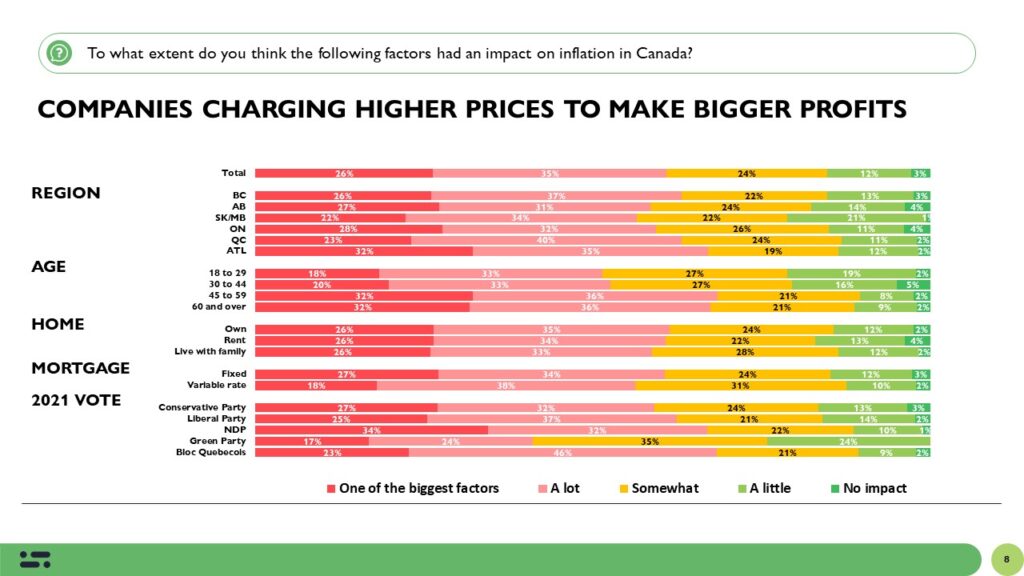

Perceived Causes of Inflation

Canadians attribute the causes of inflation mainly to ‘greedflation’ and government spending. They also demonstrate a reasonable understanding of global supply chain issues contributing to inflation. This points towards a more nuanced understanding of economic dynamics and factors driving inflation, showing that Canadians are not solely blaming local factors but are also aware of international factors. However, the extent to which they attribute inflation to the federal carbon tax, particularly among Conservative voters, indicates how politicized the carbon price has become.

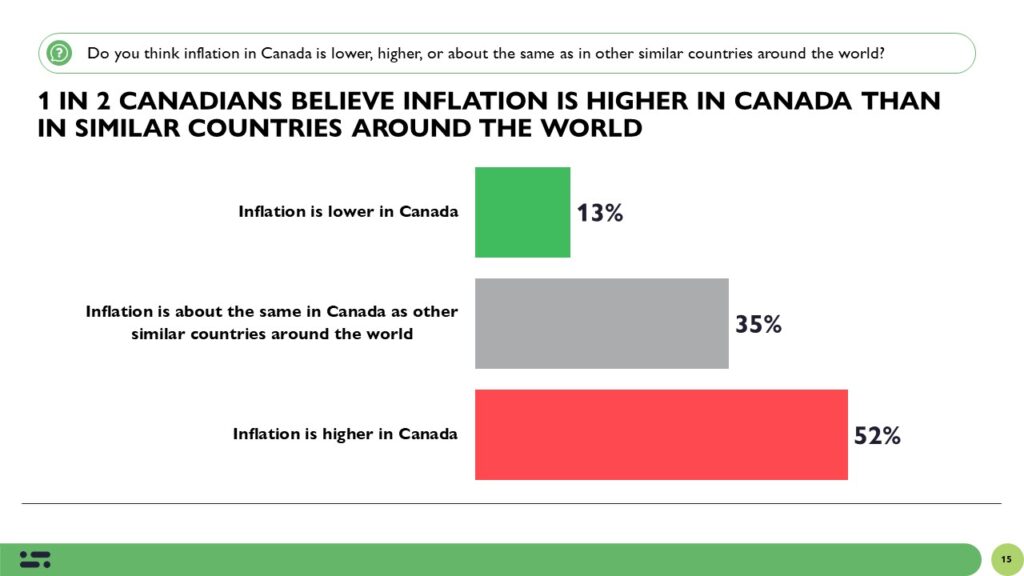

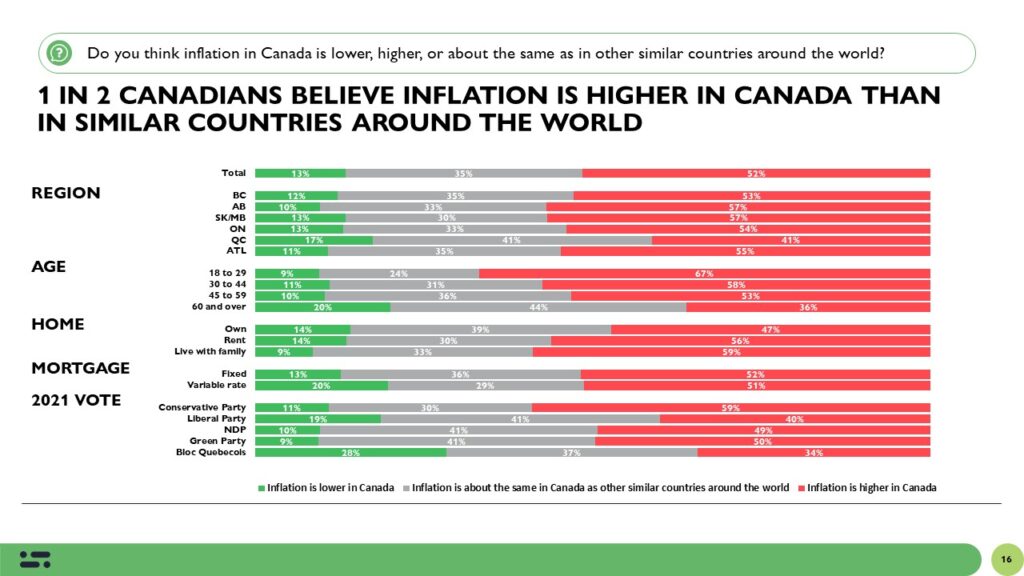

Perceptions of Canada’s Inflation Rate Relative to G7

The fact that only 13% of Canadians think that Canada’s inflation is lower than other parts of the world, despite it being the lowest in the G7, underscores a disconnect between perceptions and reality. It suggests a need for better communication from the government on this matter. If a majority, including 40% of Liberal voters, erroneously think that Canada’s inflation is higher, it points to a significant communications challenge for the Liberal government and one it needs to address if it’s narrative around economic management and the cost of living is going to connect.

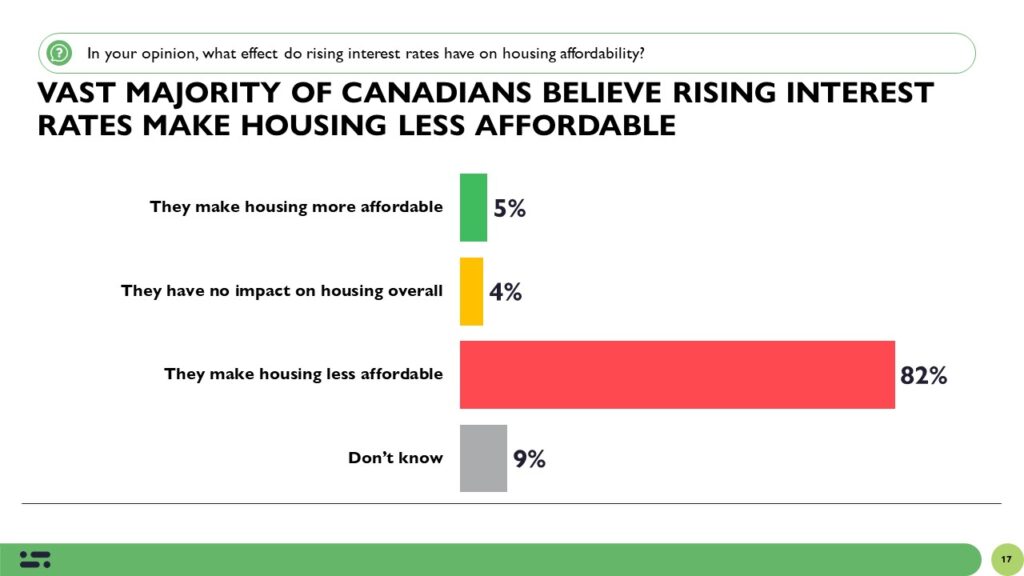

Impact of Rising Interest Rates on Housing

A majority of Canadians (82%) believe that rising interest rates are contributing to more expensive housing. This perception highlights the complexity and depth of public opinion about inflation and interest rates, suggesting that Canadians see the issues through the lens of personal impact, like housing affordability.

The Upshot

These survey results hold significant political implications. For the incumbent Liberals, the data highlights a need for enhanced communication to correct the public’s understanding and perception of inflation and interest rates. The party faces the challenge of managing its image regarding its influence over the Bank of Canada, and there is a crucial need to clarify the distinction in roles and independence. The misperceptions about Canada’s inflation rate compared to the global landscape indicate an opportunity for the Liberals to demonstrate their economic management skills and challenge the narrative.

However, the data also presents opportunities for opposition parties. The Conservatives, for instance, have focused on the discontent regarding the federal carbon tax general and linking it to inflation will only help to animate its base. They could also tap into the belief that rising interest rates contribute to expensive housing, a key issue for many Canadians. For the NDP, the widespread unacceptability of causing an economic slowdown to reduce inflation might be a point of commonality with their voters that they can leverage.

Overall, this survey paints a picture of a Canadian public that holds complex, sometimes contradictory views on inflation and interest rates. While there is a general understanding of some economic principles, there’s also clear confusion and political polarization. The findings suggest that the government, the Bank of Canada, and opposition parties all have significant roles to play in shaping, influencing, and responding to these public perceptions.

Inflation has a tendency to kill governments. Because of confusion over what is causing it and who is responsible for taming it, governments are often blamed for both.

METHODOLOGY

The survey was conducted with 2,486 Canadian adults from July 20 to 25, 2023. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.0%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.